September 15, 2021

www.angelone.in

Technical & Derivatives Report

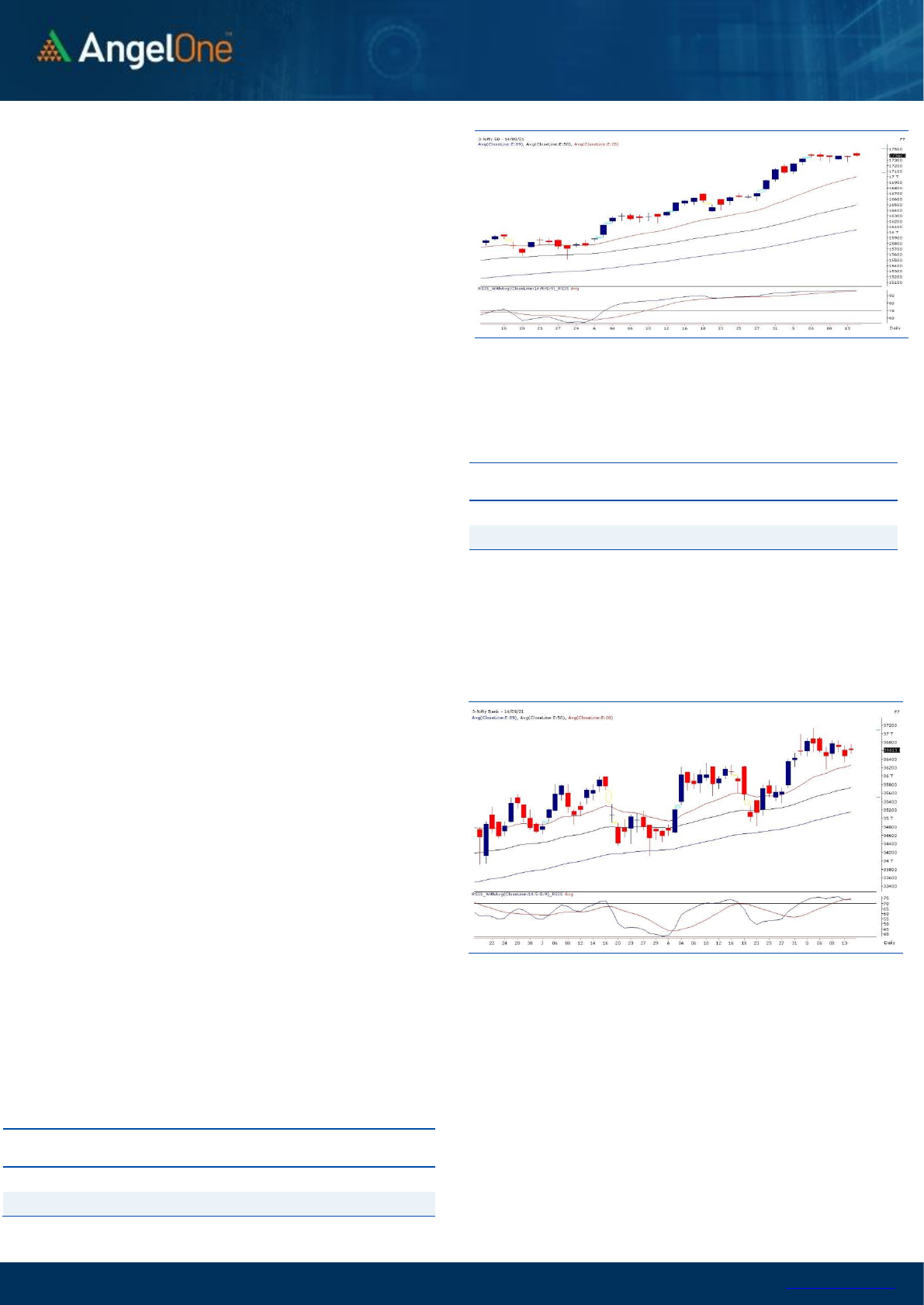

Exhibit 1: Nifty Daily Chart

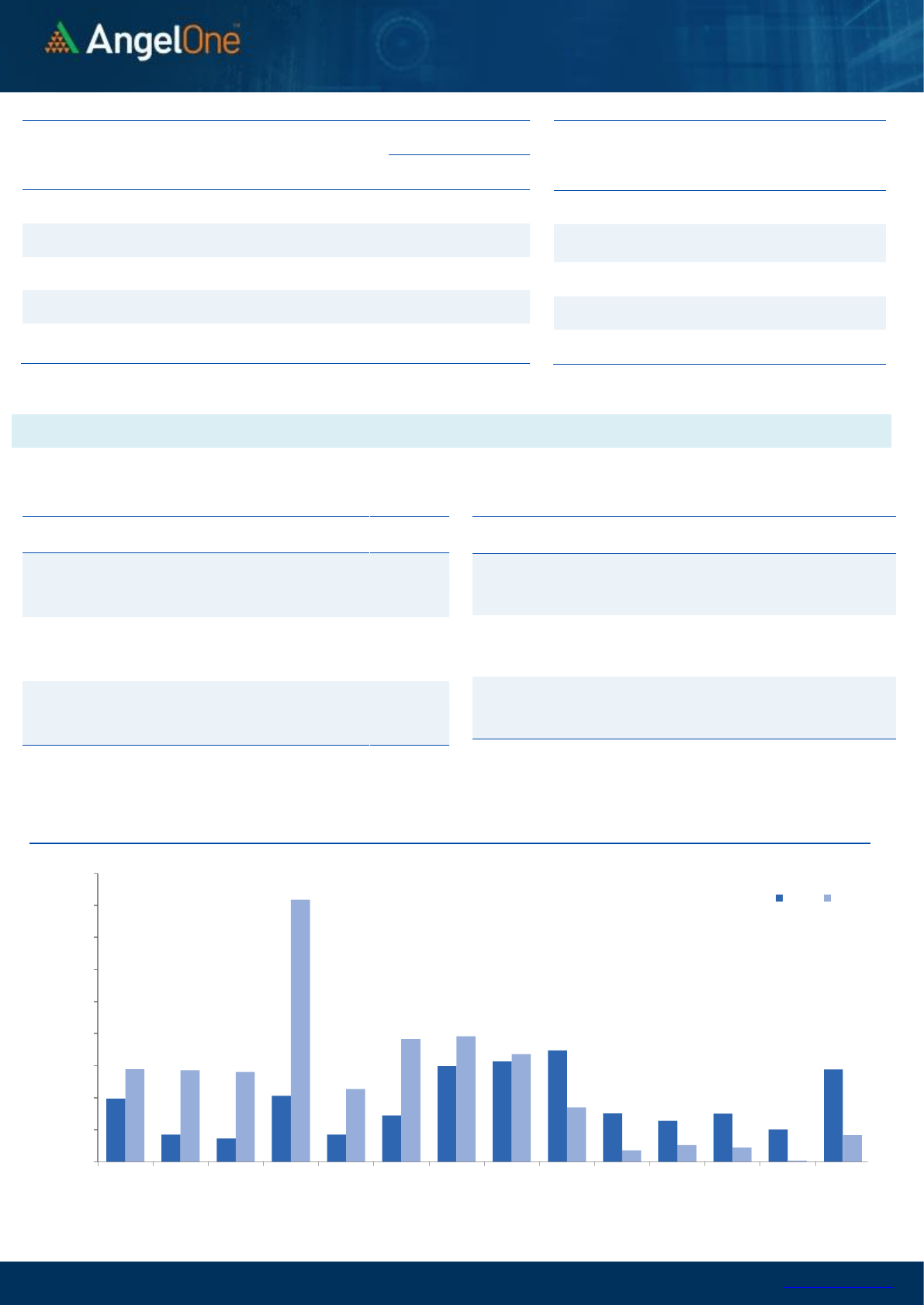

Nifty Bank Outlook - (36613)

The banking index had a positive start in tandem with the

benchmark. However after the initial head-start, the follow up

move was once again missing. For the remaining part of the

session, BANKNIFTY remained in a positive territory but it was

more of a consolidation within a slender range.

Now if we look at the intraday time frame chart, we can see a

range shrinking day by day. Generally when the consolidation

price movement reached a converging point, the breakout

becomes imminent on either side. So on the higher side, 36700 is

the level to watch; whereas on the flipside, the lower end of this

consolidation range is at 36300. Let’s see whether it really triggers

real momentum outside this range or not.

