TOP PICKS REPORT

D E C E M B E R

2015

Research Team

Angel Top Picks - December 2015

The domestic benchmark equity market indices - Sensex and Nifty - ended the month

of November 2015 in the negative territory, correcting by 1.9% and 1.6%, respectively.

A higher possibility of the Federal Reserve increasing interest rates in December 2015,

as perceived by the market, dampened market sentiments.

In November 2015, among sectoral indices, the top two gainers were the BSE

Consumer Durables Index and the BSE Auto Index, which rose by 5.0% and 4.4%,

respectively. Among the top losers were the BSE Healthcare Index and the BSE Realty

Index, which fell by 9.8% and 2.0%, respectively. Foreign Institutional Investors (FIIs)

were net seller in Indian equities to the tune of ~`7,074cr and Domestic Institutional

Investors (DIIs) were net buyers in Indian equities to the tune of ~`6,548cr, for the

month of November 2015.

During the month, the BSE Midcap index has outperformed the broader market indices.

We believe mid-cap companies having strong fundamentals have the potential to

outperform the broader market, going forward as well. We are replacing Inox Wind

with Blue Star in our top picks recommendation.

We expect some volatility in the market, ahead of the upcoming review of interest

rates in the US. However, any positive outcome in terms of passing of the Goods and

Services Tax (GST) bill in the winter session of the parliament would be a positive for

the market. Further, declining interest rates, lower current account deficit and

expectation of a stable currency would create positive sentiment for market.

Large Cap

Company

Sector

CMP Target Upside

EPS

PER

EV/Sales

ROE

(`)

(`)

(%)

FY16

FY17

FY16

FY17

FY16

FY17

FY16

FY17

Amara Raja

Auto & Auto Ancill.

846

1,040

23.0

28.8

37.1

29.4

22.8

2.9

2.4

23.4

24.1

Ashok Leyland

Auto & Auto Ancill.

90

111

23.2

3.4

4.7

26.5

19.2

1.4

1.1

17.7

22.2

Axis Bank

Financials

462

630

36.3

35.7

43.5

12.9

10.6

0.0

0.0

17.9

18.9

HCL Tech

IT

841

1,132

34.7

55.8

62.9

15.1

13.4

2.4

1.9

23.0

19.8

HDFC Bank

Financials

1,062

1,262

18.8

49.3

61.0

21.5

17.4

0.0

0.0

18.5

19.7

ICICI Bank

Financials

263

354

34.5

21.0

24.4

12.5

10.8

0.0

0.0

14.4

14.7

Infosys

IT

1,046

1,306

24.9

58.3

63.7

17.9

16.4

3.3

2.8

20.9

19.7

Larsen & Toubro

Construction

1,341

1,646

22.8

61.5

65.6

21.8

20.4

2.1

1.8

13.4

14.0

LIC Housing Finance Financials

462

571

23.5

33.0

40.2

14.0

11.5

0.0

0.0

19.7

20.5

Source: Angel Broking

Mid Cap

Company

Sector

CMP Target Upside

EPS

PER

EV/Sales

ROE

(`)

(`)

(%)

FY16

FY17

FY16

FY17

FY16

FY17

FY16

FY17

Blue Star

Capital Goods

357

429

20.3

13.7

17.2

26.0

20.8

1.0

0.8

26.1

25.4

Ipca labs

Pharmaceuticals

757

900

18.9

13.4

28.0

56.5

27.0

3.1

2.7

7.4

14.0

Jagran Prakashan Media

146

169

15.6

8.9

9.9

16.4

14.8

2.1

1.9

20.9

20.4

MT Educare

Others

140

169

21.0

7.7

9.4

18.2

15.0

1.9

1.4

20.2

21.1

Radico Khaitan

Others

109

156

43.6

5.7

7.1

19.1

15.3

1.4

1.3

8.3

9.5

Siyaram Silk Mills

Others

1,165

1,354

16.3

89.9

104.1

13.0

11.2

0.8

0.7

17.9

17.8

Surya Roshni

Others

135

183

36.0

14.7

18.3

9.2

7.3

0.5

0.4

9.7

11.0

Source: Angel Broking

December 8, 2015

Please refer to important disclosures at the end of this report.

1

Top Picks Report

December 2015

Top Picks - Large Cap

December 8, 2015

Please refer to important disclosures at the end of this report.

2

Top Picks Report

December 2015

Stock Info

Amara Raja Batteries

CMP (`)

846

Amara Raja Batteries Ltd (ARBL) is the second largest lead acid storage battery

TP (`)

1,040

manufacturer. ARBL has been outpacing market leader Exide (ARBL grew 24%

Upside

23%

CAGR over FY2010-15 as compared to Exide's growth of 13%), leading to market

share improving from 25% in FY10 to about current 35% . ARBL's outperformance

Sector

Auto ancillary

is mainly due to market share gains in automotive segment driven by introduction

Market Cap (` cr)

10,469

of technologically superior products developed with technological support from

Beta

0.9

global battery leader Johnson Controls Inc (which also holds 26% stake in ARBL).

52 Week High / Low

1,132/709

With the automotive OEM policy of having multiple vendors and a strong brand

recall in the replacement segment, ARBL is well poised to further gain market share.

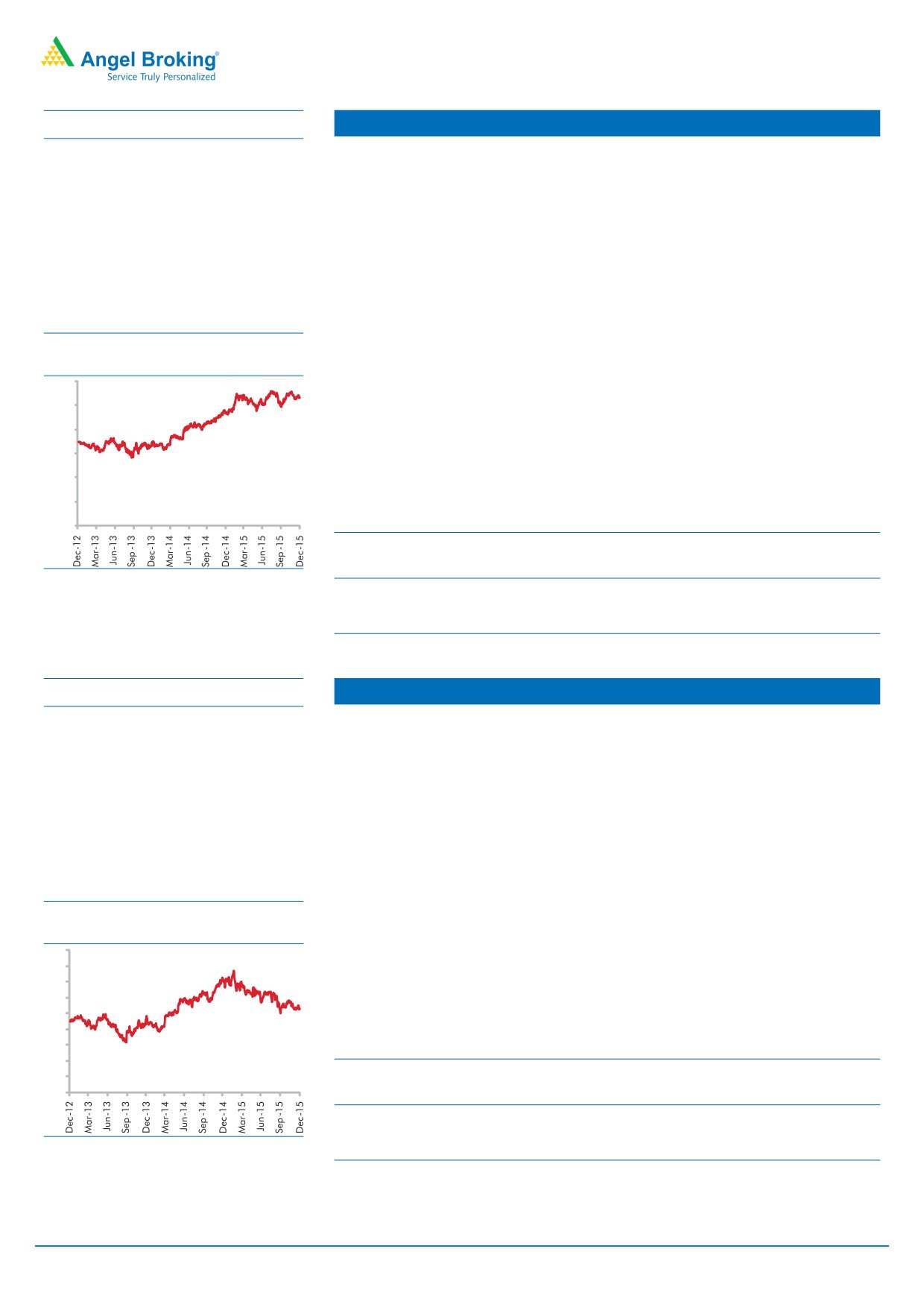

3 year-Chart

Given the economic recovery and market share gains, ARBL revenues are likely to

grow strongly 18% over the next two years as against industry growth of 10-12%.

1,000

ARBL is a well diversified auto ancillary player having presence across the automotive

800

and the industrial segment and a broad OEM as well as replacement customer

600

base. We believe ARBL is a high quality stock to play the auto sector revival. We

400

assign a P/E multiple of 28x to FY2017E earnings and arrive at a target price of

200

`1,040/share.

0

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2016E

4,892

17.4

492

28.8

23.4

29.4

6.9

16.8

2.9

FY2017E

5,871

17.6

634

37.1

24.1

22.8

5.5

13.6

2.4

Stock Info

Ashok Leyland

CMP (`)

90

Ashok Leyland Ltd (ALL) is the second largest medium and heavy commercial vehicle

TP (`)

111

(MHCV) manufacturer in the country, commanding a market share of about 28%.

The MHCV segment is in an upcycle, given the uptick in economic growth which

Upside

23%

should result in better freight movement. Further, improvement in fleet operators

Sector

Automobile

profitability on account of firm freight rates and decline in diesel prices has led to

Market Cap (` cr)

25,641

huge pent up demand getting converted into sales. We expect the MHCV segment

Beta

1.3

to post a 15% CAGR over FY2015-2018, thereby benefiting ALL.

