OCT 25, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

Nifty Bank Outlook (40784)

The banking space has seen strong traction throughout the week,

especially on Friday; courtesy to gigantic leap in Axis bank post its

stellar quarterly numbers. In this course of action, BANKNIFTY has

outperformed the benchmark index and procured 3.76 percent of

gains on a weekly basis. The weekly closure above 40600 construes

a positive development ahead of the truncated Diwali week.

On the technical aspect, the index is firmly placed above all the

major exponential moving averages on the daily chart, signifying

inherent bullishness. Also, on the weekly time frame, the index has

closed at the highest level ever, adding to a buoyant sentiment. As

far as levels are concerned, 40000 – 39800 is expected to act as the

sacrosanct support zone for the index. On the flip side, the index is

all set to re-claim the lifetime high zone in the comparable period.

We remain to have a sanguine view in the banking space, where

any dip towards the mentioned support could be utilized to add

long bets.

Key Levels

Support 1 – 40600 Resistance 1 – 41500

Support 2 – 40350 Resistance 2 – 41670

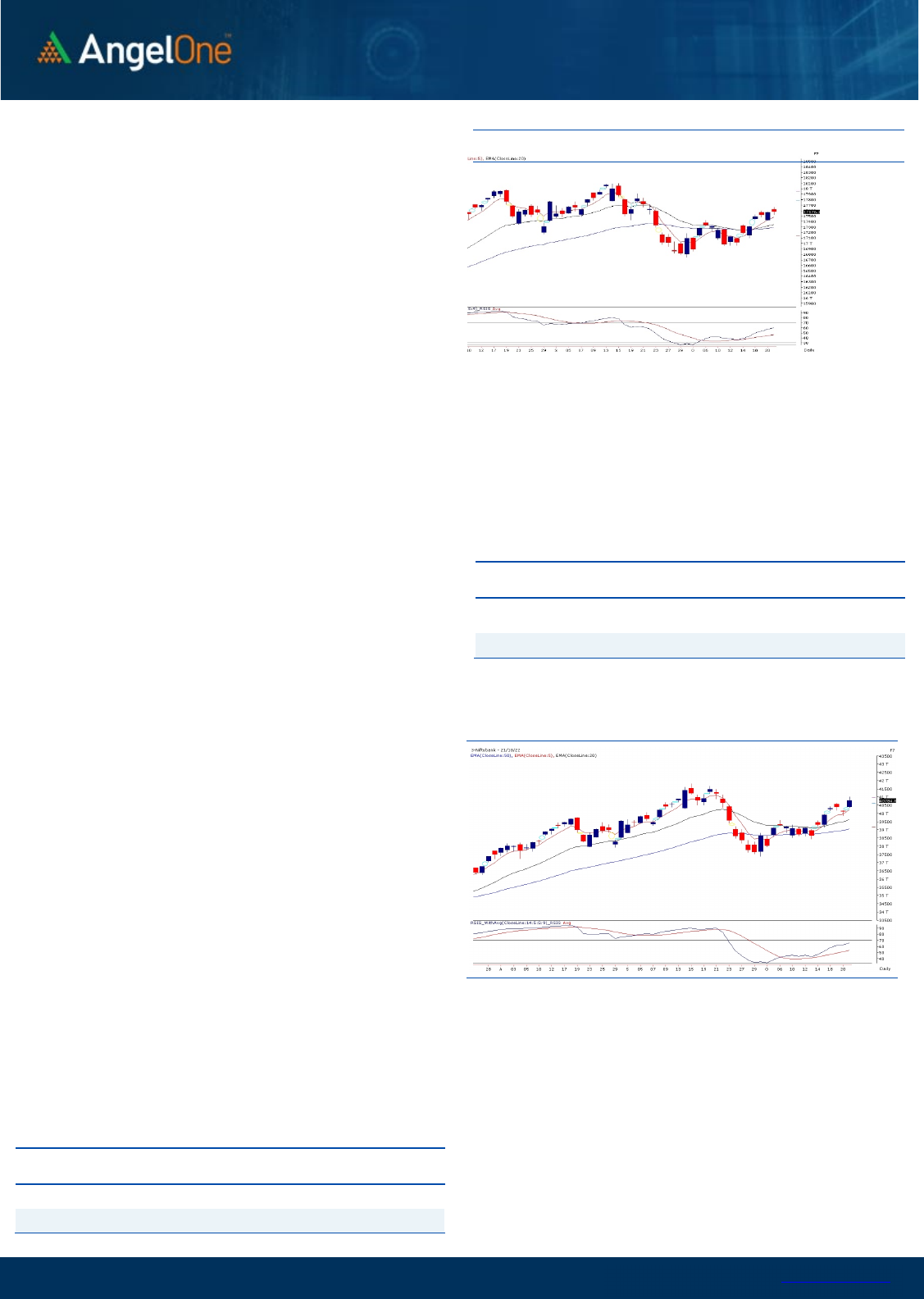

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (59307) / Nifty (17576)

Last week, our markets started on a sluggish note as global markets

once again looked a bit tentative over the previous weekend.

