1

For Private C

irculation Only

Technical and Derivatives Review | November 18, 2021

17700 becomes a trend deciding level for Nifty

Sensex (59575) / Nifty (17765)

Source: Tradingview.com

Future outlook

We had an excellent start to the week on Monday owing to favourable global cues. However, markets failed to sustain at higher as

the early morning gains just disappeared in the first half. During the remaining part of the day, Nifty kept flirting around the

equilibrium point. Eventually in the absence of any momentum, Nifty ended the session tad above the 18100 mark. As the week

progressed, markets started becoming a bit nervous and hence, we could see it grinding lower gradually by breaking minor supports

on the way through. The selling aggravated on Thursday and in the process we first breached 17800 and then went on to even slide

below the crucial support of 17700. Due to the modest recovery in the latter half, the bulls managed to defend this level on a closing

basis.

During the week, Nifty did correct by nearly a couple of percent; which certainly cannot be considered as a major damage. Also it did

close above the key support on a weekly basis but the way overall things are positioned, we will not be surprised to see it

surrendering (17700) in the first half of the forthcoming week itself. Since last few days, we have been mentioning the ‘Head and

Shoulder’ pattern on the daily chart of Nifty which was in process. After Thursday’s close, the final (right) shoulder of this pattern is

completed and prices are placed exactly at the ‘Neckline’ point of the same. A sustainable move below 17700 (which seems likely)

would activate the pattern and as a result of this, we could see a fresh leg of correction in coming days. After this, next levels to

watch out for would be 17450 and 17200, where one needs to reassess the situation. On the flipside, if Nifty manages to hold 17700

and move higher first, then 18000 – 18200 are to be considered as strong hurdles, which as of now we do not expect to get

surpassed in the near future.

The major culprit in this week’s correction was the continuous weakness in banking and metal counters. Although banking index is

nearing its strong support zone, we do not expect any major bounce back in this space. Apart from this, the broader market looked a

bit tentative on Thursday and the way it’s closed; things do not augur well for the bulls. To summarize, we advise traders to remain

light which we have been advocating of late and even if one wants to accumulate stocks with a broader perspective, one needs to be

a bit patient as we expect some reasonable prices to come in next few days.

