Please refer to important disclosures at the end of this report

1

Vijaya Diagnostic Centre Limited

IPO NOTE Vijaya Diagnostic Centre Limited.

August 31, 2021

Vijaya Diagnostic Centre was incorporated in 2002, and is the largest integrated

diagnostic chain in southern India. Vijaya Diagnostic provides integrated services

of pathology and radiology and offers around 740 routine tests, 870 specialized

pathology tests, 220 basic tests, and 320 advanced radiology tests. Vijaya

diagnostic network consists of 80 diagnostic centers and 11 reference labs across

13 cities. Companies 81% of revenue comes from Hyderabad.

Positives:

(a)

Fastest growing diagnostic chain with a dominant position in south

India. Between 2017 and 2020 volume of tests has grown by15% while volume of

patients has grown by 14%. (b). The Company provides Integrated diagnostic

services of pathology & Radiology under one roof. (c). Company has a very high

brand recall in its core market of Hyderabad and derives 92% of its revenues from

the high margin B2C business.

Investment concerns: (a) Company has a very high concentration toward one city

with Hyderabad accounting for 81% of the revenues. Increase in competition in

the main market can impact growth as well as EBITDA margins. (b) In FY2021

company had got some benefits due to increase in Covid related tests, which is

not expected to continue in the future and can have an adverse impact on the

volume growth of the company. (c) Low promoter holding will also be an issue for

the company as post IPO promoter holding will be relatively low at 32.7%

Outlook & Valuation: Based on FY2021 numbers, IPO is priced at a Price to

Earnings of 64.3 times and EV/EBITDA of 30 times at the upper price band of the

IPO, which is in line with the listed peer group. Company already has a higher

market share in key geographi like Hyderabad and we do not expect the covid

related benefit to continue in coming years. We believe that at ₹531, all the near

term positives are priced in and leaves limited upside for the investors. Hence, we

are assigning a “NEUTRAL” recommendation to the Vijaya Diagnostic centre

limited IPO.

