1

For Private Circulation Only

Technical and Derivatives Review

| July 09, 2021

Struggle continues for 16000, global sell off became spoilsport

Sensex (52386) / Nifty (15690)

Source: Trading View

Future outlook

Previous Friday’s tail end recovery was followed by a gap up opening on Monday to kick-start the new trading week. We clearly

shrugged off mixed global cues early in the morning and traded firmly post the opening as well. Although we did not add significant

gains after the opening hour, the Nifty maintained its positive posture throughout the session to close tad below the 15850 mark.

Throughout the first half of the week, our markets traded positively to once again challenge the all-time high. However on the

weekly expiry day, markets had a rough day which was mainly on the back of the negative development across the globe.

Fortunately, the fall got arrested in the vicinity of the support zone to eventually conclude the week tad below 15700.

In last month or so, we have seen multiple attempts to reach the millstone of 16000; but markets are clearly struggling as something

or other appears from nowhere to dampen the sentiments. The way we closed on Wednesday, we were all set to see the magical

figure; but global sell off became the spoilsport on this occasion. Fortunately there was no follow through to this selling momentum

as we saw Nifty stabilising after entering the key support zone of 15650 – 15600. Honestly when market fails to surpass a specific

level after the multiple attempts, it is considered as an ominous sign. But fortunately there has not been any brutal correction seen

so far, which bodes well for the bulls. After last two days’ of price action, our confidence of predicting Nifty towards 16000 or

beyond in the ongoing leg has certainly shaken a bit; but we would still remain hopeful as long as Nifty holds a strong support zone

of 15600 – 15450. If these levels are violated then one should get prepared for a decent short term correction in the market. Until

then better to trade with a positive bias.

During the first half, 15750 – 15800 are the levels to watch out for and the first of sign of strength would come only after reclaiming

15800 on a closing basis. We reiterate that, if this has to happen, the banking continues to be the key factor as it’s trading around its

crucial support area. Traders are advised to remain light and stick to stock centric approach by following strict stop losses. Also, it’s

important to keep a close eye on the global developments as well which is likely to set the tone for the forthcoming week.

.

2

For Private Circulation Only

Technical and Derivatives Review

| July 09, 2021

FIIs Long Short Ratio plunged to 55%

Nifty spot closed at 15689.80 this week, against a close of 15722.20 last week. The Put-Call Ratio has decreased from 1.09 to 0.94.

The annualized Cost of Carry is positive at 3.80%. The Open Interest of Nifty Futures increased by 4.33%.

Derivatives View

Nifty current month future closed with a premium of 32.65 points against a premium of 25.00 points to its spot. Next month future

is trading at a premium of 77.80 points.

