December 30, 2021

www.angelone.in

Technical & Derivatives Report

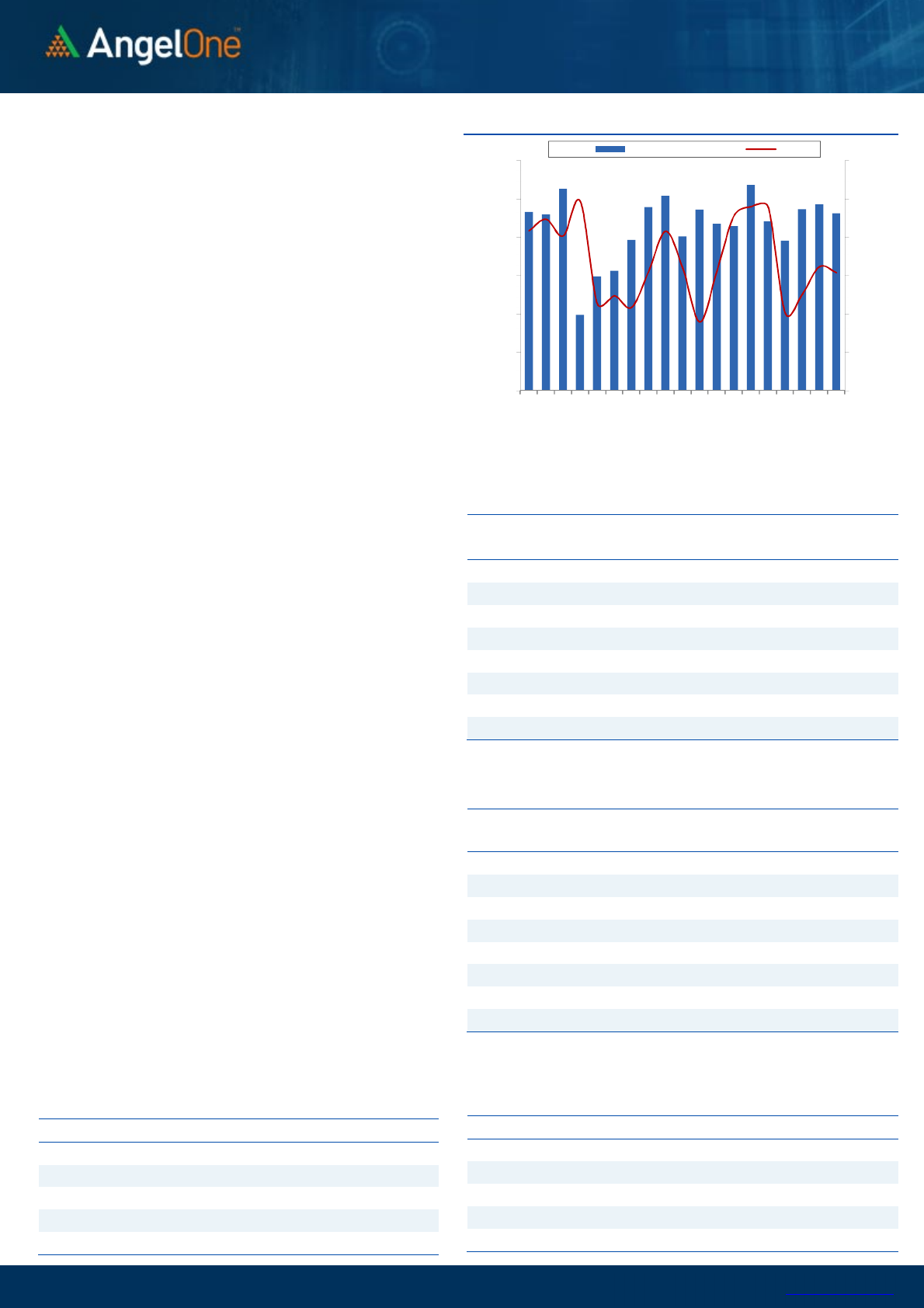

Nifty Bank Outlook - (35045)

NIFTY BANK has seen a lackluster day of trade, as it is being

ranged bound from the past two consecutive sessions and

finding difficulties to surge above the long-awaited resistance

zone of its 200 DEMA. However, the index managed to sustain

above the 35000 mark but has lost traction from the market

participants.

