Technical Picks | March 5, 2016

Nifty may take a breather at 7550, but avoid shorting

Sensex (24646) / Nifty (7485)

The market was inflicted with high volatility as it started the

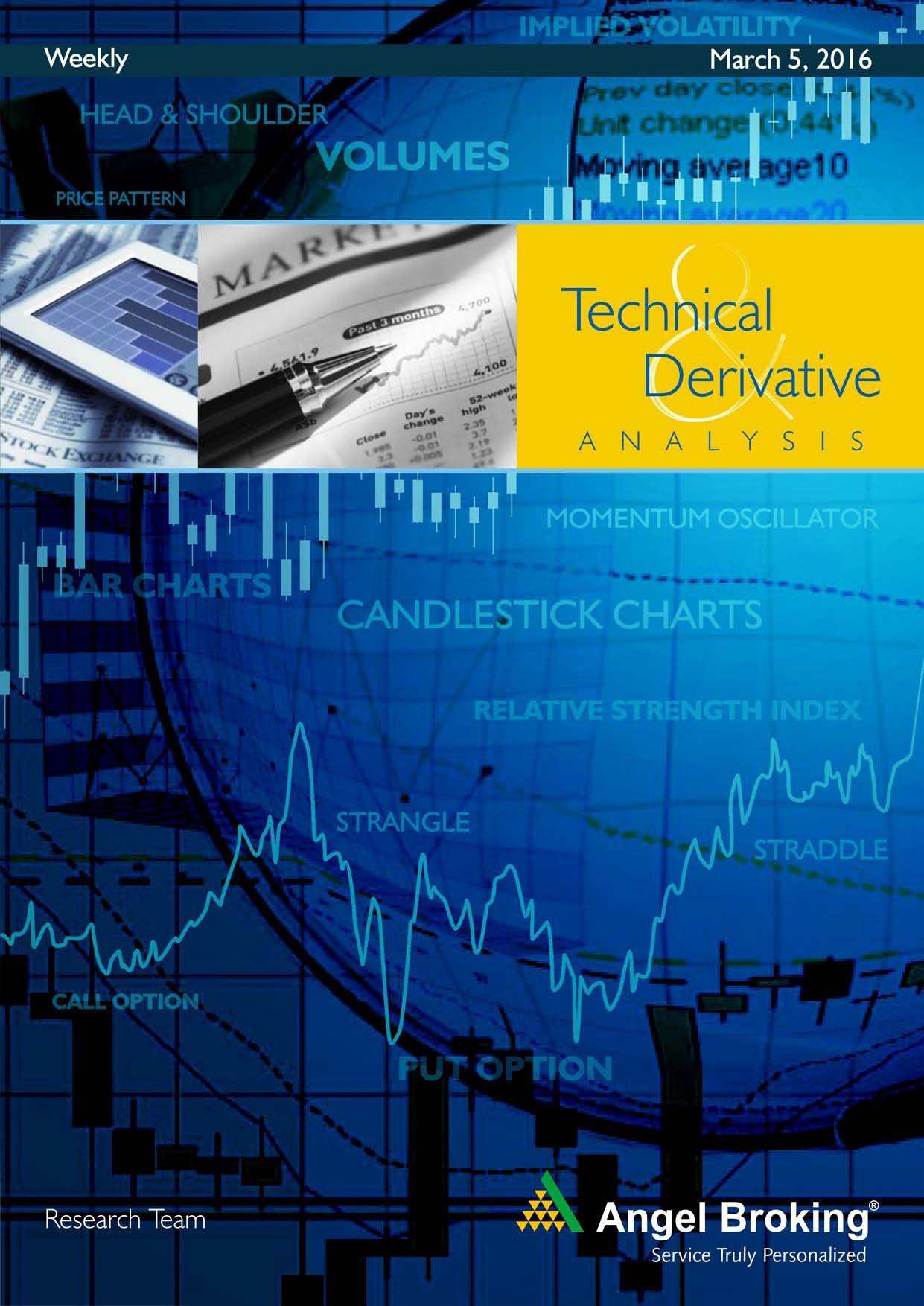

Exhibit 1: Nifty Weekly chart

proceedings for the week at the backdrop of the

announcement of Union Budget 2016-17. The Nifty had a

rollercoaster move on Monday with it making a 52-week low

of 6825.80. But post the conclusion of the budget speech, it

underwent a sharp recovery from the lower levels and

managed to offset a major portion of the day’s losses to

finally close just a tad below the 7000 mark. The bullishness

spilled over Tuesday with the Nifty opening gap up and the

same was followed by a tremendous intraday rally. The

upward momentum got accelerated further in the following

sessions; in the process, the Nifty surpassed the 7500 mark.

The index eventually ended the week with an enormous gain

of 6.48% over the previous week’s closing, which is the

biggest weekly gain in the last four years.

Source: Company, Angel Research

Pattern formation:

