March 29, 2023

www.angelone.in

Technical & Derivatives Report

Nifty Bank

Outlook (

39

568

)

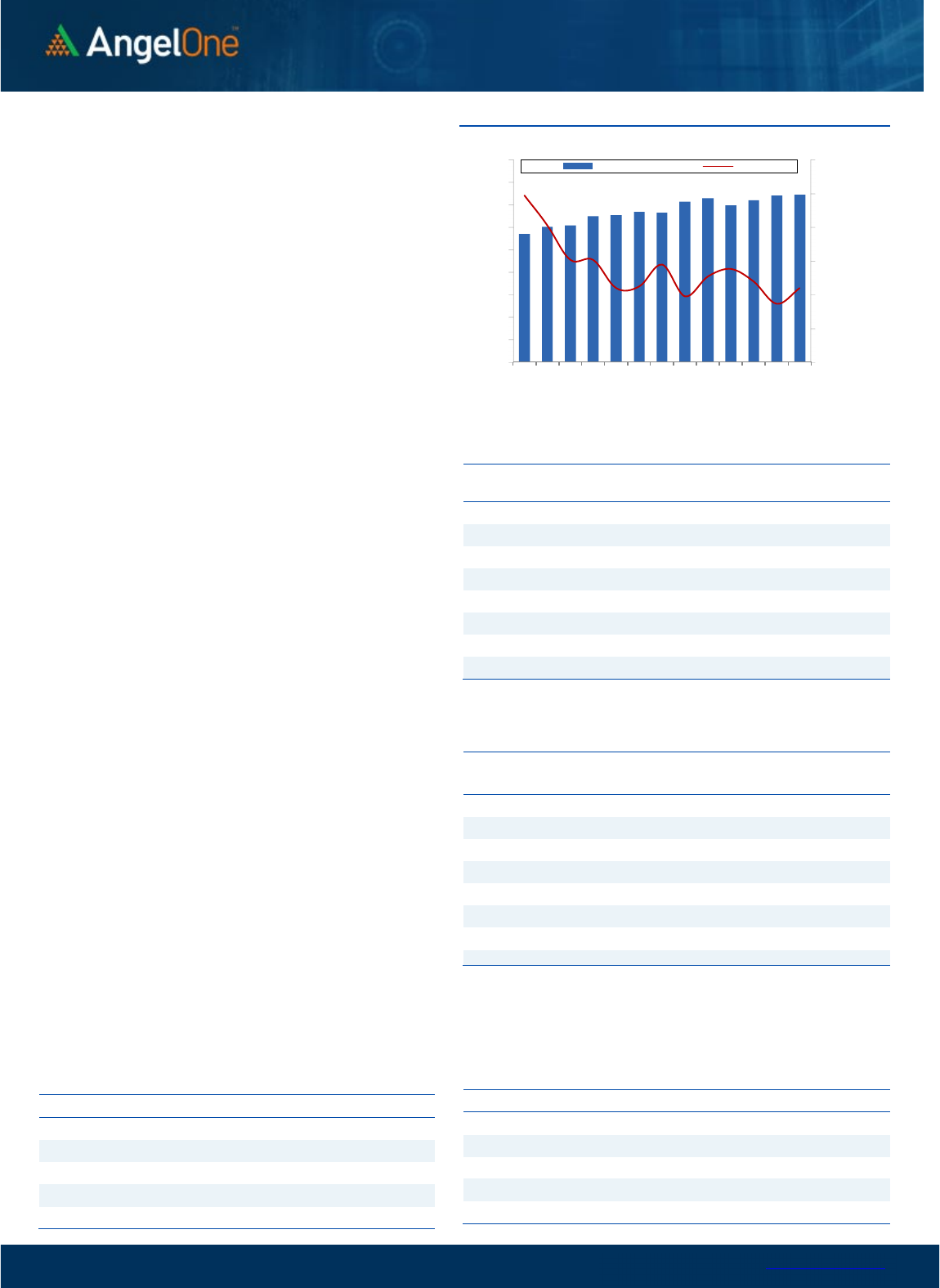

Bank Nifty began positively but lacked follow-up buying in the

morning session, resulting in prices remaining within a range for

most of the day. However, during the last hour, prices gained

strong traction and ended at the day's highest point, up 0.35% at

39,568.

Yesterday, the Bank Index managed to defend the low of the Doji

pattern formed on Monday, thanks to heavyweight private banks.

