SEPT 22, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

Nifty Bank Outlook (41468)

Ahead of the weekly expiry and key event of the FOMC meeting,

the bank index started on a muted note and then slipped lower

below the 40900 levels. During the second half, there was a modest

recovery to eventually reclaim 41200 levels on closing base and

end with a loss of 0.64%.

Despite a strong bounce back in the last two sessions, we

mentioned avoiding being complacent as we are still not out of

woods, and we are in a consolidation phase. Now if we

meticulously observe the daily chart, prices are trapped within the

big bullish candle left on the 14th September and the next

directional move can only be seen once the index breaks the

consolidation range. If we observe the intraday charts, we are

witnessing a Symmetrical Triangle formation with support placed

around 40800 - 40500 levels whereas, on the higher side, 41600 -

41840 remains a stiff resistance. Traders are advised, to keep a tab

on the mentioned levels and ideally should play the consolidation

by buying around the support and selling around the resistance

levels.

Key Levels

Support 1 – 40800 Resistance 1 – 41600

Support 2 – 40500 Resistance 2 – 41840

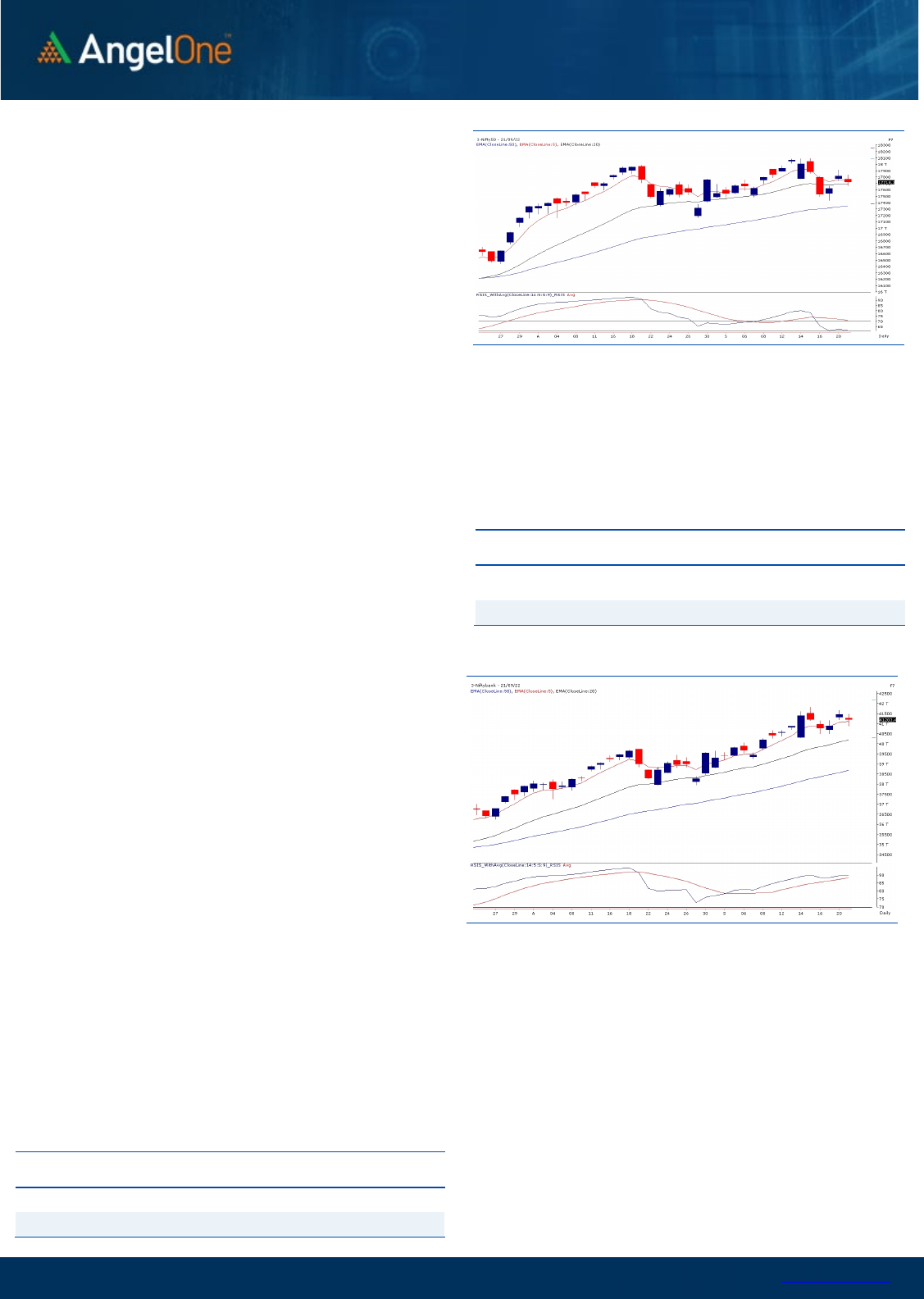

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank

Weekly

Chart

Sensex (59457) / Nifty (17718)

The Indian equity market started the day on a mild note amid mixed

global cues, wherein the benchmark index seemed a bit nervous

from the early trades. During the mid-session, an intense bout of

sell-off triggered, tumbling the index from the top towards 17660

odd zone. However, the bulls retaliated from the lows and made a

modest recovery to pare down some losses. With such a volatile

session, the Nifty concluded the day with a correction of 0.55

percent and settled a tad above the 17700 level.

Technically speaking, the index seems tentative at higher levels and

again slipped in the broad consolidation range. However, the

undertone is likely to remain in favor of the bulls, and as far as levels

are concerned, 17820-17860 zone still holds the sturdy wall for the

index and any persistent breakthrough could only open the gates

for further upside. On the flip side, 17540 - 17500 has seen some

strong resurgence in providing vital support and thus could be seen

as a crucial juncture to add longs for intraday dips, while the

