Please refer to important disclosures at the end of this report

1

WINDLAS BIOTECH LIMITED

IPO NOTE WINDLAS BIOTECH LIMITED.

August 3, 2021

Windlas Biotech Ltd. The company was incorporated in 2001 based in Dehradun.

The Company operating with 3 business verticals - 1. CDMO Products and

services, 2. Domestic trade generics and Over-the-counter (OTC) market 3.

Exports. The company currently owns and operates four manufacturing facilities

located at Dehradun in Uttarakhand. As of March 31, 2021, their manufacturing

facilities had an aggregate installed operating capacity of 7,063.83 million

tablets/capsules, 54.46 million pouch/ sachet and 61.08 million liquid bottles.

Positives:

(a)

Leading CDMO in India with a focus on the chronic therapeutic

category. (b) Promoter having experience of over two decades in manufacturing

both solid, liquid, and CDMO business along with a good regulatory compliance

track record. (c) Innovative portfolio of complex generic products supported by

robust R&D capabilities. (d)Provides CDMO services to 7 of the top-10 Indian

Pharmaceutical formulations companies. Clients like – Pfizer, Sanofi, Cadila, etc.

Investment concerns: (a) High dependency on CDMO business, 85% of FY2021

revenues. Any slow down in CDMO business can hurt the company’s growth

outlook. (b)Companies top-10 customers contributed 58% of revenue, company

highly dependent on them. (c)Working capital days have increased from 13 days

in FY2020 to 70 days in FY2021.

Outlook & Valuation: Based on FY-2021 adjusted earnings, IPO is priced at PE of

22.2x and EV/EBITDA of 15.58x at the upper band of the IPO price, which is

slightly better than the peer’s companies. The Company has a very healthy

balance sheet with negative Net Debt/ Equity. Quality CDMO business has huge

potential in India in the near future and the company having a good regulatory

compliance track record. We expect the upcoming expansion plan in Dehradun

and increase in capacity utilization will be the next growth drivers for the

company. We are assigning a “SUBSCRIBE” recommendation to the issue.