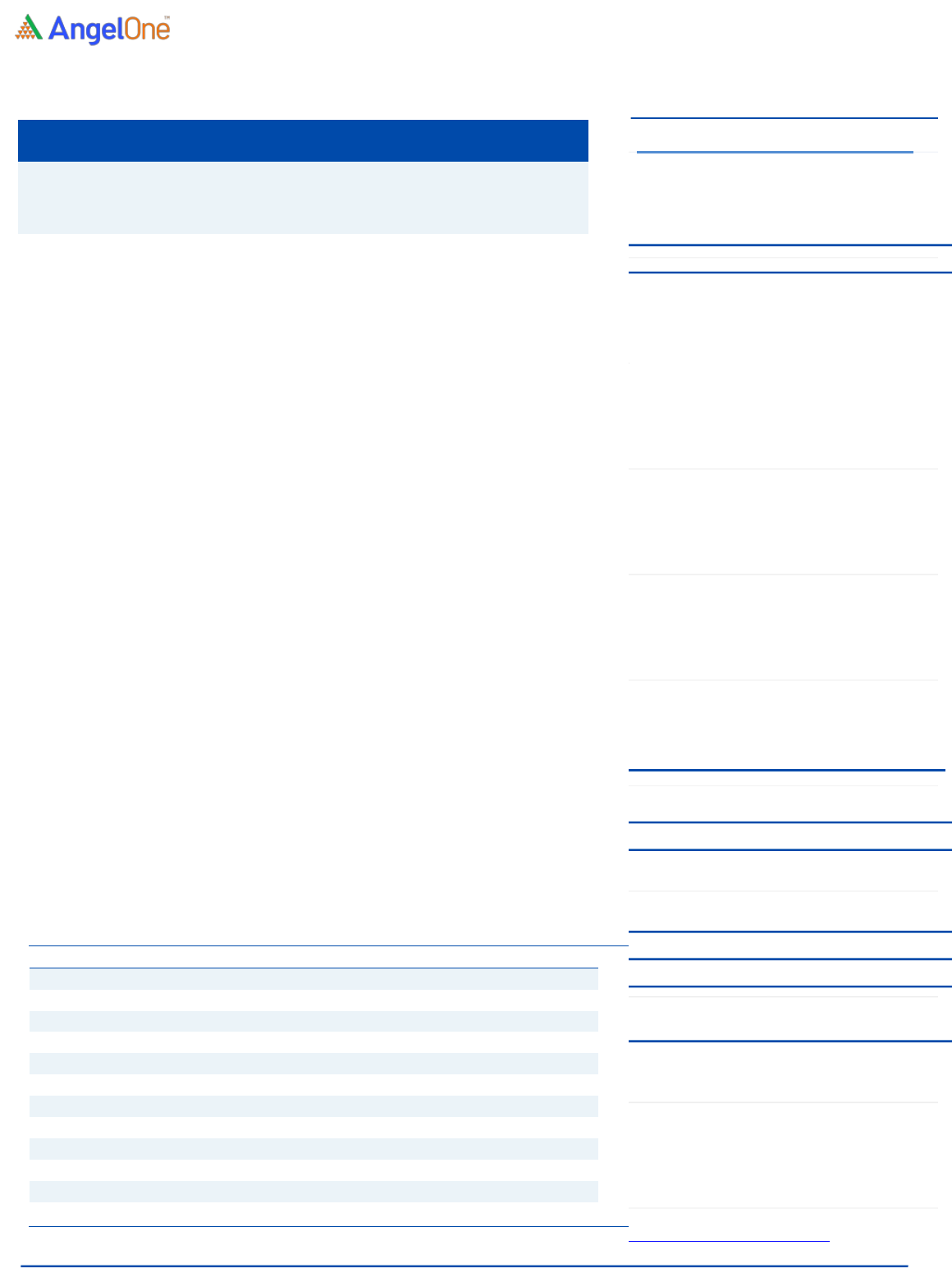

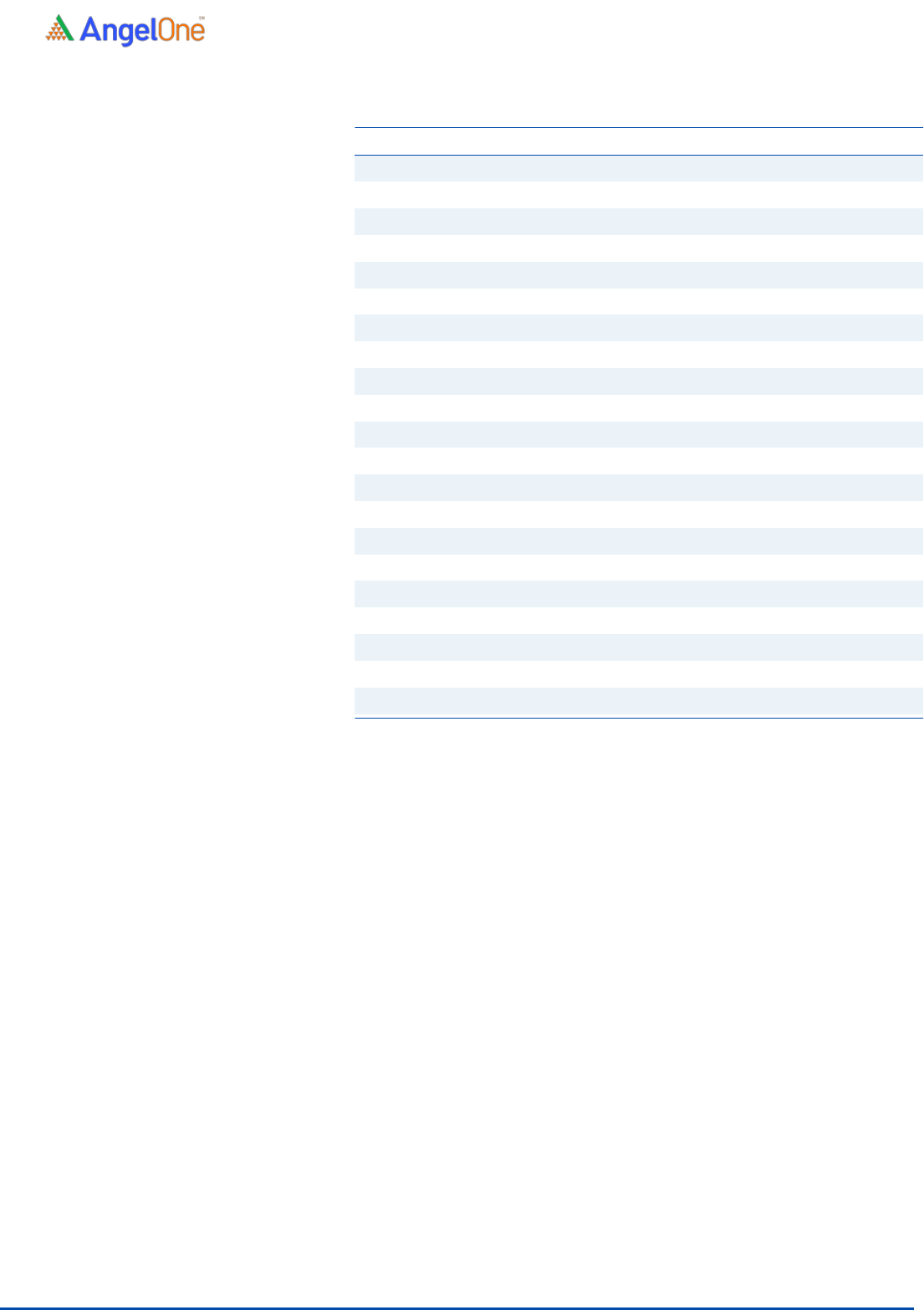

Key Financials

Y/E March (₹ cr)

FY19

FY20

FY21

Net Sales

292.5

338.8

376.7

% chg

-

15.8

11.2

Net Profit

46.4

62.7

85.1

% chg

-

35.1

35.7

EBITDA (%)

40.5

43.7

47.2

EPS

4.5

6.1

8.3

P/E (x)

118.0

86.6

64.3

P/BV (x)

26.1

19.7

15.1

RONW (%)

22

23

24

ROCE (%)

23

23

26

EV/EBITDA

46.4

36.7

30.0

EV/Sales

18.8

16.1

14.2

Source: Company, Angel Research

NEUTRAL

Issue Open: September 01, 2021

Issue Close: September 03, 2021

Issue Details

Face

Value: ₹1

Present Eq. Paid up Capital: ₹4.53 Cr

Issue Size: ₹1,894** Cr

Offer for Sale: ₹1,894** Cr

Price Band: ₹522 - 531

Lot Size: 28 shares and in multiple thereafter

Expected Listing : 14th September 2021

Employee Discount - ₹52 per share

Post-issue mkt. cap: * ₹5323 Cr - ** ₹5,414 Cr

Promoters holding Pre-Issue: 37.78%

Promoters holding Post-Issue: 32.7%

*Calculated on lower price band

** Calculated on upper price band

Book

Building

QIBs

50% of issue

Non-Institutional

15% of issue

Retail

35% of issue

Post issue Shareholding pattern

Promoters

Others

32.7%

67.3%

Vijaya Diagnostic Centre Limited | IPO Note

August 31, 2021

2

Company background

Vijaya Diagnostic Centre Limited was incorporated on June 5, 2002. Vijay

Diagnostic is the largest integrated diagnostic chain in southern India, by

operating revenue, and also one of the fastest-growing diagnostic chain by

revenue for fiscal year 2020.

Vijaya offers an one-stop solution for pathology and radiology testing services

to their customers through their extensive operational network, which consists

of 80 diagnostic centres and 11 reference laboratories across 13 cities and

towns in the states of Telangana; Andhra Pradesh.

