August 8, 2015

Technical Picks |

Major hurdle for the bulls remain at 8650

Sensex (28236) / Nifty (8565)

A smart rally on previous Friday was followed by a soft opening

Exhibit 1: Nifty Weekly chart

on Monday mainly due to mixed global cues. However, during

the remaining part of the session, the Nifty traded with a positive

bias and closed tad below the 8550 mark. On Tuesday, we

witnessed a bit of volatility on account of RBI Monetary policy.

However, this turned out to be a non-event due to widely

expected outcome. As a result, the Nifty ended the session with

a muted closing on Tuesday. The remaining all sessions of the

week traded with a mildly positive bias and as a result, the

benchmark index eventually concluded the week marginally

Source: Falcon

beyond the 8550 mark. All major sectoral indices managed to

Exhibit 2: Nifty Daily chart

close in the green amongst which the Auto, Healthcare,

Consumer Durables and Capital Goods became the major

gainers. For the second consecutive week, the Nifty ended with

a marginal gain of 0.37% over the previous week's closing.

Pattern formation:

The '89-day EMA' and the '89-week EMA' are placed at

27824 / 8419 and 25832 / 7779 levels, respectively.

The '20-day EMA' and the '20-week EMA' are placed at

28032 / 8497 and 27831 / 8432 levels, respectively.

Source: Falcon

correction towards 8450 - 8350 cannot be ruled out. On the

Future outlook

upside, a major hurdle for the bulls is seen at 8650. For the

Despite being an eventful week (Quarterly numbers of numerous

extension of current up move, the Nifty needs to convincingly

index constituents and the RBI Monetary Policy), our markets

cross this hurdle. Only in this scenario, we may witness a rally

remained muted and traded within a narrow range. This was

towards 8720 - 8800 levels. However, we are of the opinion

very much on our expected lines as we had clearly mentioned

that this bullish scenario is only possible if the Bank Nifty

about the range bound action along with a lot of stock specific

surpasses the 19200 mark; because, the major chunk in Nifty

action in the market. The current daily chart structure of Nifty

is made up of banking stocks. Thus, we would closely keep our

doesn't suggest anything apart from the 'Doji' candle which was

eyes on the Bank Nifty's movement as well. Considering above

formed on Thursday. Going forward, a sustainable move below

mentioned evidences, we advise traders to remain light on

the low (8551.50) of this pattern may apply immediate brakes

positions and continue with a stock specific approach.

on the current optimism. In this scenario, a possibility of a minor

For Private Circulation Only | Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP00000154 6 Angel Securities Ltd:BSE: INB010994639/

1

INF010994639

NSE:

INB230994635/INF230994635

Membership

numbers:

