1

For Private Circulation Only

Technical and Derivatives Review | March 04, 2022

No respite yet, Nifty at seven-month low

Sensex (54334) / Nifty (16245)

Source: Tradingview.com

Future outlook

After previous Thursday’s brutal knock, market recovered a fair bit of ground and this week, for first three sessions, Nifty remained

in a range of 300 points with volatile swings on both sides. All this while, 16500 provided some support; but on Friday, the global

worries once again spooked market participants to not only open below this level but went on to even challenge 16200 on an

intraday basis. Although it ended the week tad above it, the Nifty confirmed a lowest close in last seven months. Friday’s correction

was no surprise to us as the consolidation in previous three sessions was clearly hinting towards the new round of selling and this is

what we witnessed throughout the day.

Now if we meticulously observe Friday’s price action, we can see moderate damage in key indices, but individual stocks were falling

like a bottomless pit. Hence although markets are oversold since last few days, there is no respite overall and of course we cannot

forget, this correction has lot to do with the geopolitical concerns with respect to Russia and Ukraine. So, till the time things do not

stabilize there, market is likely to sway on news flows. Hence one should certainly brace up for similar volatility and surprises on

either side. Although such war kind of scenarios are always tricky, we can clearly see negative trend on weekly time frame charts. In

addition, the falling slope of ‘RSI-Smoothened’ oscillator is an indication of further weakness. So, although Nifty has reached to our

initial target of 16200, we do not want to pre-empt any near term bottom here.

From an investors’ point of view this is certainly an excellent opportunity to bag quality propositions in a staggered manner; but for

traders, it would be difficult to say that worse is behind us. We do not want to sound too pessimistic but looking at the current

scenario, we will not be surprised to see Nifty entering sub-16000 terrain. In a worst-case scenario, we do not expect Nifty below

15500 – 15200 as of now. Let’s see how things pan out going ahead and obviously all eyes on global development. In case of any

positive surprise next week, we would be keeping a close eye on few scenarios. As far as levels are concerned, 16000 – 15900 is to

be seen as immediate supports; whereas on the higher side, 16450 followed by 16600 are to be considered as strong resistances.

We reiterate, the pragmatic approach would be to follow stock specific approach (identifying apt theme is the key) and should avoid

aggressive bets overnight for a while.