In order to reduce cyclicality, ALL is also focusing on increasing light commercial

52 Week High / Low

100/43

vehicles (LCVs) and exports. ALL-Nissan JV developed LCV - "Dost" has been received

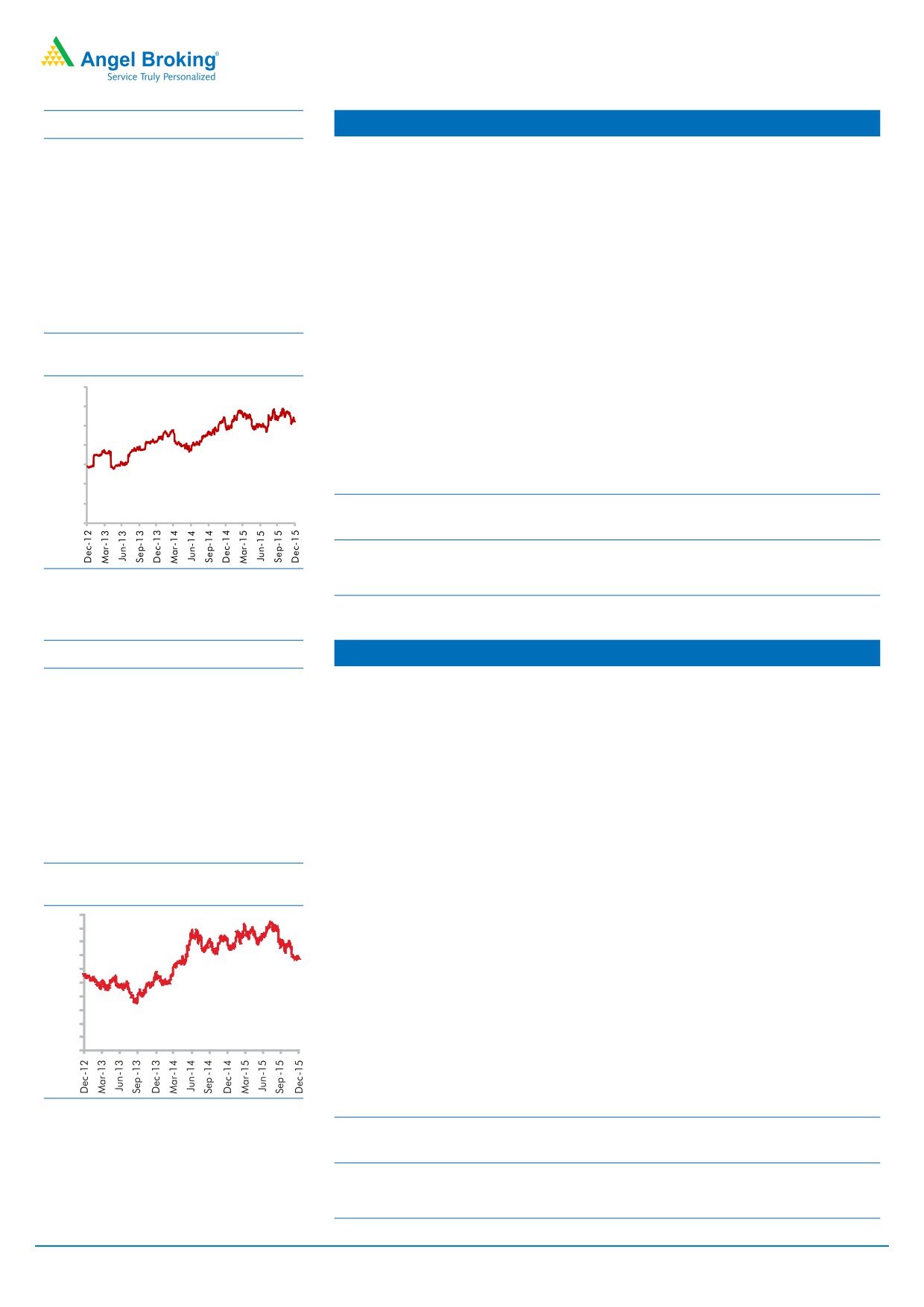

3 year-Chart

well and has captured a market share of 6% within three years of its launch. Also,

ALL is targeting new markets in Africa and Middle East to increase export contribution

100

from the current 15% to 33% over the next five years.

80

ALL's margins are likely to improve 400 bp yoy over FY2015-17 period on account

60

of double-digit growth in MHCVs and reduced discounting.

40

We are positive on ALL, given the cyclical upturn in MHCVs and on account of

20

additional growth avenues. We assign EV/EBIDTA multiple of 13x to FY2017E

0

EBIDTA to arrive at a target price of `111/share.

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

17,995

11.4

979

3.4

17.7

26.5

4.6

13.3

1.4

FY2017E

21,544

11.6

1,331

4.7

22.2

19.2

4.3

10.7

1.1

December 8, 2015

Please refer to important disclosures at the end of this report.

3

Top Picks Report

December 2015

Stock Info

Axis Bank

CMP (`)

462

Consistent earnings growth along with expansion: The bank has been reporting

TP (`)

630

robust NII growth, backed by strong retail loan growth, coupled with healthy growth

in CASA deposits. Over the past five years, Axis Bank has expanded its branch

Upside

36%

network at around 21.2% CAGR (~2,743 branches as of 2QFY2016). In its deposit

Sector

Banking

mix as well, CASA and Retail Term Deposits now comprise a healthy 80%. Retail

Market Cap (` cr)

109,853

advances to total advances stands at ~40% as of 2015 against ~20% in FY2011.

Beta

1.4

Healthy Asset quality: Sectors like engineering, iron & steel, infrastructure (including

power) and textile have contributed a large part of the stressed assets for the banking

52 Week High / Low

655/446

industry. While Axis Bank's exposure to these sectors is at around 17%, the bank has

been able to manage its asset quality relatively better than its public sector peers and

3 year-Chart

has been able to keep its Gross as well as Net NPAs within control. The bank has

700

guided at addition of stressed assets being lower in FY2016, than in FY2015.

600

500

Outlook: Healthy pace of branch expansion and a strong distribution network

400

continue to be the driving force for the bank's retail business. While the near term

300

asset quality environment remains challenging, the bank in our view will be able to

200

absorb the credit costs given the adequate profitability. Further, given its strong

100

CASA and retail network, the bank is positioned strongly to benefit once the macros

0

revive. The stock currently trades at 1.9x P/ABV FY2017E. We recommend a Buy

rating on the stock with a target price of `630.

Source: Company, Angel Research

Y/E

Op Inc. NIM

PAT

EPS

ABV

RoA RoE

P/E P/ABV

March

( ` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2016E

26,473

3.5

8,472

35.7

213.1

1.7

17.9

12.9

2.2

FY2017E

31,527

3.6

10,309

43.5

246.9

1.8

18.9

10.6

1.9

Stock Info

HCL Technologies

CMP (`)

841

Healthy pipeline: In terms of order flow in FY2015, HCL Tech has signed

TP (`)

1,132

58 transformational engagements with US$5bn+ of TCV. During 1QFY2016, the

company has signed in excess of US$1bn worth of orders and has indicated that its

Upside

35%

order book is 10% higher than its highest order book. These bookings saw significant

Sector

IT

momentum driven by Next-gen ITO, Engineering Services Outsourcing, Digital and

Market Cap (` cr)

118,437

Modern Apps deals, each of which had a component of new technology constructs

like Digitalization, Cloud etc.

Beta

0.6

Robust outlook: We expect HCL Tech to post a USD and INR revenue CAGR of

52 Week High / Low

1,058/725

13.0% and 13.2%, respectively, over FY2015-17E. On the operating front, HCL

Tech's EBIT margin has been around 22.3% in FY2015, a dip of 185bp over the

3 year-Chart

previous financial year. Going ahead, the Management expects EBIT margins to

1,400

1,200

sustain at 21-22%, driven by moving work offshore and efficiency-led gains. We

1,000

expect the EBIT and PAT to post a 12.9% and 10.6% CAGR, respectively, over

800

FY2015-17E.

600

Outlook and Valuations: At current valuations, the stock is attractively valued and

400

hence we maintain our buy with a price target of `1,132.

200

0

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

42,038

23.2

7,862

55.8

23.0

15.1

3.5

10.4

2.4

Source: Company, Angel Research

FY2017E

47,503

23.5

8,862

62.9

19.8

13.4

2.6

8.2

1.9

December 8, 2015

Please refer to important disclosures at the end of this report.

4

Top Picks Report

December 2015

Stock Info

HDFC Bank

CMP (`)

1,062

Strong capital adequacy, expanding network, to sustain traction in market share:

TP (`)

1,262

HDFC Bank's capital adequacy ratio as of 2QFY2016 stood strong at 15.5%, with

Tier1 ratio at 12.8%, which positions the bank to continue on its growth path and

Upside

19%

increase its market share. During the past one year, the bank has added 627

Sector

Banking

branches which should aid it in maintaining above system-average retail loan

Market Cap (` cr)

268,055

growth on the asset side and CASA accretion on the liability side.

Beta

0.9

Asset quality rock-solid: The bank has been able to maintain its asset quality

consistently. Asset quality continued to remain healthy with the Gross NPA rate at

52 Week High / Low

1,128/916

0.91% in a challenging macro environment while the Net NPA rate stands at 0.25%.

3 year-Chart

Outlook: The bank's credit and deposit growth continues to beat the industry growth

1,200

rate, driven by dominant market position in most retail business segments, healthy

1,000

CASA and continued network expansion. This provides strong visibility for a robust

800

20% earnings trajectory, coupled with high quality of earnings on account of high

quality retail business and strategic focus on highly rated corporates. This in our

600

view justifies a premium valuation multiple. At the current market price, the bank is

400

trading at 3.2x FY2017E ABV. We recommend a Buy rating on the stock, with a

200

target price of `1,262.

0

Y/E

Op Inc. NIM

PAT

EPS

ABV

RoA RoE

P/E P/ABV

March

( ` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

Source: Company, Angel Research

FY2016E

38,309

4.3

12,363

49.3

285.4

1.9

18.5

21.5

3.7

FY2017E

47,302

4.3

15,302

61.0

332.2

1.9

19.7

17.4

3.2

Stock Info

ICICI Bank

CMP (`)

263

Strong CASA provides comfort: ICICI Bank has strategically transformed itself over

TP (`)

354

the past few years, which has resulted in a significantly better balance sheet and

earnings quality. The CASA ratio, which was at 29% at the end of FY2009, has

Upside

35%

improved to around 45.5% as of FY2015. Apart from the paradigm shift in the

Sector

Banking

deposit mix reflected in its healthy CASA ratio, the bank has gradually reduced its

Market Cap (` cr)

152,967

international business, which has led to sustainable improvement in its NIM.

Beta

1.5

Well positioned for cyclical revival: The bank's substantial branch expansion from

1,438 branches at the end of FY2009 to nearly 4,050 branches by FY2015, and

52 Week High / Low

393/248

strong capital adequacy (Tier-I at 12.6%) has positioned it to grow its loan book at

a faster clip as and when the business environment turns conducive.

3 year-Chart

450

Outlook: At the current market price, the bank's core banking business (after

400

adjusting `67/share towards value of subsidiaries) is trading at 1.4x FY2017E ABV.

350

300

The valuation discount in our view vis-à-vis other private banks adequately factors

250

in the relatively higher stressed assets that the bank is facing in the near term. We

200

recommend a Buy rating on the stock, with a target price of `354.

150

100

Y/E

Op Inc. NIM

PAT

EPS

ABV

RoA RoE

P/E P/ABV*

50

0

March

( ` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2016E

35,168

3.4

12,479

21.4

124.9

1.6

14.7

12.5

2.1

Source: Company, Angel Research

FY2017E

40,517

3.4

14,680

25.2

149.8

1.6

15.2

10.8

1.8

Note: * without adjustment for subsidiaries

December 8, 2015

Please refer to important disclosures at the end of this report.

5

Top Picks Report

December 2015

Stock Info

Infosys

CMP (`)

1,046

Guidance - to achieve a 10-12% CC growth in FY2016: During 2QFY2016 Infosys

TP (`)

1,306

has reinforced its USD revenue growth guidance of 10-12% on CC basis in FY2016;

it has decreased its growth guidance for the current financial year from 7.2%-9.2%

Upside

25%

in US$ terms (given in 1QFY2016) to 6.4%-8.4% qoq in US$ terms. This change in

Sector

IT

the dollar revenue is mainly to factor in the anticipated currency movement. We

Market Cap (` cr)

240,226

expect the company to post ~10.7% USD revenue growth in FY2016.

Beta

0.7

Aims to be US$20bn company by FY2020: The company expects its revenue to

rise to US$20bn by FY2020, up from US$8.7bn now, as it focuses on acquisitions

52 Week High / Low

1,219/933

and win more new technology services, implying a 14% CAGR over the period.

Over the near term, we expect Infosys to post a 10.7% USD revenue growth in

3 year-Chart

FY2016. Over FY2015-17E, we expect USD and INR revenue to grow at a CAGR

1,400

of 10.7% and 11.2%, respectively. The Management expects to lead industry growth

1,200

from FY2017 onwards.

1,000

800

Outlook and Valuations: The stock trades at current valuations of 16.4x FY2017E

600

earnings. We recommend a Buy on the stock with a price target of `1,306.

