Initiating Coverage | Infrastructure

January 10, 2013

Unity Infraprojects

BUY

CMP

`46

Cruising on order inflow

Target Price

`59

Unity Infraprojects (UIP) is one of the fastest growing mid-cap company in the

Investment Period

12 Months

infrastructure space with focus on civil construction segment (residential,

commercial and industrial structure portfolio) and infrastructure projects in

Stock Info

irrigation & water and transportation segments. The company has a healthy order

book of `4,495cr as of 2QFY2013. Given the strong bid pipeline and L1 status

Sector

Infrastructure

for projects worth `1,400cr, we estimate UIP to report a revenue CAGR of 11.5%

Market Cap (` cr)

342

over FY2012-FY2014E. Its focus on high growth buildings and water/irrigation

Net debt (` cr)

539

segment provides confidence on future growth. We initiate coverage with a Buy

rating and a SOTP target price of `59.

Beta

1.5

Comfortable order book-to-sales provides revenue visibility: The company’s order

52 Week High / Low

56/34

book stands at `4,495cr (excluding L1 orders worth `1,400cr) as on 2QFY2013,

Avg. Daily Volume

59,385

thereby translating into a book-to-bill ratio of 2.2x trailing revenues. This gives a

Face Value (`)

2

comfortable revenue visibility for the next two years given the short execution

period of 24-30 months. The order book mix comprises of projects in the civil

BSE Sensex

19,664

(52%), irrigation & WS (21%) and transportation (27%) segments.

Nifty

5,969

Well diversified order book with pan - India presence: UIP initially started off with

Reuters Code

UTIL.BO

a presence in Maharashtra and historically remained skewed towards projects in

Bloomberg Code

UIP@IN

and around Maharashtra. It has come a long way in the last decade, making

its presence felt across India by diversifying into new verticals and bidding for new

projects across the country. As on 30th September 2012, 59.1% of UIP’s order

Shareholding Pattern (%)

book catered to the North, South and East regions of the country.

Promoters

62.7

Foray into asset ownership model: From being a mere EPC player, UIP has forayed

MF / Banks / Indian Fls

6.4

into asset ownership model through its wholly owned subsidiary Unity Infrastructure

Assets Ltd and has bagged 3 BOT projects under its portfolio. The company has

FII / NRIs / OCBs

2.4

started construction activity in one of its road BOT project - the Chomu-Mahla project

Indian Public / Others

28.5

and is in an advanced stage of achieving financial closure for the other two projects.

Valuation & recommendation: On the back of healthy order book and growth

Abs. (%)

3m

1yr

3yr

potential, we believe the company would clock revenue CAGR of 11.5% over

Sensex

5.5

21.6

12.2

FY2012-2014E. The stock is currently trading at a P/E of 3.5x and 3.1x our FY2013

and FY2014 diluted earnings estimates. We have used sum-of-the-parts (SOTP)

Uip

(5.7)

20.0

(60.7)

method to value the stock. We value the construction business at a P/E of 3.5x

FY2014E earnings (~30% discount to larger companies under coverage) and UIP’s

BOT projects on a DCF basis at a CoE of 16%. We initiate coverage on the stock

with a Buy rating and target price of `59, indicating an upside of 27%.

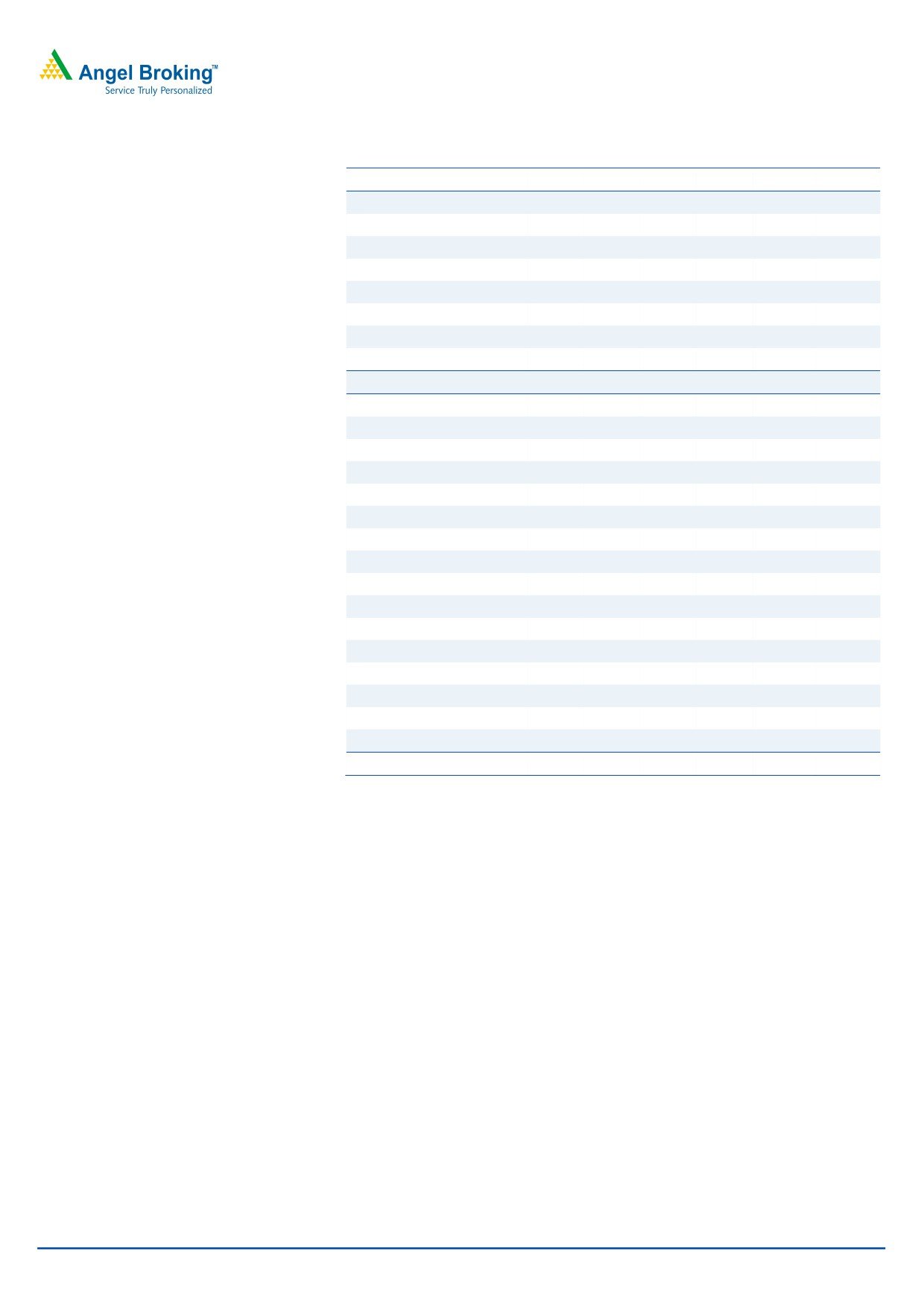

Key Financials (Standalone)

Y/E March (` cr)

FY2011

FY2012

FY2013E

FY2014E

Net Sales

1,702

1,973

2,180

2,455

% chg

15.2

15.9

10.5

12.6

Adj.Net Profit

94

104

99

111

% chg

10.8

9.7

(4.7)

12.4

EBITDA (%)

13.4

13.8

13.7

13.4

FDEPS (`)

12.7

14.0

13.3

15.0

P/E (x)

3.6

3.3

3.5

3.1

P/BV (x)

0.5

0.5

0.4

0.4

RoE (%)

15.5

14.8

12.5

12.5

RoCE (%)

15.1

15.9

15.5

14.9

EV/Sales (x)

0.6

0.5

0.5

0.5

EV/EBITDA (x)

4.5

3.8

3.8

3.6

OB/Sales (x)

2.1

2.1

2.2

2.4

Viral Shah

Order Inflows

1,725

2,676

2,879

3,353

022-39357800 Ext: 6829

% chg

(23.7)

55.1

7.6

16.5

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Unity Infraprojects | Initiating Coverage

