1

For Private Circulation Only

Technical and Derivatives Review | September 24, 2021

Despite early hiccups, benchmark ends at new highs

Sensex (60048) / Nifty (17853)

Source: Tradingview.com

Future outlook

Monday morning, the global screen was looking extremely terrible and in line with SGX Nifty, we started the week around the 17450 mark.

Surprisingly, after the initial hiccup, we witnessed a v-shaped recovery not only to erase losses but also to trade in the green above 17600.

However, it could not decouple itself from the global peers for a long time as the markets took a U-turn post the mid-session, to finally

sneak below 17400 on a closing basis. The following session initially traded weak but thereafter the global markets stabilized so as ours.

After entering a key support zone of 17350 – 17250, the Nifty reversed in the upward direction and then kept thrashing all intermediate

hurdles one after another. In fact, due to decent rally in the latter half of the week, Nifty went on to register a new high convincingly above

the 17900 mark.

Our markets had a remarkable comeback in last four sessions as we not only managed to recover from lows but also went on to clock fresh

highs. We have clearly outperformed the global peers because despite a relief move in last two days, they are still trading well below their

highs. Honestly speaking, the recovery beyond 17600 has certainly surprised us but eventually market is superior. Ideally, after market

surpassing previous highs, our cautious stance should have been negated; but there are a few time-wise projections as well as negative

divergence in ‘RSI-Smoothened’ oscillator, clearly holding us back. Hence we would keep reassessing the situation closely for next few days.

As far as levels are concerned, every 100 points psychological level from here would be seen as immediate resistance i.e. 17900 – 18000.

On the flipside, 17700 – 17650 are to be seen as key supports.

We advise traders to continue with a stock specific approach but keep booking timely profits as well and also avoid carrying aggressive

overnight bets. Meanwhile all eyes on global markets and on how banking index move ahead from here on which could probably decide the

next path of action for markets.

2

For Private Circulation Only

Technical and Derivatives Review | September 24, 2021

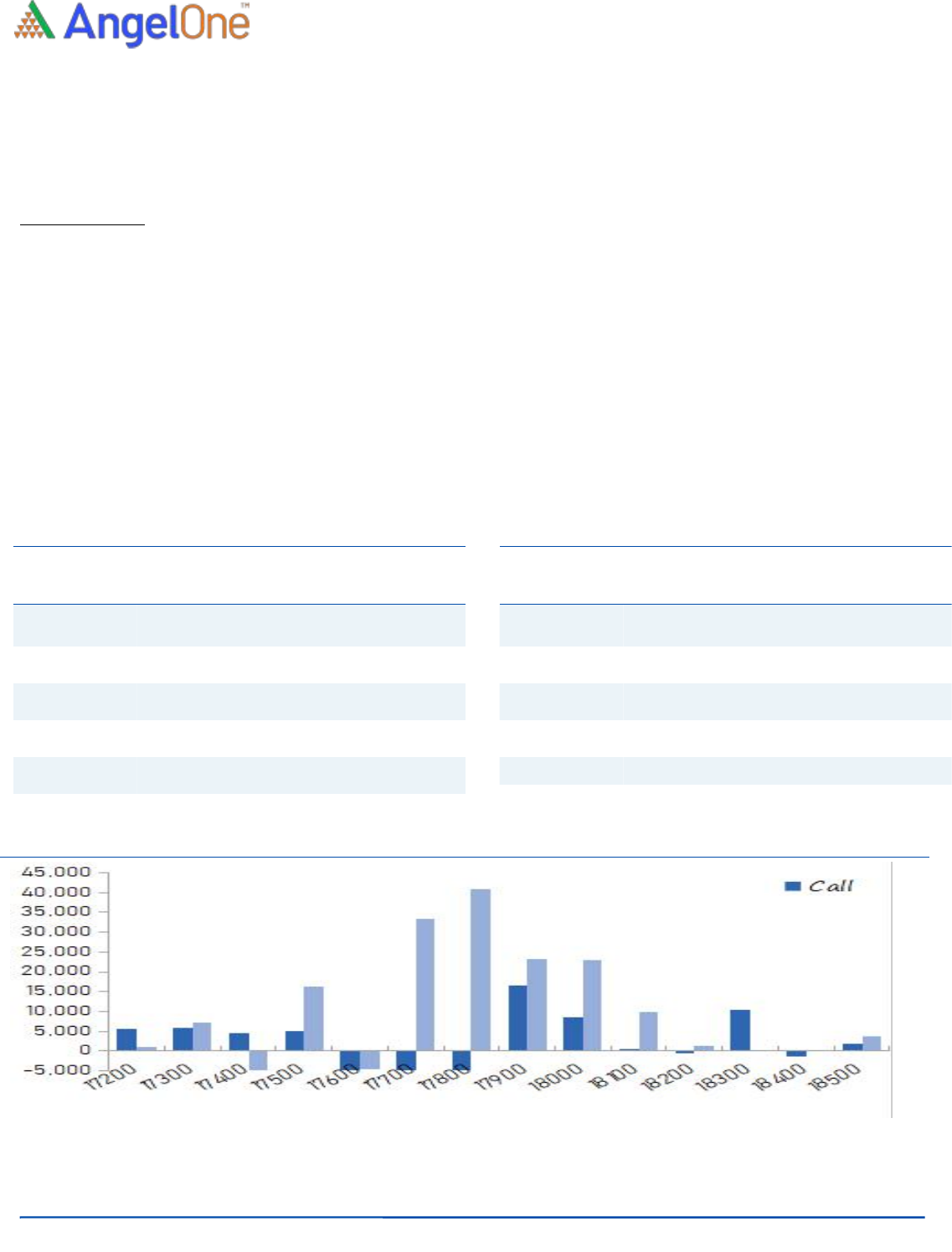

Options data hints support at 17800-17700

Nifty spot closed at 17853.20 this week, against a close of 17585.15 last week. The Put-Call Ratio has increased from 1.15 to 1.27.

The annualized Cost of Carry is positive at 0.14%. The Open Interest of Nifty Futures decreased by 4.77%.

Derivatives View

Nifty current month future closed with a discount of 4.85 points against a premium of 19.85 points to its spot. Next month future is

trading at a premium of 26 points.

Nifty started the week on a negative note where unwinding was seen in Nifty while Bank Nifty corrected due to short formation.

Nifty almost corrected upto 17300, but we witnessed a sharp recovery on the weekly expiry day an the index marked new high

before end of the week. The Banking index too witnessed short covering and recovered all the losses seen at the start of the week.

FII’s unwound some of their index futures longs but were buyers in the stock futures segment. In options segment, the call writers

ran to cover their positions on the weekly expiry day as the index surpassed its important hurdles. Now highest open interest is

placed at 18000 call which would be seen as immediate resistance. On the flipside, 17800-17700 is seen as immediate supports.

Traders are advised to trade with a stock specific approach and avoid aggressive overnight positions.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

AUBANK

6495500

33.57

1072.45

(4.25)

METROPOLIS

412800

27.41

3040.15

(3.27)

GUJGASLTD

6371250

25.57

622.25

(6.24)

TATACONSUM

10733850

25.21

838.10

(4.34)

RAMCOCEM

2404650

21.31

967.40

(4.45)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

GODREJPROP

3277300

75.37

2194.65

35.50

INDHOTEL

17569500

36.35

179.25

19.82

PVR

3348389

28.29

1512.95

8.32

BALKRISIND

1744000

28.08

2663.20

6.70

GMRINFRA

120577500

21.05

36.10

14.24

3

For Private Circulation Only

Technical and Derivatives Review | September 24, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com