400

200

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

0

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

60,250

28.0

13,391

58.3

20.9

17.9

3.8

11.8

3.3

Source: Company, Angel Research

FY2017E

66,999

28.0

14,632

63.7

19.7

16.4

3.2

10.0

2.8

Stock Info

Larsen & Toubro

CMP (`)

1,341

L&T's Management sees a bid pipeline of `3,70,000cr (`1,00,000cr of this would

TP (`)

1,646

be from the international markets), which are at different stages of awarding.

Considering the huge bid-pipeline and the company's wide presence across sub-

Upside

23%

verticals, it should attain its 5-7% revised order inflow growth guidance for FY2016E.

Sector

Infrastructure

L&T, as of 2QFY2016-end, is sitting on an order book of `2,44,097cr, which gives

Market Cap (` cr)

124,862

revenue visibility for over the next 30 months. Considering the huge order book,

Beta

1.2

we expect L&T to report a 12.5% yoy top-line growth for FY2016E.

With legacy Hydro-carbons projects in Middle-East nearing completion, we expect

52 Week High / Low

1,893/1,326

the Hydro-carbons business to show signs of turn-around by 4QFY2016.

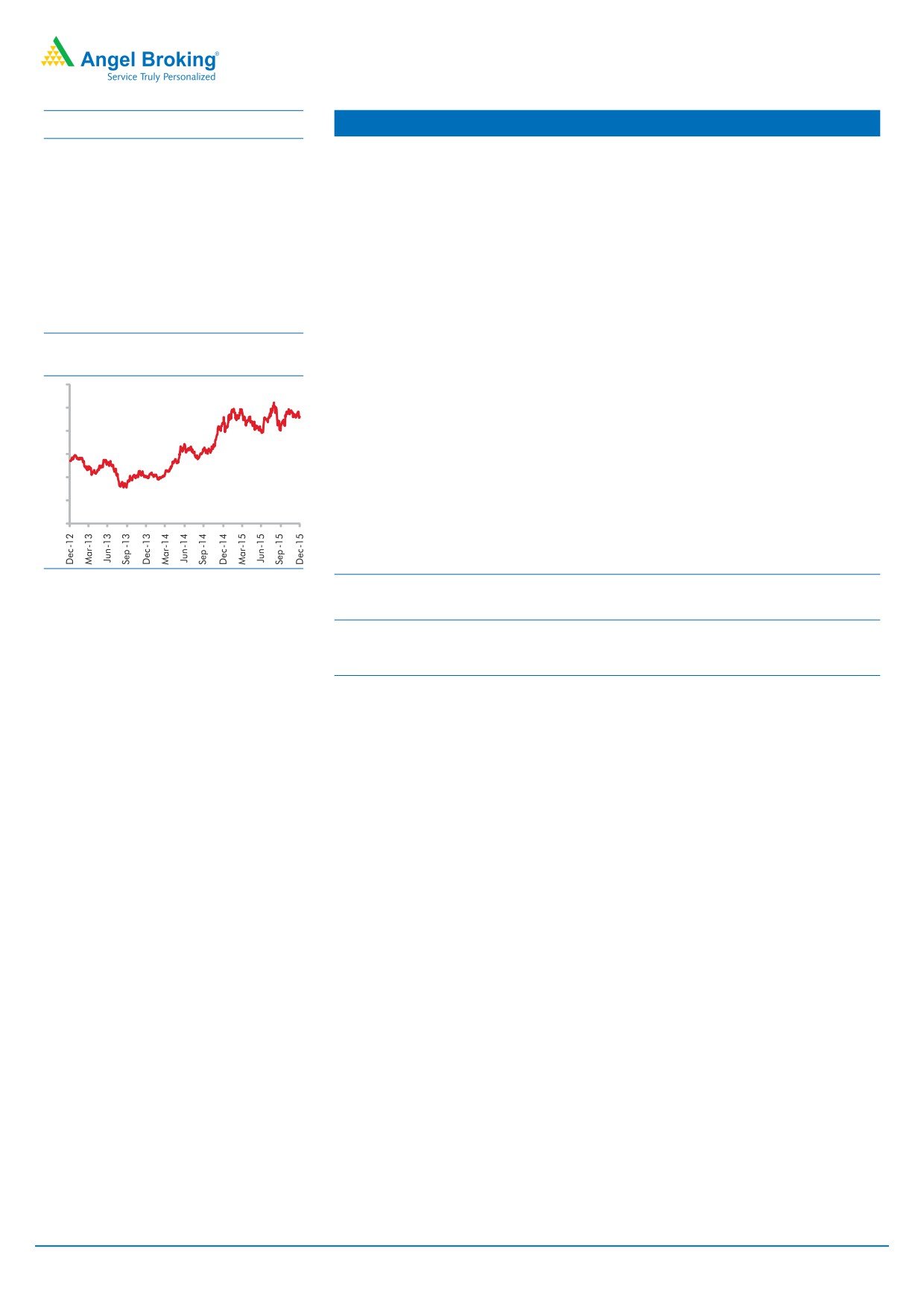

3 year-Chart

Accordingly, L&T could see consol. EBITDA margin expansion, in FY2017E.

2,000

The standalone D/E ratio (2QFY2016) stands at 0.41x. Divestment of non-strategic

1,800

1,600

holdings, further equity infusion in infra projects and listing of L&T InfoTech would

1,400

address the IDPL equity requirements to a certain extent.

1,200

1,000

Ascribing separate values to the parent business (on P/E basis) and to investments

800

600

in subsidiaries (using P/E, P/BV and M-cap basis), we arrive at a FY2017E based

400

target price of `1,646. At the current market price of `1,341, the standalone entity

200

0

is trading at an implied P/E multiple of 13.2x (FY2017), which is attractive. We are

of the view that L&T is a proxy play for investors wanting to ride on the revival of the

Indian infrastructure growth story. We recommend a Buy on the stock.

Source: Company, Angel Research

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

64,148

11.5

5,776

61.5

13.4

21.8

2.2

18.6

2.1

FY2017E

73,241

11.7

6,155

65.6

14.0

20.4

2.0

16.1

1.8

December 8, 2015

Please refer to important disclosures at the end of this report.

6

Top Picks Report

December 2015

Stock Info

LIC Housing Fin.

CMP (`)

462

Significant under penetration of mortgages in India: India is expected to witness a

TP (`)

571

robust housing finance growth going forward as the mortgage penetration in India

remains at very low levels at 8% to GDP as compared to the developed countries

Upside

24%

where it is in the range of 60-100%. Given the strong growth outlook (amongst the

Sector

HFC

fastest growing loan segments at the industry levels, while overall credit growth

Market Cap (` cr)

23,332

remains sub-10%) as well as relatively healthy asset quality, in our view, make

mortgage finance one of the most attractive BFSI segments.

Beta

1.4

NIM expansion visible: LIC Housing Finance is able to raise funds from low-cost

52 Week High / Low

526/377

NCDs due to its strong AAA credit rating and backing by strong promoters like LIC.

The company has seen a significant reduction in its cost of funds to 9.29% as

3 year-Chart

against 9.68% a year ago. In a declining interest rate environment, NBFC's like LIC

600

Housing are well-placed to increase margins in our view.

500

Outlook: Despite competition in mortgages, volume growth in the individual loans

400

segment remains fairly strong. LICHF continues to grow its retail loan book at a

300

healthy pace with healthy asset quality. We expect the company to post a healthy

200

loan book CAGR of 18.7% over 2015-17E which is likely to reflect in an earnings

100

CAGR of 20.5%, over the same period. At the current market price, it is trading at

0

2.2x FY2017E ABV. We recommend a Buy rating on the stock, with a target price

of `571.

Source: Company, Angel Research

Y/E

Op Inc. NIM

PAT

EPS

ABV

RoA RoE

P/E P/ABV

March

( ` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2016E

3,101

2.5

1,664

33.0

176.7

1.4

19.7

14.0

2.6

FY2017E

3,745

2.5

2,029

40.2

207.6

1.4

20.5

11.5

2.2

December 8, 2015

Please refer to important disclosures at the end of this report.

7

Top Picks Report

December 2015

Top Picks - Mid Cap

December 8, 2015

Please refer to important disclosures at the end of this report.

8

Top Picks Report

December 2015

Stock Info

Blue Star

CMP (`)

357

Blue Star is one of the largest air-conditioning companies in India. The overall

TP (`)

429

outlook for the room air-conditioner (RAC) market in India is favourable as India

has one of the lowest penetration rates in the world. As per the Management,

Upside

20%

penetration rate of ACs in India is a mere 3% vs 25% in China. With rising income

Sector

Cons. Durable

levels, the penetration level is expected to improve which augurs well for Blue Star's

Cooling Products Division (CPD).

Market Cap (` cr)

3,208

Its RAC business has been outgrowing the industry by ~10% points over the last

Beta

0.7

few quarters, resulting in the company consistently increasing its market share

52 Week High / Low

395/274

(~7% in FY2014 to 10% at present), a trend that the Management is confident of

maintaining in the near future. This has resulted in CPD's share in overall revenues

increasing from~23% in FY2010 to ~42% in FY2015 (expected to improve to

3 year-Chart

~47% in FY2017E). With strong brand equity and higher share in split ACs, we

450

400

expect the CPD to continue to drive growth.

350

Aided by increasing contribution from the CPD, we expect the overall top-line to

300

post a revenue CAGR of 11.8% over FY2015-17E and margins to improve from

250

200

5.3% in FY2015 to 6.9% in FY2017E. Moreover, the proposed merger with Blue

150

Star Infotech will provide cash influx and thus strengthen the balance sheet.

100

50

At the current market price, the stock trades at 20.8x its FY2017E earnings and

-

0.8x its FY2017E EV/sales v/s its close peer Voltas, which trades a 1.5x its FY2017E

EV/sales. At target P/E multiple of 25.0x, the implied FY2017E EV/sales multiple

works out to 1.1x, which is comforting. Hence we recommend a Buy on the stock.

Source: Company, Angel Research

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

3,548

6.3

123

13.7

26.1

26.0

6.6

15.9

1.0

FY2017E

3,977

6.9

164

17.2

25.4

20.8

4.3

12.3

0.8

Stock Info

Ipca Labs.

CMP (`)

757

Domestic formulations business - the cash cow: IPCA has been successful in

TP (`)

900

changing its business focus to the high-margin chronic and lifestyle segments from

the low-margin anti-malarial segment. The chronic and lifestyle segments,

Upside

19%

comprising CVS, anti-diabetics, pain-management, CNS and dermatology products,

Sector

Pharmaceutical

constitute more than 50% of the company's domestic formulation sales.

Market Cap (` cr)

9,557

Exports under pressure: On the formulations front, IPCA has been increasing its

Beta

0.5

penetration in regulated markets, viz Europe and the US, by expanding the list of

generic drugs backed by its own API. However, after the USFDA inspection at the

52 Week High / Low

888/667

company's 3 manufacturing facilies, the company has received import alerts,

consequent to which the company had voluntarily decided to temporarily suspend

3 year-Chart

shipments from these manufacturing facility to the US markets till this issue was

1,000

addressed. These developments have impacted FY2015/FY2016.

800

Outlook and Valuations: For FY2016, the Management has given a guidance of

7-8% yoy growth on the sales front. While the problems are likely to persist in

600

FY2016, still, given the valuations and improvement expected from FY2017E

400

onwards, we maintain our Buy rating on the stock with a price target of `900.

200

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2016E

3,363

12.9

169

13.4

7.4

56.6

4.0

24.3

3.1

FY2017E

3,909

18.6

353

28.0

14.0

27.0

3.5

14.4

2.7

December 8, 2015

Please refer to important disclosures at the end of this report.

9

Top Picks Report

December 2015

Stock Info

Jagran Prakashan

CMP (`)

146

We expect Jagran Prakashan (JPL) to register a healthy net sales CAGR of ~15%

TP (`)

169

over FY2015-17E, on back of (a) strong growth in advertising revenue due to

improvement in GDP growth, (b) improvement in circulation revenue owing to

Upside

16%

combination of increase in cover price and volume growth.

