Please refer to important disclosures at the end of this report

1

VRL Logistics (VRL) is among the leading pan-India passenger and goods

transportation companies. It has an established brand name in the transportation

industry in India with one of the largest fleet of commercial vehicles in the private

sector. Goods transportation is the primary business of the company accounting

for ~76% of the overall revenues (for 9MFY2015). It also provides luxury bus

services across South and West of India. Additionally, it has operations that

include courier services, hotel (restaurant) operations, sale of power (Wind Power

business) and air chartering services.

Main business to benefit from improving macro condition: VRL’s main business,

which is goods transportation, has one the largest fleet size that serves a broad

range of industries, including the fast moving consumer goods (FMCG) sector as

well as other industries including food, textiles, apparel, furniture, appliances,

pharmaceutical products, rubber, plastics, metal and metal products, wood,

glass, automotive parts and machinery. We believe that the policy reforms, lower

inflation levels and interest rate cuts will provide boost to commercial activity in

the country. On the back of said outcomes, the main business and especially Less

than Truck Load business (LTL - which is a high margin business), stands to

benefit from improving macro conditions.

GST implementation to benefit the logistics sector: At present, the duty and

taxation structure is such that the goods are taxed multiple times (while crossing

boundaries) as they move across the country. The varying taxation system across

29 states and seven union territories has obstructed the creation of national

network. The planned GST is expected to eradicate multiple taxes and tariffs at

state level and proposes taxation at the national level. In our view, this will benefit

the logistics sector and especially major players like VRL. VRL has a pan India

presence with agencies, branches and hubs spread out across the country.

Outlook and Valuation: The company’s net sales have grown at a CAGR of

18.9% over FY2011 to `1,494cr in FY2014. The EBITDA margin has been

declining (from 18.7% in FY2011 to 13.8% in FY2014) but has recovered well in

9MFY2015 to the level of 17.0%. The net profit has grown at a CAGR of 15.3%

over FY2011-FY2014. At the higher end of the price band, the stock is valued at

19.6x its FY2015E annualized earnings which we believe is attractive considering that

similar logistic companies like Transport Corp trades at 25.0x its FY2015E earnings.

Considering the improving economic outlook, its pan-India presence and resonable

valuations, we recommend a Subscribe to the issue at the upper price band.

Key Financials

Y/E March (` cr) FY2012

FY2013

FY2014

Net Sales 1,130 1,325 1,494

% chg 27.2 17.3 12.7

Adj. Net Profit 77 46 52

% chg 125.7 (40.4) 14.0

OPM (%) 17.0 14.7 13.8

EPS (`) 10.9 6.5 6.1

P/E (x)* 24.4 40.9 35.9

P/BV (x)* 10.0 6.5 6.1

RoE (%) 47.8 19.2 17.5

RoCE (%) 15.8 12.9 13.4

EV/Sales (x)* 2.2 1.9 1.6

EV/EBITDA (x)* 12.8 12.6 11.4

Source: Company, Angel Research; Note: *The above numbers are considering subscription at the

upper end of the price band

SUBSCRIBE

Issue Open: April 15, 2015

Issue Close: April 17, 2015

Post-issue implied mcap**:

`

1,779cr-1,870cr

Note:**at Lower and Upper price band respectively

QIBs At least 50%

Non-Institutional At least 15%

Retail At least 35%

Post Issue Shareholding Pattern

Promoters Group 69.6

MF/Banks/Indian

FIs/FIIs/Public & Others

30.4

Promoters holding Pre-Issue: 77.2%

Promoters holding Post-Issue: 69.6%

Issue Details

Book Building

Face Value:

`

10

Present Eq. Paid up Capital:

`

85.5cr

Offer Size: 2.3cr Shares

Post Eq. Paid up Capital:

`

9.1cr

Issue size (amount)**:

