1

For Private Circulation Only

T

ech

nica

l and Derivative

s

Review

|December 16, 2022

Global woes drag Nifty below 18350

Sensex (61338) / Nifty (18269)

Source: Tradingview.com

Future outlook

We had a nervous start for the week on Monday in line with not so favorable global cues. Nifty challenged 18400 in initial hours; but

fortunately, it took a U-turn after testing the midpoint of 18400-18300 support range. The upward move continued for next couple

of sessions to almost reclaim the 18700 mark. On Wednesday night, Fed announced a rate hike by 50 bps, which was in line with

consensus; however, later, the Fed governor’s commentary spooked market participants across the globe. This poured complete

water on early week recovery.

The benchmark index Nifty has now sneaked below the key swing low of 18350 on a closing basis. Ideally looking at the price

structure, the development does not augur well for the bulls. A close below this support opens the possibility of extended correction

in the coming week. We may be biased, but we are still not convinced with this close. Only a follow through selling may lead to

further weakness towards 18130 - 18000 - 17900 in coming sessions. Even if this scenario pans out, we do not expect the correction

to aggravate below the lower end of this support range. The higher degree up trend remains intact as long as we manage to hold

this. Since market was deeply overbought, we must consider this as a running correction. On the flipside, 18450 - 18600 are to be

treated as immediate hurdles. If bulls have to regain their strength, 18450 needs to be surpassed with some authority, which will

negate the breakdown from small ‘Head and Shoulder’ pattern on daily time frame chart.

Traders are advised to stay light for a while. Let either market complete its correction first or reclaim key levels on the upside to

resume the bullish trend. First half of the forthcoming week would be quite crucial for our markets. Let’s see how global market

behaves and hopefully, there is no major aberration on the global front.

