November 23, 2021

www.angelone.in

Technical & Derivatives Report

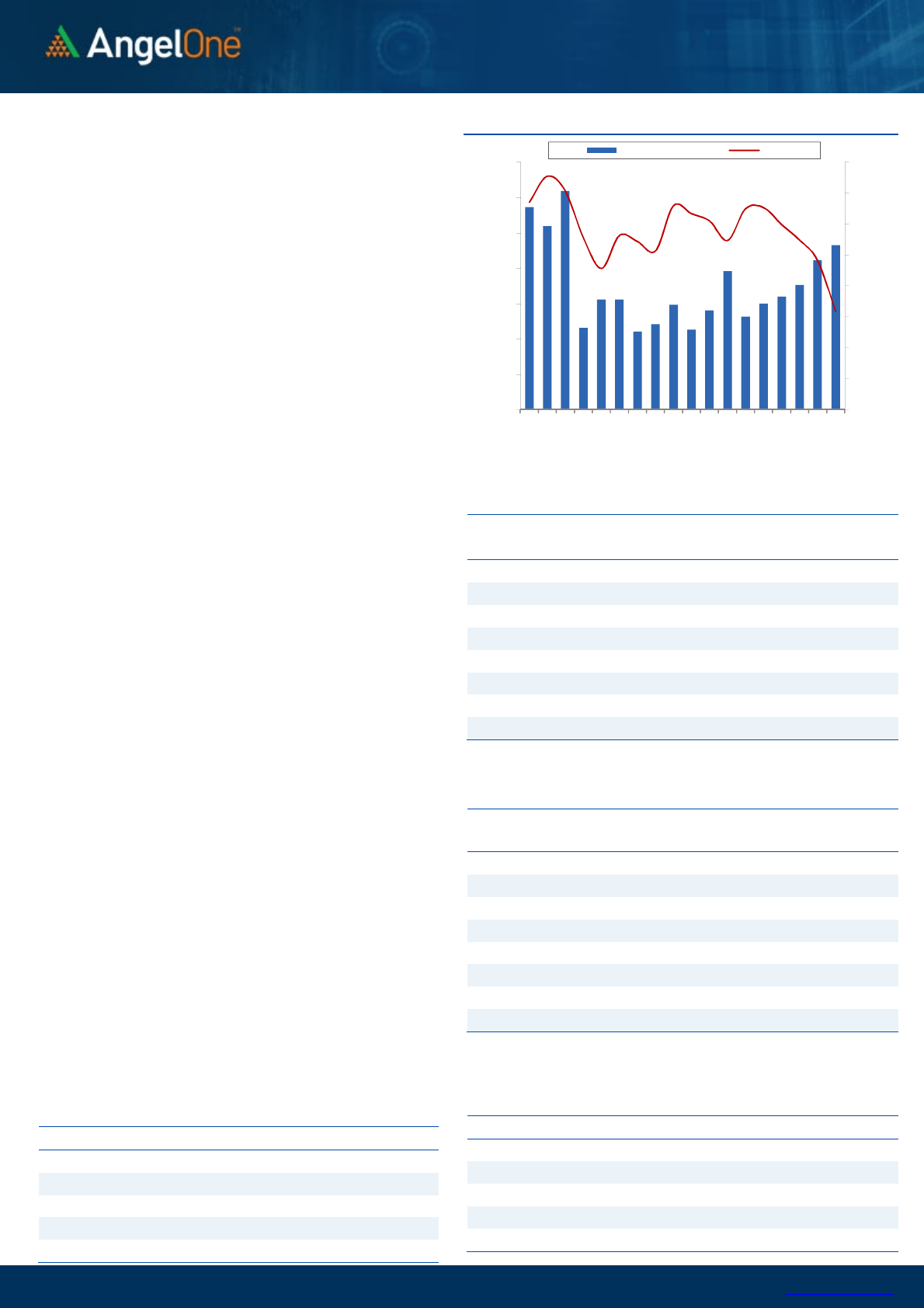

Nifty Bank Outlook - (37129)

Post a long weekend, the bank nifty started on a positive note in fact

above the Thursday’s high. However, it slipped lower right from the

word go and the selling pressure got intense to break one by one key

support levels with ease to mark an intraday low of 36655. Eventually,

with some modest recovery in the fag end the bank index ended with

a loss of 2.23% tad at 37129.

