1

For Private Circulation Only

T

ech

nical and Derivative

s

Review

|November 04, 2022

Bulls continue with their hegemony

Sensex (60950) / Nifty (18117)

Source: Tradingview.com

Future outlook

Markets had a buoyant start for the new trading week on Monday and previous week’s struggle around 17800 finally came to an

end as we managed to open convincingly above it. After the initial upticks, index slipped into a consolidation and kept flirting with

psychological mark of 18000. The buying re-emerged towards the fag end in some of the heavyweights, which helped Nifty finally

surpass this key figure with some authority. This was followed by yet another gap up on the subsequent day and then Nifty went on

to surpass September month high of 18115. During the remaining part of the week, markets looked lethargic with no intent to move

beyond the 18200 mark. However, the bulls had enough strength to defend 18000 convincingly to eventually conclude the week by

pocketing nearly couple of percent on a weekly basis.

We started off well as global markets continued with their recovery mode and sentiments were much improved globally over the

previous weekend. In this process, we managed to go past the study wall of 18000 – 18100; but due to lack of follow up buying,

were unable to capitalize on the head start. Around the mid-week, the US markets once again looked a bit shaky and post the Fed

policy, reacted adversely to haunt market participants across the globe. We did react at the opening on Thursday; but immediately

this tremor was absorbed in our market. Without making any damage, we did recover on the same day and then went on to post a

weekly close above 18100 on Friday. This is a clear indication; how strong our markets have been of late. Undoubtedly, the bulls

continue with their hegemony in the domestic markets and are eying record highs now. If there is no aberration globally, we are

good to go towards 18250 – 18350 first and then a march towards previous highs 18600 looks very much on cards in the ongoing

calendar year. As far as supports are concerned, 18000 followed by 17900 should be treated as sacrosanct zone and any intra-week

decline would provide opportunities to create fresh longs.

Traders are advised to continue with an optimistic approach and now, with other sectors chipping in, we expect a good broad-based

buying in the forthcoming week. The banking was slightly muted in the latter half of the week; but never mind, it is just a breather

around previous highs after such a spectacular rally in the recent time. Soon, we would expect banking to resume its upward trend.