BSE

028/NSE:09946

August 8, 2015

Technical Picks |

Weekly Pivot Levels For Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

27,687

27,962

28,161

28,436

28,635

NIFTY

8,382

8,473

8,540

8,631

8,698

BANKNIFTY

18,574

18,734

18,919

19,079

19,264

ACC

1,343

1,371

1,394

1,422

1,445

AMBUJACEM

222

225

229

232

236

ASIANPAINT

848

874

900

925

952

AXISBANK

563

571

580

589

598

BAJAJ-AUTO

2,410

2,474

2,541

2,605

2,672

BANKBARODA

171

178

185

193

200

BHEL

230

248

268

286

306

BPCL

883

919

941

978

1,000

BHARTIARTL

398

405

416

423

435

BOSCH LIMITED

23,772

24,904

25,802

26,934

27,831

CAIRN

158

162

169

173

180

CIPLA

688

702

716

730

744

COALINDIA

390

402

425

437

460

DRREDDY

3,928

4,094

4,210

4,375

4,492

GAIL

331

336

346

351

361

GRASIM

3,646

3,728

3,785

3,866

3,924

HCLTECH

908

923

941

957

974

HDFCBANK

1,062

1,077

1,097

1,113

1,133

HDFC

1,251

1,275

1,313

1,336

1,374

HEROMOTOCO

2,495

2,578

2,686

2,770

2,877

HINDALCO

101

105

109

113

116

HINDUNILVR

885

895

910

920

935

ICICIBANK

296

303

311

319

327

IDEA

156

162

168

174

180

INDUSINDBK

909

928

955

974

1,001

INFY

1,030

1,063

1,084

1,117

1,139

ITC

315

320

327

331

338

KOTAKBANK

667

686

699

718

732

LT

1,654

1,744

1,794

1,884

1,934

LUPIN

1,599

1,647

1,682

1,730

1,765

M&M

1,278

1,334

1,388

1,444

1,498

MARUTI

4,335

4,394

4,439

4,498

4,543

NMDC

99

102

103

105

107

NTPC

130

132

135

137

140

ONGC

258

270

277

290

296

POWERGRID

137

138

141

142

144

PNB

145

152

158

166

171

RELIANCE

955

970

992

1,006

1,028

SBIN

259

270

281

292

303

SUNPHARMA

806

829

843

866

881

TCS

2,443

2,498

2,540

2,595

2,637

TATAMOTORS

365

379

388

402

410

TATAPOWER

67

68

70

71

72

TATASTEEL

235

249

259

272

282

TECHM

501

518

538

555

576

ULTRACEMCO

3,037

3,120

3,188

3,271

3,339

VEDANTA

121

125

128

132

136

WIPRO

547

558

569

580

591

YESBANK

802

812

829

839

856

ZEEL

387

399

408

420

429

Technical Research Team

For Private Circulation Only | Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP00000154 6 Angel Securities Ltd:BSE: INB010994639/

2

INF010994639

NSE:

INB230994635/INF230994635

Membership

numbers:

BSE

028/NSE:09946

August 8, 2015

Derivatives Review |

BankNifty may breach its narrow range of 18800-19100

Nifty spot closed at 8564.60 this week against a close of 8532.85 last week. The Put-Call Ratio has increased from 0.91 to 0.99 levels

and the annualized Cost of Carry is positive at 6.29%. The Open Interest of Nifty Futures decreased by 1.23%.

Put-Call Ratio Analysis

Implied Volatility Analysis

PCR-OI has decreased from 0.91 to 0.99 levels mainly due to

Implied Volatility (IV) for NIFTY has decreased from 13.42% to

open interest addition in put options. Huge buildup was visible

13.15%. Historical volatility (HV) of NIFTY is at 15.74% and

in 8600-9000 call options last week. On the other hand in put

that for BANKNIFTY is trading at 20.74%. Liquid counters having

options good amount of build-up was visible in 8200-8600

very high HV are MOTHERSUMI, AMARAJABAT, JPPOWER,

strikes. Maximum buildup in current series is seen in 8800 call

PIDILITIND and BHEL. Stocks where HV are on lower side are

& 8200 put options.

SUNPHARMA, WOCKPHARMA, AMTEKAUTO, AXISBANK and

TATAMTRDVR.

Open Interest Analysis

Cost-of-Carry Analysis

Total open interest of market has increased from

Nifty current month futures closed at a premium of 29.50 points

`1,84,198/- cr. to `2,13,910/- cr. Stock futures open interest

against a premium of 36.80 points to its spot. Next month

has increased from `64,552/- cr. to `66,874/- cr. Liquid

future is trading with premium of 69.25 points. Liquid counters

counters names which added significant positions last week

where CoC is high are KOTAKBANK, BPCL, HDFCBANK, VEDL

are HEROMOTOCO, BHEL, DRREDDY, BPCL and CIPLA. On

and BANKBARODA. Stocks with negative CoC are DLF, BHEL,

the other hand unwinding was visible in counters like

GAIL, MARUTI and ULTRACEMCO.

ICICIBANK, ACC, TCS, AXISBANK and ONGC.

