03

1

For Private Circulation Only

Technical and Derivatives Review | September 09, 2021

Thinnest weekly range at record highs

Sensex (58305) / Nifty (17369)

Source: Trading View

Future outlook

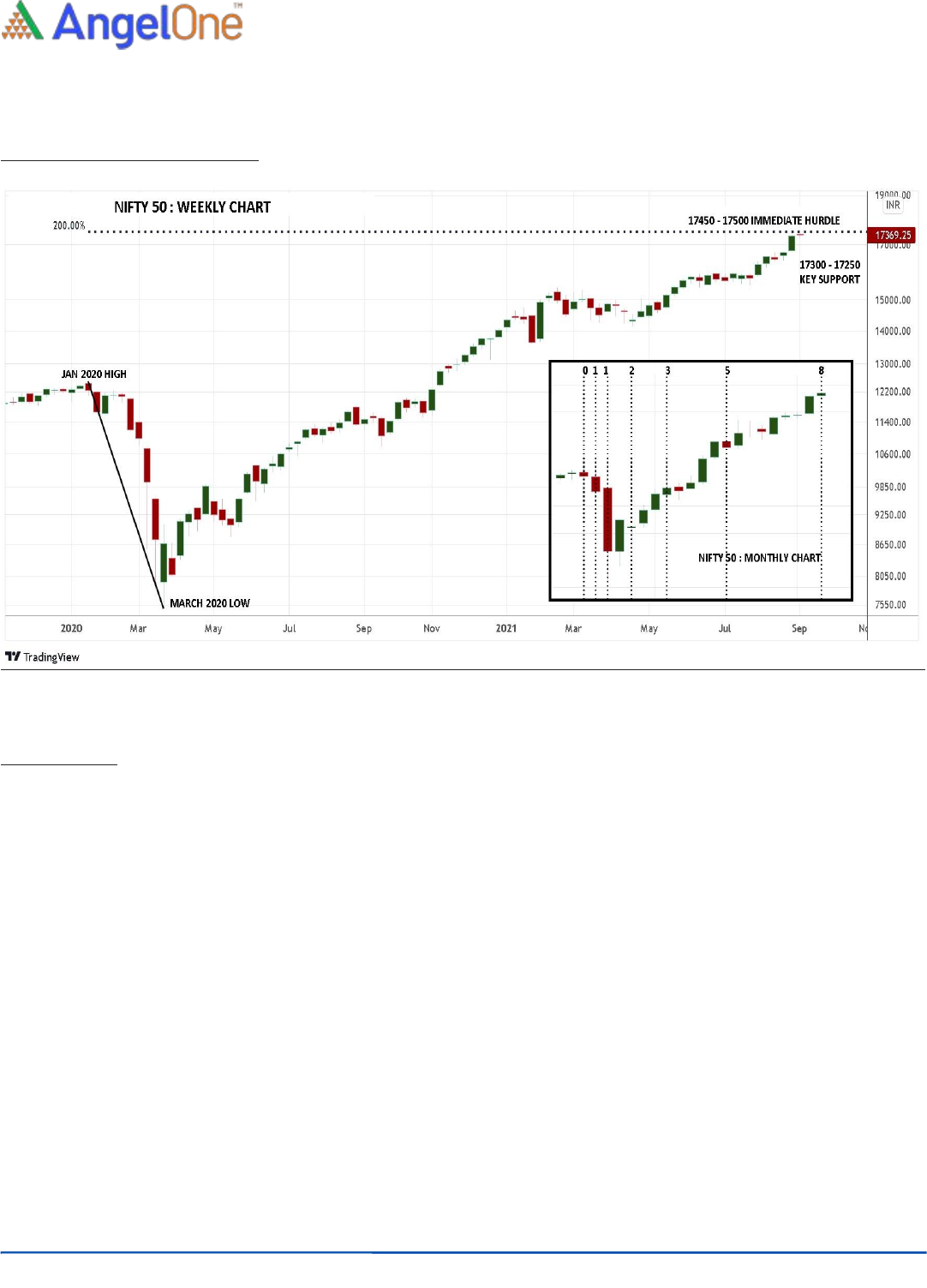

Markets had a positive start on Monday and without wasting much of a time, Nifty continued with its streak of achieving new

milestones. During the first couple of sessions, Nifty clocked back to back fresh highs beyond 17400; but failed to close beyond it on

both the occasions. In the latter half, we saw some hint of profit booking but mighty bulls came back strongly not only to defend key

supports but also to lift the benchmark index beyond 17350 comfortably to mark highest ever weekly close.

The price action in key indices this week was extremely dull as we witnessed one of the thinnest weekly trading ranges for a long

time now. Although Nifty looked a bit uncomfortable around 17400 throughout this week, we did not see any major weakness

overall. The moment it falls by nearly a percent, the buying tends to happen immediately. As of now, clearly bulls are having a firm

grip on the market but as we have been mentioning since a week or so, they would find a bit difficult now going ahead. We reiterate

our observations for becoming slightly cautious at current levels. They are, 1) we can see Nifty reaching the 200% ‘Fibonacci

Retracement’ of the last year’s massive decline from Jan’20 high to March’20 low, 2) Time-wise, Nifty has entered 7th zone as per

‘Fibonacci Time Series’ on the monthly time frame chart.

It may look a bit contradictory to adopt a cautious stance when market is making new highs almost every day. But these mentioned

evidences have proved their efficacy in the past and hence cannot be overlooked. So let’s see how things shape up going ahead. As

far as levels are concerned, 17450 – 17500 would now be seen as sturdy wall; whereas on the flipside, the first sign of weakness

would come only after confirming a single day close below the support zone of 17300 – 17250. We advise traders to continue with a

stock centric approach by following strict stop losses and booking timely profit is also highly recommended

.

