November 22, 2021

www.angelone.in

Technical & Derivatives Report

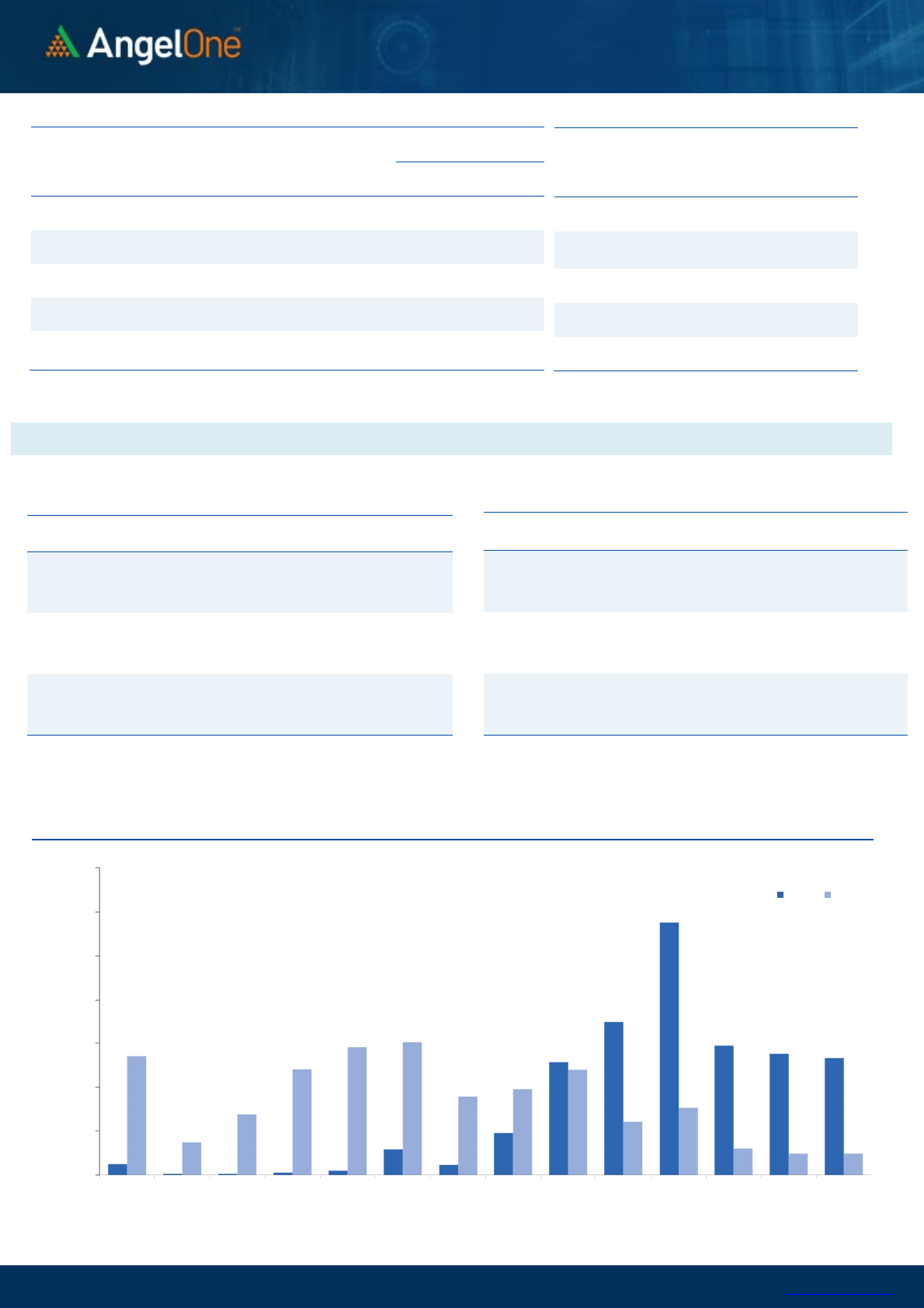

Nifty Bank Outlook - (37976)

The truncated week began on a cheerful note and then the banking

index touched 39100 plus levels in the early morning trade. After

posting these highs index attracted fresh selling pressure which got

extended in next three sessions without any look back to first breach

38300-38400 on Tuesday and then test 37700-37800 on Thursday.