Investment Arguments

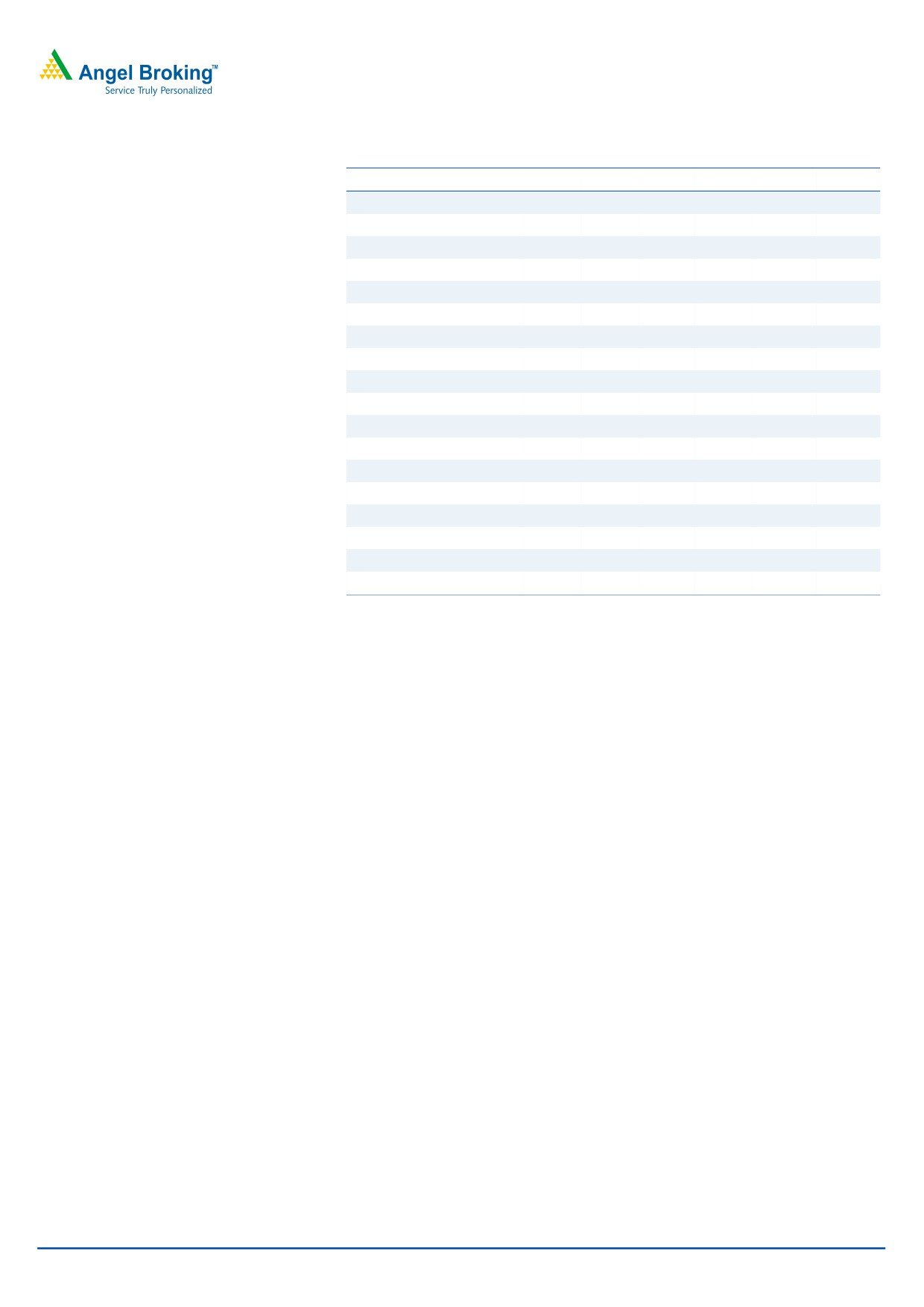

Comfortable order book-to-sales provides revenue visibility

Comfortable order book-to-sales ratio

UIP has a presence across three verticals namely-(a) civil construction (residential,

of

2.2x trailing revenues, gives

commercial and industrial structure portfolio), (b) water and irrigation and

comfortable visibility for the next two

(c) transportation. UIP has seen its order book swell from `2,410cr in FY2008 to

years’ revenues given the short

~`4,200cr by FY2012 end, indicating a five-year CAGR of 15%. The company’s

execution period of 24-30months.

order book currently stands at ~`4,495cr (excluding L1 orders of ~`1,400cr)

which translate into a book-to-bill ratio of 2.2x trailing revenues. The civil

construction segment contributes 52% and transportation segment contributes 27%

of the total order book. Going forward, we expect the civil and transportation

segments to be the growth drivers for the company.

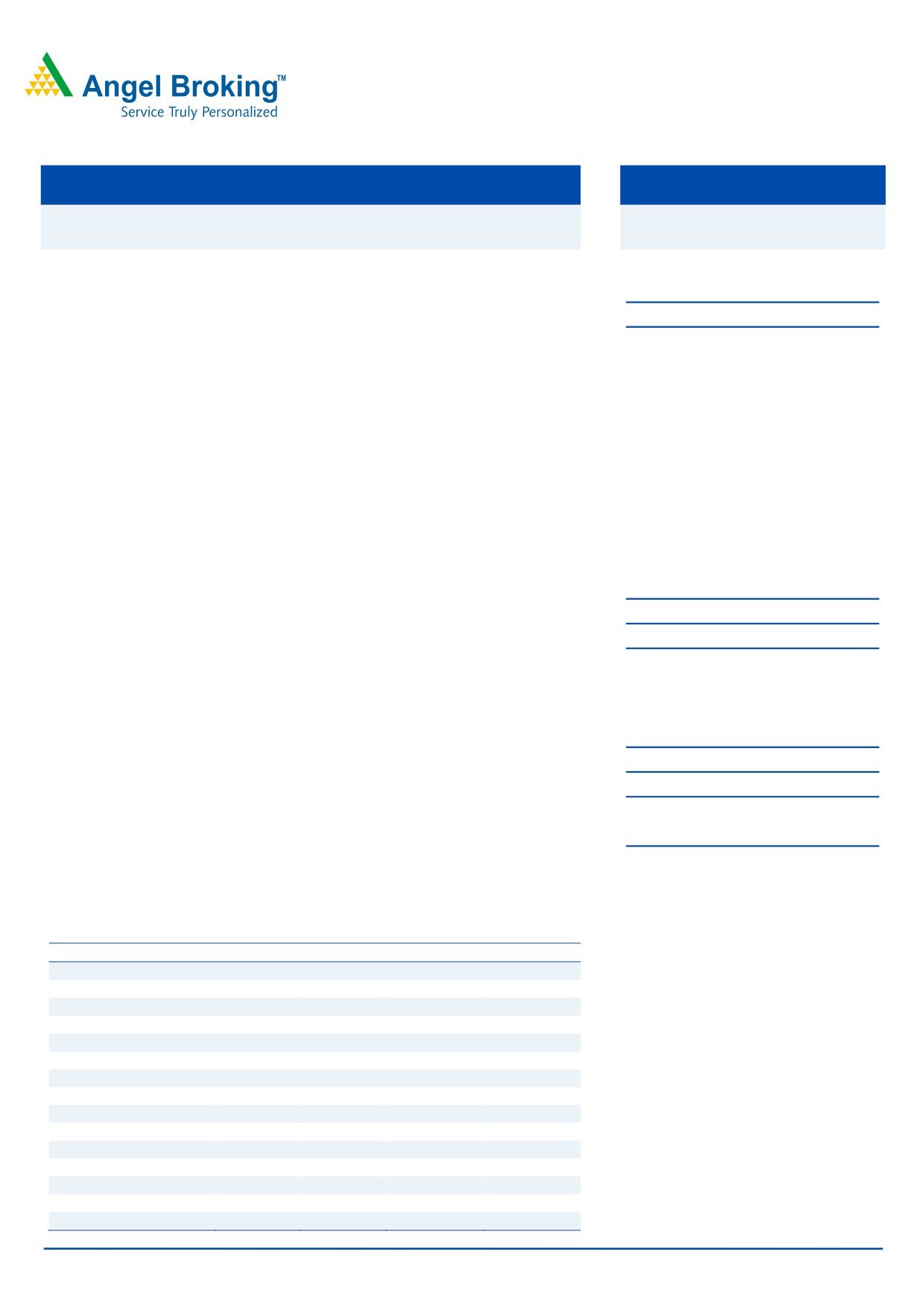

UIP has a comfortable order book-to-sales ratio of 2.2x trailing revenues, which

gives comfortable visibility for the next two years’ revenues given the short

execution period of 24-30 months. Given the strong bid pipeline and L1 status of

projects worth `1,400cr, we estimate the company would see order inflows of

`2,879cr and `3,353cr in FY2013 and FY2014 respectively. Thus, we expect

the company’s order book to stand at

`4,898cr and `5,798cr in FY2013

and FY2014 respectively with the civil and transportation segment contributing

a major share.

