The Indian shipbuilding industry is poised for significant growth, driven by factors like rising global trade, increased government investments, and strategic initiatives like ‘Make in India.’ In this context, two prominent players, Cochin Shipyard and Garden Reach Shipbuilders, are attracting considerable attention. Both offer strong fundamentals, robust order books, and promising futures. But which one should you choose?

Let’s dive deep and compare their strengths and weaknesses to help you make an informed decision

Cochin Shipyard: Established in 1972, this Indian company is a leader in building and repairing all types of vessels. They also specialize in upgrading and extending the lifespan of ships. Notably, Cochin Shipyard was the first greenfield shipbuilding yard in the country.

GRSE: Founded in 1884, this Indian company primarily builds warships for the Indian Navy and Indian Coast Guard. They hold the distinction of being the first Indian company to export warships and have delivered 100 warships to the Indian Navy and Coast Guard to date.

| Metrics | Cochin Shipyard | GRSE |

| Market Cap | Rs 16,959 Crore | Rs 9,670 Crore |

| P/E Ratio | 40.6 | 34.9 |

| ROE | 6.57% | 16.4% |

| Debt to Equity | 0.12 | 0.01 |

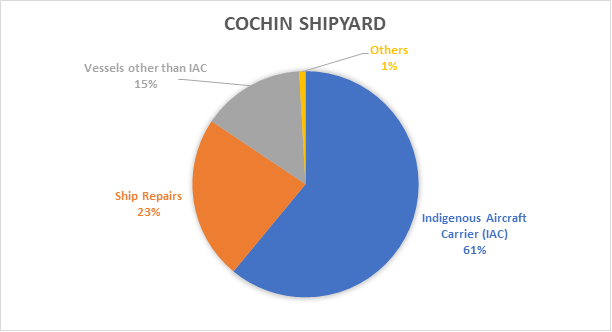

Both Cochin Shipyard and GRSE are prominent Indian shipbuilding companies offering diverse services. Cochin Shipyard focuses on commercial vessels, including tankers, carriers, and passenger ships, while also specialising in high-power tugboats and air defence ships. Their expertise extends to ship repair and marine engineering.

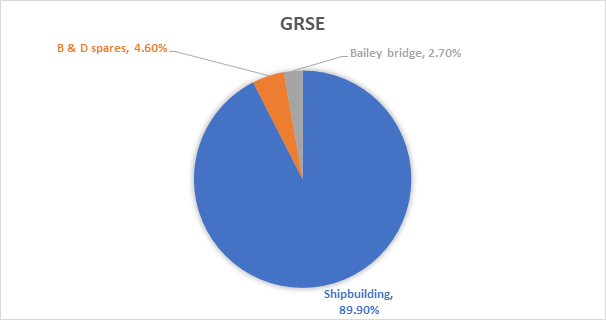

GRSE, on the other hand, caters primarily to the defence sector, constructing warships like frigates and corvettes, along with vessels for anti-submarine warfare and surveys. Their engineering division diversifies their offerings with portable bridges, marine pumps, and deck machinery items, further strengthening their presence in the marine industry.

Cochin Shipyard boasts a significant shipbuilding capacity of up to 1,10,000 DWT, demonstrating its ability to construct large vessels. Additionally, its ship repair capability extends to vessels as large as 1,25,000 DWT, highlighting its comprehensive service offering.

In contrast, GRSE focuses on warship construction, capable of concurrently building 20 warships, ranging from smaller 5-ton boats to massive 24,600-ton fleet tankers, showcasing its versatility in the naval shipbuilding domain.

Cochin Shipyard’s order book is Rs 22,000 crore, while GRSE’s is Rs 23,740 crore. This is a significant amount of business for both companies, and it is likely to support their growth in the coming years.

Cochin Shipyard reported robust financial performance with significant year-on-year growth across key financial parameters. Revenue surged 40% to Rs 954 crore, driven by strong demand for its shipbuilding and ship repair services. Operating profit also witnessed a 40% jump to Rs 195 crore, reflecting the company’s efficient operations and cost management. Notably, the company’s Profit After Tax (PAT) witnessed the strongest growth, soaring 59% to Rs 191 crore, demonstrating its profitability and financial strength.

GRSE.’s financial performance shows a mixed bag. Revenue grew 32% year-over-year to Rs 898 crore, while operating profit increased by a modest 2%, reaching Rs 49 crore. However, the company’s profit after tax (PAT) saw a strong 37% surge, reaching Rs 81 crore.

Both Cochin Shipyard and GRSE have outlined positive future outlooks.

Cochin Shipyard is targeting ship repair revenue of approximately Rs,200 crores in the next three years and aims to maintain a profit after tax (PAT) margin of 16-17% for the full financial year. Their current order book extends for around seven years, providing solid revenue visibility.

GRSE, on the other hand, is focusing on maintaining a PAT margin above 7.5%. Their order book extends for the next five years, with peak revenue expected in FY25 or FY26, hinting at promising growth potential soon.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Dec 8, 2023, 2:14 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates