03

1

For Private Circulation Only

Technical and Derivatives Review | September 17, 2021

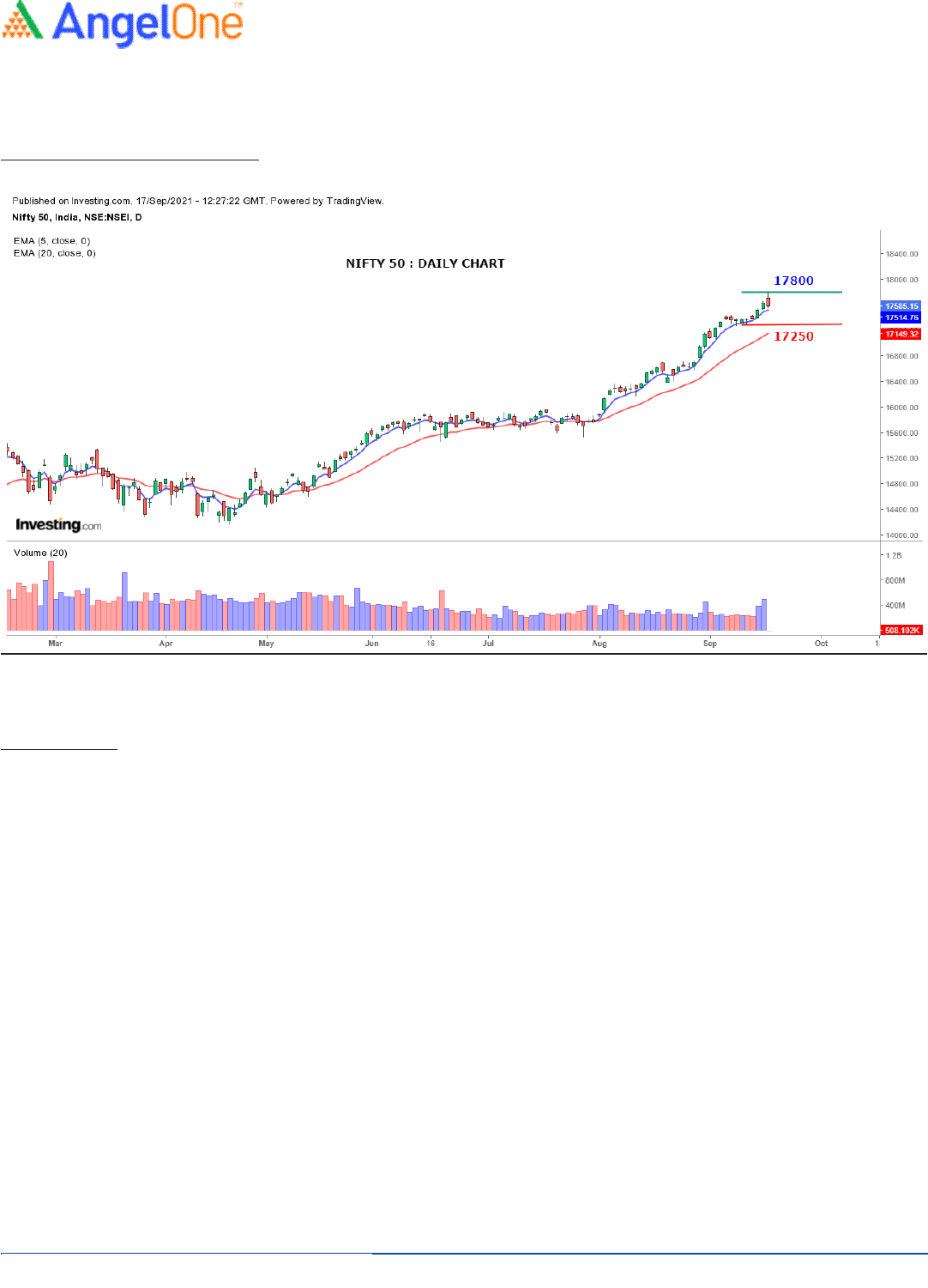

Hint of profit booking at all time high

Sensex (59016) / Nifty (17585)

Source: Investing.com

Future outlook

After an extended weekend, markets opened on a flat note on Monday. During the first couple of sessions, we witnessed some

consolidation with Nifty gradually moving towards 17400. However, the remaining part of the week panned out so well for the bulls as we

saw Nifty resuming its upward trajectory to register new highs every day by a fair margin. On Friday, the positive momentum was carried

over to even almost reach the new milestone of 17800. Unfortunately, it could not keep up with the same momentum as we witnessed a

decent profit booking after marking a new high of 17792.95. Eventually the week ended tad below the 17600 mark by adding more than a

percentto the previous weeklyclose.