On the technical chart, the index is placed at the supporting

trend-line of the previous swing lows, and any breach below the

same could further drag the index towards the 34000 mark. On

the oscillator front, MACD is hovering in a negative trajectory

suggesting inherent weakness. The trend is expected to persist

until a decisive close above the long-term exponential moving

average occurs. At the current juncture, 35500-35700 hold the

crucial resistance zone, while on the flip side, 34000 is expected

to act as an immediate support zone.

Key Levels

Support 1 – 34500 Resistance 1 – 35500

Support 2 – 34400 Resistance 2 – 35700

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

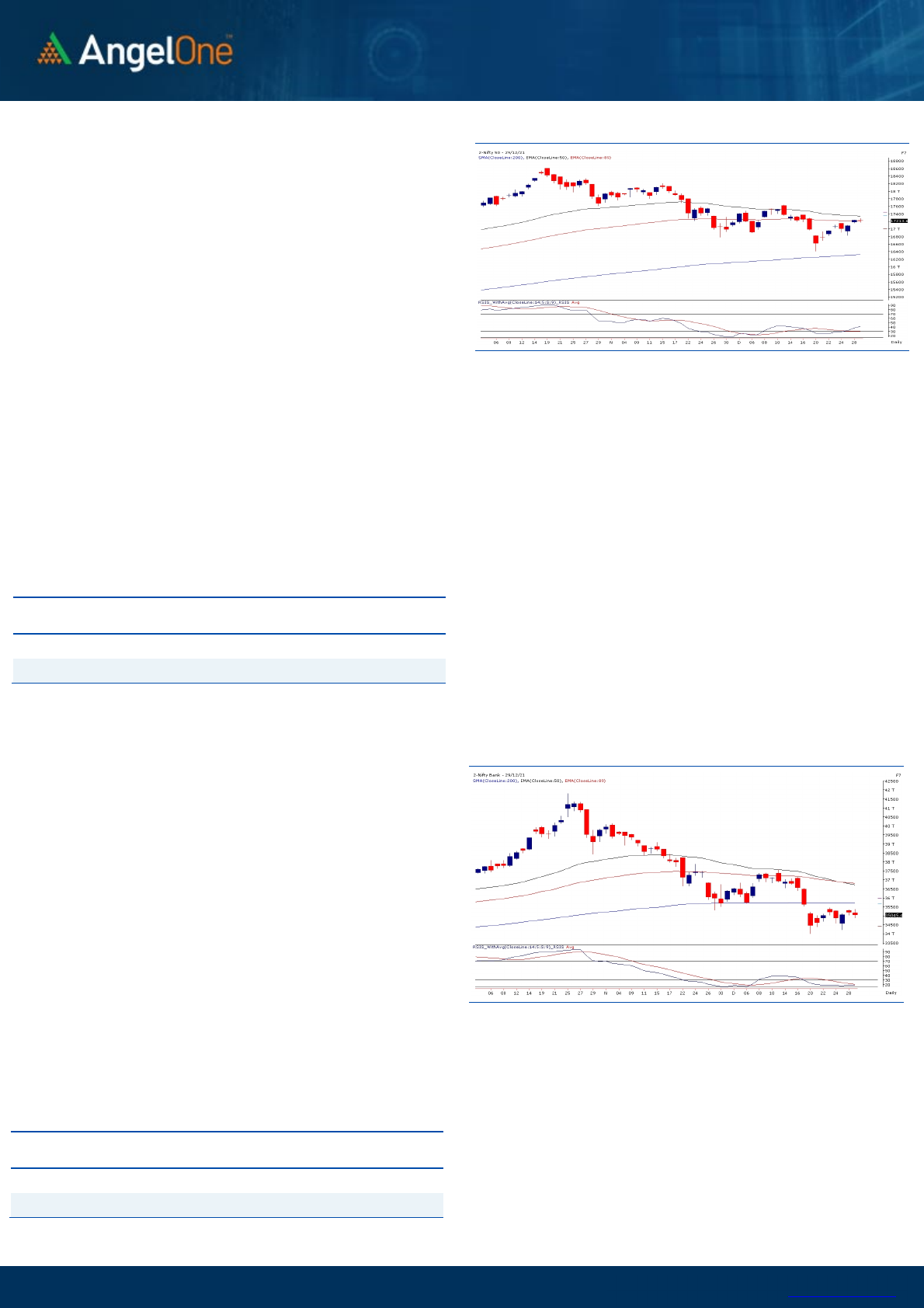

Sensex (57806) / Nifty (17214)

We had a muted start to yesterday’s session in the absence of

any major trigger on the global as well as domestic front. In the

initial hour, we did move towards 17300 but this attempt

eventually failed as we witnessed some profit booking at higher

levels. Although, market saw a small dip towards the end, the

Nifty managed to defend the 17200 mark on a closing basis.

