May 25, 2022

www.angelone.in

Technical & Derivatives Report

Nifty Bank Outlook

-

(342

90

)

The banking index started the day on a flat note in line with

benchmark index. In the first half, some of the banking

heavyweights showed buying interest, which pushed the

BANKNIFTY towards the 34500 mark. However similar to

Monday, the profit booking took place in the latter half to erase

all gains and eventually ended the session around the 34300

mark.

Market is clearly lacking direction as well as momentum since

last couple of sessions. Both counterparties are able to defend

their territories successfully because we tend to see some

buying at lower levels and the moment we reach the resistance

zone, the tentativeness is clearly visible. For the coming

session, the immediate hurdles are now seen around 34600 –

34800 – 35000; whereas on the flipside, the support remains at

34000 – 33800. Traders are advised to trade the range and till

the time we do not convincingly move out of the range, the

aggressive bets should strictly be avoided.

Key Levels

Support 1 – 34000 Resistance 1 – 34600

Support 2 – 33800 Resistance 2 – 34800

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (54

053

) / Nifty (16

125

)

Weak Asian cues led to a timid start to our domestic market,

wherein the benchmark index tumbled in the initial hours. The

Nifty50 index kept hustling in a slender range for most of the

session and witnessed a lackluster day of trade. The correction

was aggravated by the fag end that dragged the Nifty below the

16100-sub zone, but soon after, some recovery poured in. At last,

the index concluded the day a tad above the 16100 level with a cut

of 0.55 percent.

On the technical aspect, a consecutive day of sell-off certainly

showcased the tentativeness among the market participants

amid the expiry week. At the current juncture, the psychological

mark of 16000 is likely to act as a sacrosanct support zone for

the index, wherein the placement of the index above the unfilled

gap of the 16000 mark could be seen as the last resort of relief

for the bulls. Meanwhile, volatility is likely to be seen amid the

expiry week.

Key Levels

Support 1 – 16000 Resistance 1 – 16400

Support 2 – 15900 Resistance 2 – 16500

Looking at the recent development,

16400

is expected to act

as an intermediate resistance zone, followed by the sturdy

wall of the unfilled gap of 16480-16650 odd zone. On the

contrary, the 16000 mark is expected to act as the sheet

anchor, while any breach below could again dampen the

market sentiments. The momentum is likely to be seen only

when the index comes out from the ongoing slender range

bound movement. Till then, traders are advised to stay

abreast with the global developments and have a stock-

centric approach to trading opportunities.

www.angelone.in

Technical & Derivatives Report

May 25, 2022

View

We began Tuesday’s session slightly higher but

witnessed follow-up selling right from the word go

to tank below 16150 in the preliminary hour. The

index made an attempt of recovery but bear were

not ready to give up and hence we observed another

round of selling to drag index below 16100.

Eventually, we settled the day tad above 16100 with

a cut of more than half a percent.

FIIs were net sellers in the cash market segment

to the tune of Rs. 2393 crores. Simultaneously, in

Index futures, they sold worth Rs.644 crores with

a rise in open interest, indicating addition of fresh

shorts.

In yesterday’s session, we observed fresh short

addition in Nifty and mixed activity was seen in

banking index. Stronger hands too added bearish

bets in index futures but preferred covering shorts

in stock futures segment. The volatility index (INDIA

VIX) surged nearly 10% in single day, further rise in

same wouldn’t be a good indication. Interestingly,

despite yesterday’s selling we couldn’t hardly see

any relevant unwinding in 16000 put strike, which

suggests traders are expecting major correction.

However, call writer continues adding positions in

16100-16500 strikes. At current juncture, 16000-

16100 remains a strong demand zone and until be

sustain above same trader’s should avoid bearish

bets.

Comments

The Nifty futures open interest has increased by 4.50%.

and BANK Nifty futures open interest has decreased by

0.03% as the market closed at 16125.15.

The Nifty May future closed with a discount of 20.45

point against a discount of 31.35 point in the last trading

session. The June series closed at a discount of 24.35

point.

The INDIA VIX increased from 23.39 to 25.63. At the

same time, the PCR-OI of Nifty decreased from 1.01 to

0.90.

Few of the liquid counters where we have seen high

cost of carry are L&TFH, PNB, IBULHSGFIN, GSPL and

HDFCAMC.