Finally, due to some respite in the latter half on the weekly expiry day,

we concluded the week tad below 38000.

As mentioned in our recent commentaries, we were not very

optimistic especially on this space and as expected it remained one of

the major culprit to drag the benchmark index towards 17700. During

this chores of action, we saw the banking index achieving the first

target of 37700 and any further damaged below 37400-37500 shall not

be a very good indication for bulls. Thus, all eyes on this space for the

coming monthly expiry week; one should keep a close tad on the

above mentioned levels. On the higher side, 38200-38400 shall be

looked as immediate supply zone.

Key Levels

Support 1 – 37500 Resistance 1 – 38200

Support 2 – 37400 Resistance 2 – 38400

Exhibit 2: Nifty Bank Daily Chart

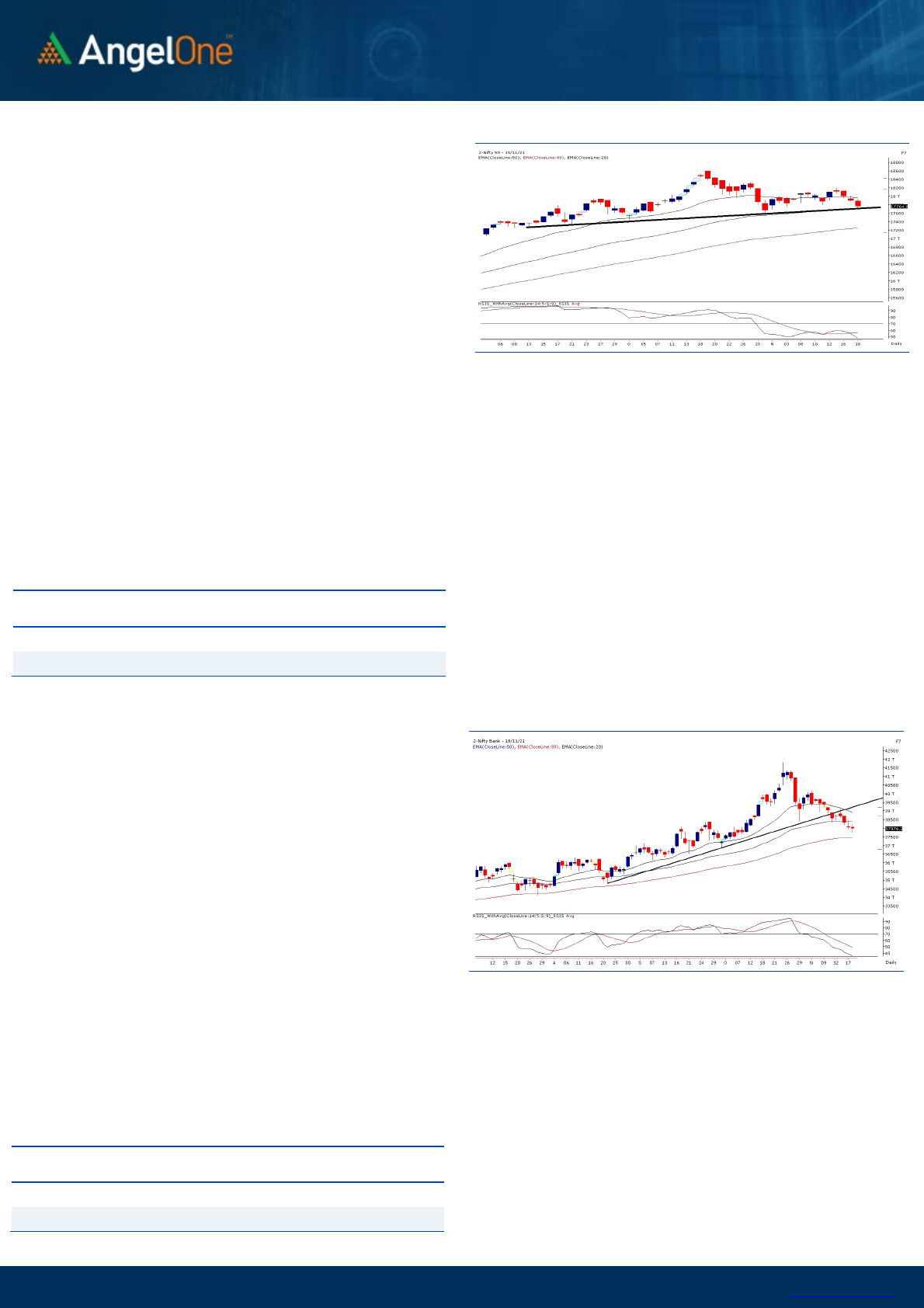

Sensex (59575) / Nifty (17765)