However, market participants at our end pounced on to this

opportunity as we witnessed a V-shaped recovery to reclaim the

17300 mark. Adding to this, the sentiments on global front

improved drastically as the week progressed which provided the

much-needed impetus for our domestic markets. As a result, we

kept marching higher in latter half to eventually conclude the pre-

Diwali week convincingly above 17500 by adding over a couple of

percent gains to the bulls’ kitty.

Most of our recent hope or anticipation has turned into a reality and

in the process, rock solid support zone around 17000 – 16800 has

certainly proved its significance. The bulls were determined to

defend this last week and with slight improvement in global peers,

fueled the rally in our market to regain some strength. From a

technical standpoint, Nifty is now placed in a safer territory and

from hereon, the immediate support is visible in the vicinity of

17400 – 17350. Since the undertone is strongly bullish, one should

continue with an optimistic bias and should continue using

intermediate declines to add bullish bets. On the higher side, Nifty

has reached to our immediate targets of 17500 – 17600; but now,

we can safely extend these projections towards 17800 and even

retesting of 18000 cannot be ruled out. For this to happen, we do

not require flamboyant moves from global bourses, rather their

stability is the need of the hour and hence, no negative news would

be considered as good news only.

Sectorally, the banking outshined by a fair margin last week,

especially on Friday after the stellar Quarterly numbers from

private banking giant, Axis Bank. This heavyweight space is likely

to be the major charioteer and once other heavyweight too starts

chipping in, markets are good to go towards the 18000 mark. As

far as the broader market is concerned, it remained quite last

week; but if we see global uncertainty completely disappearing,

the midcaps will have a strong comeback soon.

Key Levels

Support 1 – 17540 Resistance 1 – 17810

Support 2 – 17500 Resistance 2 – 17880

www.angelone.in

Technical & Derivatives Report

OCT 25, 2022

View

Finally, after last three weeks we manged to breach

the resistance zone around 17500 on the closing basis.

We had a sluggish start for the week, but strong buying

emerged on Monday to almost recoup all the losses

seen on last Friday. Next day, we had a bumped up

start and we managed to reclaim 17500 and this was

followed by rough move towards 17650.

FIIs were net buyers in the cash market segment to

the tune of Rs. 439 crores. Simultaneously, in Index

futures, they bought worth Rs. 494 crores with a rise

in open interest; indicating formation of long positions

on Friday’s session.

In F&O space, fresh long formations are seen in Nifty

and Bank Nifty. Post some selling in initial three days,

stronger hands turned net buyers in the cash segment.

In the Index futures, they added bullish bets in index as

well as stock futures segment. Hence the FIIs ‘Long

Short Ratio’ has improved from 23% to 30%. We

observed fresh writing in 17500 and 17600 put strikes.

On the other side, 17600-18200 call options added huge

positions which could be on short side. At current

juncture, 17300-17400 is a strong demand zone for the

benchmark index and until we manage to sustain

above same the biasness remains positive.

Comments

The Nifty futures open interest has increased by

1.52%. and Bank Nifty futures open interest has

increased by 5.75% as the market closed at 17576.30.

The Nifty October future closed with a discount of

11.85 point against a discount of 23.25 point in the last

trading session. The November series closed at a

premium of 17.50 point.

The INDIA VIX increased from 17.23 to 17.42. At the

same time, the PCR-OI of Nifty has decreased from

1.22 to 1.03.

Few of the liquid counters where we have seen high

cost of carry are IDEA, BALRAMCHIN, ASTRAL, BPCL

and MFSL.

