1

For Private Circulation Only

Technical and Derivatives Review | November 03, 2021

Nifty ends the truncated week around 17800

Sensex (59772) / Nifty (17829)

Source: Tradingview.com

Future outlook

We inaugurated the festive week on a cheerful note on Monday and witnessed some hiccups in the initial two hours of trade. As we

progressed, the buying interest emerged to slowly and steadily move beyond 17950. On the following day, we again started

positively but failed to sustain at higher levels after retesting the psychological barrier of 18000. After undergoing a small correction

on Tuesday, the subsequent session started positively and Nifty made one more attempt towards 18000. Once again we witnessed

some nervousness at higher levels as the selling augmented in the latter half to pull the Nifty back to 17800.

Since it was a truncated week on the back of Diwali festival, markets remained more or less in a range of merely 300 points, where

both the support and resistance range played out accurately. Historically it’s observed that market do not correct during the Diwali

week and this is what we witnessed in last three sessions. But we must accept the fact; markets were a bit tentative in last couple of

sessions. Since there was no major action in the week gone by, our overall view remains the same as we had mentioned in our

previous commentary. We continue to remain cautious on the market because of few technical developments, they are as follows:

1) the ‘Lower Top Lower Bottom’ on daily chart got confirmed last Friday after breaking below 18000. 2) this coincided with the

violation of the key short term moving average of ’20-day EMA’, which is now acting as a sturdy wall. 3) More importantly, if we take

a glance at the monthly chart, we can see a formation of ‘Shooting Star’ pattern, which certainly does not bode well for the bulls.

Traders are advised not to carry aggressively bets on the long side as long as we remain below 18000 – 18100 on a closing basis. On

the flipside, we may see this corrective move extending towards 17450 first and if things worsened then the possibility of sliding

towards 17200 – 17000 cannot be ruled out. The coming week would be quite crucial for the market as it may dictate the near term

direction.

2

For Private Circulation Only

Technical and Derivatives Review | November 03, 2021

No meaningful change in F&O space

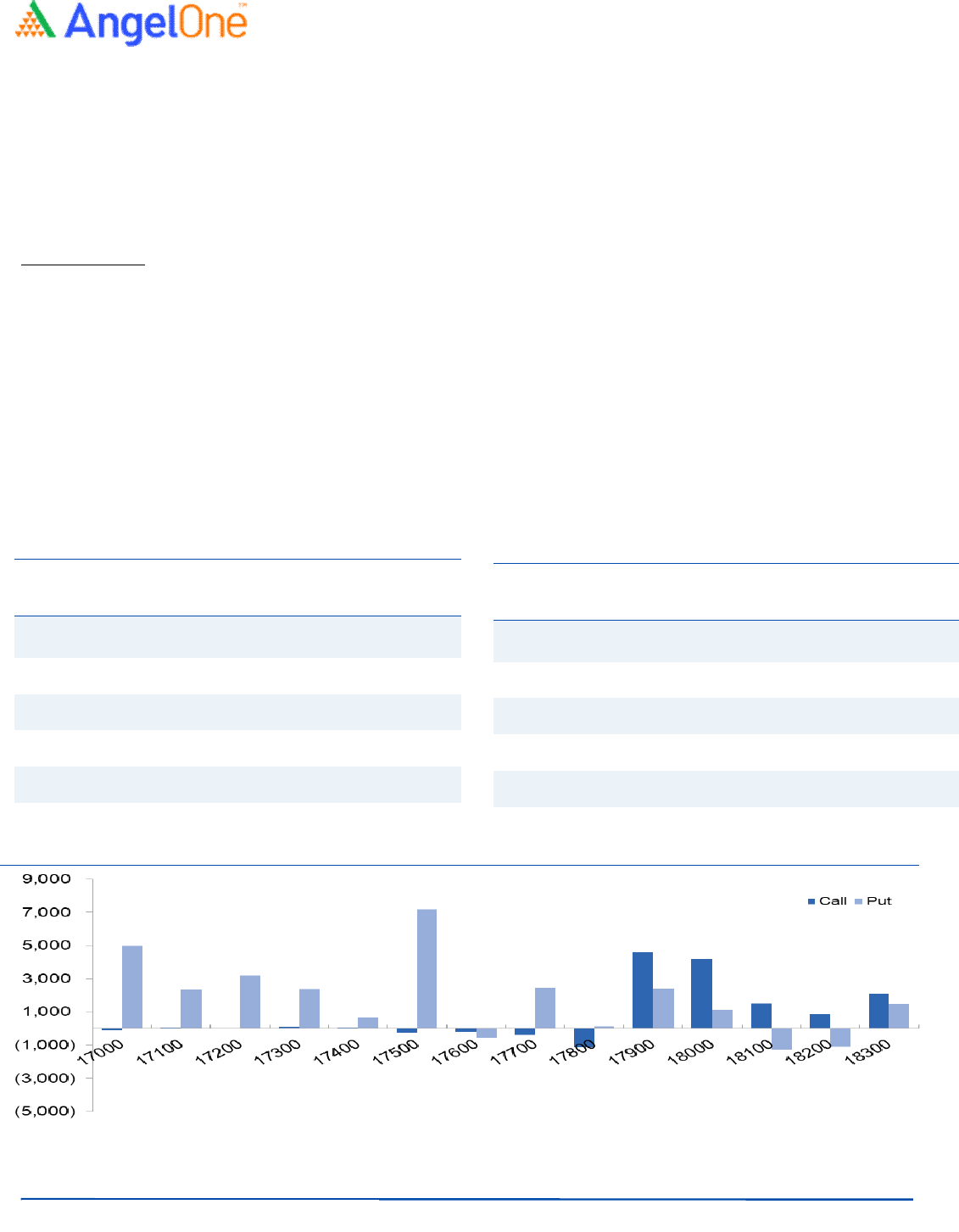

Nifty spot closed at 17829.20 this week, against a close of 17671.65 last week. The Put-Call Ratio has increased from 0.75 to 0.81.

The annualized Cost of Carry is positive at 1.69%. The Open Interest of Nifty Futures decreased by 3.06%.

Derivatives View

Nifty current month future closed with a premium of 17.95 points against a premium of 43.65 points to its spot. Next month future

is trading at a premium of 80.45 points.

It was a truncated festive week with no major price action and open interest activities. The benchmark index grinded in the range of

merely 300 points to concluded ninth tenth per cent higher to previous week’s close. In F&O space, we saw some open interest

reduction in Nifty; whereas, no relevant change was observed in banking index. 18000 call options added good amount of build-up;

suggesting market may face strong hurdle around this zone. On the other side, some build-up was seen in 17800 strike. Throughout

the week, we hardly saw any relevant development in derivatives segment hence, we would stick to the view of staying light in index

and opt for stock specific trades

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

M&M 10761100 38.70 852.70 (3.83)

IRCTC 14476375 23.56 822.25 (3.22)

MARICO 7229000 20.93 552.50 (2.43)

PIIND 1504000 19.03 2733.60 (9.08)

ESCORTS 9710800 14.76 1506.30 (4.54)

Weekly change in OI

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

ABFRL 11809200 27.44 286.15 8.72

SBIN 120505500 21.51 530.30 5.05

INDIAMART 264450 20.46 7356.15 2.86

IBULHSGFIN 31334800 20.12 226.20 3.93

TRENT 2348275 17.87 1097.40 8.82

Short Formation

3

For Private Circulation Only

Technical and Derivatives Review | November 03, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivative Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in