The bank nifty has been a clear under performer and the way it slipped

yesterday the bears are definitely in strong momentum. Since we have

already witnessed a decent correction from all time high in a short

span of time the oscillators are in oversold territory hence we may see

some in between bounce. However as highlighted above the

momentum is gripped by bears and the bounce are likely to be short

lived. Hence, we advise to lighten up longs in case we see any bounce.

In such scenario, immediate resistance can be seen around 37600 –

37800 levels. On the flip side, support is at 36600 and 36200 levels.

Key Levels

Support 1 – 36600 Resistance 1 – 37600

Support 2 – 36200 Resistance 2 – 37800

Exhibit 2: Nifty Bank Daily Chart

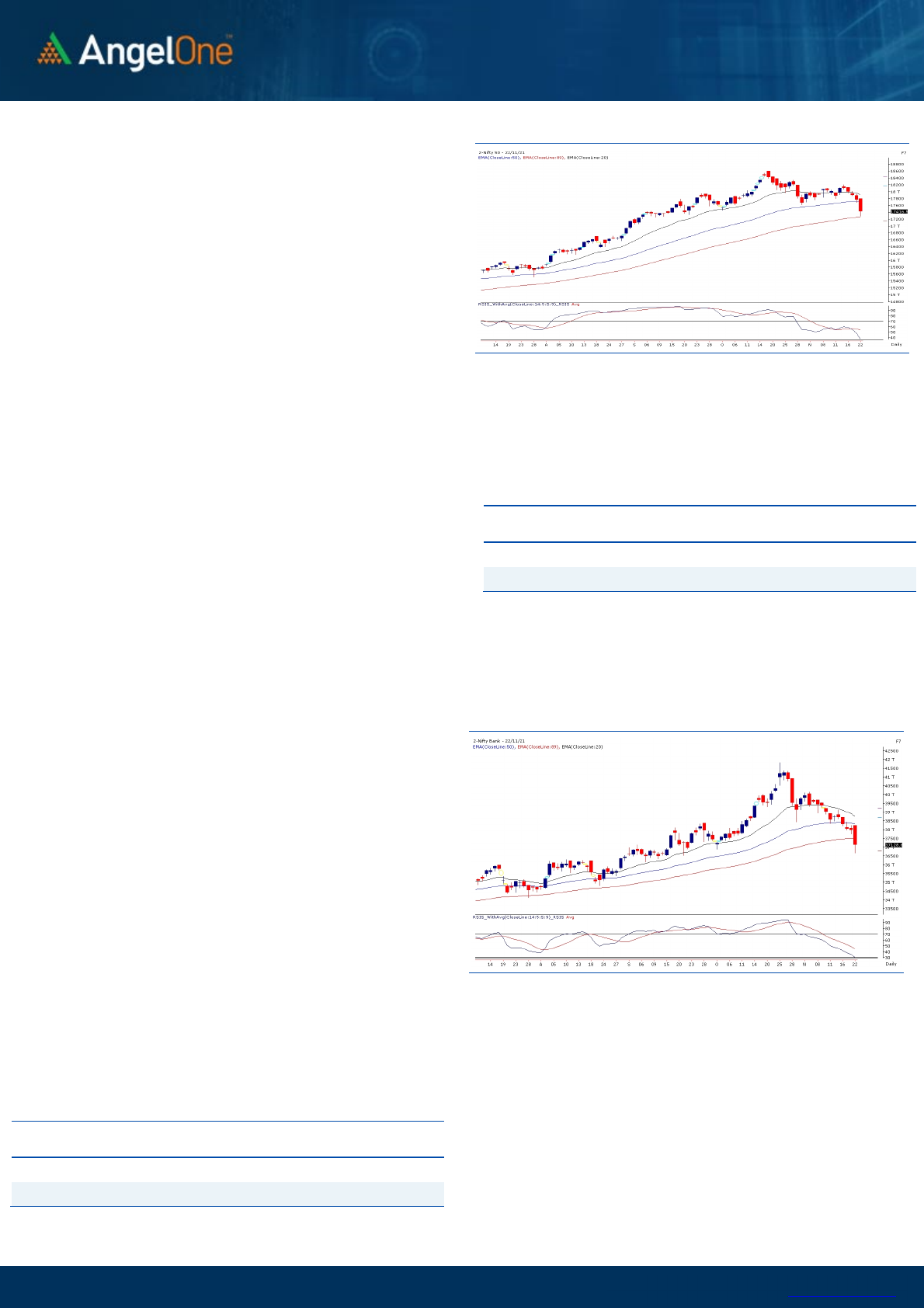

Sensex (58466) / Nifty (17417)

