FEB 28, 2023

www.angelone.in

Technical & Derivatives Report

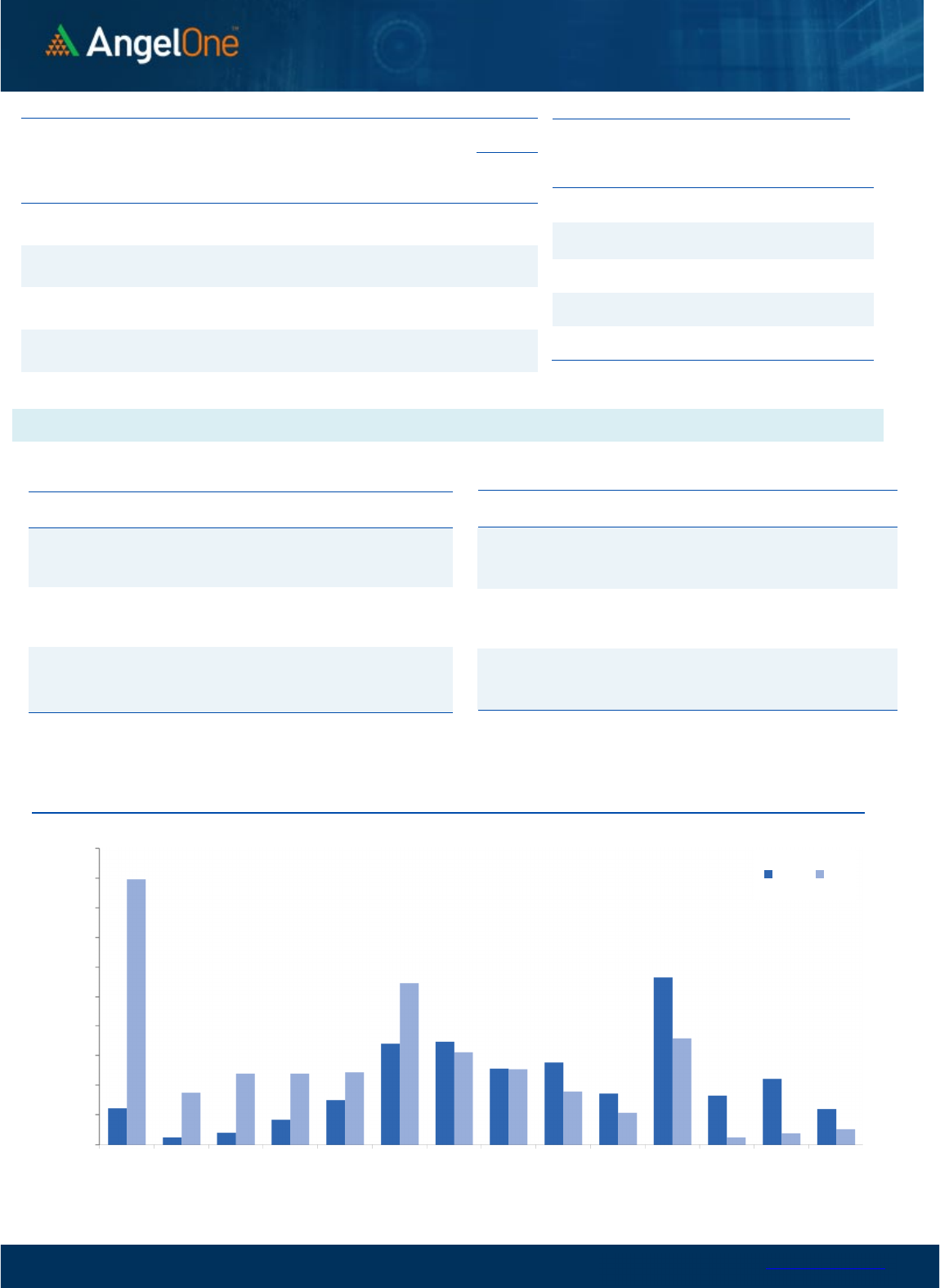

Nifty Bank

Outlook (

40307

)

Recent sell off was mainly Financial stocks driven and surprisingly,

this space has started to show some outperformance in last couple

of trading sessions. Yesterday morning, the BANKNIFTY started the

week on a flat note but within few minutes, corrected in tandem

with benchmark index. However later, we witnessed smart

recovery across the banking space, but Nifty remained sluggish due

to non-performance of other heavyweight sectors. The buying

accelerated towards the latter part of the session to conclude with

precisely a percent gain convincingly above the 40000 mark.