Historical Volatility

SCRIP HV

AXISBANK 40.17

LAURUSLABS 44.41

BERGEPAINT 32.56

MPHASIS 43.54

HAVELLS 37.02

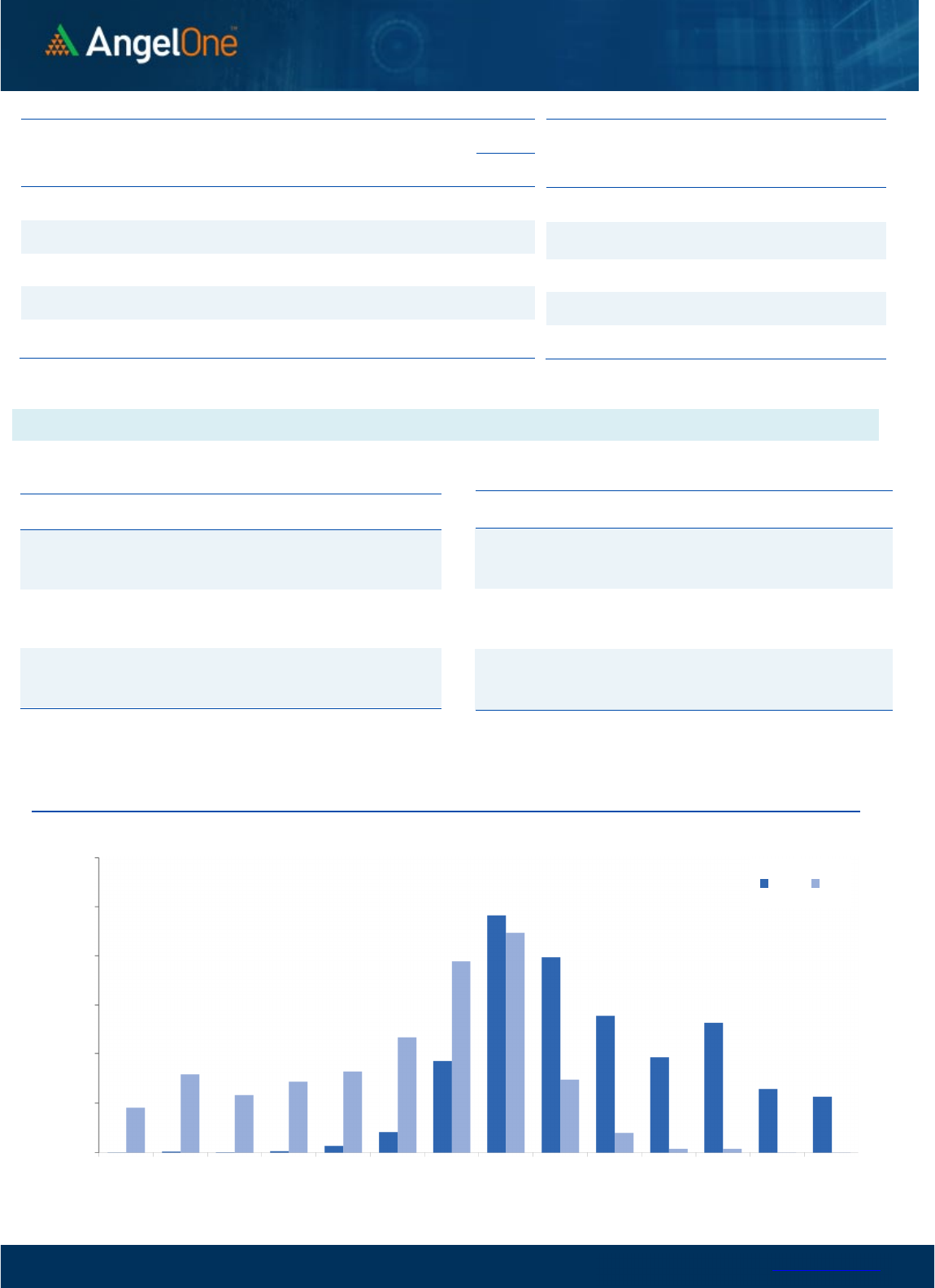

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

10/3 10/6 10/10 10/12 10/14 10/18 10/20

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BERGEPAINT 9005700 22.41 585.35 -5.34

AXISBANK 59740800 16.77 900.40 8.25

LAURUSLABS 7235100 16.68 486.30 -7.15

BAJFINANCE 5434500 13.48 7192.70 -3.22

METROPOLIS 732900 11.55 1588.75 2.08

SRTRANSFIN 4600800 11.00 1197.70 -2.10

SBICARD 5846400 10.18 865.45 -2.45

MFSL 2763150 9.87 698.50 -1.87

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GUJGASLTD 6141250 -25.95 501.80 3.99

