July 29, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

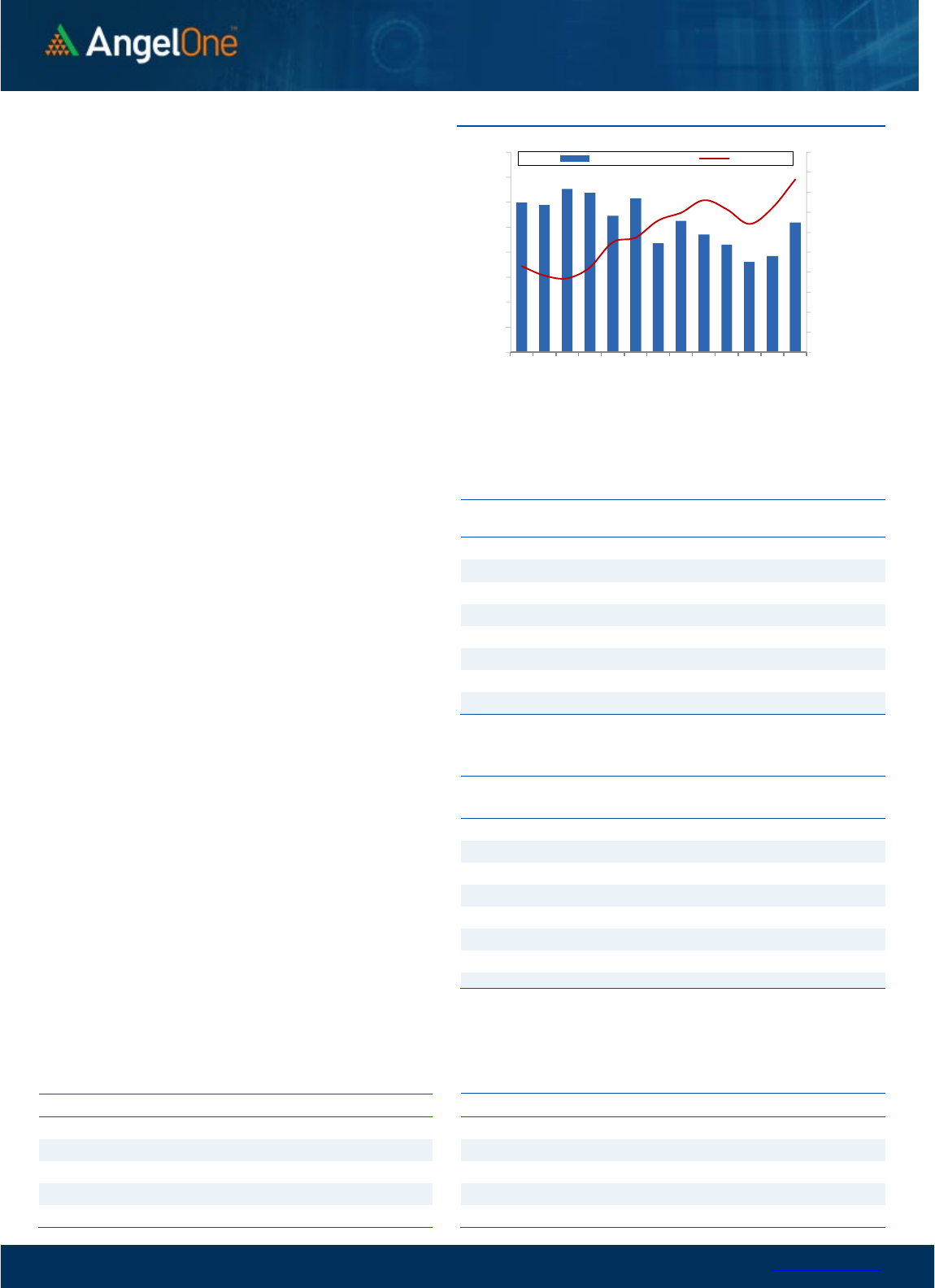

Nifty Bank Outlook - (37378)

Bank Nifty as well started the expiry session with a huge gap up

opening, and with positive momentum throughout the day ended with

gains of over 1.50% at 37378.