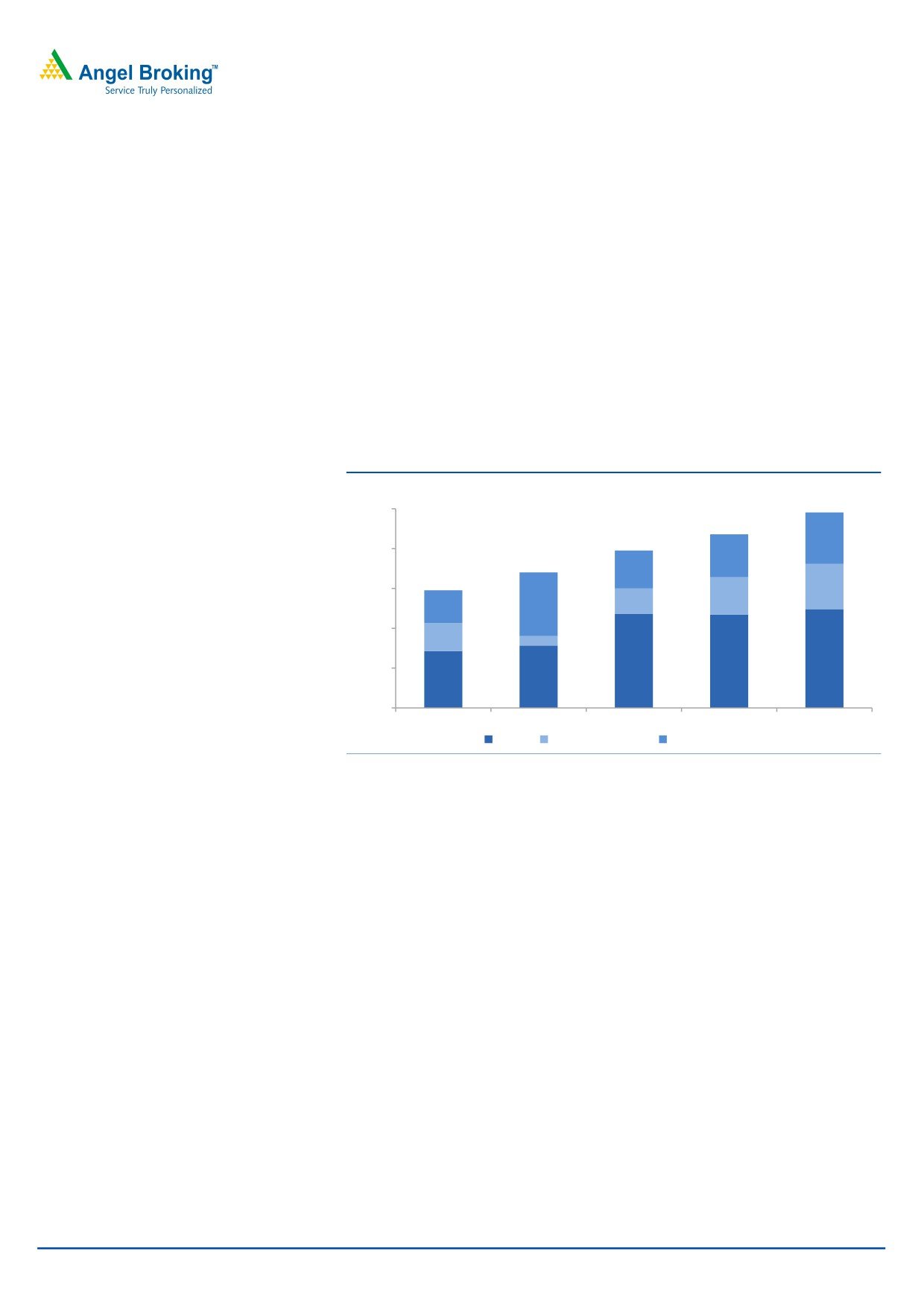

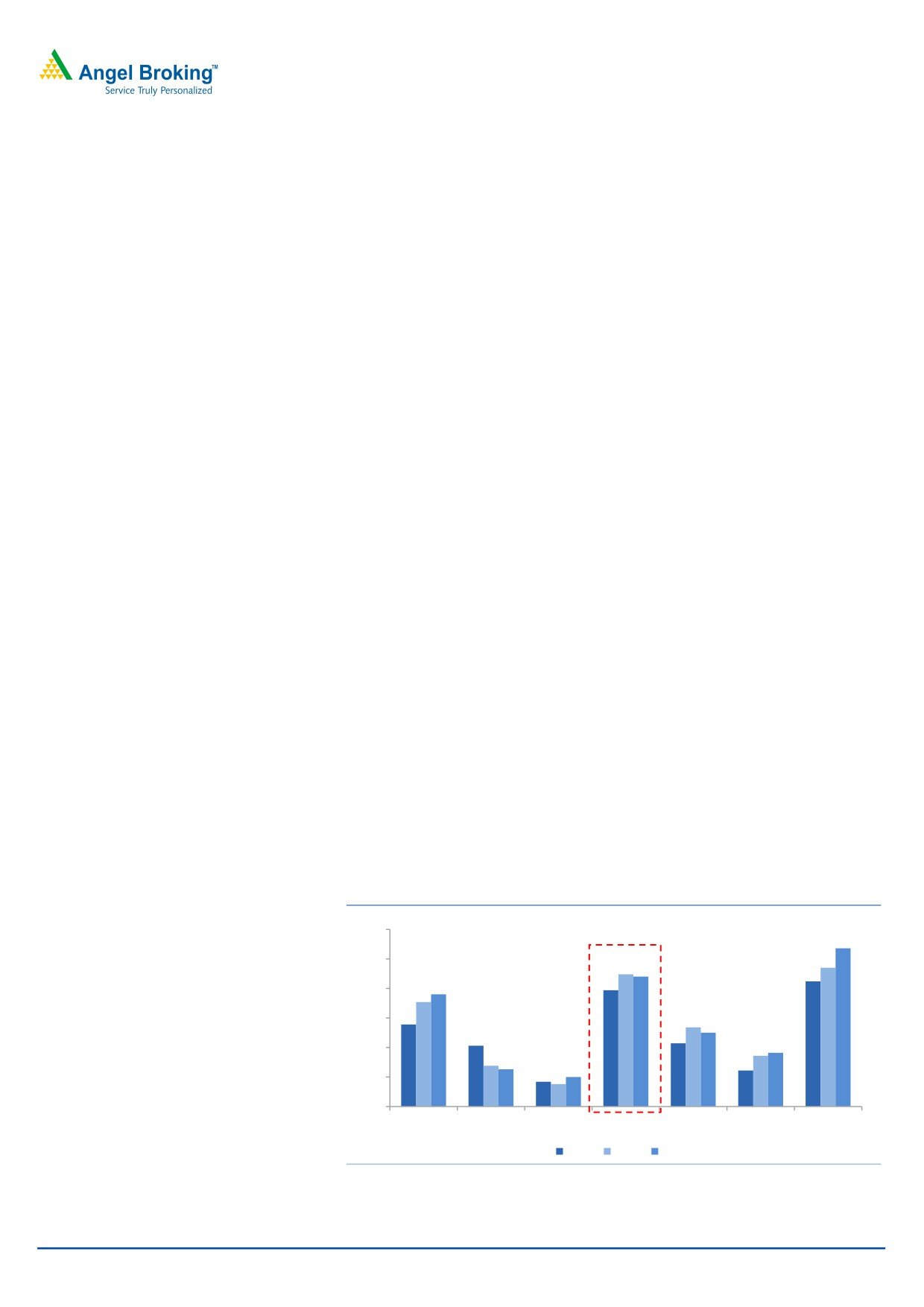

Exhibit 1: Order book trend and OB-to-sales

Exhibit 2: Transportation segment gains momentum

120

7000

2.4

2.4

2.4

2.4

100

6000

2.2

2.3

24

20

21

5000

2.3

80

33

2.1

55

2.2

4000

29

29

2.1

60

14

26

2.2

3000

2.1

40

9

2000

2.1

53

50

51

50

2.0

1000

20

35

2.0

0

1.9

0

FY10

FY11

FY12

FY13E

FY14E

FY10

FY11

FY12

FY13E

FY14E

Order book (` cr)

Order-to-sales ratio (x)