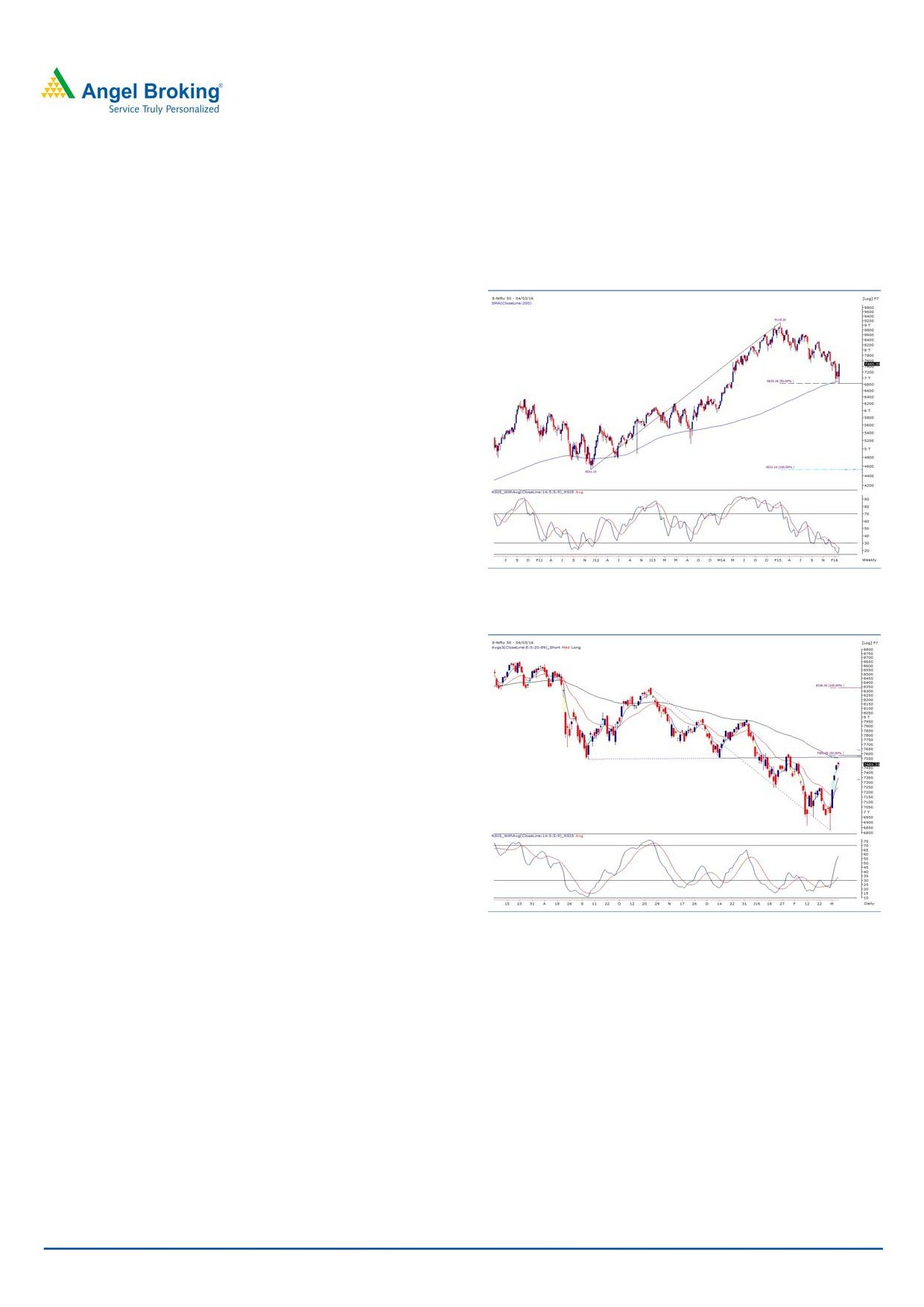

Exhibit 2: Nifty Daily chart

The ’89-day EMA’ and the ’89-week EMA’ for the

Sensex/Nifty are placed at

24869

/

7555 and

25646 / 7755 levels, respectively.

The ’20-day EMA’ and the ‘20-week EMA’ for the

Sensex/Nifty are placed at

23852

/

7247 and

24995 / 7592 levels, respectively.

Future outlook

The concluded week was clearly dominated by the bulls

wherein the Nifty rallied by around 10% from its Monday’s

intraday low. Market participants have taken the budget in

the positive vein and it is now being anticipated that the RBI

Source: Company, Angel Research

might initiate further cuts in the interest rate. During the

week, the Nifty took support at the 50% retracement level of

Considering multiple resistances, a minor pull back cannot

the entire up move from 4531.15 to 9119.20, which also

be ruled out although the overall view remains positive. We

coincides with the ‘200 SMA’ on the weekly chart. Also, we

advise traders not to get carried away in the anticipated

witnessed a positive divergence of the ‘RSI-smoothened’

corrective price action and suggest towards remaining light

oscillator on the daily chart. The up move was in line of our

on positions until there is a decisive development on the

anticipation and we were vocal about the same in our daily

charts. Going forward, if the Nifty manages to overcome

reports. The short term downtrend of the Nifty got negated

the 7600 mark, then we may see an extension of the up

as it formed ‘Higher Highs’ on the daily chart after a period

move towards 7750 - 7800 levels; whereas 7300 - 7250

of four months. At the current juncture, the Nifty is trading

zone on the downside would now act as a crucial support for

near its resistance of 7550 (previous breakdown level) on

the Nifty.

the daily chart, which coincides with the ‘89 DEMA’ and 50%

retracement level of the previous down move from 8336.30

to 6825.80.