`

451cr -

`

468cr

Price Band**: `

195-205

Milan Desai

+91 22 4000 3600 Ext: 6846

V

RL Logistics

IPO Note

IPO Note

|

Logistics

April 11, 2015

V

RL Logistics

|

IPO Note

A

pril 11, 2015

2

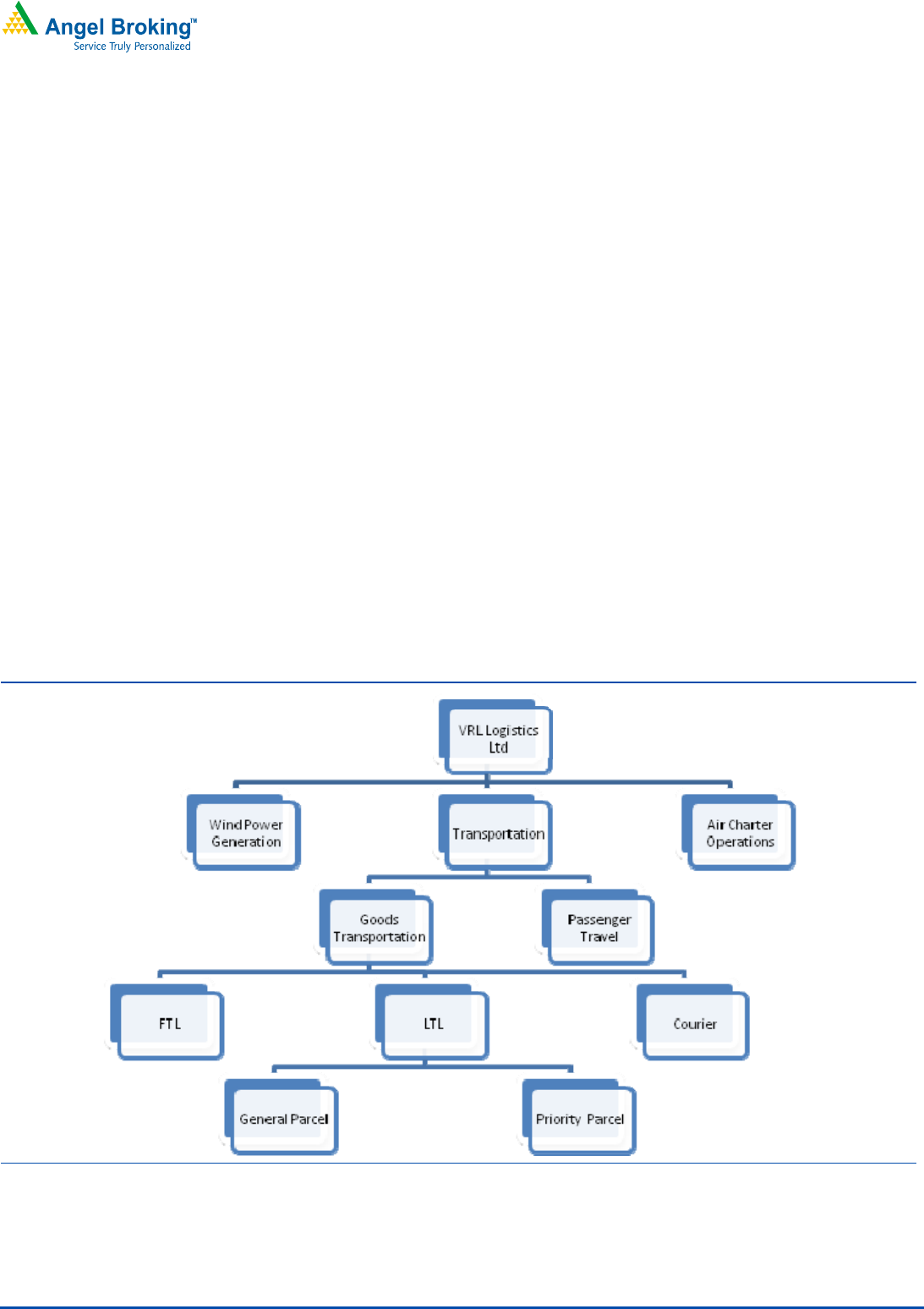

Company Background

VRL is one of the leading pan-India surface logistics and parcel delivery service

providers. It has the largest fleet of commercial vehicles in the private sector in

India. It provides general parcel and priority parcel delivery (less than truckload

[LTL] services), courier and full-truckload (“FTL”) services through its widespread

transportation network in 28 States and four Union Territories across India. As of

September 30, 2014, the company had 603 branches (583 leased branches and

20 owned branches) and 346 agencies across India, and of 603 branches, 48 (41

leased branches and seven owned branches) served as strategic transhipment

hubs for operations.

Goods transportation is the primary business of the company accounting for ~76%

of its overall revenues (for 9MFY2015). As of December 31, 2014, the goods

transportation fleet included 3,546 owned vehicles. A large fleet, mostly owned by

the company, enables it to reduce dependence on hired vehicles. The company

also provides luxury bus services (focused on high density urban commuter cities)

across the States of Karnataka, Maharashtra, Goa, Andhra Pradesh, Telengana,

Tamil Nadu, Gujarat and Rajasthan. As of December 31, 2014, it owns and

operates 455 buses. Bus operations accounted for ~20% of the overall revenues

for 9MFY2015. The revenue from other operations includes courier services, hotel

(restaurant) operations, sale of power (Wind Power business) and air chartering

services.

Exhibit 1: Structure

Source: Company, Angel Research

V

RL Logistics

|

IPO Note

A

pril 11, 2015

3

Issue Details

The issue comprises of Fresh Issue of equity shares of `10 each in the price band

of `195-`205 aggregating up to `117cr; and offer for sale by private equity firm

NSR PE Mauritius LLC and Promoter Group of 1.71cr shares. The issue constitutes

25% of the post issue paid-up equity share capital of the company.

