FEB 27, 2023

www.angelone.in

Technical & Derivatives Report

Nifty Bank

Outlook (

39909

)

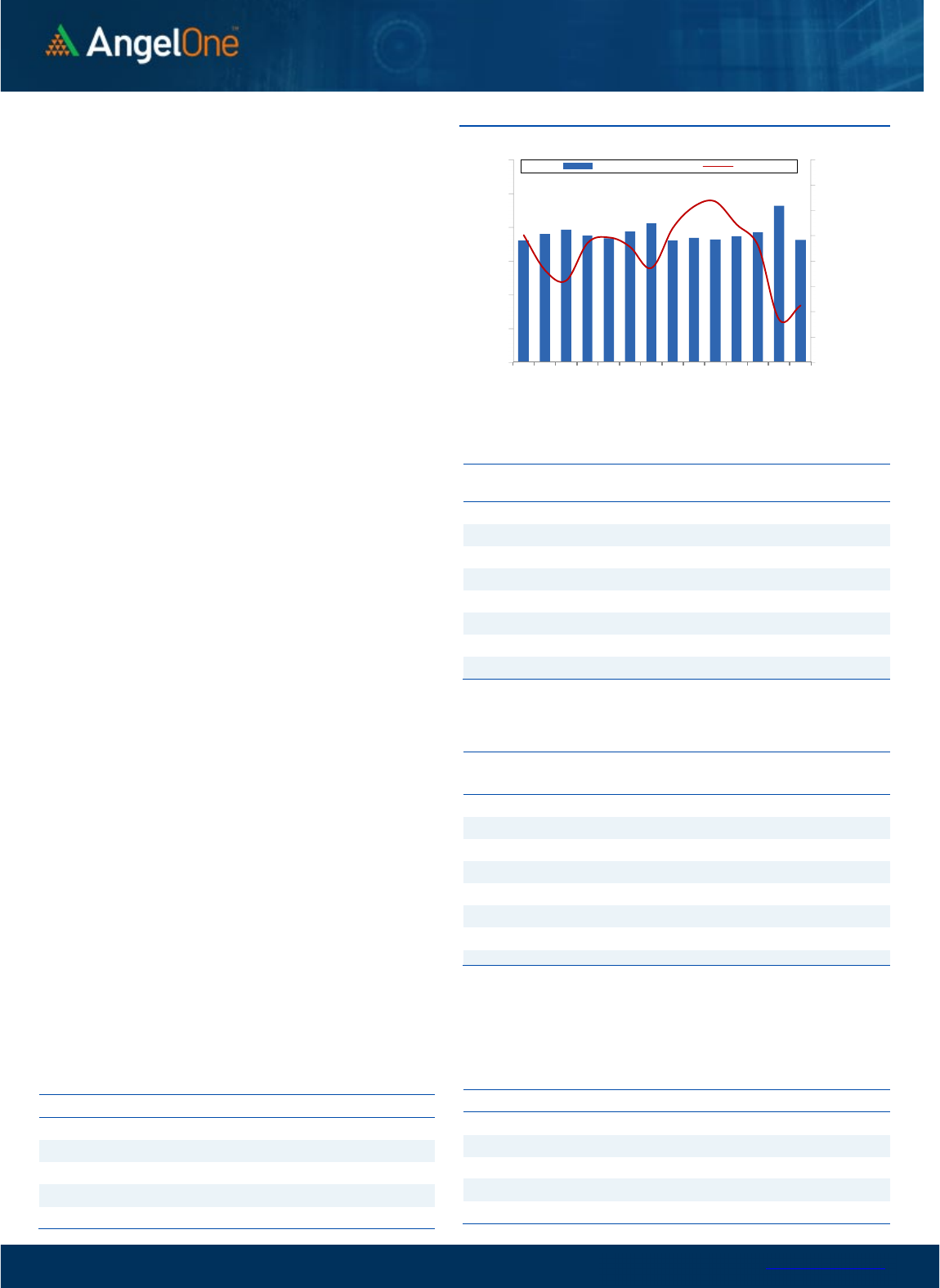

The bank index was the major culprit during the week as it dragged

the broader markets down. It was down around 3% on weekly basis

and ended a tad above the 39900 level.

