September

2

6

, 2023

www.angelone.in

Technical & Derivatives Report

8

Nifty Bank Outlook (

4

4

766

)

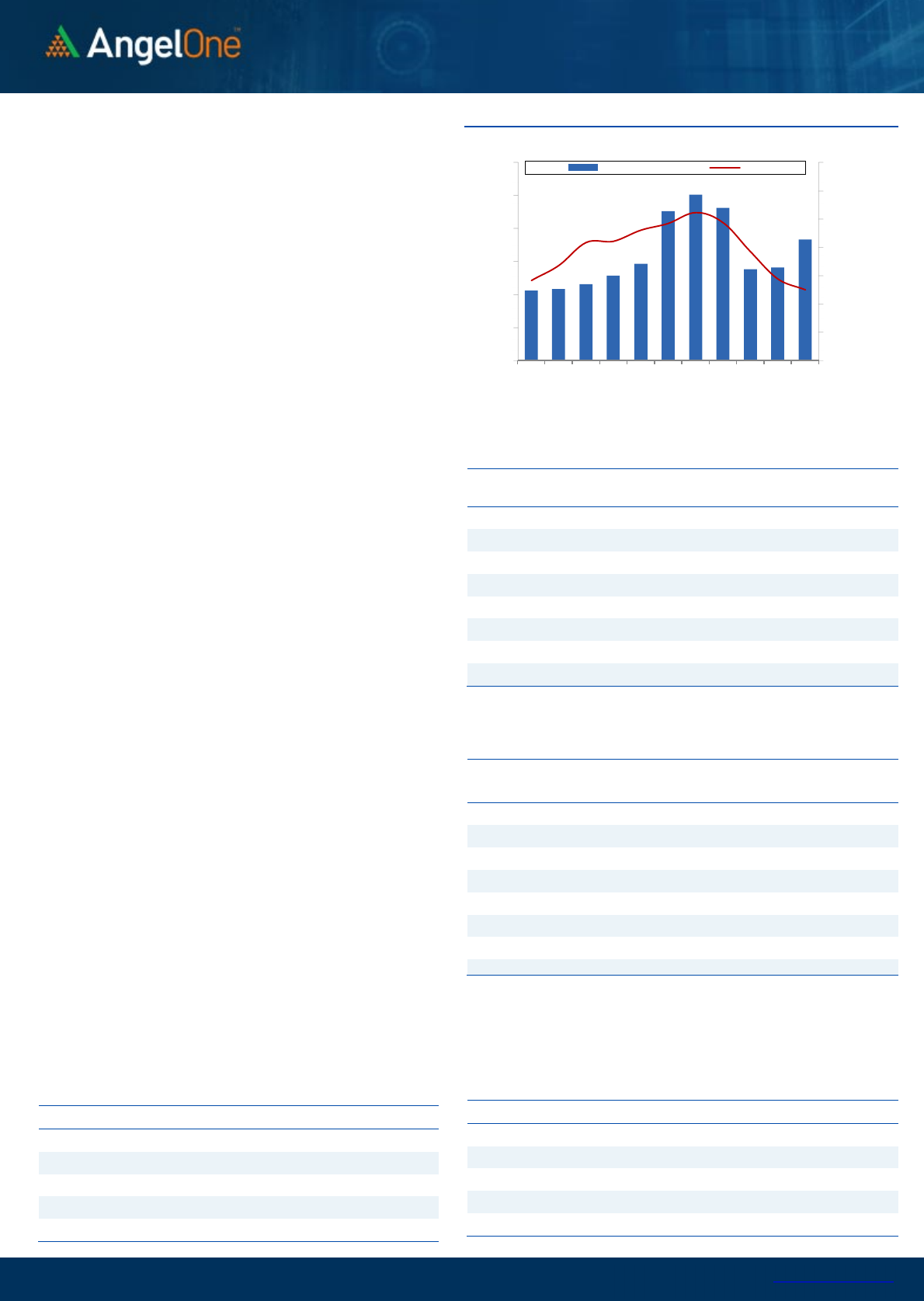

Last week's correction was followed by a mild start for the monthly

expiry week; courtesy to mixed global cues. Post this, the banking

index had a decent decline; which represented an ideal opportunity

for buyers to step in and set the trend for the remainder of the day.

