1

For Private Circulation Only

Technical and Derivatives Review |March 05, 2023

Strong recovery in Nifty, led by the rally in Banks

Sensex (59809) / Nifty (17594)

Source: Tradingview.com

Future outlook

Our market started the week on a bleak note taking cues from the weak global bourses, wherein the benchmark index tested the

Budget day’s swing low and dented market sentiments. Nifty struggled near the 200 SMA throughout the week until the last session,

when a robust recovery was seen in the broader market space. Eventually, the week closed on a positive note, procuring 0.74

percent from its previous week’s closure and Nifty settled a tad below the 17600 level.

The upsurge in the Adani group companies post the block deal has its rub of effect on the PSU Banks, eventually spreading the cheer

in the broader market. From a technical perspective, the recent price action could be seen as constructive development for our

markets as the index witnessed a modest recovery from the 200 SMA and made a strong closure on the daily time frame. As far as

levels are concerned, 17500 is now likely to be seen as the immediate support zone, while the sacrosanct support lies around the

17350-17400 zone, coinciding with the 200 SMA. On the flip side, the bearish gap of 17770-17800 is expected to act as the sturdy

hurdle for Nifty in a comparable period.

Going forward, we remain sanguine and would advise the traders to utilize the dips to add long position in the index. The

participation from the high-beta Banking space has provided the much needed impetus and is likely to continue in the near term.

Simultaneously, one should also keep a close tab on the Mid-cap space, which is expected to provide immense trading opportunities

in the near period.

2

For Private Circulation Only

Technical and Derivatives Review |March 05, 2023

Sho

rt Form

at

ion

Short rollover for key indices

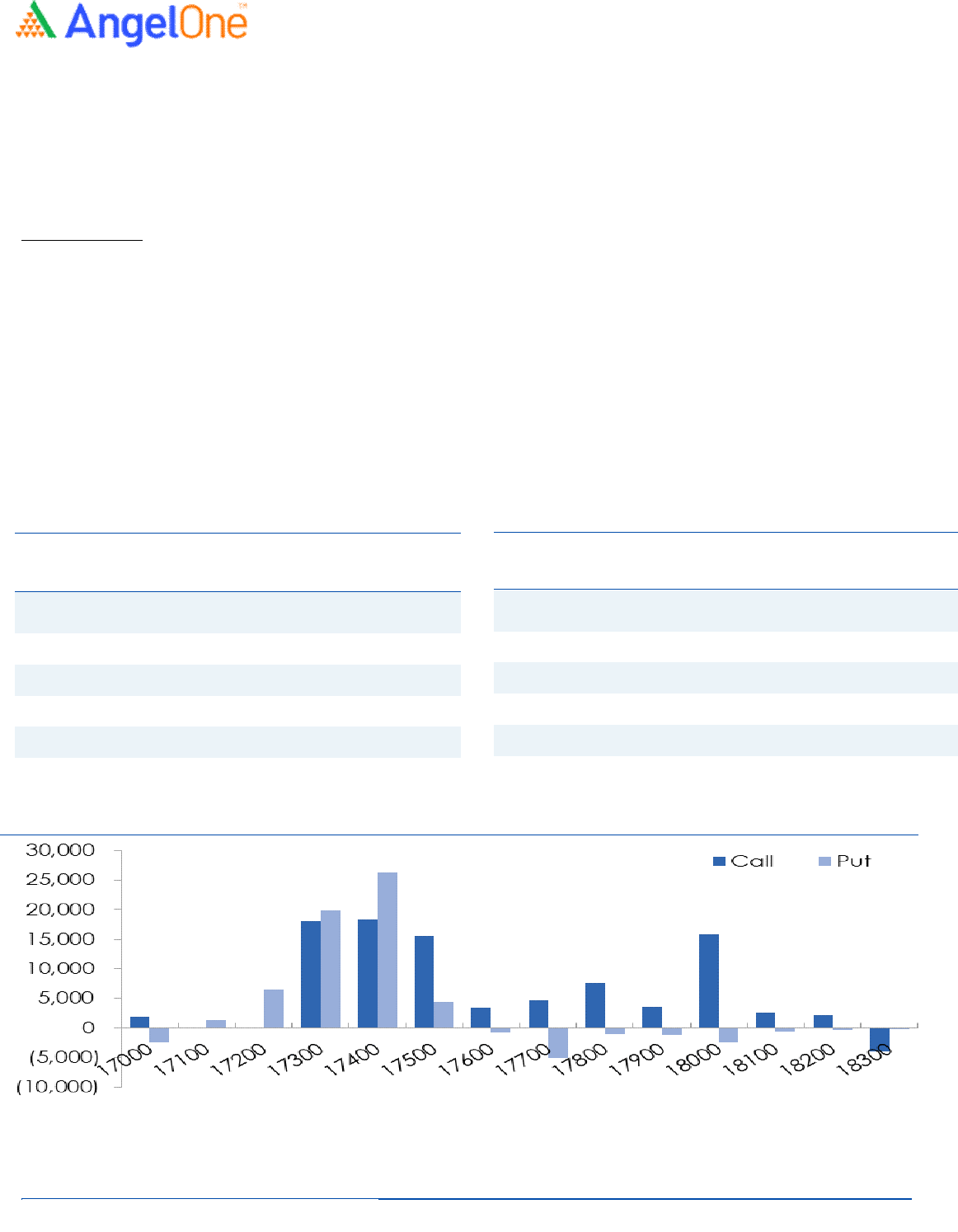

Nifty spot closed at 17594.35 this week, against a close of 17465.80 last week. The Put-Call Ratio has decreased from 0.878 to 1.17

on Weekly basis. The annualized Cost of Carry is positive at 6.16%. The Open Interest of Nifty Futures increased by 7.14 %.

Derivatives View

Nifty current month’s future closed with a premium of 77.20 against a premium of 90.45 points to its spot in the previous week.

Next month’s future is trading at a premium of 175.95 points.

After recent sell-off finally we saw a sharp rally on Friday to conclude the week around 17600 mark. During the selling, we witnessed

decent amount of shorts in key indices but on the final day of the week short covering was seen in Nifty and banking index added

fresh longs. In options front, put writers added huge positions in 17400-17600 strikes, suggesting strong base formation around

17400-17500 now. On the other side, 17700-17900 call strikes added some fresh bets. Stronger hands have covered shorts, led

‘Long Short Ratio’ to surge to 23% from 18% WoW. The above data points hints, market has certainly bottom out and we may see

extension of upmove in the festive week.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

TATASTEEL 235460500 33.26 107.75 (2.36)

MPHASIS 2090000 29.91 2083.85 (5.50)

PEL 7553150 28.86 787.70 (1.54)

VEDL 39914000 24.46 291.10 (1.59)

HDFCAMC 3018600 19.70 1806.80 (1.25)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ADANIENT 16582250 20.23 1891.20 43.43

INDIAMART 318600 18.86 4894.00 4.74

TORNTPOWER 3687000 17.83 514.35 2.76

ABCAPITAL 34975800 15.31 155.70 9.00

ABB 1630750 15.25 3330.90 5.55

3

For Private Circulation Only

Technical and Derivatives Review |March 05, 2023

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 - 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in

the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

4

For Private Circulation Only

Technical and Derivatives Review |March 05, 2023

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel One Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel One Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in

the subject company. Research analyst has not served as an officer, director or employee of the subject company.