OCT 28, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

Nifty Bank Outlook (41299)

Yesterday too BANKNIFTY had a pleasant start along with the

benchmark. But once again we failed to capitalise on the early

morning lead. The BANKNIFTY kept sulking throughout the session

as it kept sliding gradually after testing the hurdle around 41500.

Due to some modest recovery towards the end, the BANKNIFTY

managed to close with slightly over four tenths of a percent gains.

It seems the banking index is taking a breather before unfolding the

next leg of the rally to enter the uncharted terrain. Although we

are showing some signs of fatigue at higher levels, we continue to

remain upbeat and expect the momentum to resume soon. As far

as levels are concerned, 41000 - 40700 is likely to provide cushion

to any correction; whereas on the flipside, it would be a challenging

task to surpass the stiff hurdles around 41600 - 41800.

Key Levels

Support 1 – 41000 Resistance 1 – 41600

Support 2 – 40700 Resistance 2 – 41800

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (59757) / Nifty (17737)

Our market has seen an optimistic start with a decent gap up on the

expiry trade. But soon after, the index gradually descended towards

the 17650 zone until the bulls retaliated from the support zone at

the fag end and pared down the losses to eventually enter inside

the positive terrain. With such a sharp recovery, Nifty managed to

defend 17700 with some authority by adding nearly half a percent

to the previous close.

On the technical perspective, the crucial support of the 17650 was

firmly safeguarded, implying the resilience of the technical support.

However, some tentativeness was evident on the higher grounds as

the index struggled to breach the 17800 zone in the entire week. In

terms of technical levels, any breach above the mentioned

resistance could surge the market toward the 18000 zone in a

comparable period (which we believe should happen anytime

soon). At the same time, on the lower end, the 17650-17600 could

be seen as immediate support, followed by the sacrosanct support

around the 17500 mark.

Going forward, our market is likely to remain upbeat in the near

term, wherein any minor dip could be seen as an opportunity for

the bulls to add long bets. We may expect gradual moves in key

indices, but individual pockets are performing well. Hence, it’s

advisable to keep focusing on such potential movers, which are

likely to provide better trading opportunities.

Key Levels

Support 1 – 17600 Resistance 1 – 17850

Support 2 – 17500 Resistance 2 – 17940

www.angelone.in

Technical & Derivatives Report

OCT 28, 2022

View

On the monthly expiry session, the benchmark index

opened on a strong note around 17750 but failed to

sustain at higher levels to hit intraday lows of 17654.50

in the final hour. Due to sharp recovery in the last

couple of minutes, the index managed to conclude tad

above 17700.

FIIs were net buyers in the cash market segment to

the tune of Rs. 2818 crores. Simultaneously, in Index

futures, they bought worth Rs. 4104 crores with a good

amount of decline in open interest, due to the expiry.

Festive series bought back the optimism and we saw

Nifty and BankNifty rallying 5.46% and 9.70%

respectively. We observed mix of short covering and

long formation in both the indices; however, series on

series we saw open interest reduction. Rollover for

Nifty and BankNifty stood at 76% and 77% respectively,

which is lower than the three-month average.

Interestingly, FIIs covered decent shorts and preferred

rolling over longs formed in October series, which is

indeed a positive development. For now, 17500-17600

is a strong demand zone, whereas, resistance is

placed around 17900-18000 levels.

Comments

The Nifty futures open interest has decreased by

19.85%. and Bank Nifty futures open interest has

decreased by 20.00% as the market closed at

17736.95.

The Nifty November future closed with a premium of

52.25 point against a premium of 32.30 point in the

last trading session. The December series closed at

a premium of 111.05 point.

The INDIA VIX decreased from 16.88 to 16.59. At the

same time, the PCR-OI of Nifty has increased from

0.96 to 1.10.

Few of the liquid counters where we have seen high

cost of carry are IDEA, PETRONET, INDUSTOWER,

FSL and IOC.