Civil segment

Transportation segment

Irrigation & WS segment

Source: Company, Angel Research

Source: Company, Angel Research

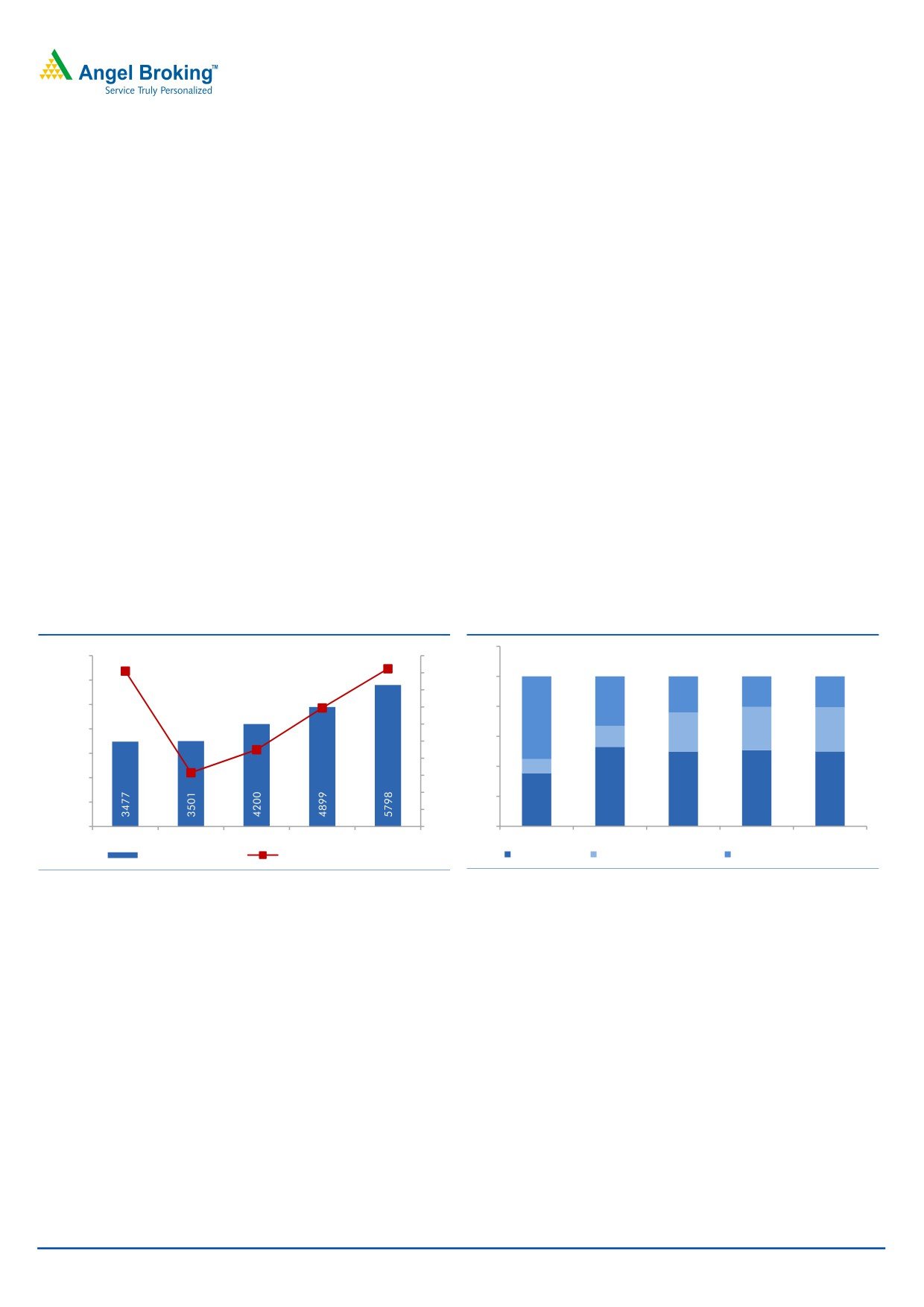

Well diversified order book with pan-India presence

As on 2QFY2013, UIP’s 59.1% of order

UIP initially started off with a presence in Maharashtra and historically remained

book caters to regions (North, South and

skewed towards projects in and around Maharashtra. It has come a long way in

East) apart from the Western region.

the last decade, making its presence felt across India by diversifying into new

verticals and bidding for new projects across the country. As on 30th September

2012, 59.1% of UIP’s order book catered to regions (North, South and East) other

than the Western region.

Over a period, UIP has built a strong and esteemed clientele, especially

comprising government clients. Of the total order book, 87.7% comprises of

government orders while private client orders account for the balance 12.3%. We

believe, strong and timely execution by the company has enabled it to develop a

strong relationship with its clientele which has resulted in it getting repetitive orders

from both - government as well as private clients.

January 10, 2013

2

Unity Infraprojects | Initiating Coverage

Exhibit 3: Order book break up - client wise

Exhibit 4: Diversified order book with pan India presence

Source: Company, Angel Research

Source: Company, Angel Research

Foray into asset ownership model

Moving up the chain by foraying into

From being a mere EPC player, UIP has forayed into the asset ownership model

asset ownership model through its

through its wholly owned subsidiary Unity Infrastructure Assets Ltd and has bagged

wholly

owned subsidiary Unity

3 BOT projects under its portfolio. The company has started construction activity in

Infrastructure Assets Ltd. However, EPC

one of its road BOT project, ie the Chomu-Mahla project and is in an

is going to remain the prime focus for

advanced stage of achieving financial closure for other two projects-(a)

the company.

Suratgarh-Sriganganagar BOT project and (b) Punjab/Haryana border BOT

project. The company expects to achieve financial closure by 4QFY2013, post

which it would start construction activity on the projects.

Exhibit 5: BOT Project details

Project

Chomu-Mahala Punjab Haryana

Suratgarh-Sriganganagar

Type

Toll

Toll

Toll

Status

Under Dev.

FC awaited

FC awaited

km

70

68

76

State

Rajasthan

Punjab/Haryana

Rajasthan

Concession (Yrs)

25

27

11

TPC(` cr)

198

510

330

Equity(` cr)

34

153

93

Debt(` cr)

146

357

231

Grant(` cr)

18

0

5.7

Traffic growth (%)

6%

7%

6%

Toll growth (%)

5%

5%

6%

Interest Rate (%)

12.5%

12.0%

12.0%

Source: Company, Angel Research

Real estate investment to yield value in the long run

UIP made a slow and small foray into the real estate development business

through its wholly owned subsidiary-Unity Realty Developers Ltd for undertaking all

real estate projects. UIP has a total land bank of 40acres in Bangalore and

Kolkata and also has 0.8mn sqft and 2.67mn sqft of developmental land in Goa

and Nagpur respectively. UIP has sold its stake (19%) in the 400 hotel room

project in Pune to Kamat Hotels for `46cr. Out of this amount, the company has

already received `35cr till date; while the remaining `11cr is expected to be

received by February 2013.

January 10, 2013

3

Unity Infraprojects | Initiating Coverage

Exhibit 6: Summary of real estate projects

Projects

Area

Type

Investment in (` cr)

Nagpur

2.67mn sqft

Commercial

36

Goa

0.8mn sqft

Commercial

10

Kolkata

25 acres

Commercial + Residential

60

Bangalore

15 acres

Commercial + Residential

77

Source: Company, Angel Research

UIP made a slow and small foray

After venturing into commercial real estate, the company is planning to develop

into the real estate development

residential real estate in Bangalore and Kolkata. Initially, the management plans to

business through its wholly owned

start construction in Bangalore and then foray into the Kolkata market. The

subsidiary-Unity Realty Developers Ltd

company is planning to launch its Bangalore real estate project towards

for

undertaking all real estate

4QFY2013 end as it is expecting to receive necessary clearances within the next

projects.

two to three months. In phase-I, the company is planning to construct 0.7mn sqft

of commercial cum residential space and expects the realisation from this project

to be in the range of `3,500-4,000 per sqft.

As far as the Nagpur project is concerned, no significant progress has been made

in the last six months. The company has received 3 land parcels till date and is

expecting to receive the remaining land parcels within the next two to three months

from Nagpur Municipal Corporation. Once the entire land parcel is available the

company is expected to start construction activity.

However, owing to significant delay in start of construction activity and in the

absence of clarity on the exact development schedule for all four projects, we have

not assigned any value to the real estate investments.

