OCT 31, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

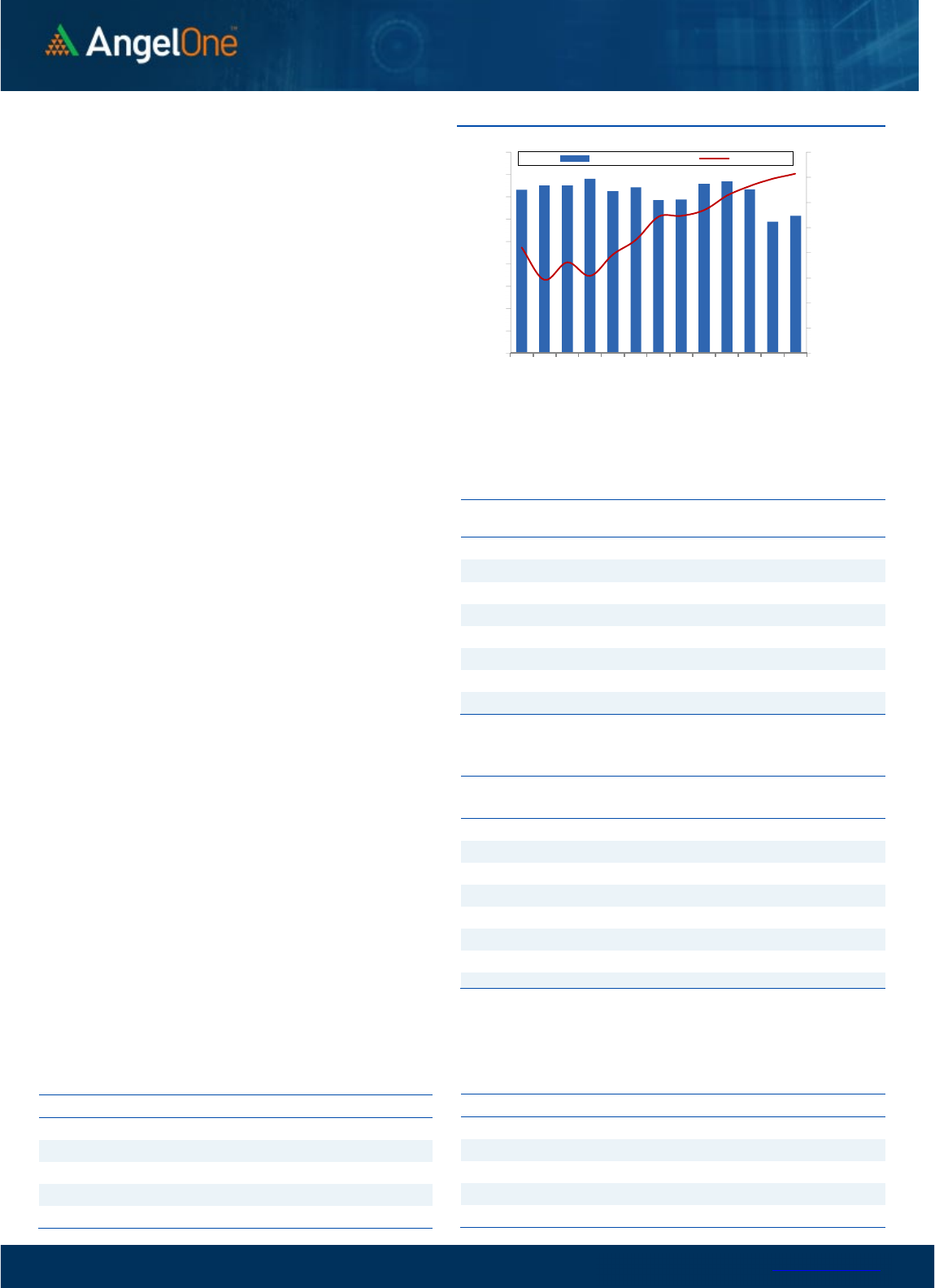

Nifty Bank Outlook (40911)

The Bank Nifty index has witnessed a subdued move throughout

the week and has slightly underperformed the benchmark index.

On weekly basis, the index has surged 0.51 percent and maintained

its positive stature for the fourth consecutive week. The index has

sustained at higher grounds throughout the truncated week and

settled a tad below the 41000 mark.