Historical Volatility

SCRIP HV

NMDC 49.82

RBLBANK 72.12

GMRINFRA 48.50

JSWSTEEL 45.57

DABUR 27.33

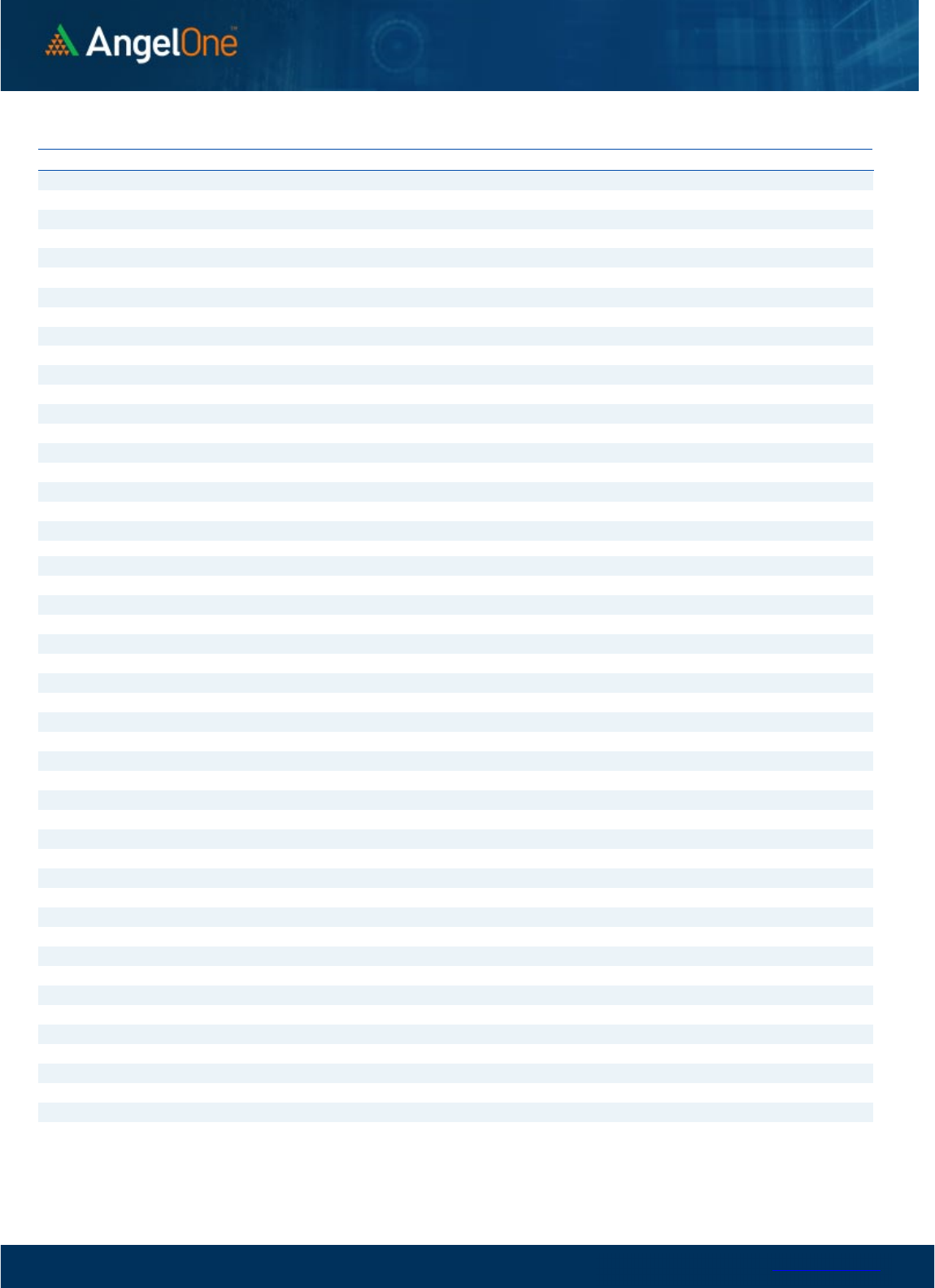

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

18000

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

10/7 10/11 10/13 10/17 10/19 10/21 10/27

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CUMMINSIND 3089400 7.29 1250.00 2.62

MPHASIS 2328200 6.65 1969.95 -2.95

PAGEIND 89010 6.19 50870.40 -2.24

LICHSGFIN 14266000 5.19 422.00 0.65

ASTRAL 1486100 3.66 1959.20 -1.22

MFSL 2528500 1.33 677.45 -0.39

BALRAMCHIN 8131200 0.97 332.15 0.09

ASIANPAINT 6323600 0.84 3043.45 -1.24

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

NMDC 14190600 -39.43 104.30 13.38

ALKEM 229800 -36.06 3113.90 0.67

AARTIIND 1813050 -28.76 691.65 1.06

PFC 54343000 -27.62 109.90 3.42

POWERGRID 28096200 -27.26 223.90 2.16

TVSMOTOR 5482400 -25.89 1124.55 -2.51

PNB 237376000 -25.36 43.00 -0.23

GMRINFRA 110430000 -25.35 37.60 6.31

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.10 0.82

BANKNIFTY 0.99 0.94

RELIANCE 0.53 0.52

ICICIBANK 0.59 0.54

INFY 0.76 0.64

www.angelone.in

Technical & Derivatives Report

OCT 28, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Nov Series) are given as an information and not as a recommendation.