Clearly, if banking had not participated yesterday, it could have

been a disaster for our benchmark index and would have certainly

dampened the overall sentiments. Single-handedly, banking pulled

the Nifty higher to defend the ‘200-day SMA’ on a closing basis. For

BANKNIFTY, Thursday’s ‘Dragonfly Doji’ pattern has now been

activated and since it has also closed above ‘5-day EMA’, we expect

the recovery to extend in coming session. As far as levels are

concerned, 40600 – 40900 are the next levels to watch out for,

whereas on the flipside, 40000 – 39700 should act as a strong

support. Any minor decline should ideally be used to create fresh

long positions in the index.

Key Levels

Support 1 – 40000 Resistance 1 – 40600

Support 2 – 39700 Resistance 2 – 40900

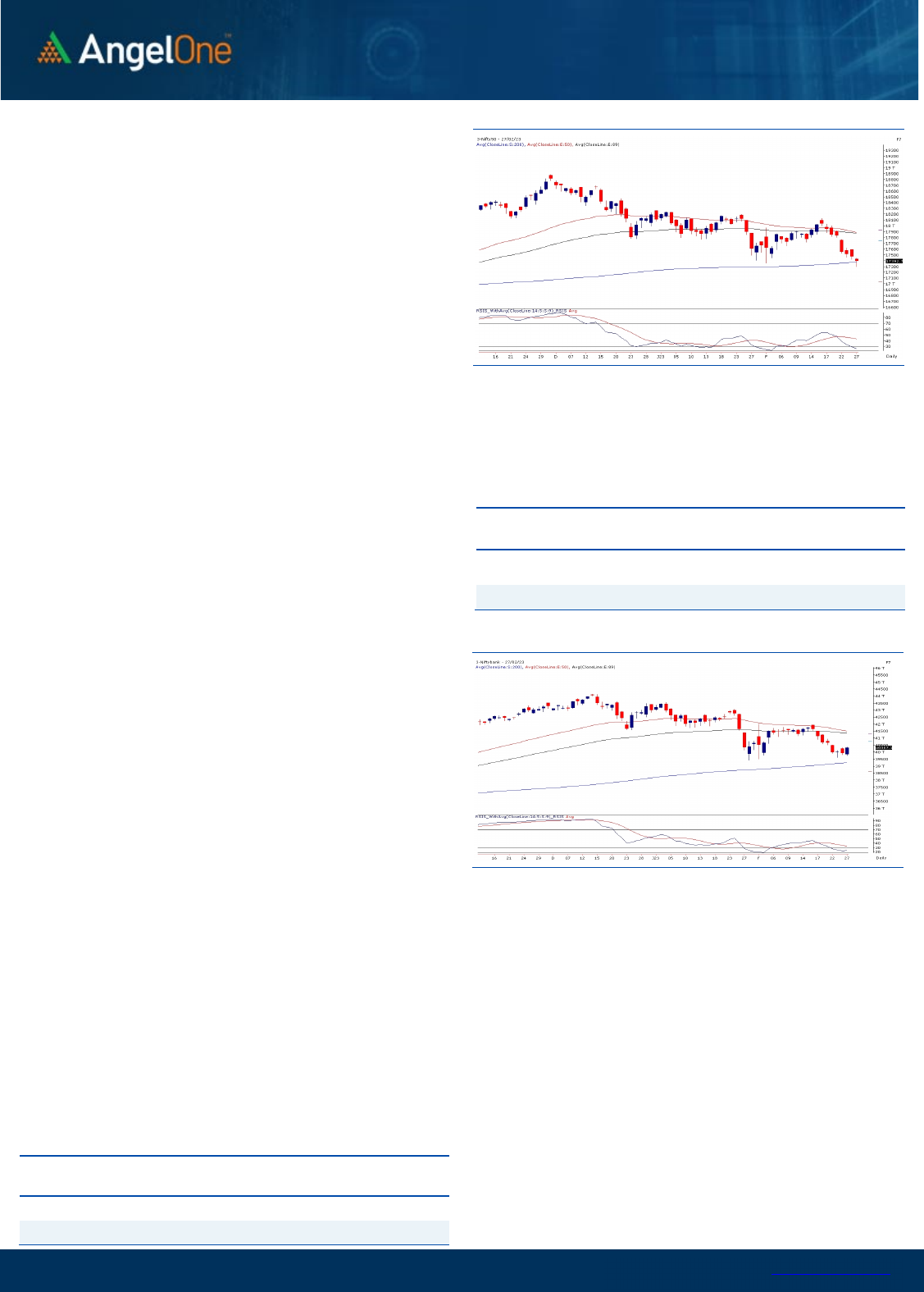

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

59

288

) / Nifty (

1

7

393

)

The weakness in the global markets led to a bleak start for Indian

equities, wherein the benchmark index tested the Budget day’s low

to daunt the market sentiments. However, by the penultimate hour

some buying emergence from the lows led to a modest recovery in

Nifty. With all the hustle, the benchmark index concluded the

seventh consecutive day in red with a cut of 0.42 percent.

Technically, the chart is placed at a critical zone of make or break

and looking at the continuity of the sell-off, one needs to be

prepared for any scenario. However, the formation of the ‘Hammer’

candle on the technical chart that too around 200 SMA could be

seen as a ray of hope for a reversal from the ongoing selling saga. A

follow-up buying with a close above yesterday’s high would

authenticate the trend reversal in the near term. As far as levels are

concerned, any closure below 17350 could drag Nifty toward the

17200-17100 zone in the comparable period. While on the higher

end, the 17550-17600 is likely to be seen as immediate resistance

for the index.

Since the market is highly oversold, one needs to keep a cautious