Prices thereafter swung to and fro, rising intermittently to only face

selling at higher prices; indicating an intense tug of war between bulls

and bears to reinforce their control. Amidst this engaging volatile day

of trend, Nifty Bank settled for the day above 44750; almost 154 points

higher from previous days close.

From a Technical standpoint, it appears to be a slight change post 4-

days of intensive sell-off last week. Prices for this heavyweight index,

have so far failed to facilitate trades to the downside on Friday and

yesterday as well, suggested by the fact that the index did not make a

sustained new low and have bounced back every time prices went

below the low of 44592.45 made on Thursday. However, despite this

slight change, a lot needs to be done from bulls if they are to assert

their control over Bank Nifty and to start with a close above the

psychological 45000 level would be very ideal.

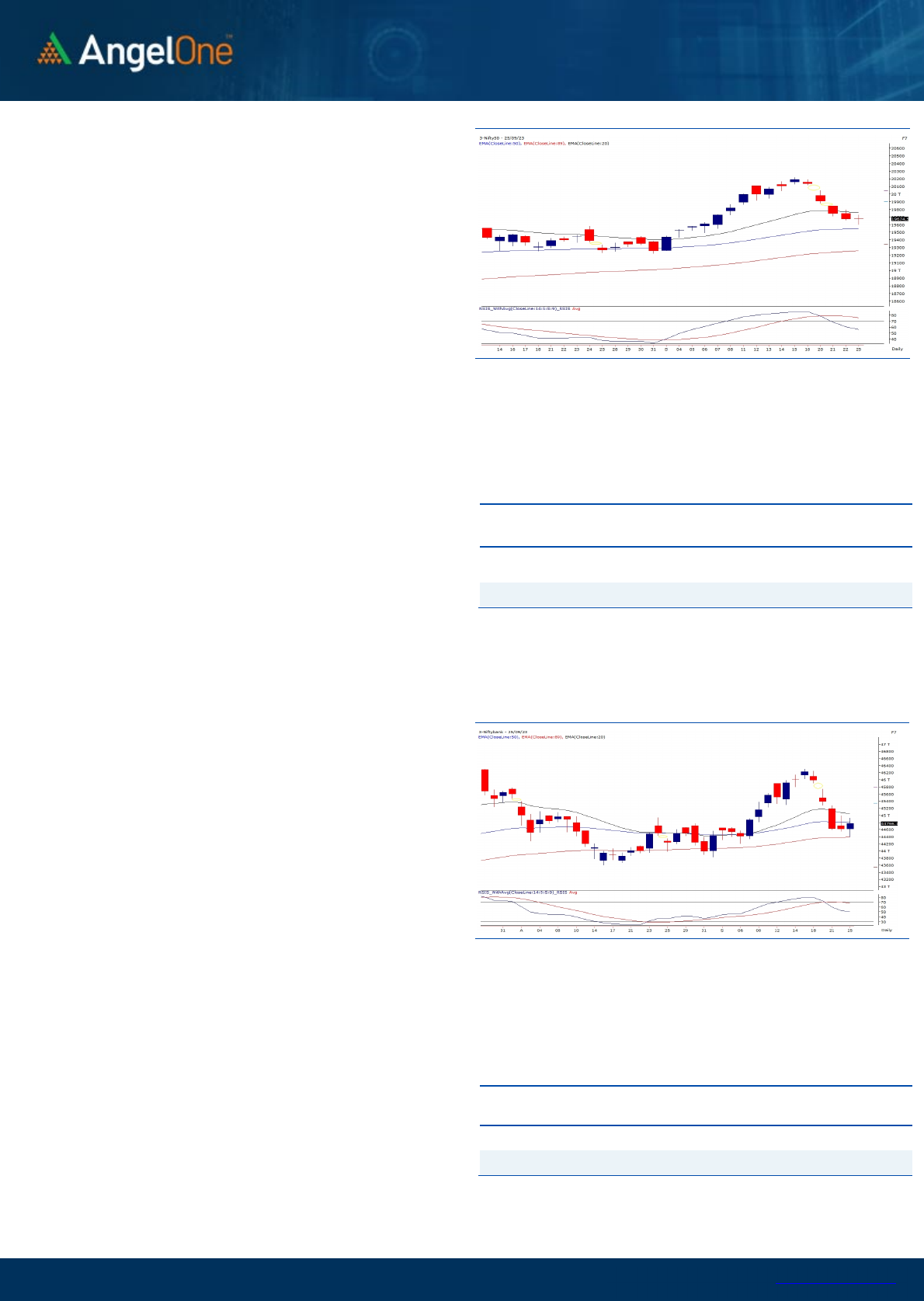

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

6

6

0

24

) / Nifty (

19

67

5

)