Now, as we are approaching the monthly expiry and the year-

end too, we are not seeing any major action in key indices. Since

we have entered a strong resistance zone of 17200 – 17300, there

is no sufficient force available to go beyond it. On the flipside, key

supports are being tested but are defended too successfully. We

expect similar sort of action in the coming session as well and

despite being a monthly expiry, the volatility is likely to remain

on the lower side. As far as supports are concerned, 17160 – 17100

are to be considered as immediate support and resistance

remains at 17300. We advise traders to continue with a stock

specific approach as we are seeing good traction in individual

pockets.

Key Levels

Support 1 – 17100 Resistance 1 – 17300

Support 2 – 17000 Resistance 2 – 17400

www.angelone.in

Technical & Derivatives Report

December 30, 2021

View

One day ahead of the monthly expiry, we had a muted

start and almost throughout the day, it remained as it

as. We did made an early attempt towards 17300

which got sold into but at the same time, the bias

wasn’t bearish also; because we did manage to

defend 17200 with an ease. Overall it was a day of

consolidation for key indices as we are approaching

the year end now.

FIIs were net sellers in the cash market segment to

the tune of Rs. 975 crores. In index futures, they sold

worth Rs. 162 crores with rise in open interest

indicating short positions created in yesterday’s

session.

In F&O space, we observed some buying interest in

both indices after a quite some time which is indeed

an encouraging sign. FIIs too preferred covering few

of their shorts and added fresh longs. The call writers

of 17300-17500 strikes seems to have piled up their

positions and on the other side, 17100-17200 puts

added some fresh positions. Highest open interest

concentration is now placed at 17000 put and 17500

call options. Considering the derivatives activity, till

the time we are holding onto the support zone of

17100-17150, we would advocate using declines to add

fresh longs. For the expiry session, one can look to

buy ATM call towards the mentioned zone but at the

same time, one should take some money off that table

if we reaches the higher end of the range.