For Private Circulation Only

1

Technical Picks | March 5, 2016

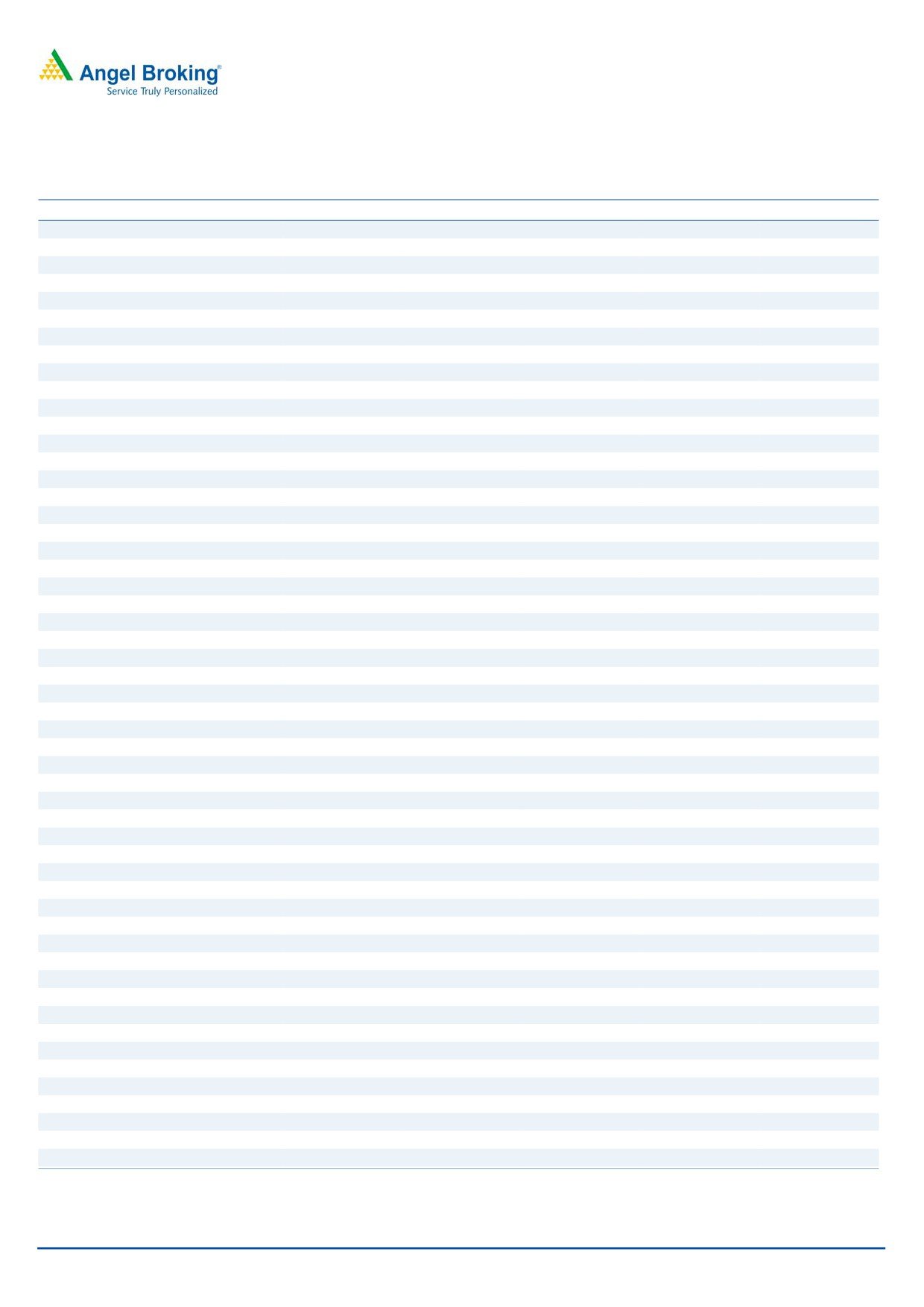

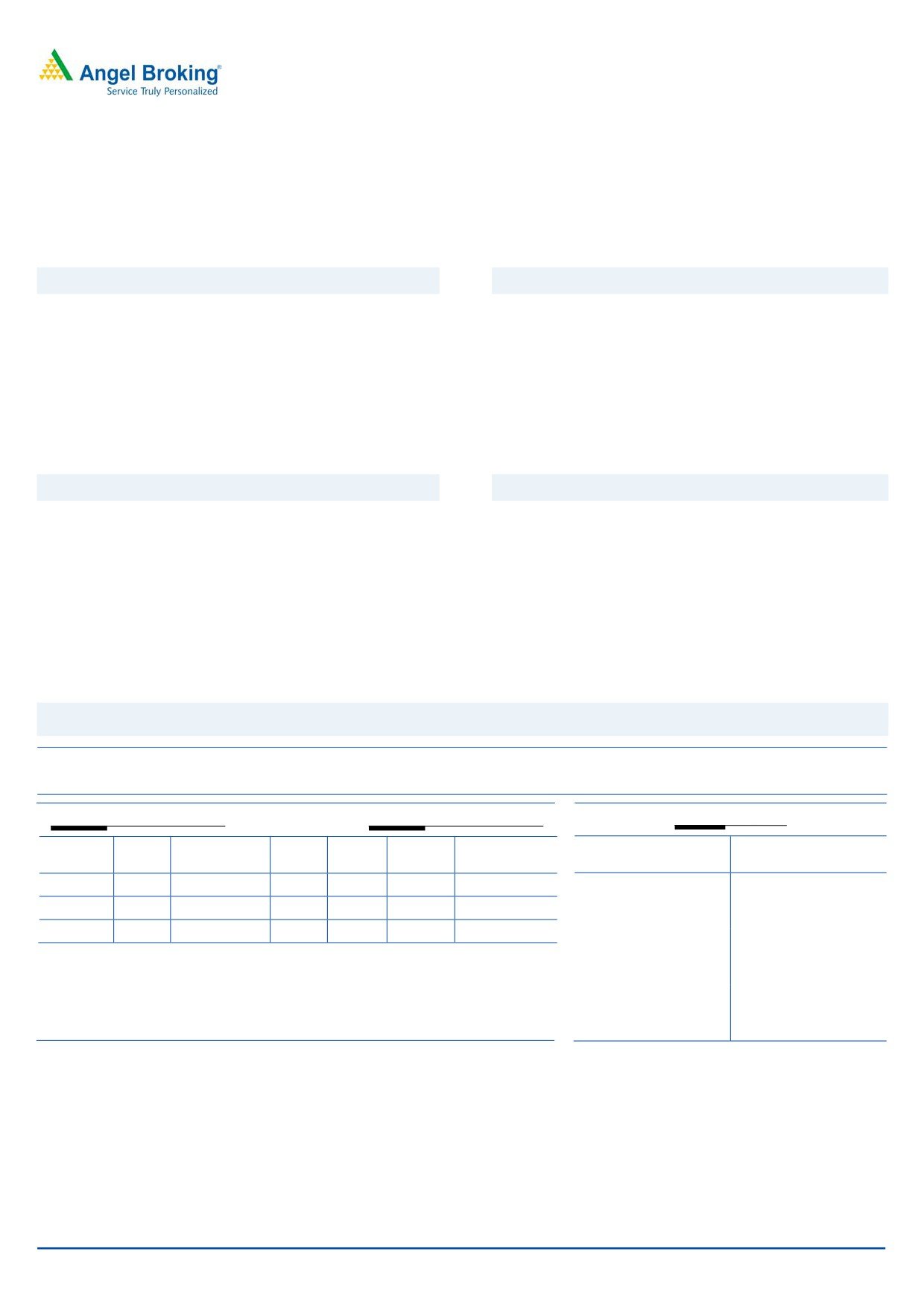

Weekly Pivot Levels For Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

21729

23188

23953

25412

26178

NIFTY

6592

7039

7272

7719

7952

NIFTY BANK

12688

14014

14733

16058

16777

ACC

1139

1189

1224

1275

1310

ADANIPORTS

183

204

217

238

250

AMBUJACEM

179

191

197

209

215

ASIANPAINT

813

839

868

894

923

AXISBANK

358

387

403

432

448

BAJAJ-AUTO

2115

2211

2267

2363

2420

BANKBARODA

118

133

143

158

168

BHEL

84

96

102

114

120

BPCL

709

762

790

843

871

BHARTIARTL

299

314

325

341

352

BOSCH

15969

16613

17022

17666

18075

CAIRN

106

117

125

136

144

CIPLA

489

513

529

554

570

COALINDIA

298

312

320

333

341

DRREDDY

2866

3060

3171

3364

3476

GAIL

268

305

327

363

385

GRASIM

3156

3336

3433

3613

3711

HCLTECH

761

798

832

870

904

HDFC

982

1055

1096

1169

1209

HDFCBANK

894

957

991

1054

1088

HEROMOTOCO

2334

2585

2722

2973

3110

HINDALCO

61

70

76

85

91

HINDUNILVR

803

826

841

864

879

ICICIBANK

166

193

209

236

252

IDEA

99

102

106

109

113

INDUSINDBK

760

838

880

957

999

INFY

1019

1095

1144

1220

1268

ITC

240

278

306

343

372

KOTAKBANK

556

611

640

695

725

LT

986

1090

1157

1260

1328

LUPIN

1641

1710

1765

1834

1889

M&M

1139

1177

1229

1267

1319

MARUTI

3011

3283

3465

3737

3919

NTPC

113

120

124

131

135

ONGC

171

186

203

218

236

POWERGRID

126

132

136

142

146

PNB

65

74

79

