February 22, 2022

www.angelone.in

Technical & Derivatives Report

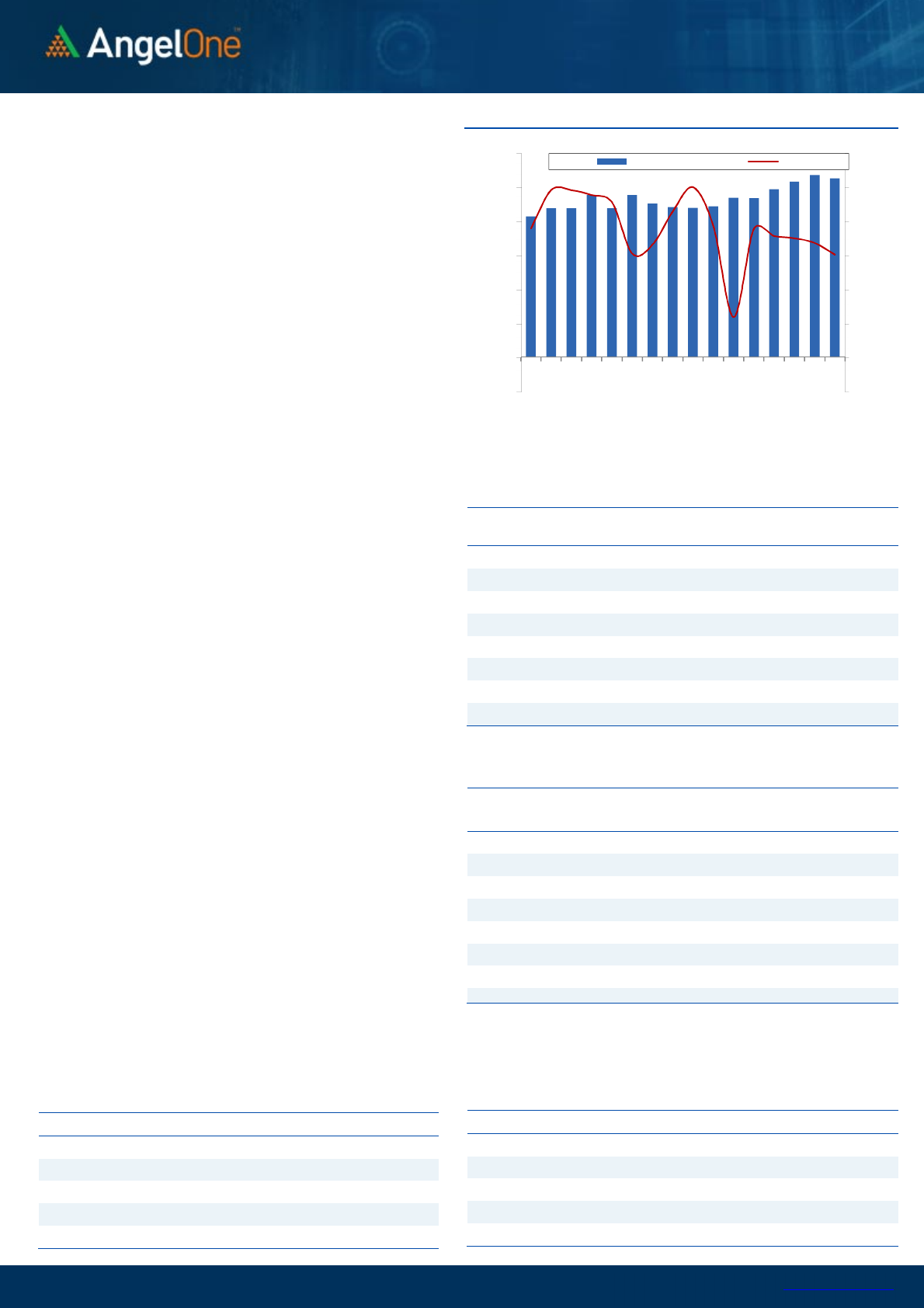

Nifty

Bank Outlook

-

(37686)

An action-packed session was seen in the banking space,

wherein the bulls took charge past the initial hiccups and helped

the banking index to settle in green. The Bank Nifty index

outperformed the benchmark index to conclude the day in green

with mere gains of 0.23 percent at 37686 levels.