Historical Volatility

SCRIP HV

DIVISLAB 38.56

PVR 49.47

COROMANDEL 37.67

TECHM 39.36

HINDUNILVR 30.05

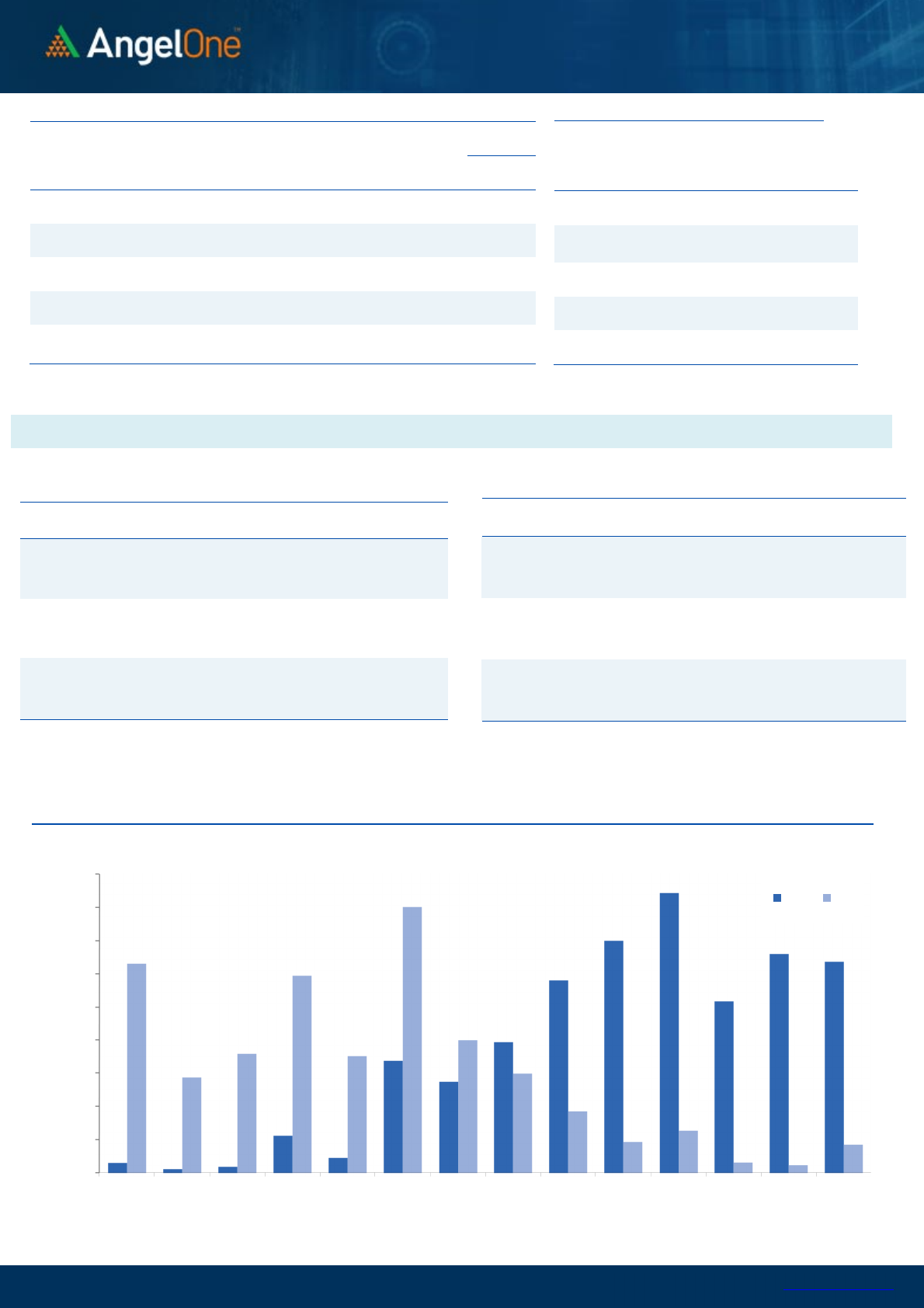

Nifty Vs OI

15400

15600

15800

16000

16200

16400

16600

5,000

6,000

7,000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

5-6 5-10 5-12 5-16 5-18 5-20 5-24

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ABBOTINDIA 33870 24.20 18197.00 3.04

PETRONET 19002000 20.67 224.90 -0.20

DIVISLAB 2864800 18.00 3661.70 -6.02

GMRINFRA 145125000 17.14 37.00 1.37

IDEA 815010000 15.02 9.00 0.00

NAVINFLUOR 454725 14.96 3717.15 1.34

COROMANDEL 1811675 13.50 973.00 4.44

UBL 1403700 13.38 1461.65 -0.28

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ASTRAL 737550 -20.04 1675.25 -1.63