NMDC 40431150 -20.92 130.35 -1.54

COFORGE 851700 -20.84 3862.15 2.68

HDFCAMC 2064000 -15.82 2069.55 2.12

LALPATHLAB 1100250 -13.87 2561.90 2.81

POLYCAB 975900 -13.39 2698.10 1.83

CROMPTON 5619000 -13.39 373.55 -2.16

ICICIPRULI 7428000 -12.00 510.00 -1.80

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.03 0.95

BANKNIFTY 1.15 0.86

RELIANCE 0.52 0.47

ICICIBANK 0.52 0.29

INFY 0.49 0.42

www.angelone.in

Technical & Derivatives Report

OCT 25, 2022

*Report as per Friday 21

st

October closing

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Oct Series) are given as an information and not as a recommendation.

Nifty Spot =

17

576.

30

FII Statistics for

October

2

1

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

6928.58 6434.82 493.76

196110 17962.83 9.14

INDEX

OPTIONS

712737.93 702844.66 9893.27

1865339 169867.75 31.59

STOCK

FUTURES

60316.62 59798.19 518.43

2183291 150484.95 0.58

STOCK

OPTIONS

16728.03 16444.79 283.24

166332 12294.16 3.19

Total 796711.16

785522.46

11188.70

4411072

350609.69

12.27

Turnover on

October

2

1

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

473238 44840.91 17.29

Index Options

91686896 42497.38 -15.89

Stock

Futures

2362396 169777.90 36.46

Stock Options

4691086 3999.76 37.45

Total

4,691,086 3999.76 20.84

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17700 52.15

25.75

74.25

17725.75

Sell

17800 26.40

Buy

17700 52.15

40.00

160.00

17740.00

Sell

17900 12.15

Buy

17800 26.40

14.25 85.75 17814.25

Sell 17900 12.15

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17700 188.25

58.50

41.50

17641.50

Sell

17600 129.75

Buy 17700 188.25

102.15

97.85

17597.85

Sell 17500 86.10

Buy

17600 129.75

43.65 56.35 17556.35

Sell 17500 86.10

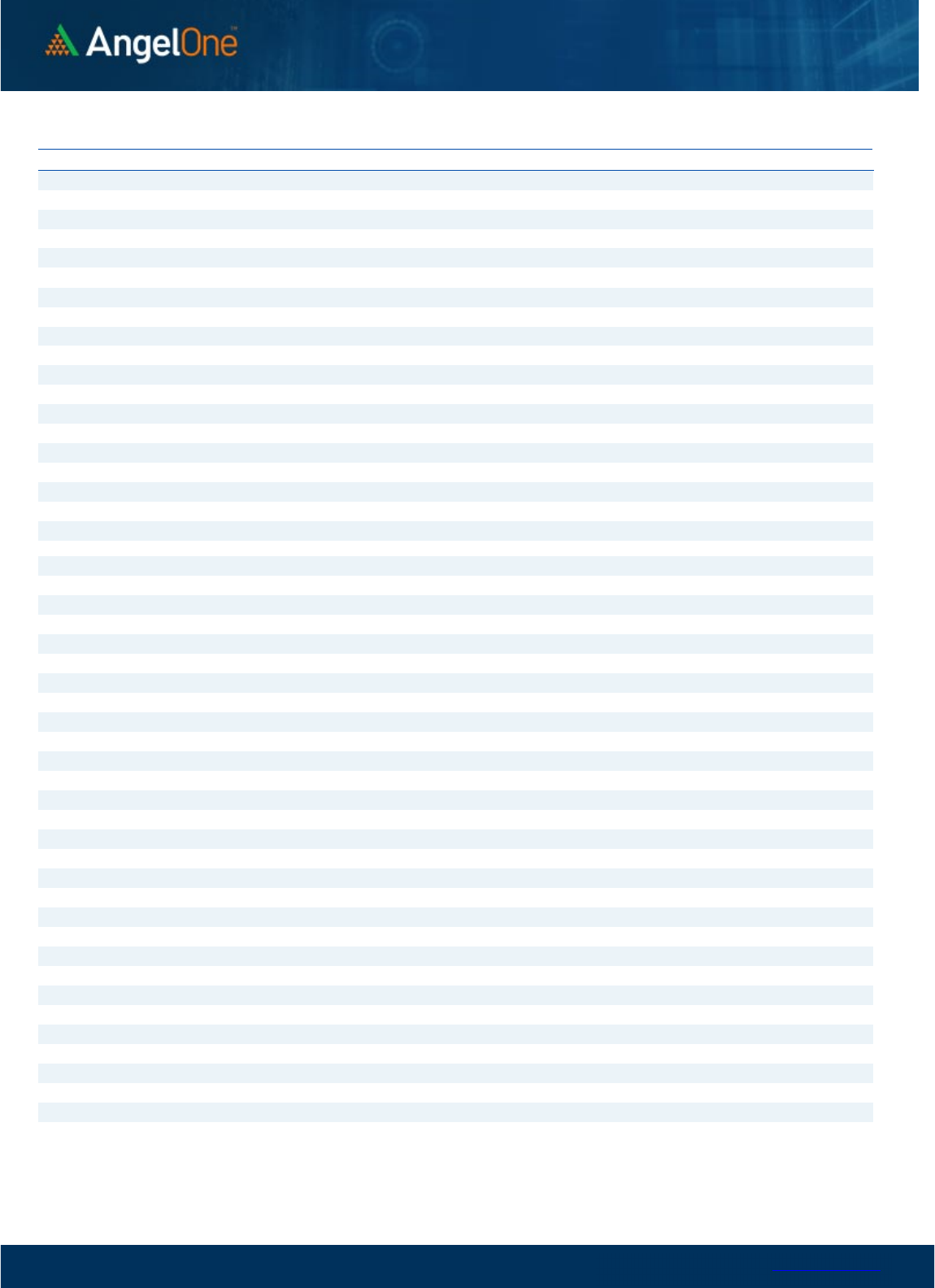

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200

Call Put

www.angelone.in

Technical & Derivatives Report

OCT 25, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT

3,232

3,272

3,327

3,367

3,422