Exhibit 2: Share Holding pattern

Particulars Pre-Issue Post-Issue

No. of shares

(%) No. of shares (%)

Promoter and Promoter Group 6,60,46,000

77.2% 6,34,80,000 69.6%

NSR 1,92,54,912

22.5% 47,04,912 5.2%

Others 2,35,250

0.3% 2,30,58,567 25.3%

Total 8,55,36,162

100% 9,12,43,479 100%

Source: Company, Angel Research

Objects of the Fresh Issue

Purchase of goods transportation vehicles amounting to `67cr.

Repayment/pre-payment, in full or part, of certain borrowings availed by the

company amounting to `28cr.

The balance, which is contingent upon the issue price will be utilised for

general corporate purpose.

V

RL Logistics

|

IPO Note

A

pril 11, 2015

4

Investment Arguments

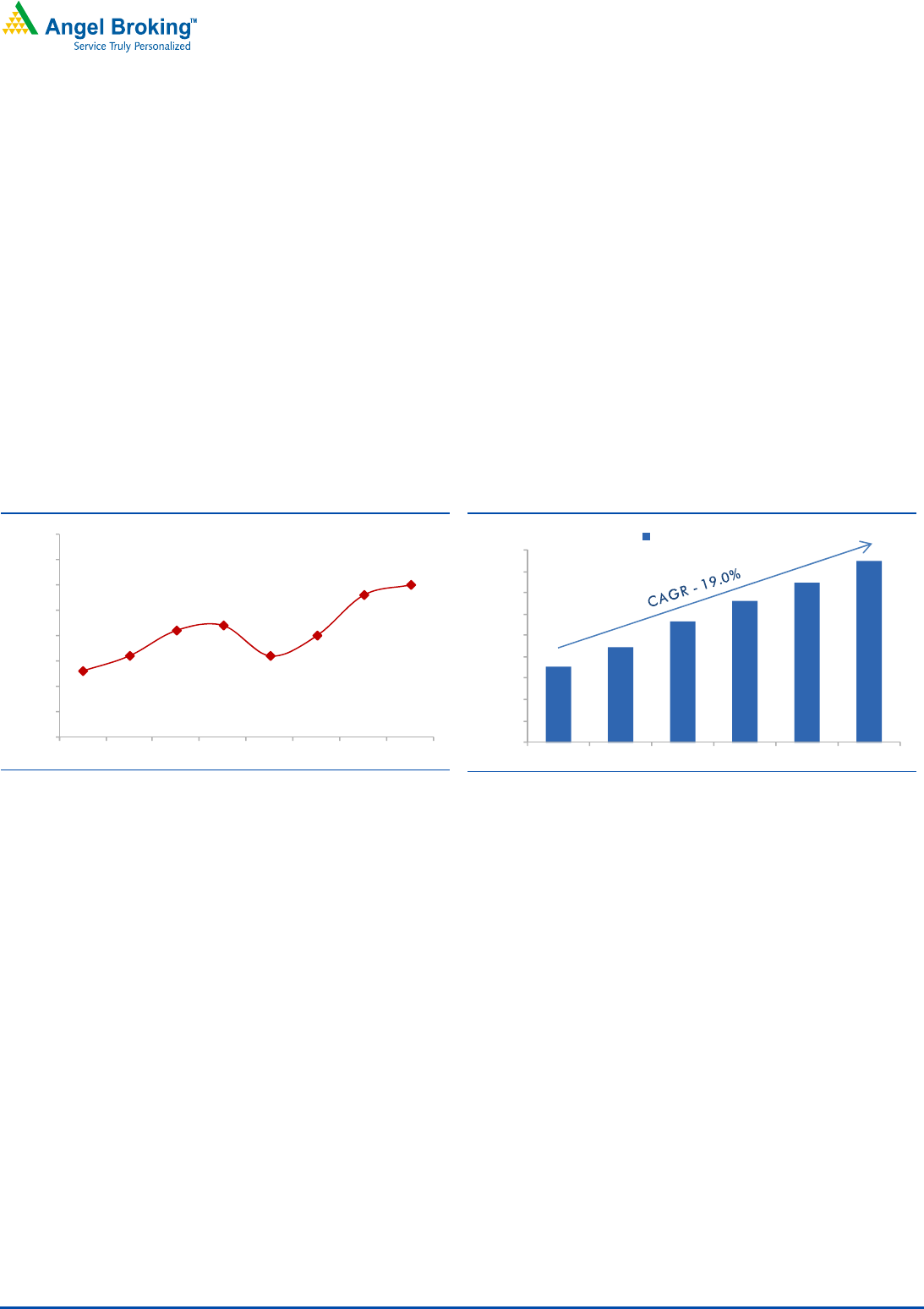

Economic revival augers well for Goods Transportation Business

VRL derives majority of its revenue from the goods transportation business

(~76% of total). It has the distinction of owing one of the largest fleets in the

private sector, if not the largest. As of 31

st

December, 2014, the company’s fleet

strength stood at 3,546 vehicles serving a broad range of industries, including the

fast moving consumer goods (FMCG) sector as well as other industries including

food, textiles, apparel, furniture, appliances, pharmaceutical products, rubber,

plastics, metal and metal products, wood, glass, automotive parts and machinery.