Comments

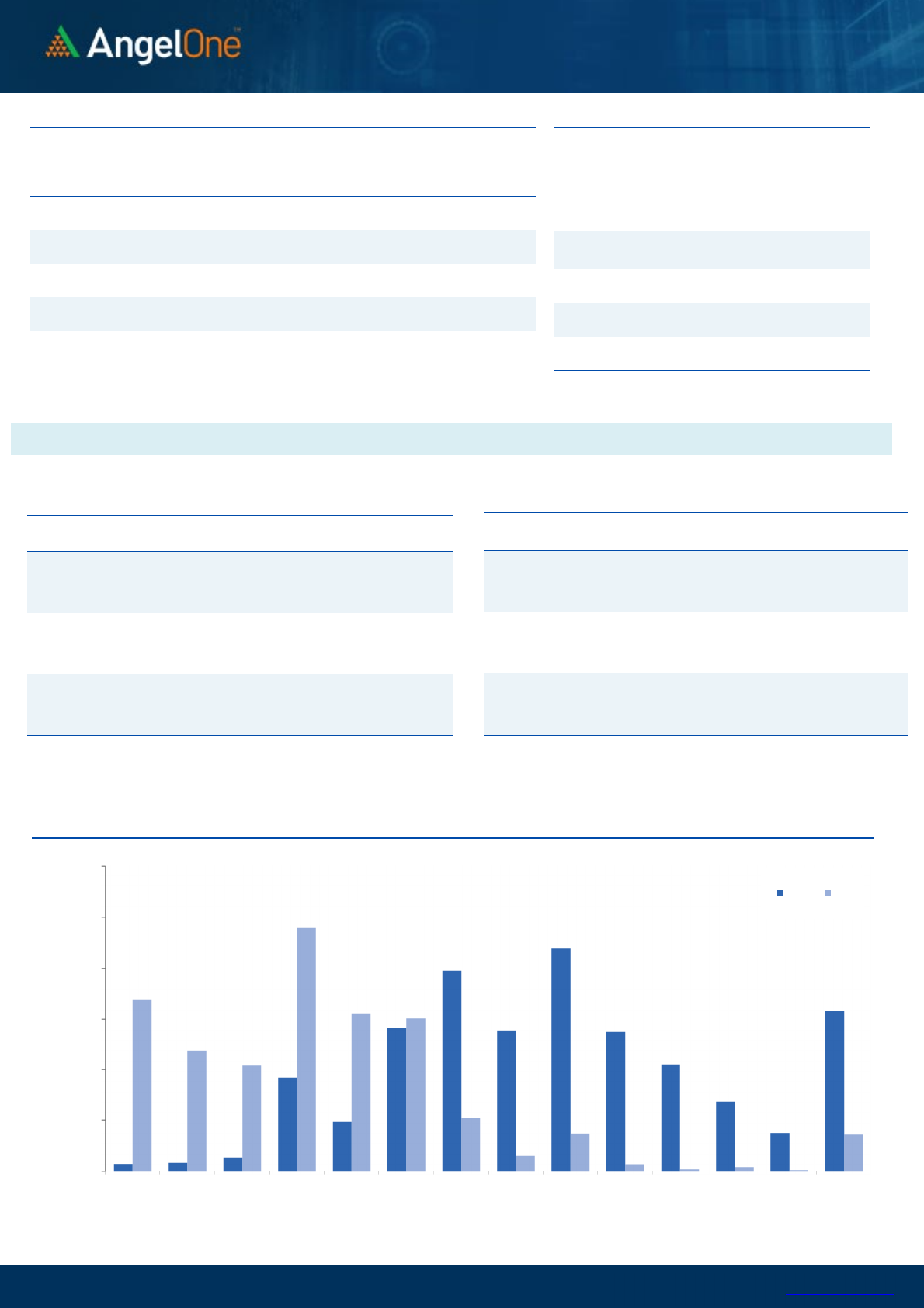

The Nifty futures open interest has decreased by 0.96%.

and BANK Nifty futures open interest has increased by

2.56 % as market closed at 17213.60 levels.

The Nifty December future closed with a premium of 2.3

point against a premium of 13.5 point in last trading

session. The January series closed at a premium of

49.75 point.

The INDIA VIX decreased from 16.47 to 16.24. At the

same time, the PCR-OI of Nifty has decreased from 1.34

to 1.19

Few of the liquid counters where we have seen high

cost of carry are ADANIENT, IBULHSGFIN, FSL,

INDIAMART, AND TRENT

Historical Volatility

SCRIP HV

JKCEMENT

42.89

BAJAJ-AUTO

31.47

EICHERMOT

38.43

SUNPHARMA

34.66

LAURUSLABS

51.10

Nifty Vs OI

16600

16800

17000

17200

17400

17600

17800

10,000

10,500

11,000

11,500

12,000

12,500

13,000

11-22 11-2411-2611-30 12-2 12-6 12-8 12-1012-2712-29

(`000)

Openinterest

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

JKCEMENT

420350 43.66 3202.20 -5.38

POWERGRID

36275066 27.19 204.60 -0.17

ASTRAL

581625 16.27 2276.05 1.68

EICHERMOT

3363150 7.45 2562.25 3.12

ATUL

49875 6.06 8898.70 0.72

L&TFH

74470780 4.12 77.95 -0.45

BANKBARODA

153960300 4.08 80.95 0.06

PEL

3295325 3.99 2615.65 0.52

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

SYNGENE

1036150 -13.97 606.10 1.56

MRF

64760 -13.75 72559.35 1.26

GSPL

1018300 -12.30 294.30 -0.73

CUMMINSIND

1413000 -9.25 938.90 -0.08

DIXON

431250 -9.19 5555.05 -0.67

AARTIIND

2115650 -8.73 994.15 0.42

IPCALAB

2511225 -8.12 2119.85 1.50

COFORGE

728000 -7.96 5649.10 -0.26

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

1.19 1.01

BANKNIFTY

0.72 0.97

RELIANCE

0.57 0.49

ICICIBANK

0.56 0.44

INFY

0.97 0.81

www.angelone.in

Technical & Derivatives Report

December 30, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Spot = 17213.60

FII Statistics for December 29, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