The week began with a lack of significant movement, and as the day

progressed, the key index showed no clear direction. Prices

experienced volatile moves within a certain range and eventually

concluded near the opening level, displaying no major change from the

closing levels of Friday.

From a technical standpoint, there are no major noteworthy

alterations, although there was a bit of relief yesterday following the

sharp sell-off witnessed during the last week. Amid a tug-of-war

between bulls and bears within a tight range, prices formed a classic

'Doji' pattern, indicating uncertainty at the current levels. On the daily

chart, prices found support at 19600, which represents a convergence

of support derived from the 50SMA and a 61.8% retracement of the

recent rally. For the bulls to stage a comeback, they must safely defend

this level and potentially initiate a strong rebound in the days ahead.

With the market breadth improving and intraday indicators still

showing oversold conditions with positive divergence, there remains a

sense of optimism. However, it's essential to acknowledge that last

week's decline was disheartening, and the task of the bulls in regaining

control is formidable. Traders are advised to proceed cautiously and

take measured steps. Buying opportunities can be considered on price

dips, while profit-taking should be exercised at higher levels. In this

context, the immediate resistance levels are seen at 19800 to 19850,

whereas immediate support lies at 19600, followed by 19500.

Traders should monitor these levels closely and make their trading

decisions accordingly. Additionally, individual stocks in the midcap

segment displayed strength after the last week's turmoil, offering

potential for outperformance, making it worthwhile for traders to

focus on specific stock-related opportunities.

Key Levels

Support 1 – 19600 Resistance 1 – 19800

Support 2 – 19500 Resistance 2 – 19850

As far as levels are concerned, 45250-45300 is likely to resist any rise

and challenge the repair job from bulls. On the other hand, the zone

of 44200-44300 is likely to cushion any aggression from sellers.

Key Levels

Support 1 – 44300 Resistance 1 – 45250

Support 2 – 44200 Resistance 2 – 45300

www.angelone.in

Technical & Derivatives Report

September

2

6

, 2023

View

The Indian equity market witnessed a volatile day of

trade, wherein the benchmark index Nifty50 made

some strong whipsaw moves but settled on a muted

note, forming a ‘Doji’ on the daily time frame chart.

FIIs were net sellers in the cash market segment to

the tune of Rs. 2333 cr. Simultaneously, they sold

worth Rs. 1466 cr in Index futures with a fall in open

interest, suggesting short formation.

On the derivatives front, we witnessed a mixed trade

in key indices at the start of the expiry week. On the

options front, the 19500 put strike holds the highest

OI concentration, indicating strong support. On the

other side, the highest OI concentration stands at

19800 call strike, indicating the intermediate

resistance. Considering the mentioned data, the

benchmark index is likely to hover within the

mentioned range for the expiry week. Also, we would

advise traders to avoid aggressive bets for the time

being and stay selective with stock performance for

an outperformance.

Comments

The Nifty futures open interest has increased by 3.33%

and Bank Nifty futures open interest has increased by

6.67% as the market closed at 19674.55.

The Nifty September future closed with a premium of

25.95 points against 34 points in the last trading

session. The October series closed at a premium of

145.80 points.

The INDIA VIX has increased from 10.66 to 10.90. At the

same time, the PCR-OI of Nifty has decreased from 0.93

to 0.91.

A few of the liquid counters where we have seen high

cost of carry are DELTACORP, BERGEPAINT, MCX,

RAMCOCEM and BALRAMCHIN.