January 10, 2013

4

Unity Infraprojects | Initiating Coverage

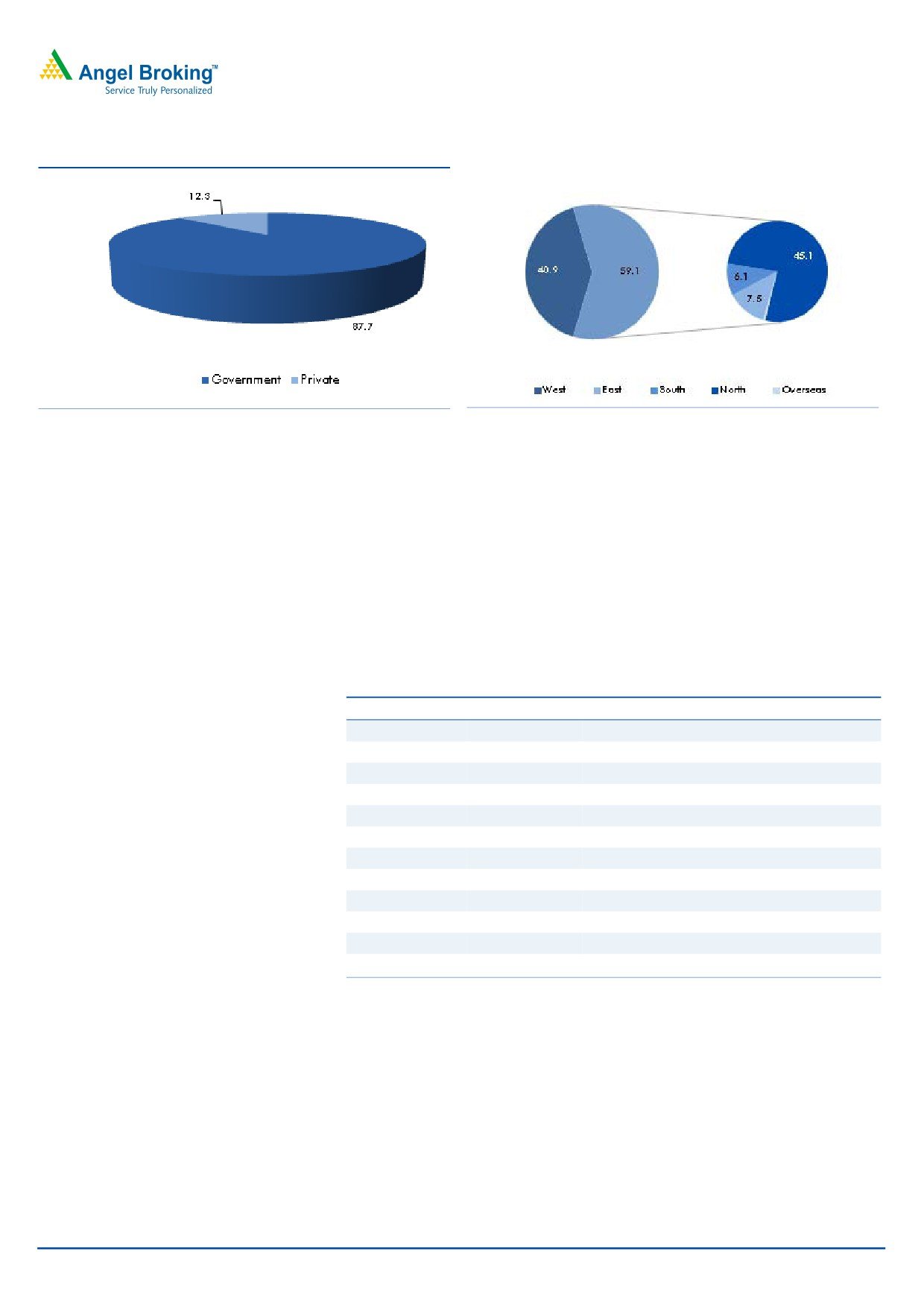

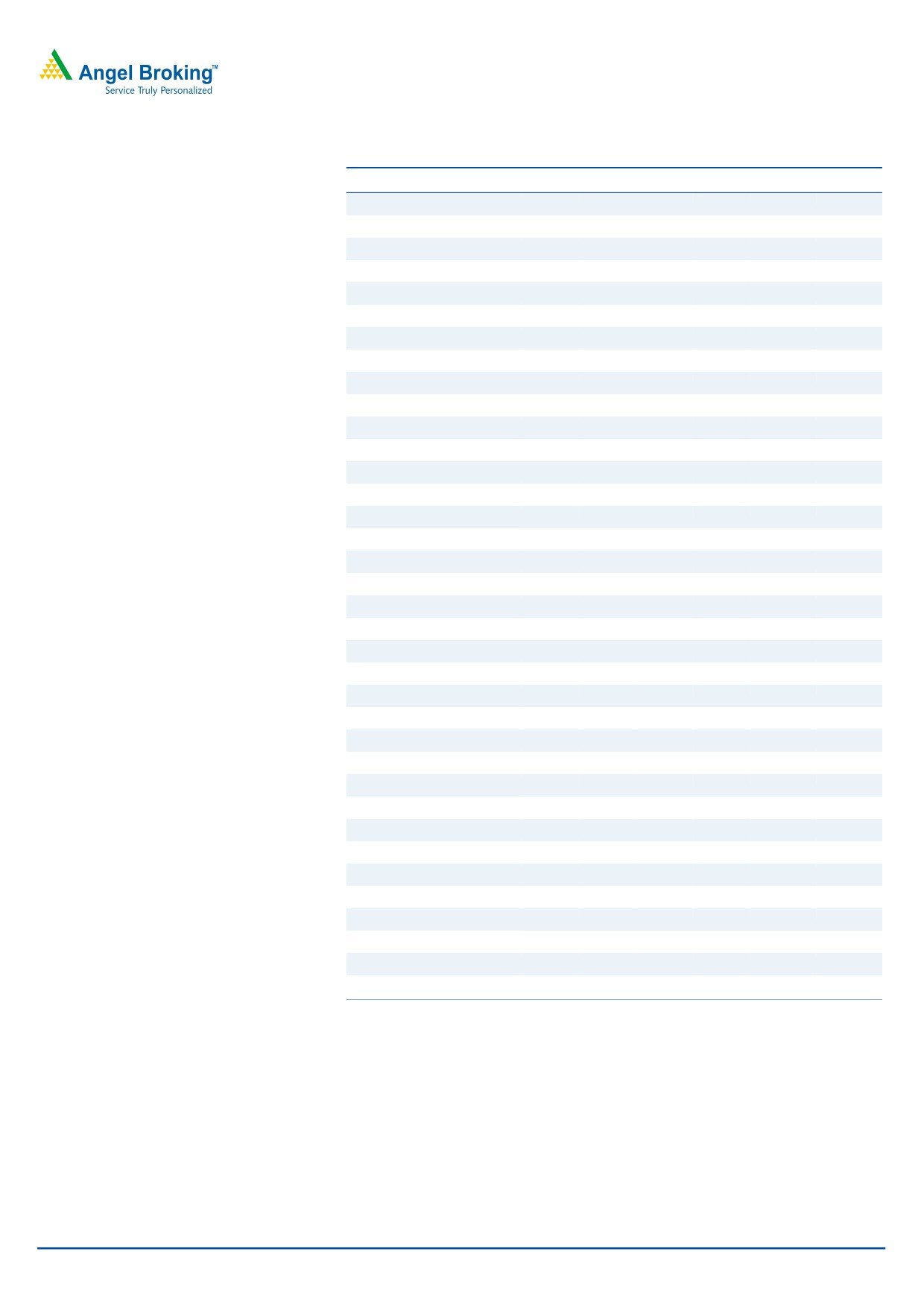

Financial analysis

Strong order book to drive revenue growth

The company’s order book stood at `4,495cr (excluding L1 orders of `1,400cr) in

2QFY2013, thereby converting into order book-to-sales ratio of 2.2x trailing

revenues. This provides comfortable revenue visibility over the next two to three

years. Given the healthy order book, we expect revenues to clock a CAGR of

11.5% over FY2012-FY2014E. Thus, we estimate revenues to increase from

`1,973cr in FY2012 to `2,455cr in FY2014. On the back of recently awarded

BOT projects and shorter execution cycle we believe the civil construction and

transportation segment would contribute the most to UIP’s revenue growth in the

medium term. However, going forward, we expect the water and irrigation

segment to drive revenue growth over a long period.

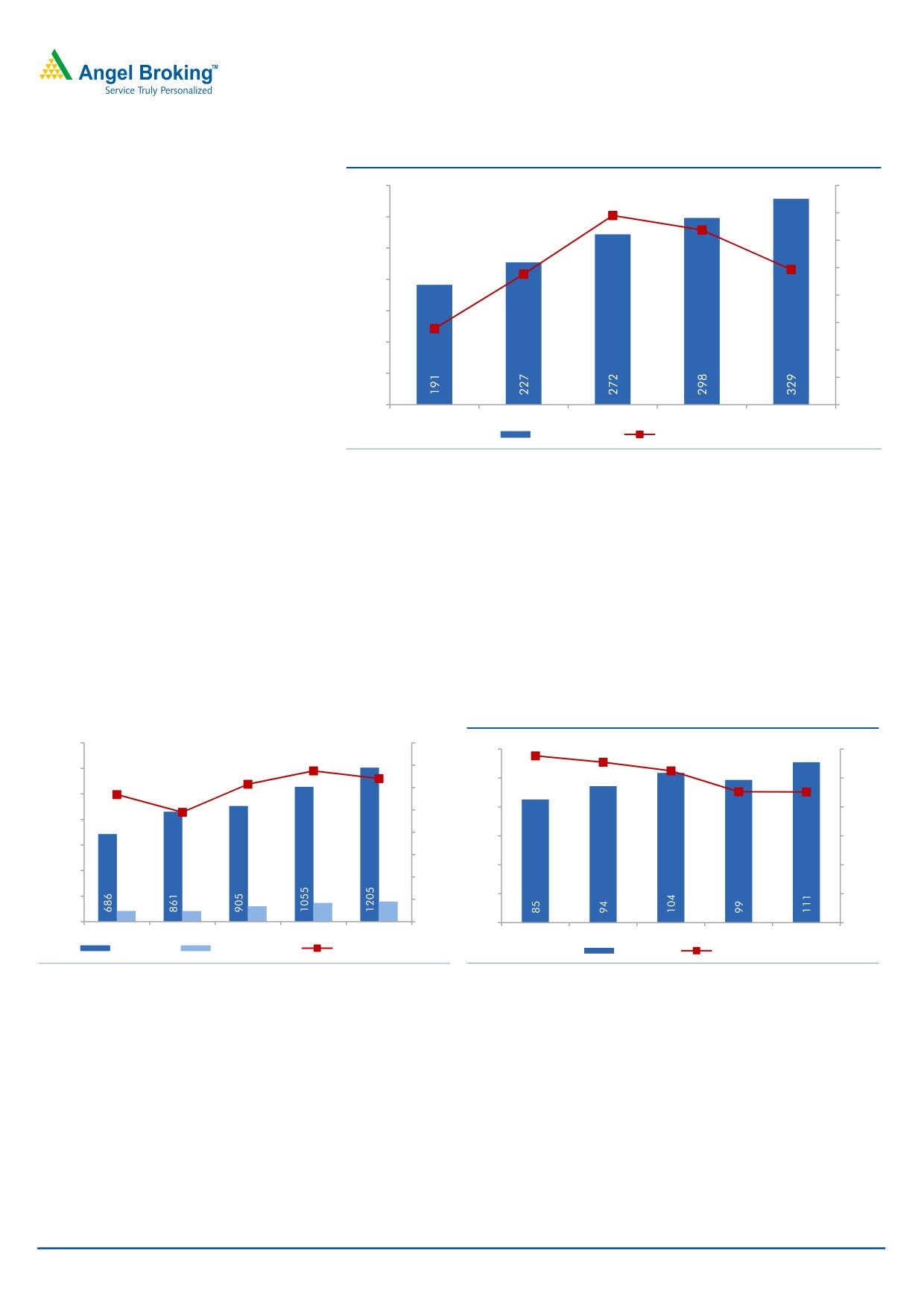

Exhibit 7: Revenues to clock a CAGR of 11.5% over FY2012-2014E

(` cr)

2,500

647

2,000

539

477

1,500

567

469

412

800

316

1,000

350

119

1184

1172

1240

500

715

783

0

FY10

FY11

FY12

FY13E

FY14E

Civil

Transportation

Irrigation & WS

Source: Company, Angel Research

Margins to sustain at current levels

Historically UIP has enjoyed one of the highest operating margins among its peers.