Key Levels

Support 1 – 36510

Resistance 1 – 36700

Support 2 – 36300

Resistance 2 – 36860

Exhibit 2: Nifty Bank Daily Chart

Hence, traders should keep a watch on the development there and

we reiterate to have a thematic approach and be fussy in stock

selection.

Key Levels

Support 1 – 17300

Resistance 1 – 17450

Support 2 – 17250

Resistance 2 – 17500

Sensex (58247) / Nifty (17380)

Nifty started the day on a positive note and marked a new high of

17438. However, it failed to show a follow up move and gave up

some of the gains to end below 17400.

Although we saw a new high in Nifty, the index traded within a

narrow range throughout the day. In last few sessions, Nifty has

traded within a range of 17250-17430 and as we approached the

higher end of the range yesterday, we saw signs of fatigue at higher

levels. The stock specific momentum continued where better trading

opportunities are seen for day traders. Until we see a clear breakout

from the range of 17250-17450, we continue with our advice for

traders to avoid aggressive trades in index and rather focus on stock

specific ideas. In last few day’s, the banking index too has seen a

sideways move and looking at the lower time frame chart, we expect

a breakout soon on either side which could then lead to momentum

in the benchmark as well.

.

www.angelone.in

Technical & Derivatives Report

September 15, 2021

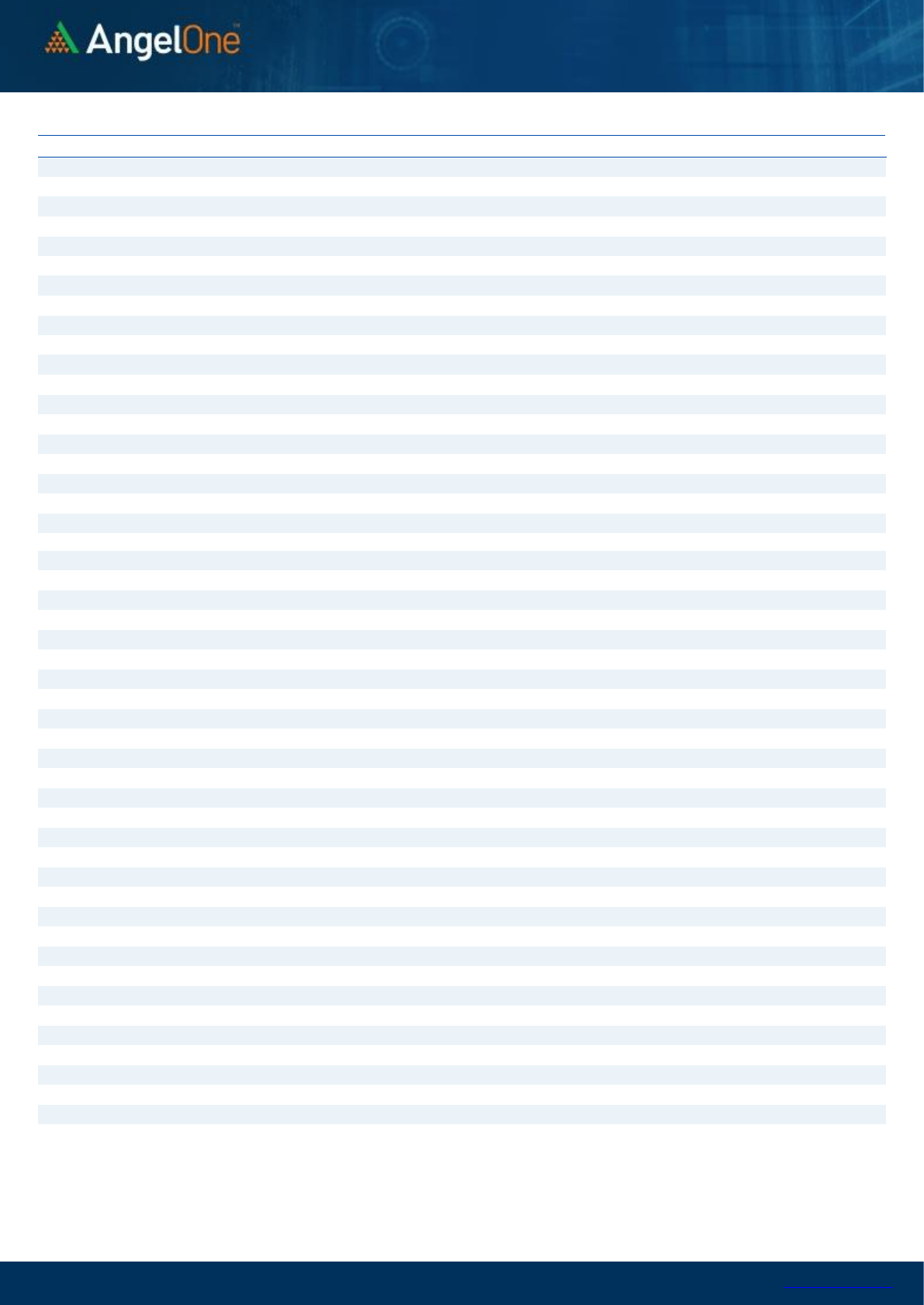

Nifty Vs OI

16200

16400

16600

16800

17000

17200

17400

17600

,0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

8/25 8/27 8/30 9/1 9/3 9/7 9/9 9/14

(`000)

Openinterest Nifty

View

◼ Post Monday’s recovery, our market had a positive start

yesterday. The benchmark clocked yet another record

high but as we progressed follow-up buying was

missing and hence we concluded the with the marginal

gains.

◼ FIIs were net buyers in cash market segment to the tune

of Rs. 1649 crores. In index futures, they sold worth

Rs. 197 crores with some fall in open interest indicating

blend of long unwinding and short formation.

◼ In F&O space, we hardly saw any relevant open interest

activities in both the indices inline with recent trend.

Stronger hands continued with their buying in equities

