May 24, 2022

www.angelone.in

Technical & Derivatives

Report

Nifty Bank Outlook

-

(34248)

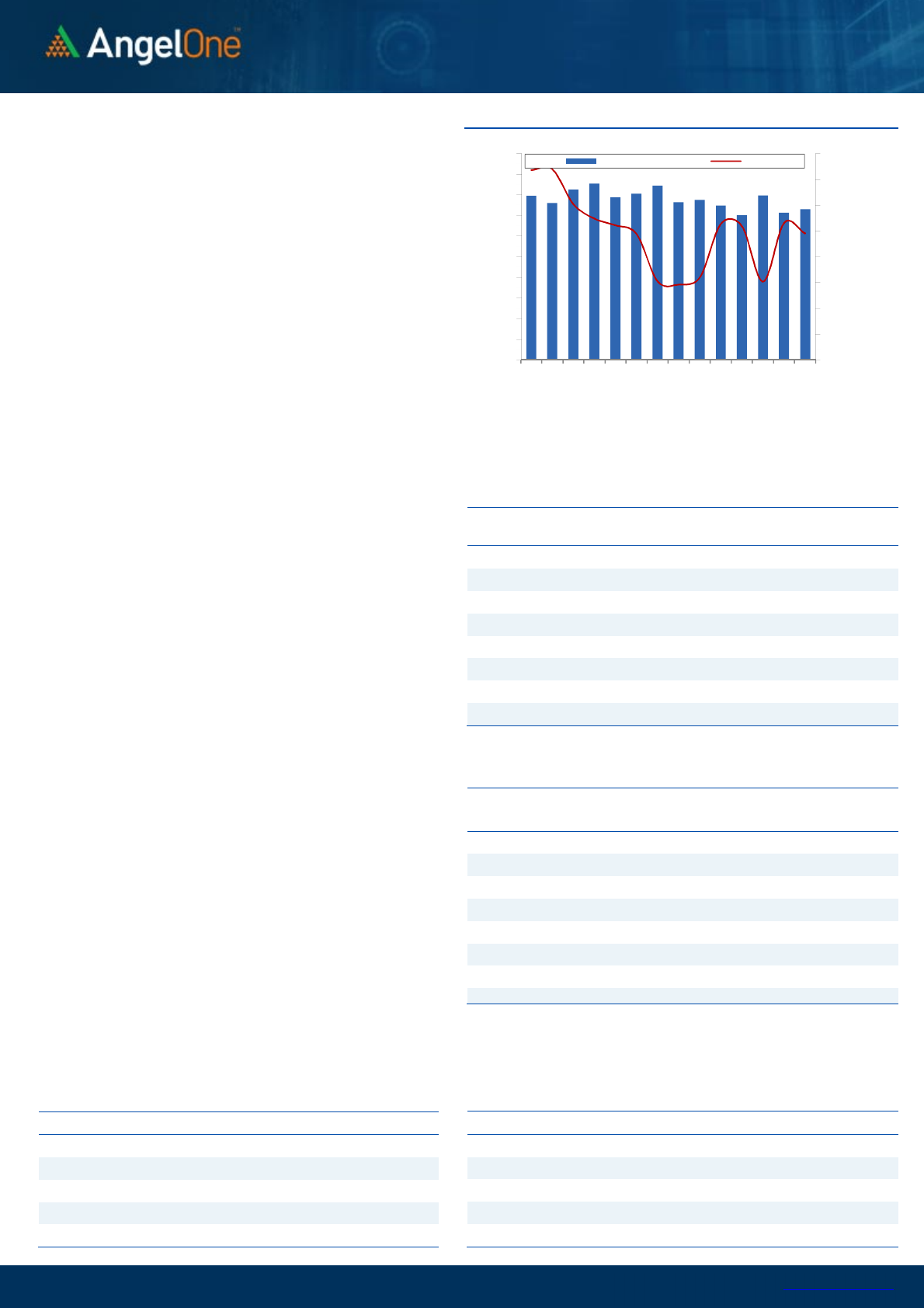

Similar to benchmark, the banking index too opened higher and

remained at elevated levels for the most part of the session. In

this process, the BANKNIFTY moved closer to the key resistance

zone of 34800 – 35000. Some of the banking counters were

doing extremely good around the mid-session; but all of a

sudden, the selling reappeared across the broader market. In

fact, it intensified towards the end to pare down all gains and

conclude marginally in the red.

