1

For Private Circulation Only

Technical and Derivatives Review | March 12, 2022

Global uncertainty subsides, Nifty reclaims 16600

Sensex (55550) / Nifty (16630)

Source: Tradingview.com

Future outlook

Markets had a terrible start to the week gone by as tensions escalated between Russia and Ukraine over the previous weekend. This

resulted in a massive gap down on Monday. Fortunately, the damage was not much thereafter as we witnessed Nifty making

attempts of stabilizing around 15700. Post this, the global uncertainty subsided a bit which resulted into a complete V-shaped

recovery in the following two sessions. Since the market was deeply oversold, the speed at which it made a comeback, was really

remarkable. Eventually, with some range bound movement on Friday, Nifty ended the week with decent gains over couple of a

percent.

It was certainly an action packed week for our markets and although, the beginning was a bit unpleasant, we must cherish the

spectacular recovery we had in the latter half of the week. Until last week, we were a bit convinced of having one more round of

selling to enter sub-16000 terrain. Market did have a short lived appearance below this; but fortunately, all’s well that ends well.

Now the way market has rebounded sharply, it has all the ingredients needed for confirming a bottom. But since the current

situation is connected to war kind of scenario, we are waiting for further confirmation beyond certain levels but practically, we have

already changed our stance in last couple of sessions. As far as levels are concerned, 16750 – 16800 remains to be a key hurdle and

any sustainable move above this would confirm Tuesday’s low as a bottom. On the flipside, 16450 followed by 16200 are to be seen

as immediate supports.

Going ahead, we expect some consolidation in key indices and lot of adjustment would continue to happen in individual stocks. For

the coming week, in case of index consolidation, one should focus on stock specific moves, which are likely to continue and can

provide excellent trading opportunities.