view and avoid undue risk for the time being. Meanwhile, a close

tab should be kept on global developments, which may lead to

an immediate trend setup, and it is advisable to be very selective

in finding trading opportunities.

Key Levels

Support 1 – 17350 Resistance 1 – 17550

Support 2 – 17200 Resistance 2 – 17600

www.angelone.in

Technical & Derivatives Report

FEB 28, 2023

View

We had a negative start for the week, follow-up

selling dragged index towards 17300. Post some

consolidation in the midst, some buying emerged to

end tad below 17400.

FIIs were net sellers in the cash market segment to

the tune of Rs. 2023 crores. Simultaneously, in Index

futures, they sold worth Rs. 683 crores with some

rise in open interest, indicating short formation.

Yesterday, we saw addition of mixed bet but

considering the price action it seems majority are on

the long side. Stronger hands continue selling streak

not only in equities but also in index futures

segment. In options front, we saw fresh build-up in

17400 call options and considering the high implied

volatility than the puts it clearly suggest these are

long positions. On the other side, 17400 put

witnessed fresh writing. For coming session, any

follow-up buying shall be an encouraging sign for the

market. On the upside, 17600 remains a sturdy

hurdle and any sustainable move beyond same shall

boost the overall sentiments in our market.

Comments

The Nifty futures open interest has increased by 6.68%

and Bank Nifty futures open interest has increased by

14.48% as the market closed at 17392.70.

The Nifty March future closed with a premium of

105.25 point against a premium of 90.45 point in the

last trading session. The April series closed at a

premium of 201.50 point.

The INDIA VIX decreased from 14.18 to 13.87. At the

same time, the PCR-OI of Nifty has decreased from 0.79

to 0.72.

Few of the liquid counters where we have seen high

cost of carry are COALINDIA, AARTIIND, CUB,

RAMCOCEM and CANBK.