88

93

RELIANCE

903

955

986

1038

1069

SBIN

140

164

177

201

214

SUNPHARMA

810

833

857

881

904

TCS

2012

2185

2288

2461

2564

TATAMOTORS

269

306

328

365

386

TATAPOWER

55

57

58

61

62

TATASTEEL

229

259

275

305

321

TECHM

384

418

441

474

497

ULTRACEMCO

2549

2728

2869

3048

3189

VEDL

62

75

82

95

103

WIPRO

491

514

531

554

572

YESBANK

624

692

731

798

837

ZEEL

348

372

388

412

429

Technical Research Team

For Private Circulation Only

2

Derivatives Review | March 5, 2016

Liquidity flowing in our market; stay long.

Nifty spot closed at 7485.35 this week, against a close of 7029.75 last week. The Put-Call Ratio has increased from 0.82 to 1.00

levels and the annualized Cost of Carry is negative at 4.51%. The Open Interest of Nifty Futures increased by 21.78%.

Put-Call Ratio Analysis

Implied Volatility Analysis

PCR-OI has increased from 0.82 to 1.00 levels mainly due

Implied Volatility (IV) for NIFTY has decreased from

to huge OI addition in put options. 7000-7400 strikes of

19.64% to 15.19%. Historical volatility (HV) of NIFTY is at

put options added significant OI, while IV’s plunged more

27.61% and that for BANKNIFTY is at 37.64%. Liquid

than 400 bps indicating short formation. In call options,

counters having very high HV are ITC, MARUTI,

7400-7800 strikes added good amount of build-up.

HEROMOTOCO, ONGC and ICICIBANK. Stocks where

Maximum build-up in current series is seen in 7500 call

HV are on lower side are EICHERMOT, LUPIN, MARICO,

options and 7000 put options.

CROMPGREAV and JISLJALEQS.

Open Interest Analysis