On technical aspects, the 37000 mark has proved to be the

strong demand zone from where the bulls reign, and till the

index sustains above the same, the sentiments are expected to

remain on the upward trend. However, the significant indicators

have not shown any firm bullish reversal indication, and hence

a cautious approach is advised in the present scenario. In

contrast, a closure above 38200 could affirm the strength in

market sentiments. Therefore, for immediate term 37000-

38200 is the primary range for the index, and any decisive

breach could dictate the next set of the rally in the market. Going

forward, the volatility index is placed near 23 levels signifying

the rise in uncertainty. Thus, looking at the data and concerns

over global bourses, avoiding any aggressive overnight bets and

tracking the global market is advisable.

Key Levels

Support 1 – 37000 Resistance 1 – 38000

Support 2 – 36800 Resistance 2 – 38200

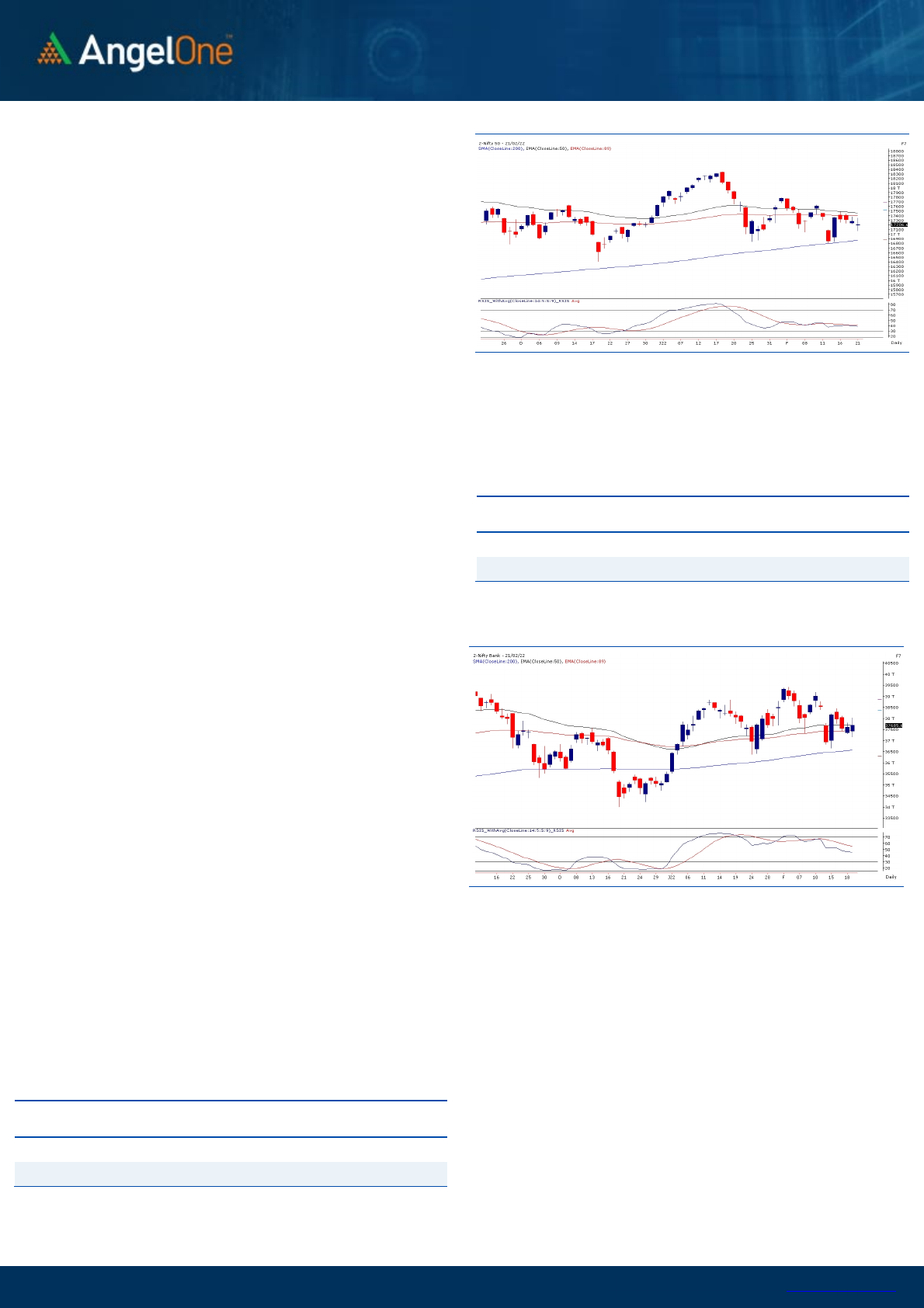

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (57684) / Nifty (17207)