As a result, once again, Bank Nifty outperformed. The recent price

action has resulted the trading range getting coiled, waiting for a

burst of momentum. Yesterday, prices ended slightly below the

breakout levels of a higher range, and it would be interesting to see

how prices react in the coming session. On the monthly expiry, the

key resistance level would be 39,700-39,800, beyond which further

traction could be seen towards 40,000 and then 40,200. On the

downside, the support has shifted higher towards 39,200-39,000

for the expiry session. Traders should monitor these levels and

trade accordingly. It is also advisable to avoid aggressive bets

ahead of the mid-week holiday.

Key Levels

Support 1 – 39200 Resistance 1 – 39800

Support 2 – 39000 Resistance 2 – 40000

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Intra-day Chart

Sensex (

57

6

1

4

) / Nifty (

169

52

)

The Indian equity market had a lackluster day of trade amid the

absence of buying interest. Despite a positive start, suggested by

the SGX Nifty, bulls lacked the confidence to capitalize on the move

and the benchmark index hustled in a slender range throughout the

day. Amidst the dull day, Nifty corrected 0.20 percent from its

previous day’s close and settled slightly above the 16950 level.

On the technical front, no sign of respite was seen in the index as it

struggled in a tight range. There have been no significant changes in

the chart structure, showcasing the timidity among the market

participants. As far as levels are concerned, 16900 remains the

immediate support, followed by the sacrosanct support of the

16850-16800 zone. While on the higher end, 17100-17200 is likely

to act as the sturdy wall, and an authoritative breach beyond the

same could only trigger some more respite in the comparable

period.

Key Levels

Support 1 – 16850 Resistance 1 – 17100

Support 2 – 16800 Resistance 2 – 17200

Going forward, we would advocate the participants to keep a

close tab on the mentioned levels and avoid undue risk in the

market. Even though the indices are not doing much, sector

churning is visible in the broader market, and hence one should

focus on identifying such potential movers. In the meanwhile,

stay abreast with global developments.

www.angelone.in

Technical & Derivatives Report

March 29, 2023

View

Tuesday, we had a positive start tad above 17000 but

failed to hold on to the gains post opening to drag

index towards 16900. However, on account of some

respite in final hour we settled the day around

16950.

FIIs turned net buyer in the cash market segment to

the tune of Rs. 1513 crores. Simultaneously, in Index

futures, they sold worth Rs. 931 crores with rise in

open interest, indicating short formation.

In the F&O space, we could hardly any fresh build-up

in key indices. Surprisingly, FIIs turned net buyers in

equities but preferred selling index futures segment.

Their index futures Long Short Ratio has slightly

decreased from 17% to 16%. In index options front,

we observed good amount of writing in 17000-17150

call strikes. On the other side, 16800-16900 put

strikes added some build-up but the quantum

remained insignificant. It’s been more than ten

trading session that index has been grinding in a

range of 16800-17250 and until we don’t see any

sustainable move beyond the mentioned range

traders should avoid stay light especially in index and

find opportunities in individual counters.

Comments

The Nifty futures open interest has decreased by 2.07%

and Bank Nifty futures open interest has decreased by

2.43% as the market closed at 16951.70.

The Nifty March future closed with a premium of 18.90

point against a premium of 51.65 point in the last

trading session. The April series closed at a premium of

121.1 point.

The INDIA VIX has decreased from 15.44 to 15.10. At

the same time, the PCR-OI of Nifty has decreased from

0.85 to 0.80.

Few of the liquid counters where we have seen high

cost of carry are ABCAPITAL, HDFCAMC, AARTIIND,

BIOCON and LICHSGFIN.