Vijaya offers a comprehensive range of approximately 740 routine and 870

specialized pathology tests and approximately 220 basic and 320 advanced

radiology tests that cover a range of specialties and disciplines, as of June 30,

2021.

Company provides value-added services such as home collection of

specimens, house calls and various delivery or access modes (i.e., at

diagnostic centres, SMS, email and web portal) for test reports. They have

implemented a ‘hub and spoke’ model, whereby specimens are collected

across multiple locations within a catchment area or a region for delivery to

their reference laboratories for diagnostic testing.

Issue details –

The issue comprises of offer for sale of upto ₹1,894 crore (3.56 crores

shares) with the price band of ₹522-₹531.

Objectives of the Offer

To carry out the Offer for Sale of up to 35,688,064 Equity Shares by the

Selling Shareholders.

Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

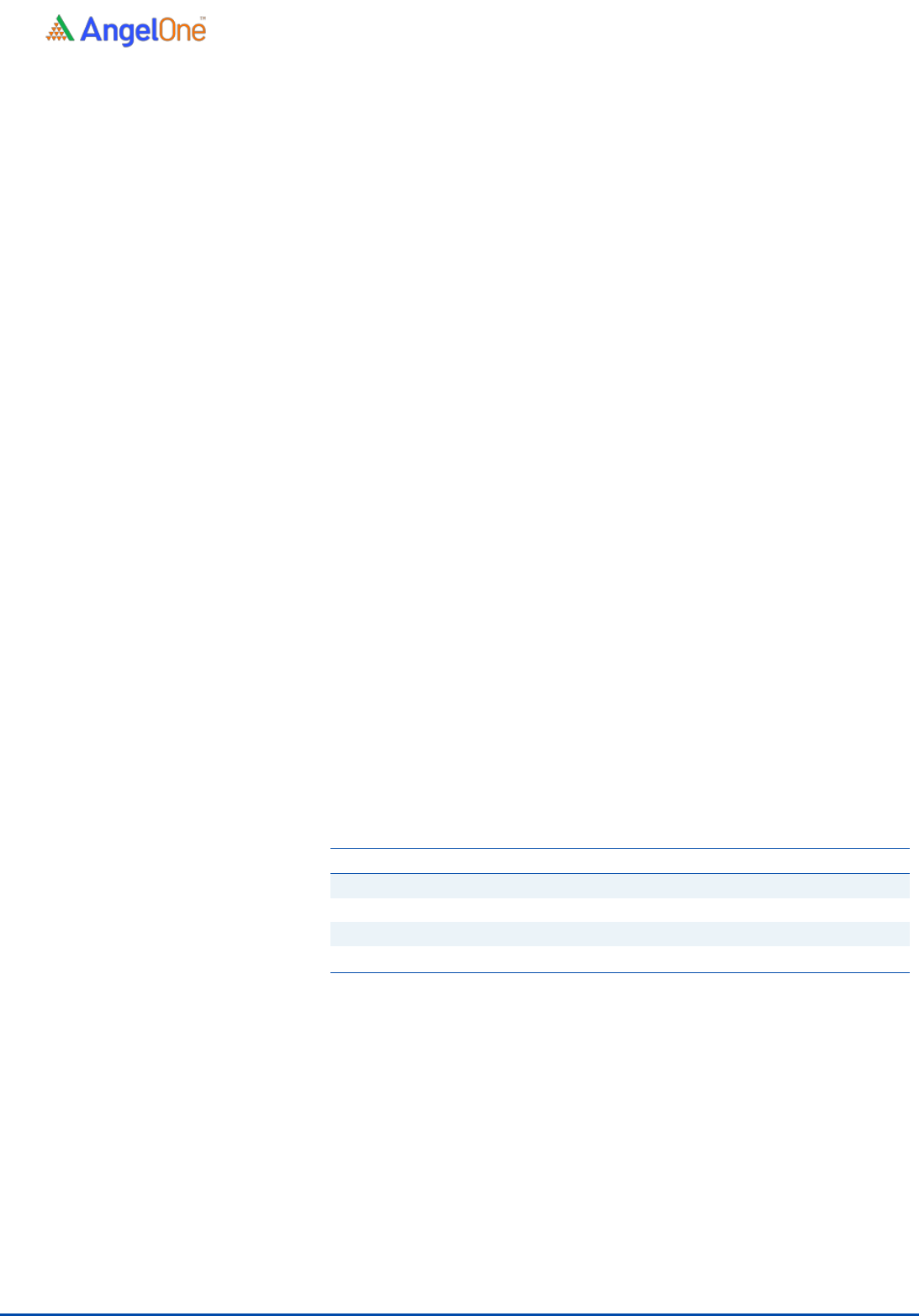

Pre & Post Shareholding

(Pre-issue)

(Post-issue)

Particular

No of shares

%

No of shares

%

Promoter & Promoter Group

6,09,51,621

59.7%

5,58,53,325

54.7%

Public

4,10,14,305

40.2%

4,61,12,601

45.2%

Total

10,19,65,926

100%

10,19,65,926

100%

Source: Company, Angel Research

Vijaya Diagnostic Centre Limited | IPO Note

August 31, 2021

3

Key Management Personnel

Dr. S. Surendranath Reddy is the executive Chairman of our Company. He holds

a bachelor’s degree in medicine from Shri Venkatesvara University and a

provisional degree of Doctor of Medicine in Radiology from Osmania Medical

College, Hyderabad. He has over 19 years of experience with our Company. He is

a life member of the Indian Radiological and Imaging Association.