Historical Volatility

SCRIP HV

BAJAJ-AUTO 28.40

MPHASIS 41.11

ZEEL 53.49

UPL 37.18

MOTHERSON 45.43

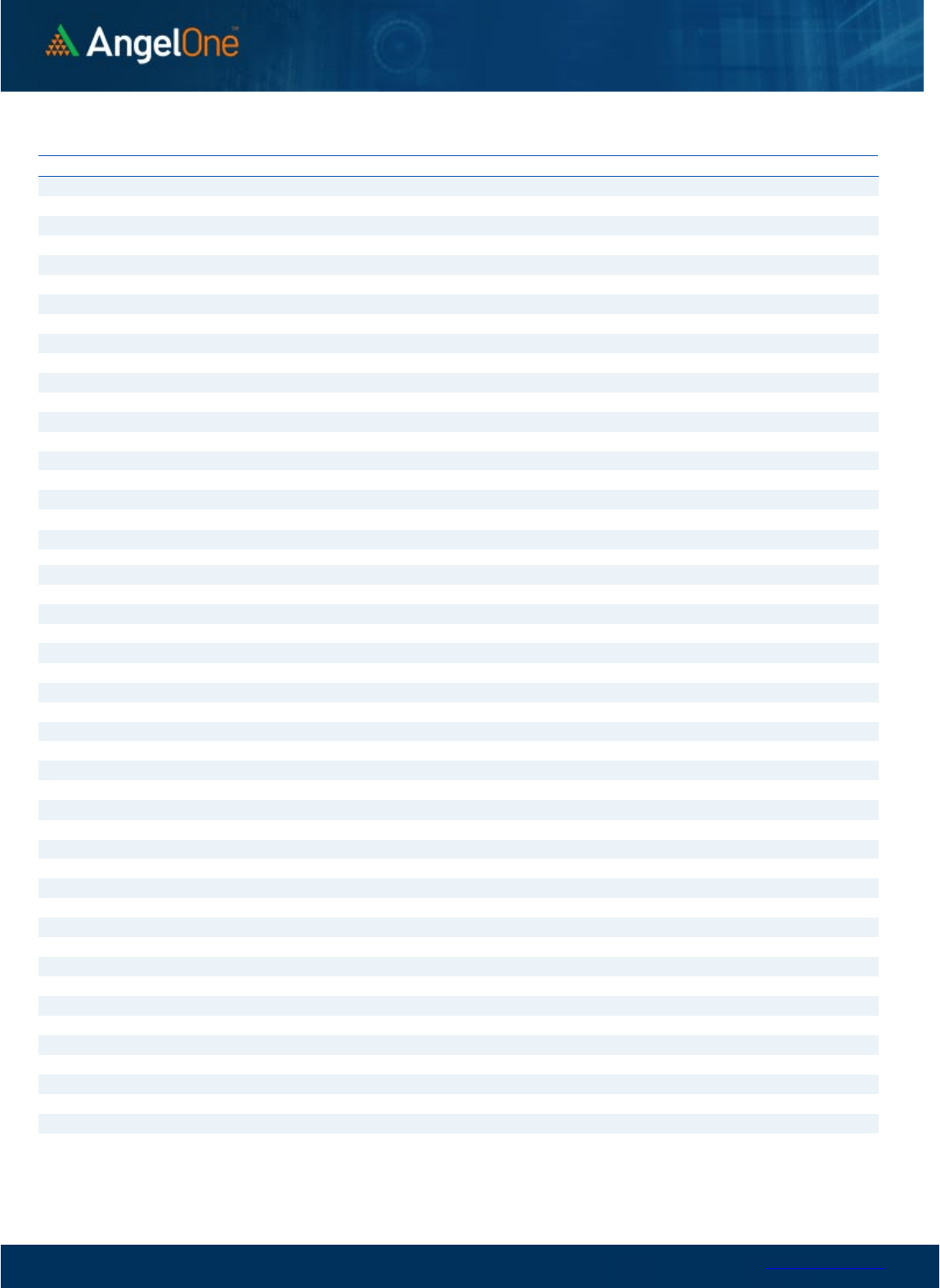

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/7 2/9 2/13 2/15 2/17 2/22 2/24

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

MPHASIS 1910425 18.75 2039.85 -7.25

ESCORTS 1232000 15.29 1981.75 -1.97

GNFC 8899800 8.32 530.55 -3.70

HINDPETRO 23724900 7.38 214.30 -1.28

IGL 7907625 7.31 435.55 -0.71

BOSCHLTD 149050 7.23 17878.55 0.33

PVR 2466827 6.97 1529.35 -4.53

ADANIENT 14730500 6.80 1193.55 -8.94

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ZEEL 66729000 -8.92 182.95 -6.47