Cost-of-Carry Analysis

Total open interest of market has increased from

Nifty current month futures closed at a discount of 25.00

`1,68,030/- cr. to `2,12,493/- cr. Stock futures open

points against a premium of 25.40 points to its spot. Next

interest has increased from `50,078/- cr. to `56,552/- cr.

month future is trading with premium of 2.40 points.

Large cap names which added significant positions last

Liquid counters where CoC is high are IDFC, HINDALCO,

week are ONGC, HEROMOTOCO, CIPLA, COALINDIA

JINDALSTEL, LT and CIPLA. Stocks with negative CoC are

and JINDALSTEL. On the other hand unwinding was visible

COALINDIA, BAJAJ-AUTO, HEROMOTOCO, TECHM and

in counters like GAIL, BANKBARODA, PNB, BAJAJ-AUTO

TATASTEEL.

and POWERGRID.

Derivative Strategy

Scrip: BHEL

CMP : `107.50

Lot Size : 2000

Exercise Date (F & O) :

31st Mar 2016

View: Mildly Bullish

Strategy: Long Call Ladder.

Expected Payoff

Buy/Sell

Qty

Scrip

Strike

Series

Option

Buy/Sell Rate

Closing Price

Expected

Price

Type

(`)

(`)

Profit/Loss

BUY

2000

BHEL

110

MAR

CE

4.00

95

(`2.00)

SELL

2000

BHEL

120

MAR

CE

1.50

105

(`2.00)

SELL

2000

BHEL

130

MAR

CE

0.50

115

`3.00

LBEP - `112

UBEP - `138

125

`8.00

Max. Risk: Unlimited

Max. Profit: `16,000

If BHEL continues to move above UBEP on expiry

If BHEL closes between `120-`130 levels on

135

`3.00

expiry.

145

(`7.00)

NOTE: Profit can be booked before expiry if BHEL moves in favourable direction and time value decays.

For Private Circulation Only

3

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

For Private Circulation Only

4