We believe that the policy reforms, lower inflation levels and resultant rate cuts will

provide boost to commercial activity in India. On the back of said outcomes, the

main business of the company should perform well with improving macro

condition.

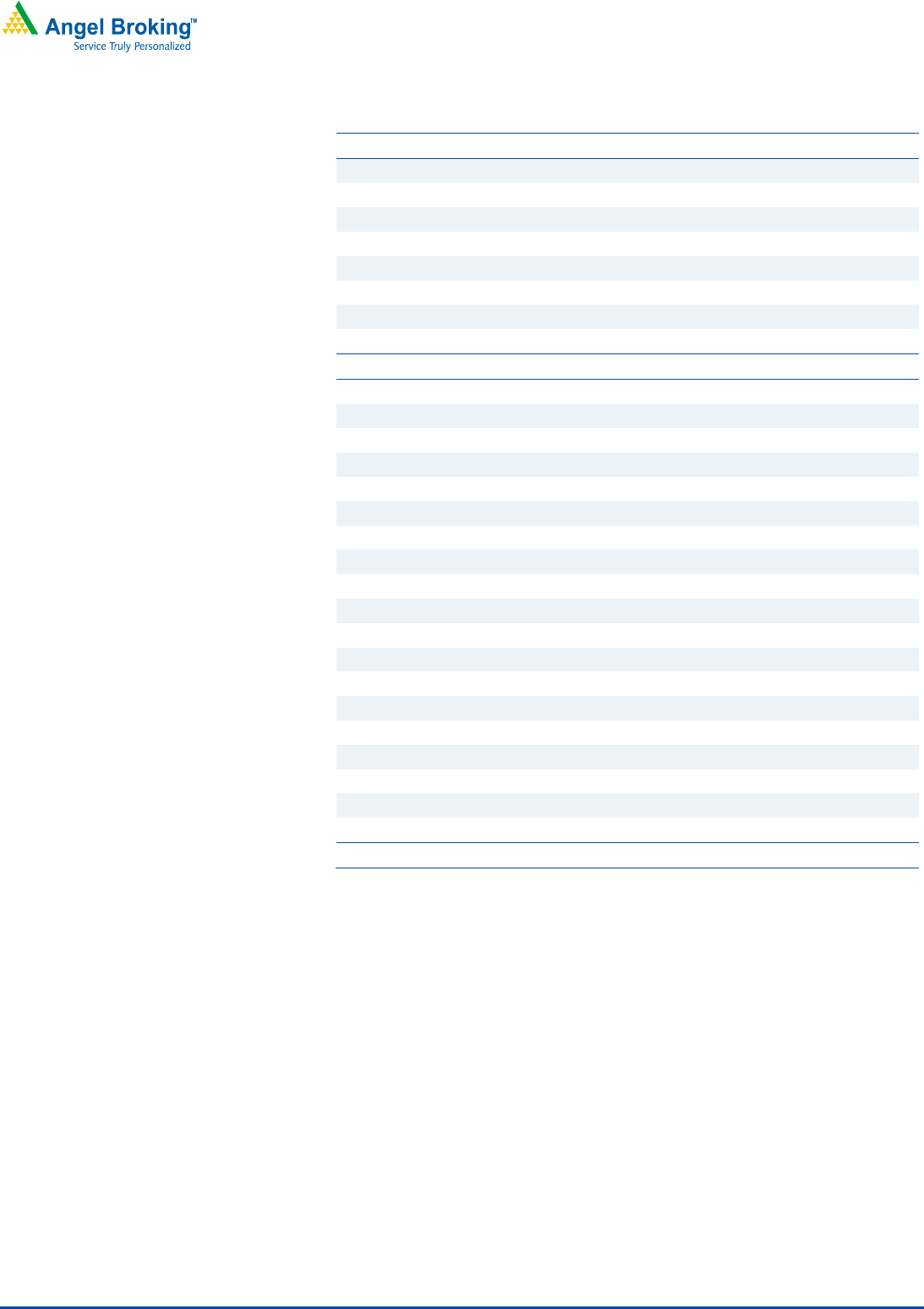

Exhibit 3: Expected Growth in GDP

7.3

7.6

8.1

8.2

7.6

8.0

8.8

9.0

6.0

6.5

7.0

7.5

8.0

8.5

9.0

9.5

10.0

FY2010 FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E

(%)