Similar to the benchmark, the move during the February month for

the Banking space has been precisely within the trading range of

the Union Budget Day and after failing to surpass the 42000 levels

the prices have now slipped towards the lower range placed in the

vicinity of 39500. Now, prices are also placed around a key

ascending trend line support coinciding with 200SMA, where on

Thursday we saw a formation known as ‘Dragon Fly Doji’. Despite

the weakness on Friday, the low of this pattern is still intact, and

hence also considering the oversold conditions of major indicators,

we refrain from going fresh shorts at current levels. Going ahead,

we continue to see strong support in the zone of 39500 – 39300

levels whereas, on the flip side, we sense a sustained trade beyond

40200 – 40300 can trigger a smart bounce back. Traders are

advised to keep an eye on recent draggers from the banking space

that are trading around key supports, as they can certainly provide

better trading opportunities.

Key Levels

Support 1 – 39600 Resistance 1 – 40300

Support 2 – 39300 Resistance 2 – 40800

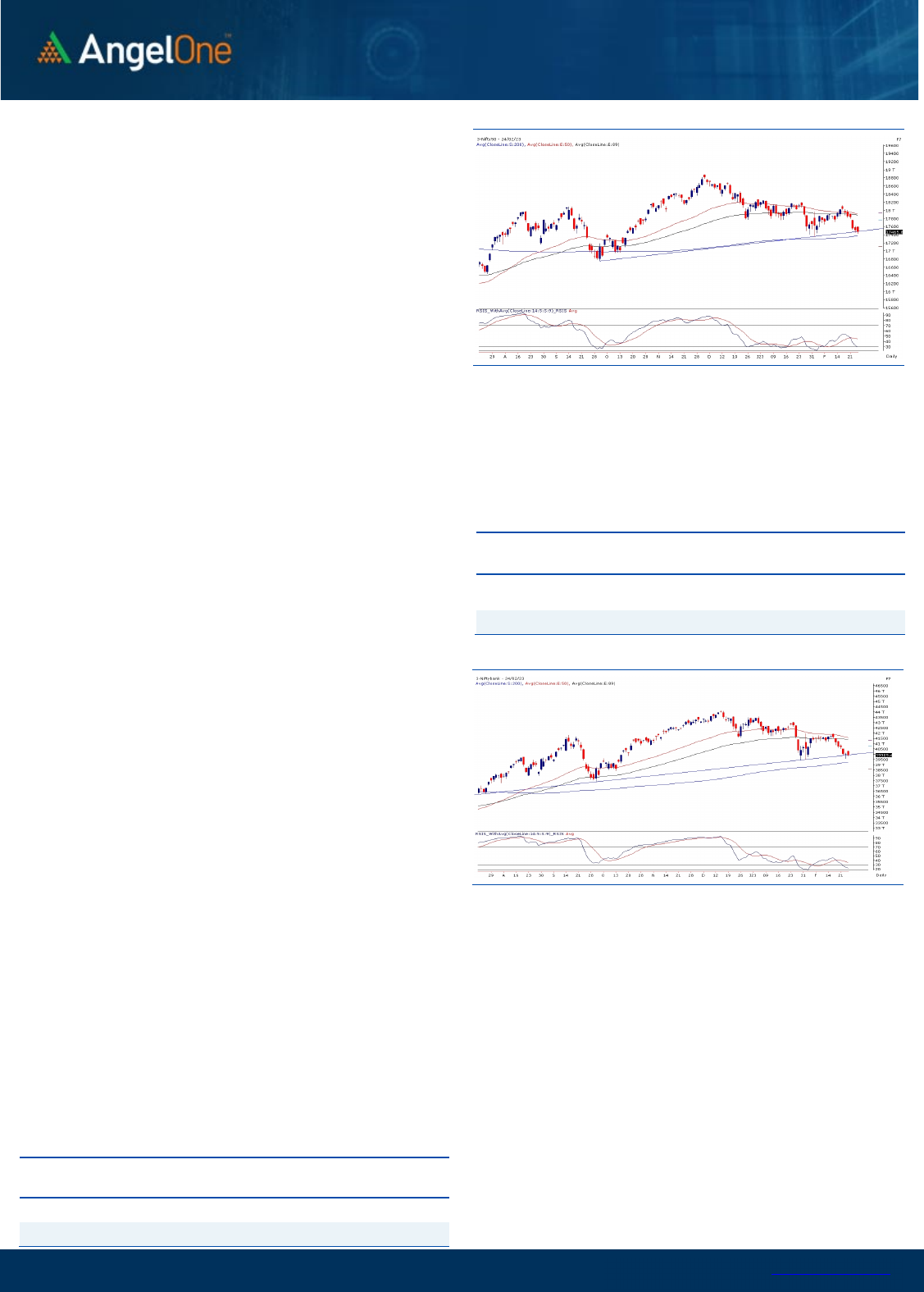

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

59

464

) / Nifty (

1

7

466

)