The Indian equity market had a nervous start to the week

tracking the weakness in global bourses. However, post the

initial hiccups, bulls managed to minimize the damage, which

resulted in a decent recovery around the mid-session.

Eventually, ensuing the showdown, the Nifty50 index concluded

the day marginally in favor of the bears with a Doji look-alike

candle formation, a tad above 17200.

The support base around 17100 – 17000 once again proved to be

the sacrosanct zone, from where the market has witnessed a

substantial pullback indicating the sentiments of our domestic

participants but failed to endure the highs. A firm tug of war was

seen in yesterday’s trade among the various sectors in which

bears have taken the show in the latter part. On the technical

front, Nifty remains in the slender range showcasing

indecisiveness due to the external global scenarios. As far as

levels are concerned, a strong base of 17100 – 17000 is expected

to provide the cushion. While on the higher side, the immediate

resistance could be seen at 17500.

Looking at the range

-

bound movement and technical setup,

the index is expected to remain in the mentioned slender

range until any decisive breach on either side happens. The

global market would play a vital role in any decisive breach

and until then, aggressive overnight bets should strictly be

avoided.

Key Levels

Support 1 – 17100 Resistance 1 – 17450

Support 2 – 17000 Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

February 22, 2022

View

Nifty started the week on a negative note and then

witnessed swings on both sides. Eventually, it ended

with a loss of 0.40% tad above 17200.

FIIs were net sellers in the cash market segment to

the tune of Rs. 2262 crores. In Index futures, they sold

worth Rs. 217 crores with a fall in open interest

indicating long unwinding in yesterday’s session.

Yesterday, we witnessed long unwinding in Nifty

futures whereas the Bank Nifty relatively

outperformed, and long formations were seen. FII’s

remain sellers in the cash segment whereas in Index

futures they unwound some of their long positions.

Highest open interest build-up in out of the money

CALL options is seen at 18000 strike however we

continue to see 17500 as immediate resistance where

a decent build-up can be seen in call options. On the

flip side, the highest build-up is seen at 17000 PUT

indicating a support level for the monthly expiry.

Traders should continue to focus on stock-specific

trades however aggressive overnight positions

should be avoided.

Comments

The Nifty futures open interest has decreased by 1.50%.

and BANK Nifty futures open interest has increased by

3.56% as market closed at 17206.65 levels.

The Nifty February future closed with a discount of 1.45

point against a premium of 1.10 point in last trading

session. The March series closed at a premium of 46.85

point.

The INDIA VIX increased from 22.16 to 22.90. At the

same time, the PCR-OI of Nifty has decreased from 1.10

to 1.06.

Few of the liquid counters where we have seen high

cost of carry are LAURUSLABS, PAGEIND,

BALRAMCHIN, GRANULES AND M&MFIN.