It seems traders are perfectly respecting all technical levels as

yesterday we took a U-turn precisely after entering a strong

hurdle of ’20-day EMA’ placed around 34800 – 35000. Within no

time, banking index fell nearly 600 points from day’s high, which

does not bode well for the bulls. For the coming session, the

resistance remains at mentioned levels of 34800 – 35000 and

till the time, we do not surpass it, one should avoid aggressive

longs in banking counters. On the flipside, the sacrosanct

support is placed in the zone of 34000 – 33800. Traders are

advised to trade the range and hence, the strategy has to be buy

near supports and exit as close as possible to resistances.

Key Levels

Support 1 – 34000 Resistance 1 – 34800

Support 2 – 33800 Resistance 2 – 35000

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (54289) /

Nifty (16215)

The Indian equity market started the day with high volatility at the

opening bell, led by mixed global cues and domestic macro

developments over the weekend. The benchmark index Nifty50

soon collected optimism and progressed upwards to test the

crucial resistance zone of 16400 odd levels. Though in the latter

half, the momentum depleted as broad-based profit booking was

seen in various counters, and the benchmark index pared down

all the initial gains to conclude the day a tad above 16200 levels

with a mere cut of 0.32 percent.

We allude to our previous commentary of not being complacent

with single-day momentum until the sturdy hurdle of the unfilled

gap at the 16480-16650 zone is not taken out by the bulls, that

certainly is seen in the market. The undertone is expected to

remain upbeat till the index holds over the 16000 psychological

mark. And looking at the technical setup, the market is likely to

trade in the mentioned slender range till a decisive breakout is

not seen on either side in the near period. Meanwhile, broad-

based traction has been observed across the bourses on the

sectoral front, wherein the significant benefactors that boosted

the positive sentiments were the Auto and IT space. At the same

time, the crackdown in the metal sector has dampened the

overall sentiments in the market.

Going forward, where the index is

likely to remain in the

slender range, many stock-specific adjustments are likely to

continue. Hence, traders are advised to have a stock-centric

approach and stay abreast with the global and domestic

developments on a regular basis.

Key Levels

Support 1 – 16100 Resistance 1 – 16400

Support 2 – 16000 Resistance 2 – 16500

www.angelone.in

Technical & Derivatives Report

May 24, 2022

View

Post Friday strong close, we began the week

slightly positive and then follow-up buying emerged

to once again test 16400 but unfortunately the index

couldn’t sustain at higher levels to conclude the day

tad above 16200.

FIIs were net sellers in the cash market segment

to the tune of Rs. 1951 crores. Simultaneously, in

Index futures, they sold marginally with a decent

fall in open interest, indicating blend of long

unwinding and short covering.

Despite decent volatility, we could hardly see any

relevant open interest change in both the indices.

Stronger hands continue to curb liquidity from

Indian equity market but added bullish bets in stock

futures. In index options front, some build-up was

seen in 16100 put strike which could act as a support

zone now. On the other side, 16400 and 16500 call

strikes added fresh positions. At current juncture,

16000-16100 is the immediate demand zone and we

believe until we manage to sustain above same

traders should use decline to add longs. On the

higher side, around 16400 is the strong hurdle and

sustain move beyond same shall boost the overall

sentiments.

Comments

The Nifty futures open interest has increased by 1.24%.

and BANK Nifty futures open interest has decreased by

0.27% as the market closed at 16214.70.

The Nifty May future closed with a discount of 31.35 point

against a discount of 12.90 point in the last trading

session. The June series closed at a discount of 34.95

point.

The INDIA VIX increased from 23.10 to 23.39. At the same

time, the PCR-OI of Nifty decreased from 1.07 to 1.01.

Few of the liquid counters where we have seen high

cost of carry are COLPAL, RBLBANK, METROPOLIS,

ABFRL and JINDALSTEL.