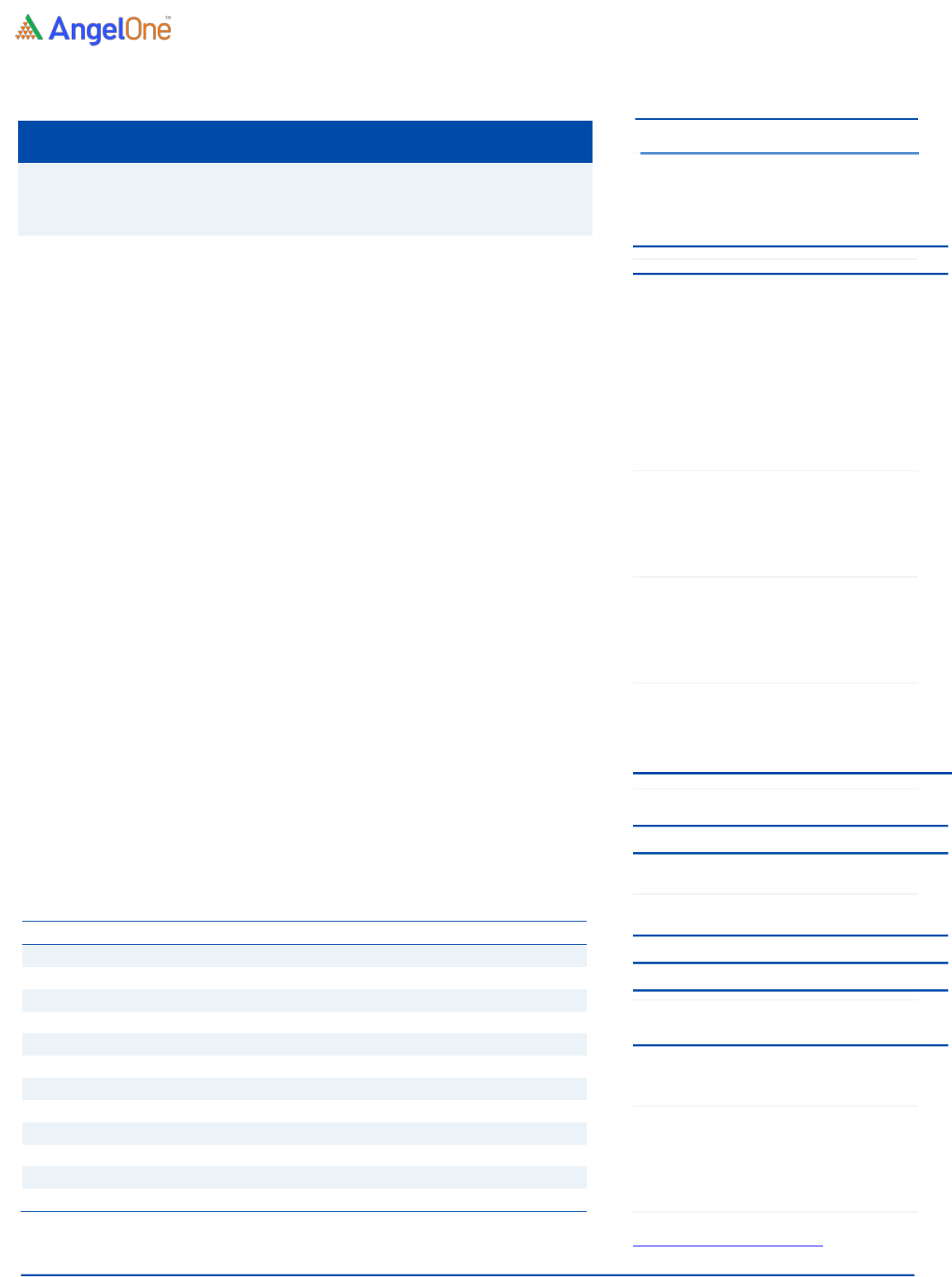

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

206

263

300

% chg

-

27.6

14.1

Net Profit

21

38

52

% chg

-

84.0

38.3

EBITDA (%)

16.4

20.9

21.9

EPS (`)

9.0

17.0

23.6

P/E (x)

120.4

63.5

45.9

P/BV (x)

30.1

20.4

14.5

ROE (%)

50.0

38.3

36.8

ROCE (%)

29.0

22.4

24.1

EV/EBITDA

72.8

45.1

37.8

EV/Sales

11.9

9.4

8.3

Source: Company, Angel Research.

Note: Valuation ratios at upper price band.

SUBSCRIBE

Issue Open: August 4, 2021

Issue Close: August 6, 2021

Issue Details

Face Value: ₹5

Present Eq. Paid up Capital: ₹6.4 Cr

Issue Size: ₹401 Cr

Offer for Sale: ₹236.5 Cr

Fresh issue: ₹165 Cr

Price Band: ₹448-460

Lot Size: 30 shares and in multiple thereafter

Expected Listing : 17th August 2021

Post-issue mkt. cap: * ₹976 Cr - ** ₹1,003 Cr

Promoters holding Pre-Issue: 78%

Promoters holding Post-Issue: 65.2%

*Calculated on lower price band

** Calculated on upper price band

Book

Building

QIBs

50% of issue

Non-Institutional

15% of issue

Retail

35% of issue

Post issue Shareholding pattern

Promoters

Others

65.2%

34.8%

Windlas Biotech Limited | IPO Note

August 3, 2021

2

Company background

Incorporated in 2001, Windlas Biotech Ltd is one of the leading companies in the

pharmaceutical formulations contract development and manufacturing organizations

(CDMO) segment in India. The company offers a range of CDMO services from product

discovery to product development, licensing, and commercial manufacturing of generic

products including complex generics.

It further sells its own branded products in the trade generics and OTC markets.

Currently, the focus of the company is to launch complex generic products in the chronic

therapeutic category related to lifestyle-related disorders. The business operates in 3

verticals; 1. CDMO Products and services, 2. Domestic trade generics and Over-the-

counter (OTC) market (nutraceutical and health supplement products), and 3. Export.