On the technical aspect, the banking index is still in the bullish

trajectory as it hovers well above all its major exponential moving

averages on the daily chart. However, some tentativeness was

evident as the index hesitated to re-test the lifetime highs post a

promising start of the week. Meanwhile, the undertone is strongly

upbeat, wherein any minor correction could be seen as an

opportunity to add fresh longs. As far as levels are concerned, the

unfilled gap placed around 40350-40200 is likely to act as the

sacrosanct support zone in this week. While on the flip side, the

lifetime highs of the 41800-41850 odd zone is to be seen as

intermediate resistance, and any breach above the same could

trigger the next leg of a rally in the banking space.

Key Levels

Support 1 – 40500 Resistance 1 – 41600

Support 2 – 40350 Resistance 2 – 41850

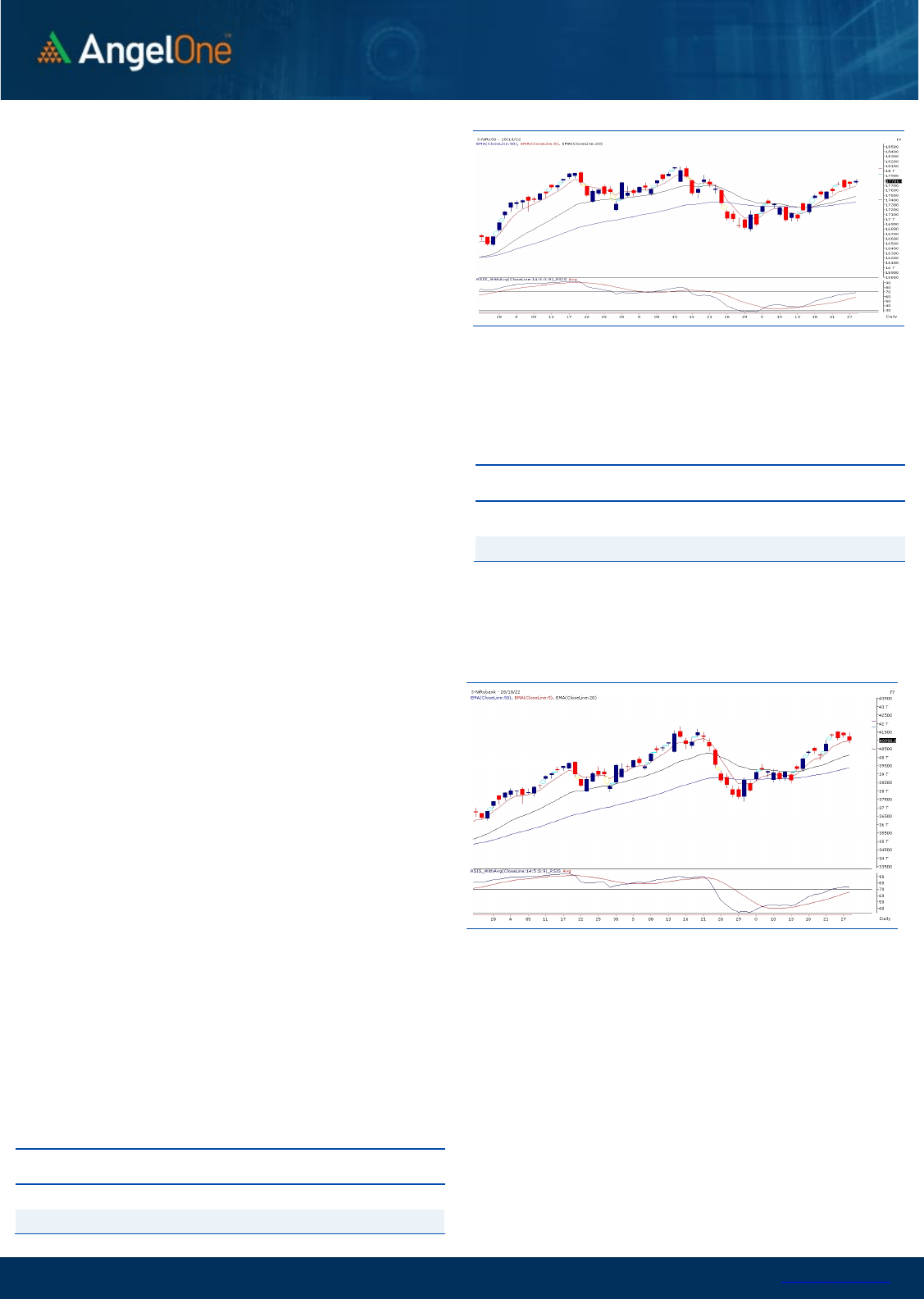

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (59960) / Nifty (17787)

