1

For Private Circulation Only

Technical and Derivatives Review | October 08, 2021

Highest close for Nifty, but still 18000 remains untouched

Sensex (60059) / Nifty (17895)

Source: Tradingview.com

Future outlook

Nifty started the week on a positive note on Monday and witnessed some momentum to reclaim 17700 with an ease. On Tuesday,

the global cues were a bit nervous, but still, we managed to shrug off the negativity and rallied higher post the opening to surpass

the 17800 mark. However, one day ahead of the weekly expiry, our markets finally reacted to the global weakness. The index

consolidated throughout the first half, but witnessed a sharp fall post midsession to end the day tad above 17600. The opening on

the expiry day was absolutely a shocker for bears as the shaky global markets recovered overnight and remained firm thereafter. As

a result, the Nifty continued its March towards the recent highs.

The RBI governor announced its monetary policy on Friday and the outcome was very much in line with the general consensus.

Markets did not look much excited as it turned out to be non-event. There was no follow up seen in key indices throughout the

remaining part of the session. Eventually Nifty ended the week around the 17900 mark, which is the highest ever close for our

markets. Considering the recent behaviour of the market, it is pretty clear that the bulls are not willing to let loose their firm grip so

easily. But we reiterate it is that sort of phase of the market, which may not be easy to participate in. We are not at all convinced

trading aggressively on the long side at this moment, yes there could be odd thematic moves that can be focused on but do not

want to go all guns blazing at such elevated levels.

As far as levels are concerned, 17900 – 17950 remains to be a sturdy wall and on the flipside, 17600 has become a sacrosanct

support now. The way we are following US markets of late; all eyes on them how they move going ahead. Also, as far as BANKNIFTY

is concerned, nobody knows what it is up to. Clearly directionless and is flirting around key support as well as resistance levels. The

IT heavyweight TCS is going to flag off the result season. Let’s see if any exciting outcome from this pushes Nifty beyond 18000 or

not.