2

For Private Circulation Only

Technical and Derivatives Review | March 12, 2022

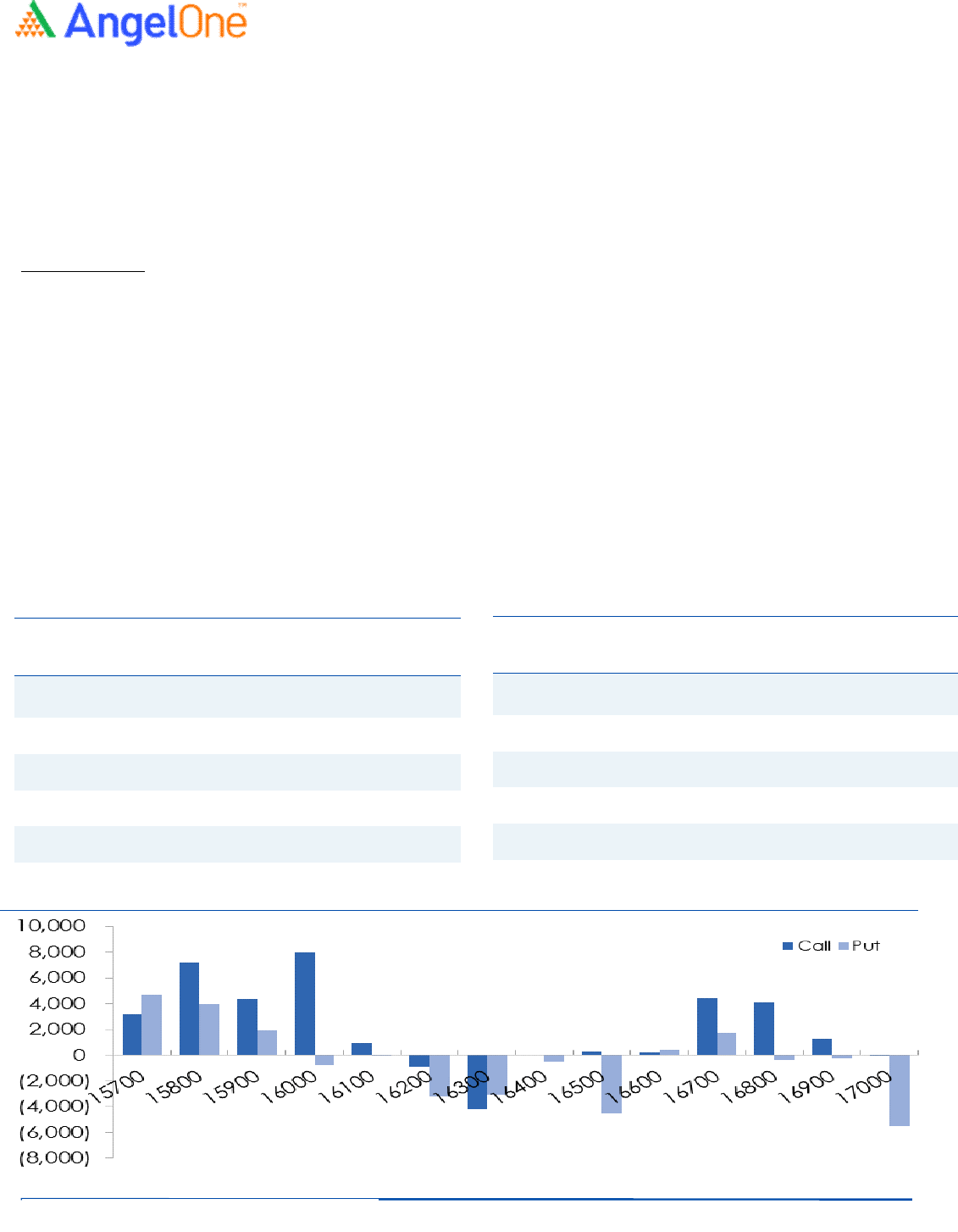

PCR-OI finally normalises above 1

Nifty spot closed at 16630.45 this week, against a close of 16245.35 last week. The Put-Call Ratio has decreased from 0.85 to 1.03.

The annualized Cost of Carry is positive at 1.90%. The Open Interest of Nifty Futures increased by 6.69%.

Derivatives View

Nifty current month future closed with a premium of 17.30 points against a premium of 13.60 points to its spot. Next month future

is trading at a premium of 64.40 points.

We began the week with a downside gap and then went to touch 15700; but luckily no further damage was observed in fact index

rebounded with a force after to reclaim 16750 on the weekly expiry session. On Friday, the Nifty entered the consolidation mood

and hence we ended the week tad above 16600. As far as F&O activities are concerned, we saw blend of long formation and short

covering in Nifty and BankNifty. In Nifty options, the buildup remained scattered in call as well as put options; however, 16500 put

and 17000 call strikes are attracting traders’ attention. Stronger hands remained net sellers in equity and added mixed bets in index

futures segment with majority on the short side. Form the coming week, 16400-16500 should we the support zone; whereas

resistance is placed around 16700-16800 zone. Traders are advocated trading with a positive bias and should continue focusing

individual space.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

COFORGE

1764800 248.64 4312.85 (6.74)

JKCEMENT 496825 76.12 2306.35 (12.02)

GSPL 2138600 69.54 268.35 (4.40)

WHIRLPOOL 647500 47.16 1579.85 (3.22)

MOTHERSUMI 35346500 44.73 131.85 (3.62)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ONGC

46107600 64.78 175.20 7.85

CHAMBLFERT 2472000 38.14 425.00 9.61

GNFC 3646500 32.88 708.85 18.13

ATUL 116550 29.72 9555.15 11.89

BALRAMCHIN 9198400 28.38 489.70 16.19

Short Format

ion

3

For Private Circulation Only

Technical and Derivatives Review | March 12, 2022

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in

the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

4

For Private Circulation Only

Technical and Derivatives Review | March 12, 2022

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.