During the last week, Nifty did correct by nearly a couple of percent;

which certainly cannot be considered as a major damage. Also it did

close above the key support on a weekly basis but the way overall

things are positioned, we will not be surprised to see it surrendering

(17700) in the first half of this week itself. Since last few days, we have

been mentioning the ‘Head and Shoulder’ pattern on the daily chart of

Nifty which was in process. After Thursday’s close, the final (right)

shoulder of this pattern is completed and prices are placed exactly at

the ‘Neckline’ point of the same. A sustainable move below 17700

(which seems likely) would activate the pattern and as a result of this,

we could see a fresh leg of correction in coming days. After this, next

levels to watch out for would be 17450 and 17200, where one needs to

reassess the situation. On the flipside, if Nifty manages to hold 17700

and move higher first, then 18000 – 18200 are to be considered as

strong hurdles, which as of now we do not expect to get surpassed in

the near future. The major culprit during the last week’s correction was

the continuous weakness in banking and metal counters. Although

banking index is nearing its strong support zone, we do not expect any

major bounce back in this space.

Key Levels

Support 1 – 17700 Resistance 1 – 17880

Support 2 – 17450 Resistance 2 – 18030

Exhibit 1: Nifty Daily Chart

Apart from this, the broader market looked a bit tentative on

Thursday and the way it’s closed; things do not augur well for the

bulls. To summarize, we advise traders to remain light which we

have been advocating of late and even if one wants to accumulate

stocks with a broader perspective, one needs to be a bit patient as

we expect some reasonable prices to come in next few days.

www.angelone.in

Technical & Derivatives Report

November 22, 2021

View

For the third consecutive session, Nifty slipped lower and

on Thursday, the index plunged below 17700 but due to

some respite in the midst concluded the week tad above

17750 with a cut of almost two percent against previous

week close.

FIIs were net sellers in the cash market segment to the

tune of Rs. 3931 crores. In index futures, they sold worth

Rs. 180 crores with increase in open interest indicating

short formations on Thursday.

In F&O space, we saw open interest addition in both the

indices which clearly suggests fresh shorts where formed

during the week (wherein banking index added massive

shorts as outstanding contracts surged more than 20%).

Stronger hands too preferred adding bearish bets in index

futures, resulting Long Short Ratio declining from 57% to

54%. For the coming monthly expiry, we noticed massive

writing in 17800-18000 call strikes which may now act as a

sturdy wall now. The above data hints further pain going

ahead; hence, would advocate traders avoiding any kind of

bottom fishing for now and infact aggressive traders

should buy ATM or slightly OTM puts incase of any

recoveries.

Comments

The Nifty futures open interest has increased by 2.97%. Bank

Nifty futures open interest has increased by 4.53% as market

closed at 17764.80 levels.

The Nifty November future closed with a premium of 28.1

point against a premium of 10.5 point in last trading session.

The December series closed at a premium of 86.3 point.

The INDIA VIX decreased from 14.98 to 14.87. At the same

time, the PCR-OI of Nifty has decreased from 0.81 to 0.78.