Leading pharma companies i.e. Pfizer Ltd, Sanofi India Ltd, Cadila Healthcare Ltd,

Emcure Pharmaceuticals Ltd, Eris Lifesciences Ltd, Intas Pharmaceuticals Ltd, and

Systopic Laboratories Private Limited are some of the marquee customers of Windlas

Biotech. Its manufacturing facilities are located at Dehradun with an installed operating

capacity of 7,063.83 million tablets/ capsules, 54.46 million pouch/ sachet, and 61.08

million liquid bottles.

Issue details

The issue comprises of offer for sale of upto ₹236.5 crore and Fresh issue of 165

crores with the price band of ₹448-460.

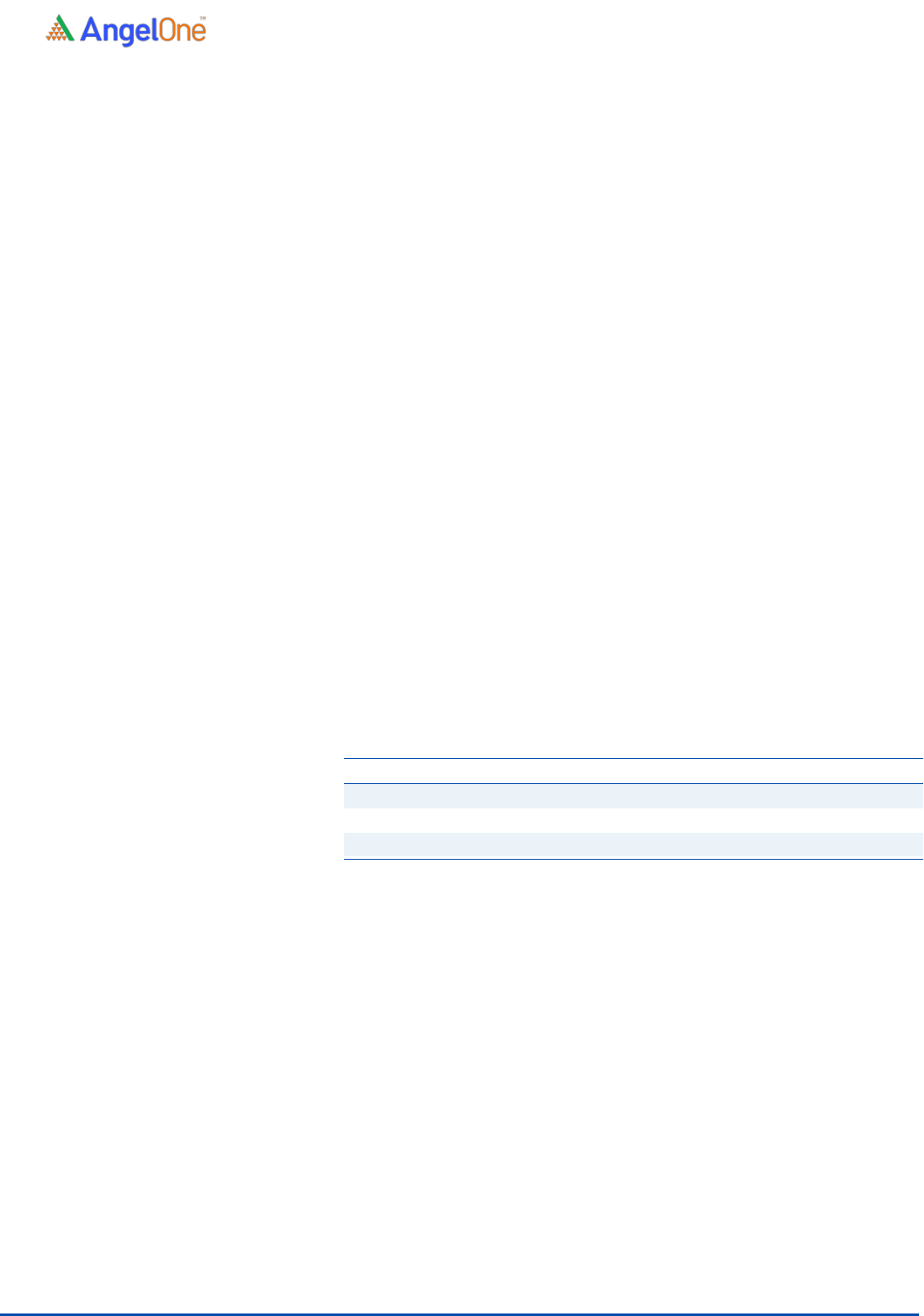

Pre & Post Shareholding Pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

1,42,01,787

78.0%

1,42,01,215

65.2%

Public

40,05,632

22.0%

75,93,160

34.8%

Total

1,82,07,419

100%

2,17,94,376

100%

Source: Company, Angel Research

Objectives of the Offer

Purchase of equipment required for capacity expansion of their existing

facility at the Dehradun. (50 Cr)

Funding incremental working capital requirements of the Company. (47.5 Cr)

Repayment of certain borrowings (20 Cr.)

Windlas Biotech Limited | IPO Note

August 3, 2021

3

Key Management Personnel

Vivek Dhariwal is the Chairman and Non-Executive Independent Director of the

Company. He holds a bachelor’s degree in technology (chemical engineering) from

the Indian Institute of Technology, Bombay and a master’s degree in science

(chemical engineering) from University of Kentucky.

Ashok Kumar Windlass is the Wholetime Director of our Company. He holds a

diploma in civil engineering from Government Polytechnic, Ambala City. He has

over 20 years of experience in the manufacturing and pharmaceutical business in

India. He is one of Promoters and one of the founders of Company.

Hitesh Windlass is the Managing Director of Company. He holds a bachelor’s

degree in ceramic engineering from the Indian Institute of Technology, Banaras

Hindu University, a master’s degree in science in materials science and