Since last few days, Nifty was trapped in a small range and finally it managed to find some momentum. The trend is extremely strong but

honestly, the current move is not giving us comfort at all. We reiterate that when things start to look hunky dory and there are no signs of

correction, market surprises. Yes, it’s difficult to predict the precise time, but it’s always better to be safe than sorry. As of now, we are not

advising to short but at least one can choose to keep booking profits on a regular interval and stay light on positions. Friday’s sharp

correction from higher levelsis clearly anindication of this and hence, we continue with our cautious stance. As far as levels are concerned,

17700 – 17800 are to be seen as immediate hurdles; whereas on the flipside, 17450 – 17250 should be treated as key supports. The first

sign of real weakness would comeonly if westart sliding belowthe lower range.

The banking space had a lion share in last three days’ rally as we saw BANKNIFTY coming out of its long slumber phase to post fresh record

high. In fact, on Friday as well, the broader market was sulking after the initial up move; but banking index managed to close in the green.

Going ahead, all eyes would be on this heavyweight basket, because if Nifty has to move towards 18000, this space needs to continue its

momentum. In addition, the broader end of the spectrum had a fabulous run throughout the week but we saw some decent profit booking

in this space as well on the last day, which does not bode well. Hence, we remain a bit sceptical and we expect the picture to get clear in

thecoming week itself.