Few of the liquid counters where we have seen high cost of

carry are ESCORTS, VEDL, BOSCHLTD, ATUL AND MGL

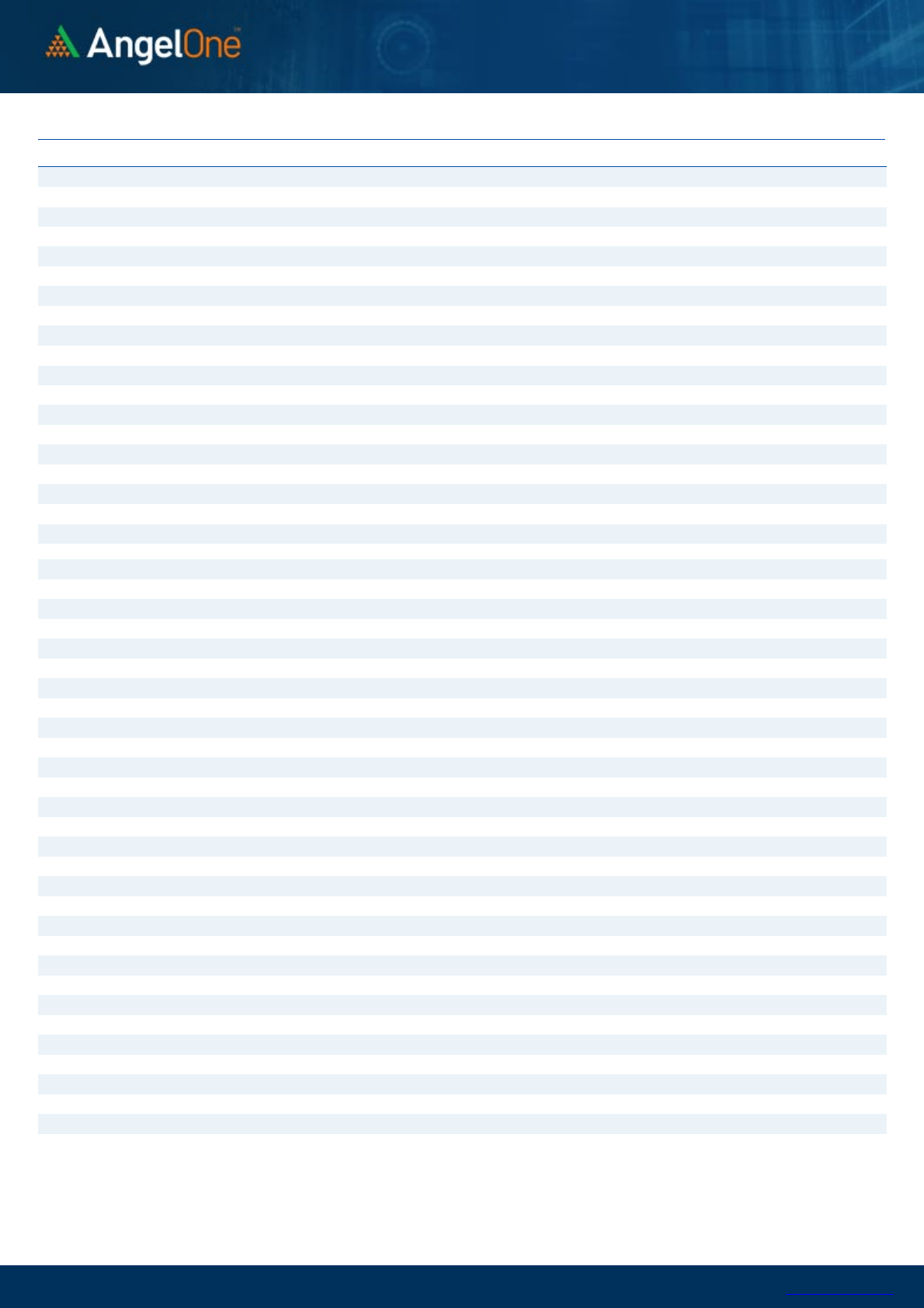

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

18300

18400

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

10-2010-2210-2610-28 11-1 11-3 11-5 11-1111-1511-17

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

JKCEMENT

207725 20.75 3513.55 -2.11

SBICARD

1869000 10.79 1028.95 -3.03

IPCALAB

3170025 7.31 2077.20 -0.90

GODREJPROP

2574325 7.20 2177.70 -2.12

NAM-INDIA

3222400 7.01 403.35 -3.74

RECLTD

47610000 6.93 136.25 -1.73

PNB

299760000 5.39 41.65 2.58

NMDC

109531600 5.29 135.80 -1.66

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GSPL

1251200 -12.59 309.20 -3.95

APOLLOHOSP

2357375 -8.83 5588.60 -2.34

IRCTC

11800375 -8.46 890.65 -1.59

CUMMINSIND

2254200 -8.10 915.35 -1.07

NAVINFLUOR

697275 -7.30 3551.40 -0.84

WHIRLPOOL

437500 -6.47 2280.90 -1.60

MCX

1510250 -6.15 1812.05 -3.28

SYNGENE

1304750 -5.36 605.10 -0.71

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.78 0.85

BANKNIFTY

0.66 0.82

RELIANCE

0.47 0.42

ICICIBANK

0.39 0.42

INFY

0.52 0.48

Historical Volatility

SCRIP HV

ESCORTS

47.54

VEDL

59.19

BOSCHLTD

41.29

ATUL

38.77

MGL

37.32

www.angelone.in

Technical & Derivatives Report

November 22, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Spot = 17764.80

FII Statistics for November 18, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