2

For Private Circulation Only

Technical and Derivatives Review | March 04, 2022

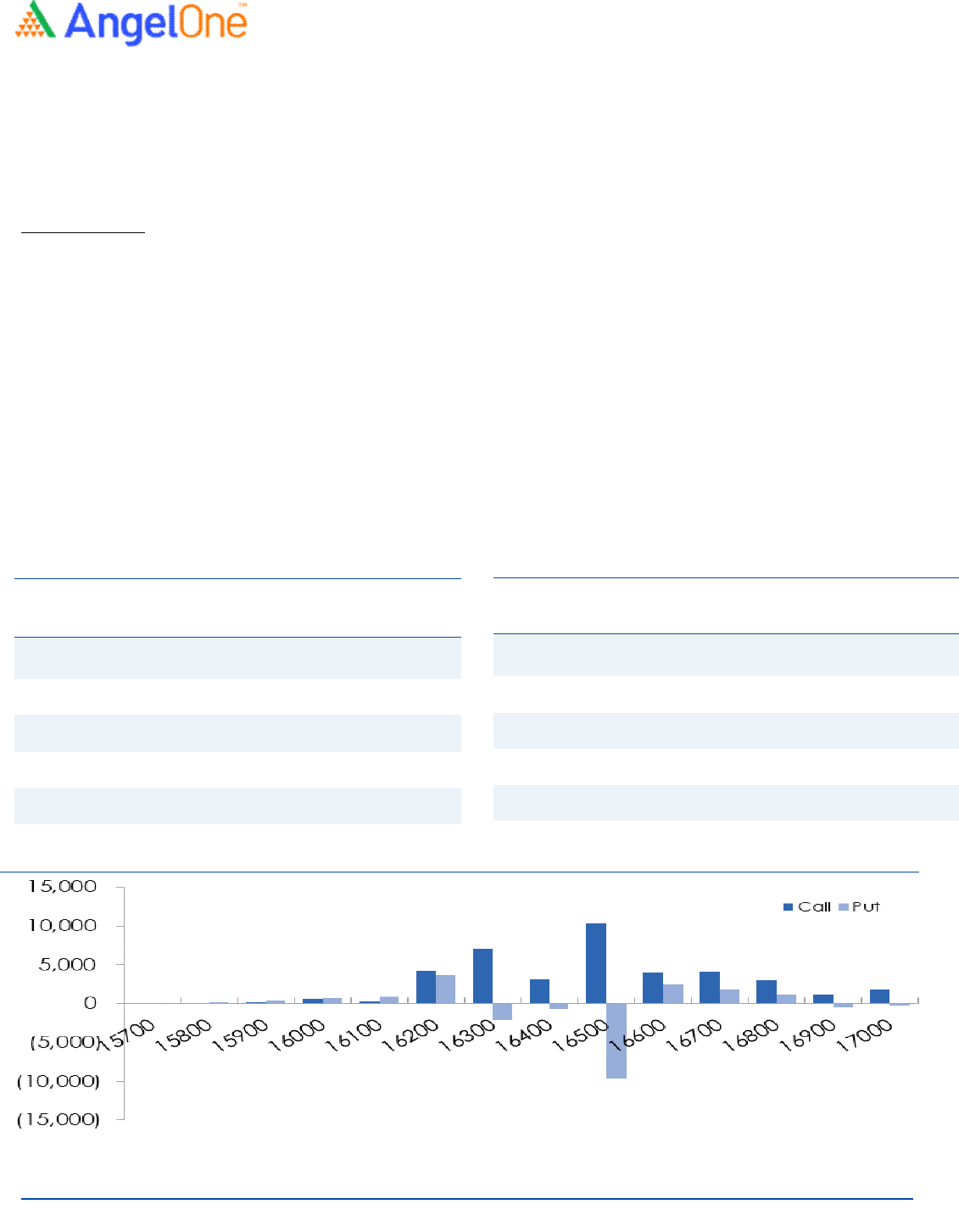

16100-16200 remains the make or break zone

Nifty spot closed at 16245.35 this week, against a close of 16658.40 last week. The Put-Call Ratio has decreased from 0.91 to 0.85.

The annualized Cost of Carry is positive at 0.93%. The Open Interest of Nifty Futures increased by 22.80%.

Derivatives View

Nifty current month future closed with a premium of 13.60 points against a discount of 2.35 points to its spot. Next month future is

trading at a premium of 62.20 points.

Post last week’s massive fall, we saw index consolidating in the range of 16350-16800 except for Friday wherein index tested the

previous swing lows. However, due to some respite in the midst we managed to conclude the week above 16200. We observed

massive build-up in banking index especially; the open interest jumped up 85% in a week and in case of Nifty, open interest surged

24%. We believe majority of the positions formed in both the indices are on short side. Stronger hands continued relentless selling in

equities. Meanwhile, they exited decent shorts and added fresh longs in index futures segment; resulting ‘Long Short Ratio’ surged

to 62% from 48% Wow. In options front, we observed fresh writing in 16200-16300 puts. For the coming week, it would be

interesting to see if we manage to sustain above 16100-16200 zone. Hence, traders should keep a close tab on above mentioned

levels and continue trading in individual space.

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ULTRACEMCO

3151500 57.87 6051.90 (7.88)

ASIANPAINT 6150600 51.22 2746.90 (12.13)

BIOCON 18715100 47.49 329.00 (16.77)

RAMCOCEM 2321350 38.77 735.05 (5.59)

DALBHARAT 757750 37.77 1406.55 (10.96)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

INDUSTOWER

23668400 120.13 208.70 1.68

PERSISTENT 499350 32.63 4082.25 5.39

TRENT 2960900 22.39 1095.05 2.22

INTELLECT 594750 17.48 682.65 5.53

RELIANCE 33749000 12.29 2332.75 1.93

Short Formation

3

For Private Circulation Only

Technical and Derivatives Review | March 04, 2022

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivative Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in

the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

4

For Private Circulation Only

Technical and Derivatives Review | March 04, 2022

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.