Historical Volatility

SCRIP HV

JINDALSTEL 63.99

JSWSTEEL 51.65

DIVISLAB 37.72

NMDC 51.63

TATASTEEL 53.94

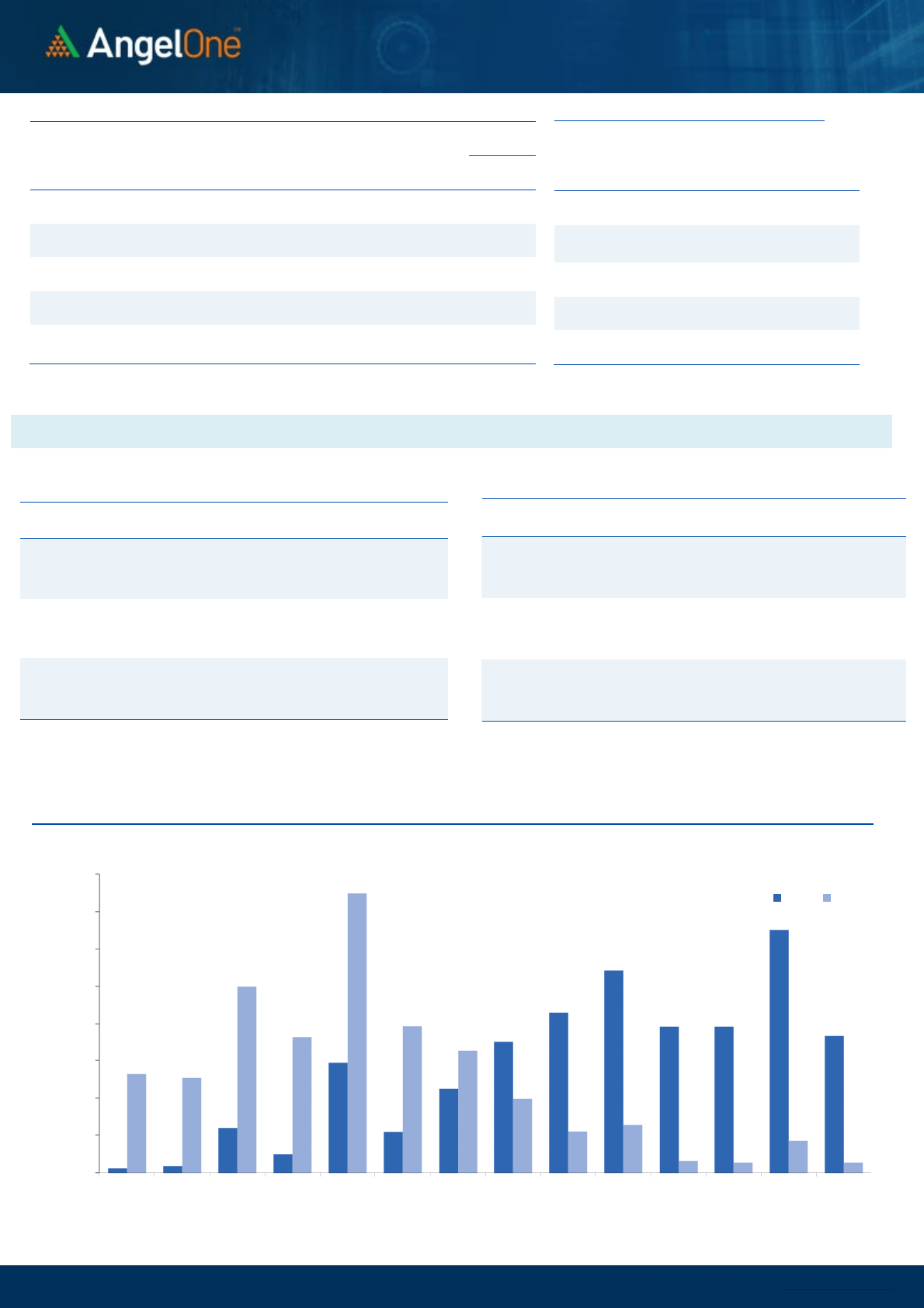

Nifty Vs OI

15200

15400

15600

15800

16000

16200

16400

16600

16800

5,000

6,000

7,000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

5-4 5-6 5-10 5-12 5-16 5-18 5-20

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ABB 511500 33.20 2297.00 0.35

JINDALSTEL 34822500 22.43 395.55 -17.08

ASTRAL 922350 20.39 1700.90 0.82

UBL 1238050 19.13 1463.70 -1.14

M&M 14391300 15.87 941.90 3.82

HAL 2681375 15.44 1815.85 3.28

CUMMINSIND 1412400 12.69 1014.70 0.24

APLLTD 1483300 12.41 761.45 0.91

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BHEL 105357000 -20.11 51.10 -3.85