The bank nifty has witnessed a remarkable run for the July series as it

rallied more than 11% and has been the charioteer of the recent up

move. During this run, bulls broke above crucial resistance one by one

and are now placed in a very strong position. With a day to go for the

weekly candle to complete, prices have already broken above a trend

line resistance formed by joining all-time high to the recent lower tops;

confirmation of this breakout can fuel a rally in August month as well.

Having said that, traders are advised not to be complacent and keep

booking timely profits as the oscillators have entered the overbought

zone and inbetween bouts of profit booking cannot be ruled out. The

ideal strategy would be to have a stock-specific approach and for

index-specific trades, they should prefer dips to add longs. As far as

levels are concerned, immediate support is placed at 37000 - 36800

levels whereas resistance is at 37500 - 38000 levels.

Key Levels

Support 1 – 37000 Resistance 1 – 37500

Support 2 – 36800 Resistance 2 – 38000

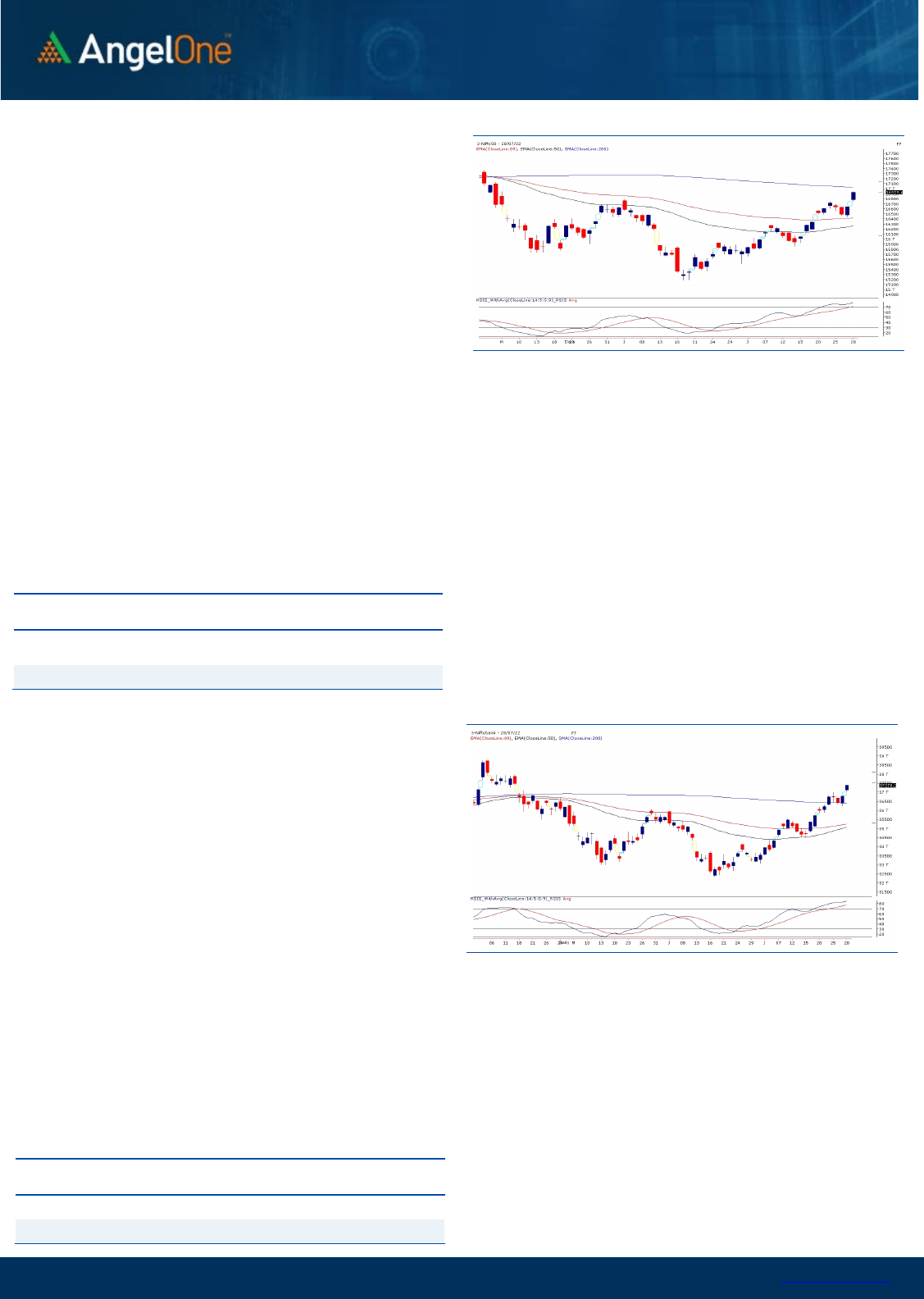

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (56858) / Nifty (16930)