Historical Volatility

SCRIP HV

IBULHSGFIN

75.24

BHEL

62.72

GAIL

39.56

ABCAPITAL

52.00

HAL

42.16

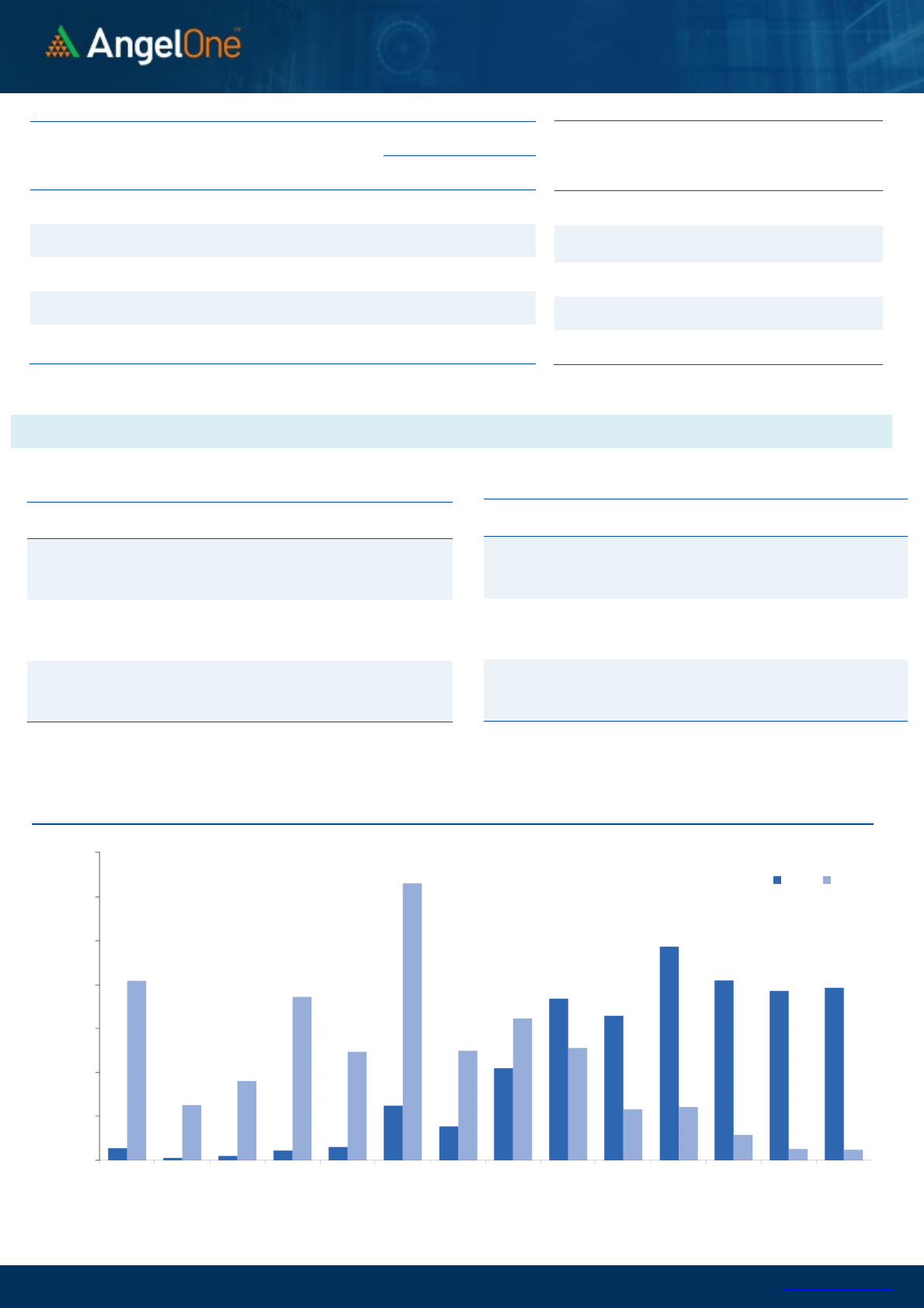

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

1-31 2-2 2-4 2-8 2-10 2-14 2-16 2-18

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IDEA

912240000 17.48 11.25 5.63

INDIAMART

530175 9.36 4757.65 -0.37

CROMPTON

3521100 9.17 392.40 0.09

INTELLECT

495000 8.37 670.25 -1.60

LTTS

857000 8.26 4365.75 -1.85

INDHOTEL

19888790 7.06 204.95 -1.14

JKCEMENT

354025 6.53 2911.05 -2.33

RECLTD

38544000 6.45 125.50 -0.63

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AMBUJACEM

18849000 -16.92 338.55 0.10

RAMCOCEM

1956700 -14.68 823.95 -1.21

LALPATHLAB

893625 -10.20 2684.40 -1.72

IBULHSGFIN

34977300 -10.16 166.35 -10.13

GUJGASLTD

2580000 -8.91 660.05 0.14

ONGC

36806000 -8.41 163.40 -1.74

COFORGE

758500 -8.19 4412.90 2.23

UBL

943950 -7.98 1525.35 -1.37

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY

1.06 0.83

BANKNIFTY

0.99 0.89

RELIANCE

0.56 0.55

ICICIBANK

0.50 0.53

INFY

0.43 0.46

www.angelone.in

Technical & Derivatives Report

February 22, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (February Series) are given as an information and not as a recommendation.