Historical Volatility

SCRIP HV

GRANULES 41.87

TORNTPOWER 38.76

BANDHANBNK 48.38

ACC 41.13

IEX 43.19

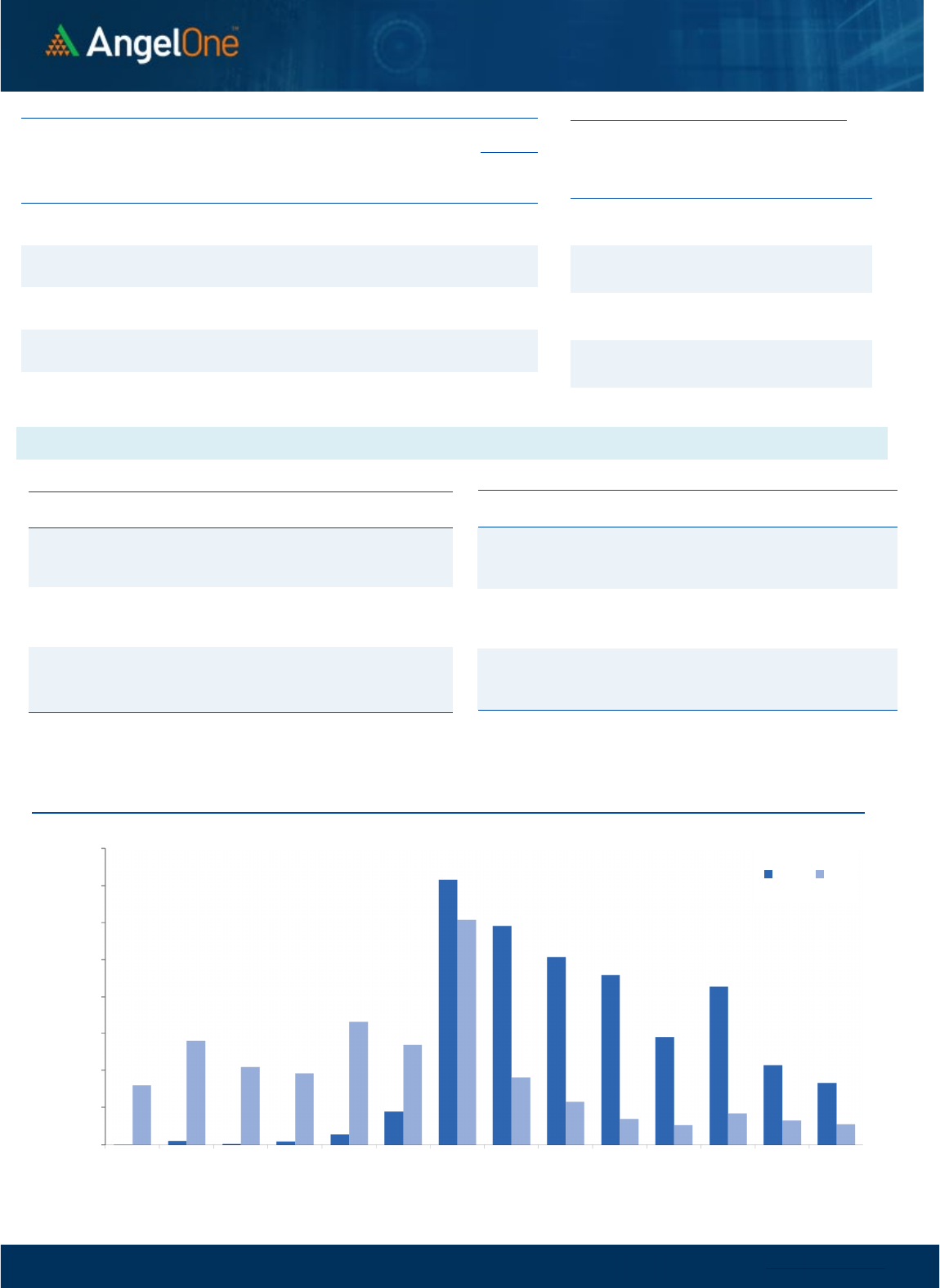

Nifty Vs OI

16600

16800

17000

17200

17400

17600

17800

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

3/9 3/13 3/15 3/17 3/21 3/23 3/27

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ATUL 169275 12.40 6986.25 0.06

DEEPAKNTR 2303500 10.60 1798.15 0.56

SUNTV 9457500 10.38 397.90 -2.82

WHIRLPOOL 1019550 9.63 1322.15 -0.57

MOTHERSON 83598750 8.75 62.90 -1.95

BHEL 76650000 8.68 70.10 -1.33

IDEA 616490000 6.78 5.90 -2.46

BHARATFORG 8342000 6.54 750.20 -0.95

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

FSL 17600 -17.30 107.30 -3.24

MFSL 3610100 -12.89 608.95 -2.20

CROMPTON 5958000 -12.63 295.05 -0.66

OFSS 265000 -11.96 3212.55 -0.50

JKCEMENT 424250 -11.15 2844.85 0.09

M&MFIN 26372000 -10.54 221.40 1.10

TORNTPOWER 2209500 -10.35 511.35 4.58

ASTRAL 2073183 -9.79 1301.30 -1.49

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.80 0.95

BANKNIFTY 0.91 0.98

RELIANCE 0.63 0.64

ICICIBANK 0.79 0.69

INFY 0.50 0.57

www.angelone.in

Technical & Derivatives Report

March 29, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

6

9

51

.70

0900

Lot Size = 75

FII Statistics for

March

2

8

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

7673.50

8604.43

(930.93) 229012

20293.93

2.21

INDEX

OPTIONS

1622095.73

1630676.42

(8580.69) 3159989

282587.54

(2.98)