US Fed chairman did not shock the markets this time as they announced

a rate hike of 75 bps which was very much in line with expectations. In

fact, the dovish commentary lifted the overall sentiments in US

markets, which had a favorable rub off effect in our markets at the

opening yesterday. We started the session with a decent bump up

above the 16750 mark, which kept on accelerating as the day

progressed. Eventually, the benchmark index Nifty managed to close at

3-month high by adding more than 1.70% to the previous close.

Our market had shown a glimpse of some strength during Wednesday’s

session and with global market boost, we managed to extend the move

beyond the 16900 mark. With yesterday’s strong rally, 17000 is very

much in sight now which is also closer to the ‘200-SMA’ level of 17030.

Most likely, we would see index hastening towards this junction in the

coming session as well and then we’ll have to see whether market

participants opts to take some money there or they continue to move

towards 17200. In our sense, the bias remains strongly bullish and any

decline towards 16830 – 16750 should be used to go long. However

having said that, it’s advisable not to get too complacent at this

juncture and hence, one needs to follow one step at a time strategy.

Key Levels

Support 1 – 16830 Resistance 1 – 17030

Support 2 – 16750 Resistance 2 – 17200

Apart from this, we witnessed a good broad based participation in

last couple of days and hence, one should keep focusing on such

potential candidates who are likely to outperform the key indices

going forward.

www.angelone.in

Technical & Derivatives Report

July 29, 2022

View

Our market has seen a strong day of trade on the

expiry session amid favorable global conditions. The

benchmark index Nifty50 gained over 1.70 percent to

close a tad above 16900 levels.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1638 crores. Simultaneously, in Index

futures, they bought worth Rs. 1797 crores with a

decrease in open interest, indicating short covering.

Looking at the F&O data, we have witnessed short

covering in both indices on the expiry day. Rollover for

Nifty stood at 76%; which is higher than previous series

and in case of banking index it’s slightly lower at 82%.

