1

For Private Circulati

on Only

Technical and Derivatives Review

| June 18, 2021

Nifty ends its weekly winning streak but holds key supports

Sensex (52344) / Nifty (15683)

Source: Trading View

Future outlook

Monday’s session started on a flat note; however, before anyone could realize Nifty was down by nearly 200 points within the first

half an hour to test the 15600 mark. This was followed by a bounce back and then consolidation for the major part of the first half.

During the second half, bulls again picked up some momentum to erase all the morning losses and ended marginally in the green tad

above 15800. On the following day, Nifty reached yet another milestone of 15900; but thereafter, some sort of tentativeness was

visible in the banking space as well as the broader market. The real impact of this was witnessed on Friday as we saw Nifty tumbling

more than 300 points in a matter of 2 hours. The action was not done yet as we saw almost a v-shaped recovery in the remaining

part of the session to conclude with negligible loss. On a weekly basis, Nifty shed more than seven tenths of percent.

It was clearly an action packed week for markets and despite we defending key levels, the Nifty ended its recent winning streak on a

weekly basis. Now the kind of price action we experienced on Friday, it’s like ‘Half glass full or half empty’. As an optimist, the key

indices have managed to hold crucial levels but from a pessimist’s perspective, we are struggling at higher levels and importantly,

the outperforming MIDCAP index has started to display some signs of exhaustion. In our previous weekly commentary, we had

mentioned how the NIFTY MIDCAP 50 has reached a cluster of various Fibonacci ratios and this week’s correction has clearly

validated our assumption. We are now stepping into a monthly expiry week and looking at overall positioning of our market, we

expect the volatility to increase a bit. If we take a glance at the weekly chart of Nifty, we can see two back to back small body

candles and this week’s formation resembles a ‘Hanging Man’ pattern. Such pattern requires confirmation in the form of breaking

it’s low. Hence, it would be interesting to see how things pan out in the first half of the forthcoming week. As far as levels are

concerned, 15820 – 15880 to be seen as immediate resistances; whereas on the lower side, 15550 – 15450 – 15400 are to be seen

as support levels. We advise traders to lighten up positions at higher levels and it’s better to go one step at a time for a time being.

This week Sectorally we saw lot of churning where defensive spaces like FMCG and IT showed some strength. Amongst the losers,

Metals had a terrible week as we saw more than 6% cut in the index. Despite some recovery, the banking index ended the week with

nearly one and half percent loss. On expected lines, the NIFTY MIDCAP 50 index saw a meaningful correction over 3% this week.

2

For Private Circulati

on Only

Technical and Derivatives Review

| June 18, 2021

Profit booking drags Nifty off the highs ahead of expiry week

Nifty spot closed at 15683.35 this week, against a close of 15799.35 last week. The Put-Call Ratio has decreased from 1.35 to 1.18.

The annualized Cost of Carry is positive at 5.18%. The Open Interest of Nifty Futures decreased by 17.45%.

Derivatives View

Nifty current month future closed with a premium of 44.15 points against a premium of 17.95 points to its spot. Next month future

is trading at a premium of 96.65 points.