The SGX Nifty was indicating a pleasant start for the week in line with

cheerful global bourses. However we did not open with the same

positivity and in fact gave up all gains in the initial trades itself. As the

day progressed, the selling augmented across the broader market to

break all intermediate supports one after another. During the final

hour, market managed to minimize the damage; but still ended the

session with nearly a couple of percent loss.

With yesterday’s correction, Nifty marked the weakest session in last

eight odd months. Throughout last week, our market was feeling the

pressure and kept sliding gradually towards the key support of 17700.

Technically this level was important because it coincided with the

crucial neckline support of bearish ‘Head and Shoulder’ pattern which

formed over the past couple of months. With reference to our recent

commentary, we had anticipated formation of this pattern and

yesterday finally it got confirmed as we convincingly closed below the

neckline of the same. Yesterday’s massive fall finally validates our

recent cautious stance on the market. Yesterday’s low precisely

coincides with the daily ’89-EMA’ and generally we consider this as a

sheet anchor for prices. But this time, we do not expect it to play similar

kind of role for the market. We may see small rebounds since market is

a bit oversold, but the possibility of extending this correction is pretty

high.

Exhibit 1: Nifty Daily Chart

After

17250

, the Nifty is likely to continue this weakness towards

the psychological level of 17000; where one need to reassess the

situation. On the flipside, 17500 – 17650 are now to be considered

as immediate hurdles. Traders are advised to use in between

recoveries to lighten up longs and don’t be in a hurry to make

bottom fishing.

Key Levels

Support 1 – 17300 Resistance 1 – 17500

Support 2 – 17250 Resistance 2 – 17650

www.angelone.in

Technical & Derivatives Report

November 23, 2021

View

We had a optimistic start for the monthly expiry week

to touch 17800 in the early morning trade. However,

inline to recent trend we saw selling pressure to first

drag index below 17700 and then 17300 . Due to some

respite in the fag end index concluded the day tad

above 17400.

FIIs were net sellers in the cash market segment to

the tune of Rs. 3439 crores. In index futures, they

bought worth Rs. 134 crores with increase in open

interest indicating long formations.

In F&O space, we saw open interest addition in both the

indices which suggest continuation of short formation

for the fourth consecutive sessions. Surprisingly, FIIs

were net buyers in index and stock futures segment

which hints they preferred adding some longs. In index

options front, we saw massive writing in 17500-17800

call options; whereas, 17200-17250 put strikes added

some fresh bets. The PCR-OI plunged further to 0.67 and

we believe market has turned oversold and any bounce

back move can’t be ruled out. At this point in time, 17500-

17600 shall act as a study hurdle and 17200-17300 levels

are the immediate support zone.

Comments

The Nifty futures open interest has increased by 1.78%.

and Nifty futures open interest has increased by 6.90%

as market closed at 17416.50 levels.

The Nifty November future closed with a premium of

18.50 point against a premium of 28.1 point in last

trading session. The December series closed at a

premium of 67.95 point.

The INDIA VIX increased from 14.87 to 17.51. At the same

time, the PCR-OI of Nifty has decreased from 0.78 to

0.67.

Few of the liquid counters where we have seen high

cost of carry are KOTAKBANK, VEDL, ASHOKLEY, NTPC

and BHEL.

