1

For Private Circulation Only

Technical and Derivatives Review | May 06, 2022

Stressful time continues, all eyes on global peers

Sensex (54836) / Nifty (16411)

Source: Tradingview.com

Future outlook

The May month kick-started on a weak note in-line with what SGX was indicating. However, on that day we did see some buying at

lower levels which helped erasing most of the losses to close convincingly above 17000. After a day’s break, we resumed on

Wednesday with some hesitance around 17100. Later on, a surprising Rate hike by RBI triggered massive sell off in our markets to

send Nifty below the key support zone of 16800 with some authority. On the following day, it appeared as if the selling was an

overreaction; but this time, global markets became the spoilsport. With a huge gap down on Friday, our markets started around the

16400 mark. Fortunately, due to lack of follow through selling, we did not extend the damage and closed around the opening point.

It was one of the worst weeks in last three months as Nifty shed more than 4% this week. Mostly, global factors tend to trigger such

substantial sell offs but, on this occasion, it was initiated due to domestic developments and then to rub salt in the wound, global

cues fuelled the corrective move. Honestly speaking, we did not expect the fall to extend below 16500 but when global uncertainty

comes, no level is respected. Globally, things have become extremely bleak, and it would be very difficult to assess the situation

there. Despite this, we do not want to get carried away and hence, would avoid going short aggressively. If we take a glance at the

daily time frame chart, we can see ‘Pennant’ pattern target in the vicinity of 16200 – 16000, which is not far away from current level.

Hence, we would rather wait for some reversal in coming week. On the higher side, 16500 followed by 16700 are the immediate

levels to watch out for. Let’s see how things pan out globally and be hopeful for some sustainable relief on that front.