Sunil Chandra Kondapally is the Executive Director of our Company. He has been

associated with our Company since incorporation. He holds a bachelor’s degree in

science in electrical engineering from Florida State University. He has over 17

years of experience in the field of pharmaceutical industry. He founded a

pharmaceutical services company Trikona Pharmaceuticals Private Limited in 2016

and QPS Bioserve India Private Limited in 2004.

S. Geeta Reddy is a Non-Executive Director of our Company. She holds a

bachelor’s degree in law from Osmania University.She is enrolled as an

Advocate with the Andhra Pradesh High Court in 1986. She is on the board of

directors of various companies such as, Sura Agritech Private Limited, Iffco

Kisan SEZ Limited, Namrata Diagnostic Centre Private Limited, Vijaya

Hospitals Private Limited and Doctorslab Medical Services Private Limited.

Nishant Sharma is the Non-Executive Director – Nominee Director of our

Company. He holds a master’s degree in biochemical engineering and bio-

technology from the Indian Institute of Technology Delhi and a master’s

degree in business administration from the Harvard University. He has over

18 years of experience in across various fields.

Shekhar Prasad Singh is the Non-Executive Director – Independent Director of

our Company. He is a retired IAS officer of 1983 batch. Previously, he acted

as Chief Secretary to Government of Telangana.

Dr. D Nageshwar Reddy is the Non-Executive Director – Independent Director

of our Company. He holds a degree from University of Madras in general

medicine and a D.M in gastroenterology from Postgraduate Institute of

Medical Education and Research, Chandigarh. He is currently the Chairman of

Asian Institute of Gastroenterology, Hyderabad.