Generally, the Muhurat Trading Day is considered a lull session but

this time, we kicked off the new SAMVAT as well as the week with a

decent bump up on Monday. Importantly, unlike most of the

Muhurat sessions, the gains were here to stay as we managed to

hold the initial lead convincingly. This was followed by back to back

gap up openings but the follow up was clearly missing. Eventually,

the range bound week ended with more than a percent gains on a

weekly basis.

Although, despite being a truncated week, we managed to add

something on week-on-week basis; practically, the trading action

was very dull. Market failed to capitalise on all head-starts as we

saw some challenges around the 17800 mark. On the other hand,

the bulls were successfully able to defend 17600, which made the

weekly range to shrink to merely 200 points. In our sense, markets

have opted to take some breather before unfolding the next leg of

the rally. As far as supports are concerned, 17600 - 17500 are to be

treated as key levels and till the time, it remains unbroken, there is

no reason to worry for. On the flipside, it’s a matter of time, we

would see Nifty surpassing 17800 to retest the psychological

junction of 18000.

Traders are advised to remain upbeat and keep a close watch on

thematic moves which may get unfolded in the first half of this

week. The banking has taken a pause after the recent run but

soon it is likely to move beyond all time highs to enter an

uncharted territory.

Key Levels

Support 1 – 17600 Resistance 1 – 17940

Support 2 – 17500 Resistance 2 – 18000

www.angelone.in

Technical & Derivatives Report

OCT 31, 2022

View

The truncated festive week ended on a positive note,

the index reclaimed 17800 and maintained positive

posture despite some profit booking at higher levels.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1569 crores. Simultaneously, in Index

futures, they sold worth Rs. 624 crores with a good

amount of rise in open interest, indicating addition of

shorts.

On Friday, we saw mixed activity in Nifty and short

formation was seen in banking index. Stronger hands

too added few shorts in index futures segment but

preferred buying equities. Their Long Short Ratio has

surged drastically from 13% to 57%, as they covered

decent portion of shorts and rolled over bullish bets

in the month of November. In index options front,

build-up was scattered between 17800-18000 call and

17500-17800 put strikes. At current juncture, 17500-

17600 zone remains a strong demand zone and as long

we manage to sustain above same, traders’ are

advocated to use intraday dips to add fresh longs in

system.

Comments

The Nifty futures open interest has increased by

4.37%. and Bank Nifty futures open interest has

increased by 7.93% as the market closed at 17786.80.

The Nifty November future closed with a premium of

43.40 point against a premium of 52.25 point in the

last trading session. The December series closed at

a premium of 106.30 point.

The INDIA VIX decreased from 16.59 to 15.92. At the

same time, the PCR-OI of Nifty has increased from

1.10 to 1.12.

Few of the liquid counters where we have seen high

cost of carry are IDEA, PETRONET, INDUSTOWER,

FSL and IOC.