STOCK

FUTURES

41436.68

41584.09

(147.41) 2256740

144136.92

(0.46)

STOCK

OPTIONS

9964.57

10149.69

(185.12) 162539

10183.89

(10.84)

Total 1681170.48

1691014.63

(9844.15) 5808280

457202.28

(2.06)

Turnover

on

March

2

8

, 202

3

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

478236 43375.18 -15.58

Index

Options

297521233

55019.77 -13.73

Stock

Futures

2175360 134403.53

-12.35

Stock

Options

3276265 2350.67 7.39

Total

3,276,265 2350.67 -13.13

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17000 42.00

29.15

70.85

17029.15

Sell

17100 12.85

Buy

17000 42.00

38.60

161.40

17038.60

Sell

17200 3.40

Buy

17100 12.85

9.45 90.55 17109.45

Sell

17200 3.40

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

16900 30.90

20.25

79.75

16879.75

Sell 16800 10.65

Buy 16900 30.90

27.70

172.30

16872.30

Sell

16700 3.20

Buy

16800 10.65

7.45 92.55 16792.55

Sell 16700 3.20

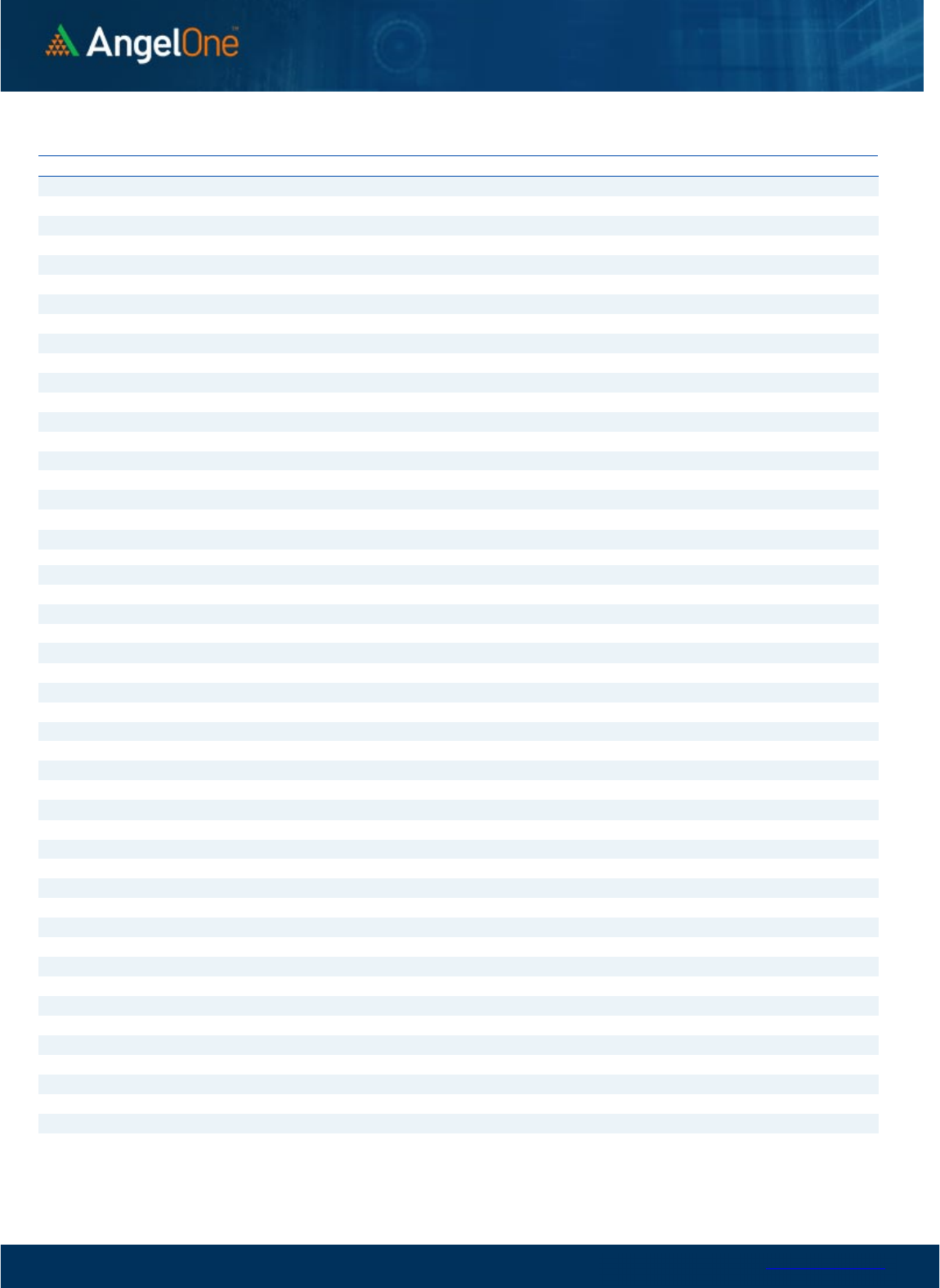

Nifty Put-Call Analysis

,0

2000,000

4000,000

6000,000

8000,000

10000,000

12000,000

14000,000

16000,000

16400 16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700

Call Put

www.angelone.in

Technical & Derivatives Report

March 29, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,476

1,538

1,636

1,698

1,796

ADANIPORTS 541 567

598

624

654

APOLLOHOSP

4,209

4,271

4,307

4,370

4,406

ASIANPAINT

2,741

2,763

2,787

2,808

2,832

AXISBANK 821 827

832

838

843

BAJAJ-AUTO

3,734

3,763

3,798

3,827

3,863

BAJFINANCE

5,459

5,497

5,561

5,598

5,662

BAJAJFINSV

1,196

1,209

1,229

1,242

1,262

BPCL 332 336

339

343

347

BHARTIARTL 729 739

752

762