ADANIPORTS

784

793

808

817

833

APOLLOHOSP 4,273 4,331

4,381

4,438

4,488

ASIANPAINT

3,018

3,055

3,110

3,147 3,202

AXISBANK

837

869

887

919

938

BAJAJ-AUTO 3,598 3,633

3,677

3,712

3,756

BAJFINANCE 6,942 7,067

7,279

7,404

7,616

BAJAJFINSV

1,635

1,660

1,700

1,725

1,765

BPCL

295

297

299

300

302

BHARTIARTL

784

791

797

804 810

BRITANNIA

3,737

3,765

3,790

3,818

3,843

CIPLA 1,123 1,129

1,138

1,144

1,154

COALINDIA 236 237

239

241

243

DIVISLAB 3,495 3,533

3,601

3,639

3,707

DRREDDY 4,262 4,297

4,343

4,377

4,423

EICHERMOT 3,511 3,570

3,627

3,687

3,744

GRASIM 1,641 1,659

1,687

1,705

1,733

HCLTECH

1,005

1,016

1,023

1,034

1,041

HDFCBANK

1,420

1,429

1,443

1,453

1,467

HDFCLIFE 531 536

542

548

554

HDFC 2,320 2,335

2,357

2,372

2,394

HEROMOTOCO

2,536

2,553

2,565 2,582 2,594

HINDALCO 381 387

393

399

404

HINDUNILVR

2,581

2,618

2,642

2,678

2,703

ICICIBANK

877

892

901

916

925

INDUSINDBK 1,120 1,131

1,150

1,161

1,180

INFY

1,485

1,493

1,499

1,507

1,514

ITC

339

342

348

351

356

JSW STEEL

609

616

623

630

637

KOTAKBANK

1,839

1,871

1,898

1,930

1,957

LT

1,832

1,854

1,890

1,912

1,948

M&M

1,232

1,244

1,257

1,269

1,281

MARUTI 8,560 8,632

8,713

8,785 8,866

NESTLEIND

19,842

20,068

20,209 20,436 20,577

NTPC

162

164

166

168

170

ONGC

127

129

131

134

136

POWERGRID

212

215

217

219

222

RELIANCE 2,435 2,453

2,485

2,503 2,535

SBILIFE 1,218 1,232

1,241

1,255

1,264

SBIN

553

557

561

565

570

SUNPHARMA 966 972

982

988

998

TCS

3,108

3,123

3,142

3,156

3,175

TATACONSUM

740

751

766

777

792

TATAMOTORS

391

394

398

402

406

TATASTEEL 98 99

100 101 102

TECHM

1,026

1,033

1,039

1,047

1,052

TITAN

2,622

2,644

2,662

2,684

2,701

ULTRACEMCO

6,261

6,312

6,367

6,417

6,472

UPL

680

690

707

717

734

WIPRO 379 381

382

384

385

www.angelone.in

Technical & Derivatives Report

OCT 25, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.