engineering from The Georgia Institute of Technology and a master’s degree in

business administration from the Graduate School of Business, University of

Chicago. He has set up our Domestic Trade Generics, OTC Brands and Exports

SBVs and plays a significant role in driving the technical operations, quality, R&D,

manufacturing strategy and financial strategy of our Company.

Manoj Kumar Windlass is the Joint Managing Director of Company. He holds a

bachelor’s degree in business administration from Georgia State University,

Atlanta. He has over 15 years of experience in product development, operations,

procurement and portfolio functions of the medicine business. He has set up

CDMO Services and Products SBV and plays a significant role in driving the

product portfolio decisions and overall commercial operations.

Pawan Kumar Sharma is an Executive Director of our Company. He holds a

bachelor’s degree in Law from the Hemwati Nandan Bahuguna Garhwal University,

Srinagar (Garhwal). He is responsible for the commercial and administrative

activities of the Company. He has over 20 years of experience in the

pharmaceutical industry.

Windlas Biotech Limited | IPO Note

August 3, 2021

4

Consolidated Profit & Loss Account

Y/E March (₹ Cr)

FY2019

FY2020

FY2021

Total operating income

307

329

428

% chg

-

7.0

30.0

Total Expenditure

269

287

373

Cost of Material Consumed

188

224

271

Changes in Inventories

4

(13)

4

Employee Benefit Expenses

43

44

58

Other Expenses

34

32

40

EBITDA

39

41

55

% chg

-

7.7

31.9

(% of Net Sales)

12.5

12.6

12.8

Depreciation& Amortisation

11

9

13

EBIT

27.9

32.2

41.7

% chg

-

15.2

29.7

(% of Net Sales)

9.1

9.8

9.8

Finance costs

4.8

2.5

1.3

Other income

4.3

2.5

3.1

(% of Sales)

1.4

0.8

0.7

Recurring PBT

27.3

32.1

43.5

% chg

-

17.5

35.5

Gain/loss in Joint Venture/associate

(0.8)

(7.5)

(0.2)

Exceptional item

49.5

-

(21.6)

