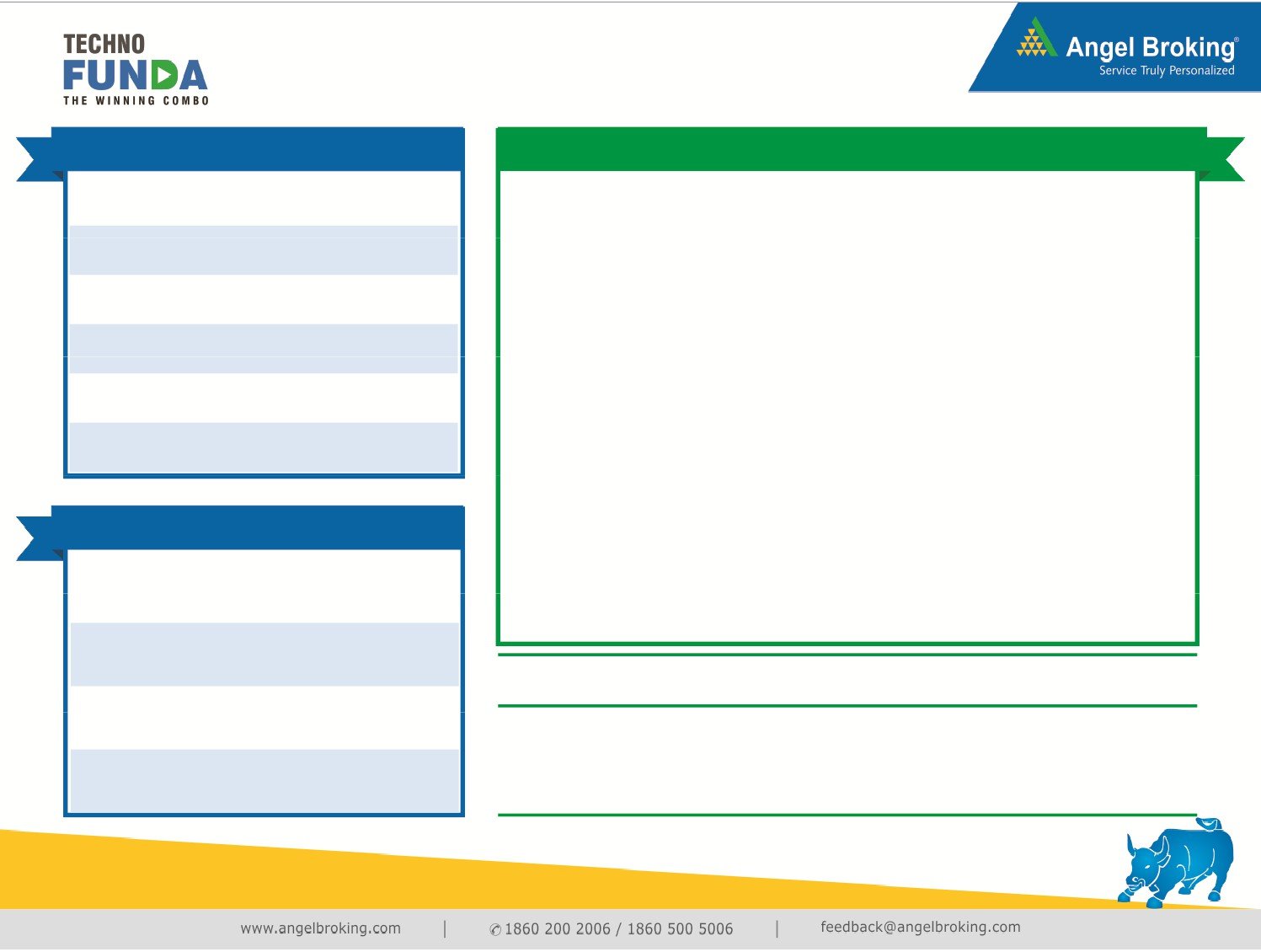

Range

Stop Loss

Target

Coal India (NSE Cash) - BUY

293 - 288

266

342

Daily Chart

Technical Evidences

Since last nine months, the stock has been

consolidating in a falling channel.

The prices have shown breakout from the

channel with higher volumes, thus

indicating start of an uptrend in the stock.

The prices, which were trading within the

‘Bollinger Bands’ in last nine months, have

given breakout from the upper band.

The ‘RSI Smoothed’ oscillator is also

showing positive crossover from its

average on daily and weekly charts.

Considering the positive placement of

‘SuperTrend’ and ‘PSAR’ indicators, we

expect this stock to give a decent up move

in the medium term.

Thus, it can be bought from current level to

a decline up to `288 for a target of `342

in coming three months. A stop loss can

be placed at ` 266.

Source: Falcon ( Chart time: 10:00 IST )

May 30, 2016

Stock Info

Coal India

Strong production growth to drive revenues: Coal India’s (CIL) production has

Sector

Mining

increased at a CAGR of ~8% over the last two years, as against a CAGR growth

of 1.8% between FY2010-14. Off-take growth has also picked up to 9% yoy in

Market cap

177,711

FY2016 as against a CAGR growth of 3.2% in FY2010-14. With India still being

a net importer of coal, we believe CIL’s production and off-take would continue

Beta

0.8

to increase at similar rates over the coming years. CIL has already finalised plans

to achieve targeted production of 925MT by FY2020 and is planning to increase

production to 1bn tonne. We believe the production growth target is a bit too

52 week high/low

447/272

optimistic and expect CIL’s production to grow at a CAGR of ~8%.

Asset quality: CIL’s net realisation is significantly lower than the landed price of

Avg. Daily Volume

35,70,263

imported coal, despite the low prevailing global prices, providing enough

cushion to pass on any cost escalations. The increasing share of washed coal will

Face Value (`)

10

also help improve realizations. Further, technological and infrastructural

enhancements, coupled with operating efficiencies from rising production will

help to keep production costs low.

Shareholding Pattern (%)

Outlook: Coal India is a strong play on the domestic power demand with the

current Government taking proactive measures to resolve issues within this space.

The stock is currently trading at ~6x FY2018E EV/EBITDA. With a strong dividend

Promoters

79.7

yield of ~7%, the current valuation looks attractive.

MF / Banks / Indian Fls

8.6

Company

Sales

OPM PAT EPS ROE P/E P/ABV EV/EBITDA EV/Sales

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FII / NRIs / OCBs

8.6

FY2017E

82,770

23.7

16,653

26.4

41.6

11.1

4.5

5.9

1.6

Indian Public / Others

3.1

FY2018E

86,807

22.6

17,496

27.7

42.0

10.5

4.3

5.9

1.5

May 30, 2016

Research Team Tel: 022 - 3935 7800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and

Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a

Mutual Fund Distributor. Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel

or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst

has not received any compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst has not

served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be

construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of

an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the

merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a

company's fundamentals and, as such, may not match with a report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not

represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/

group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the

disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Coal India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

April 18, 2016