During the last week, the sell-off exaggerated once the 17800

support was broken and like a tumbling house of cards, there was

selling in the broader markets. After five days of continuous

weakness, the prices had the lowest close in the last four months to

end a tad above 17450 with a weekly loss of more than 2.5%

After the major traction seen on the Union Budget Day, the entire

February month has traded in a range and after failing to hold the

higher end of the range the prices have now slipped towards the

lower end of this range. Technically, if we see this lower end around

17400 – 17350 coincides with an ascending trendline and 200SMA

support. This set-up of support is visible in all the major indices and

hence the market is at a make-or-break level. Considering the

oversold conditions, we remain hopeful that this key support will be

defended and hence we refrain from creating fresh short positions

over here. If in case the support is broken, then the 17200 – 17100

would be the next support to watch out for, where one can pick

good quality propositions in a staggered manner.

Immediate resistance is seen around 17600 beyond which some

positive developments may trigger and for the tide to turn back

in the bulls' favor will have to close above 17800 on a sustained

basis. With global uncertainty, volatility is likely to remain on the

higher side and hence traders are advised to keep a tab on the

mentioned levels and trade accordingly.

Key Levels

Support 1 – 17400 Resistance 1 – 17600

Support 2 – 17350 Resistance 2 – 17700

www.angelone.in

Technical & Derivatives Report

FEB 27, 2023

View

The selling extended on Friday to end the week tad

above 17450 mark.

FIIs were net sellers in the cash market segment to

the tune of Rs. 1470 crores. Simultaneously, in Index

futures, they sold worth Rs. 260 crores with some fall

in open interest, indicating long unwinding.

During February series, we saw addition of shorts in

both the key indices. However, we saw open interest

addition series on series and especially banking index

which added more than 35%, suggesting decent

amount of positions have been rolled over to March

series. Stronger hands have been adding shorts and

they also preferred rolling over same hence their

index futures ‘Long Short Ratio’ declined to 18% from

23% on a weekly basis. The above data hints, decent

portion of shorts are intact in system and considering

FIIs LSR, we believe market is extremely oversold for

now. Hence, traders should lighten up shorts if any.

For now, 17600 strikes are attracting decent build-up

and surpassing of same should fuel the momentum

on the upside.

Comments

The Nifty futures open interest has decreased by 6.77%

and Bank Nifty futures open interest has increased by

37.19% as the market closed at 17465.80.

The Nifty March future closed with a premium of 90.45

point against a premium of 111.75 point in the last

trading session. The April series closed at a premium of

190.20 point.

The INDIA VIX decreased from 15.07 to 14.18. At the

same time, the PCR-OI of Nifty has decreased from 0.93

to 0.79.

Few of the liquid counters where we have seen high

cost of carry are COALINDIA, AARTIIND, CUB,

RAMCOCEM and CANBK.

