1

For Private Circulation Only

Technical and Derivatives Review |October 23, 2023

Global overhang keeps market in check; Midcap index in jeopardy

Sensex (65398) / Nifty (19543)

Source: Tradingview.com

Future Outlook

The Indian equity market started the week on a cautious note, wherein the benchmark index initially showed some resilience to the

global uncertainties and tried making a move on the higher front. But by the latter half of the week, it succumbed to the global

pressure and slipped towards the pivotal support zone. Eventually, Nifty took a breather after two consecutive weeks of recovery

and managed to withhold the crucial zone 19500, with a cut of over a percent in the week.

Technically, the Nifty50 index was restrained from the bearish gap on the daily chart and reverted towards the pivotal level amidst

the unfavourable global scenario. Fortunately, there has not been a significant plunge in our indices, rather just a retraction into the

consolidation zone. The market conditions remain tentative till global uncertainty prevails and the same could be seen on the

technical charts. As far as levels are concerned, the bullish gap of 19490-19450 withholds immediate support, followed by 19400,

while any breakdown could disrupt the ongoing view, and the recent swing low of 19333 would become very much in the vicinity.

On the higher end, 19700-19750 is expected to act as an immediate hurdle, followed by the formidable resistance of 19850-19880

(Bearish Gap) and an authoritative breakthrough could only re-strengthen the lost momentum to the bulls of D-Street.

Going ahead, we would likely remain cautious amidst the ongoing geopolitical scenario, which may be deceptive and could trap the

traders on either side. Hence, one needs to follow the aforementioned levels thoroughly and in the meantime, stay abreast with the

geopolitical developments. Also, it is advisable to avoid aggressive overnight bets as an intense bout of profit booking/correction is

evident in the Midcap space as indicated by the negative crossover of the 'RSI-Smoothened in weekly time frame chart. This

condition is very rare as the negative development in this oscillator is visible in the extreme overbought territory, coupled with a

breakdown in prices during Friday's session.

2

For Private Circulation Only

Technical and Derivatives Review |October 23, 2023

Sho

rt

Form

at

ion

Stronger hands added bearish bets

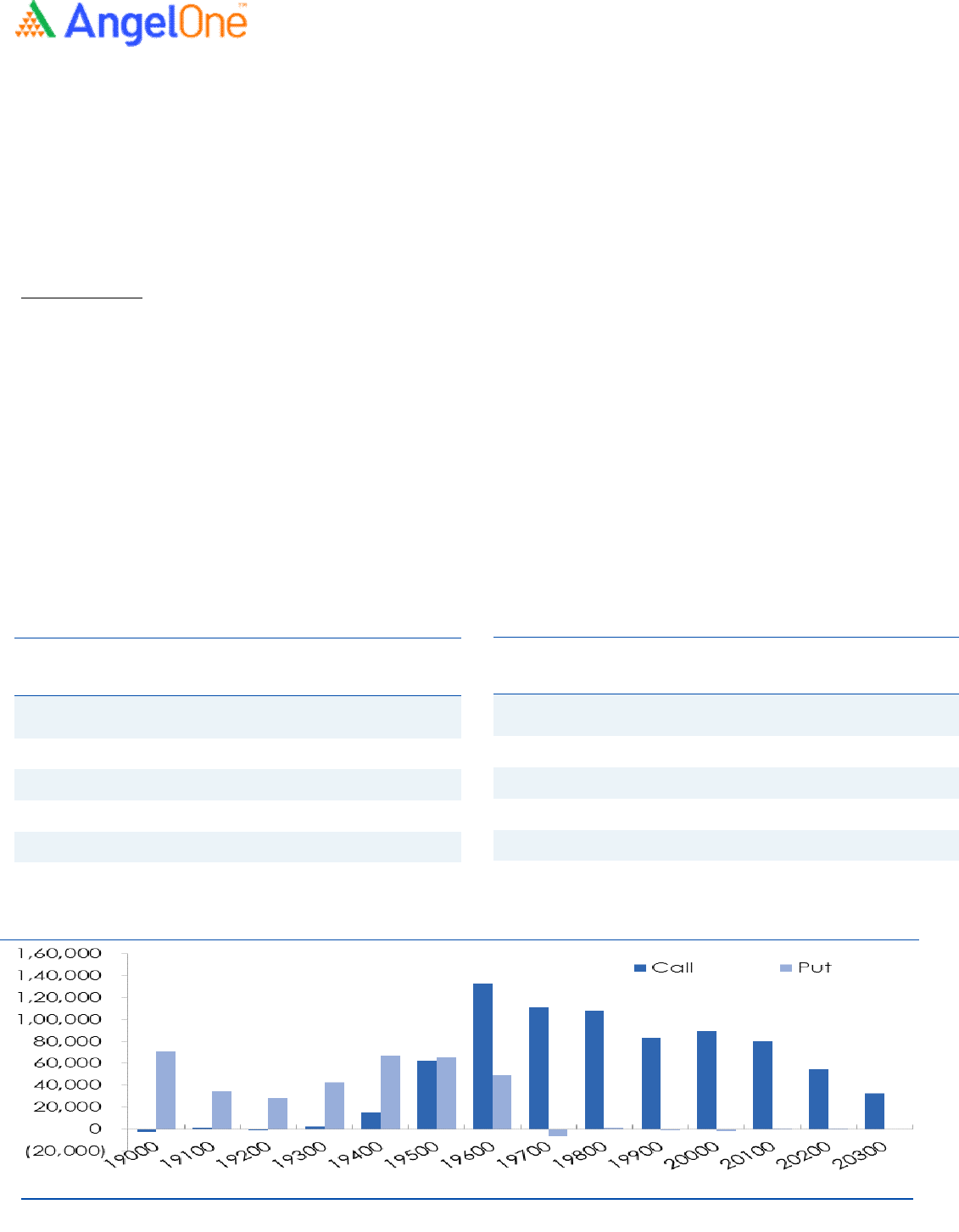

Nifty spot closed at 19542.65 this week, against a close of 19751.05 last week. The Put-Call Ratio has decreased from 1.14 to 0.90 on