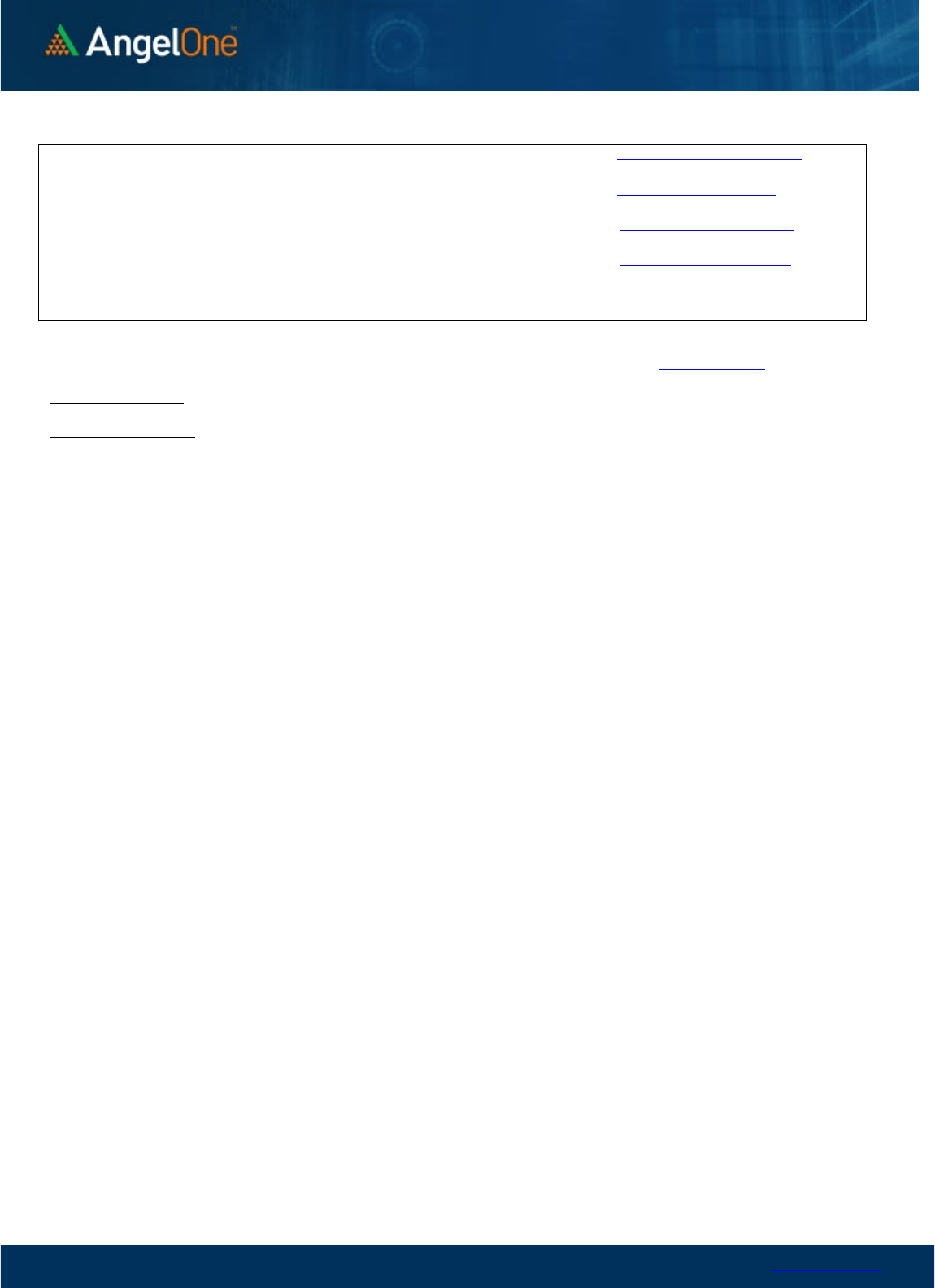

In NIFTY options, the concentration of OI is seen at the

16800-16700 put strikes, which is likely to be seen as

immediate support. While on the contrary, a

considerable OI concentration is built on the 17000 call

strike, which is expected to act as the primary

resistance for the index. Considering the recent

developments and price action, our market is likely to

remain upbeat, wherein any minor correction could be

utilized to add long positions. Also, it is advisable to

look for opportunities outside the index and stay

abreast with global developments.

Comments

The Nifty futures open interest has decreased by

15.76%. and BANK Nifty futures open interest has

decreased by 25.8% as the market closed at 16929.60.

The Nifty Aug future closed with a premium of 25.60

point against a premium of 11.50 point in the last

trading session. The Sep series closed at a premium

of 70.45 point.

The INDIA VIX decreased from 18.13 to 17.01. At the

same time, the PCR-OI of Nifty has increased from

1.24 to 1.43.

Few of the liquid counters where we have seen high

cost of carry are BAJFINANCE, BAJAJFINSV,

IBULHSGFIN, BIOCON and NESTLEIND.