(%)

INDEX

FUTURES

5570.47 5732.12 (161.65) 175520 15215.31 9.75

INDEX

OPTIONS

478975.67 474342.27 4633.40

1977629 171112.25 8.01

STOCK

FUTURES

27846.91 28111.36 (264.45) 1713995 120666.36 (0.35)

STOCK

OPTIONS

14513.98 14330.54 183.44

317373 22616.24 0.15

Total

526907.03

522516.29

4390.74

4184517

329610.16

3.89

Turnover on December 29, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

374904 32638.15 9.96

Index Options

67763574 5914432.65

20.75

Stock Futures

1748974 124925.74

-9.18

Stock Options

2272798 169104.03

-22.18

Total

7,21,60,250 6241100.57

18.15

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17200 69.70

46.00 54.00 17246.00

Sell

17300 23.70

Buy

17200 69.70

63.90 136.10 17263.90

Sell

17400 5.80

Buy

17300 23.70

17.90 82.10 17317.90

Sell

17400 5.80

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17200 100.05

50.95 49.05 17149.05

Sell

17100 49.10

Buy

17200 100.05

79.55 120.45 17120.45

Sell

17000 20.50

Buy

17100 49.10

28.60 71.40 17071.40

Sell

17000 20.50

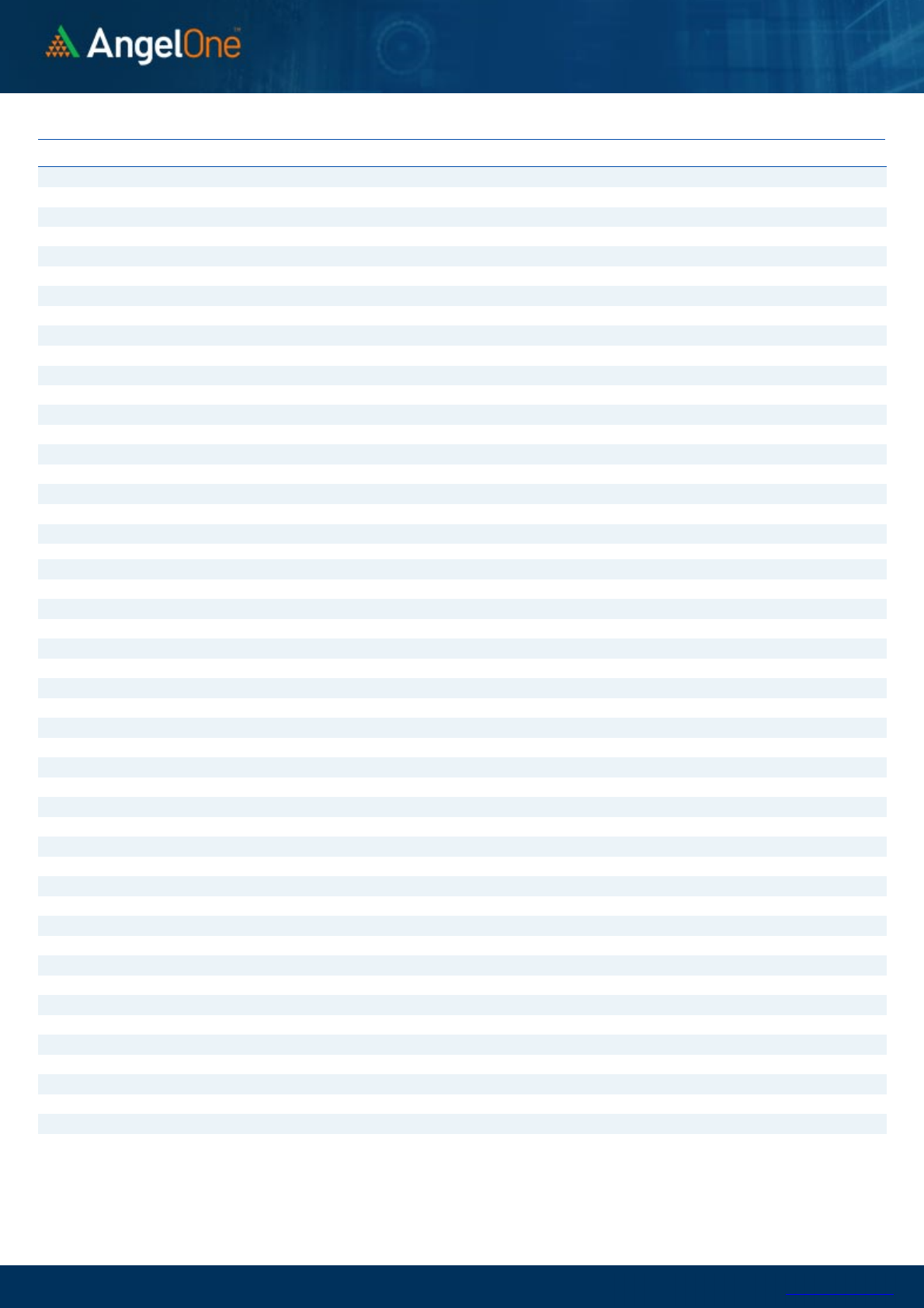

Nifty Put-Call Analysis

,0

2000,000

4000,000

6000,000

8000,000

10000,000

12000,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

December 30, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 712 717

726 731 740

ASIANPAINT 3,327 3,347

3,367 3,387 3,406

AXISBANK 660 665

672 678 685

BAJAJ-AUTO 3,111 3,187

3,228 3,304 3,345

BAJFINANCE 6,808 6,860

6,905 6,957 7,002

BAJAJFINSV 15,818 16,033

16,182 16,397 16,546

BPCL 375 378

380 384 386

BHARTIARTL 670 673

678 682 687

BRITANNIA 3,507 3,533

3,552 3,578 3,596

CIPLA 924 930

939 944 953

COALINDIA 144 146

147 149 150