Vijaya Diagnostic Centre Limited | IPO Note

August 31, 2021

4

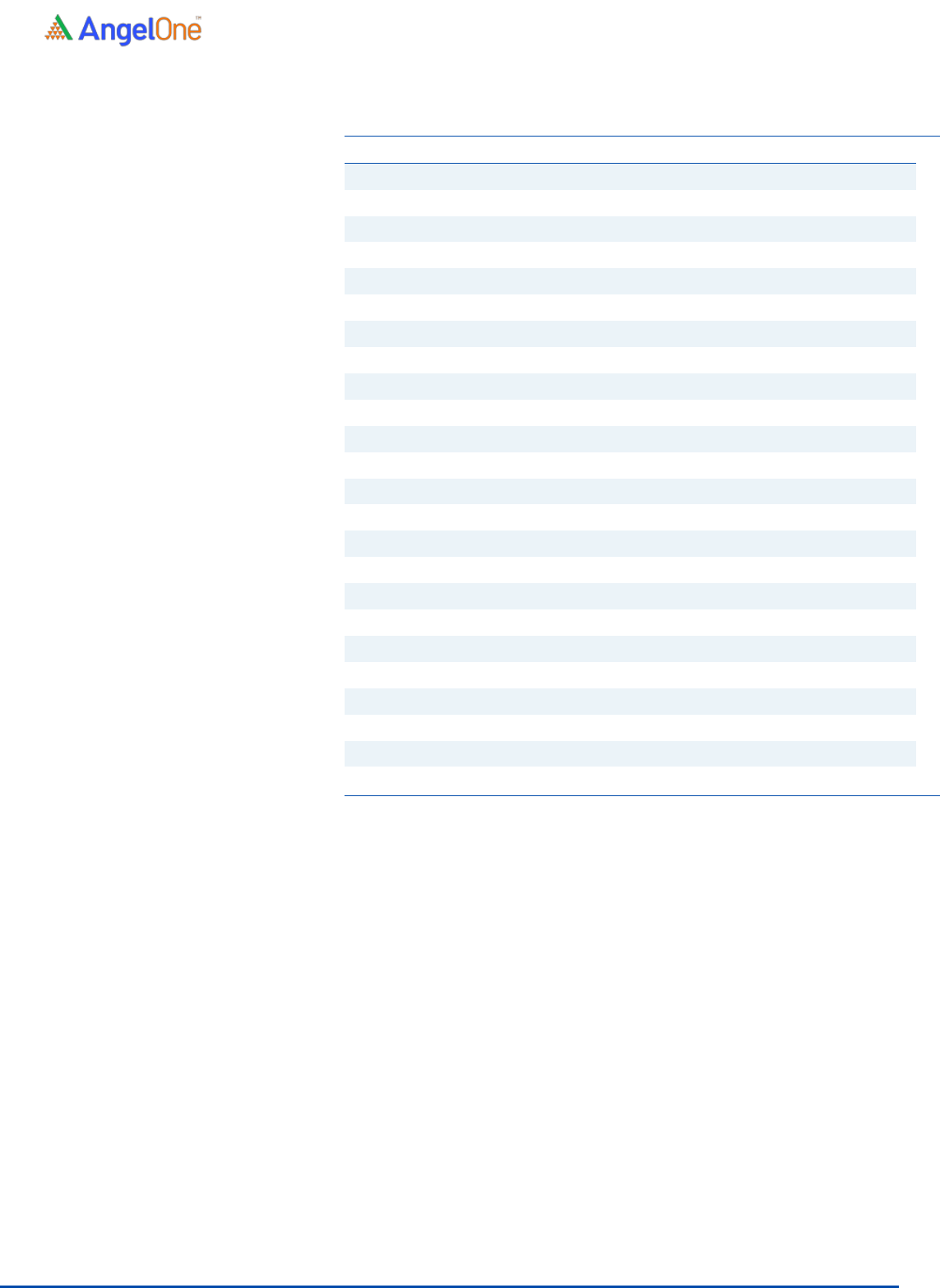

Consolidated Profit & Loss Account

Y/E March (₹ cr)

FY19

FY20

FY21

Total operating income

292.5

338.8

376.7

% chg

-

15.8

11.2

Total Expenditure

184.3

206.1

210.6

Cost of materials consumed

40.4

43.9

57

Employee Benefit Expense

53.8

62.4

57.4

Other Expenses

90.1

99.8

96.2

EBITDA

108.2

132.7

166.1

% chg

-

22.6

25.2

(% of Net Sales)

37.0

39.2

44.1

Depreciation& Amortisation

39.6

49.1

50.4

EBIT

68.6

83.6

115.7

% chg

-

21.9

38.4

(% of Net Sales)