GNFC 3890900 -14.41 661.85 4.21

IRCTC 13750625 -12.60 653.25 -1.13

ABBOTINDIA 27270 -11.36 17738.10 -1.69

BAJAJ-AUTO 2981500 -11.09 3786.15 0.23

INDIAMART 327900 -9.71 4279.10 0.54

L&TFH 51830592 -9.29 76.75 0.46

IEX 43908750 -8.52 193.80 -0.33

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.01 0.84

BANKNIFTY 0.91 0.91

RELIANCE 0.43 0.37

ICICIBANK 0.51 0.46

INFY 0.40 0.39

www.angelone.in

Technical & Derivatives Report

May 24, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Spot = 162

14.70

FII Statistics for

May

2

3

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4838.54 5759.31 (920.77) 183823 14723.13 11.05

INDEX

OPTIONS

1056857.01 1039952.96 16904.05

1528187 121736.38 (21.31)

STOCK

FUTURES

19544.89 19501.12 43.77

2417214 145668.64 3.37

STOCK

OPTIONS

9274.52 9296.75 (22.23) 160967 10064.66 1.80

Total

1090514.96

1074510.14

16004.82

4290191

292192.81

(6.82)

Turnover on

May

23

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

546397 45544.05 2.41

Index

Options

76340023 6426504.79

29.30

Stock

Futures

2287767 139986.01

72.24

Stock

Options

4744963 306511.14

6.12

Total

47,44,963 306511.14

28.48

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

16200 143.40

45.45

54.55

16245.45

Sell

16300 97.95

Buy

16200 143.40

80.90

119.10

16280.90

Sell

16400 62.50

Buy

16300 97.95

35.45 64.55 16335.45

Sell 16400 62.50

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

16200 153.15

42.25

57.75

16157.75

Sell

16100 117.90

Buy

16200 153.15

73.70

126.30

16126.30

Sell

16000 90.00

Buy

16100 117.90

31.45 68.55 16068.55

Sell

16000 90.00

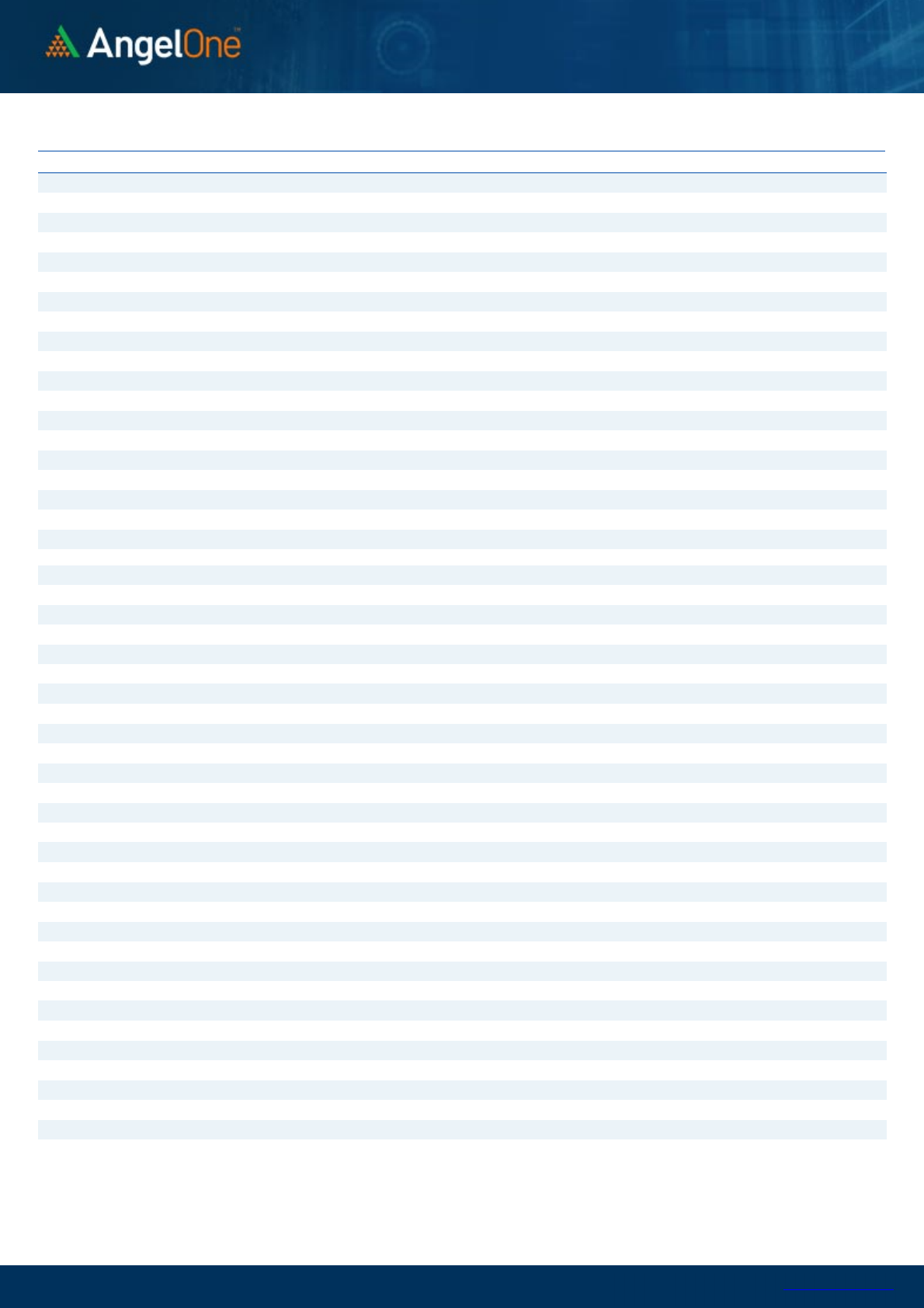

Nifty

Put

-

Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

7000,000

8000,000

15600 15700 15800 15900 16000 16100 16200 16300 16400 16500 16600 16700 16800 16900

Call Put

www.angelone.in

Technical & Derivatives Report