Nifty Spot = 17206.70

FII Statistics for

February

21

, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

5044.32 5261.05 (216.73) 192948 16971.99 (1.48)

INDEX

OPTIONS

556012.72 555167.15 845.57

1513617 133829.35 5.65

STOCK

FUTURES

41477.24 40166.55 1310.69

1958392 132729.18 0.73

STOCK

OPTIONS

17456.89 17256.02 200.87

319329 22849.27 (1.92)

Total

619991.17

617850.77

2140.40

3984286

306379.79

2.21

Turnover

on

February

21

, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

543647 48777.49 35.31

Index Options

71169723 6467080.33 52.38

Stock Futures

1863974 126753.90 68.96

Stock Options

3492830 253267.72 17.11

Total

7,70,70,174

6895879.44 50.85

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

17200 153.85

49.25 50.75 17249.25

Sell

17300 104.60

Buy

17200 153.85

87.70 112.30 17287.70

Sell

17400 66.15

Buy

17300 104.60

38.45 61.55 17338.45

Sell

17400 66.15

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

17200 147.35

39.15 60.85 17160.85

Sell

17100 108.20

Buy

17200 147.35

68.80 131.20 17131.20

Sell

17000 78.55

Buy

17100 108.20

29.65 70.35 17070.35

Sell

17000 78.55

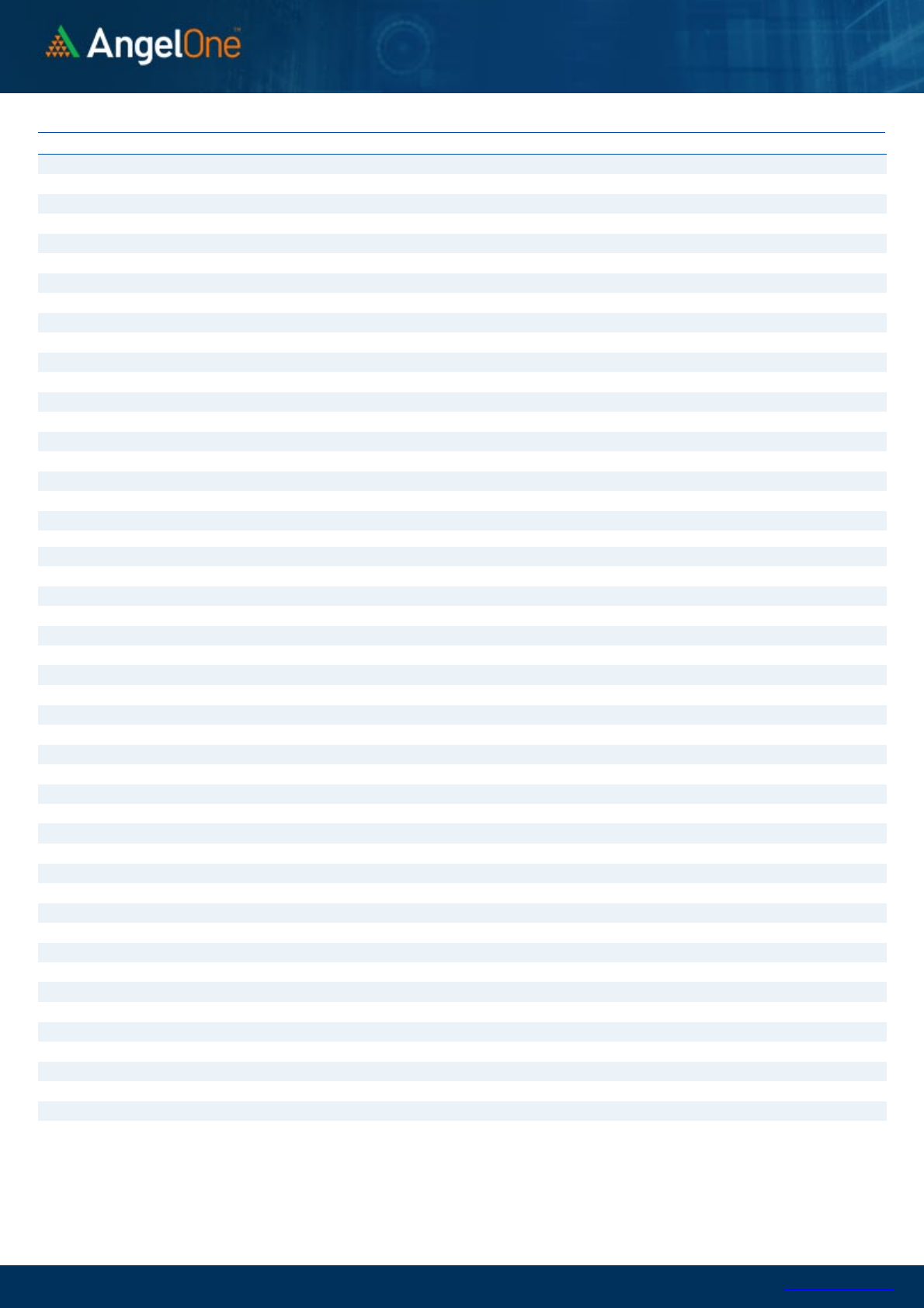

Nifty Put

-

Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

7000,000

16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800

Call Put

www.angelone.in

Technical & Derivatives Report

February 22, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 699 705

716 722 733

ASIANPAINT 3,170 3,211

3,245 3,285 3,319

AXISBANK 767 778

787 798 808

BAJAJ-AUTO 3,524 3,552

3,595 3,623 3,666

BAJFINANCE 6,830 6,918

6,999 7,088 7,169

BAJAJFINSV 15,552 15,782