sacrosanct support lies at the 17400 mark.

Going forward, the market is likely to remain volatile, mirroring

the global bourses. We reiterate to keep a close tab on the

mentioned levels. Also, one should continue with the stock-

specific approach, as even though the indices may not be doing

much, the individual stocks are not at all short of action. Hence

one should continue to identify such potential movers and trade

accordingly.

Key Levels

Support 1 – 17540 Resistance 1 – 17820

Support 2 – 17400 Resistance 2 – 17860

www.angelone.in

Technical & Derivatives Report

SEPT 22, 2022

View

We had a slightly nervous start and saw some selling

in the midst to plunge towards 16650. However, yet

another round of recovery was seen which got sold

into in the final hour to conclude the day tad above

17700.

FIIs were net sellers in the cash market segment to

the tune of Rs. 461 crores. Simultaneously, in Index

futures, they sold worth Rs. 1092 crores with rise in

open interest, indicating addition of bearish bets.

In the derivatives segment, we witnessed mixed open

interest activity in both the key indices. In the initial two

sessions, we observed a blend of short covering and

minor longs especially in the banking index followed

by some profit booking on Wednesday. Stronger hands

added some shorts yesterday after last two sessions

short covering. Now, their index futures Long Short

Ratio is at 35%. On the options front, we saw a good

amount of writing in the 17800 call strike since early

morning trade on Wednesday. On the contrary, a

decent amount of unwinding was seen in 17600 and

17650 put strike. Post the Fed meet outcome the

volatility is expected to remain on the higher side.

Hence, we would advocate traders to stay light on the

weekly expiry session.

Comments

The Nifty futures open interest has decreased by

0.34%. and Bank Nifty futures open interest has

decreased by 9.60% as the market closed at 17718.35.

The Nifty Sep future closed with a premium of 13.10

point against a premium of 5.75 point in the last

trading session. The Oct series closed at a premium

of 67.75 point.

The INDIA VIX increased from 18.79 to 19.32. At the

same time, the PCR-OI of Nifty has decreased from

1.15 to 0.95.

Few of the liquid counters where we have seen high

cost of carry are CUB, ABB, GAIL, INTELLECT and

OBEROIRLTY.