2

For Private Circulation Only

T

ech

nica

l and Derivative

s

Review

|December 16, 2022

Short Format

ion

An intense week of trade; data suggests timidness

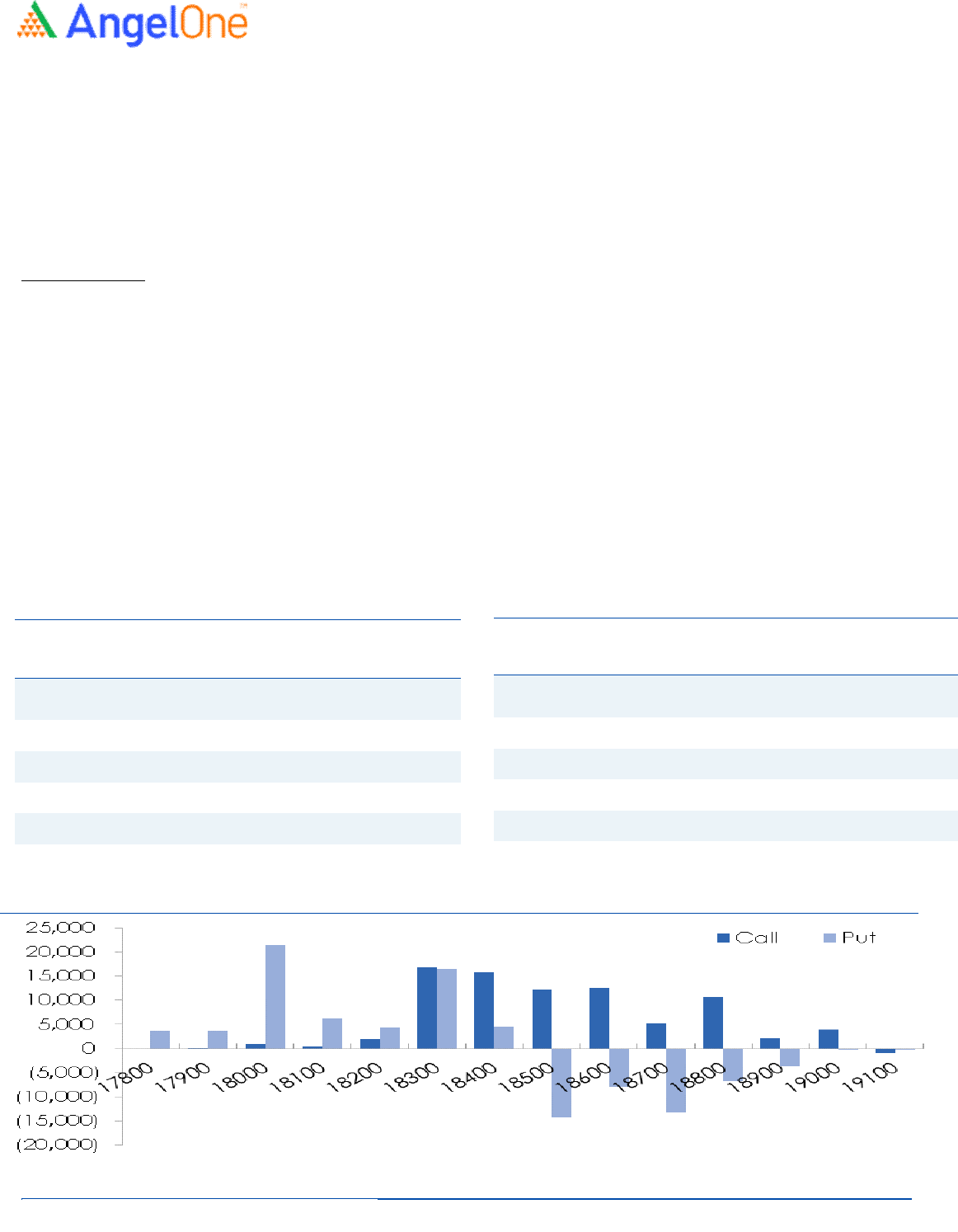

Nifty spot closed at 18269 this week, against a close of 18496.60 last week. The Put-Call Ratio has increased from 0.76 to 0.81 on

Weekly basis. The annualized Cost of Carry is positive at 9.17%. The Open Interest of Nifty Futures decreased by 2.67%.

Derivatives View

Nifty current month’s future closed with a premium of 59.65 against a premium of 87.05 points to its spot in the previous week.

Next month’s future is trading at a premium of 174.40 points.

The weakness in the global market post the Fed rate hike and the hawkish commentary has dampened the overall sentiments,

mirroring to which our market witnessed a strong correction in the last two trading sessions. The benchmark index plunged below

the critical support of 18350 and concluded the week on a negative note with a cut of over a percent. Looking at the derivative data,

we have witnessed a mixed bag of trade throughout the week in both indices and both concluded the week with long unwinding. On

options front, the piling up of positions is visible in the 18100-18000 put strikes, indicating a downward shift in the support base. On

the flip side, decent stack of OI concentration is seen around 18400-18600 call strikes, signifying the immediate resistance for Nifty.

Meanwhile, the stronger hands turned to net sellers this week as they exited longs and added short position, resulting in a plunge to

the ‘Long Short Ratio’ that further cooled off to 55% from 58%, on a weekly basis.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

METROPOLIS 1755000 74.59 1297.05 (9.16)

LALPATHLAB 1569750 64.37 2242.55 (7.90)

IRCTC 20811875 22.06 673.65 (6.61)

LAURUSLABS 11241200 21.61 389.40 (6.29)

CANFINHOME 4969575 17.93 525.50 (6.16)

Weekly change in OI

Long Fo

rmation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

BALRAMCHIN 11185600 28.80 395.85 4.29

TATAMOTORS 82897950 13.96 420.25 1.18

IDEA 622160000 11.42 8.35 3.73

IBULHSGFIN 47780000 10.85 147.40 3.95

BALKRISIND 2078700 9.36 2114.60 2.28

3

For Private Circulation Only

T

ech

nica

l and Derivative

s

Review

|December 16, 2022

Sameet Chavan

C

hief An

alyst

–

T

e

chnical

& Derivati

ves

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krisha[email protected]

Research Team Tel: 022 - 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in

the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

4

For Private Circulation Only

T

ech

nica

l and Derivative

s

Review

|December 16, 2022

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.