DIVISLAB 4,480 4,551

4,588 4,659 4,697

DRREDDY 4,704 4,769

4,808 4,873 4,913

EICHERMOT 2,433 2,498

2,535 2,599 2,636

GRASIM 1,573 1,589

1,614 1,630 1,655

HCLTECH 1,267 1,280

1,289 1,302 1,311

HDFCBANK 1,440 1,447

1,454 1,461 1,468

HDFCLIFE 636 640

644 648 651

HDFC 2,535 2,549

2,565 2,579 2,595

HEROMOTOCO 2,396 2,415

2,429 2,447 2,461

HINDALCO 447 451

454 458 461

HINDUNILVR 2,286 2,297

2,309 2,319 2,332

ICICIBANK 724 730

738 743 751

IOC 110 111

112 112 113

INDUSINDBK 845 858

866 879 887

INFY 1,868 1,877

1,885 1,894 1,903

ITC 214 215

218 219 222

JSW STEEL 640 648

653 660 665

KOTAKBANK 1,740 1,752

1,766 1,778 1,792

LT 1,879 1,887

1,898 1,906 1,917

M&M 823 828

836 840 848

MARUTI 7,194 7,272

7,319 7,397 7,443

NESTLEIND 19,168 19,284

19,367 19,483 19,567

NTPC 121 122

123 125 126

ONGC 136 137

139 141 142

POWERGRID 201 203

204 206 208

RELIANCE 2,364 2,383

2,401 2,420 2,438

SBILIFE 1,156 1,171

1,182 1,196 1,207

SHREECEM 26,322 26,469

26,607 26,754 26,892

SBIN 445 450

456 461 467

SUNPHARMA 806 822

833 849 860

TCS 3,665 3,680

3,700 3,715 3,735

TATACONSUM

716 721

725 730 734

TATAMOTORS 470 473

477 480 485

TATASTEEL 1,098 1,107

1,117 1,126 1,136

TECHM 1,759 1,773

1,797 1,811 1,835

TITAN 2,350 2,376

2,396 2,422 2,442

ULTRACEMCO 7,332 7,376

7,418 7,463 7,505

UPL 747 753

760 766 773

WIPRO 695 699

705 709 715

www.angelone.in

Technical & Derivatives Report

December 30, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial

interest in the subject company. Research analyst has not served as an officer, director or employee of the subject company.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelbroking.com