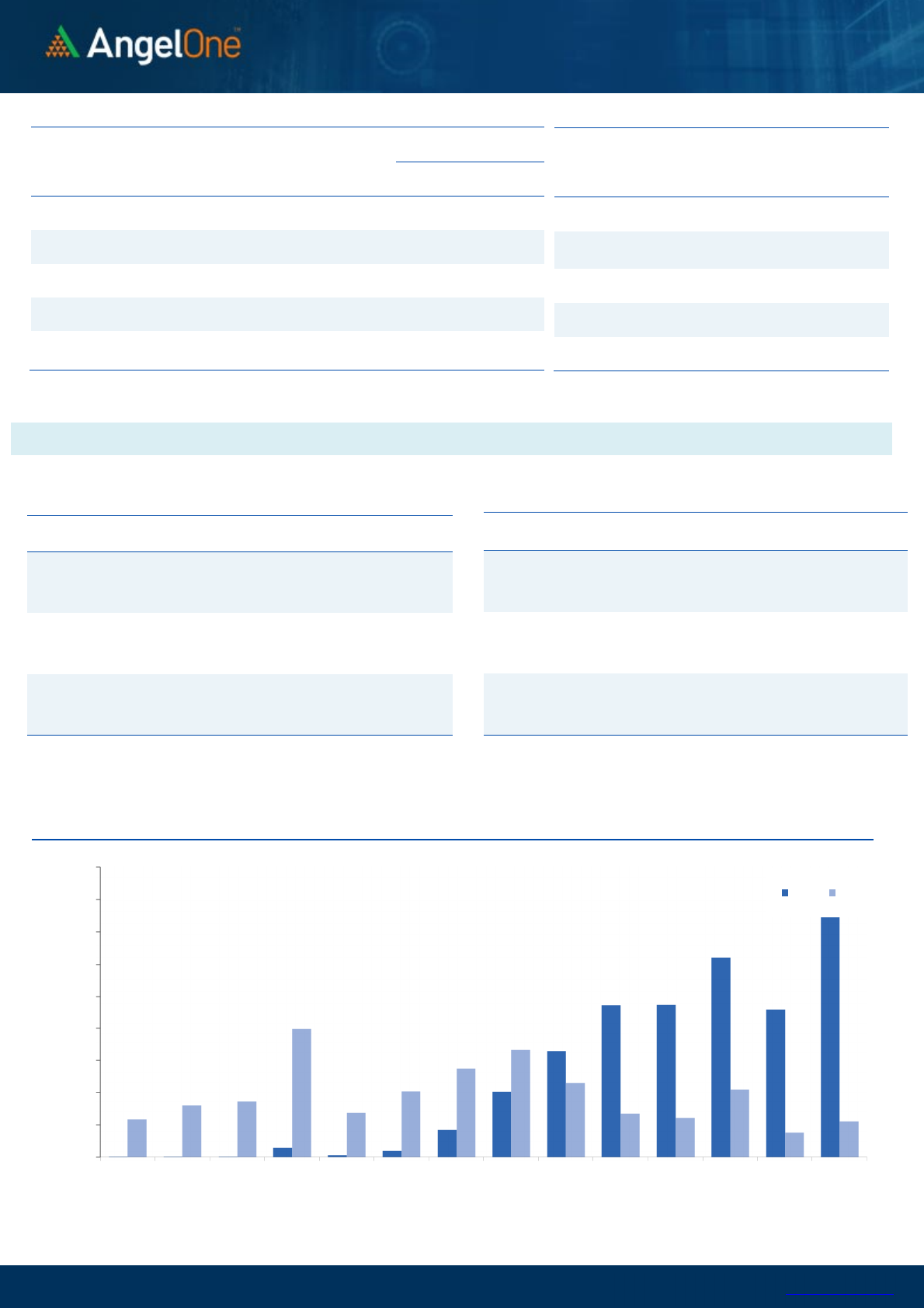

Nifty Vs OI

16800

17000

17200

17400

17600

17800

18000

18200

18400

10,000

10,500

11,000

11,500

12,000

12,500

13,000

13,500

10-25 10-27 10-29 11-2 11-4 11-10 11-12 11-16 11-18

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

UBL

1726900 19.47 1586.70 -2.60

BEL

27842600 13.09 203.00 -2.77

POWERGRID

25945045 12.93 194.20 0.62

IPCALAB

3507075 10.63 2031.70 -0.70

EICHERMOT

4820900 10.42 2547.95 -2.22

NAVINFLUOR

756000 8.42 3287.50 -7.26

RELIANCE

36653750 7.24 2363.75 -4.39

AMBUJACEM

13099500 7.19 388.70 -2.88

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ESCORTS

7778100 -12.78 1802.75 -0.25

INDIAMART

205725 -11.91 7520.60 -1.15

IDEA

921060000 -10.20 10.60 6.00

LTTS

612400 -9.60 5348.35 -4.97

ASTRAL

550825 -9.00 2228.35 -3.32

LALPATHLAB

569000 -8.89 3471.50 -3.58

SRF

3528625 -8.63 2093.90 -4.65

PFIZER

198000 -8.33 4934.70 -2.90

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.78 0.85

BANKNIFTY

0.66 0.82

RELIANCE

0.47 0.42

ICICIBANK

0.39 0.42

INFY

0.52 0.48

Historical Volatility

SCRIP HV

ALKEM

31.55

NAVINFLUOR

52.22

AARTIIND

44.72

DEEPAKNTR

56.09

NAUKRI

50.01

www.angelone.in

Technical & Derivatives Report

November 23, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Spot = 17416.55

FII Statistics for November 22, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