Historical Volatility

SCRIP HV

BERGEPAINT 29.56

CANBK 42.52

ZYDUSLIFE 28.74

GRANULES 38.28

DRREDDY 25.05

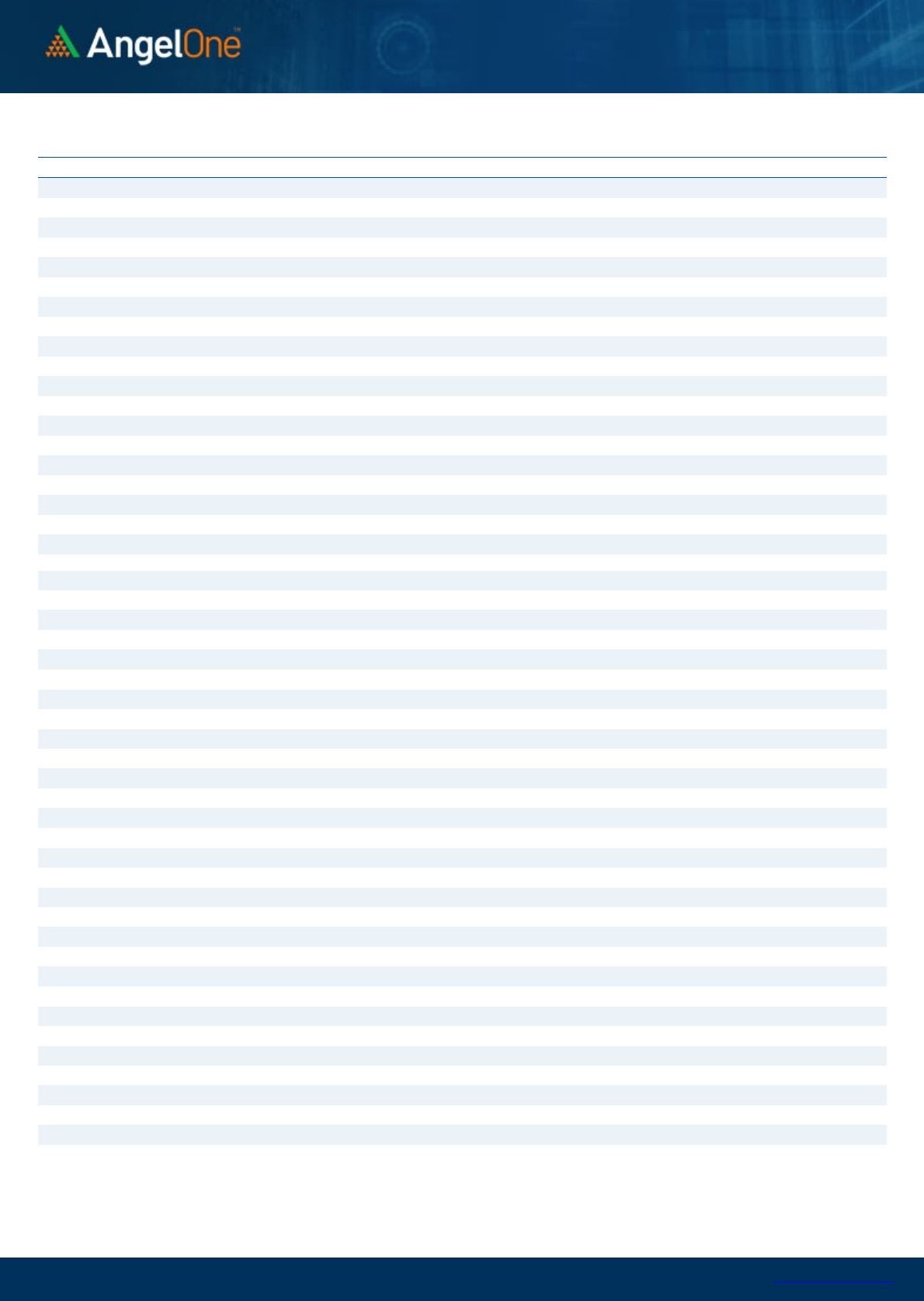

Nifty Vs OI

19200

19400

19600

19800

20000

20200

20400

20600

10,000

10,500

11,000

11,500

12,000

12,500

13,000

9-7 9-11 9-13 9-15 9-19 9-25

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

DALBHARAT 1731500 23.55 2337.25 3.73

PNB 273440000 16.77 80.20 3.55

GODREJPROP 4129175 14.43 1595.85 3.70

BALRAMCHIN 12747200 14.11 440.25 6.45

PERSISTENT 1165325 13.27 5917.40 1.23

BAJFINANCE 4582125 12.01 7819.80 4.69

ESCORTS 1757800 11.85 3235.05 3.68

TVSMOTOR 8311100 11.14 1515.55 1.01

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

DELTACORP 17600 -18.91 142.80 -18.43

TATACHEM 8204900 -13.56 1045.30 0.86

CANBK 59861700 -12.27 375.05 -2.17

IRCTC 16408875 -11.11 689.20 4.09

HEROMOTOCO 4003200 -8.95 2974.70 -0.96

CUMMINSIND 5788800 -8.16 1736.25 0.83

GRANULES 13910000 -8.11 333.75 -1.30

M&MFIN 43000000 -7.25 300.10 -0.12

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.91 0.90

BANKNIFTY 0.82 0.92

RELIANCE 0.46 0.48

ICICIBANK 0.40 0.50

INFY 0.45 0.54

www.angelone.in

Technical & Derivatives Report

September

2

6

, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

19

674.

55

FII Statistics for

September

2

5

, 2023

Detail Buy

Contracts

OI Value

(in Cr.)

Sell Net CHANGE

INDEX

FUTURES

4080.62 5546.64 (1466.02) 196388 16901.08 7.53

INDEX

OPTIONS

1282288.85 1281370.16 918.69

4485396 363940.42 7.66

STOCK

FUTURES

65447.53 63108.13 2339.40

2387137 189288.52 1.01

STOCK

OPTIONS

31762.22 31863.44 (101.22) 341788 27575.95 (4.56)

Total

1383579.22

1381888.37

1690.85

7410709

597705.97

4.81

Turnover on

September

2

5

, 2023

Instrument

No. of

Contracts

Turnover

(in Cr.)

Change

(%)

