1

For Private Circulation Only

Technical and Derivatives Review

| July 02, 2021

Nifty defends 15650, week concluded with some hopes

Sensex (52485) / Nifty (15722)

Source: Trading View

Future outlook

Trading for the week started with an upside gap on Monday at new record high. However, since there was follow up buying missing

in the heavyweight constituents, the Nifty kept descending gradually after registering a high of 15915.65 in the opening trade. For

the major part of the day, index consolidated with a mild negative bias to eventually conclude tad above the 15800 mark by

shedding nearly three tenths of a percent. The similar trend continued for the following sessions and in the process, Nifty went on to

test sub-15700 levels. Fortunately on Friday, there was some buying observed at lower levels, which resulted in defending the key

support of 15650 successfully.

It was probably the dullest week in last fifteen months our markets have experienced. There have been many instances where key

indices undergo some sort of consolidation and trades in a slender range, but mostly in such times, the action continues in individual

themes and there are ample of opportunities available in the market to keep the traders engrossed. Barring Friday, stock specific

moves were also missing throughout this week which was frustrating for momentum traders. Now as far as levels are concerned, we

managed to hold crucial support of 15650. As long as 15650 – 15450 are being held, the bulls have no reason to worry for. On the

upside, reaching the new milestone of 16000 has become challenging and the market clearly seem to be waiting for some sort of

trigger to reach there. Before this, 15800 followed by 15900 are to be seen as immediate hurdles.

With Friday’s some positivity, the hopes have certainly built for benchmark index to head higher towards the millstone in the

forthcoming week. But we reiterate, if that has to happen, the banking space certainly needs to come out of its slumber phase. Let’s

see how things pan out going ahead and till then it’s better to keep a close tab of all the mentioned levels.