Historical Volatility

SCRIP HV

IDEA 86.03

IBULHSGFIN 76.66

RBLBANK 73.37

ZEEL 66.70

HINDCOPPER 66.47

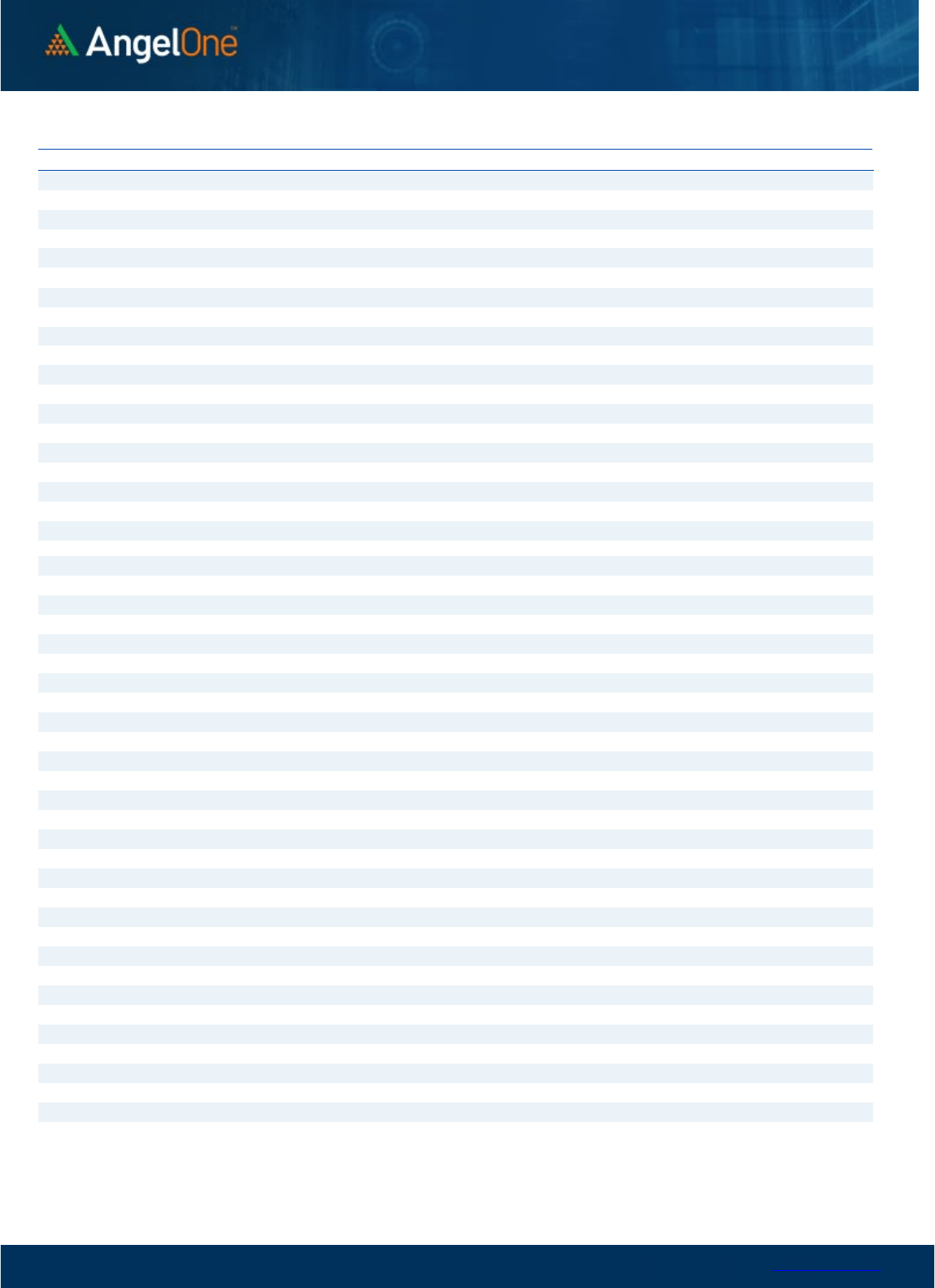

Nifty Vs OI

15200

15400

15600

15800

16000

16200

16400

16600

16800

17000

17200

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

7/12 7/14 7/18 7/20 7/22 7/26 7/28

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BIOCON 17231600 19.47 306.75 -5.03

SBICARD 6996000 15.37 929.20 4.52

DIXON 744375 6.78 3578.50 -3.57

LAURUSLABS 6621300 5.51 525.25 2.15

ASTRAL 691075 5.06 1791.85 0.29

HDFCLIFE 30991400 4.29 531.65 2.35

M&MFIN 24760000 3.43 197.20 -0.58

BALRAMCHIN 6507200 2.34 383.80 2.27

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IBULHSGFIN 21360000 -48.29 114.75 12.08

ONGC 45957450 -39.24 130.25 1.59

CUB 5240000 -38.28 161.15 0.28

CONCOR 4008000 -32.93 686.05 0.79

COALINDIA 31941000 -31.01 202.85 -0.37

M&M 10845100 -29.90 1149.15 1.21

ACC 2077000 -29.42 2180.80 -0.42

DELTACORP 13751700 -27.89 193.25 0.34

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.43 1.00

BANKNIFTY 1.09 0.90

RELIANCE 0.58 0.38

ICICIBANK 0.72 0.46

INFY 0.66 0.40

www.angelone.in

Technical & Derivatives Report

July 29, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot = 16

,

929

.