Sector

Media

Further the acquisition of a radio business (Radio City) would also boost the

Market Cap (` cr)

4,943

company's revenue going ahead. Radio City has ~20 stations across 7 states in

Beta

0.6

the country and is second only to ENIL in all its operating circles, ie Delhi, Mumbai,

Bengaluru, Chennai, Ahmedabad, Hyderabad, Pune and Lucknow. The company

52 Week High / Low

108/157

covers ~51% (~66mn people) of the total radio population.

3 year-Chart

Raw material prices (newsprint costs) have been declining over the past 5 quarters

160

and are expected to remain stable, going forward. Thus, considering lower news

150

print costs, healthy sales, and higher margins in the radio business, we expect the

140

130

company to post a adj. net profit CAGR of ~20% over FY2015-17E to `325cr.

120

110

Considering Dainik Jagran's status as the most read Hindi newspaper and its strong

100

presence in the rapidly growing Hindi markets of Bihar, Haryana, Jharkhand, Punjab,

90

80

Madhya Pradesh and Uttar Pradesh, we expect JPL to benefit from an eventual

70

60

recovery in the Indian economy. Hence, we maintain an Accumulate rating on the

stock with a target price of `169.

Y/E

Sales OPM Adj. PAT EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

2,170

27.2

290

8.9

20.9

16.4

3.4

7.8

2.1

FY2017E

2,355

26.2

325

9.9

20.4

14.8

3.0

7.4

1.9

Stock Info

MT Educare

CMP (`)

140

MT Educare has strong positioning in the Secondary School and Higher Secondary

TP (`)

169

School coaching business in Mumbai location (contributes ~80% to the overall

revenue). The company , this year, has introduced a technology, the unique - Learning

Upside

21%

Management System (LMS) - for strengthening its offering in its core business.

Sector

Education

We expect MT Educare to report a healthy top-line performance, going forward,

Market Cap (` cr)

553

on the back of strong growth across the pre-university (PU) college business, Shri

Beta

1.0

Gayatri Educational Society (SGES), and the Lakshya business. Further, we also

expect the company to report a strong growth in the CA segment in Tamil Nadu

52 Week High / Low

152/96

and Mumbai.

3 year-Chart

We expect strong revenue from government projects. In this segment, MT Educare

160

provides coaching for competitive exams like Engineering, Medical, CA etc. to

150

backward classes and poor students who can't afford coaching fees, while the fees

140

130

are subsidised by the government.

120

110

We estimate MT Educare to report net sales CAGR of ~27% to ~`366cr and adj.net

100

profit CAGR of ~20% to `37cr over FY2015-17E. At the current market price, MT

90

80

Educare trades at a P/E of 15.0x its FY2017E earnings. We have a Buy rating on

70

60

the stock and target price of `169 (18x FY2017E EPS).

Y/E

Sales OPM Adj. PAT EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2016E

286

18.3

31

7.7

20.2

18.2

3.8

10.3

1.9

FY2017E

366

17.7

37

9.4

21.1

15.0

3.2

8.1

1.4

December 8, 2015

Please refer to important disclosures at the end of this report.

10

Top Picks Report

December 2015

Stock Info

Radico Khaitan

CMP (`)

109

The IFML segment is under penetrated and leaves scope for growth for domestic

TP (`)

156

liquor companies. Going forward, increase in income levels would lead to higher

growth in IFML brands. RKL has strong brands in the premium liquor category,

Upside

43%

which should lead to higher revenue for the company. The company's premium

Sector

Breweries & Distilleries

offerings reported a CAGR of ~26% over the last seven-year period, and we expect

Market Cap (` cr)

1,424

the growth momentum to continue.

We expect the price of ENA (key raw material) to remain stable and potentially

Beta

0.8

even decline, going forward. This is because sugar production during the year has

52 Week High / Low

131/78

risen by ~16% yoy and demand for ethanol from Indian oil marketing companies for

blending with petrol is also expected to be lower due to an unfavourable price differential.

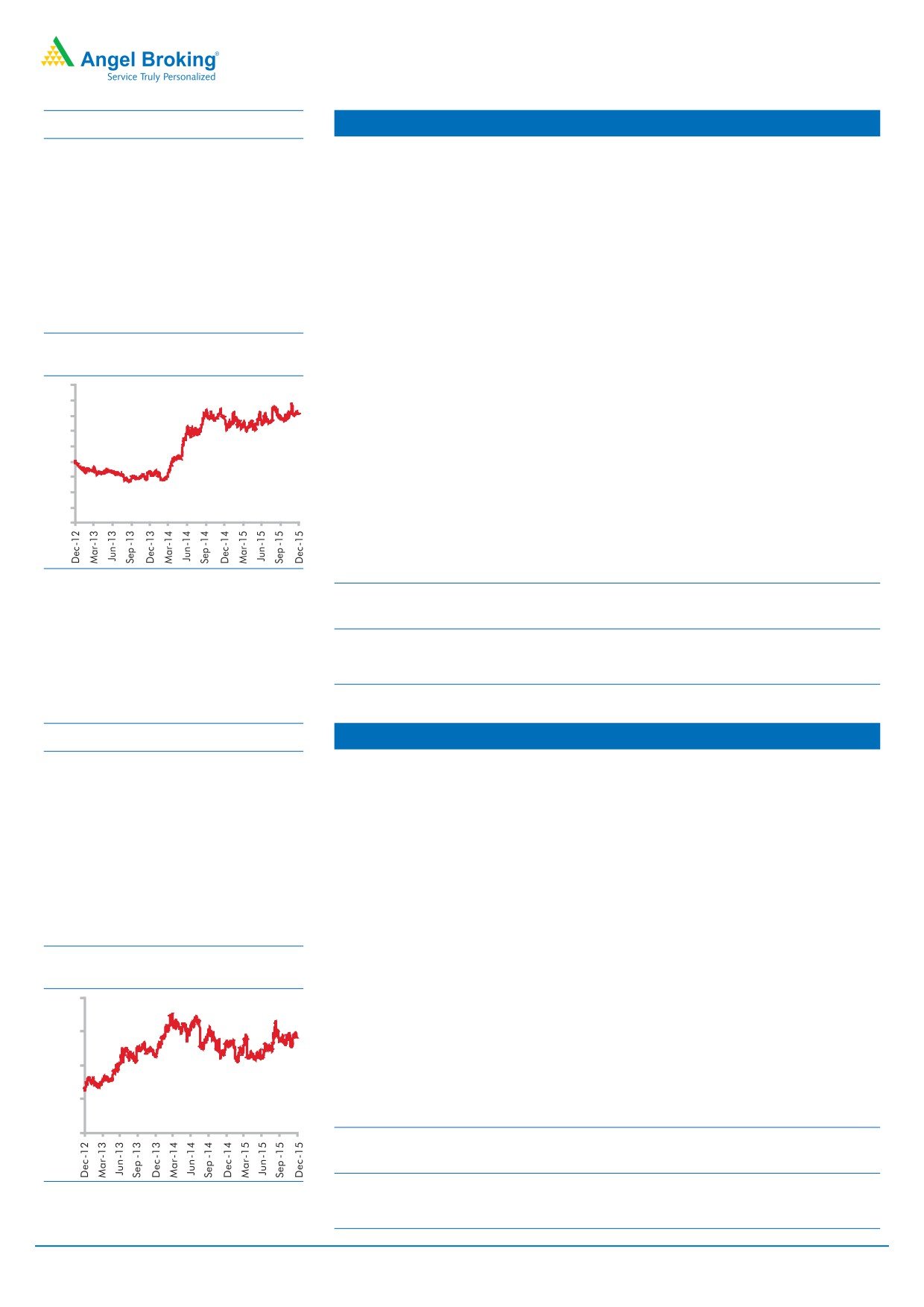

3 year-Chart

We expect a significant hike in liquor prices in the coming financial year as there

170

160

haven't been any significant ones in recent times. Also, we believe that industry

150

leader - United Spirit would shift focus on profitability over volume growth considering

140

130

the debt on its Balance Sheet, which in turn, would lead to increased scope for

120

other liquor companies to hike prices.

110

100

RKL is trading at 1-year forward EV/Sales multiple of 1.3 x, which is at huge

90

80

discount to its close peer, United Spirits (4.6x). We have a Buy rating on the stock

70

and target price of `156 (22x FY2017E EPS).

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

1,565

12.2

75

5.7

8.3

19.1

1.6

11.3

1.4

FY2017E

1,687

13.0

95

7.1

9.5

15.3

1.5

9.7

1.3

Stock Info

Siyaram Silk

CMP (`)

1,165

SSML has strong brands which cater to premium as well as popular mass segments

TP (`)

1,354

of the market. The company's brands include Siyaram's Mistair, J. Hampstead,

Royal Linen, Casa, Moda, Zenesis ,Moretti etc. Further, in FY2014, SSML entered

Upside

16%

the ladies' salwar kameez and ethnic wear segment with its brand Siya. Going

Sector

Textile

forward, we believe that the company would be able to leverage its brand equity

Market Cap (` cr)

1,092

and continue to post strong performance.

The company has a nationwide network of about 1,600 dealers and business

Beta

0.8

partners, which enables it to scale the entire country. The company has a retail

52 Week High / Low

1,400/780

network of 160 stores and plans to add another 300-350 stores over the next three

or four years. Further, the company's brands are sold across 3,00,000 multi brand

3 year-Chart

outlets in the country.

1,600

Going forward, we expect SSML to report a net sales CAGR of ~10% to ~`1,815cr

1,400

1,200

and adj.net profit CAGR of ~12% to `98cr over FY2015-17E on back of market

1,000

leadership in blended fabrics, strong brand building, wide distribution channel,

800

strong presence in tier II and tier III cities and emphasis on latest designs and

600

affordable pricing points. At the current market price, SSML trades at an inexpensive

400

valuation (at a P/E of 11.2x its FY2017E earnings). We have a Buy rating on the

200

stock and target price of `1,354.

0

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

1,636

11.5

84

89.9

17.9

13.0

2.1

6.7

0.8

FY2017E

1,815

11.5

98

104.1

17.8

11.2

1.9

6.0

0.7

December 8, 2015

Please refer to important disclosures at the end of this report.

11

Top Picks Report

December 2015

Stock Info

Surya Roshni

CMP (`)

135

To benefit from structural shift in lighting industry: We expect SRL to benefit from

TP (`)

183

the structural shift in the lighting industry towards LED lighting, which is expected to

grow at a CAGR of 28% over FY2015E-21E. SRL is the second largest lighting

Upside

36%

company in India with a market share of ~ 25%. With demand for LEDs expected

Sector

Cons. Durable

to rise, the company would be a key beneficiary, given that the company's "Surya"

Market Cap (` cr)

590

brand is well recognized and has superior market reach comprising of 2 lakh plus

retailers.

Beta

1.8

Higher contribution from lighting division to boost margins: SRL's other business,

52 Week High / Low

163/89

Steel Pipes, entails low profitability and has higher debt, thus having resulted in

high overall debt/equity for the company. The Lighting business' contribution to the

3 year-Chart

overall top-line of the company has increased from 30% in FY2012 to 40% in

180

160

FY2015. The Lighting business commands higher margins (10.7%) vs. the steel

140

business (2.9%) and contributes 70% to the profitability. We expect the Lighting

120

business's contribution to rise on account of growth coming in from LEDs, thus

100

80

enhancing overall profitability.

60

40

Declining interest rates to assist in reducing debt burden: We expect SRL to benefit

20

from a reduction in interest rates by the RBI (75bp FY2016). With interest rates

-

expected to reduce further, SRL's interest expense will be lower and we expect the

company to use its healthy cash flows from the Lighting business to slowly reduce

its debt.

Source: Company, Angel Research

Outlook and Valuations: In our view, SRL would benefit from a higher contribution

from the Lighting business and a lower interest rate environment, going forward.

SRL trades at 7.4x its FY2017 earnings. We have a Buy rating on the stock with a

target price of `183.