Tax

12.3

8.5

6.2

PAT (reported)

63.8

16.2

15.6

% chg

-

(74.6)

(4.0)

(% of Net Sales)

20.8

4.9

3.6

Basic & Fully Diluted EPS (Rs)

3.5

8.9

8.6

Source: Company, Angel Research

Windlas Biotech Limited | IPO Note

August 3, 2021

5

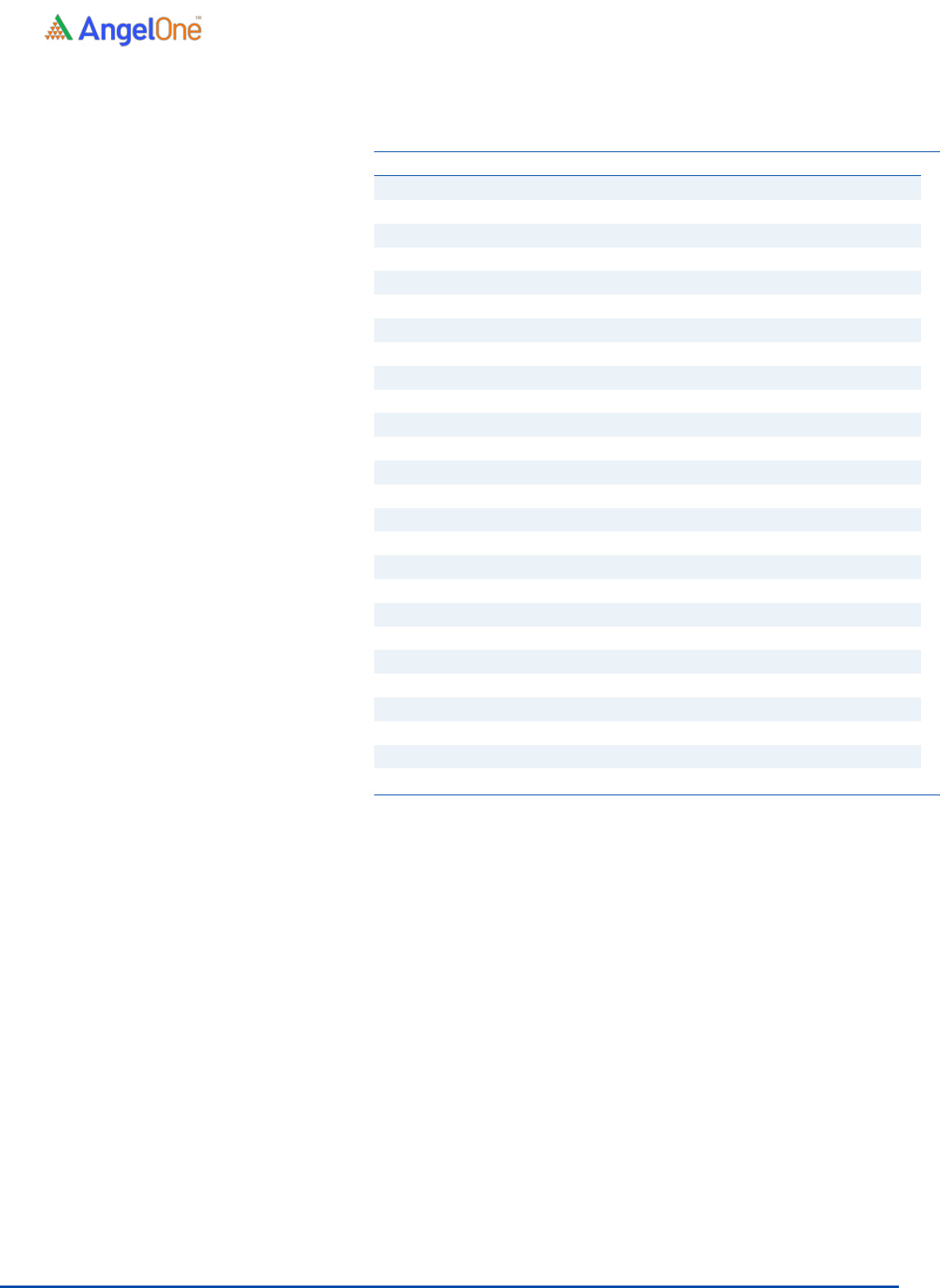

Consolidated Balance Sheet

Y/E March (₹ Cr)