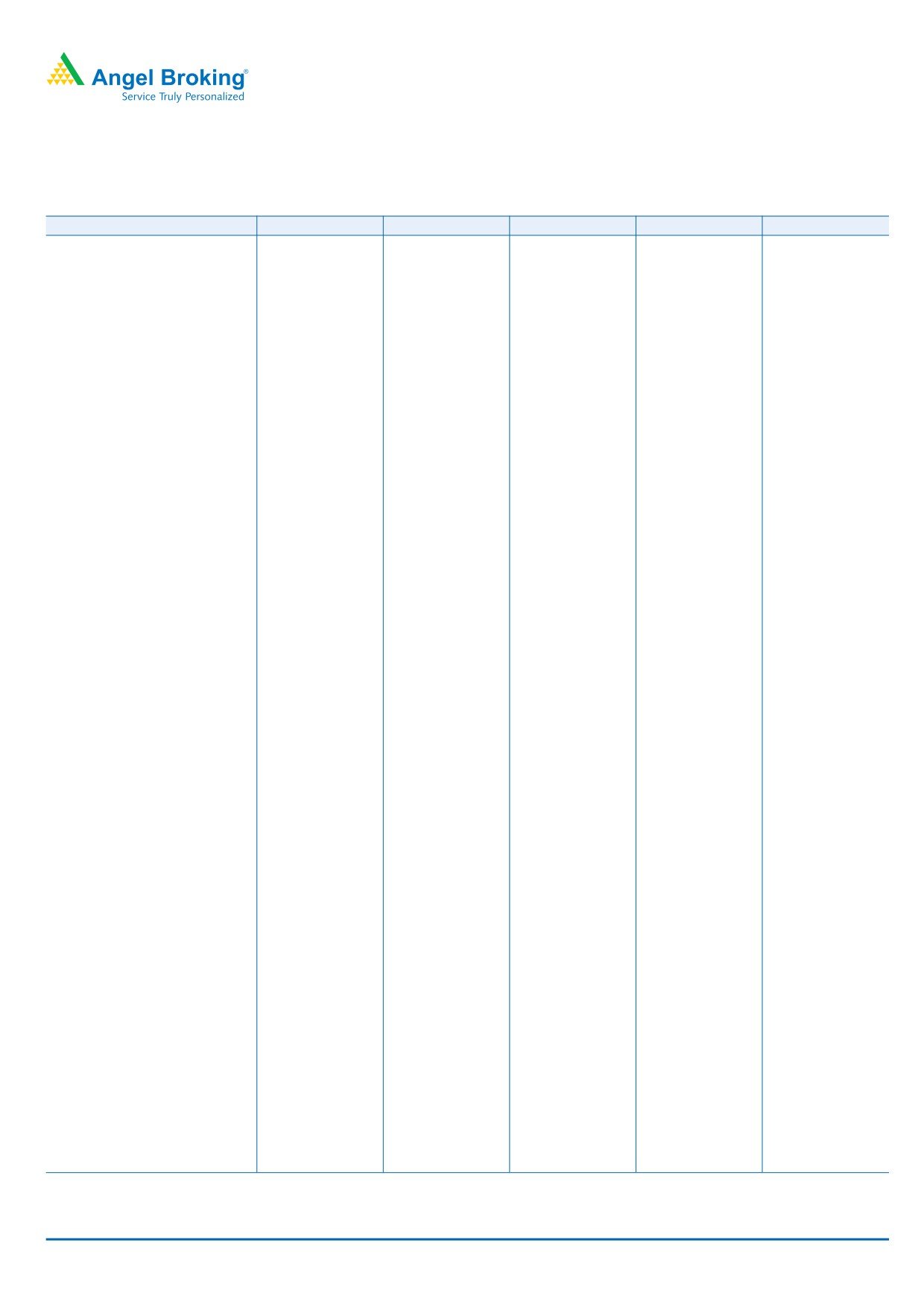

Derivative Strategy

Scrip : BANKNIFTY

CMP : `18,979.90

Lot Size : 25

Exercise Date (F & O) :

27th. Aug 2015

View: Volatile

Strategy: Long Strangle

Expected Payoff

Buy/Sell

Qty

Scrip

Strike

Series

Option

Buy/Sell Rate

Closing Price

Expected

Price

Type

(`)

(`)

Profit/Loss

BUY

25

BANKNIFTY

18700

AUG

PE

200.00

17700

`590.00

SELL

25

BANKNIFTY

19200

AUG

CE

210.00

18200

`90.00

LBEP

-

`18290

UBEP - `19610

18700

(`410.00)

19200

(`410.00)

Max. Risk: `10,250/-

Max. Profit: Unlimited

If BANKNIFTY closes between two strikes on expiry.

If BANKNIFTY closes above UBEP or below LBEP on expiry.

19700

`90.00

NOTE: Profit can be booked before expiry if BANKNIFTY moves in favorable direction and time value decays.

20200

`590.00

For Private Circulation Only | Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP00000154 6 Angel Securities Ltd:BSE: INB010994639/

3

INF010994639

NSE:

INB230994635/INF230994635

Membership

numbers:

BSE

028/NSE:09946

Weekly

Research Team Tel: 022 - 39357800

Disclaimer

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel

or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company

covered by Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of

securities of the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer, director or

employee of company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and

trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited

has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation

or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited

endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other

reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure’ report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)