Historical Volatility

SCRIP HV

GAIL 35.64

WHIRLPOOL 31.87

HINDALCO 48.15

SYNGENE 33.39

NATIONALUM 50.25

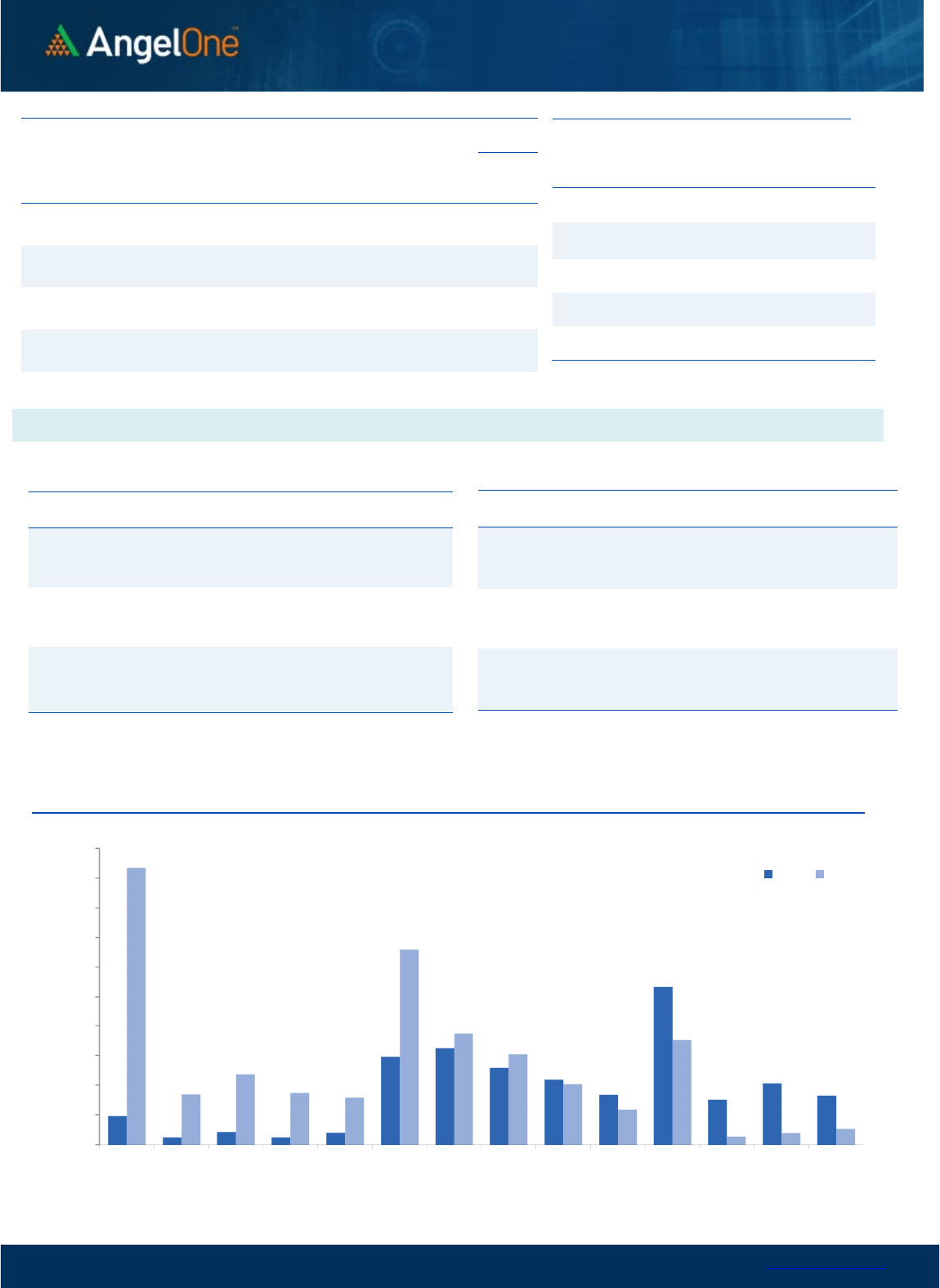

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/2 2/7 2/9 2/13 2/15 2/17 2/22

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GAIL 65797650 18.21 103.45 5.31

PEL 5861350 15.96 794.15 0.04

GNFC 8216000 12.38 551.70 5.05

ADANIENT 13792000 11.17 1315.55 -4.96

HDFCAMC 2521800 10.93 1815.25 2.57

ESCORTS 1068650 9.96 2016.00 -1.38

MPHASIS 1608750 6.73 2198.05 0.68

BERGEPAINT 6997100 6.67 558.05 -0.66

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ZEEL 73266000 -9.87 195.55 -1.80

AARTIIND 4340950 -5.93 537.00 2.82

ONGC 33121550 -5.61 155.00 2.57

ASHOKLEY 65185000 -5.34 141.30 0.32

VOLTAS 4494000 -4.76 895.20 -1.10

TECHM 10676400 -4.08 1119.00 -0.94

GLENMARK 4484850 -4.06 438.55 -2.00

APOLLOTYRE 11238500 -3.57 318.65 -3.02

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.79 0.89

BANKNIFTY 0.62 0.99

RELIANCE 0.71 0.45

ICICIBANK 0.83 0.67

INFY 0.65 0.62

www.angelone.in

Technical & Derivatives Report

FEB 27, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

465.80

0900

Lot Size = 75

FII Statistics for

February

2

4

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4870.69

5130.94

(260.25) 168553

15296.99

(1.45)