Change

INDEX

FUTURES

7266.55 7132.80 133.75

183672 16319.90 1.52

INDEX

OPTIONS

568145.36 563708.48 4436.88

1689019 149713.89 33.59

297314.41

STOCK

FUTURES

54880.49 53424.46 1456.03

1840982 132554.28 (0.16)

STOCK

OPTIONS

39155.42 37928.54 1226.88

334695 24869.60 (4.92)

Total

669447.82

662194.28

7253.54

4048368

323457.67

11.18

43446.77

Turnover on November 22, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

486985 43913.25 33.38

Index Options

67040623 6157081.47

-56.64

Stock Futures

2228998 167840.28 55.12

Stock Options

4381113 354363.23 12.02

Total

7,41,37,719 6723198.23

-54.13

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17400 136.05

50.10 49.90 17450.10

Sell

17500 85.95

Buy

17400 136.05

86.85 113.15 17486.85

Sell

17600 49.20

Buy

17500 85.95

36.75 63.25 17536.75

Sell

17600 49.20

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17400 103.10

34.15 65.85 17365.85

Sell

17300 68.95

Buy

17400 103.10

58.40 141.60 17341.60

Sell

17200 44.70

Buy

17300 68.95

24.25 75.75 17275.75

Sell

17200 44.70

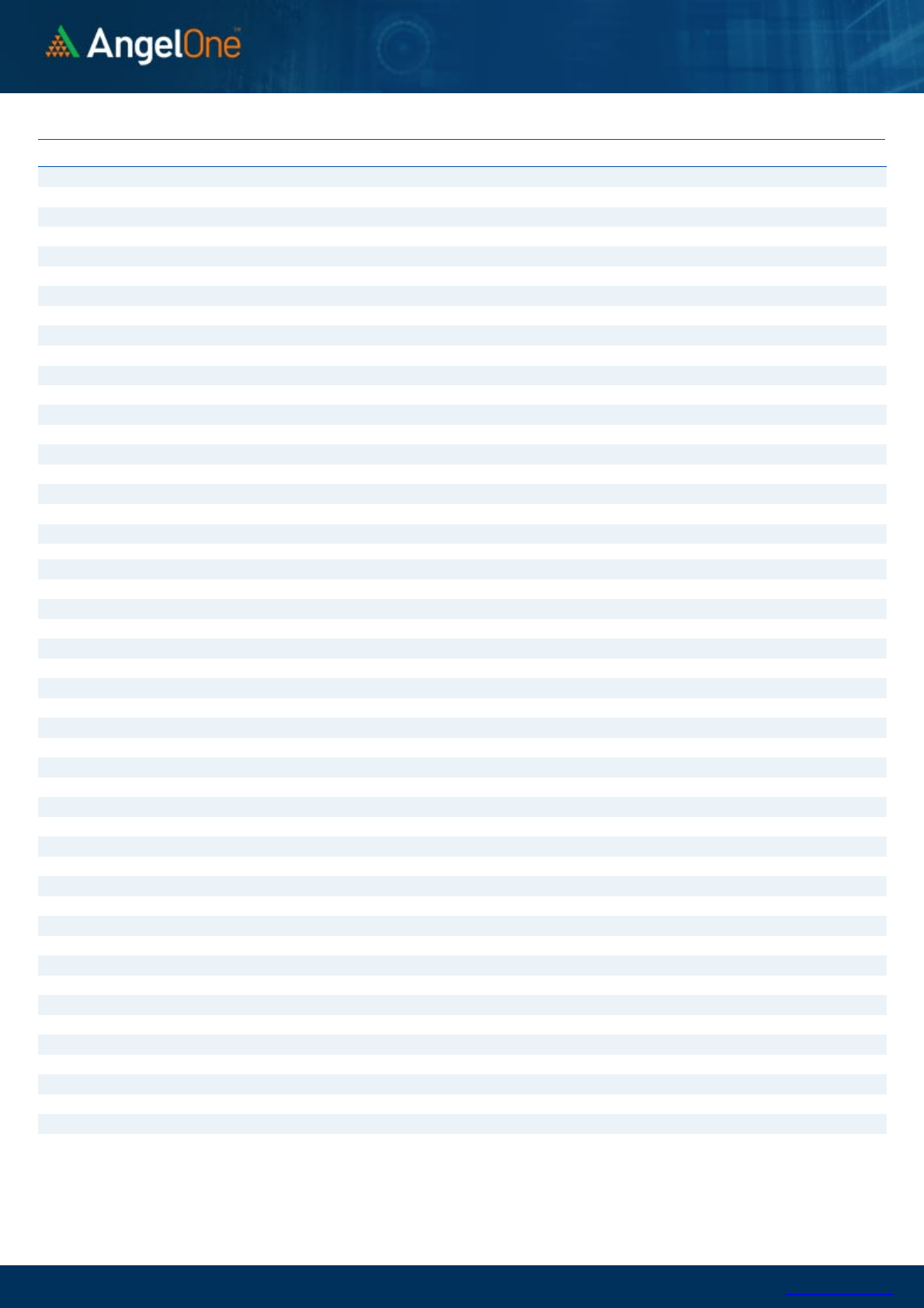

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

7000,000

8000,000

9000,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

November 23, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 688 702

717 731 747

ASIANPAINT 3,168 3,215

3,262 3,308 3,355

AXISBANK 657 672

692 707 728

BAJAJ-AUTO 3,336 3,390

3,480 3,534 3,624

BAJFINANCE 6,663 6,861

7,188 7,385 7,712

BAJAJFINSV 16,038 16,556

17,348 17,866 18,658

BPCL 384 390

399 405 414

BHARTIARTL 721 731

744 754 767