Historical Volatility

SCRIP HV

SBICARD 39.46

MARUTI 35.68

BALRAMCHIN 56.52

TATACHEM 46.91

PETRONET 30.96

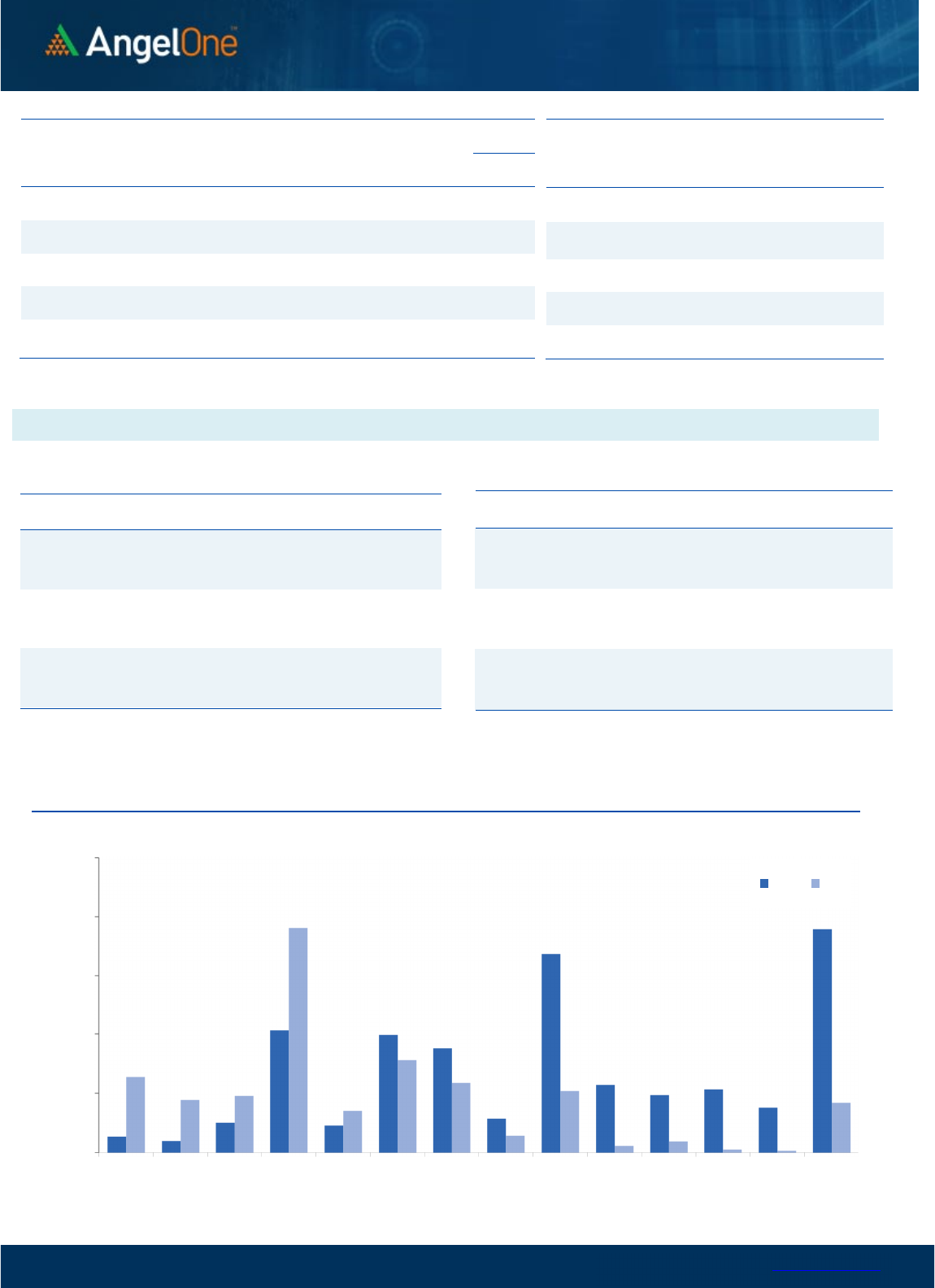

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

18000

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

10/10 10/12 10/14 10/18 10/20 10/25 10/28

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

HONAUT 30780 62.99 39543.95 2.90

NMDC 18783650 32.37 100.95 -3.66

CROMPTON 5485500 16.58 353.50 -3.81

BALRAMCHIN 9337600 14.84 310.05 -6.74

MARUTI 3199100 12.66 9492.65 4.84

SYNGENE 2364000 12.09 613.15 3.05

SBICARD 6824000 12.09 810.30 -5.61

PAGEIND 99705 12.02 49225.20 -3.56

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

TVSMOTOR 5101600 -6.95 1127.15 -0.12

MFSL 2393300 -5.35 701.70 3.22

RECLTD 43000000 -5.17 99.85 3.29

JINDALSTEL 25863750 -5.07 453.90 -3.52

MGL 3149600 -5.02 855.95 -1.47

BAJAJ-AUTO 1504000 -3.97 3670.55 1.51

SHREECEM 282950 -3.84 21779.60 0.63

IGL 10495375 -3.70 422.50 -0.88

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.12 0.89

BANKNIFTY 0.71 0.93

RELIANCE 0.58 0.40

ICICIBANK 0.50 0.60

INFY 0.63 0.60

www.angelone.in

Technical & Derivatives Report

OCT 31, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Nov Series) are given as an information and not as a recommendation.