2

For Private C

irculation Only

Technical and Derivatives Review | November 18, 2021

Stronger hands added bearish bets in index futures

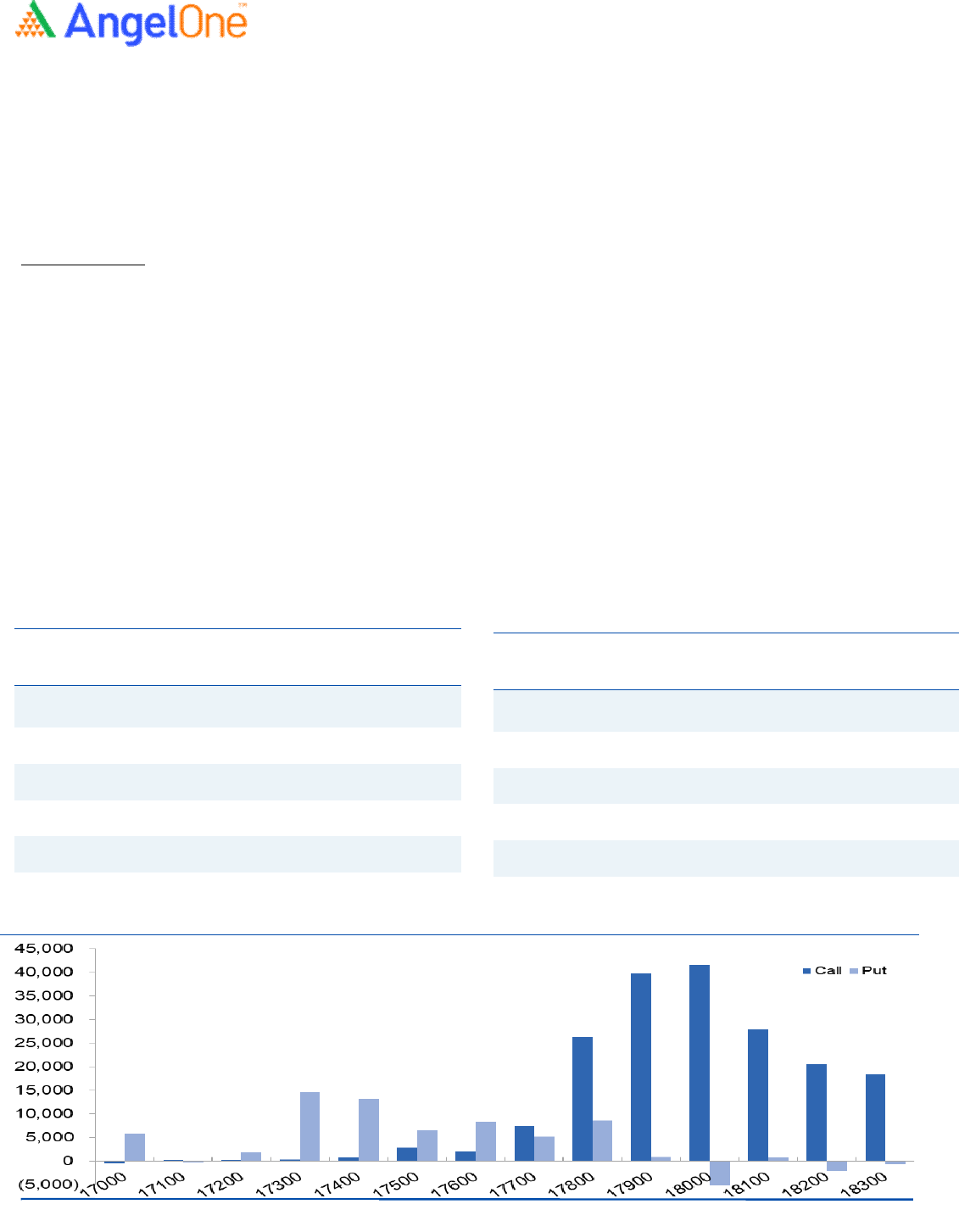

Nifty spot closed at 17764.80 this week, against a close of 18102.75 last week. The Put-Call Ratio has decreased from 1.16 to 0.78.

The annualized Cost of Carry is positive at 8.25%. The Open Interest of Nifty Futures increased by 7.06%.

Derivatives View

Nifty current month future closed with a premium of 28.10 points against a premium of 30.70 points to its spot. Next month future

is trading at a premium of 86.30 points.

The benchmark index reclaimed 18200 in the early morning trade on Monday but due to lack of follow-up buying attracted decent

profit booking. Infact, next three session market continued to slide lower breaching important supports one by one. On Thursday,

the index plunged below 17700 but due to some respite in the midst concluded the week tad above 17750 with a cut of almost two

percent. In F&O space, we saw open interest addition in both the indices with clearly suggests fresh shorts where formed during the

week (wherein banking index added massive shorts as outstanding contracts surged more than 20%). Stronger hands too preferred

adding bearish bets in index futures, resulting Long Short Ratio declining from 57% to 54%. For the coming monthly expiry, we

noticed massive writing in 17800-18000 call strikes which may now act as a sturdy wall now. The above data hints further pain going

ahead; hence, would advocate traders avoiding any kind of bottom fishing for now and infact aggressive traders should buy ATM or

slightly OTM puts incase of any recoveries.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

IPCALAB 3170025 41.17 2038.20 (5.91)

RECLTD 47610000 34.29 136.05 (6.53)

GRANULES 15120250 21.72 305.85 (1.92)

MANAPPURAM 26460000 20.39 183.50 (16.06)

AXISBANK 62208000 19.98 707.95 (4.16)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

COFORGE 863800 47.08 5510.30 1.85

METROPOLIS 911800 14.40 3155.05 2.12

APOLLOHOSP 2357375 13.80 5598.55 19.78

LTTS 677400 8.49 5630.15 6.21

PIIND 1695500 8.01 2874.10 4.58

Short Formation

3

For Private C

irculation Only

Technical and Derivatives Review | November 18, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivative Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in