16,010 16,240 16,468

BPCL 361 365

369 373 377

BHARTIARTL 696 703

710 717 723

BRITANNIA 3,398 3,437

3,468 3,507 3,538

CIPLA 888 898

906 915 923

COALINDIA 158 160

162 163 165

DIVISLAB 4,190 4,224

4,285 4,319 4,379

DRREDDY 4,198 4,248

4,333 4,382 4,467

EICHERMOT 2,645 2,672

2,695 2,722 2,746

GRASIM 1,656 1,674

1,706 1,724 1,755

HCLTECH 1,142 1,153

1,161 1,173 1,181

HDFCBANK 1,481 1,502

1,516 1,537 1,551

HDFCLIFE 570 576

583 589 596

HDFC 2,394 2,415

2,431 2,453 2,469

HEROMOTOCO 2,652 2,683

2,715 2,746 2,778

HINDALCO 500 506

517 524 535

HINDUNILVR 2,275 2,285

2,295 2,304 2,314

ICICIBANK 730 742

752 765 775

IOC 117 118

120 121 122

INDUSINDBK 935 944

958 967 981

INFY 1,674 1,702

1,720 1,748 1,766

ITC 215 216

219 220 223

JSW STEEL 613 618

626 632 640

KOTAKBANK 1,778 1,802

1,827 1,852 1,876

LT 1,831 1,847

1,866 1,882 1,901

M&M 823 832

841 850 860

MARUTI 8,313 8,463

8,594 8,743 8,874

NESTLEIND 17,695 17,901

18,030 18,236 18,365

NTPC 129 131

132 134 135

ONGC 160 162

165 166 169

POWERGRID 194 196

198 200 201

RELIANCE 2,354 2,377

2,407 2,430 2,460

SBILIFE 1,109 1,122

1,136 1,149 1,164

SHREECEM 23,631 24,155

24,574 25,098 25,517

SBIN 498 505

511 518 524

SUNPHARMA 825 834

849 859 874

TCS 3,629 3,674

3,751 3,796 3,873

TATACONSUM

696 705

713 722 730

TATAMOTORS 479 487

494 501 508

TATASTEEL 1,158 1,170

1,186 1,198 1,214

TECHM 1,393 1,406

1,423 1,435 1,453

TITAN 2,374 2,414

2,451 2,491 2,528

ULTRACEMCO 6,717 6,765

6,839 6,887 6,961

UPL 687 696

710 719 733

WIPRO 549 560

566 577 584

www.angelone.in

Technical & Derivatives Report

February 22, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.