2

For Private Circulation Only

T

ech

nical and Derivative

s

Review

|November 04, 2022

Short Formation

FIIs long short ratio shows an encouraging sign

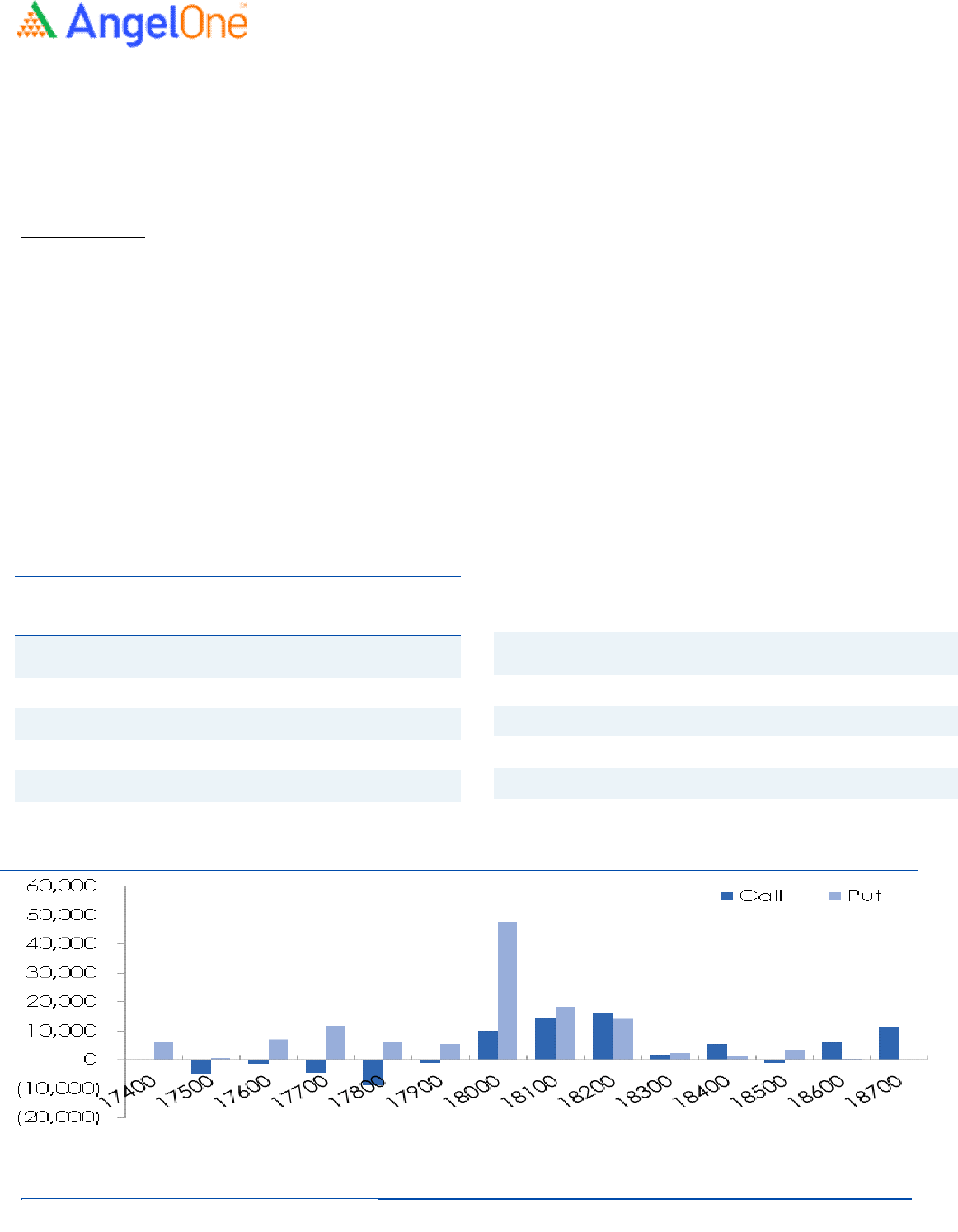

Nifty spot closed at 18117.15 this week, against a close of 17786.80 last week. The Put-Call Ratio remains unchanged at 1.12 on

Weekly basis. The annualized Cost of Carry is positive at 7.37%. The Open Interest of Nifty Futures increased by 9.17%.

Derivatives View

Nifty current month’s future closed with a premium of 76.85 against a premium of 43.40 points to its spot in the previous week.

Next month’s future is trading at a premium of 152.90 points.

The Indian equity market witnessed a splendid start to the week, as the benchmark index reclaimed the 18000 mark and maintained

its positive stature throughout. There have been mixed positions in the F&O space throughout the week, starting from long

additions to unwinding in both indices, but on the net, it stayed on the long side. On the options front, the piling up of positions is

visible in the 18100-18000 put strikes, indicating nearby support formation for Nifty. While on the higher end, the OI concentration

is disintegrated at every 100 points, suggesting a series of resistance, starting from 18100 to 18500 call strikes. Simultaneously, the

stronger hands have remained steady with their bullish bets as the ‘Long Short Ratio’ slightly expanded to 58% from 57% on WoW

basis. Going ahead, the undertone is likely to remain bullish, and any intra-week dip could be seen as an opportunity to add long

bets in the index.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

INTELLECT 4115500 138.37 434.35 (13.69)

COROMANDEL 2489900 130.52 957.20 (2.36)

BANDHANBNK 47635200 73.52 229.45 (13.79)

VOLTAS 6378900 59.38 847.65 (3.24)

LICHSGFIN 20198000 45.23 363.75 (14.02)

Weekly change in OI

Long Fo

rmation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

VEDL 44063900 49.75 324.25 13.65

JKCEMENT 517750 43.42 2797.00 8.07

TITAN 6734250 37.51 2788.90 1.65

RAIN 13443500 30.60 172.60 6.58

ALKEM 317200 30.53 3247.25 3.86

3

For Private Circulation Only

T

ech

nical and Derivative

s

Review

|November 04, 2022

Sameet Chavan

C

hief An

alyst

–

Technical

& Derivati

ves

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 - 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in

the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

4

For Private Circulation Only

T

ech

nical and Derivative

s

Review

|November 04, 2022

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.