TVSMOTOR 5817700 -7.61 1085.20 -2.26

ZYDUSLIFE 7032600 -6.55 456.05 -2.42

AARTIIND 4095300 -5.66 536.75 -0.07

COROMANDEL 1710100 -4.94 891.90 0.52

BAJAJ-AUTO 1194750 -3.94 3639.90 -5.28

TECHM 10289400 -3.62 1113.95 -0.52

MCX 991200 -3.43 1385.20 1.22

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.72 0.86

BANKNIFTY 1.04 0.96

RELIANCE 0.68 0.51

ICICIBANK 0.80 0.51

INFY 0.58 0.50

www.angelone.in

Technical & Derivatives Report

FEB 28, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

392.70

0900

Lot Size = 75

FII Statistics for

February

2

7

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3927.37

4610.04

(682.67) 178537

16184.89

5.92

INDEX

OPTIONS

1214761.87

1207172.76

7589.11

2501444

224628.90

15.52

STOCK

FUTURES

9853.68

9529.85

323.83

2181530

141019.08

0.91

STOCK

OPTIONS

8436.03

8593.28

(157.25) 85109

5550.80

22.45

Total 1236978.95

1229905.93

7073.02

4946620

387383.67

8.35

Turnover

on

February

2

7

, 202

3

Instrumen

t

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

374863

35251.75 -4.75

Index Options

1688718

31

54232.39 14.28

Stock Futures

691677

44016.40 11.11

Stock Options

2214971

2844.48 -1.63

Total

2,214,97

1

2844.48 7.38

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17500 291.65

57.70

42.30

17557.70

Sell

17600 233.95

Buy

17500 291.65

109.25

90.75

17609.25

Sell

17700 182.40

Buy

17600 233.95

51.55 48.45 17651.55

Sell

17700 182.40

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17500 201.30

36.10

63.90

17463.90

Sell 17400 165.20

Buy 17500 201.30

67.60

132.40

17432.40

Sell

17300 133.70

Buy

17400 165.20

31.50 68.50 17368.50

Sell 17300 133.70

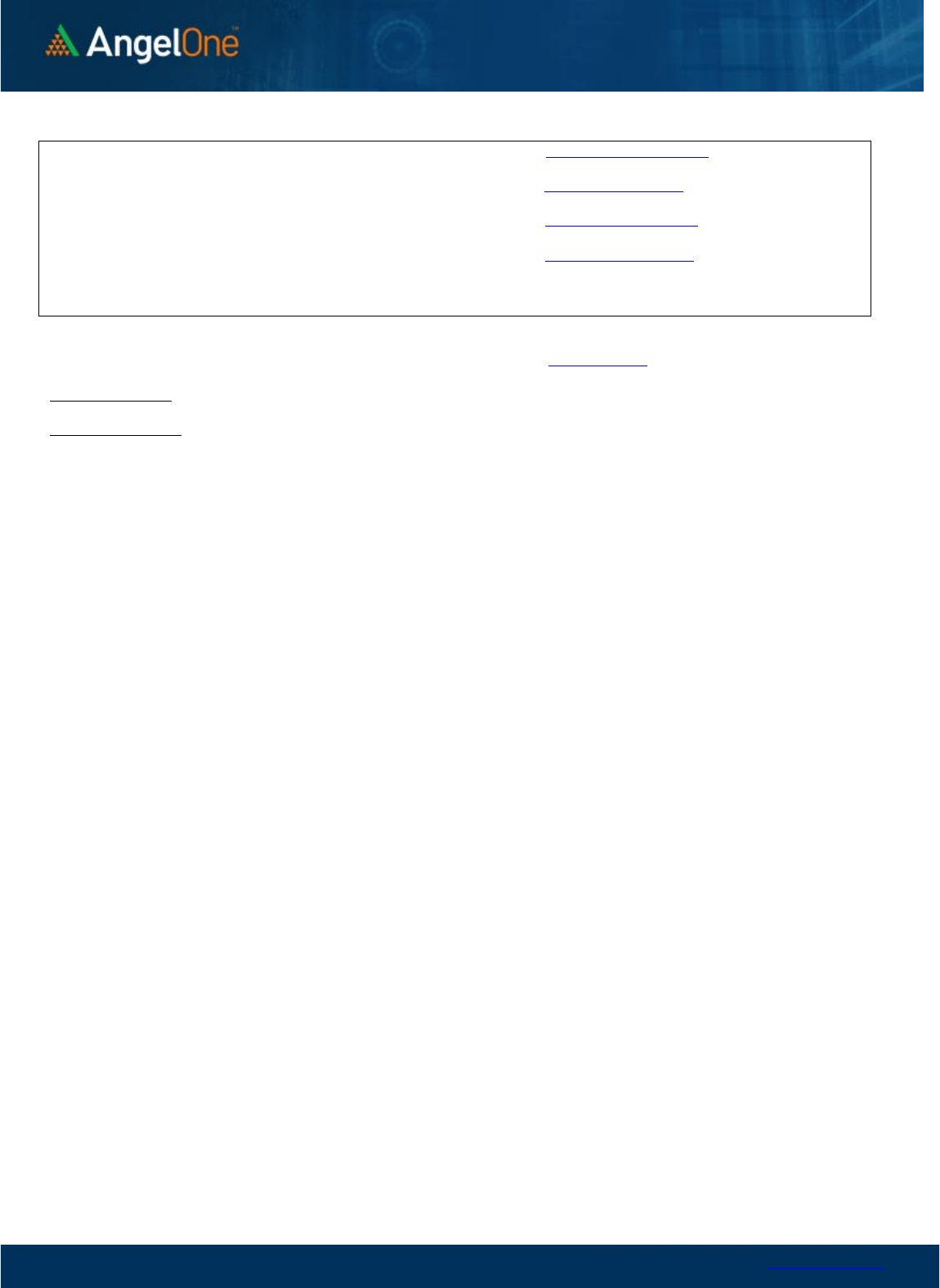

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300

Call Put

www.angelone.in

Technical & Derivatives Report

FEB 28, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,030

1,112

1,213

1,295

1,396

ADANIPORTS 544 553

562

572

581