2

For Private Circulation Only

Technical and Derivatives Review

| July 02, 2021

Trended move to unfold only above 15800

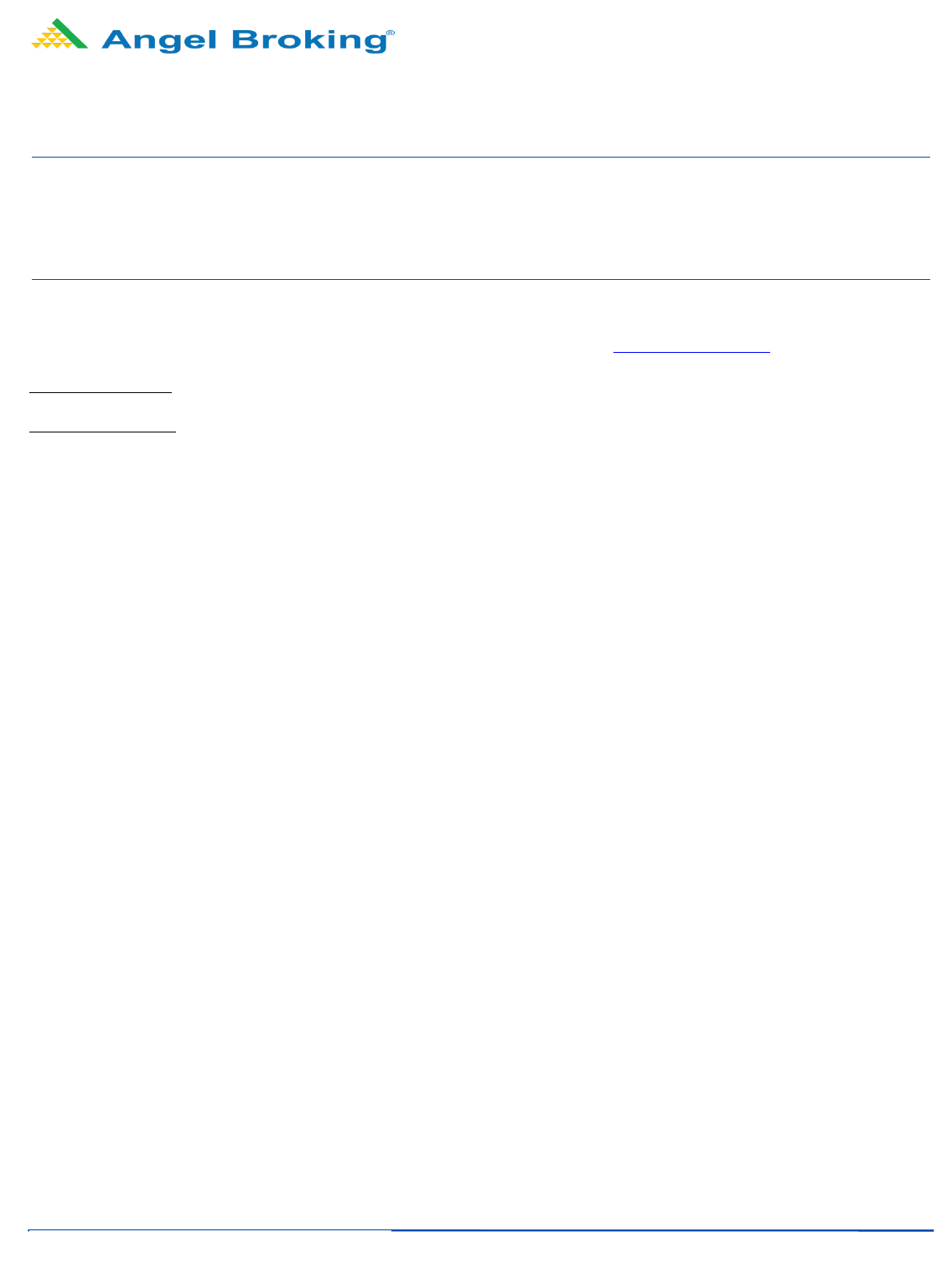

Nifty spot closed at 15722.20 this week, against a close of 15860.35 last week. The Put-Call Ratio has decreased from 1.20 to 1.09.

The annualized Cost of Carry is positive at 1.66%. The Open Interest of Nifty Futures decreased by 2.10%.

Derivatives View

Nifty current month future closed with a premium of 25 points against a premium of 27.65 points to its spot. Next month future is

trading at a premium of 70.95 points.

In options segment, open interest addition was seen in 15800-16000 strikes while 15500 and 15200 put options witnessed open

interest build up. Highest open interest for coming weekly series is placed at 15800 call and 15700 put options.

Nifty started the week on an optimistic note above 15900, but it failed to show any follow-up move and corrected gradually during

the week to end tad above 15700 mark. During the week, we have not seen any major build-up in Nifty, but some shorts were added

in the banking index. FII’s unwound some of their longs in the index futures and their ‘Long Short Ratio’ has declined to 74.70

percent from last week’s 80 percent. In weekly options segment, build up is seen in 15800 call option which has the highest open

interest and thus is the near term resistance. The data is scattered in 15700-15500 puts indicating supports at every 100 point

difference. The option IV have declined significantly resulting in lower premiums. The index is trading close to the support end and

hence, traders should look for buying opportunities on dips. Although, the momentum on the higher side too could be restricted and

only if we see the index surpassing 15800 and call writers unwind their positions, then a trended move would unfold on upside.

.

Weekly change in OI

Short Fo

rmation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

HDFCLIFE 20387400 121.59 689.90 (5.07)

CHOLAFIN

10503750

54.18

512.15

(4.18)

IDFCFIRSTB

168150000

42.09

54.25

(7.42)

SHREECEM

148925

28.91

27143.55

(5.77)

INDUSTOWER

15080800

18.69

235.90

(4.11)

Long Formation

Scrip

OI

Futures

OI

Chg (%)

Price

Price

Chg(%)

TATACHEM 9003000 30.93 770.95 7.01

TORNTPHARM

776000

26.69

2962.60

2.00

SRF

353625

18.27

7516.05

6.00

LALPATHLAB

454750

16.68

3318.15

5.25

DABUR

7538750

15.87

5

90.45

4.16

3

For Private Circulation Only

Technical and Derivatives Review

| July 02, 2021

Research Team Tel: 022 - 39357600 (Extn – 6844) Website: www.angelbroking.com

For Derivative Queries E-mail: [email protected]

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com