Source: Company, Angel Research

Exhibit 4: Goods Transportation Business Trend

711

889

1,130

1,325

1,494

1,698

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

FY2010 FY2011 FY2012 FY2013 FY2014 FY2015E*

(`)

Goods Transport Business Revenue

Source: Company, Angel Research; *Note- FY2015E represents annualized

numbers

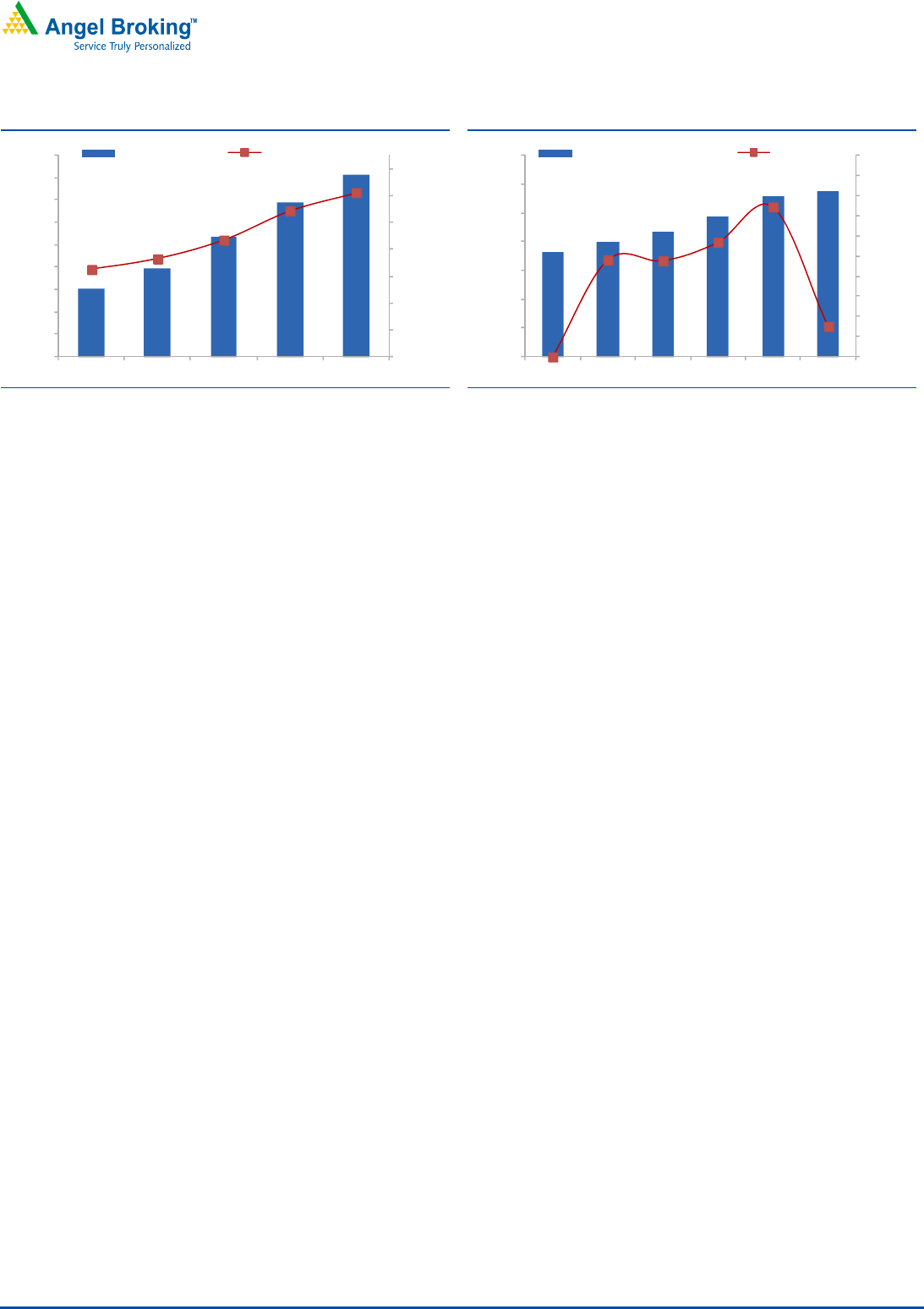

Lower Oil prices, a near-term boon

Diesel is a major component of company’s operating expenses and all of its

vehicles run on diesel. As a percentage of net sales, diesel expense for 9MFY2015

stood at 27.3%. The company has adjusted freight rates periodically in the past

when the diesel prices have been on the rise. However, during the IPO meet, the

Management stated that the company has not reduced the freight rates during the

recent decline in fuel prices. Diesel prices which increased from an average of

`36/litre in FY2010 to an average of `56 in FY2014 started to decline since

October 2014 (`63/litre) and are currently at ~`52/litre. In the near term, the

diesel prices are expected to be at current levels and this will have a favorable

impact on the company.