Index Futures

396791 32280.36

-11.60

Index

Options

396086557

62159.92

9.61

Stock Futures

2204365 179045.05

98.56

Stock

Options

5435263 3904.50 -15.55

Total

54,35,263

3904.50 47.53

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

19600 138.15

63.10

36.90

19663.10

Sell

19700 75.05

Buy

19600 138.15

103.45

96.55

19703.45

Sell

19800 34.70

Buy

19700 75.05

40.35 59.65 19740.35

Sell

19800 34.70

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

19800 134.30

59.75

40.25

19740.25

Sell 19700 74.55

Buy 19800 134.30

96.20

103.80

19703.80

Sell

19600 38.10

Buy

19700 74.55

36.45 63.55 19663.55

Sell 19600 38.10

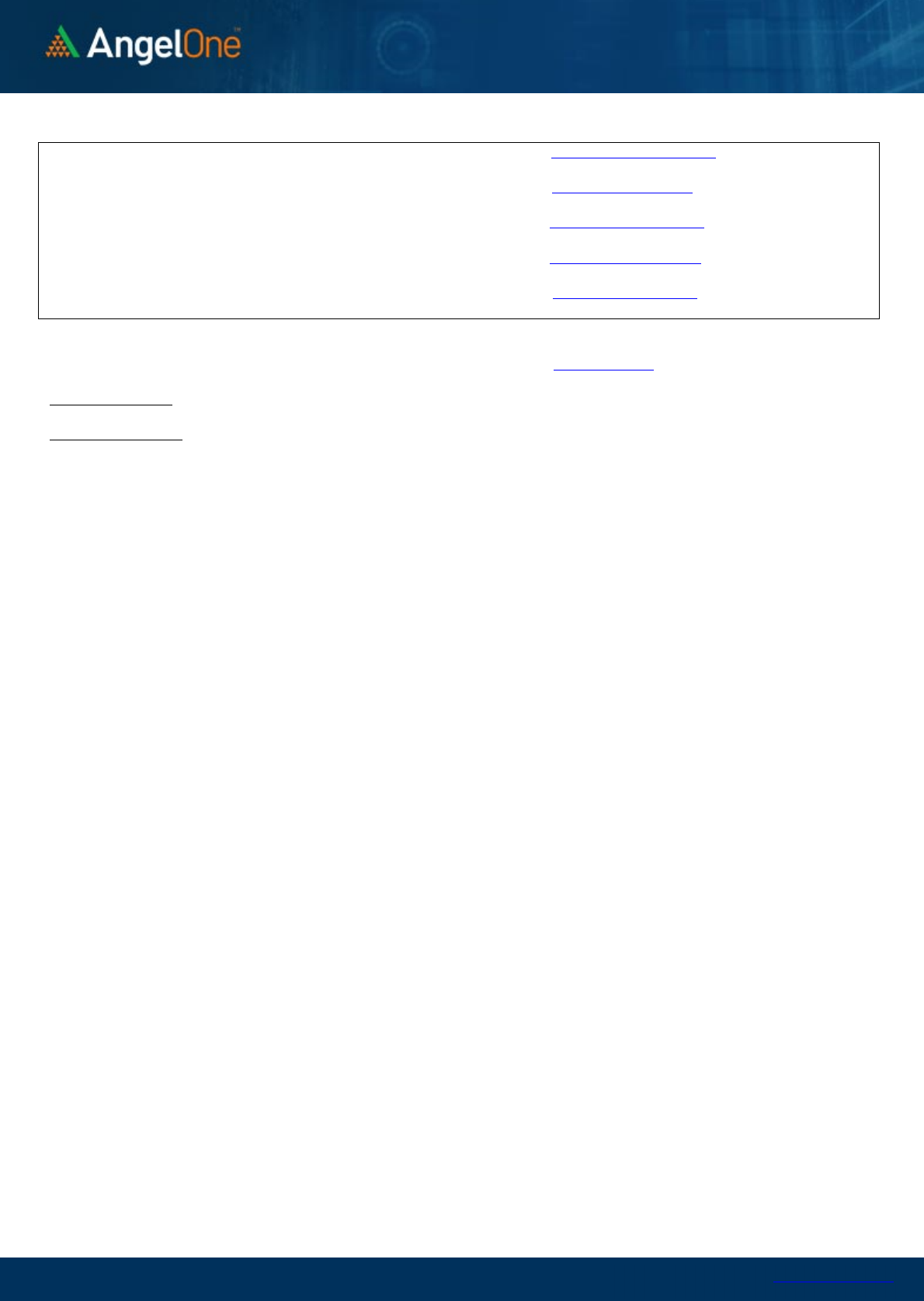

Nifty Put

-

Call Analysis

,0

2000,000

4000,000

6000,000

8000,000

10000,000

12000,000

19000 19100 19200 19300 19400 19500 19600 19700 19800 19900 20000 20100 20200 20300

Call Put

www.angelone.in

Technical & Derivatives Report

September

2

6

, 2023

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIENT 2,400 2,441 2,465 2,506 2,530