6

0

FII Statistics for

July

2

8

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

8437.42 6640.09 1797.33

115923 10094.20 (26.80)

INDEX

OPTIONS

1838280.83 1835046.14 3234.69

761561 65914.09 (53.52)

STOCK

FUTURES

25745.50 24731.94 1013.56

2127195 141436.39 (6.27)

STOCK

OPTIONS

5513.41 5581.54 (68.13) 35764 2413.83 (75.41)

Total 1877977.16

1871999.71

5977.45

3040443

219858.51

(27.81)

Turnover on

July

2

8

, 2022

Instrument

No. of

Contracts

Turnov

er

( in Cr.

)

Change

(%)

Index Futures

643627 56453.94 37.98

Index Options

252822959 22543435.75 120.73

Stock Futures

2381818 156274.27 12.61

Stock Options

3659778 252825.95 -8.49

Total

36,59,778 252825.95 115.66

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

16900 323.15

53.60

46.40

16953.60

Sell

17000 269.55

Buy

16900 323.15

100.10

99.90

17000.10

Sell

17100 223.05

Buy

17000 269.55

46.50 53.50 17046.50

Sell

17100 223.05

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 16900 273.10

37.95

62.05

16862.05

Sell

16800 235.15

Buy 16900 273.10

73.45

126.55

16826.55

Sell 16700 199.65

Buy

16800 235.15

35.50 64.50 16746.50

Sell

16700 199.65

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

16200 16300 16400 16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500

Call Put

www.angelone.in

Technical & Derivatives Report

July 29, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

753

759

764

770

775

APOLLOHOSP

4,106

4,148

4,177

4,219

4,248

ASIANPAINT

3,147

3,210

3,245 3,308 3,343

AXISBANK

717

721

728

732

738

BAJAJ-AUTO 3,806 3,832

3,873 3,899

3,940

BAJFINANCE

6,315

6,696

6,903 7,284

7,491

BAJAJFINSV 12,741 13,692

14,457

15,408

16,174

BPCL

319

322

326

329

333

BHARTIARTL

655

661

670

676

685

BRITANNIA

3,817

3,843

3,863 3,889 3,908

CIPLA

955

961

970

976

985

COALINDIA

199

201

203

205

207

DIVISLAB 3,743 3,797

3,828

3,881

3,913

DRREDDY

4,137

4,198

4,257

4,318

4,377

EICHERMOT 3,006 3,030

3,055

3,079

3,104

GRASIM

1,523

1,537

1,552

1,566

1,581

HCLTECH 926 936

943

953

959

HDFCBANK

1,404

1,411

1,417

1,424

1,430

HDFCLIFE 513 522

529

539

545

HDFC

2,307

2,323

2,334 2,349

2,361

HEROMOTOCO

2,725

2,753

2,782

2,810

2,840

HINDALCO

382

387

391

396 401

HINDUNILVR 2,570 2,595

2,610

2,635

2,650

ICICIBANK

802

808

812 818

822

INDUSINDBK

978

998

1,009

1,029

1,040

INFY

1,476

1,497

1,511

1,531

1,545

ITC 301 302

304

305

306

JSW STEEL

592

604

616

628

639

KOTAKBANK

1,742

1,785

1,808

1,852

1,875

LT

1,772

1,787

1,801

1,816

1,830

M&M 1,129 1,139

1,146

1,156

1,162

MARUTI 8,565 8,643

8,707 8,785

8,848

NESTLEIND

18,087

18,600

18,972

19,485

19,857

NTPC 148 149

150 151

152

ONGC

127

129

130 131

132

POWERGRID

208

211

213

216

218

RELIANCE 2,402 2,429

2,449

2,476

2,496

SBILIFE 1,130 1,161

1,178

1,208

1,225

SHREECEM

19,110

19,763

20,692

21,345

22,275

SBIN

525

529

533

537 541

SUNPHARMA

872

883

890

902

908

TCS

3,180

3,220

3,242 3,282

3,304

TATACONSUM

794

800

805

811 816

TATAMOTORS 418 430

440

452 461

TATASTEEL 95 98

100 103 105

TECHM

1,004

1,021

1,032

1,049

1,060

TITAN

2,291

2,313

2,327

2,349 2,364

ULTRACEMCO

6,377

6,424

6,492

6,539

6,607

UPL

715

721

726

733

737

WIPRO

409

412

415 418 421

www.angelone.in

Technical & Derivatives Report

July 29, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.