Nifty Spot =

17

786.80

FII Statistics for

October

2

8

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3112.28 3736.16 (623.88) 132238 12398.18 4.64

INDEX

OPTIONS

626579.01 622332.19 4246.82

1203127 111880.91 43.67

STOCK

FUTURES

11215.42 12006.24 (790.82) 2139682 142378.08 5.58

STOCK

OPTIONS

9048.49 8903.96 144.53

72029 5145.34 151.19

Total 649955.20

646978.55

2976.65

3547076

271802.51

17.49

Turnover on

October

2

8

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

341244 32757.78 -45.56

Index Options

76259339 40232.73 -11.56

Stock

Futures

817765 55903.69 -64.82

Stock Options

2642190 3898.11 27.39

Total

2,642,190 3898.11 -50.38

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17800 300.80

53.65

46.35

17853.65

Sell

17900 247.15

Buy

17800 300.80

101.45

98.55

17901.45

Sell

18000 199.35

Buy

17900 247.15

47.80 52.20 17947.80

Sell 18000 199.35

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17700 273.60

39.90

60.10

17660.10

Sell

17600 233.70

Buy 17700 273.60

76.60

123.40

17623.40

Sell 17500 197.00

Buy

17600 233.70

36.70 63.30 17563.30

Sell 17500 197.00

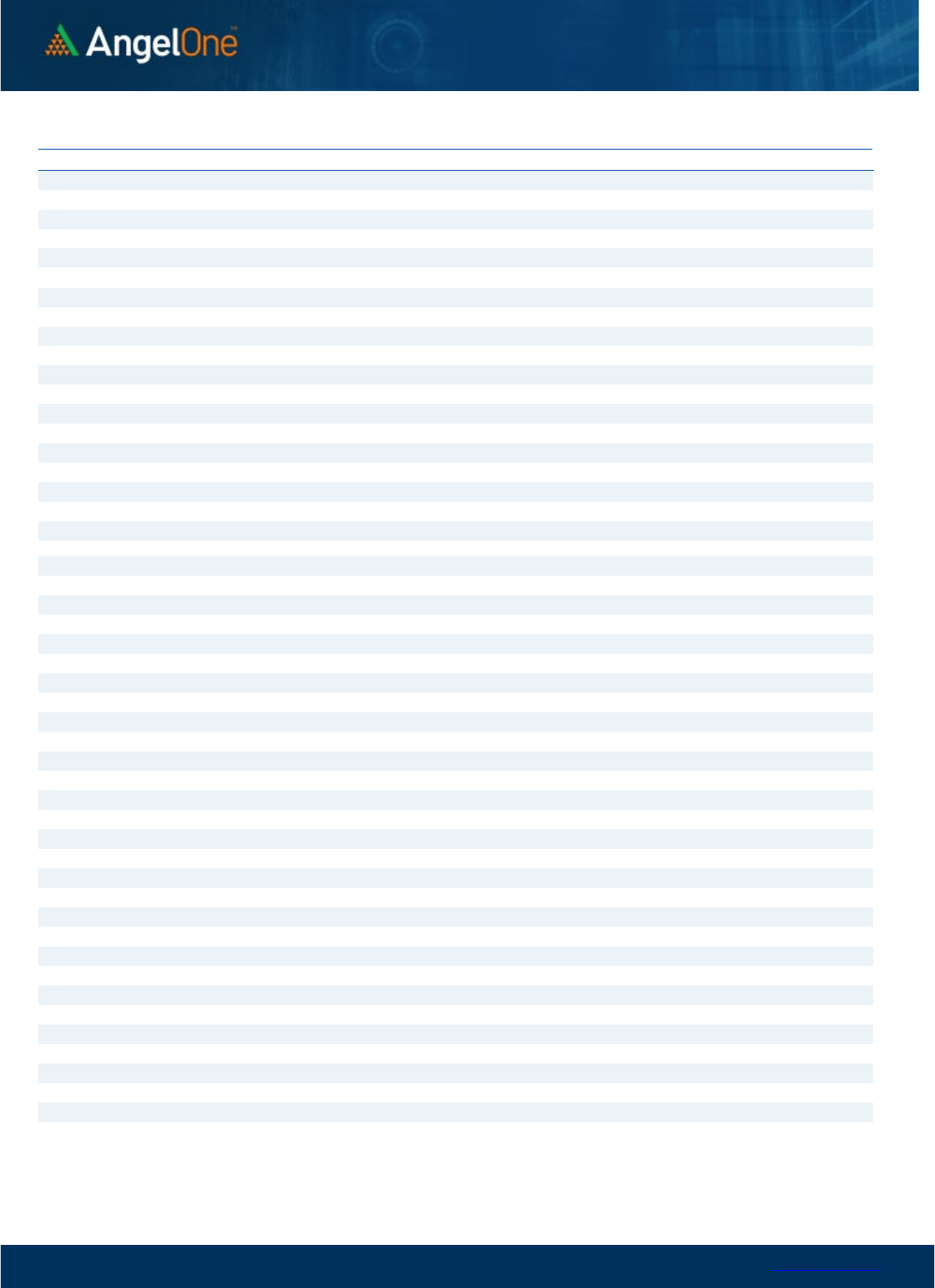

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

OCT 31, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT 3,246 3,285

3,336

3,375 3,427

ADANIPORTS

807

813

824

831

842

APOLLOHOSP 4,353 4,460

4,522 4,629

4,691

ASIANPAINT 3,023 3,038

3,055 3,070 3,087

AXISBANK

888

895

907

914

926

BAJAJ-AUTO 3,586 3,628

3,674 3,716

3,762

BAJFINANCE

6,916

6,961

7,026

7,071

7,136

BAJAJFINSV

1,624

1,639

1,650

1,664

1,675

BPCL

298

301

305

307

311

BHARTIARTL

804

811