Nifty Spot =

17736.95

FII Statistics for

October

2

7

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

13585.54 9481.47 4104.07

126371 11801.83 (29.65)

INDEX

OPTIONS

2202496.52 2185235.45 17261.07

837408 76416.41 (50.70)

STOCK

FUTURES

29100.24 26543.56 2556.68

2026578 142236.49 (5.86)

STOCK

OPTIONS

5487.76 5327.68 160.08

28675 2237.21 (78.75)

Total 2250670.06

2226588.16

24081.90

3019032

232691.94

(27.53)

Turnover on

October

2

7

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

640177 60167.07 44.26

Index Options

268585005 45493.71 15.15

Stock

Futures

2263749 158893.42 -11.17

Stock Options

2577233 3060.02 4.41

Total

2,577,233 3060.02 1.75

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17700 353.15

58.20

41.80

17758.20

Sell

17800 294.95

Buy

17700 353.15

105.05

94.95

17805.05

Sell

17900 248.10

Buy

17800 294.95

46.85 53.15 17846.85

Sell 17900 248.10

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17700 275.35

39.35

60.65

17660.65

Sell

17600 236.00

Buy 17700 275.35

77.70

122.30

17622.30

Sell 17500 197.65

Buy

17600 236.00

38.35 61.65 17561.65

Sell 17500 197.65

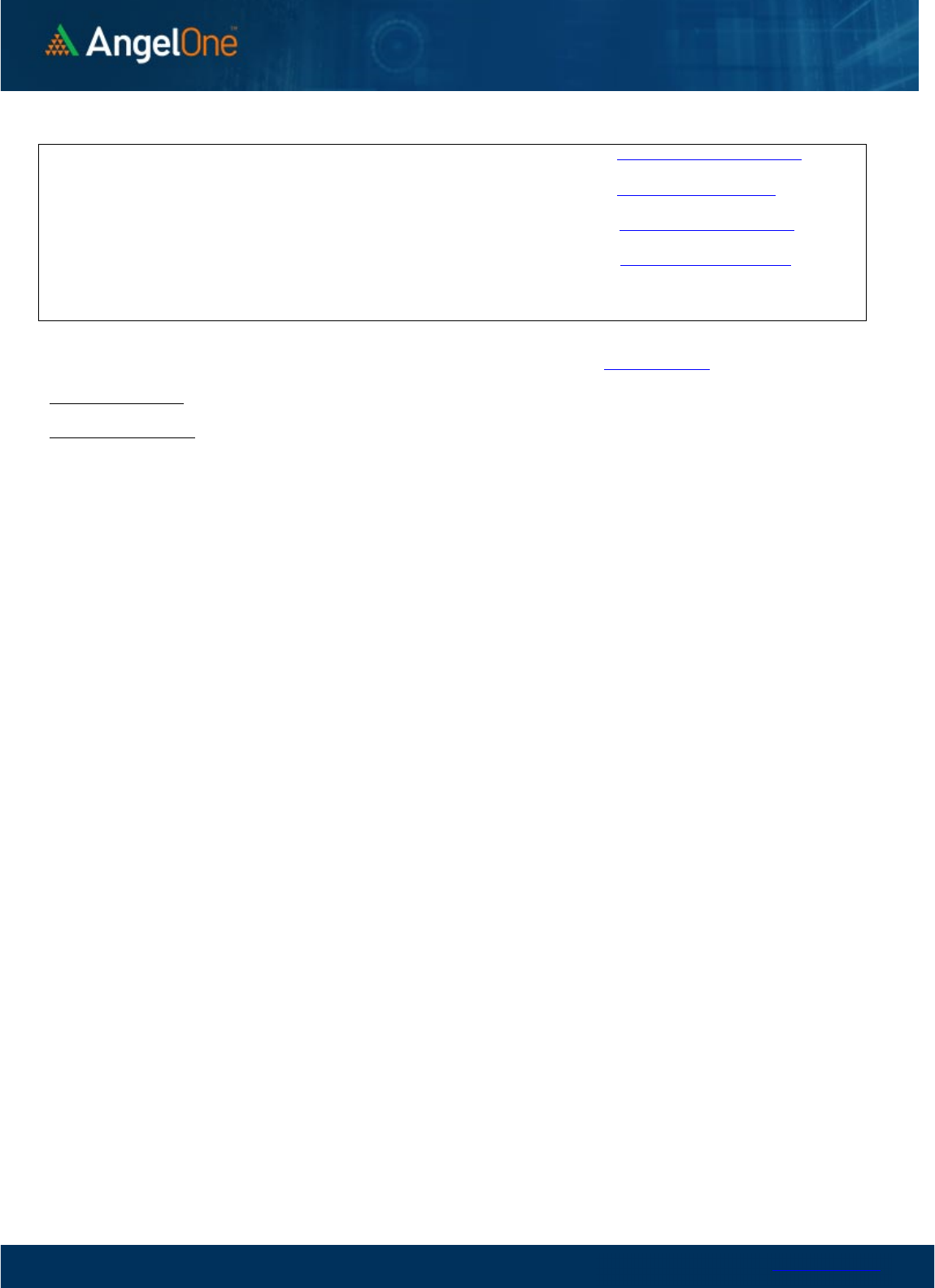

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

OCT 28, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT 3,268 3,296

3,326

3,354

3,384

ADANIPORTS

784

803

813 832

842

APOLLOHOSP 4,348 4,390

4,445

4,486

4,541

ASIANPAINT

2,976

3,010

3,066

3,100

3,156

AXISBANK

893

904

912

923

931

BAJAJ-AUTO 3,555 3,589

3,640

3,673

3,724

BAJFINANCE 6,758 6,865

7,037

7,144

7,316

BAJAJFINSV

1,587

1,609

1,643

1,665

1,698

BPCL 301 303

305

307

309

BHARTIARTL 797 807