Y/E

Sales OPM PAT

EPS

RoE

P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

( %)

(x)

(x)

(x)

(x)

FY2016E

2,992

8.1

64

14.7

9.7

9.2

0.9

5.9

0.5

FY2017E

3,223

8.4

80

18.3

11.0

7.3

0.8

5.2

0.4

December 8, 2015

Please refer to important disclosures at the end of this report.

12

Top Picks Report

December 2015

Macro watch

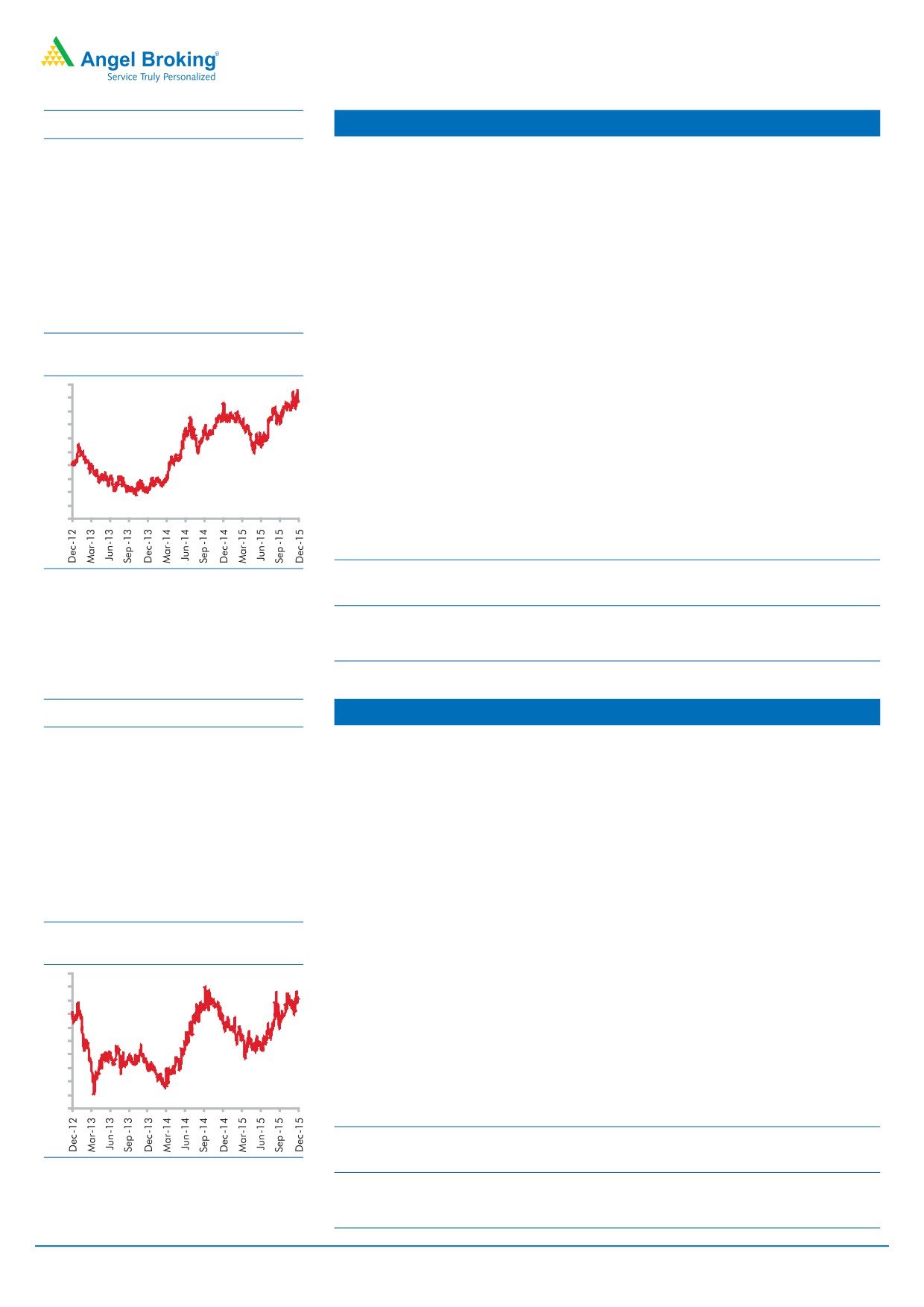

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.4

7.0

6.3

7.5

7.5

6.0

8.0

7.4

5.2

7.0

7.0

4.8

6.7

6.7

6.6

5.0

7.0

6.4

4.2

4.1

4.0

3.6

3.6

6.0

2.8

3.0

5.0

3.0

2.5

2.5

4.7

5.0

2.0

4.0

1.0

3.0

-

Source: CSO, Angel Research

Source: Ministry of Commerce, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

6.0

5.4

5.2

5.4

5.3

4.9

5.0

5.0

5.0

4.4

4.3

3.7

3.7

4.0

3.3

3.0

2.0

1.0

-

Source: Ministry of Commerce, Angel Research

Source: Ministry of Commerce, Angel Research

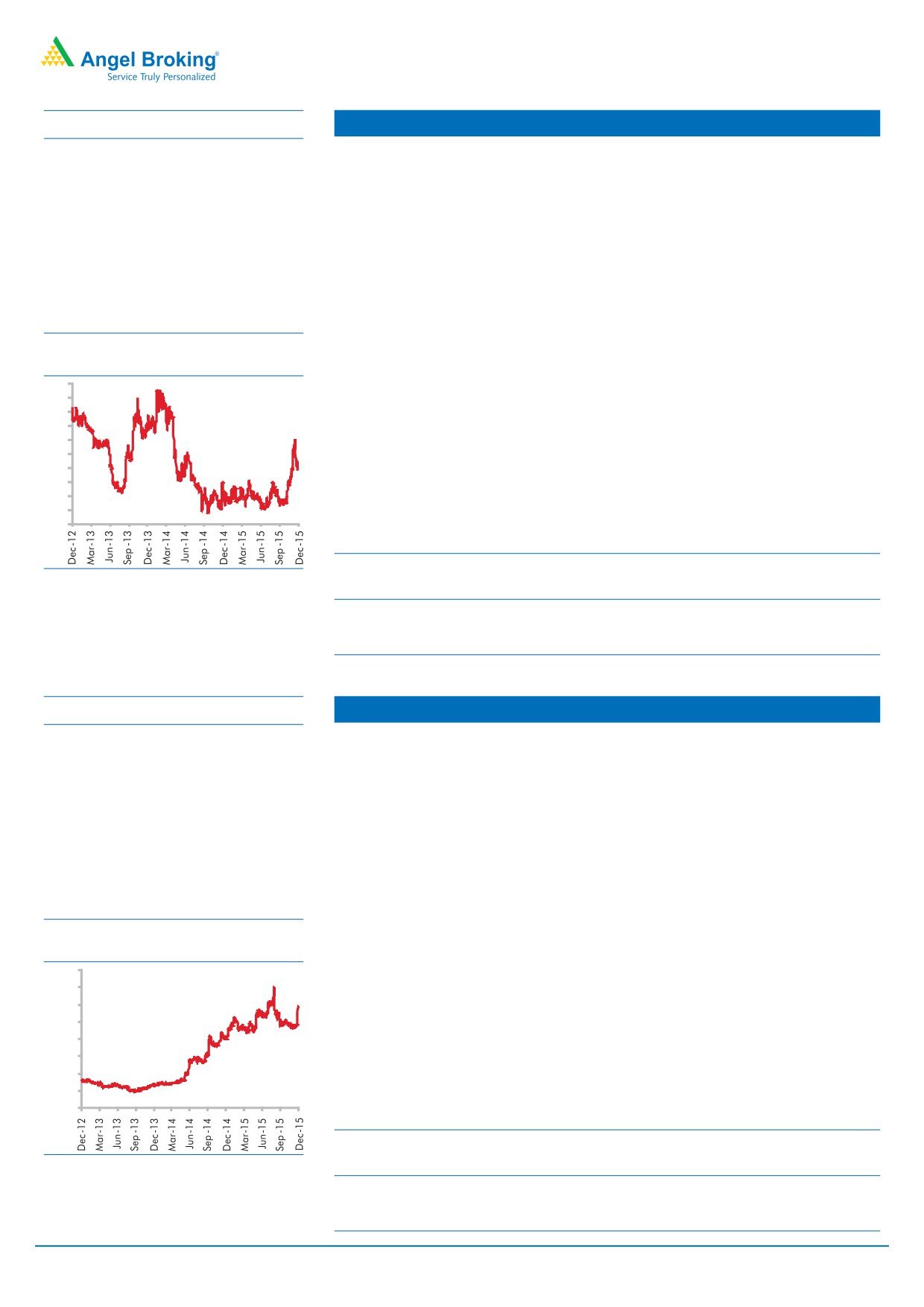

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

Source: Ministry of Commerce, Angel Research

Source: Ministry of Commerce, Angel Research

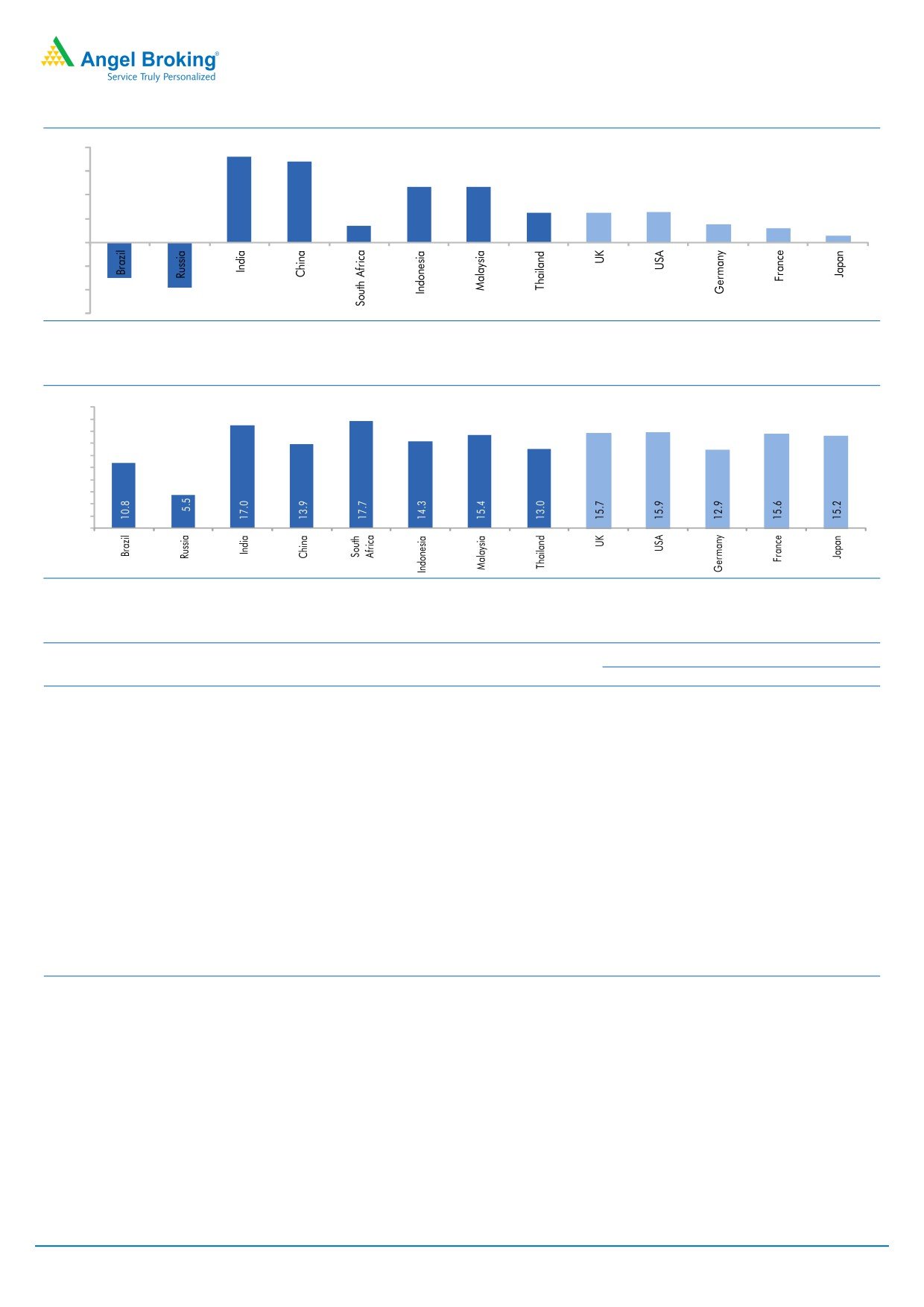

Exhibit 7: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

6.0

5.3

4.7

4.7

4.0

2.9

2.3

2.2

1.8

2.0

1.0

1.2

1.0

-

(2.0)

(4.0)

(4.1)

(4.5)

(6.0)

Source: Bloomberg, Angel Research

December 8, 2015

Please refer to important disclosures at the end of this report.