but remained sellers in index and stock futures segment.

In Nifty options front, massive writing was seen in

17450-17550 call strikes which restricted the upside

yesterday. On the other side, we saw some build-up in

17300 put option. Considering the above data points,

we would advise traders to keep booking profit in index

and continue trading in individual counters.

Comments

◼ The Nifty futures open interest has increased by 1.22%.

Bank Nifty futures open interest has decreased by 0.26%

as market closed at 17380.00 levels.

◼ The Nifty September future closed with a premium of

4.95 point against a premium of 4.00 point in last

trading session. The October series closed at a premium

of 35.40 point.

◼ The INDIA VIX decreased from 14.02 to 13.57. At the

same time, the PCR-OI of Nifty has decreased from 1.33

to 1.19.

◼ Few of the liquid counters where we have seen high cost

of carry are ADANIENT, IDEA, BHEL, CANBK and

BHARATFORG.

OI Gainers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IRCTC

2553200

50.96

3738.35

8.93

IPCALAB

253125

16.46

2637.90

1.82

IDEA

930580000

15.18

8.70

9.38

UBL

1600900

14.01

1586.60

-0.53

PIIND

1194250

13.01

3497.60

1.65

MARICO

11676000

11.63

558.30

-2.93

INDUSINDBK

17045100

9.52

1036.60

4.32

BHEL

131061000

9.22

58.00

5.42

OI Losers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ZEEL

67038000

-14.70

261.55

39.44

HINDALCO

34885900

-9.86

477.95

-0.18

LICHSGFIN

24086000

-6.51

419.60

0.10

SRF

699000

-6.43

10676.45

-0.34

DEEPAKNTR

2736000

-6.35

2451.10

0.66

NAM-INDIA

4249600

-6.21

437.85

0.38

EXIDEIND

36500400

-5.46

182.60

-0.65

KOTAKBANK

17575200

-4.43

1867.75

1.37

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

NIFTY

1.19

0.95

BANKNIFTY

0.80

0.93

RELIANCE

0.47

0.41

ICICIBANK

0.43

0.40

INFY

0.51

0.40

Historical Volatility

SCRIP

HV

SYNGENE

38.67

IGL

39.09

COALINDIA

38.24

MINDTREE

47.83

ASTRAL

51.50

www.angelone.in

Technical & Derivatives Report

September 15, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Spot = 17380

0900 Lot Size = 75

FII Statistics for September 14, 2021

Detail

Buy

Net

Contracts

Open Interest

Sell

Value

(in Cr.)

