1

For Private Circulation Only

Technical and Derivatives Review | April 08, 2022

Mixed sentiments in key indices, broader market outshines

Sensex (59447) / Nifty (17785)

Source: Tradingview.com

Future outlook

On Monday, the news flow with respect to the merger of two giant companies, HDFC Ltd and HDFC Bank resulted in a complete gush

in these heavyweights and then rub off of this was seen across the broader market. In this process, the key indices, Nifty and Bank

Nifty just took off right from the word go. Since the HDFC conglomerate is known for its reputation, this development provided the

much needed impetus to the rally. However, on the following sessions, the momentum fizzled out and as a result, key indices

witnessed a decent profit booking for three consecutive sessions. Fortunately, on Friday, markets recovered from key levels to

conclude the week tad below 17800.

It has been an eventful week for our markets specifically, because it started with a bang due to HDFC twins merger news and then

on the last day, the RBI monetary policy became the show stopper. Although the way market kicked off on Monday, the following

sessions were not up to the mark. After giving a single day abnormal surge, both these stocks witnessed a decent profit booking

thereafter. Fortunately, post the monetary policy, market took it positively and ended the week slightly inside the safe terrain. For

the coming week, 17600 followed by 17400 are likely to provide some cushion for the index and till the time, we do not close below

these key levels, we would continue with our ‘Buy on decline’ strategy. On the flipside, the first sign of strength would be visible

after surpassing the 17900 mark.

Despite some mid-week hiccups, we managed to defend key supports and going by the famous phrase ‘All’s well that ends well’, we

must look at the optimistic close. The coming week is going to be the truncated one and hence, do not expect any big bang moves in

key indices. The upside as of now looks limited for the week towards 18000 – 18100. But the way broader market kept buzzing in the

challenging phase this week as well, one must continue to focus outside the index.

2

For Private Circulation Only

Technical and Derivatives Review | April 08, 2022

An action-packed start to the FY23

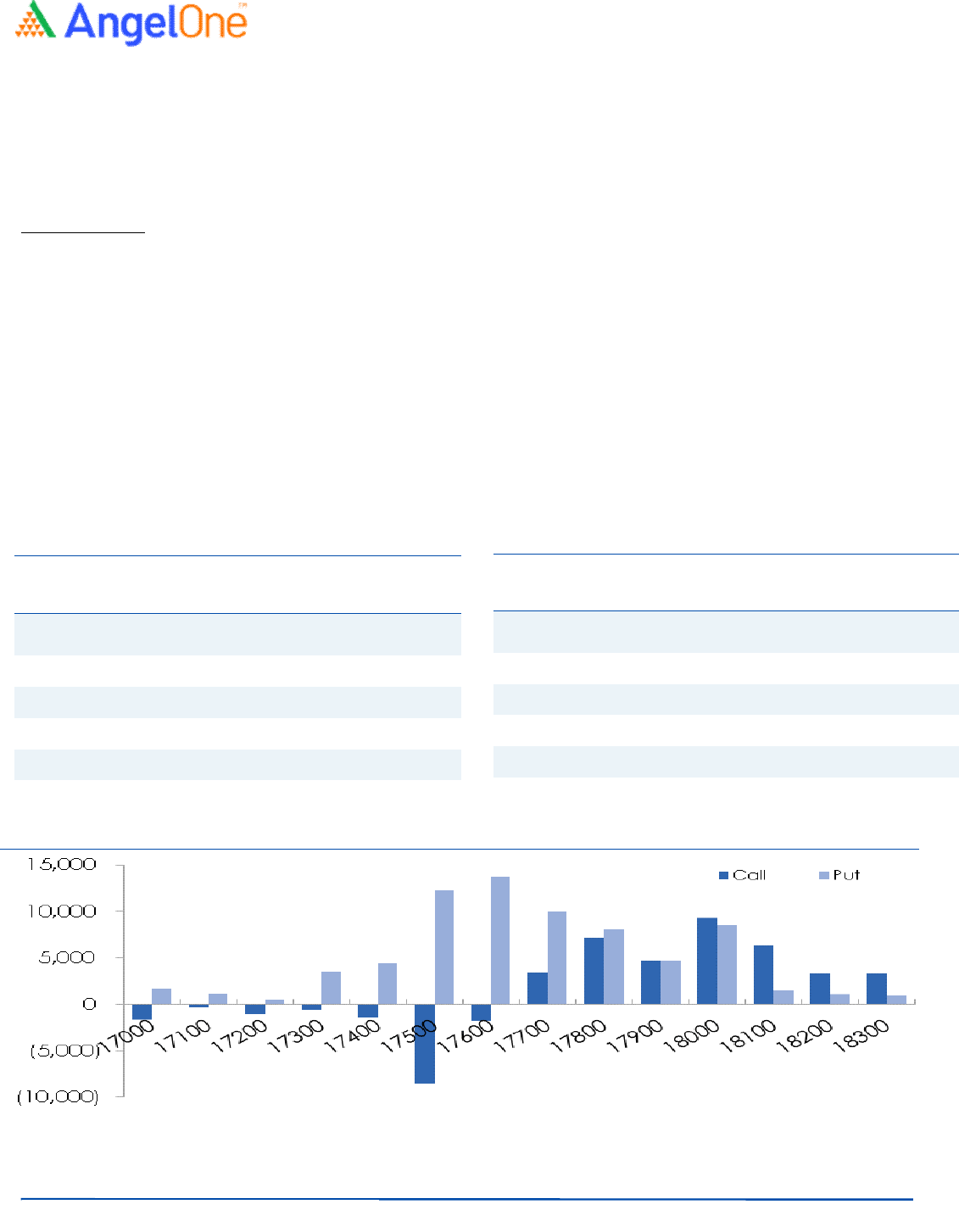

Nifty spot closed at 17784.35 this week, against a close of 17670.45 last week. The Put-Call Ratio has decreased from 1.30 to 1.01.

The annualized Cost of Carry is positive at 9.69%. The Open Interest of Nifty Futures decreased by 28.76%.

Derivatives View

Nifty current month future closed with a premium of 94.40 points against a premium of 90.80 points to its spot. Next month future

is trading at a premium of 139.70 points.

The start of FY23 has indeed been a roller coaster ride for the equity market, wherein the benchmark index pared down the initial

gains of the week, though concluding the week in favor of the Bulls. Taking a glance at the F&O data, we observed mixed activity

during the week, wherein the stronger hands were seen closing their short positions, followed by a mix of long building and

unwinding throughout the week. In the options segment, the pile-up is clearly visible in 17600-17700 Put strikes. While on the

contrary, a considerable OI concentration is built on the 18000 call option, breaching which a strong momentum could be seen in

the comparable period. Considering recent development, we remain upbeat on the market and expect the bullish momentum to

continue. Also, traders are advised to use any declines to add new long positions.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ZEEL 86106000 28.17 287.30 (2.69)

RBLBANK 59829900 26.65 128.40 (3.96)

ONGC 56741300 13.79 171.50 (2.56)

IDFC 116180000 13.61 62.80 (2.03)

MPHASIS 1704850 9.76 3181.15 (3.34)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

BSOFT 6087900 35.82 492.45 5.74

IOC 54704000 27.59 127.80 7.44

TATACOMM 4279200 26.33 1353.60 15.91

BALRAMCHIN 8300800 23.94 513.15 6.83

CANFINHOME 3785925 20.59 661.45 9.71

Short Formation

3

For Private Circulation Only

Technical and Derivatives Review | April 08, 2022

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in

the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

4

For Private Circulation Only

Technical and Derivatives Review | April 08, 2022

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.