Going forward, on the back of its current order book mix we believe the company

will sustain EBITDA margins in the range of 13-14% over the next few years. This is

mainly owing to the order book mix; of the total order book, more than 70% is

accounted by the civil and water segments, which enjoy relatively better margins

compared to projects in the road segment. In our view, owing to a high proportion

of revenue coming from the high margin accretive segments, the company would

be able to deliver robust profits.

January 10, 2013

5

Unity Infraprojects | Initiating Coverage

Exhibit 8: Healthy margins to continue

350

14.0

13.4

13.8

13.7

13.8

300

13.6

250

13.4

13.4

200

13.0

13.2

150

13.0

100

12.8

50

12.6

0

12.4

FY10

FY11

FY12

FY13E

FY14E

EBITDA (` cr)

EBITDAM (%)

Source: Company, Angel Research

Earnings growth to be under pressure due to high interest cost

On the bottom-line front, we expect UIP to register earnings of `99cr and `111cr

for FY2013 and FY2014 respectively. The lower earnings are mainly due to a

higher interest expense which continues to remain a concern, with the net interest

at 5.9% of net revenues. For FY2013 and FY2014 we are factoring in an

interest cost of

`147cr and

`157cr respectively. We expect UIP’s debt to

bloat to `1,205cr in FY2014 from `905cr in FY2012 (owing to elongated

working capital cycle).

Exhibit 9: Debt level to increase substantially over FY2012-14E

Exhibit 10: High interest cost dents PAT growth

1,400

8.0

5.8

120

6.0

6.7

5.5

5.2

6.4

4.5

1,200

6.1

7.0

4.5

5.7

100

5.0

6.0

1,000

4.9

5.0

80

4.0

800

4.0

60

3.0

600

3.0

40

2.0

400

2.0

147

157

121

20

1.0

200

84

83

1.0

0

0.0

0

0.0

FY10

FY11

FY12

FY13E

FY14E

FY10

FY11

FY12

FY13E

FY14E

Debt (` cr)

Int. cost (` cr)

Int. as % sales

PAT (` cr)

PATM (%)

Source: Company, Angel Research

Source: Company, Angel Research

January 10, 2013

6

Unity Infraprojects | Initiating Coverage

Equity requirement to the tune of ~`175cr

The company has a total equity requirement to the tune of `225cr for its three BOT

projects. It has already invested ~`50cr-60cr in under-development BOT portfolio

till 1HFY2013 and would require an incremental equity investment of ~`175cr

over the next two to three years. According to the management, the company is

looking to dilute 14% stake in its wholly owned subsidiary Unity Infrastructure

Assets Ltd and is in an advanced stage of negotiation with some PE investors for

raising

`175cr. We believe this would help the company fund its equity

requirements.

Peer comparison

UIP is a dominant player with more than a decade of experience in civil

construction and infrastructure development space and has a unique business

model. Therefore identical comparison with other players in this segment is not

possible. However, we have considered other companies that are present in the

construction business and bid for similar projects. From the table below, it can be

referred that UIP has decent return ratios and enjoys higher margins as compared

to other companies.

Exhibit 11: Relative valuation table

EBITDA

PAT

Mcap

P/E

P/BV

P/Sales

EV/EBITDA

EV/Sales

RoE (%)

Margin (%)

Margin (%)

(` cr) FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E FY14E

Simplex Infra

1,121

9.8

7.2

0.9

0.8

0.2

0.1

7.7

5.0

0.7

0.5

9.1

9.1

1.7

1.9

11.2

Unity Infra

342

3.5

3.1

0.4

0.4

0.2

0.1

5.5

3.6

0.7

0.5

13.7

13.4

4.5

4.5

12.5

J. Kumar Infra

640

8.0

6.5

1.2

1.0

0.6

0.5

4.1

3.4

0.6

0.5

15.4

15.4

6.8

6.9

17.1

JMC Projects

301

12.4

9.9

0.7

0.7

0.1

0.1

5.0

4.0

0.3

0.2

5.2

6.1

1.0

1.2

6.7

Pratibha Ind

556

5.8

4.3

0.9

0.7

0.3

0.2

4.9

4.2

0.7

0.6

13.7

13.7

4.6

4.8

18.4

Source: Company, Angel Research Note: *Figures are Bloomberg estimates; CMP is as on 10th January 2013.

January 10, 2013

7

Unity Infraprojects | Initiating Coverage

Valuation and Outlook

On the back of a healthy order book and growth potential, we expect the company

to clock a revenue CAGR of 11.5% over FY2012-2014. Going forward, we believe

the company would sustain EBITDA margins in the range of 13-14% over the next

few years, based on the current order book mix. Due to this, we expect the diluted

earnings per share to improve from `14 in FY2012 to `15 in FY2014, indicating a

CAGR of 3.5%.

The stock is currently trading at a P/E of 3.5x and 3.1x our FY2013 and FY2014

diluted earnings estimates. We have used SOTP method to value the stock. We

value the construction business at a P/E of 3.5x FY2014 earnings estimate (~30%

discount to larger companies under coverage) and UIP’s BOT projects on a DCF

basis at a CoE of 16%. However, we have not assigned any value to the real estate

investments owing to significant delay in start of construction activity and in the

absence of clarity on the exact development schedule for all (four) of its projects.

We initiate coverage on the stock with a Buy rating and target price of `59,

indicating an upside of 27%.