Change

Change

(%)

INDEX

FUTURES

2726.36

2923.36

(197.00)

174556

15376.61

(0.23)

4849.58

INDEX

OPTIONS

189207.26

190522.00

(1314.74)

1450810

127856.51

6.94

297314.41

STOCK

FUTURES

11545.49

11741.65

(196.16)

1478297

127222.73

0.35

18904.77

STOCK

OPTIONS

18466.65

18568.94

(102.29)

285427

24644.51

4.95

22378.01

Total

221945.76

223755.95

(1810.19)

3389090

295100.36

3.43

343446.77

Turnover on September 14, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

174876

15657.67

-20.21

Index Options

38663756

3473298.67

10.77

Stock Futures

719603

61509.04

32.01

Stock Options

2982919

263275.68

28.54

Total

42,541,154

3813741.06

11.95

Bull-Call Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

150.00

44.50

55.50

17444.50

Sell

17500

105.50

Buy

17400

150.00

79.55

120.45

17479.55

Sell

17600

70.45

Buy

17500

105.50

35.05

64.95

17535.05

Sell

17600

70.45

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

164.20

43.70

56.30

17356.30

Sell

17300

120.50

Buy

17400

164.20

75.70

124.30

17324.30

Sell

17200

88.50

Buy

17300

120.50

32.00

68.00

17268.00

Sell

17200

88.50

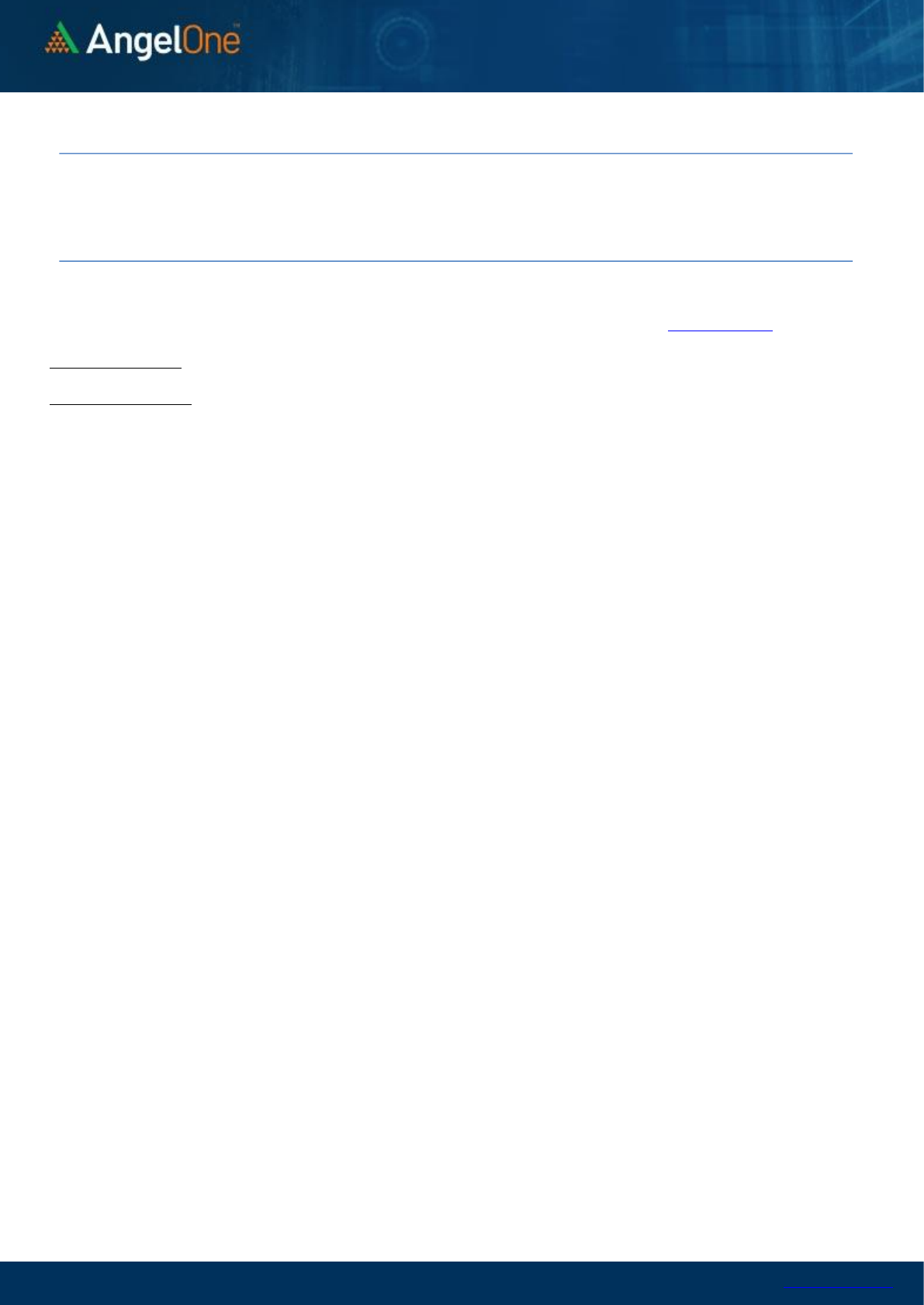

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

September 15, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

737

746

755

764

772

ASIANPAINT

3,338

3,350

3,369

3,382

3,401

AXISBANK

784

789

795

800

806

BAJAJ-AUTO

3,659

3,705

3,736

3,782

3,813

BAJFINANCE

7,330

7,374

7,452

7,496

7,574

BAJAJFINSV

16,645

16,738

16,889

16,982

17,133

BPCL

483

488

496

501

508

BHARTIARTL

684

689

694

700

705

BRITANNIA

4,042

4,072

4,112

4,142

4,183

CIPLA

945

949

954

958

962

COALINDIA