13

Top Picks Report

December 2015

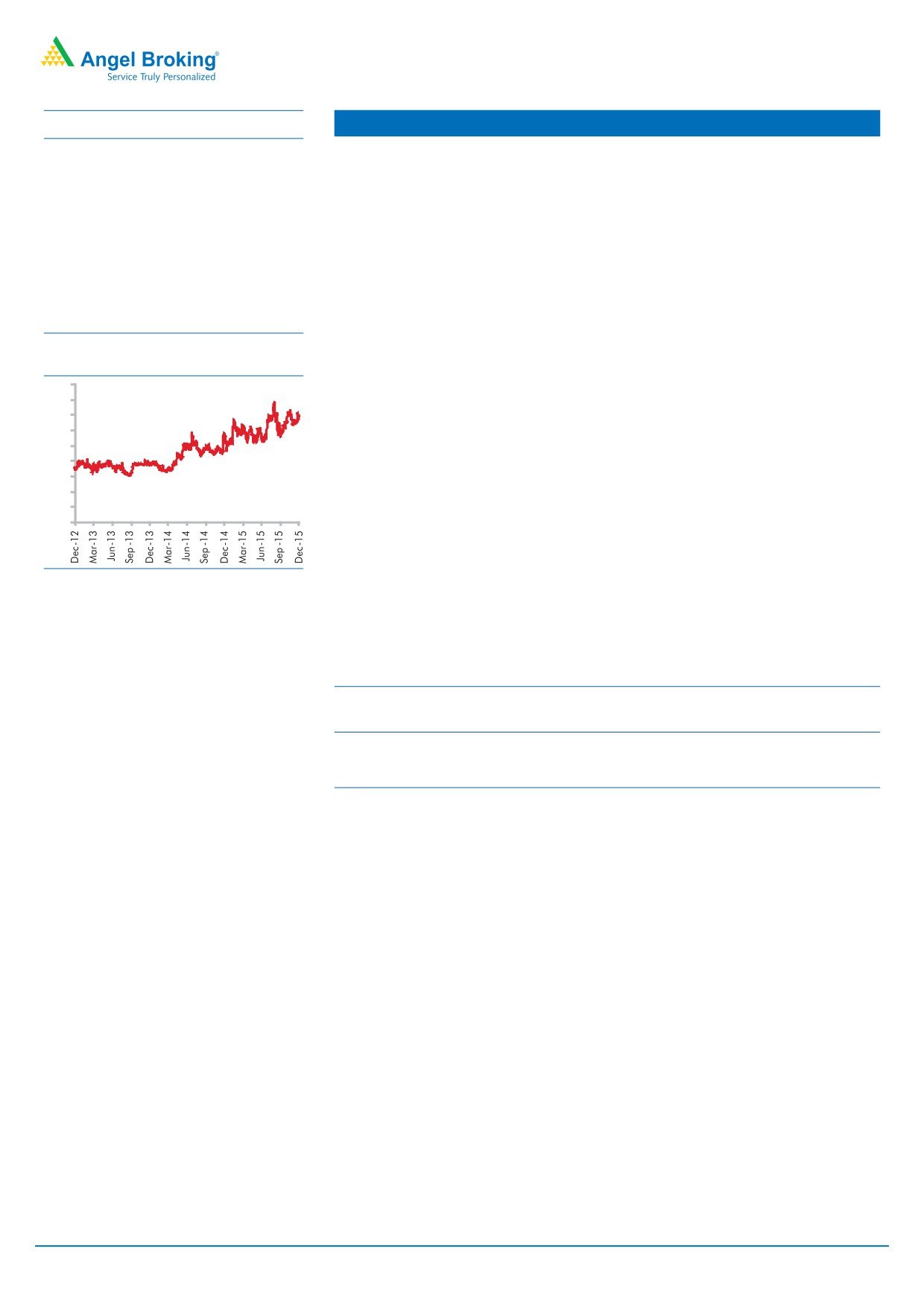

Exhibit 8: 2015 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

8.0

7.3

6.8

6.0

4.7

4.7

4.0

2.5

2.5

2.6

1.4

1.5

2.0

1.2

0.6

-

(2.0)

(3.0)

(4.0)

(3.8)

(6.0)

Source: IMF, Angel Research

Exhibit 9: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

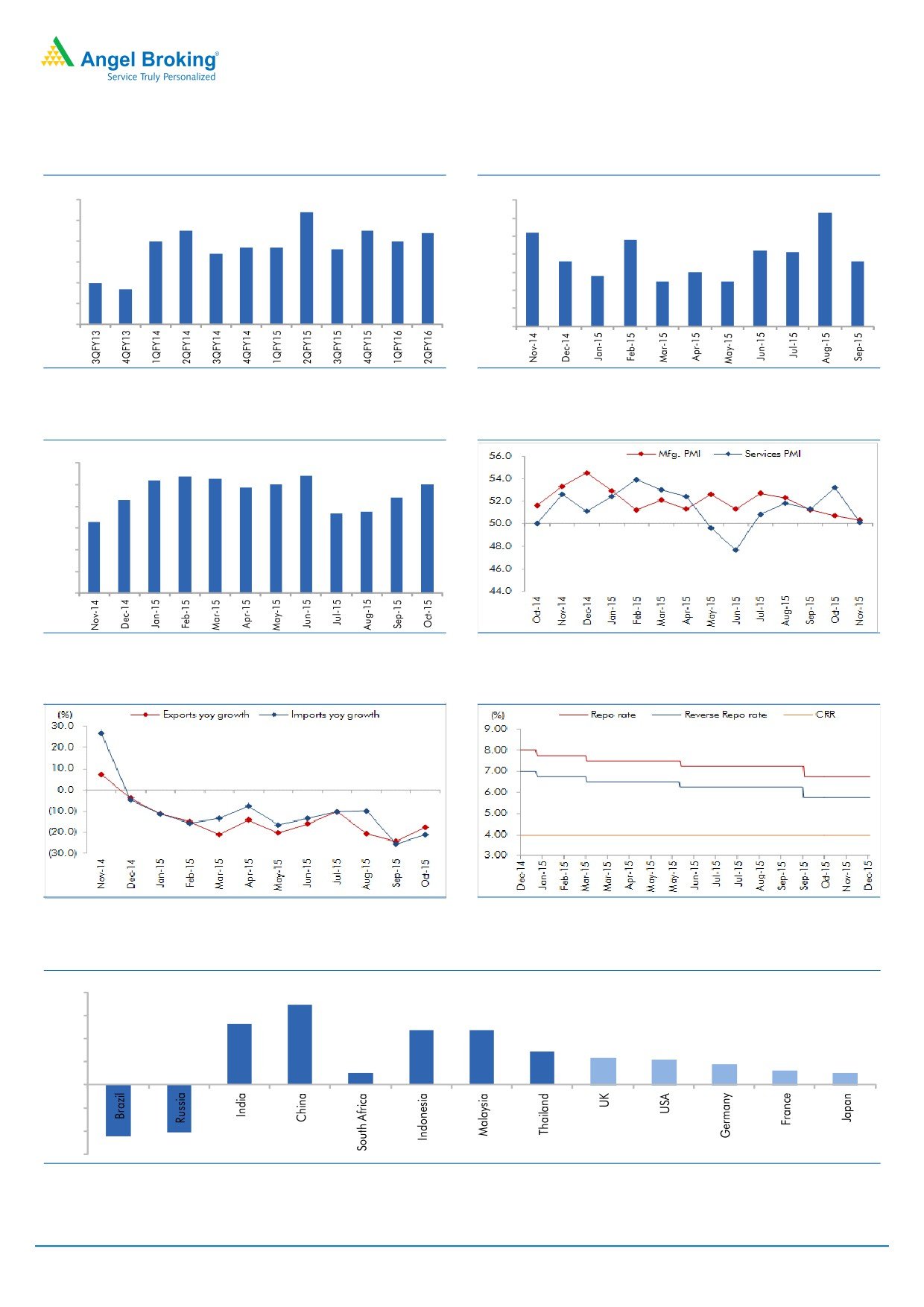

Exhibit 10: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

45,361

(5.6)

(0.3)

(17.1)

Russia

Micex

1,755

(0.5)

3.4

9.2

India

Nifty

7,782

(3.3)

(2.7)

(9.0)

China

Shanghai Composite

3,525

1.9

14.3

37.3

South Africa

Top 40

44,347

(9.6)

1.8

0.3

Mexico

Mexbol

42,994

(5.2)

0.1

(0.3)

Indonesia

LQ45

777

(2.2)

3.2

(12.1)

Malaysia

KLCI

1,668

(0.6)

3.6

(8.4)

Thailand

SET 50

856

(7.1)

(4.1)

(19.5)

USA

Dow Jones

17,848

(0.4)

9.0

(0.6)

UK

FTSE

6,238

(2.7)

2.7

(6.5)

Japan

Nikkei

19,504

4.4

1.9

12.0

Germany

DAX

10,752

(0.9)

6.4

6.6

France

CAC

4,715

(4.7)

3.6

11.5

Source: Bloomberg, Angel Research

December 8, 2015

Please refer to important disclosures at the end of this report.

14

Top Picks Report

December 2015

Stock Watch

December 8, 2015

Please refer to important disclosures at the end of this report.