Change

INDEX

FUTURES

4640.37 4820.01 (179.64) 180927 16409.20 6.03

INDEX

OPTIONS

1194376.96 1185860.25 8516.71

1264355 114457.46 (24.00)

297314.41

STOCK

FUTURES

25372.24 25291.71 80.53

1843940 135566.56 0.14

STOCK

OPTIONS

28217.86 28280.55 (62.69) 352027 26627.67 (0.21)

Total

1252607.43

1244252.52

8354.91

3641249

293060.89

(9.61)

43446.77

Turnover on November 18, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

358550 32922.44 34.85

Index Options

152545227

14200464.07 124.66

Stock Futures

1351256 108200.63 50.04

Stock Options

3887859 316341.36 0.64

Total

15,81,42,892

14657928.50 117.75

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17800 119.40

44.60 55.40 17844.60

Sell

17900 74.80

Buy

17800 119.40

74.65 125.35 17874.65

Sell

18000 44.75

Buy

17900 74.80

30.05 69.95 17930.05

Sell

18000 44.75

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17800 122.85

41.70 58.30 17758.30

Sell

17700 81.15

Buy

17800 122.85

70.45 129.55 17729.55

Sell

17600 52.40

Buy

17700 81.15

28.75 71.25 17671.25

Sell

17600 52.40

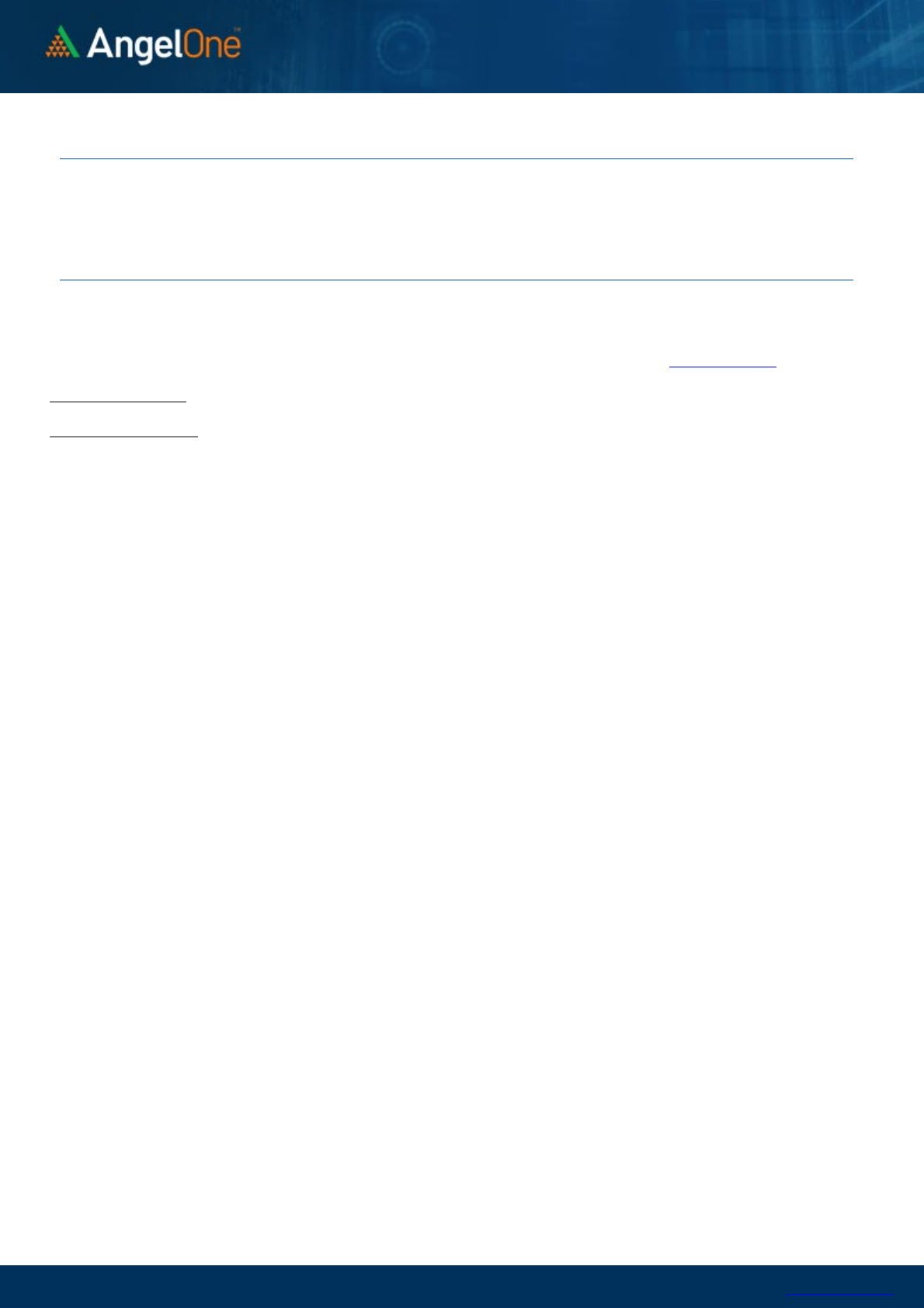

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

7000,000

17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300

Call Put

www.angelone.in

Technical & Derivatives Report

November 22, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 703 714

728 740 753

ASIANPAINT 3,188 3,207

3,234 3,253 3,280

AXISBANK 694 700

708 714 722

BAJAJ-AUTO 3,486 3,517

3,556 3,587 3,626

BAJFINANCE 7,283 7,384

7,541 7,642 7,799

BAJAJFINSV 17,407 17,664

18,068 18,325 18,729

BPCL 398 402

409 412 419