FY2019

FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

6.4

6.4

6.4

Other equity (Retained Earning)

187.2

203.2

192.7

Shareholders Funds

193.6

209.7

199.1

Total Loans

22.9

22.2

30.2

Other liabilities

2.6

2.3

2.8

Total Liabilities

219.0

234.1

232.1

APPLICATION OF FUNDS

Property, Plant and Equipment

59.7

66.1

92.5

Capital work in Progress

4.6

-

0.0

Right of Use

4.2

3.6

3.0

Goodwill

-

-

-

Other Intangible Assets

0.4

0.6

0.5

Investments

101.5

94.0

-

Current Assets

120.5

168.0

194.3

Inventories

19.0

49.3

41.5

Investments

20.9

22.3

23.1

Trade Receivables

61.7

63.9

79.4

Cash and Cash Equivalents

12.9

18.1

15.9

Bank Balance other than cash and cash

equivalents

0.3

0.3

15.2

Other Financial Assets

0.1

0.1

0.5

Current Tax Assets (Net)

-

0.9

4.0

Other Current Assets

5.5

13.1

14.8

Current Liability

79.1

104.3

64.0

Net Current Assets

41.3

63.7

130.3

Other Non Current Asset

7.4

6.2

5.8

Total Assets

219.0

234.1

232.1

Source: Company, Angel Research

Windlas Biotech Limited | IPO Note

August 3, 2021

6

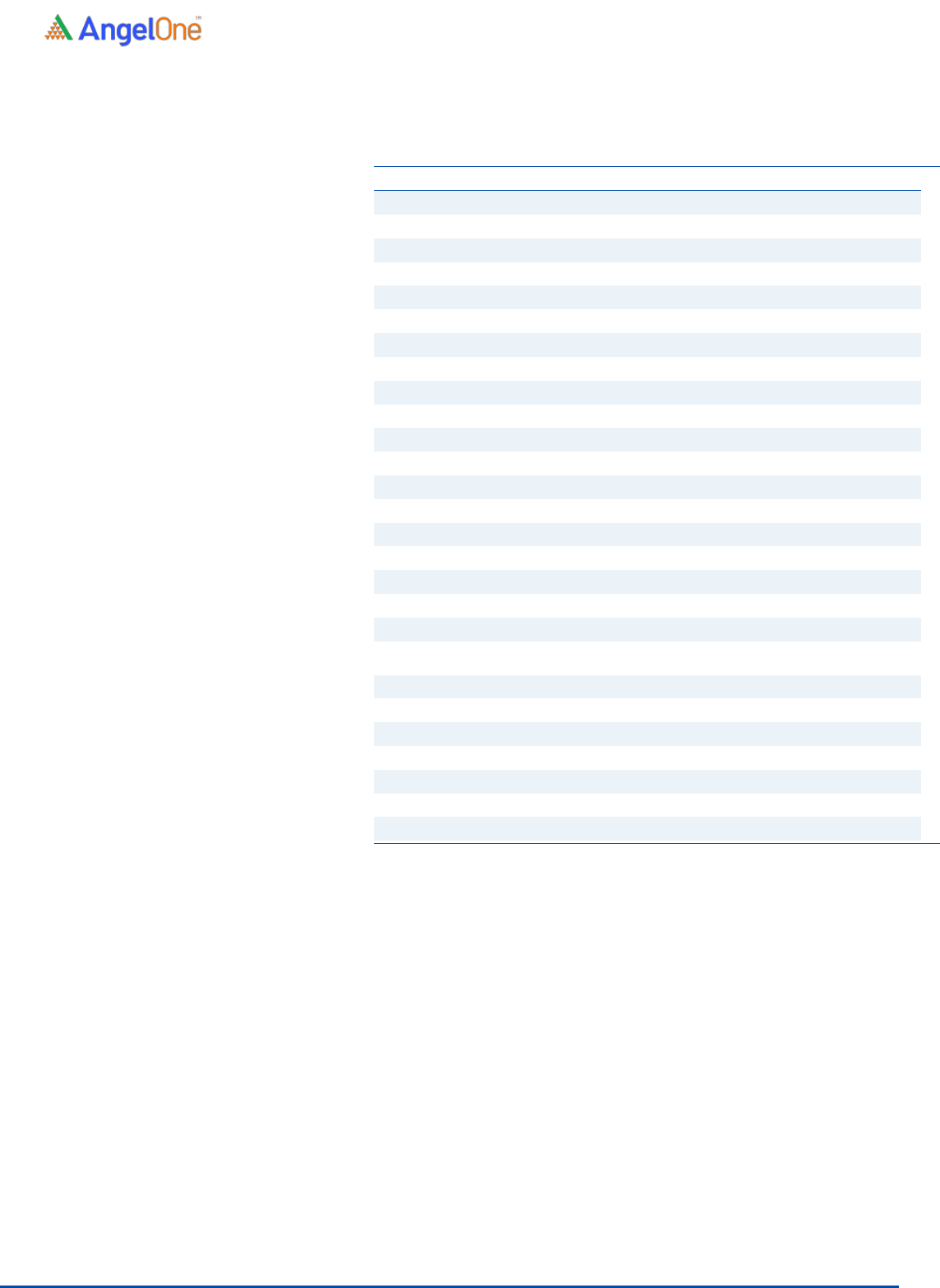

Consolidated Cash Flow Statement

Y/E March (₹ Cr)

FY2019

FY2020

FY2021

Operating profit before working capital changes

42.2

42.0

58.0

Net changes in working capital

(11.5)

(3.5)

(40.0)

Cash generated from operations

30.7

38.4

18.0

Direct taxes paid (net of refunds)

(12.1)

(13.4)

(6.5)

Net cash flow (used in)/from operating activities