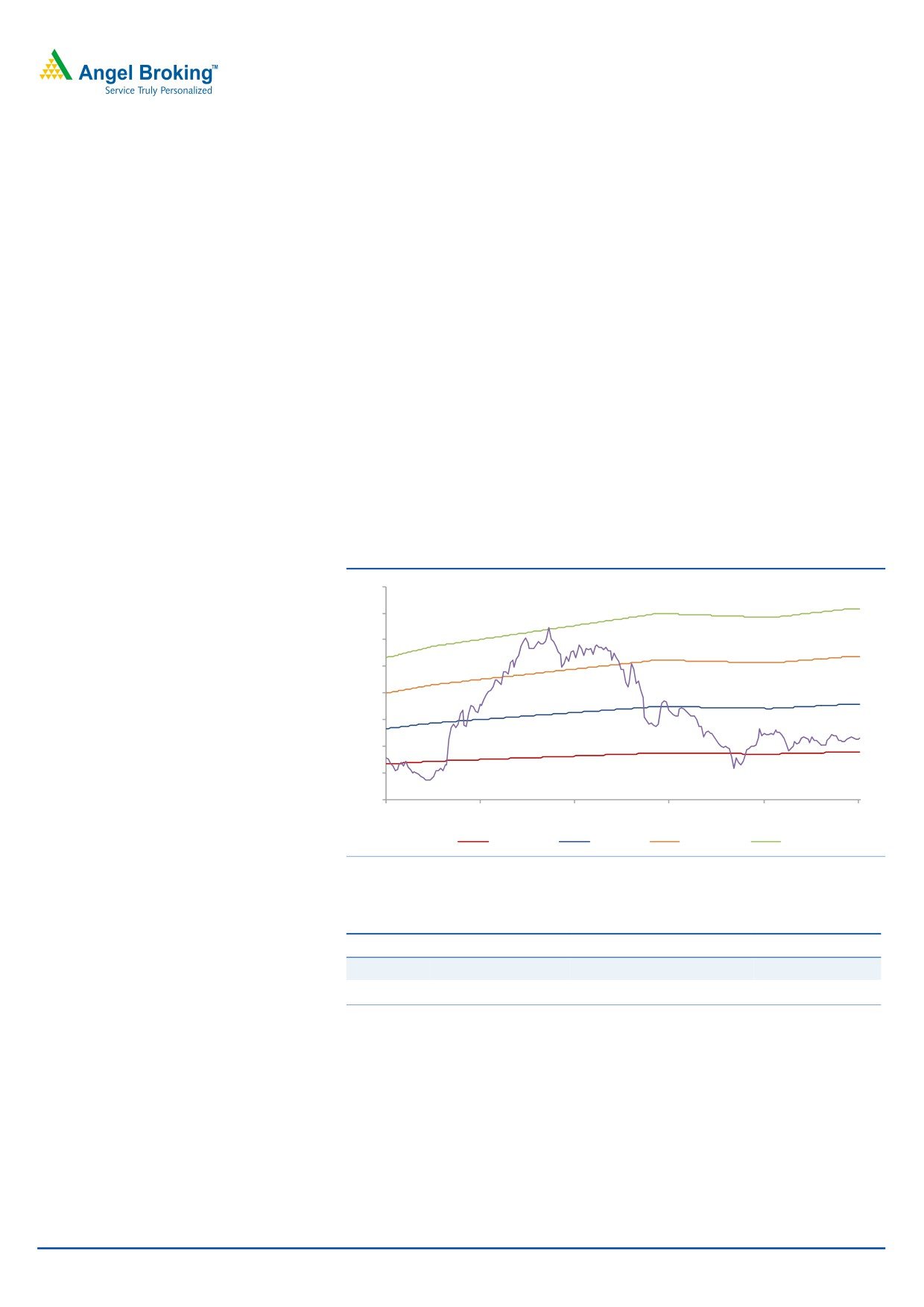

Exhibit 12: P/E Band

160

140

120

100

80

60

40

20

0

Nov-08

Sep-09

Jul-10

May-11

Mar-12

Jan-13

2.5x

5x

7.5x

10x

Source: Company, Angel Research

Exhibit 13: Angel EPS forecast vs consensus

Angel forecast

Bloomberg consensus

Variation (%)

FY2013E

13.3

12.7

4.8

FY2014E

15.0

15.0

(0.1)

Source: Company, Angel Research

January 10, 2013

8

Unity Infraprojects | Initiating Coverage

Concerns

Execution risk

Any delay in under construction BOT

Execution risk could be for various reasons such as delay in land acquisition by

projects would adversely impact our

NHAI/state and thus the delay in providing Right of Way, and delay in clearances

NPV valuations.

from authorities such as environment, forest and railways etc in the road sector.

Such delay has a greater impact in a BOT project as compared to an EPC project.

Hence, any delay in under construction BOT projects would adversely impact our

NPV valuations.

Slowdown in award of new projects

Order inflow acts as a catalyst for EPC

The company’s order book mainly comprises of orders from the Western (40.9%)

arm; any slowdown in awarding of

and Northern (45.1%) regions. Therefore, any slowdown in award of projects from

projects would negatively impact the

the government or/and private client would negatively impact the company’s

company’s performance.

performance.

Interest rate risks

Any hike in the interest rates could

The inherent nature of the EPC business requires high working capital cycle. As on

increase its interest costs.

2QFY2013, the company has a high interest expense at 9.8% of revenues. Going

forward, any hike in the interest rates could increase the company’s interest costs

and affect its earnings growth.

Commodity risks

All EPC players are facing pressures from the recent price inflation in commodities

such as aggregates, cement, sand, bitumen and steel, which directly affect

margins. However, the company has mitigated risk as most of the company’s

order book has a price escalation clause.

High working capital cycle

Most infrastructure companies are witnessing high working capital cycles, high

interest rates and stretched balance sheets. However, as compared to its peers, UIP

has an even higher net working capital cycle (220 days in FY2012). This is mainly

due to high government orders which make for 87.7% of the total order book.

Exhibit 14: High working capital cycle

Net working Capital cycle (days)

300

268

250

220

190

200

150

125

91

100

63

50

50

0

NCC Sadbhav

L&T

Unity Infra Pratibha

J kumar

IVRCL

Ind.

FY10

FY11

FY12

Source: Company, Angel Research

January 10, 2013

9

Unity Infraprojects | Initiating Coverage

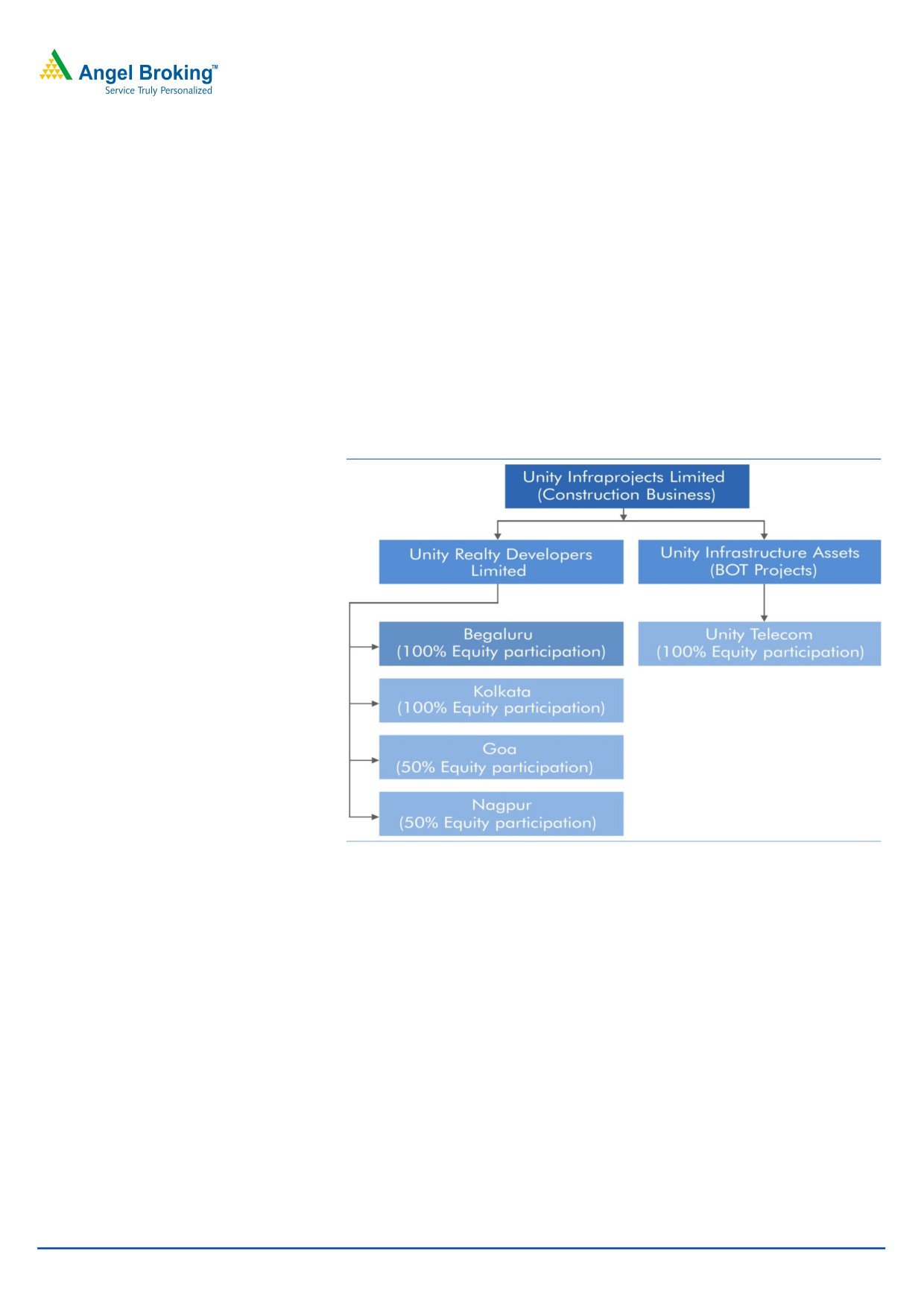

Company background

Unity Infraprojects Ltd (UIP) is a mid-size engineering and construction company

with focus on civil construction and infrastructure development in India. The

company is the flagship unit of the Mumbai based KK Group of Companies. The

company is focused in areas, such as civil construction and infrastructure

development projects. The company has three subsidiaries, namely Unity Realty

and Developers Ltd, Unity Infrastructure Assets Ltd and Unity Telecom Ltd. UIP was

incorporated as Unity Builders Ltd on April 9, 1997. The company changed its

name to Unity Infraprojects Ltd on January 14, 2000. The company has gained

credibility owing to its quick turnaround time, in-time and within-cost deliveries,

organizational strength and financial stability and above all, international

standards.