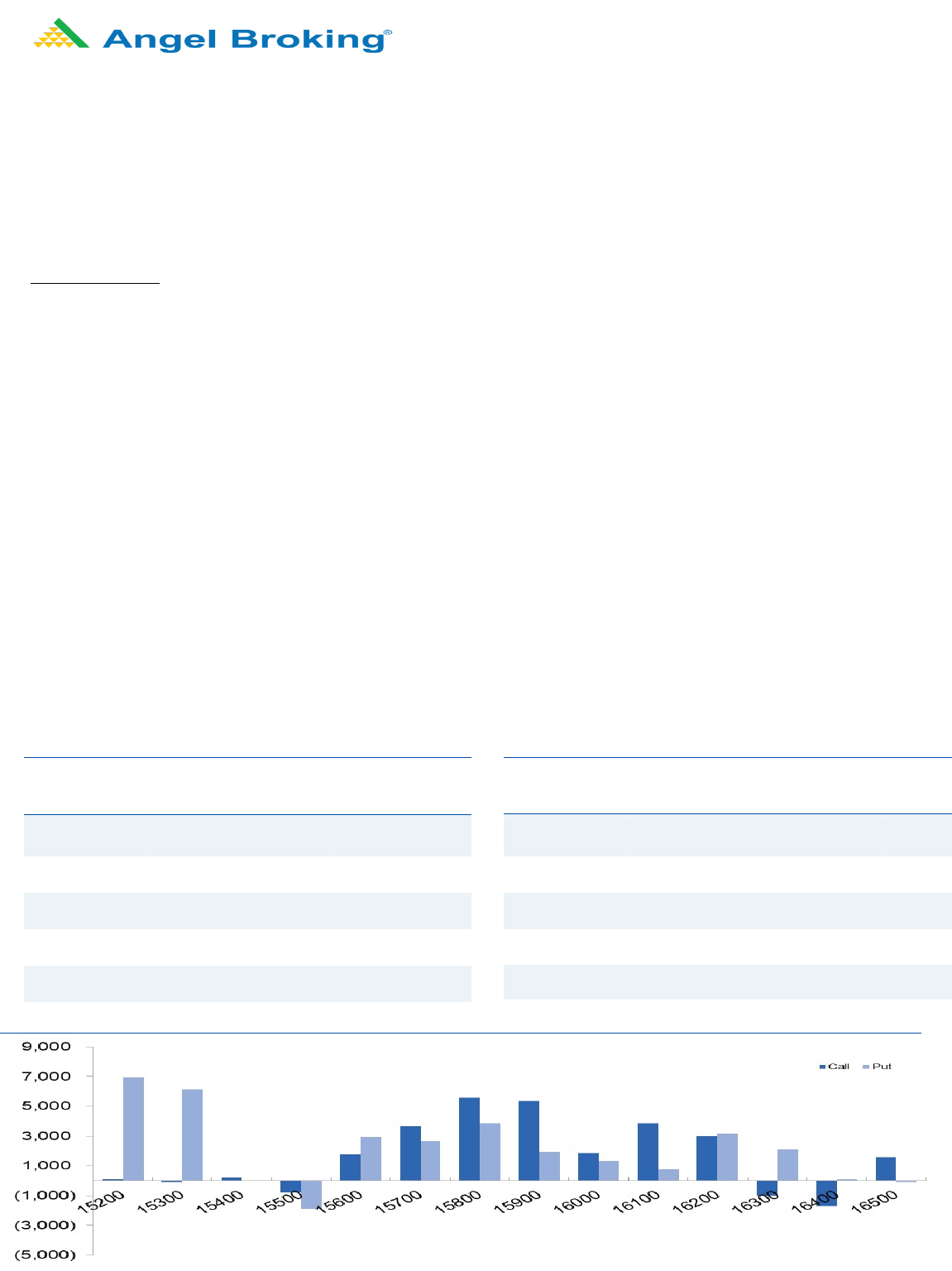

In options segment, hardly saw any relevant open interest addition in the monthly expiry series. In weekly series, 14600-14700 put

strikes added decent positions. On the other side, 14700 call added meaningful positions. Highest open interest for coming weekly

series is placed at 15800 call and 15600 put options.

Post last Friday’s final recovery, we started-off the fresh week on a cheerful note and traded strong to reclaim 15900 mark.

However, index consolidated in the midst of week wherein 15900 acted as a sturdy hurdle. On the weekly expiry day, we witnessed

decent selling pressure due to nervousness been throughout the globe to drag Nifty below 15700 mark. In absence of any relevant

recovery, we concluded the week around the support zone of 15700. During the week, hardly saw any fresh build-up when market

witnessed strength, however, short addition was seen in last two trading sessions. Stronger hands were net sellers in equities and

also preferred adding good amount of shorts in index futures. This resulted, their index futures long short ratio falling to 55%.

Interestingly, the PCR-OI at 0.94 hints market is oversold and surge in Nifty Futures premium bodes well for Bulls. Hence, trades are

advised to wait and watch for follow-up action before initiating any aggressive directional bets and prefer trading in individual

counters.

.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

TATAMOTORS 140579100 54.30 304.80 (11.77)

NMDC

93190300

44.12

170.60

(6.95)

TVS

MOTOR

6771800

24.47

602.25

(1.75)

BANDHANBNK

17919000

21.57

317.35

(1.26)

TCS

9537000

17.92

3216.75

(3.56)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

LALPATHLAB 551500 21.28 3460.55 4.29

BAJFINANCE

4219625

21.00

61

65.15

2.61

BERGEPAINT

3172400

16.57

844.75

4.27

MFSL

3030950

16.46

1079.10

3.72

AMBUJACEM

19110000

15.82

364.10

6.96

3

For Private Circulation Only

Technical and Derivatives Review

| July 09, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelbroking.com

For Derivative Queries E-mail: [email protected]

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com