CUMMINSIND 1222800 -13.42 1015.85 0.27

NAM-INDIA 3116800 -12.92 271.10 -0.09

ADANIPORTS 84415000 -12.82 752.15 -0.16

ATUL 168900 -11.93 8071.20 -0.59

IGL 13921875 -11.63 368.80 -0.91

TORNTPOWER 3571500 -11.45 430.50 0.10

RAIN 7023000 -9.15 155.75 -2.75

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.90 0.77

BANKNIFTY 0.91 0.92

RELIANCE 0.45 0.44

ICICIBANK 0.50 0.54

INFY 0.41 0.59

www.angelone.in

Technical & Derivatives Report

May 25, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Spot = 16

12

5

.15

FII Statistics for

May

2

4

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4703.69 5347.63 (643.94) 183512 15048.04 5.32

INDEX

OPTIONS

674406.60 674918.69 (512.09) 1981475 161763.12 12.30

STOCK

FUTURES

60724.92 58946.59 1778.33

2458187 148422.27 (0.41)

STOCK

OPTIONS

8863.32 8914.29 (50.97) 152142 9626.98 (2.99)

Total

748698.53

748127.20

571.33

4775316

334860.41

4.63

Turnover

on

May

24

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

531413 43923.32 -3.56

Index

Options

92138876 7709106.40

19.96

Stock

Futures

2613070 158645.41

13.33

Stock

Options

4161300 262029.52

-14.51

Total

41,61,300 262029.52

18.14

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

16100 129.50

49.05

50.95

16149.05

Sell

16200 80.45

Buy

16100 129.50

84.35

115.65

16184.35

Sell

16300 45.15

Buy

16200 80.45

35.30 64.70 16235.30

Sell 16300 45.15

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

16100 126.35

38.40

61.60

16061.60

Sell

16000 87.95

Buy

16100 126.35

66.70

133.30

16033.30

Sell

15900 59.65

Buy

16000 87.95

28.30 71.70 15971.70

Sell

15900 59.65

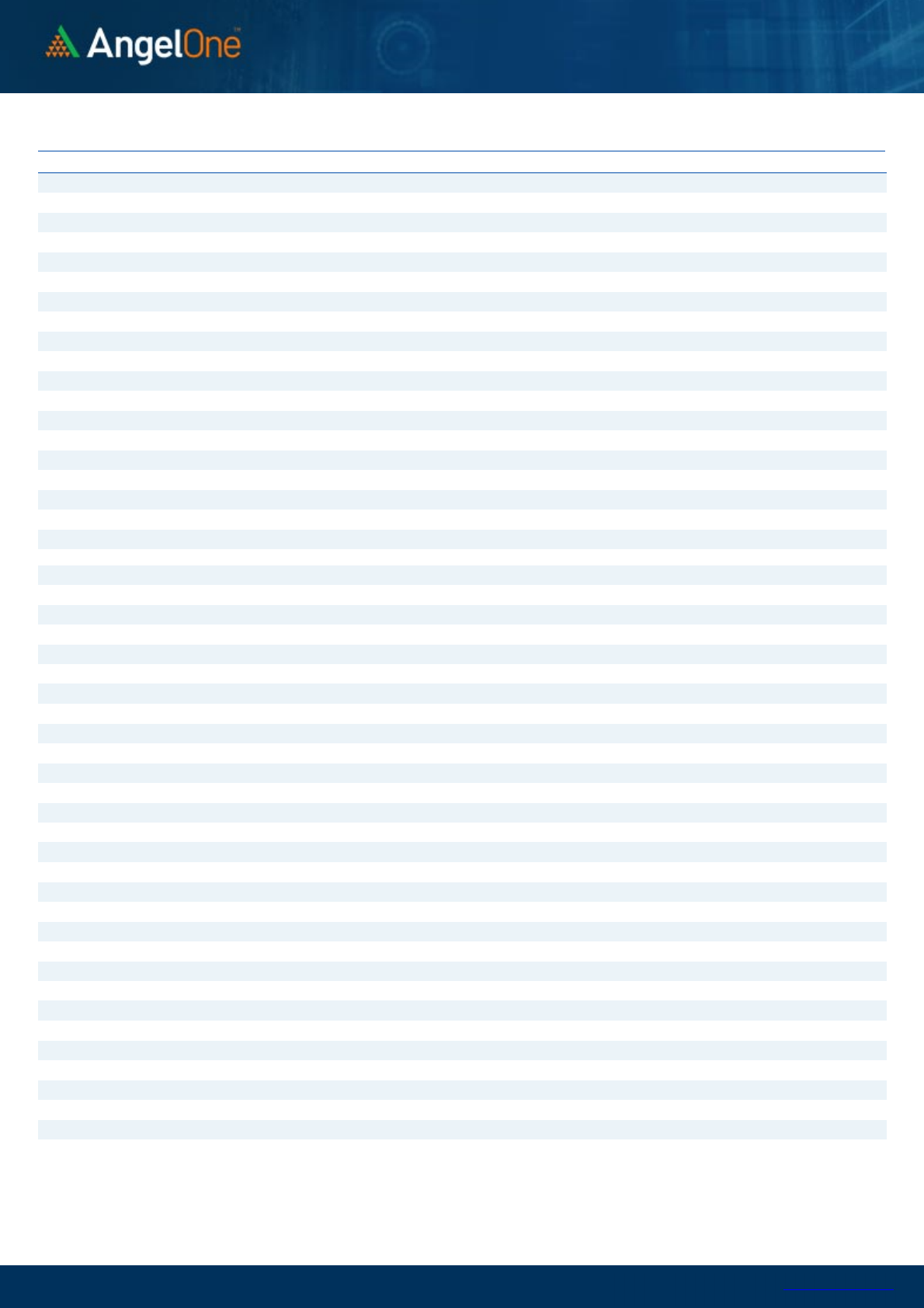

Nifty Put

-

Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

7000,000

8000,000

9000,000

15500 15600 15700 15800 15900 16000 16100 16200 16300 16400 16500 16600 16700 16800

Call Put

www.angelone.in

Technical & Derivatives Report