18.7

25.0

11.5

Purchase of property, plant & equipment

(9.0)

(15.3)

(5.8)

Interest received

0.7

0.9

1.7

Others

3.0

0.1

(16.0)

Cash Flow from Investing

(5.3)

(14.3)

(20.2)

Proceeds/(Repayment) of Short-Term Borrowings

(4.4)

3.9

8.5

Share Issue Expense

-

0

(1.3)

Proceeds from issue of equity shares

4.8

-

-

Repayment of Long-Term Borrowings

(1.3)

(6.3)

(4.6)

Repayment of Lease liabilities (principal portion)

(0.4)

(0.4)

(0.5)

Interest paid (including interest on lease liabilities)

(5.0)

(2.5)

(1.4)

Cash Flow from Financing

(6.2)

(5.4)

0.8

Inc./(Dec.) in Cash

7.2

5.2

(8.0)

Opening Cash balances

7.2

12.9

18.1

Cash acquired on acquisition

(1.5)

-

5.8

Closing Cash balances

12.9

18.1

15.9

Source: Company, Angel Research

Key Ratio

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

130.6

51.7

53.8

P/CEPS

11.3

32.8

29.4

P/BV

4.3

4.0

4.2

EV/Sales

2.8

2.6

2.0

EV/EBITDA

22.0

20.3

15.6

Per Share Data (Rs)

EPS (Basic)

3.52

8.9

8.6

EPS (fully diluted)

3.5

8.9

8.6

Cash EPS

40.9

14.0

15.7

Book Value

106.3

115.2

109.4

Returns (%)

ROE

33.0

7.7

7.8

ROCE

12.7

13.7

18.0

Turnover ratios (x)

Receivables (days)

73.3

71.0

67.8

Inventory (days)

22.6

54.7

35.4

Payables (days)

-

-

-

Working capital cycle (days)

95.9

125.7

103.2

Source: Company, Angel Research

Windlas Biotech Limited | IPO Note

August 3, 2021

7

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.