V

RL Logistics

|

IPO Note

A

pril 11, 2015

5

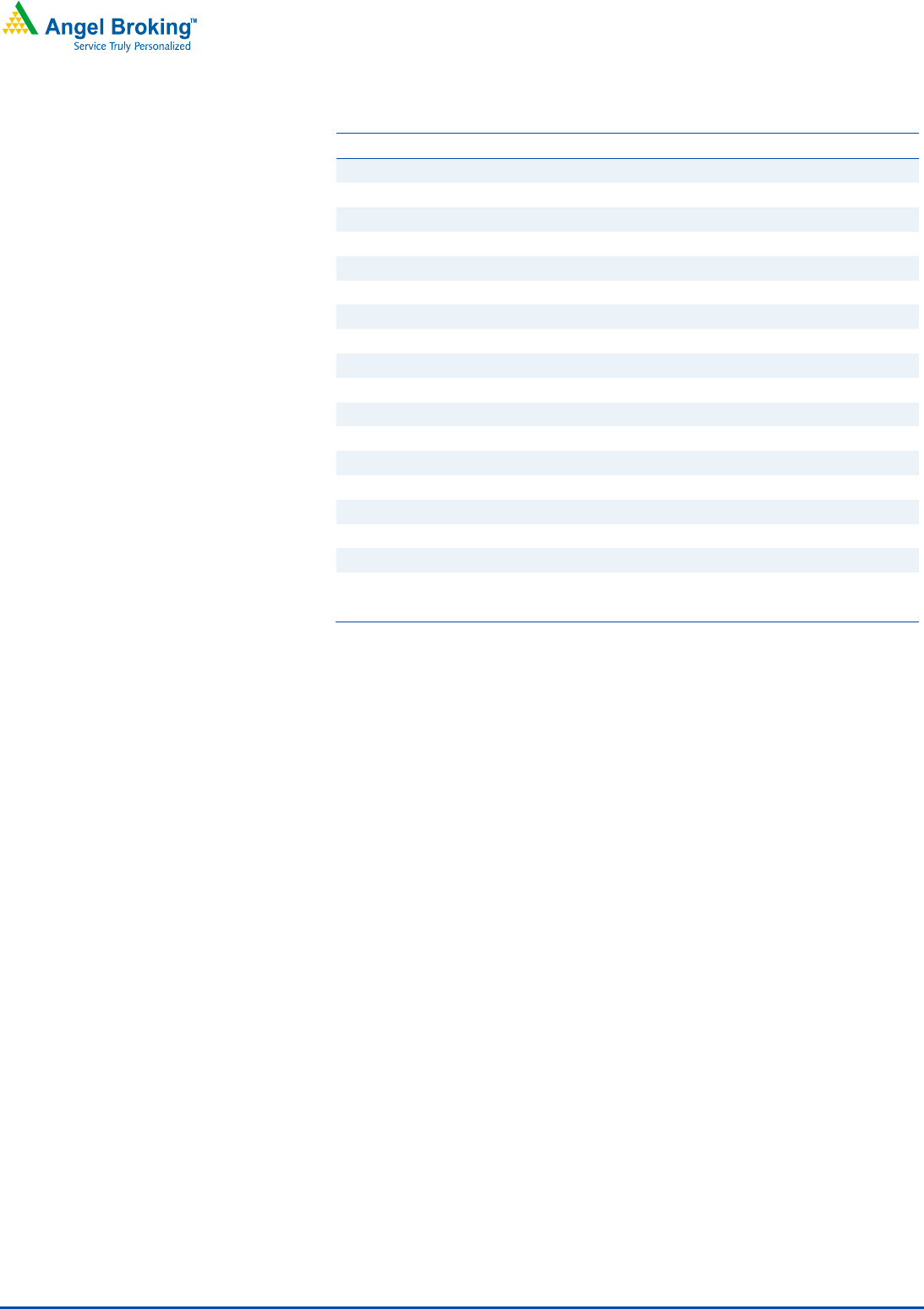

Exhibit 5: Diesel as % of Net sales

153

198

268

343

407

21.5

22.3

23.7

25.9

27.2

15.0

17.0

19.0

21.0

23.0

25.0

27.0

29.0

-

50

100

150

200

250

300

350

400

450

FY2010 FY2011 FY2012 FY2013 FY2014

(%)

(` Cr)

Diesel Cost (LHS) % of Net Sales (RHS)

Source: Company, Angel Research

Exhibit 6: Average Diesel Price Trend

36

40

44

48

56

57

-

9.6

9.5

11.4

14.9

3.0

-

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

18.0

20.0

-

10

20

30

40

50

60

70

FY2010 FY2011 FY2012 FY2013 FY2014 FY2015

(%)

(`/litre)

Average Price of Diesel (LHS) Change (RHS)

Source: Company, Angel Research, Indian Oil Corp.