BRITANNIA 3,535 3,558

3,593 3,617 3,652

CIPLA 870 883

896 909 922

COALINDIA 147 149

151 153 155

DIVISLAB 4,556 4,618

4,728 4,789 4,900

DRREDDY 4,518 4,563

4,626 4,671 4,734

EICHERMOT 2,470 2,509

2,556 2,595 2,642

GRASIM 1,727 1,753

1,776 1,801 1,824

HCLTECH 1,089 1,099

1,113 1,123 1,137

HDFCBANK 1,469 1,492

1,522 1,546 1,576

HDFCLIFE 669 679

694 704 720

HDFC 2,856 2,875

2,905 2,924 2,954

HEROMOTOCO 2,571 2,603

2,651 2,682 2,730

HINDALCO 426 434

441 449 456

HINDUNILVR 2,359 2,374

2,392 2,407 2,425

ICICIBANK 724 738

754 768 784

IOC 120 122

126 128 132

INDUSINDBK 970 988

1,007 1,026 1,044

INFY 1,731 1,745

1,765 1,779 1,800

ITC 223 227

234 238 245

JSW STEEL 637 647

655 665 674

KOTAKBANK 1,877 1,916

1,980 2,019 2,083

LT 1,805 1,835

1,867 1,897 1,930

M&M 872 886

908 923 945

MARUTI 7,572 7,718

7,953 8,099 8,334

NESTLEIND 18,398 18,697

19,131 19,430 19,865

NTPC 125 128

132 135 139

ONGC 141 144

149 152 156

POWERGRID 189 192

194 197 199

RELIANCE 2,290 2,327

2,388 2,425 2,486

SBILIFE 1,107 1,129

1,159 1,181 1,212

SHREECEM 25,778 26,190

26,740 27,153 27,703

SBIN 461 474

490 502 518

SUNPHARMA 748 759

777 788 806

TCS 3,396 3,427

3,472 3,503 3,547

TATACONSUM

788 800

820 832 851

TATAMOTORS 458 472

492 506 526

TATASTEEL 1,118 1,142

1,169 1,193 1,220

TECHM 1,486 1,514

1,548 1,575 1,610

TITAN 2,273 2,332

2,412 2,471 2,552

ULTRACEMCO 7,413 7,533

7,671 7,791 7,929

UPL 683 700

723 740 764

WIPRO 625 635

648 657 670

www.angelone.in

Technical & Derivatives Report

November 23, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in