152

154

155

156

157

DIVISLAB

5,000

5,047

5,119

5,167

5,239

DRREDDY

4,883

4,907

4,948

4,972

5,013

EICHERMOT

2,773

2,797

2,833

2,857

2,894

GRASIM

1,583

1,597

1,609

1,623

1,634

HCLTECH

1,195

1,217

1,229

1,251

1,262

HDFCBANK

1,535

1,542

1,553

1,560

1,571

HDFCLIFE

732

736

740

743

748

HDFC

2,773

2,796

2,832

2,855

2,891

HEROMOTOCO

2,777

2,814

2,838

2,875

2,899

HINDALCO

468

473

478

483

488

HINDUNILVR

2,720

2,741

2,773

2,794

2,825

ICICIBANK

702

705

709

712

717

IOC

113

114

115

116

117

INDUSINDBK

983

1,010

1,024

1,051

1,066

INFY

1,670

1,678

1,687

1,695

1,704

ITC

213

214

216

218

219

JSW STEEL

686

690

696

700

706

KOTAKBANK

1,830

1,849

1,864

1,883

1,898

LT

1,667

1,682

1,690

1,705

1,714

M&M

741

746

749

754

757

MARUTI

6,796

6,845

6,900

6,949

7,004

NESTLEIND

19,911

20,071

20,340

20,500

20,769

NTPC

114

115

116

116

117

ONGC

121

123

124

125

127

POWERGRID

173

173

174

175

176

RELIANCE

2,348

2,358

2,376

2,386

2,404

SBILIFE

1,152

1,161

1,168

1,177

1,184

SHREECEM

30,234

30,446

30,616

30,828

30,998

SBIN

430

431

434

436

439

SUNPHARMA

772

776

782

787

793

TCS

3,798

3,842

3,869

3,913

3,941

TATACONSUM

873

877

882

886

890

TATAMOTORS

300

303

305

308

310

TATASTEEL

1,432

1,442

1,459

1,469

1,486

TECHM

1,419

1,435

1,446

1,463

1,474

TITAN

2,020

2,038

2,050

2,067

2,079

ULTRACEMCO

7,770

7,813

7,893

7,936

8,016

UPL

742

747

756

761

770

WIPRO

667

670

673

676

679

www.angelone.in

Technical & Derivatives Report

September 15, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst - Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com