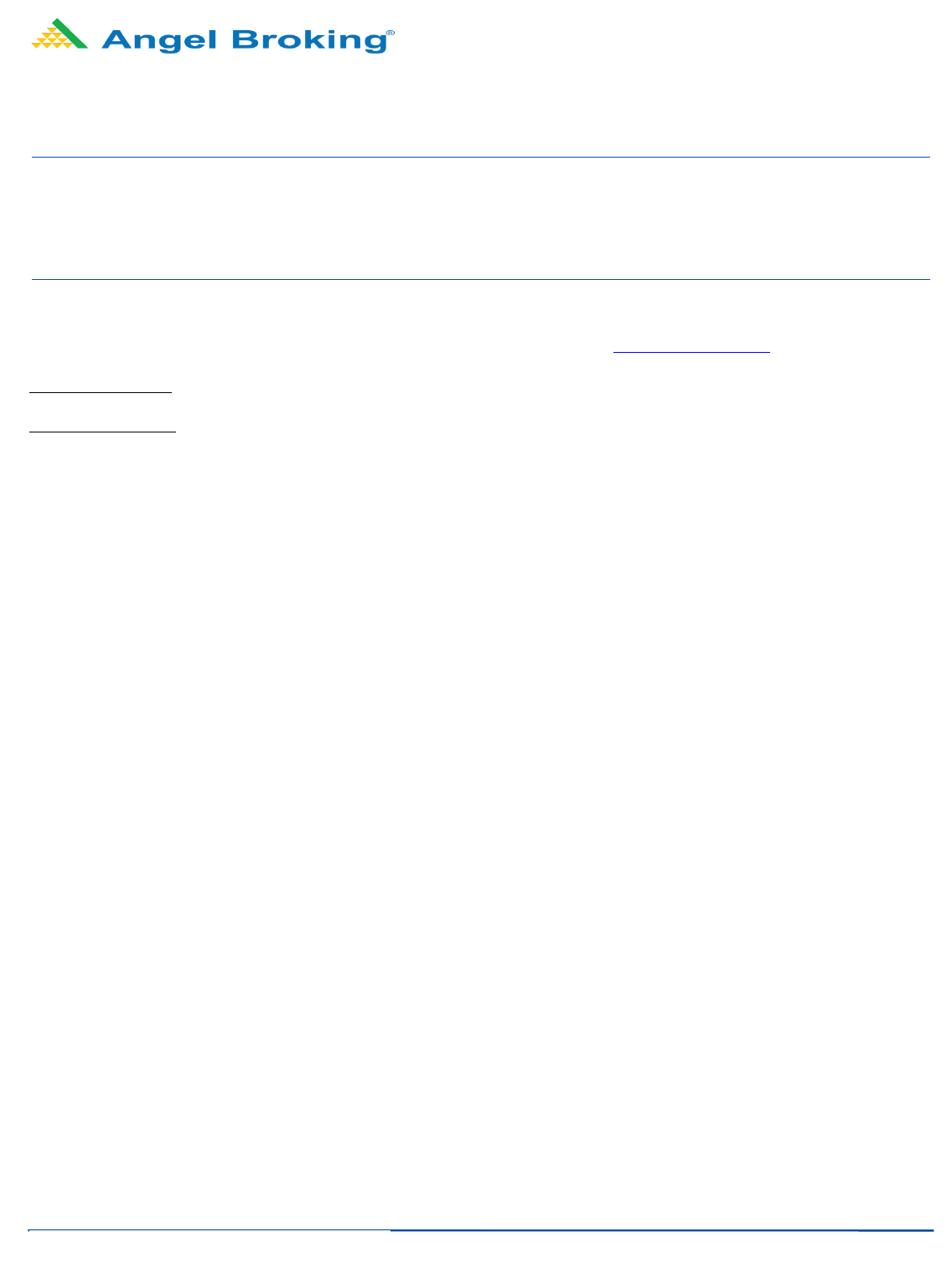

In options segment, 15700-16000 call options witnessed decent addition of open interest while some addition was seen 15600-

15400 puts too. Maximum build-up in the monthly series is placed in 16000 call and 15000 put options. However, since 15000 is far

from the current market price, more weightage should be given to 15500 put option which also has decent build up.

Post some volatility at the start of the week, Nifty recovered from the lows and marked a record of 15900. However, we witnessed

some cool-off from the highs and the index corrected to sneak below 15500 on Friday. Due to recovery in the later half on the last

day, Nifty managed to end the week tad below 15700. Nifty corrected mainly because of profit booking as the open interest declined

by more than 17 percent ahead of the monthly expiry week. Bank Nifty which has been an underperformer recently, added some

shorts during the week. FII’s were long heavy at the end of last week with their ‘Long Short Ratio’ at 82 percent; but they unwound

some of their longs and added shorts which has now brought this ratio down to about 68 percent. Decent built up was seen in call

options which indicates resistance around 15800 followed by 16000 mark for the coming week. On the flipside, 15500-15450 would

be seen as the immediate support.

.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

LICHSGFIN 14362000 46.55 470.45 (10.30)

POWERGRID

25524000

35.79

233.05

(5.44)

RECLTD

24120000

20.14

147.10

(9.31)

ASHOKLEY

43065000

15.19

116.65

(11.60)

M&MFIN

47388000

10.99

158.65

(6.48)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

MARICO 6196000 22.50 521.75 5.87

IDEA

829570000

13.64

10.40

4.52

GMRINFRA

104647500

18.7

1

28.30

4.04

SUNTV

15756000

19.43

550.90

3.64

RAMCOCEM

2044250

15.07

1023.30

3.39

3

For Private Circulati

on Only

Technical and Derivatives Review

| June 18, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelbroking.com

For Derivative Queries E-mail: [email protected]

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com