03

2

For Private Circulation Only

Technical and Derivatives Review | September 17, 2021

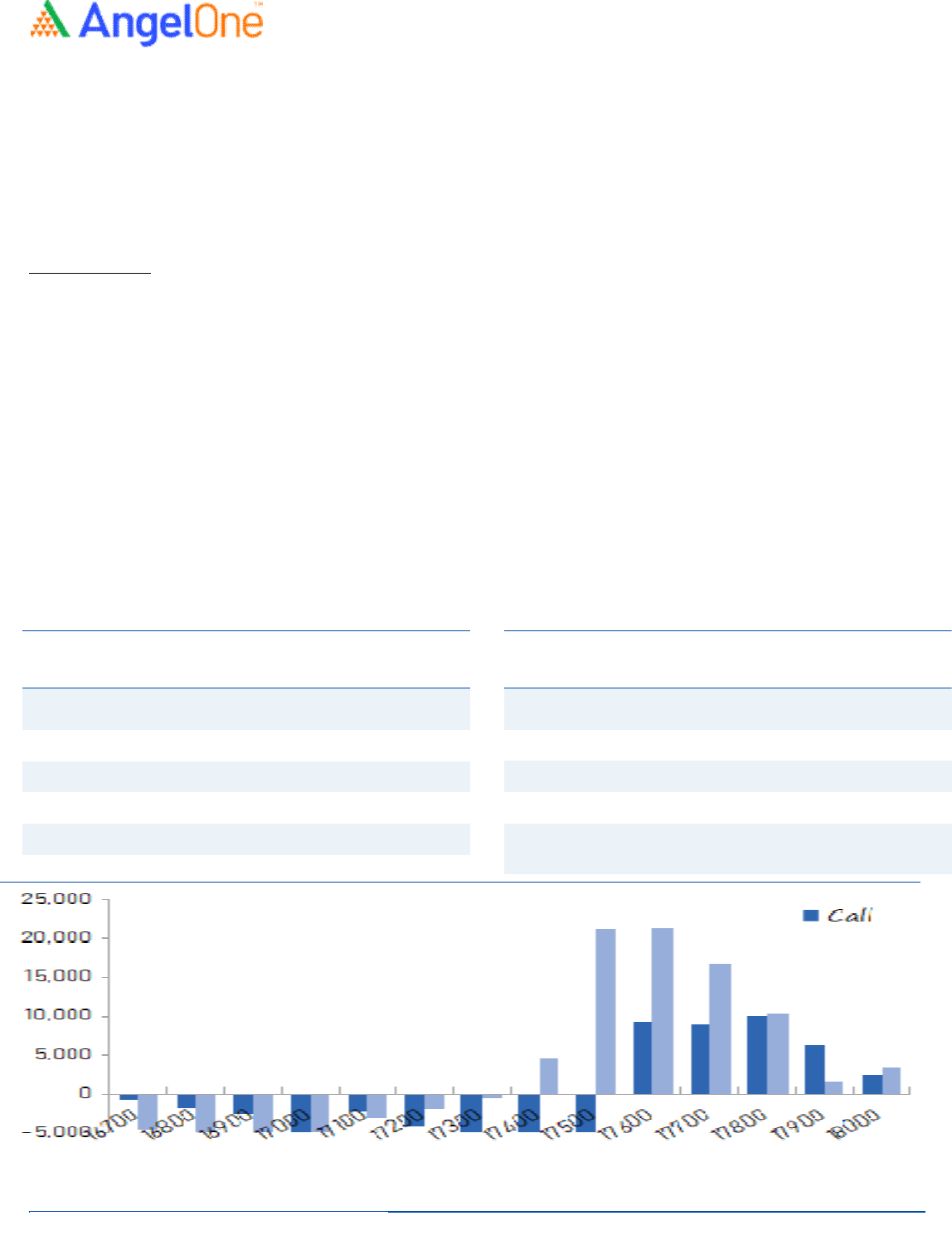

Options data hints resistance at 17800

Nifty spot closed at 17585.15 this week, against a close of 17369.25 last week. The Put-Call Ratio has decreased from 1.27 to 1.15.

TheannualizedCost of Carry ispositiveat 2.87%. The Open Interest ofNifty Futuresincreasedby 1.38%.

DerivativesView

Nifty currentmonth future closed with a premium of 19.85 points against a premium of 1.75 points to its spot. Next month future is

tradingat a premium of 50.35points.

Nifty continued to march higher and form new records every day during the week. It almost tested the 17800 mark on Friday, but

witnessed some profit booking at the end to close the week tad below 17600. The banking index outperformed this week as the

Bank Nifty posted new record high and ended with weekly gains of around 3 percent. The index witnessed formation of long

positions whichled to its outperformance. FII’s added some long positions in the index futures segment and their ‘Long Short Ratio’

currently stands around 68 percent. In options segment, open interest addition was seen in 17800 call and 17600-17500 puts too

witnessed addition of positions. The data indicates immediate resistance around 17800 followed by 18000 level. On the flipside, we

believe at-the-money put option of 17600 strike saw addition of long positions on Friday. In the coming week, 17500-17400 would

be the crucial support zone which traders should keep a watch on. It is advisable to be stock specific and avoid aggressiveovernight

positions.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ADANIENT 25149000 51.96 1486.35 (4.15)

LALPATHLAB 603750 37.22 3994.90 (3.11)

GUJGASLTD 5073750 31.57 663.65 (2.73)

LUPIN 11722350 21.28 950.40 (3.24)

TATASTEEL 47816750 14.81 1388.45 (4.23)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

IRCTC 2938325 55.40 3870.30 17.19

INDIGO 4041500 42.63 2202.75 14.84

POLYCAB 711000 24.15 2512.45 5.03

PNB 337216000 14.80 39.70 5.31

COALINDIA 55104000 14.30 156.90 5.20

03

3

For Private Circulation Only

Technical and Derivatives Review | September 17, 2021

Research Team Tel: 022- 39357600 (Extn– 6844) Website:www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivative Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel oritsassociates has not been debarred/ suspended by SEBI orany otherregulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offeringof securities of the company covered byAnalystduring the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (includingthe meritsand risks involved), and should consult their own advisors to determine the merits and

risks ofsuch an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal dataand other reliable sources

believed to be true, but we do not represent that it is accurate or complete andit should not be relied on as such, as this document is for

general guidanceonly. Angel Broking Limited or anyof itsaffiliates/ group companies shall not be in any wayresponsible for any loss or

damage thatmayarise to any person from any inadvertent error in theinformationcontained in this report. Angel Broking Limited has not

independently verified all theinformation contained within this document. Accordingly, we cannot testify, normake any representationor

warranty, express orimplied, tothe accuracy, contents or data contained within thisdocument. While Angel Broking Limitedendeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us fromdoingso.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed orpassed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use ofthisinformation.

Technical and Derivatives Team:

SameetChavan ChiefAnalyst –Technical & Derivatives sameet.chavan@angelbroking.com

RuchitJain SeniorAnalyst -Technical & Derivatives ruchit.jain@angelbroking.com

RajeshBhosale TechnicalAnalyst rajesh.bhosle@angelbroking.com

SnehaSeth Derivatives Analyst sneha.seth@angelbroking.com