GST implementation to benefit the logistics sector

The much awaited tax reform, GST, targeted to be rolled out by April 1, 2016, is

expected to have a positive impact on the logistics sector. At present, the duty and

taxation structure is such that the goods are taxed multiple times (while crossing

boundaries) as they move across the country. The varying taxation system across

29 states and seven union territories has obstructed the creation of a national

network. The planned GST is expected to eradicate multiple taxes and tariffs at

state level and proposes taxation at the national level. In our view, this will benefit

the logistics sector and especially major players like VRL. VRL has a pan India

presence with agencies, branches and hubs spread out across the country.

Additional Fleet to cater to improvement in demand

The share of road transport in India has been increasing in comparison to other

modes of transport owing to faster service and point-to-point connectivity. In the

coming years, the freight movement by roadways is expected to show robust

growth on account of improvement in the economy and improvement in

infrastructure. The company intends to utilize a major chunk (`67cr) from the fresh

issue to increase the fleet size of the goods transportation business by adding 248

new vehicles. Although a small addition to its massive fleet, this will enable VRL to

be well equipped for any increase in demand in the near future.

Sound Business Model

VRL intends to further grow its parcel delivery (comprising general parcel and

priority parcel delivery) business which has higher rates per load, and incremental

revenues with superior margins. More importantly, VRL has a diverse customer

base that is spread across all sectors. As of 9MFY2015, their largest customers in

the goods transportation business were 1.1% and top ten customers were 6.1% of

the total revenue. Ongoing accounts only comprised of 16.3% of revenues and

70% were “Paid” and “To Pay” customers. We believe that the company possesses

a very sound business model which will continue to pay off in the long run.

V

RL Logistics

|

IPO Note

A

pril 11, 2015

6

Outlook and Valuation

The company’s net sales have grown at a CAGR of 18.9% over FY2011 to

`1,494cr in FY2014. The EBITDA margins have been declining from 18.7% in

FY2011 to 13.8% in FY2014 but have recovered well in 9MFY2015 to the level of

17.0%. The net profit has grown at a CAGR of 15.3% over FY2011-FY2014. At the

higher end of the price band, the stock is valued at 19.6x its FY2015E annualized

earnings which we believe is attractive considering that Transport Corp, a similar

logistic company, trades at 25.0x its FY2015E earnings. Considering the

improving economic outlook, its pan-India presence and attractive valuations, we

recommend a Subscribe to the issue at the upper price band.

Exhibit 7: Valuations

Y/E Sales PAT

EPS RoE P/E P/B

V

EV/Sales

March (` cr) (` cr)

(`) (%) (x) (x) (x)

VRL Logistics FY2015E* 1,698 96

10.5 20.0 19.6 3.9 1.4

Transport Corp. Of India FY2015E 2,468 87

11.6 14.1 25.0 3.5 0.6

Source: Company, Angel Research; Note*FY2015E numbers are on annualized basis and considering subscription at the upper end of the price band

Key risks/concerns

Economic Slowdown: The performance of the sector is dependent on the state of

the economy. As a result, a slowdown in the Indian economy will have a negative

impact on the performance.

Short term fluctuation in Fuel prices: The company has a policy of revising its

freight charges periodically. However, the near term fluctuation in the fuel prices

will have a negative impact on the performance.

V

RL Logistics

|

IPO Note

A

pril 11, 2015

7

Profit & Loss (Standalone)

Y/E March (` cr) FY2012 FY2013 FY2014

Total operating income 1130 1325 1494

% chg

2

7.2

17.3

12.7

Operating Expenses 791

963

1,091

% chg 31.1

2

1.7

13.4

Personnel 129

148

174

% chg

2

3.4

15.0

17.7

Other 18

19

22

% chg

2

2.2

5.1

11.3

Total Expenditure 938

1,130

1,287

EBITDA 192 195 207

% chg 15.7

1.7 5.8

(% of Net Sales) 17.0

14.7

13.8

Depreciation& Amortisation 70

82

87

EBIT 122 113 120

% chg

2

5.7

(7.7) 6.3

(% of Net Sales) 7.6

7.4

9.3

Interest & other Charges 65 59 60

Other Income 5

10

10

(% of Net Sales) 0.3

0.6

0.8

Recurring PBT 57 54 60

% chg 15.8

(6.0) 11.9

Exceptional items - - 7

PBT (reported) 62 64 77

Tax (15) 18

20

(% of PBT) (23.6)

2

8.1

2

5.7

PAT (reported) 77 46 57

Extraordinary Expense/(Inc.) - - 5

ADJ. PAT 77 46 52

% chg 125.7

(40.4) 14.0

(% of Net Sales) 4.8

3.0

4.0

Basic EPS (`) 10.9 6.5 6.1

Fully Diluted EPS (`) 10.9 6.5 6.1

% chg 125.7

(40.4) (5.8)