INDEX

OPTIONS

868160.95

871207.01

(3046.06) 2165380

194829.61

18.92

STOCK

FUTURES

8216.71

8355.08

(138.37) 2161898

140758.20

0.78

STOCK

OPTIONS

8465.24

8208.49

256.75

69503

4548.30

136.04

Total 889713.59

892901.52

(3187.93) 4565334

355433.10

9.57

Turnover

on

February

2

4

, 202

3

Instrumen

t

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

388505

37011.53 -39.13

Index Options

1217549

33

47456.29 -26.88

Stock Futures

625299

39616.36 -71.09

Stock Options

2087576

2891.54 -1.09

Total

2,087,57

6

2891.54 -52.20

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17500 280.15

55.55

44.45

17555.55

Sell

17600 224.60

Buy

17500 280.15

103.65

96.35

17603.65

Sell

17700 176.50

Buy

17600 224.60

48.10 51.90 17648.10

Sell

17700 176.50

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17500 222.45

37.80

62.20

17462.20

Sell 17400 184.65

Buy 17500 222.45

71.45

128.55

17428.55

Sell

17300 151.00

Buy

17400 184.65

33.65 66.35 17366.35

Sell 17300 151.00

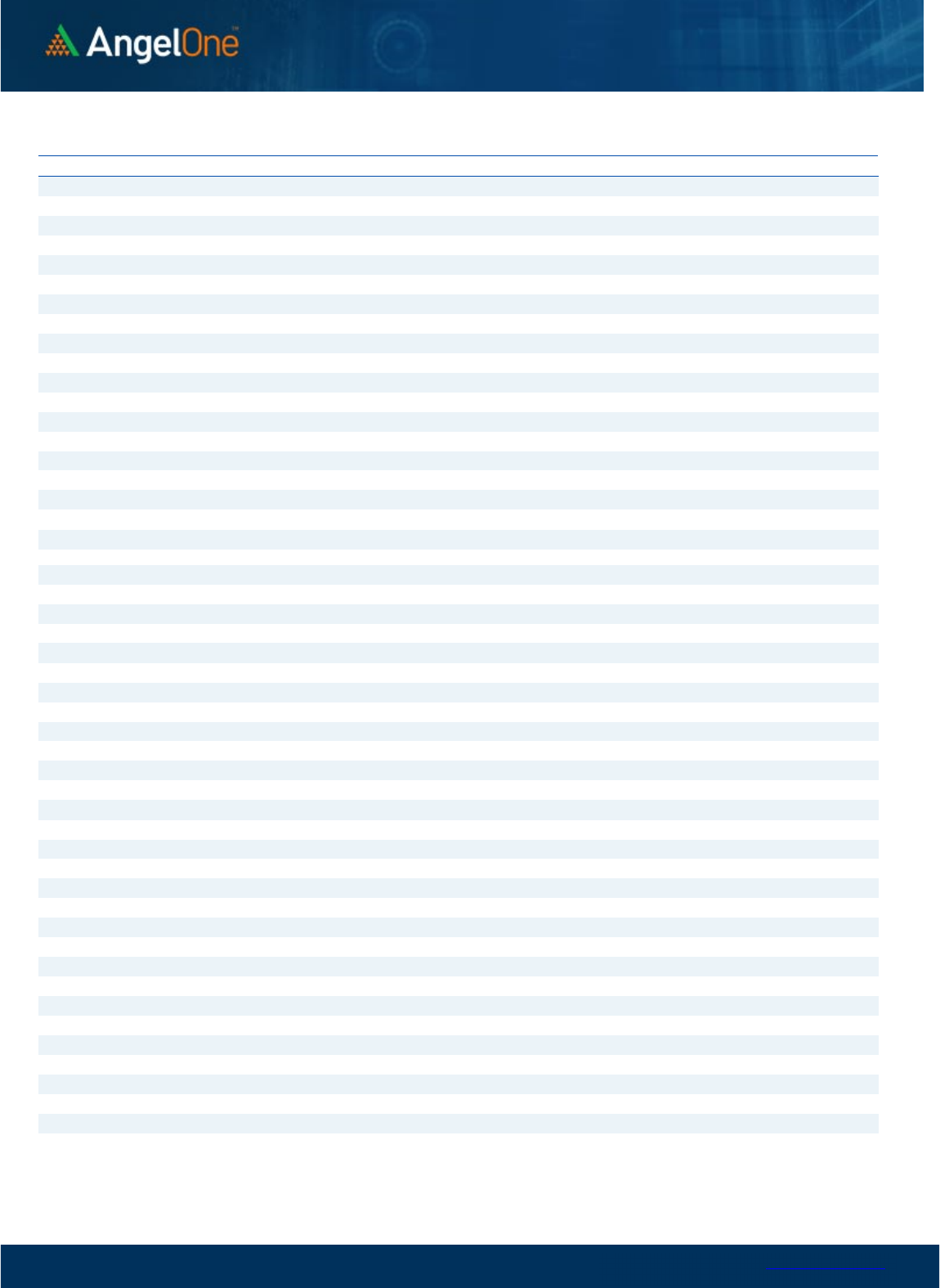

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300

Call Put

www.angelone.in

Technical & Derivatives Report

FEB 27, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,169

1,243

1,335

1,408

1,500

ADANIPORTS 533 546

556

569

579

APOLLOHOSP

4,362

4,416

4,451

4,505

4,540

ASIANPAINT

2,685

2,712

2,737

2,764

2,789

AXISBANK 840 846

850

856

860

BAJAJ-AUTO

3,811

3,831

3,853

3,872

3,894

BAJFINANCE

6,155

6,196

6,241

6,282

6,327

BAJAJFINSV

1,329

1,344

1,365

1,380

1,401

BPCL 313 315

319

321

324

BHARTIARTL 742 749

763

770

783

BRITANNIA