ADANIPORTS 813 819 825 832 838

APOLLOHOSP 4,921 5,009 5,061 5,149 5,202

ASIANPAINT 3,246 3,285 3,310 3,348 3,373

AXISBANK 996 1,007 1,017 1,028 1,038

BAJAJ-AUTO 4,952 4,979 5,019 5,046 5,087

BAJFINANCE 7,387 7,603 7,727 7,943 8,066

BAJAJFINSV 1,527 1,552 1,572 1,597 1,616

BPCL 346 349 351 354 357

BHARTIARTL 897 904 909 915 920

BRITANNIA 4,481 4,525 4,555 4,600 4,630

CIPLA 1,164 1,172 1,185 1,192 1,205

COALINDIA 278 283 286 291 294

DIVISLAB 3,660 3,694 3,722 3,756 3,784

DRREDDY 5,357 5,398 5,469 5,510 5,581

EICHERMOT 3,350 3,369 3,399 3,417 3,448

GRASIM 1,885 1,913 1,929 1,957 1,973

HCLTECH 1,243 1,253 1,267 1,277 1,290

HDFCBANK 1,517 1,524 1,532 1,539 1,548

HDFCLIFE 632 637 645 650 658

HEROMOTOCO 2,934 2,955 2,989 3,009 3,043

HINDALCO 460 465 472 476 483

HINDUNILVR 2,439 2,457 2,479 2,497 2,518

ICICIBANK 933 945 953 965 973

INDUSINDBK 1,423 1,433 1,444 1,454 1,464

INFY 1,460 1,467 1,479 1,485 1,497

ITC 435 439 442 445 448

JSW STEEL 770 775 779 784 788

KOTAKBANK 1,744 1,764 1,777 1,797 1,809

LT 2,846 2,874 2,899 2,927 2,952

LTIMINDTREE 5,300 5,338 5,399 5,437 5,498

M&M 1,560 1,575 1,597 1,612 1,635

MARUTI 10,423 10,505 10,613 10,695 10,803

NESTLEIND 22,342 22,490 22,599 22,748 22,857

NTPC 236 238 239 241 242

ONGC 184 185 186 186 187

POWERGRID 195 197 199 201 203

RELIANCE 2,320 2,330 2,345 2,356 2,371

SBILIFE 1,257 1,276 1,308 1,326 1,359

SBIN 584 589 595 600 606

SUNPHARMA 1,112 1,118 1,128 1,133 1,143

TCS 3,524 3,551 3,585 3,612 3,647

TATACONSUM

857 879 892 914 927

TATAMOTORS 613 616 621 623 628

TATASTEEL 125 126 127 128 129

TECHM 1,285 1,292 1,303 1,311 1,322

TITAN 3,233 3,259 3,287 3,312 3,340

ULTRACEMCO 8,090 8,148 8,214 8,272 8,338

UPL 607 612 618 623 630

WIPRO 408 411 415 419 423

www.angelone.in

Technical & Derivatives Report

September

2

6

, 2023

Technical and Derivatives Team:

Sameet Chavan Head Research – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Analyst - Technical rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Hitesh Rathi Analyst – Technical & Derivatives hitesh.rathi@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

We, Angel One Limited (hereinafter referred to as “Angel”) a company duly incorporated under the provisions of the Companies Act, 1956 with

its registered office at 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai – 400093, CIN: (L67120MH1996PLC101709) and

duly registered as a member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited,

Multi Commodity Exchange of India Ltd and National Commodity & Derivatives Exchange Ltd. Angel One limited is a company engaged in

diversified financial services business including securities broking, DP services, distribution of Mutual Fund products. It is also registered as a

Depository Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund

Distributor. Angel One Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164 and also registered with PFRDA as PoP ,Registration No.19092018. Angel Group does not have any joint

ventures or associates. Angel One Limited is the ultimate parent company of the Group. . Angel or its associates has not been debarred/ suspended

by SEBI or any other regulatory authority for accessing /dealing in securities Market.

AOL was merged with Angel Global Capital Private Limited and subsequently name of Angel Global Capital Private Limited was changed to Angel

Broking Private Limited (AOL) pursuant to scheme of Amalgamation sanctioned by the Hon'ble High Court of Judicature at Bombay by Orders

passed in Company Petition No 710 of 2011 and the approval granted by the Registrar of Companies. Further, name of Angel Broking Private

Limited again got changed to Angel Broking Limited (AOL) pursuant to fresh certificate of incorporation issued by Registrar of Companies (ROC)

dated June 28, 2018. Further name of Angel Broking name changed to Angel One Ltd pursuant to fresh certificate of incorporation issued by

Registrar of Companies (ROC) dated 23-09-21.

In case of any grievances please write to: support@angelone.in, Compliance Officer Details: Name : Hiren Thakkar, Tel No. –08657864228, Email

id - compliance@angelone.in

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns

to investors.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither research entity nor research analyst has been engaged in market making activity for the subject company.

www.angelone.in

Technical & Derivatives Report

September

2

6

, 2023

*

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited does not warrant the accuracy, adequacy or

completeness of the service, information and materials and expressly disclaims liability for errors or omissions in the service, information and

materials. While Angel One Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Any communication sent to clients on phone numbers or e-mail ids registered with the Trading Member is meant for client consumption and such

material should not be redistributed. Brokerage will not exceed SEBI prescribed limit. Any Information provided by us through any medium based

on our research or that of our affiliates or third parties or other external sources is subject to domestic and international market conditions and

we do not guarantee the availability or otherwise of any securities or other instruments and such Information is merely an estimation of certain

investments, and we have not and shall not be deemed to have assumed any responsibility for any such Information. You should seek independent

professional advice and/or tax advice regarding the suitability of any investment decision whether based on any Information provided by us

through the Site from inhouse research or third party reports or otherwise.

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written

consent.