818 824 831

BRITANNIA

3,707

3,742

3,767

3,802 3,827

CIPLA 1,139 1,147

1,159 1,168

1,180

COALINDIA 237 241

244

248

252

DIVISLAB 3,476 3,512

3,576

3,611

3,675

DRREDDY

4,391

4,426

4,464

4,498 4,537

EICHERMOT

3,663

3,704

3,739

3,780

3,815

GRASIM

1,632

1,658

1,698

1,724

1,764

HCLTECH 1,018 1,024

1,032

1,038

1,046

HDFCBANK

1,438

1,448

1,458

1,468

1,477

HDFCLIFE

523

527

532

535

540

HDFC

2,359

2,380

2,400

2,421

2,441

HEROMOTOCO

2,592

2,621

2,648

2,676

2,703

HINDALCO

393

399

406

412

418

HINDUNILVR 2,490 2,507

2,529

2,546 2,568

ICICIBANK

886

897

912

923

939

INDUSINDBK 1,125 1,136

1,149

1,160

1,172

INFY

1,495

1,504

1,516 1,525

1,537

ITC

343

344

347

348

350

JSW STEEL

656

663

671

678

686

KOTAKBANK

1,860

1,872

1,883

1,896

1,907

LT

1,953

1,964

1,975

1,986

1,997

M&M

1,280

1,296

1,306

1,322

1,332

MARUTI 8,866 9,179

9,365

9,678

9,863

NESTLEIND 19,913 20,098

20,235 20,420

20,557

NTPC 168 171

173

176

178

ONGC 130 132

134

136

138

POWERGRID

221

224

226

229

232

RELIANCE

2,431

2,479

2,507 2,554 2,582

SBILIFE

1,233

1,243

1,254

1,264

1,275

SBIN

558

564

573

580

589

SUNPHARMA

978

984

994

1,000

1,010

TCS

3,129

3,146

3,162

3,180

3,196

TATACONSUM

751

756

765

770

779

TATAMOTORS

404

407

409

412

414

TATASTEEL 99 100

102 104

106

TECHM

1,022

1,036

1,058

1,072

1,094

TITAN

2,677

2,707

2,723

2,752

2,769

ULTRACEMCO

6,377

6,412

6,441

6,475

6,504

UPL 699 706

711

719

724

WIPRO

380

382

384

385

388

www.angelone.in

Technical & Derivatives Report

OCT 31, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.