23.5

24.7

30.7

Interest & other Charges

13.5

15.3

15.2

Other Income

10.3

15.3

11.8

(% of Sales)

3.5

4.5

3.1

Recurring PBT

65.4

83.6

112.3

(% of Net Sales)

22.4

24.7

29.8

Tax

19.0

20.9

27.2

PAT (reported)

46.4

62.7

85.1

% chg

-

35.1

35.7

(% of Net Sales)

15.9

18.5

22.6

EPS (as stated)

4.50

6.13

8.26

% chg

-

36.2

34.7

Source: Company, Angel Research

Vijaya Diagnostic Centre Limited | IPO Note

August 31, 2021

5

Consolidated Cash Flow Statement

Y/E March (₹ cr)

FY19

FY20

FY21

Profit before tax

65.3

83.4

112.1

Depreciation

39.6

49.1

50.4

Change in Working Capital

1.7

0.1

1.3

Interest Expense

3.7

4.0

2.0

Direct Tax Paid

(18.6)

(23.2)

(31.2)

Others

10.6

6.1

12.7

Cash Flow from Operations

90.6

106.1

129.6

(Inc.)/ Dec. in Fixed Assets

(59.1)

(37.5)

(31.2)

Investment

(31.4)

1.1

(103.3)

Interest received

0.6

5.7

4.7

Cash Flow from Investing

(89.9)

(30.7)

(129.8)

Procees/Repayment of Long Term Borrowing

7.4

(8.9)

(28.2)

Dividend paid on equity shares

(2.8)

(3.2)

(1.4)

Others

(13.6)

(16.7)

(18.9)

Cash Flow from Financing

(7.1)

(29.4)

(48.6)

Inc./(Dec.) in Cash

(6.4)

45.9

(48.8)