15

Stock Watch | December 2015

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Agri / Agri Chemical

Rallis

Neutral

180

-

3,497

2,075

2,394

14.4

14.4

9.5

11.0

18.9

16.3

3.8

3.3

21.1

21.3

1.7

1.5

United Phosphorus

Buy

415

510

17,779

13,698

15,752

17.6

17.6

32.1

38.5

12.9

10.8

2.5

2.1

21.4

21.3

1.4

1.1

Auto & Auto Ancillary

Ashok Leyland

Buy

90

111

25,641

17,995

21,544

11.4

11.6

3.4

4.7

26.5

19.2

4.6

4.3

17.7

22.2

1.4

1.1

Bajaj Auto

Accumulate

2,449

2,728

70,866

23,695

27,298

21.3

20.4

134.6

151.5

18.2

16.2

5.8

4.9

31.8

30.6

2.5

2.2

Bharat Forge

Buy

834

1,016

19,405

8,013

9,250

20.0

20.3

35.2

43.1

23.7

19.3

4.7

3.8

21.6

21.8

2.5

2.1

Eicher Motors

Buy

16,231

19,036

44,073

15,379

16,498

15.6

16.6

473.2

574.8

34.3

28.2

12.7

9.4

36.7

33.2

2.8

2.5

Hero Motocorp

Accumulate

2,621

2,774

52,345

28,561

31,559

14.7

14.7

151.1

163.2

17.3

16.1

6.7

5.7

38.7

35.6

1.7

1.5

Jamna Auto Industries Neutral

124

-

990

1,292

1,486

9.3

9.8

6.0

7.5

20.7

16.5

4.3

3.6

20.7

21.8

0.8

0.7

L G Balakrishnan & Bros Neutral

506

-

794

1,254

1,394

11.6

11.8

35.9

41.7

14.1

12.1

1.9

1.7

13.5

13.8

0.7

0.7

Mahindra and Mahindra Accumulate

1,325

1,449

82,285

39,031

44,440

13.8

13.9

57.9

67.6

22.9

19.6

3.7

3.3

16.1

16.6

1.8

1.5

Maruti

Neutral

4,564

-

137,880

57,865

68,104

16.4

16.7

176.3

225.5

25.9

20.2

5.0

4.3

19.4

21.2

2.2

1.8

Minda Industries

Neutral

868

-

1,376

2,567

2,965

8.0

8.3

46.1

57.8

18.8

15.0

3.1

2.6

16.7

17.3

0.6

0.5

Motherson Sumi

Accumulate

280

313

37,043

39,343

45,100

8.8

9.1

10.1

12.5

27.7

22.4

8.8

6.9

35.3

34.4

1.0

0.9

Rane Brake Lining

Accumulate

340

366

269

454

511

11.1

11.4

23.8

28.1

14.3

12.1

2.0

1.8

14.2

15.3

0.7

0.7

Setco Automotive

Neutral

223

-

595

594

741

12.7

13.7

8.4

15.8

26.5

14.1

2.8

2.4

10.4

16.9

1.4

1.2

Tata Motors

Neutral

399

-

115,185

255,254

301,772

12.9

13.4

23.7

37.3

16.8

10.7

2.0

1.7

7.4

12.1

0.6

0.6

TVS Motor

Buy

282

338

13,388

11,569

13,648

7.3

8.7

10.3

16.1

27.4

17.5

6.8

5.3

24.8

30.5

1.1

0.9

Amara Raja Batteries

Buy

846

1,040

14,447

4,892

5,871

17.4

17.6

28.8

37.1

29.4

22.8

6.9

5.5

23.4

24.1

2.9

2.4

Exide Industries

Accumulate

141

162

11,989

6,950

7,784

14.4

14.8

6.6

7.3

21.4

19.3

2.7

2.5

12.6

12.8

1.4

1.3

Apollo Tyres

Accumulate

157

171

7,992

12,146

12,689

16.8

16.0

21.2

19.0

7.4

8.3

1.2

1.1

16.5

13.0

0.7

0.8

Ceat

Accumulate

1,038

1,119

4,200

6,041

6,597

14.1

13.7

99.5

111.9

10.4

9.3

2.1

1.7

19.6

18.5

0.8

0.7

JK Tyres

Neutral

107

-

2,419

7,446

7,669

15.2

14.0

19.6

18.4

5.4

5.8

1.4

1.1

25.2

19.5

0.7

0.6

Swaraj Engines

Neutral

910

-

1,130

552

630

14.2

14.7

44.6

54.1

20.4

16.8

4.7

4.3

23.2

25.6

1.9

1.6

Subros

Neutral

99

-

592

1,268

1,488

11.6

11.9

3.7

6.6

26.7

14.9

1.8

1.6

6.8

11.4

0.8

0.6

Indag Rubber

Neutral

226

-

593

283

329

17.0

17.2

13.0

15.4

17.5

14.7

3.8

3.2

21.8

21.6

1.8

1.5

Banking

Allahabad Bank

Neutral

73

-

4,375

8,569

9,392

2.8

2.9

16.3

27.5

4.5

2.6

0.4

0.33

7.6

11.9

-

-

Axis Bank

Buy

462

630

109,845

26,473

31,527

3.5

3.6

35.7

43.5

12.9

10.6

2.5

2.17

17.9

18.9

-

-

Bank of Baroda

Neutral

166

-

38,214

18,485

21,025

1.9

2.0

13.5

21.1

12.3

7.8

1.0

0.9

7.3

10.6

-

-

Bank of India

Neutral

122

-

9,657

15,972

17,271

1.9

2.0

15.3

33.3

8.0

3.7

0.4

0.3

3.6

7.6

-

-

Canara Bank

Neutral

253

-

13,732

15,441

16,945

2.0

2.1

46.6

70.4

5.4

3.6

0.5

0.4

8.0

11.2

-

-

Dena Bank

Neutral

43

-

2,781

3,440

3,840

2.1

2.3

7.2

10.0

5.9

4.3

0.4

0.4

6.1

7.9

-

-

Federal Bank

Neutral

58

-

9,883

3,477

3,999

3.0

3.0

5.0

6.2

11.5

9.2

1.2

1.0

10.5

11.9

-

-

HDFC

Neutral

1,186

-

187,166

10,358

11,852

3.3

3.3

41.1

47.0

28.9

25.2

5.5

5.0

24.7

24.9

-

-

HDFC Bank

Buy

1,062

1,262

268,055

38,309

47,302

4.3

4.3

49.3

61.0

21.5

17.4

3.7

3.20

18.5

19.7

-

-

ICICI Bank

Buy

263

354

152,967

34,279

39,262

3.3

3.3

21.0

24.4

12.5

10.8

2.1

1.8

14.4

14.7

-

-

IDBI Bank

Neutral

92

-

14,732

9,625

10,455

1.8

1.8

8.5

14.2

10.8

6.5

0.7

0.6

5.9

9.3

-

-

May 2011

Please refer to important disclosures at the end of this report.

16

Stock Watch | December 2015

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Indian Bank

Neutral

127

-

6,080

6,160

6,858

2.4

2.5

24.5

29.8

5.2

4.2

0.4

0.4

7.7

8.6

-

-

LIC Housing Finance

Buy

462

571

23,333

3,101

3,745

2.5

2.5

33.0

40.2

14.0

11.5

2.6

2.2

19.7

20.5

-

-

Oriental Bank

Neutral

143

-

4,301

7,643

8,373

2.4

2.4

37.2

45.4

3.9

3.2

0.3

0.3

8.2

9.4

-

-

Punjab Natl.Bank

Neutral

134

-

26,312

23,638

26,557

2.8

2.8

17.9

27.2

7.5

4.9

0.7

0.6

8.5

12.0

-

-

South Ind.Bank

Neutral

20

-

2,734

1,965

2,185

2.5

2.5

2.5

3.3

8.1

6.1

0.8

0.7

9.5

11.6

-

-

St Bk of India

Buy

239

283

185,647

82,520

93,299

2.7

2.8

20.0

24.5

11.9

9.8

1.3

1.2

11.5

12.8

-

-

Union Bank

Neutral

166

-

11,377

12,646

14,129

2.3

2.4

31.0

39.1

5.3

4.2

0.6

0.5

9.8

11.4

-

-

Vijaya Bank

Neutral

34

-

2,947

3,536

3,827

1.8

1.9

5.5

6.7

6.2

5.2

0.5

0.5

7.8

8.8

-

-

Yes Bank

Buy

735

921

30,815

7,190

9,011

3.2

3.3

58.2

69.7

12.6

10.6

2.3

1.9

19.2

19.6

-

-

Capital Goods

ACE

Neutral

43

-

424

660

839

4.7

8.2

1.0

3.9

42.9

11.0

1.3

1.2

3.2

11.3

0.8

0.6

BEML

Neutral

1,100

-

4,581

3,277

4,006

6.0

8.9

29.2

64.3

37.7

17.1

2.1

1.9

5.7

11.7

1.5

1.2

BGR Energy

Neutral

120

-

864

3,615

3,181

9.5

9.4

16.7

12.4

7.2

9.7

0.7

0.7

10.0

7.0

0.6

0.8

BHEL

Neutral

169

-

41,389

33,722

35,272

10.8

11.7

10.5

14.2

16.1

11.9

1.2

1.1

7.0

9.0

1.3

1.2

Blue Star

Buy

357

429

3,208

3,548

3,977

6.3

6.9

13.7

17.2

26.0

20.8

6.6

4.3

26.1

25.4

1.0

0.8

Crompton Greaves

Accumulate

192

204

12,062

13,484

14,687

4.9

6.2

4.5

7.1

42.8

27.1

3.0

2.8

7.2

10.8

1.0

0.9

Inox Wind

Buy

357

505

7,920

4,980

5,943

17.0

17.5

26.6

31.6

13.4

11.3

4.0

2.9

35.0

30.0

1.7

1.4

KEC International

Neutral

154

-

3,951

8,791

9,716

6.1

6.8

5.4

8.2

28.5

18.7

2.8

2.6

10.0

14.0

0.7

0.6

Thermax

Neutral

895

-

10,669

6,413

7,525

7.4

8.5

30.5

39.3

29.4

22.8

4.5

3.9

15.0

17.0

1.6

1.3

Cement

ACC

Buy

1,350

1,630

25,350

13,151

14,757

16.4

18.3

63.9

83.4

21.1

16.2

2.7

2.5

13.3

16.1

1.8

1.5

Ambuja Cements

Buy

196

233

30,402

11,564

12,556

19.4

20.7

8.9

10.1

22.0

19.4

2.8

2.6

12.8

13.8

2.3

2.1

HeidelbergCement

Neutral

75

-

1,697

1,772

1,926

13.3

15.4

1.0

3.0

74.9

25.0

1.9

1.8

2.6

7.9

1.5

1.3

India Cements

Buy

86

112

2,633

4,216

4,840

18.0

19.5

4.0

9.9

21.4

8.7

0.9

0.8

4.0

9.5

0.9

0.8

JK Cement

Accumulate

654

744

4,573

3,661

4,742

10.1

15.8

18.0

61.0

36.3

10.7

2.6

2.3

7.5

22.9

1.7

1.3

J K Lakshmi Cement

Buy

331

430

3,900

2,947

3,616

16.7

19.9

11.5

27.2

28.8

12.2

2.7

2.4

9.8

20.8

1.7

1.4

Mangalam Cements

Neutral

211

-

562

1,053

1,347

10.5

13.3

8.4

26.0

25.1

8.1

1.1

1.0

4.3

12.5

0.9

0.7

Orient Cement

Accumulate

163

183

3,335

1,854

2,524

21.2

22.2

7.7

11.1

21.1

14.7

3.0

2.6

13.3

15.7

2.5

1.8

Ramco Cements

Neutral

372

-

8,848

4,036

4,545

20.8

21.3

15.1

18.8

24.6

19.8

3.0

2.7

12.9

14.3

2.7

2.3

Shree Cement^

Neutral

11,193

-

38,993

7,150

8,742

26.7

28.6

228.0

345.5

49.1

32.4

7.2

6.1

15.7

20.3

5.2

4.2

UltraTech Cement

Accumulate

2,864

3,282

78,582

25,021

30,023

19.1

21.6

89.0

132.0

32.2

21.7

3.7

3.2

12.2

15.9

3.2

2.7

Construction

ITNL

Neutral

84

-

2,758

7,360

8,825

34.0

35.9

7.0

9.0

12.0

9.3

0.4

0.4

3.2

3.7

3.7

3.6

KNR Constructions

Accumulate

614

673

1,727

937

1,470

14.3

14.0

33.5

38.6

18.3

15.9

2.8

2.4

15.4

15.4

1.9

1.2

Larsen & Toubro

Buy

1,341

1,646

124,862

65,065

77,009

11.5

11.7

61.5

65.6

21.8

20.4

2.2

2.0

13.4

14.0

2.1

1.8

Gujarat Pipavav Port

Neutral

158

-

7,619

629

684

51.0

52.2

6.4

5.9

24.6

26.7

3.2

3.0

15.9

12.7

11.8

10.6

MBL Infrastructures

Buy

216

285

893

2,313

2,797

12.2

14.6

19.0

20.0

11.3

10.8

1.2

1.1

11.3

10.6

1.1

1.0

Nagarjuna Const.