May 24, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 733 743

762 772 790

APOLLOHOSP 3,617 3,667

3,716 3,766 3,815

ASIANPAINT 3,106 3,140

3,164 3,198 3,222

AXISBANK 660 668

676 684 692

BAJAJ-AUTO 3,706 3,746

3,810 3,850 3,915

BAJFINANCE 5,689 5,741

5,824 5,876 5,959

BAJAJFINSV 12,328 12,451

12,622 12,745 12,916

BPCL 323 327

332 337 341

BHARTIARTL 672 679

686 693 701

BRITANNIA 3,405 3,446

3,492 3,533 3,579

CIPLA 953 962

975 983 996

COALINDIA 180 182

184 187 189

DIVISLAB 3,506 3,702

4,070 4,266 4,635

DRREDDY 4,189 4,232

4,279 4,323 4,370

EICHERMOT 2,689 2,715

2,741 2,768 2,794

GRASIM 1,415 1,436

1,473 1,495 1,532

HCLTECH 1,001 1,010

1,023 1,032 1,046

HDFCBANK 1,280 1,292

1,311 1,323 1,342

HDFCLIFE 536 544

550 557 564

HDFC 2,132 2,154

2,187 2,210 2,243

HEROMOTOCO 2,556 2,590

2,645 2,680 2,734

HINDALCO 390 401

411 423 432

HINDUNILVR 2,276 2,328

2,358 2,410 2,440

ICICIBANK 696 704

715 722 733

INDUSINDBK 885 894

908 917 931

INFY 1,431 1,450

1,469 1,488 1,507

ITC 269 272

276 279 283

JSW STEEL 503 525

560 582 616

KOTAKBANK 1,825 1,840

1,856 1,870 1,886

LT 1,582 1,613

1,637 1,668 1,691

M&M 899 920

932 953 965

MARUTI 7,697 7,797

7,876 7,976 8,055

NESTLEIND 16,633 16,814

17,092 17,272 17,551

NTPC 144 147

151 154 158

ONGC 148 152

158 161 168

POWERGRID 219 222

227 230 235

RELIANCE 2,557 2,582

2,618 2,643 2,678

SBILIFE 1,047 1,062

1,077 1,092 1,107

SHREECEM 21,531 21,736

21,956 22,161 22,380

SBIN 452 456

464 468 476

SUNPHARMA 909 915

923 930 938

TCS 3,237 3,280

3,309 3,351 3,381

TATACONSUM

715 722

736 743 756

TATAMOTORS 412 417

424 429 436

TATASTEEL 945 984

1,041 1,079 1,136

TECHM 1,103 1,123

1,135 1,155 1,168

TITAN 2,101 2,126

2,163 2,188 2,225

ULTRACEMCO 5,689 5,803

6,013 6,127 6,337

UPL 772 782

798 808 825

WIPRO 453 460

464 470 474

www.angelone.in

Technical & Derivatives Report

May 24, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.