APOLLOHOSP

4,370

4,405

4,450

4,485

4,530

ASIANPAINT

2,711

2,730

2,745

2,764

2,778

AXISBANK 840 847

853

860

865

BAJAJ-AUTO

3,515

3,577

3,689

3,751

3,863

BAJFINANCE

6,084

6,139

6,190

6,245

6,296

BAJAJFINSV

1,334

1,346

1,357

1,368

1,379

BPCL 312 316

319

323

325

BHARTIARTL 733 743

749

759

765

BRITANNIA

4,316

4,352

4,411

4,447

4,506

CIPLA 936 943

956

963

976

COALINDIA 214 215

217

218

220

DIVISLAB

2,802

2,830

2,874

2,902

2,946

DRREDDY

4,286

4,354

4,422

4,490

4,558

EICHERMOT

3,043

3,087

3,146

3,190

3,250

GRASIM

1,539

1,555

1,570

1,586

1,601

HCLTECH

1,069

1,077

1,083

1,091

1,097

HDFCBANK

1,568

1,580

1,590

1,602

1,611

HDFCLIFE

473

481

486

494

499

HDFC

2,540

2,566

2,584

2,610

2,628

HEROMOTOCO

2,394

2,416

2,452

2,474

2,510

HINDALCO 396 404

409

417

423

HINDUNILVR

2,439

2,454

2,470

2,485

2,501

ICICIBANK 825 841

849

865

874

INDUSINDBK

1,057

1,069

1,080

1,092

1,102

INFY

1,479

1,494

1,517

1,532

1,555

ITC 374 378

382

387

391

JSW STEEL 658 669

677

688

696

KOTAKBANK

1,677

1,701

1,716

1,740

1,755

LT

2,054

2,084

2,112

2,142

2,170

M&M

1,227

1,242

1,264

1,279

1,301

MARUTI

8,489

8,560

8,602

8,674

8,715

NESTLEIND

18,300

18,462

18,653

18,815

19,006

NTPC 169 171

172

174

175

ONGC 152 153

155

157

158

POWERGRID 213 216

218

221

223

RELIANCE

2,332

2,350

2,370

2,388

2,408

SBILIFE

1,100

1,115

1,125

1,139

1,149

SBIN 515 521

526

532

536

SUNPHARMA 953 959

966

972

978

TCS

3,272

3,302

3,346

3,376

3,420

TATACONSUM

690 700

710

721

731

TATAMOTORS 405 411

420

426

435

TATASTEEL 102 104

107

109

112

TECHM

1,088

1,101

1,110

1,123

1,131

TITAN

2,357

2,379

2,396

2,417

2,434

ULTRACEMCO

7,087

7,137

7,186

7,236

7,285

UPL 683 696

717

730

751

WIPRO 382 386

390

394

398

www.angelone.in

Technical & Derivatives Report

FEB 28, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.