1

For Private Circulation Only

Technical and Derivatives Review | October 14, 2021

Relentless rally continues, 18000 conquered with an ease

Sensex (61306) / Nifty (18339)

Source: Tradingview.com

Future outlook

Markets had a soft opening to the week on Monday taking into consideration some nervousness in global bourses. However the

things settled thereafter as we witnessed a strong close above 17900 for the first time ever. This was followed by back to back

excellent sessions for our market and in the process; the Nifty not only reached yet another milestone of 18000 but even surpassed

it comfortably to mark new highs beyond 18300. After two weeks’ of slight pause, Nifty finally resumed its upward trajectory to add

more than a couple of percent to the mighty bulls’ kitty.

Despite being a truncated week, the bulls made their presence feel in all four trading sessions. Importantly, the banking space

provided a helping hand first when it was the most needed because the IT basket had a shaky start after weak set of numbers from

TCS over the last weekend. In fact, as the week progressed, the buying momentum accelerated in the banking counters which led

the benchmark at such record highs. This rally has been relentless in nature and we must admit that it has overshot our expectations

by a fair margin. But this is how market functions, it is always full of surprises and it moves the way it wants to. Now since we are

trading in an uncharted territory, it would be very difficult to project higher levels. Hence, 18500 is to be seen as immediate

psychological level and thereafter every 100 points round figure is to be considered as next level.

As far as supports are concerned, 18200 followed by 18000 are to be seen as strong supports for the coming days. Here, 18000 holds

a key for the bulls and as long as it’s defended comfortably, the bulls have no reason to worry for. Although the trend has been

extremely strong, we reiterate that one should avoid getting complacent at such elevated levels. The pragmatic approach would be

to go one step at a time and try to avoid aggressive bets overnight. The stock specific action continues and hence, traders are

advised to keep focusing on such bets.

2

For Private Circulation Only

Technical and Derivatives Review | October 14, 2021

Stronger hands turn buyers in derivatives segment

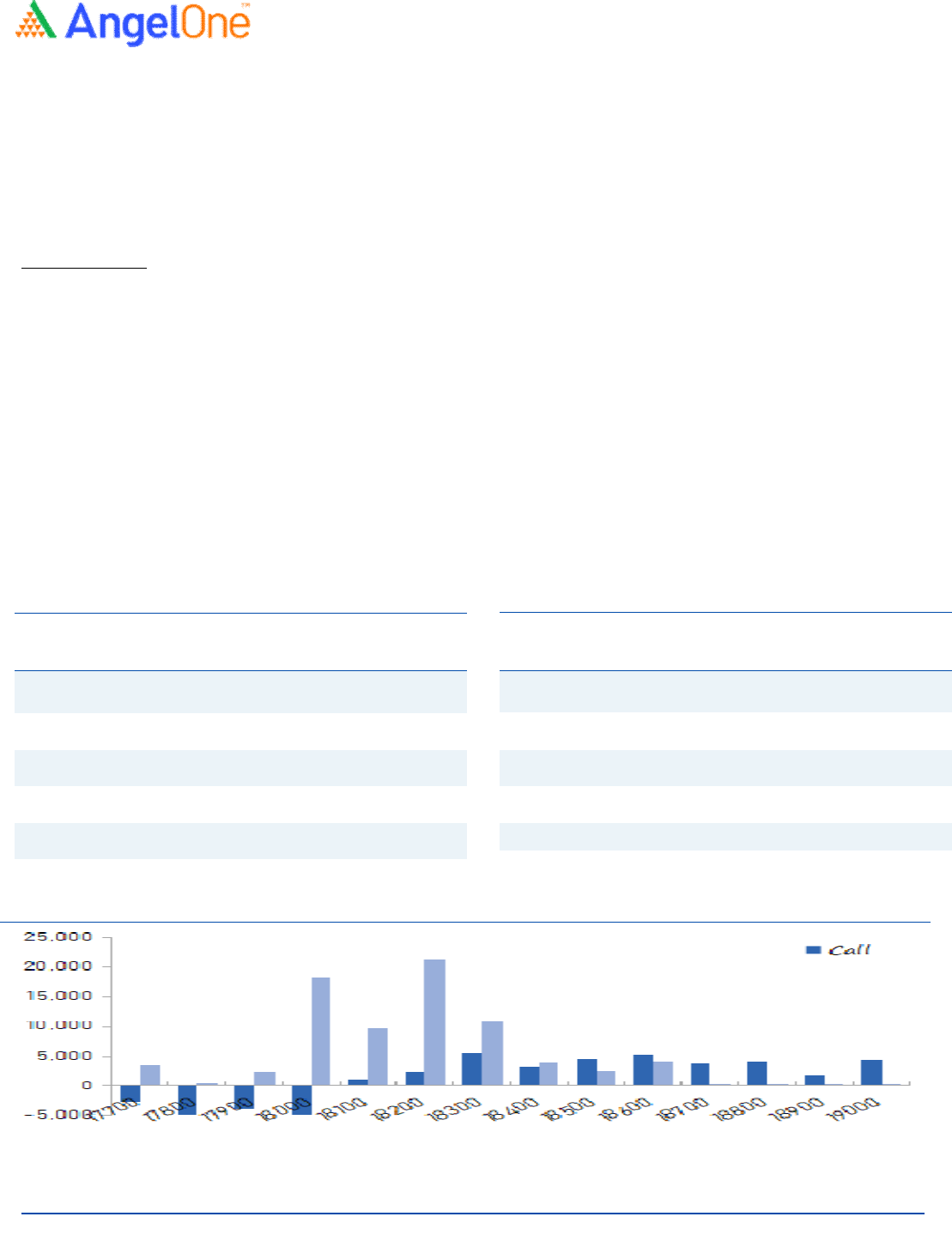

Nifty spot closed at 18338.55 this week, against a close of 17895.20 last week. The Put-Call Ratio has increased from 1.30 to 1.44.

The annualized Cost of Carry is positive at 2.34%. The Open Interest of Nifty Futures increased by 0.34%.

Derivatives View

Nifty current month future closed with a premium of 18.20 points against a premium of 17.80 points to its spot. Next month future

is trading at a premium of 47.95 points.

Nifty rallied sharply during the week to end the truncated week well above 18300. However, we did not see any relevant open

interest addition in Nifty during the week. The Banking index rallied sharply on the weekly expiry day where we witnessed some

short covering. FII’s seemed a bit skeptical at the start of the week, but then they too participated and formed long positions in

derivatives segment. They bought index futures due to which their ‘Long Short Ratio’ has increased to 67 percent. In options

segment, the call writers at 18000 strike ran to cover their positions as the market surpassed that level. Then, as the index continued

its momentum, aggressive put writing was seen which shifted the support base higher. The open interest data now indicates good

support around 18200 and then at 18000. On the flipside, 18500 would be the immediate resistance on the upside. Traders are

advised to continue to look for stock specific opportunities and trade with the momentum.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

TCS 14871900 77.24 3627.25 (7.57)

HCLTECH 23800000 21.36 1249.50 (5.50)

HDFCLIFE 22664400 18.63 696.85 (3.86)

BIOCON 19842100 12.76 348.80 (3.00)

METROPOLIS 736600 12.70 2649.50 (3.02)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

RECLTD 36078000 46.27 165.45 4.81

PFC 38898800 44.80 149.65 6.89

ZEEL 66999000 30.57 320.80 8.18

IEX 11295000 28.28 796.60 13.84

NTPC 69847800 25.75 149.15 5.37

3

For Private Circulation Only

Technical and Derivatives Review | October 14, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivative Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in