815 825

833

BRITANNIA 3,674 3,714

3,742 3,783

3,811

CIPLA 1,144 1,155

1,167 1,179

1,191

COALINDIA

238

239

241 242

243

DIVISLAB

3,581

3,601

3,618

3,638 3,654

DRREDDY

4,418

4,455

4,487

4,523

4,556

EICHERMOT 3,624 3,667

3,704 3,747

3,784

GRASIM

1,709

1,717

1,729

1,736

1,748

HCLTECH 1,012 1,022

1,030

1,040

1,048

HDFCBANK

1,442

1,448

1,458

1,464

1,474

HDFCLIFE

525

529

534

537

542

HDFC 2,342 2,363

2,384 2,404 2,425

HEROMOTOCO 2,560 2,585

2,603 2,628 2,646

HINDALCO

402

407

410 415

418

HINDUNILVR 2,470 2,495

2,512

2,537

2,554

ICICIBANK

913

919

926

932

940

INDUSINDBK 1,125 1,134

1,144

1,152

1,162

INFY 1,501 1,513

1,524

1,535

1,546

ITC

342

344

346

348 351

JSW STEEL

635

657

670

692

705

KOTAKBANK

1,829

1,847

1,867

1,886

1,906

LT

1,940

1,952

1,962

1,974

1,984

M&M

1,270

1,282

1,291 1,303

1,312

MARUTI 8,832 8,937

9,007 9,112

9,182

NESTLEIND

19,608

19,871

20,173

20,436

20,738

NTPC

166

168

170

172

174

ONGC 130 131

131

133

133

POWERGRID

215

219

222

227

230

RELIANCE

2,415

2,433

2,451

2,469

2,486

SBILIFE

1,233

1,243

1,253

1,263

1,274

SBIN

573

577

581 584

588

SUNPHARMA

985

998

1,006

1,019

1,027

TCS 3,116 3,137

3,155

3,176

3,195

TATACONSUM

750

760

770

780

790

TATAMOTORS

400

404

408

412 416

TATASTEEL

101

103

104 105

106

TECHM

1,049

1,063

1,080

1,094

1,111

TITAN

2,631

2,668

2,716

2,753

2,801

ULTRACEMCO

6,326

6,381

6,428 6,483 6,530

UPL

691

699

704

712

717

WIPRO

378

380

384

386

389

www.angelone.in

Technical & Derivatives Report

OCT 28, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.