1

For Private Circulation Only

Technical and Derivatives Review | August 27, 2021

Nifty continues to hit new milestones

Sensex (56125) / Nifty (16705)

Source: Trading View

Future outlook

Post previous weeks volatility, Nifty started the week on a positive note as the global markets recovered which led to some positive

sentiment. Market participants looked a bit perplexed on Monday, but the broader markets saw buying interest on Tuesday which

led to an upmove in the index to march towards new highs again. In next couple of sessions, Nifty consolidated within a range till

expiry and it again resumed the momentum on the last day to end the week above 16700.

Inspite of the volatility in the midcap and smallcap space, the index has managed to hold on and has continued to register new highs.

However, the broader markets got its mojo back as many stocks witnessed buying interest from their respective supports. The index

continues to be in an uptrend and thus one should continue to trade with a positive bias and avoid taking any contra trades until any

reversal seen. The only concern that we have been highlighting is the banking index which has shown a relative underperformance

for so long. But, this index is still in a consolidation phase and has not breached it's important supports. Hence, there's a good

probability of some buying interest emerging in this sector which would then lead to further support to the benchmark. The

immediate supports for Nifty are placed around 16600 and 16500 while the levels to watch on upside will be 16800 and then 17000

mark.

Recently we have seen that when everything looks hunky dory, we see some volatile stock specific moves. Also how the global

markets shape up in the near term due to events can have an impact on our markets. Hence, one should keep track on the global

developments and also book timely profits in trading positions.

2

For Private Circulation Only

Technical and Derivatives Review | August 27, 2021

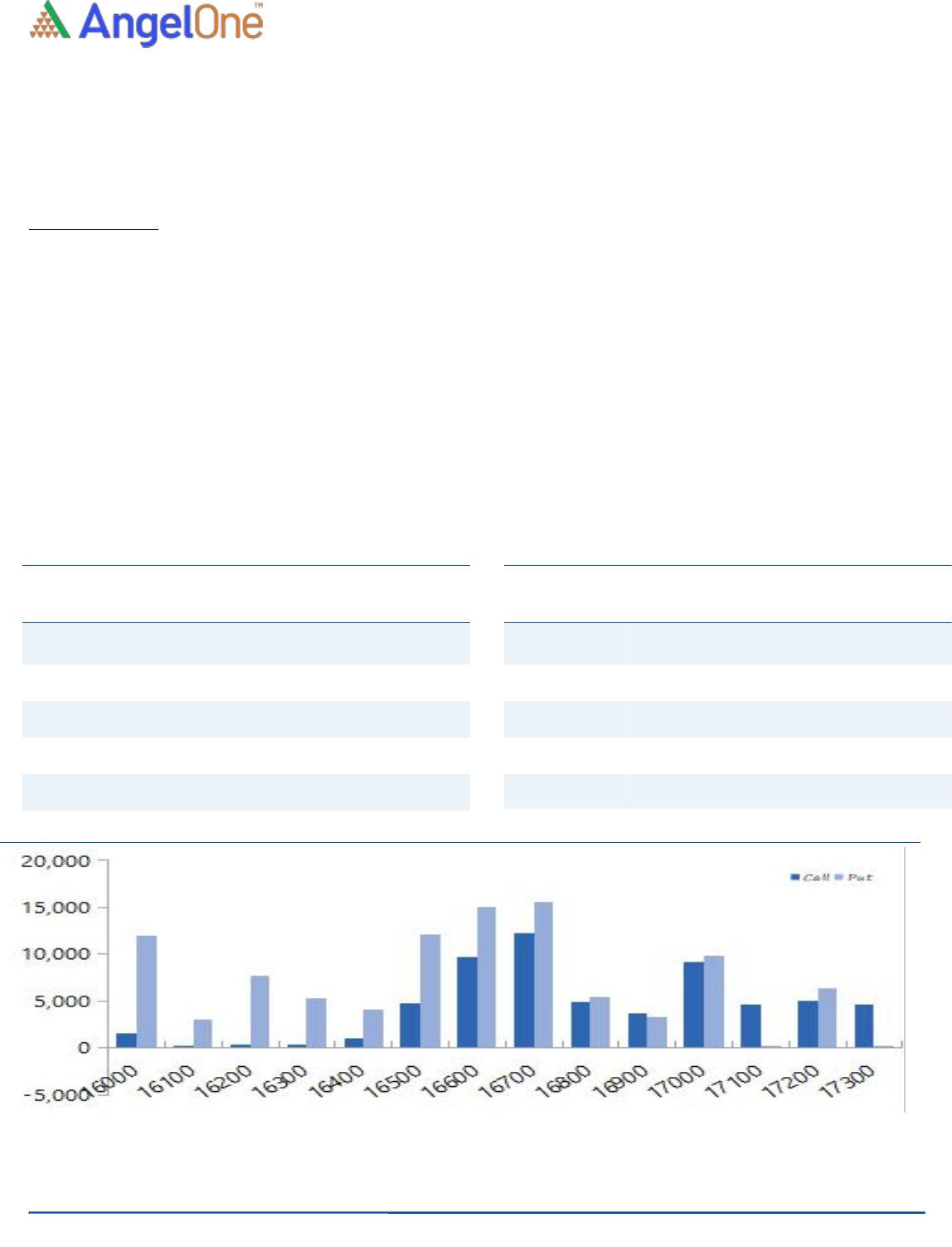

Nifty support base shifts higher to 16600

Nifty spot closed at 16705.20 this week, against a close of 16450.50 last week. The Put-Call Ratio has increased from 1.21 to 1.40.

The annualized Cost of Carry is positive at 0.83%. The Open Interest of Nifty Futures increased by 1.88%.

Derivatives View

Nifty current month future closed with a discount of 9.10 points against a premium of 16.95 points to its spot. Next month future is

trading at a premium of 31.80 points.

Nifty started the week on a positive note following the global cues. The index gradually moved higher and ended the week above

16700 with gains of over one and a half percent. The rollover data indicates that long positions in Nifty have been rolled to

September series while the shorts in the banking space have not been rolled to the next series. FII’s have rolled good amount of

stock futures longs and currently their ‘Long Short Ratio’ in index futures stands at 66 percent. The above mentioned data is

optimistic and hints that we should see a continuation of the rally in the near term and hence traders should trade with a positive

bias. It would be crucial to see how positions develop in the BankNifty index hereon and if there’s any addition of fresh long

formation in this space, then it could take the leadership in lifting the benchmark higher. As per the open interest data, 16600 would

be seen as a support for the coming week while 16800 and 17000 are levels to watch on the higher side.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

MARUTI

3506600

14.31

6656.55

(2.75)

BHARATFORG

8544000

6.31

730.60

(2.92)

EICHERMOT

4130000

5.66

2556.15

(1.23)

MARICO

10336000

5.47

527.30

(2.00)

TITAN

4750500

4.44

1830.20

(2.50)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

TORNTPOWER

3042000

11.55

490.10

8.50

ESCORTS

5894900

7.73

1353.10

13.46

HDFCAMC

950200

6.57

3043.75

3.85

ICICIBANK

86297750

5.60

700.90

2.78

NAUKRI

958000

4.39

5918.65

9.83

3

For Private Circulation Only

Technical and Derivatives Review | August 27, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com