2

For Private Circulation Only

Technical and Derivatives Review | October 08, 2021

Long formations leads Nifty to 17900

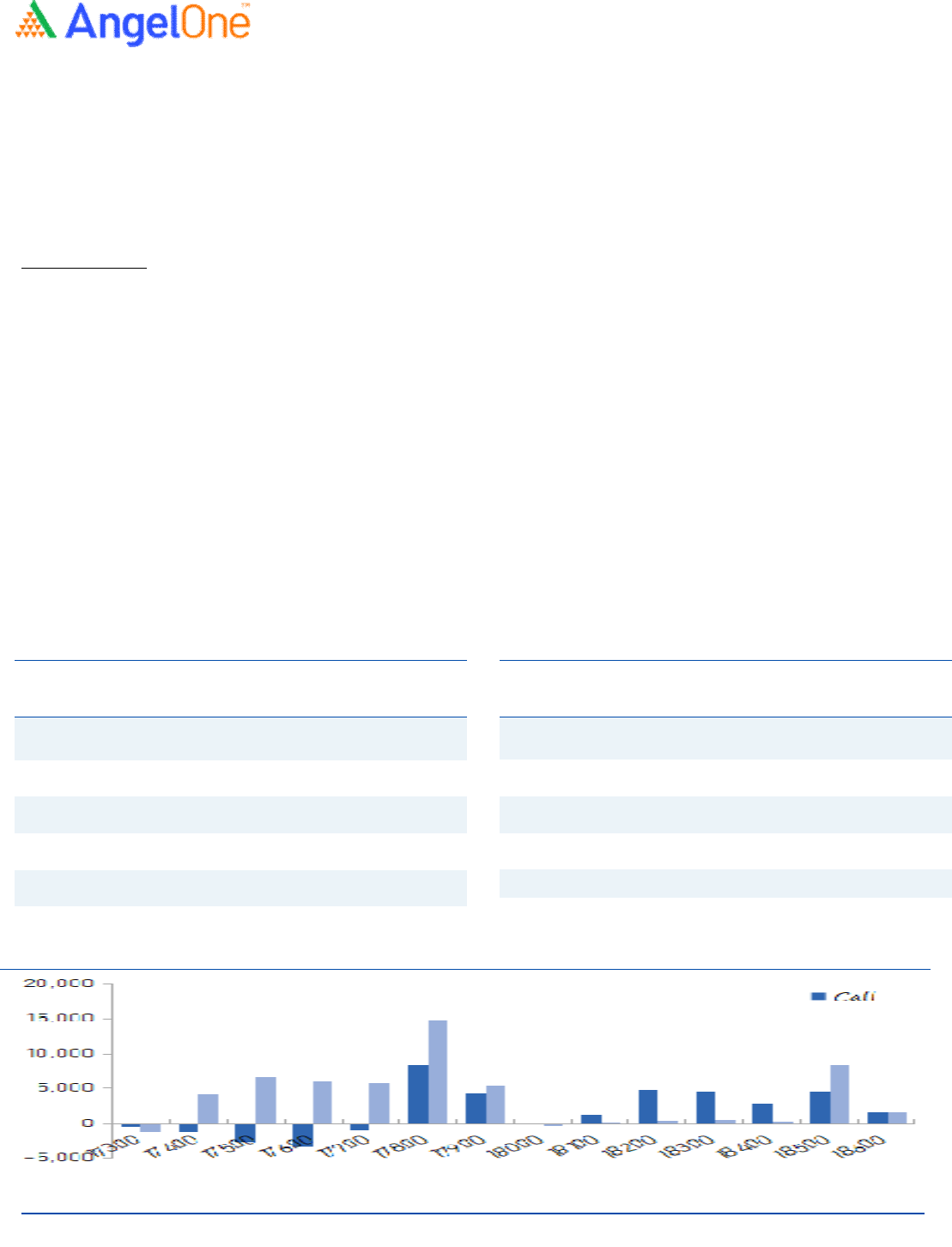

Nifty spot closed at 17895.20 this week, against a close of 17532.05 last week. The Put-Call Ratio has increased from 0.98 to 1.30.

The annualized Cost of Carry is positive at 0.50%. The Open Interest of Nifty Futures increased by 8.07%.

Derivatives View

Nifty current month future closed with a premium of 17.80 points against a discount of 1.85 points to its spot. Next month future is

trading at a premium of 49.80 points.

We saw some hiccup in the market at the start of the week, but then the Nifty resumed its positive momentum and rallied higher to

end the week around 17900. Nifty witnessed formation of long positions in the week as the upmove has been supported by rise in

open interest by over 8 percent, while the Bank Nifty index saw unwinding of positions and the open interest declined by 10

percent. During the week, FII’s have sold equities in the cash segment while in index futures, they lightened up both long as well as

short positions. Their ‘Long Short Ratio’ continues to be around the last weeks level of 58 percent. In options segment, 17800-17600

put options added decent open interest. The highest open interest in the coming weekly expiry is at 18000 call and 17800 put

options. The data indicates immediate support for Nifty in the range of 17800-17700 and resistance is seen around 18000. If Nifty

surpasses this mark and call writers start unwinding positions, then we could see a continuation of upmove towards 18200.

However, if the mentioned supports are breached then it could lead to a pause in the ongoing momentum. Traders are advised to

keep a tab on the mentioned levels and trade with a stock specific approach with proper risk management.

Weekly change in OI

Short Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

IPCALAB 841050 63.59 2332.70

(8.18)

ICICIGI 3649050 59.95 1535.60

(9.29)

CIPLA 12242750 52.82 919.45

(9.84)

INDUSTOWER 14772800 37.97 306.35

(9.21)

MGL 3941400 22.69 1071.55

(3.81)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

IRCTC 3289000 67.11 4881.20 28.12

INDIAMART 232575 40.63 8854.15 6.26

MRF 65030 29.67 86211.55 8.58

DIXON 563625 24.18 5283.00 8.27

DEEPAKNTR 2846000 21.16 2891.70 21.18

3

For Private Circulation Only

Technical and Derivatives Review | October 08, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivative Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in