May 25, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 738 745

755 762 772

APOLLOHOSP 3,535 3,583

3,662 3,710 3,788

ASIANPAINT 3,000 3,043

3,114 3,157 3,227

AXISBANK 649 656

669 677 689

BAJAJ-AUTO 3,728 3,756

3,799 3,827 3,870

BAJFINANCE 5,678 5,738

5,786 5,846 5,894

BAJAJFINSV 12,088 12,223

12,422 12,557 12,756

BPCL 325 328

331 334 337

BHARTIARTL 668 673

681 686 695

BRITANNIA 3,398 3,434

3,476 3,512 3,554

CIPLA 954 962

970 978 986

COALINDIA 178 180

183 186 189

DIVISLAB 3,479 3,570

3,741 3,833 4,004

DRREDDY 4,208 4,277

4,326 4,396 4,445

EICHERMOT 2,663 2,691

2,730 2,759 2,798

GRASIM 1,330 1,366

1,417 1,453 1,504

HCLTECH 965 978

1,000 1,014 1,036

HDFCBANK 1,286 1,302

1,314 1,330 1,342

HDFCLIFE 541 547

552 557 562

HDFC 2,129 2,168

2,197 2,236 2,265

HEROMOTOCO 2,594 2,616

2,635 2,656 2,675

HINDALCO 390 395

405 411 421

HINDUNILVR 2,253 2,281

2,331 2,359 2,409

ICICIBANK 699 704

711 715 722

INDUSINDBK 882 890

903 912 925

INFY 1,414 1,428

1,449 1,462 1,483

ITC 267 269

272 274 277

JSW STEEL 525 533

544 552 564

KOTAKBANK 1,825 1,854

1,872 1,901 1,919

LT 1,586 1,606

1,630 1,650 1,674

M&M 933 940

950 957 967

MARUTI 7,695 7,749

7,845 7,899 7,996

NESTLEIND 16,681 16,934

17,106 17,359 17,531

NTPC 143 145

148 150 154

ONGC 145 148

153 156 160

POWERGRID 222 225

227 230 232

RELIANCE 2,577 2,596

2,617 2,637 2,657

SBILIFE 1,045 1,059

1,071 1,086 1,098

SHREECEM 21,250 21,449

21,774 21,972 22,298

SBIN 456 459

463 466 470

SUNPHARMA 892 901

916 925 940

TCS 3,247 3,267

3,296 3,317 3,345

TATACONSUM

693 704

721 732 749

TATAMOTORS 412 419

423 430 435

TATASTEEL 978 992

1,016 1,030 1,054

TECHM 1,053 1,076

1,114 1,136 1,175

TITAN 2,099 2,119

2,142 2,163 2,186

ULTRACEMCO 5,762 5,815

5,886 5,939 6,010

UPL 777 785

792 800 807

WIPRO 451 455

463 467 474

www.angelone.in

Technical & Derivatives Report

May 25, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.