2

For Private Circulation Only

Technical and Derivatives Review | May 06, 2022

FIIs continued their relentless sell-off

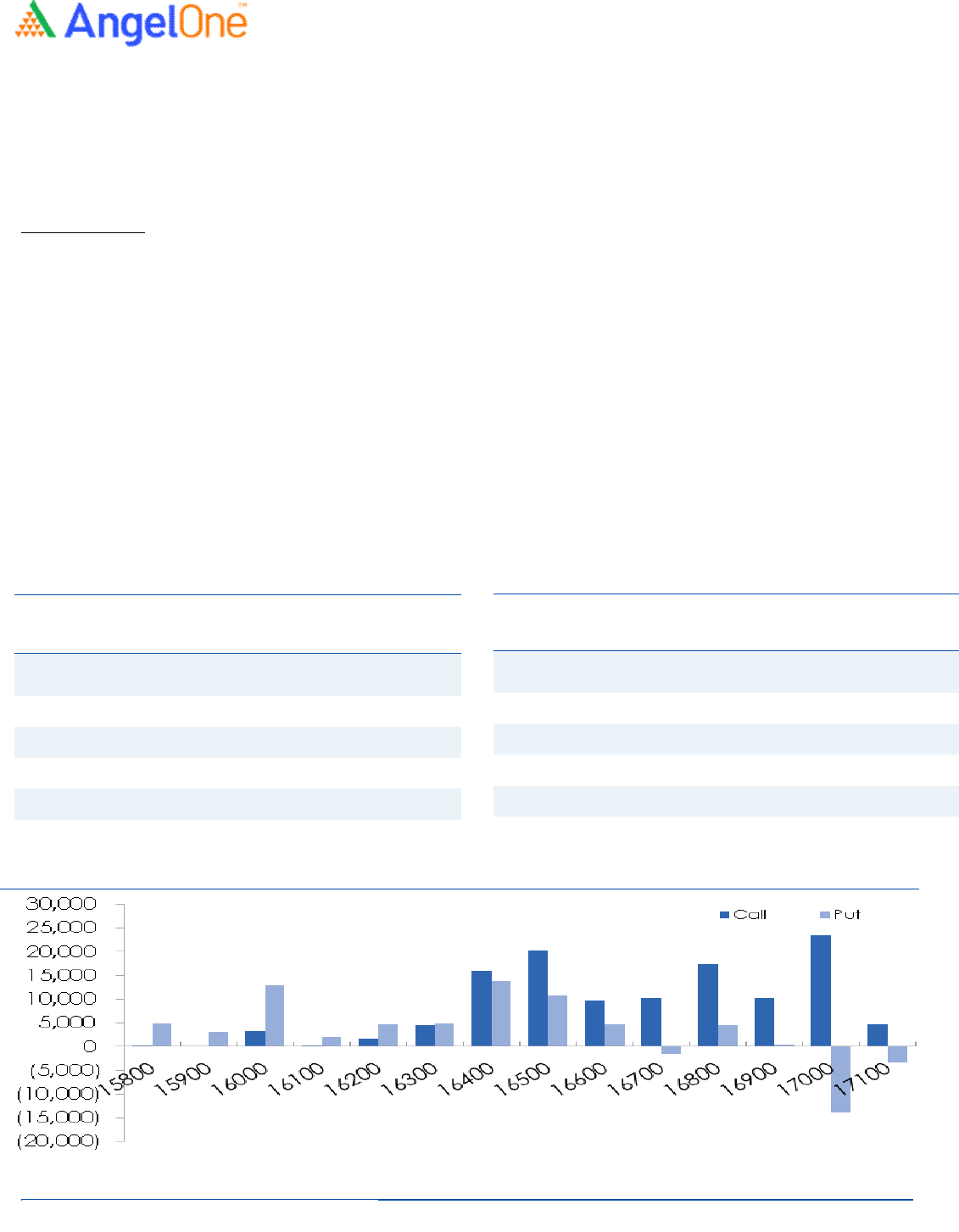

Nifty spot closed at 16419.40 this week, against a close of 17102.55 last week. The Put-Call Ratio has decreased from 0.96 to 0.74.

The annualized Cost of Carry is positive at 0.91%. The Open Interest of Nifty Futures increased by 25.01%.

Derivatives View

Nifty current month’s future closed with a premium of 8.15 points against a premium of 32.70 points to its spot. Next month’s future

is trading at a premium of 20.80 points.

A timid start for our equity market tracking the weakness among global bourses, that further got aggravated as RBI stuns with the

surprise rate hike. The benchmark index Nifty50 plummeted over 4 percent and has been the worst week in the last three months.

The technical support was treated just as a number as the stronger hands continued their relentless selling spree. Looking at the

F&O data, we observed mixed activity, wherein the stronger hands started with adding short positions, followed by an overdue long

unwinding, and ended the week with a huge short built-up. The pile-up is visible in the 16000-16200 Put strikes in the options

segment, which is expected to act as a key support zone. While on the contrary, a considerable OI concentration is built on the

16500-16700 call stikes, breaching which some assurance could be seen in the market. Considering recent developments both on

the domestic as well as the global front, strong indecisiveness could be sensed among the market participants, and thus traders are

advised to stay cautious and avoid aggressive bets till the volatility looms over.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

FSL 14716000 38.62 113.05 (9.99)

FEDERALBNK 80390000 38.60 91.35 (5.14)

DIXON 787875 38.28 3890.90 (9.51)

INDIAMART 382200 31.88 4183.70 (9.48)

TORNTPOWER 3859500 28.65 493.85 (7.48)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ABB 444000 69.30 2262.25 7.84

TATACHEM 6908000 28.21 1037.30 10.16

POWERGRID 43589376 12.38 238.65 4.33

NTPC 72526800 8.64 159.75 2.01

ONGC 50554350 5.53 167.20 3.79

3

For Private Circulation Only

Technical and Derivatives Review | May 06, 2022

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in

the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

4

For Private Circulation Only

Technical and Derivatives Review | May 06, 2022

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.