a weekly basis. The annualized Cost of Carry is at -1.28%. The Open Interest of Nifty Futures decreased by 4.49%.

Derivatives View

Nifty current month’s future closed with a discount of 14.80 against a discount of 9.00 points to its spot in the previous week. Next

month’s future is trading at a premium of 111.50 points.

The market witnessed a volatile week, initially index rebounded towards 19850 mark. However, we witnessed smart selling on

Wednesday and follow-up selling was extended till the last day to test 19550. Eventually, with no sign of recovery, the index

concluded the week tad above 19500. On the derivatives front, we observed decent unwinding in key indices on a WoW basis. FIIs

remained net sellers in equities on net basis and added bearish bets in index futures segments. Hence their LSR decreased slightly to

26% from 27% seen during the start of the week. For the coming monthly series, call writers reminded activity in 19600-19700

strikes, while no relevant activity was observed on the put side. Highest open interest concentration is now visible in 19600 call and

19500 put strikes. For now, we would advocate avoiding any aggressive directional bets in index and trade in individual space but

being selective.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

HDFCLIFE 18423900 21.47 625.60 (2.17)

BALRAMCHIN 12412800 15.76 417.25 (1.53)

JKCEMENT 778500 13.61 3250.65 (1.67)

LTIM 1919400 13.38 5099.75 (6.04)

INDIACEM 24423800 13.11 223.45 (1.37)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

DELTACORP 15545600 23.38 140.35 7.47

BHEL 118566000 11.25 128.40 2.64

COROMANDEL 1467200 9.22 1154.55 1.21

HINDUNILVR 9578100 9.12 2569.95 3.22

GRANULES 10134000 9.11 354.25 2.65

3

For Private Circulation Only

Technical and Derivatives Review |October 23, 2023

Sameet Chavan Head Research – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Analyst – Technical rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Hitesh Rathi Analyst – Technical & Derivatives hitesh.rathi@angelone.in

Research Team Tel: 022 - 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

We, Angel One Limited (hereinafter referred to as “Angel”) a company duly incorporated under the provisions of the Companies Act, 1956 with its

registered office at 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai – 400093, CIN: (L67120MH1996PLC101709) and duly

registered as a member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi

Commodity Exchange of India Ltd and National Commodity & Derivatives Exchange Ltd. Angel One limited is a company engaged in diversified

financial services business including securities broking, DP services, distribution of Mutual Fund products. It is also registered as a Depository

Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor.

Angel One Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164 and also registered with PFRDA as PoP ,Registration No.19092018. Angel Group does not have any joint ventures or

associates. Angel One Limited is the ultimate parent company of the Group. . Angel or its associates has not been debarred/ suspended by SEBI or

any other regulatory authority for accessing /dealing in securities Market.

AOL was merged with Angel Global Capital Private Limited and subsequently name of Angel Global Capital Private Limited was changed to Angel

Broking Private Limited (AOL) pursuant to scheme of Amalgamation sanctioned by the Hon'ble High Court of Judicature at Bombay by Orders

passed in Company Petition No 710 of 2011 and the approval granted by the Registrar of Companies. Further, name of Angel Broking Private

Limited again got changed to Angel Broking Limited (AOL) pursuant to fresh certificate of incorporation issued by Registrar of Companies (ROC)

dated June 28, 2018. Further name of Angel Broking name changed to Angel One Ltd pursuant to fresh certificate of incorporation issued by

Registrar of Companies (ROC) dated 23-09-21.

In case of any grievances please write to: support@angelone.in, Compliance Officer Details: Name : Hiren Thakkar, Tel No. –08657864228, Email id

- compliance@angelone.in

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns

to investors.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

4

For Private Circulation Only

Technical and Derivatives Review |October 23, 2023

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither research entity nor research analyst has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited does not warrant the accuracy, adequacy or

completeness of the service, information and materials and expressly disclaims liability for errors or omissions in the service, information and

materials. While Angel One Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with

the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Any communication sent to clients on phone numbers or e-mail ids registered with the Trading Member is meant for client consumption and such

material should not be redistributed. Brokerage will not exceed SEBI prescribed limit. Any Information provided by us through any medium based

on our research or that of our affiliates or third parties or other external sources is subject to domestic and international market conditions and we

do not guarantee the availability or otherwise of any securities or other instruments and such Information is merely an estimation of certain

investments, and we have not and shall not be deemed to have assumed any responsibility for any such Information. You should seek independent

professional advice and/or tax advice regarding the suitability of any investment decision whether based on any Information provided by us

through the Site from inhouse research or third party reports or otherwise.

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written

consent.