Historical Volatility

SCRIP HV

IDEA 81.26

IBULHSGFIN 72.97

RBLBANK 72.53

ZEEL 63.90

HINDCOPPER 62.70

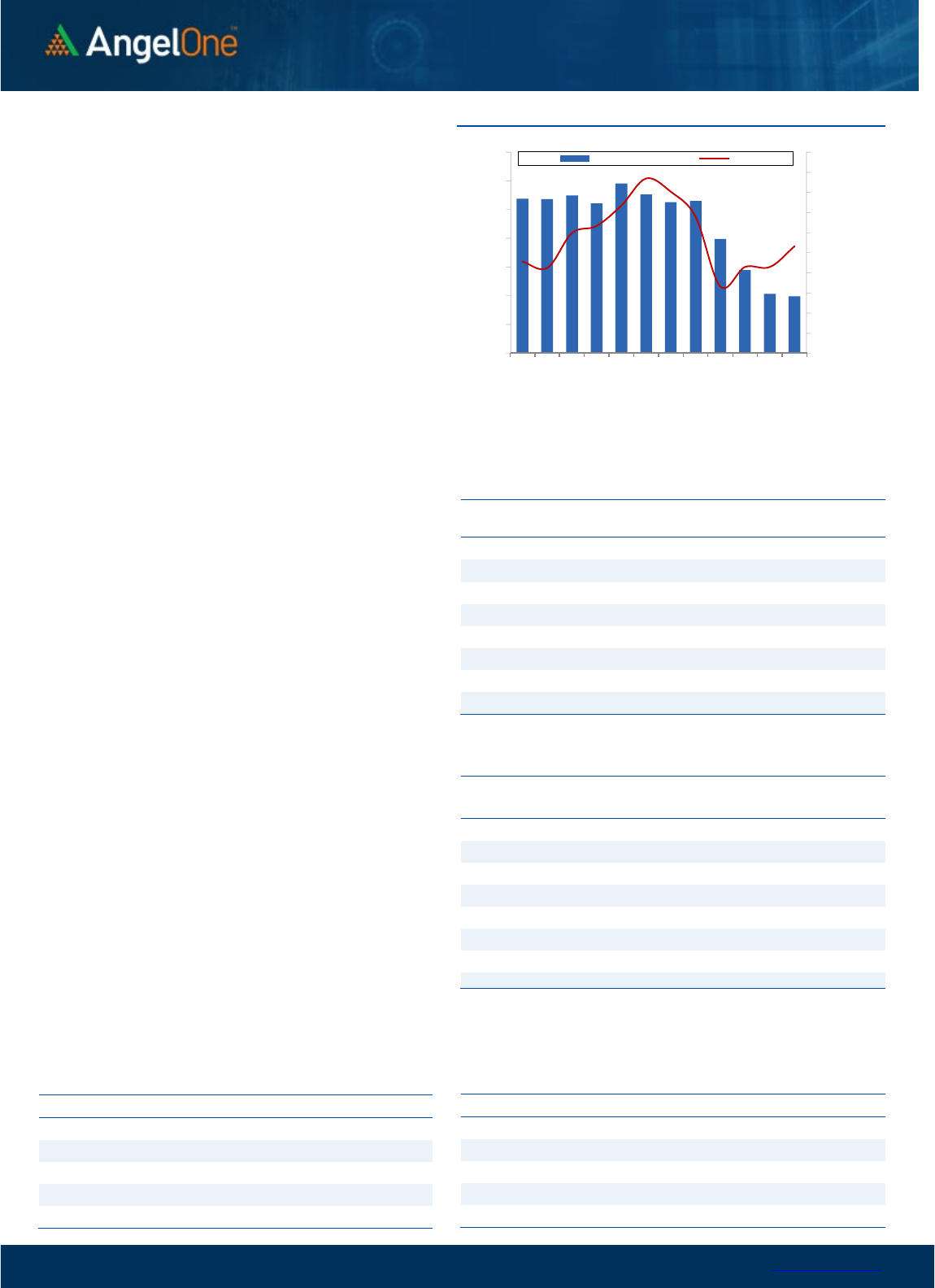

Nifty Vs OI

17200

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

11,500

12,000

12,500

13,000

13,500

14,000

14,500

15,000

9/6 9/8 9/12 9/14 9/16 9/20

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CANFINHOME 5966025 80.61 565.35 -3.93

CIPLA 8585850 14.61 1092.30 4.83

GUJGASLTD 6558750 13.01 503.15 0.24

RAIN 13394500 12.13 181.20 4.47

JKCEMENT 452250 10.91 2909.45 3.18

HONAUT 15885 9.06 40709.90 0.51

LAURUSLABS 6722100 7.95 527.65 3.92

ALKEM 483200 7.09 3319.70 2.25

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ESCORTS 1864500 -15.90 2095.20 -0.25