775

BRITANNIA

4,118

4,159

4,194

4,235

4,271

CIPLA 882 886

890

894

898

COALINDIA 207 208

210

211

212

DIVISLAB

2,740

2,773

2,808

2,842

2,877

DRREDDY

4,451

4,489

4,518

4,556

4,585

EICHERMOT

2,802

2,827

2,861

2,886

2,920

GRASIM

1,578

1,595

1,618

1,635

1,658

HCLTECH

1,024

1,032

1,048

1,057

1,073

HDFCBANK

1,557

1,569

1,576

1,587

1,595

HDFCLIFE

480

485

492

497

503

HDFC

2,551

2,566

2,575

2,589

2,599

HEROMOTOCO

2,205

2,227

2,268

2,290

2,331

HINDALCO 387 390

395

398

403

HINDUNILVR

2,448

2,465

2,489

2,507

2,531

ICICIBANK 843 849

854

860

865

INDUSINDBK 996 1,016

1,027

1,047

1,058

INFY

1,362

1,370

1,384

1,392

1,406

ITC 376 378

380

382

384

JSW STEEL 653 656

660

663

667

KOTAKBANK

1,674

1,686

1,698

1,711

1,722

LT

2,095

2,114

2,142

2,161

2,189

M&M

1,108

1,118

1,134

1,144

1,159

MARUTI

8,019

8,114

8,235

8,330

8,450

NESTLEIND

18,769

18,857

18,939

19,027

19,109

NTPC 169 171

172

173

174

ONGC 144 146

148

149

152

POWERGRID 217 220

221

224

226

RELIANCE

2,228

2,238

2,247

2,257

2,267

SBILIFE

1,077

1,084

1,095

1,103

1,114

SBIN 500 504

508

512

516

SUNPHARMA 971 978

983

989

994

TCS

3,086

3,101

3,125

3,140

3,165

TATACONSUM

686 691

695

700

705

TATAMOTORS 391 397

406

411

420

TATASTEEL 102 102

103

103

103

TECHM

1,042

1,056

1,080

1,095

1,119

TITAN

2,487

2,494

2,500

2,507

2,514

ULTRACEMCO

7,284

7,344

7,428

7,487

7,571

UPL 698 706

711

719

724

WIPRO 350 353

359

362

367

www.angelone.in

Technical & Derivatives Report

March 29, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.