V

RL Logistics

|

IPO Note

A

pril 11, 2015

8

Balance sheet (Standalone)

Y/E March (` cr) FY2012 FY2013 FY2014

SOURCES OF FUNDS

Equity Share Capital 71

181

86

Reserves& Surplus 117

108

221

Shareholders’ Funds 187

289

306

Total Loans 603

501

505

Other Long Term Liabilities 8 9 9

Long Term Provisions 2 3 3

Deferred Tax Liability (net) 69 78 83

Total Liabilities 870

879

907

APPLICATION OF FUNDS

Gross Block 1,010

1,106

1,217

Less: Acc. Depreciation 315

395

476

Less: Impairment - - -

Net Block 695

710

740

Capital Work-in-Progress 10

14

14

Lease adjustment - - -

Investments 0

0

0

Long Term Loans and advances 92

97

91

Other Non-current asset 1

1

3

Current Assets 135

143

130

Cash 14

15

15

Loans & Advances 15

19

20

Inventory 9

10

13

Debtors 79

85

80

Other current assets 19

14

2

Current liabilities 62

86

71

Net Current Assets 72

58

59

Misc. Exp. not written off - - -

Total Assets 870 879 907

V

RL Logistics

|

IPO Note

A

pril 11, 2015

9

Cash flow statement (Standalone)

Y/E March (` cr) FY2012 FY2013 FY2014

Profit before tax 62

64 77

Depreciation 70

82 87

Change in Working Capital (16) 17 (2)

Direct taxes paid 15

(18) (20)

Others 36

18 61

Cash Flow from Operations 166

163 203

(Inc.)/Dec. in Fixed Assets (231) (100) (111)

(Inc.)/Dec. in Investments (0) 0 (0)

(Incr)/Decr In LT loans & adv. (15) (4) 4

Others 3

15 16

Cash Flow from Investing (242) (90) (91)

Issue of Equity - 110 (96)

Inc./(Dec.) in loans 161

(103) 5

Dividend Paid (Incl. Tax) (23) (61) (40)

Others (63) (18) 18

Cash Flow from Financing 75

(71) (113)

Inc./(Dec.) in Cash (2) 2 (0)

Opening Cash balances 15

14 15

Closing Cash balances 14

15 15

V

RL Logistics

|

IPO Note

A

pril 11, 2015

10

Key Ratios

Y/E March FY2012 FY2013 FY2014

Valuation Ratio (x)

P/E (on FDEPS) 24.4 40.9 35.9

P/CEPS 12.8 14.6 13.5

P/BV 10.0 6.5 6.1

Dividend yield (%) 1.1 2.8 1.8

EV/Net sales 2.2 1.9 1.6

EV/EBITDA 12.8 12.6 11.4

EV / Total Assets 2.8 2.8 2.6

Per Share Data (`)

EPS (Basic) 10.9 6.5 6.1

EPS (fully diluted) 10.9 6.5 6.1

Cash EPS 20.7 18.1 16.2

DPS 2.8 7.4 4.0

Book Value 26.5 40.9 35.8

DuPont Analysis

EBIT margin 10.8 8.5 8.0

Tax retention ratio 1.2 0.7 0.7

Asset turnover (x) 1.5 1.6 1.7

ROIC (Post-tax) 20.6 9.6 10.3

Cost of Debt (Post Tax) 15.4 7.7 8.8

Leverage (x) 3.1 1.7 1.6

Operating ROE 37.0 12.7 12.7

Returns (%)

ROCE (Pre-tax) 15.8 12.9 13.4

Angel ROIC (Pre-tax) 16.7 13.3 13.9

ROE 47.8 19.2 17.5

Turnover ratios (x)

Asset TO (Gross Block) 1.3 1.3 1.3

Inventory / Net sales (days) 2.4 2.5 2.8

Receivables (days) 23.8 22.6 20.2

Payables (days) 23.4 23.9 22.2

WC cycle (ex-cash) (days) 15.6 13.3 12.3

Solvency ratios (x)

Net debt to equity 3.1 1.7 1.6

Net debt to EBITDA 3.1 2.5 2.4

Int. Coverage (EBIT/ Int.) 1.9 1.9 2.0

Note: *Valuation Ratio at the lower price band

V

RL Logistics

|

IPO Note

A

pril 11, 2015

11

Disclosure of Interest Statement VRL Logistics

1. Analyst ownership of the stock No

2. Angel and its Group companies ownership of the stock No

3. Angel and its Group companies' Directors ownership of the stock No

4. Broking relationship with company covered No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period): Reduce (-5% to -15%) Sell (< -15)

Note: We have not considered any Exposure below

`

1 lakh for Angel, its Group companies and Directors

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel has received in-principal approval

from SEBI for registering as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates

including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by

Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer, director or employee of

company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.