HEROMOTOCO 2686500 -8.91 2771.55 2.77

INDIACEM 14421700 -8.42 283.45 -2.11

MCX 3313200 -6.21 1284.25 5.02

IRCTC 13767250 -6.10 706.15 2.80

APOLLOTYRE 14210000 -5.78 288.20 -0.33

IPCALAB 1600300 -5.53 871.45 1.72

HINDALCO 29055100 -5.23 421.45 2.32

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.15 0.90

BANKNIFTY 1.07 0.85

RELIANCE 0.47 0.43

ICICIBANK 0.71 0.61

INFY 0.37 0.39

www.angelone.in

Technical & Derivatives Report

SEPT 22, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

,

718.35

FII Statistics for

September

2

1

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2399.84 3492.24 (1092.40) 119225 11186.08 7.65

INDEX

OPTIONS

905676.99 902745.75 2931.24

1537569 142587.38 10.69

STOCK

FUTURES

11386.51 12839.22 (1452.71) 2161364 151594.35 0.03

STOCK

OPTIONS

11318.84 11481.90 (163.06) 205449 14878.05 (0.17)

Total 930782.18

930559.11

223.07

4023607

320245.86

4.07

Turnover on

September

2

1

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

385227 36790.85 5.46

Index

Options

128230586

12436966.03

16.51

Stock

Futures

894379 68109.64 -0.21

Stock

Options

4169435 338167.77 -0.34

Total

4,169,435

338167.77 15.86

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17800 221.65

51.10

48.90

17851.10

Sell

17900 170.55

Buy

17800 221.65

95.40

104.60

17895.40

Sell

18000 126.25

Buy

17900 170.55

44.30 55.70 17944.30

Sell 18000 126.25

Bear

-

Put

Spreads

Action Strike Price Risk Reward BEP

Buy 17800 197.50

42.75

57.25

17757.25

Sell

17700 154.75

Buy 17800 197.50

75.40

124.60

17724.60

Sell 17600 122.10

Buy

17700 154.75

32.65 67.35 17667.35

Sell 17600 122.10

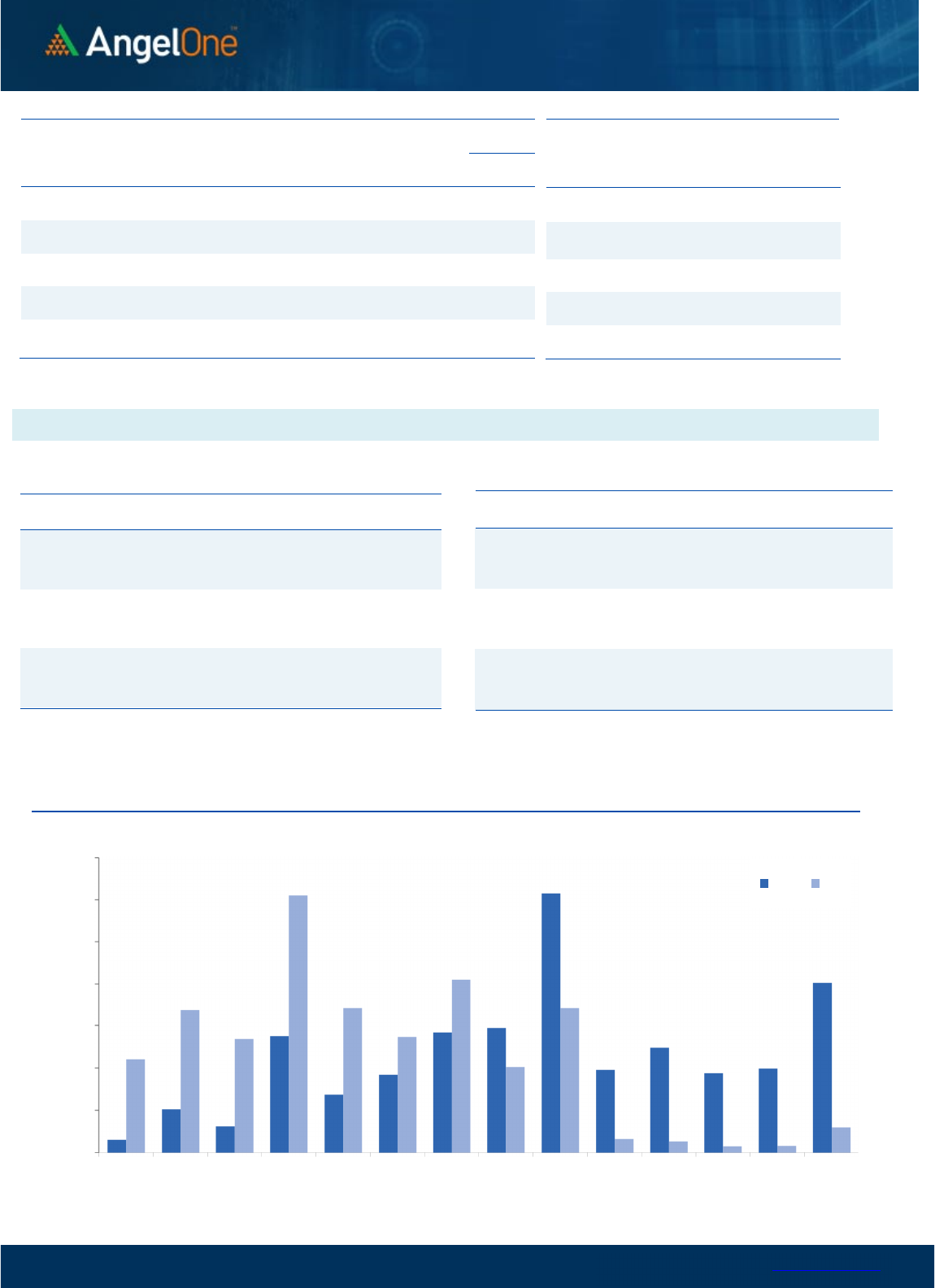

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

SEPT 22, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

883

908

942

967

1,001

APOLLOHOSP 4,497 4,551

4,610

4,664 4,722

ASIANPAINT

3,299

3,328

3,376

3,405

3,453