Neutral

78

-

4,342

7,892

8,842

8.8

9.1

3.0

5.3

26.0

14.7

1.3

1.2

5.0

8.5

0.8

0.7

PNC Infratech

Neutral

533

-

2,732

1,873

2,288

13.2

13.5

24.0

32.0

22.2

16.6

2.2

1.9

12.1

12.3

1.6

1.3

Simplex Infra

Neutral

327

-

1,615

5,955

6,829

10.3

10.5

16.0

31.0

20.4

10.5

1.1

1.0

5.3

9.9

0.8

0.7

Power Mech Projects

Neutral

610

-

897

1,539

1,801

12.8

12.7

59.0

72.1

10.3

8.5

1.6

1.3

18.6

16.8

0.6

0.5

Sadbhav Engineering

Neutral

337

-

5,784

3,481

4,219

10.7

10.8

8.0

12.0

42.2

28.1

3.9

3.4

10.3

13.5

1.9

1.6

NBCC

Accumulate

973

1,089

11,680

7,382

9,506

7.7

8.6

39.8

54.4

24.5

17.9

5.9

4.7

26.7

29.1

1.3

1.0

SIPL

Neutral

100

-

3,531

675

1,042

62.4

64.7

-

-

-

-

3.8

4.3

-

-

16.9

11.4

May 2011

Please refer to important disclosures at the end of this report.

17

Stock Watch | December 2015

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FMCG

Asian Paints

Neutral

871

-

83,537

16,553

19,160

16.0

16.2

17.7

21.5

49.3

40.5

13.1

11.8

29.4

31.2

4.9

4.2

Britannia

Neutral

2,880

-

34,554

8,065

9,395

9.6

10.2

47.2

65.5

61.0

44.0

20.3

19.2

38.3

41.2

4.1

3.5

Colgate

Neutral

992

-

26,988

4,836

5,490

19.5

19.7

48.5

53.2

20.5

18.6

15.0

13.1

99.8

97.5

5.5

4.8

Dabur India

Neutral

276

-

48,614

9,370

10,265

17.1

17.2

7.3

8.1

37.7

34.1

11.4

9.2

33.7

30.6

5.1

4.6

GlaxoSmith Con*

Neutral

6,044

-

25,416

4,919

5,742

17.2

17.4

168.3

191.2

35.9

31.6

10.2

8.7

28.8

28.9

4.7

4.0

Godrej Consumer

Neutral

1,228

-

41,804

10,168

12,886

16.1

16.1

32.1

38.4

38.3

32.0

7.8

7.2

19.7

21.0

4.2

3.3

HUL

Neutral

832

-

179,980

34,940

38,957

17.5

17.7

20.8

24.7

40.0

33.7

44.5

35.5

110.5

114.2

5.0

4.4

ITC

Buy

314

382

251,857

41,068

45,068

37.8

37.4

13.9

15.9

22.5

19.7

7.5

6.6

34.1

33.8

5.8

5.2

Marico

Neutral

426

-

27,503

6,551

7,766

15.7

16.0

10.4

12.5

41.1

34.1

11.9

9.9

33.2

32.4

4.1

3.5

Nestle*

Accumulate

5,898

6,646

56,869

11,291

12,847

22.2

22.3

158.9

184.6

37.1

32.0

19.4

17.5

55.0

57.3

4.9

4.2

Tata Global

Accumulate

135

144

8,542

8,635

9,072

9.8

9.9

6.5

7.6

20.8

17.8

2.1

2.0

6.8

7.4

0.9

0.9

IT

HCL Tech^

Buy

841

1,132

118,437

42,038

47,503

23.2

23.5

55.8

62.9

15.1

13.4

3.5

2.6

23.0

19.8

2.4

1.9

Infosys

Buy

1,046

1,306

240,226

60,250

66,999

28.0

28.0

58.3

63.7

17.9

16.4

3.8

3.2

20.9

19.7

3.3

2.8

TCS

Buy

2,324

3,165

457,947

111,274

126,852

28.4

28.7

125.4

143.9

18.5

16.2

7.3

6.8

39.9

42.2

3.7

3.2

Tech Mahindra

Buy

544

646

52,569

25,566

28,890

16.0

17.0

26.3

31.9

20.7

17.0

3.7

3.2

17.9

18.6

1.8

1.5

Wipro

Buy

575

719

142,048

52,414

58,704

23.7

23.8

38.4

42.3

15.0

13.6

2.9

2.6

19.5

18.0

2.3

1.9

Media

D B Corp

Accumulate

338

356

6,207

2,241

2,495

27.8

27.9

21.8

25.6

15.5

13.2

4.0

3.6

26.7

28.5

2.7

2.4

HT Media

Neutral

79

-

1,845

2,495

2,603

11.2

11.2

7.3

8.6

10.9

9.2

0.9

0.8

7.4

8.1

0.2

0.2

Jagran Prakashan

Buy

146

169

4,781

2,170

2,355

27.2

26.2

8.9

9.9

16.4

14.8

3.4

3.0

20.9

20.4

2.1

1.9

Sun TV Network

Neutral

378

-

14,900

2,779

3,196

70.2

70.5

22.8

27.3

16.6

13.8

4.1

3.7

26.7

28.3

5.1

4.4

Hindustan Media Ven.

Neutral

276

-

2,024

920

1,031

20.0

20.0

19.2

20.9

14.4

13.2

2.4

2.0

16.4

15.3

1.7

1.5

Metal

Coal India

Buy

328

380

206,893

76,167

84,130

19.9

22.3

22.4

25.8

14.6

12.7

5.3

5.1

35.5

41.0

2.0

1.8

Hind. Zinc

Buy

147

175

62,007

14,641

14,026

50.4

50.4

17.7

16.0

8.3

9.2

1.3

1.2

16.2

13.2

1.8

1.7

Hindalco

Neutral

79

-

16,386

104,356

111,186

8.7

9.5

6.7

11.1

11.8

7.2

0.4

0.4

3.5

5.9

0.7

0.6

JSW Steel

Neutral

975

-

23,557

42,308

45,147

16.4

20.7

(10.3)

49.5

-

19.7

1.1

1.0

(1.0)

5.6

1.6

1.5

NMDC

Neutral

91

-

35,881

8,237

10,893

46.6

44.5

9.9

11.7

9.1

7.8

1.0

0.9

12.4

13.0

4.1

3.2

SAIL

Neutral

47

-

19,226

45,915

53,954

7.2

10.5

1.5

4.4

30.9

10.6

0.4

0.4

2.3

4.1

1.1

0.9

Vedanta

Neutral

91

-

27,053

71,445

81,910

26.2

26.2

12.9

19.2

7.1

4.8

0.5

0.4

7.2

8.9

0.8

0.6

Tata Steel

Neutral

244

-

23,654

126,760

137,307

8.9

11.3

6.4

23.1

38.3

10.6

0.8

0.7

2.0

7.1

0.8

0.7

Oil & Gas

Cairn India

Neutral

136

-

25,433

11,323

12,490

49.4

51.0

20.7

20.6

6.5

6.6

0.4

0.4

6.4

6.1

1.3

0.7

GAIL

Neutral

358

-

45,354

64,856

70,933

9.1

9.6

24.0

28.9

14.9

12.4

1.3

1.2

8.8

9.6

0.9

0.8

ONGC

Neutral

224

-

191,729

154,564

167,321

36.8

37.4

28.6

32.5

7.8

6.9

1.0

0.9

12.7

13.5

1.4

1.3

Petronet LNG

Neutral

244

-

18,289

29,691

31,188

5.8

6.2

12.8

13.4

19.1

18.2

2.8

2.5

15.8

14.8

0.7

0.6

Indian Oil Corp

Accumulate

429

455

104,086

359,607

402,760

5.9

6.1

42.5

48.7

10.1

8.8

1.3

1.2

14.1

14.3

0.4

0.3

Reliance Industries

Accumulate

954

1,050

308,909

304,775

344,392

12.6

13.4

91.3

102.6

10.5

9.3

1.2

1.1

11.8

12.0

0.9

0.8

May 2011

Please refer to important disclosures at the end of this report.

18

Stock Watch | December 2015

Company Name

Reco

CMP

Target

Mkt Cap

Sales (` cr)

OPM (%)

EPS (`)

PER (x)

P/BV (x)

RoE (%)

EV/Sales (x)

(`)

Price (`)

(` cr)

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Pharmaceuticals

Alembic Pharma

Neutral

688

-

12,973

2,658

3,112

24.1

20.2

24.6

23.9

28.0

28.8

10.0

7.7

42.5

30.2

4.9

4.1

Aurobindo Pharma

Accumulate

803

872

46,866

14,923

17,162

23.0

23.0

38.2

43.6

21.0

18.4

6.5

4.9

36.0

30.2

3.5

3.0

Aventis*

Neutral

4,297

-

9,895

2,082

2,371

17.4

20.8

118.2

151.5

36.3

28.4

5.3

4.3

19.9

25.5

4.4

3.7

Cadila Healthcare

Neutral

393

-

40,274

10,224

11,840

21.0

22.0

14.6

17.6

26.9

22.4

7.4

5.8

30.8

29.0

4.0

3.4

Cipla

Neutral

645

-

51,800

14,211

16,611

20.6

19.0

27.0

28.9

23.9

22.3

4.1

3.5

18.4

16.8

3.6

3.0

Dr Reddy's

Buy

3,180

3,933

54,231

16,838

19,575

25.0

23.1

167.5

178.8

19.0

17.8

4.0

3.3

23.1

20.4

3.1

2.7

Dishman Pharma

Neutral

335

-

2,701

1,733

1,906

21.5

21.5

17.0

19.9

19.7

16.8

2.0

1.8

10.5

11.2

2.1

1.8

GSK Pharma*

Neutral

3,266

-

27,667

2,870

3,158

20.0

22.1

59.5

68.3

54.9

47.8

16.2

16.6

28.5

34.3

9.1

8.4

Indoco Remedies

Neutral

314

-

2,893

1,033

1,199

15.9

18.2

9.4

13.6

33.4

23.1

5.0

4.2

15.7

19.7

2.9

2.5

Ipca labs

Buy

757

900

9,554

3,363

3,909

12.9

18.6

13.4

28.0

56.5

27.0

4.0

3.5

7.4

14.0

3.1

2.7

Lupin

Neutral

1,831

-

82,483

13,092

16,561

25.0

27.0

50.4

68.3

36.3

26.8

7.5

5.9

22.8

24.7

6.0

4.6

Sun Pharma

Buy

777

950

187,067

28,163

32,610

25.8

30.7

17.4

26.9

44.7

28.9

4.2

3.7

13.0

16.6

6.1

5.1

Power

Tata Power

Neutral

64

-

17,350

35,923

37,402

22.6

22.8

4.1

5.2

15.8

12.5

1.2

1.1

7.5

9.3

1.4

1.3

NTPC

Buy

130

157

107,438

87,064

98,846

23.4

23.5

11.7

13.2

11.1

9.9

1.2

1.2

11.4

12.1

2.3

2.0

Power Grid

Buy

131

170

68,534

20,702

23,361

86.7

86.4

12.1

13.2

10.8

9.9

1.6

1.4

15.6

15.1

8.2

7.7

Telecom

Bharti Airtel

Neutral

321

-

128,117

101,748

109,191

32.1

31.7

12.0

12.5

26.7

25.6

1.8

1.7

6.9

6.7

1.9

1.7

Idea Cellular

Neutral

137

-

49,392

34,282

36,941

32.0

31.5

5.9

6.2

23.3

22.1

2.1

1.9

9.9

9.3

2.0

1.9

Others

Abbott India

Neutral

5,302

-

11,266

2,715

3,153

14.5

14.1

134.3

152.2

39.5

34.8

9.9

8.1

27.4

25.6

3.9

3.3

Bajaj Electricals

Buy

214

341

2,161

4,719

5,287

5.2

5.8

8.6

12.7

25.0

16.9

2.9

2.5

11.4

14.8

0.5

0.4

Banco Products (India)

Neutral

134

-

957

1,208

1,353

10.9

12.3

10.8

14.5

12.4

9.2

1.4

1.3

11.9

14.5

0.8

0.7

Coffee Day Enterprises

Neutral

253

-

5,217