03

2

For Private Circulation Only

Technical and Derivatives Review | September 09, 2021

No meaningful change in data, be stock specific

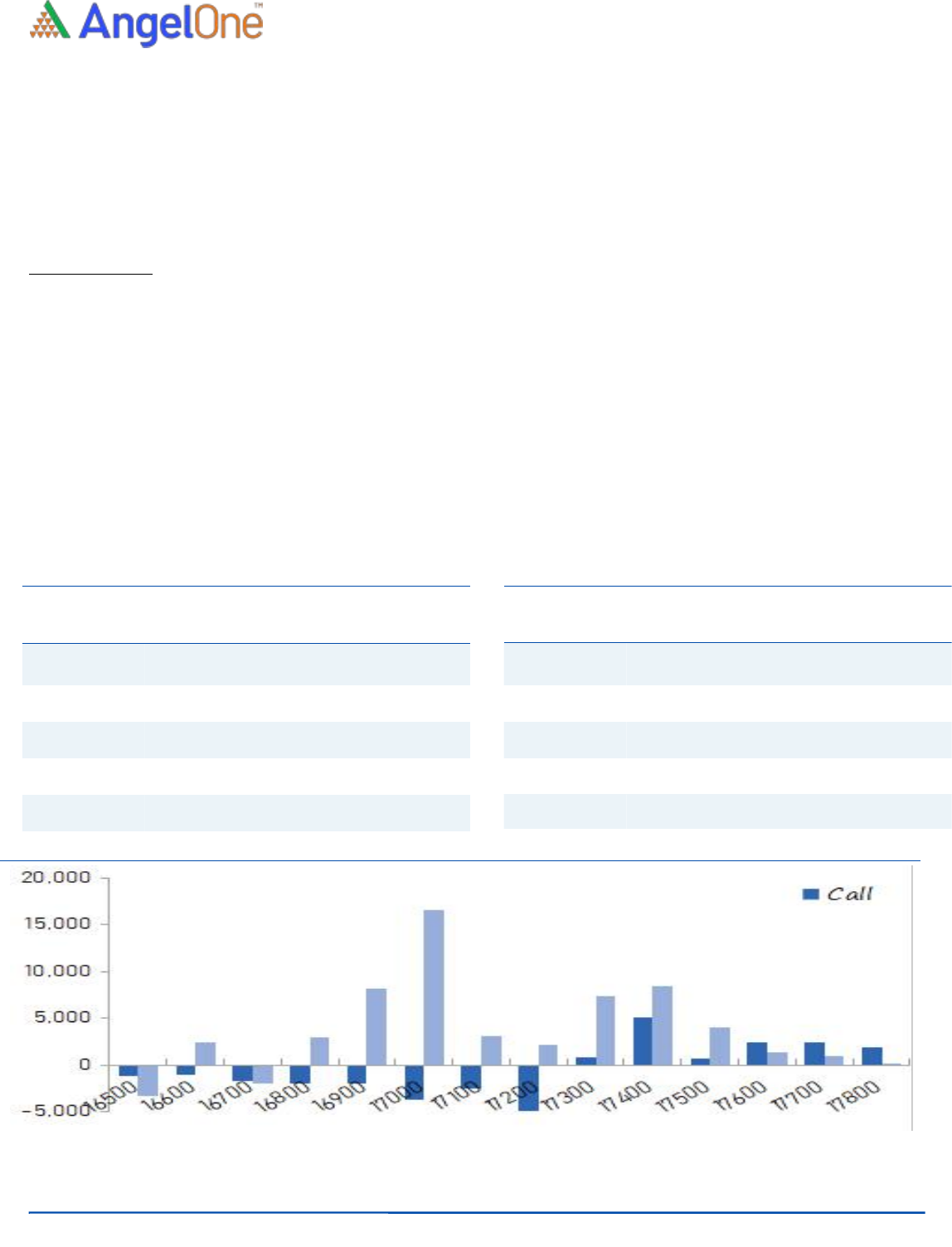

Nifty spot closed at 17369.25 this week, against a close of 17323.60 last week. The Put-Call Ratio has decreased from 1.35 to 1.27.

The annualized Cost of Carry is negative at 0.50%. The Open Interest of Nifty Futures decreased by 0.58%.

Derivatives View

Nifty current month future closed with a premium of 1.75 points against a premium of 5.75 points to its spot. Next month future is

trading at a premium of 27.75 points.

Nifty started the week on a positive note and registered new records above 17400. However, we then saw a consolidation

throughout the week wherein the benchmark resisted in the range of 17400-17450 while buying interest was seen on dips at 17300-

17250. The index ended the week on a strong foot around 17370 but no major change in open interest was seen in indices. FII’s

unwound some of their longs in the index futures and their ‘Long Short Ratio’ is above 63 percent. There was no fresh build up in

indices this week but we believe the previous longs in Nifty are still intact. In the nearby strikes, 17400 call and 17300 put has

highest open interest outstanding. The near term trading range for index is seen at 17200-17500 and hence, traders should prefer

trading with a stock specific approach.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

SBILIFE

10861500

58.45

1172.20

(5.79)

GUJGASLTD

3856250

33.20

682.30

(2.72)

BAJAJ-AUTO

3113500

20.62

3714.60

(1.54)

APOLLOHOSP

2584000

19.77

4737.05

(5.86)

NAVINFLUOR

493650

15.05

3969.60

(3.34)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

CANFINHOME

3828825

123.00

626.90

6.56

INDIAMART

277800

81.12

8911.55

9.27

IDEA

830900000

42.53

8.45

15.75

POLYCAB

572700

39.04

2392.20

7.18

IEX

8885000

30.06

600.80

10.94

03

3

For Private Circulation Only

Technical and Derivatives Review | September 09, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com