4,377

4,410

4,453

4,486

4,528

CIPLA 950 956

961

967

972

COALINDIA 214 215

216

218

219

DIVISLAB

2,830

2,873

2,922

2,965

3,014

DRREDDY

4,413

4,452

4,481

4,520

4,549

EICHERMOT

3,122

3,164

3,207

3,249

3,292

GRASIM

1,557

1,566

1,580

1,589

1,604

HCLTECH

1,071

1,083

1,094

1,106

1,116

HDFCBANK

1,565

1,577

1,597

1,610

1,630

HDFCLIFE

477

480

485

488

493

HDFC

2,541

2,559

2,588

2,607

2,636

HEROMOTOCO

2,465

2,475

2,492

2,502

2,519

HINDALCO 399 407

423

431

446

HINDUNILVR

2,450

2,467

2,489

2,506

2,528

ICICIBANK 830 835

840

845

850

INDUSINDBK

1,059

1,069

1,079

1,089

1,100

INFY

1,531

1,541

1,555

1,565

1,579

ITC 377 381

385

389

393

JSW STEEL 660 673

690

702

719

KOTAKBANK

1,675

1,686

1,705

1,716

1,735

LT

2,088

2,111

2,142

2,165

2,195

M&M

1,251

1,265

1,293

1,308

1,335

MARUTI

8,539

8,600

8,670

8,731

8,801

NESTLEIND

18,481

18,581

18,715

18,815

18,949

NTPC 169 170

171

172

172

ONGC 148 151

153

157

159

POWERGRID 211 213

214

216

217

RELIANCE

2,354

2,369

2,383

2,397

2,411

SBILIFE

1,105

1,113

1,128

1,137

1,151

SBIN 512 517

522

527

532

SUNPHARMA 953 962

973

981

992

TCS

3,354

3,377

3,406

3,429

3,457

TATACONSUM

709 713

717

720

725

TATAMOTORS 421 424

430

434

440

TATASTEEL 107 109

111

112

114

TECHM

1,100

1,110

1,125

1,135

1,150

TITAN

2,361

2,380

2,397

2,416

2,433

ULTRACEMCO

7,132

7,174

7,208

7,250

7,284

UPL 724 731

743

750

762

WIPRO 390 392

394

396

398

www.angelone.in

Technical & Derivatives Report

FEB 27, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.