Exhibit 15: Company Structure

Source: Company, Angel Research

January 10, 2013

10

Unity Infraprojects | Initiating Coverage

Annexure - I

Exhibit 16: Key projects under execution as on November 2012

Particulars

(` cr)

Civil Construction segment

Redevelopment of Lady Hardinge Hospital, New Delhi

414

Director General of the Married Accommodation Project, Delhi

299

Redevelopment of R.N. Cooper Hospital at Vile Parle, Mumbai

265

Shantigram Township, Ahmedabad

184

Construction of Assam Hills Medical College & Research Institute, Assam

157

Prison Complex i/c housing at Mandoli, New Delhi

154

Township Project for Rail Coach Factory, Raebareli, Uttar Pradesh

145

Construction of Chemical Laboratory Building, Delhi University, Delhi

122

Construction of NIFT Campus at Kharghar, Navi Mumbai

103

Construction of Indian High Commission Complex, Dhaka, Bangladesh

100

Township for DAE - Anushakti Nagar, Mumbai

97

Transportation segment

Construction of 4 -laning of Punjab/ Haryana Border - Jind Section of NH- 71 (DBFOT)

510

Widening & up gradation Mardha Village to Antela Village in Rajasthan

340

Construction of Suratgarh- Sriganganagar Section of NH-15 (DBFOT)

310

Chomu Mahla Road Project (DBFOT)

198

Irrigation & Water Supply segment

Supply, Installation & Maintenance of AMR Water meters - Mumbai

633

Construction of long tunnel from Kapurbawadi to Bhandup Complex, Mumbai

573

Replacement of existing riveted Tansa Mains from Tansa to Tarali - Thane District

325

Diversion of Water Mains by Micro-tunneling in Eastern & Western Suburbs, Mumbai

88

Source: Company, Angel Research

January 10, 2013

11

Unity Infraprojects | Initiating Coverage

Profit and Loss (Standalone)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

Net Sales

1,131

1,477

1,702

1,973

2,180

2,455

Other operating income

-

-

-

-

-

-

Total operating income

1,131

1,477

1,702

1,973

2,180

2,455

% chg

33.1

30.6

15.2

15.9

10.5

12.6

Total Expenditure

988

1,285

1,474

1,701

1,882

2,126

R.M. consumed

473

581

825

964

1,003

1,127

Construction expenses

445

613

505

575

693

781

Employee expenses

43

53

59

61

77

96

SG&A

26

38

85

101

109

123

EBITDA

143

191

227

272

298

329

% chg

34.4

34.0

18.8

19.7

9.7

10.2

(% of Net Sales)

12.6

13.0

13.4

13.8

13.7

13.4

Depreciation & Amortisation

16

17

18

20

23

28

EBIT

127

174

209

252

275

301

% chg

28.3

37.0

20.3

20.4

9.1

9.4

(% of Net Sales)

11.2

11.8

12.3

12.8

12.6

12.2

Interest & other Charges

58

84

83

121

147

157

Other Income

35

40

17

20

20

22

(% of PBT)

34.0

30.8

12.1

13.3

13.3

13.4

Share in profit of Asso.

-

-

-

-

-

-

Recurring PBT

104

130

143

150

147

165

% chg

14.1

25.0

10.3

5.0

(2.2)

12.4

Extraordinary Expense/(Inc.)

-

-

-

-

-

-

PBT (reported)

104

130

143

150

147

165

Tax

34.3

44.7

48.9

46.9

48.6

54.6

(% of PBT)

33.0

34.4

34.1

31.2

33.0

33.0

PAT (reported)

70

85

94

104

99

111

Add: Share of earnings of asso

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

70

85

94

104

99

111

ADJ. PAT

70

85

94

104

99

111

% chg

16.0

22.2

10.8

9.7

(4.7)

12.4

(% of Net Sales)

6.2

5.8

5.5

5.2

4.5

4.5

Basic EPS (`)

9.4

11.5

12.7

14.0

13.3

15.0

Fully Diluted EPS (`)

9.4

11.5

12.7

14.0

13.3

15.0

% chg

16.0

22.2

10.8

9.7

(4.7)

12.4

January 10, 2013

12

Unity Infraprojects | Initiating Coverage

Balance Sheet (Standalone)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

SOURCES OF FUNDS

Equity Share Capital

13

15

15

15

15

15

Share App Money - warrants

-

-

-

-

-

-

Reserves & Surplus

405

550

636

731

820

921

Shareholders Funds

418

565

651

746

835

936

Minority Interest

-

-

-

-

-

-

Total Loans

472

686

861

905

1,055

1,205

Deferred Tax Liability

2

1

1

(2)

(2)

(2)

Total Liabilities

892

1,253

1,513

1,650

1,889

2,139

APPLICATION OF FUNDS

Gross Block

144

154

186

222

282

342

Less: Acc. Depreciation

36

53

70

90

114

142

Net Block

107

100

116

132

168

200

Capital Work-in-Progress

-

1

11

-

-

-

Goodwill

-

-

-

-

-

-

Investments

34

34

68

54

104

179

Current Assets

1,247

1,465

1,762

1,956

2,171

2,379

Inventories

110

133

78

200

232

256

Sundry Debtors

410

562

807

890

944

1,009

Cash

111

161

189

218

278

354

Loans & Advances

615

609

680

642

710

754

Other

-

-

7

7

7

7

Current liabilities

496

347

444

493

555

620

Net Current Assets

751

1,118

1,318

1,463

1,616

1,760

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

892

1,253

1,513

1,650

1,889

2,139

January 10, 2013

13

Unity Infraprojects | Initiating Coverage

Cash Flow (Standalone)

Y/E March (` cr)

FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

Profit before tax

104

130

143

150

147

165

Depreciation

16

17

17

20

23

28

Change in Working Capital

(210)

(317)

(172)

(117)

(92)

(68)

Less: Other income

(35)

(40)

(17)

(20)

(20)

(22)

Direct taxes paid

(34)

(45)

(49)

(47)

(49)

(55)

Cash Flow from Operations

(160)

(255)

(78)

(13)

10

49

(Inc.)/ Dec. in Fixed Assets

(66)

(11)

(43)

(25)

(60)

(60)

(Inc.)/ Dec. in Investments

10

(0)

(34)

14

(50)

(75)

Other income

35

40

17

20

20

22

Cash Flow from Investing

(20)

29

(59)

9

(90)

(113)

Issue of Equity

-

1

-

-

-

-

Inc./(Dec.) in loans

193

214

174

45

150

150

Dividend Paid (Incl. Tax)

(7)

(9)

(9)

(9)

(9)

(10)

Others

1

69

(0)

(3)

0

(0)

Cash Flow from Financing

186

276

165

33

141

140

Inc./(Dec.) in Cash

6

50

28

29

61

75

Opening Cash balances

105

111

161

189

218

278

Closing Cash balances

111

161

189

218

278

354

January 10, 2013

14

Unity Infraprojects | Initiating Coverage

Key Ratios

Y/E March

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

Valuation Ratio (x)

P/E (on FDEPS)

4.9

4.0

3.6

3.3

3.5

3.1

P/CEPS

4.0

3.3

3.0

2.8

2.8

2.5

P/BV

0.8

0.6

0.5

0.5

0.4

0.4

Dividend yield (%)

1.8

2.2

2.2

2.2

2.4

2.6

EV/Sales

0.6

0.6

0.6

0.5

0.5

0.5

EV/EBITDA

4.9

4.5

4.5

3.8

3.8

3.6

EV / Total Assets

0.8

0.7

0.7

0.6

0.6

0.6

Per Share Data (`)

EPS (Basic)

9.4

11.5

12.7

14.0

13.3

15.0

EPS (fully diluted)

9.4

11.5

12.7

14.0

13.3

15.0

Cash EPS

11.5

13.8

15.2

16.7

16.5

18.8

DPS

0.8

1.0

1.0

1.0

1.1

1.2

Book Value

56.5

76.3

87.9

100.7

112.7

126.3

Dupont Analysis

EBIT margin

11.2

11.8

12.3

12.8

12.6

12.2

Tax retention ratio

67.0

65.6

65.9

68.8

67.0

67.0

Asset turnover (x)

1.7

1.6

1.4

1.4

1.4

1.4

ROIC (Post-tax)

13.0

12.2

11.4

12.6

12.1

11.9

Cost of Debt (Post Tax)

10.4

9.5

7.1

9.5

10.1

9.3

Leverage (x)

0.7

0.9

1.0

1.0

0.9

0.9

Operating ROE

14.7

14.6

15.6

15.6

14.0

14.2

Returns (%)

ROCE (Pre-tax)

16.6

16.2

15.1

15.9

15.5

14.9

Angel ROIC (Pre-tax)

19.3

18.6

17.4

18.4

18.1

17.7

ROE

18.0

17.3

15.5

14.8

12.5

12.5

Turnover ratios (x)

Asset Turnover (Gross Block)

10.2

9.9

10.0

9.7

8.6

7.9

Inventory / Sales (days)

24

30

23

26

36

36

Receivables (days)

123

120

147

157

153

145

Payables (days)

156

120

98

100

102

101

Wcap cycle (ex-cash) (days)

173

197

224

220

216

204

Solvency ratios (x)

Net debt to equity

0.9

0.9

1.0

0.9

0.9

0.9

Net debt to EBITDA

2.5

2.7

3.0

2.5

2.6

2.6

Interest Coverage

2.2

2.1

2.5

2.1

1.9

1.9

January 10, 2013

15

Unity Infraprojects | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and

its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Unity Infraprojects

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

January 10, 2013

16

Unity Infraprojects | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Viral Shah

Sr. Analyst (Infrastructure)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, FMCG)

Yaresh Kothari

Analyst (Automobile)

Ankita Somani

Analyst (IT, Telecom)

Sourabh Taparia

Analyst (Banking)

Bhupali Gursale

Economist

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Tejas Vahalia

Research Editor

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

January 10, 2013

17