BHARTIARTL 700 707

715 723 731

BRITANNIA 3,501 3,536

3,590 3,626 3,680

CIPLA 881 887

897 903 913

COALINDIA 150 152

155 156 159

DIVISLAB 4,618 4,702

4,756 4,839 4,893

DRREDDY 4,580 4,626

4,697 4,742 4,813

EICHERMOT 2,502 2,553

2,626 2,676 2,749

GRASIM 1,735 1,755

1,783 1,803 1,832

HCLTECH 1,088 1,104

1,130 1,146 1,171

HDFCBANK 1,518 1,529

1,536 1,547 1,554

HDFCLIFE 695 700

707 712 720

HDFC 2,888 2,907

2,935 2,954 2,983

HEROMOTOCO 2,609 2,647

2,705 2,743 2,801

HINDALCO 426 433

444 451 461

HINDUNILVR 2,356 2,377

2,392 2,414 2,428

ICICIBANK 751 757

762 768 773

IOC 126 128

129 131 132

INDUSINDBK 978 993

1,018 1,033 1,057

INFY 1,746 1,762

1,776 1,793 1,806

ITC 232 235

239 242 246

JSW STEEL 630 640

653 664 677

KOTAKBANK 1,978 2,001

2,032 2,055 2,085

LT 1,854 1,875

1,915 1,936 1,976

M&M 896 910

932 946 969

MARUTI 7,795 7,956

8,162 8,323 8,529

NESTLEIND 19,183 19,294

19,391 19,503 19,600

NTPC 133 134

136 137 139

ONGC 146 148

150 151 153

POWERGRID 189 191

193 194 196

RELIANCE 2,432 2,453

2,471 2,492 2,510

SBILIFE 1,162 1,172

1,189 1,199 1,215

SHREECEM 26,286 26,727

27,376 27,816 28,465

SBIN 487 495

501 509 515

SUNPHARMA 774 782

788 797 803

TCS 3,413 3,445

3,483 3,514 3,552

TATACONSUM

812 822

832 843 853

TATAMOTORS 482 496

515 529 548

TATASTEEL 1,153 1,170

1,199 1,216 1,245

TECHM 1,519 1,543

1,584 1,609 1,649

TITAN 2,421 2,450

2,485 2,513 2,548

ULTRACEMCO 7,589 7,679

7,804 7,893 8,019

UPL 726 734

748 756 770

WIPRO 634 642

654 663 675

www.angelone.in

Technical & Derivatives Report

November 22, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in