AXISBANK 796 801

809

814 821

BAJAJ-AUTO

3,671

3,701

3,754 3,784 3,837

BAJFINANCE

7,522

7,606

7,671

7,755

7,820

BAJAJFINSV

1,758

1,780

1,800

1,822

1,842

BPCL 315 318

321

323

326

BHARTIARTL 767 774

785

792

803

BRITANNIA

3,579

3,672

3,731

3,824

3,883

CIPLA 1,041 1,056

1,079

1,093

1,116

COALINDIA

225

228

230

234

236

DIVISLAB

3,519

3,546

3,595

3,622

3,671

DRREDDY 4,049 4,101

4,185

4,237

4,321

EICHERMOT 3,598 3,640

3,714

3,756

3,829

GRASIM

1,687

1,703

1,726

1,743

1,766

HCLTECH

890

895

905

910

919

HDFCBANK

1,498

1,508

1,515

1,525

1,531

HDFCLIFE

542

547

554

559

567

HDFC

2,416

2,438

2,462 2,484

2,508

HEROMOTOCO 2,744 2,760

2,784

2,801

2,824

HINDALCO

402

407

415 420

428

HINDUNILVR 2,550 2,587

2,617

2,654

2,684

ICICIBANK

901

908

913

920

924

INDUSINDBK 1,194 1,209

1,237

1,252

1,280

INFY

1,358

1,368

1,378

1,388

1,399

ITC

331

336

341 346

350

JSW STEEL 676 680

686

691

697

KOTAKBANK 1,871 1,895

1,922

1,946

1,974

LT

1,856

1,876

1,911

1,931

1,966

M&M

1,278

1,293

1,308

1,322

1,337

MARUTI

9,099

9,174

9,286 9,360

9,472

NESTLEIND

18,412

18,531

18,710

18,829

19,008

NTPC

166

167

170

171 174

ONGC 128 130

131

133

135

POWERGRID

219

223

229

233

239

RELIANCE 2,475 2,492

2,513

2,530

2,551

SBILIFE

1,287

1,297

1,308

1,317

1,328

SHREECEM 20,803 21,413

22,411

23,022

24,019

SBIN

559

564

571

576

583

SUNPHARMA

890

898

910

918

930

TCS

2,970

2,986

3,014

3,029 3,057

TATACONSUM

792 798

804

811 817

TATAMOTORS 419 423

430

434

440

TATASTEEL 102 103

105

106

108

TECHM

1,038

1,049

1,058

1,069

1,078

TITAN

2,631

2,649

2,674

2,692

2,718

ULTRACEMCO

6,145

6,229

6,381

6,466

6,617

UPL 696 707

716

726

735

WIPRO 396 398

402

405

408

www.angelone.in

Technical & Derivatives Report

SEPT 22, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.