Opening Cash balances

16.1

9.7

55.6

Closing Cash balances

9.7

55.6

6.8

Source: Company, Angel Research

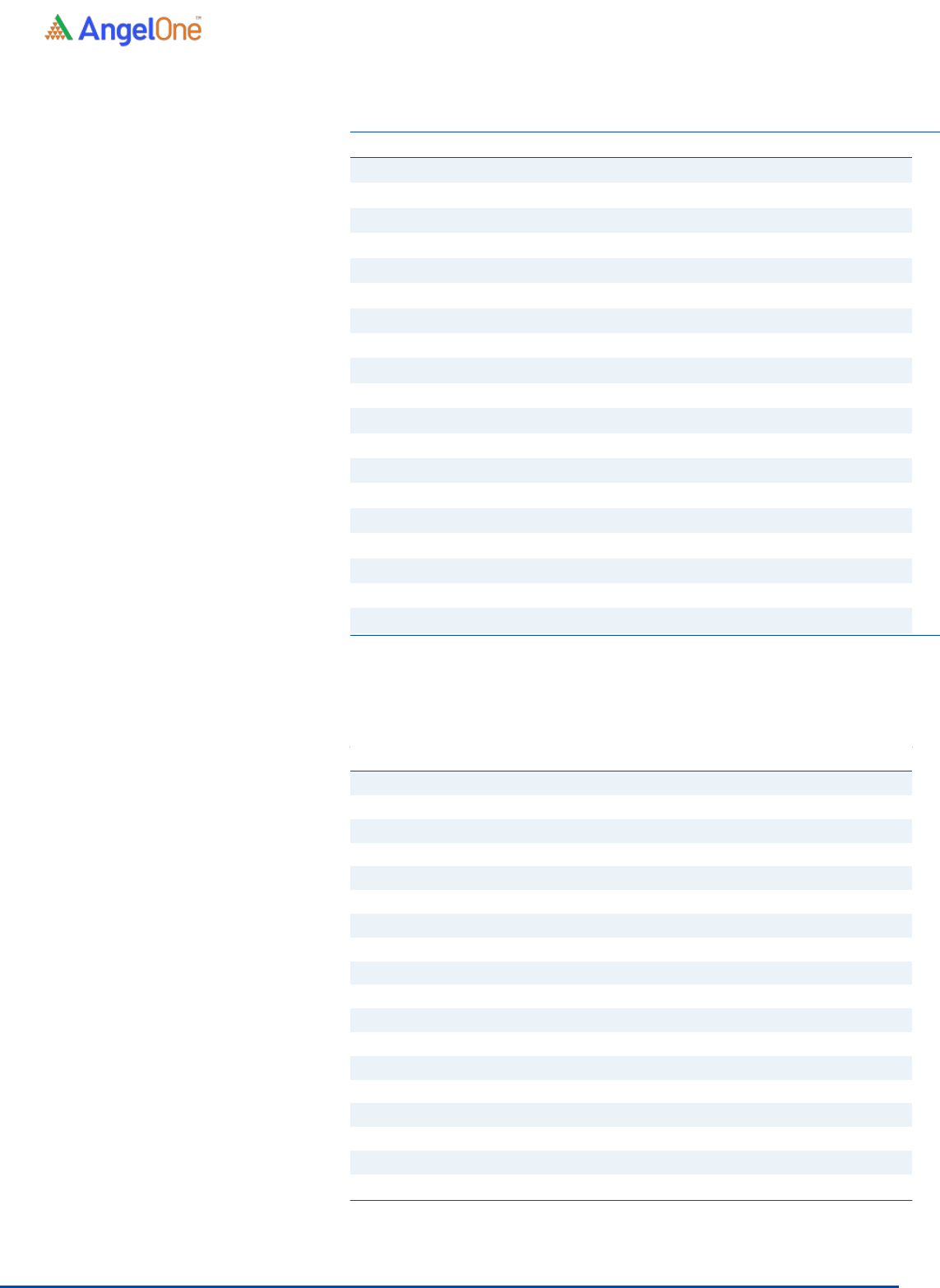

Consolidated Balance Sheet

Y/E March (₹ cr)

FY19

FY20

FY21

SOURCES OF FUNDS

Equity Share Capital

4.5

4.5

4.5

Other equity

200

270

354

Shareholders Funds

205

275

359

Total Loans

137

143

130

Other liabilities

5.4

6.8

7.8

Total Liabilities

347

424

496

APPLICATION OF FUNDS

Net Block

154

156

151

Right to use assets

108

125

126

Current Assets

137

186

238

Sundry Debtors

9

8

6

Inventories

2

3

3

Cash & Bank Balance

56

119

199

Other Assets

2

2

3

Current liabilities

57

58

44

Net Current Assets

80

128

195

Other Non Current Asset

7

14

25

Total Assets

347

424

496

Source: Company, Angel Research

Vijaya Diagnostic Centre Limited | IPO Note

August 31, 2021

6

Key Ratio

Y/E March

FY19

FY20

FY21

Valuation Ratio (x)

P/E (on FDEPS)

118.0

86.6

64.3

P/CEPS

63.4

49.4

41.3

P/BV

26.1

19.7

15.1

EV/Sales

18.8

16.1

14.2

EV/EBITDA

46.4

36.7

30.0

Per Share Data (Rs)

EPS

4.50

6.13

8.26

Cash EPS

8.4

10.8

12.8

Book Value

20.3

26.9

35.2

DPS

-

-

-

Number of share

10.20

10.20

10.20

Returns (%)

RONW

22.4%

22.8%

23.7%

ROCE

22.6%

23.4%

25.7%

Turnover ratios (x)

Asset Turnover (net)

1.9

2.3

2.6

Receivables (days)

11.4

8.5

6.2

Inventory Days

3.0

3.4

3.0

Payables (days)

196.1

179.6

140.9

Working capital cycle (days)

-181.7

-167.7

-131.7

Source: Company, Angel Research

Vijaya Diagnostic Centre Limited | IPO Note

August 31, 2021

7

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.