OCT 21, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

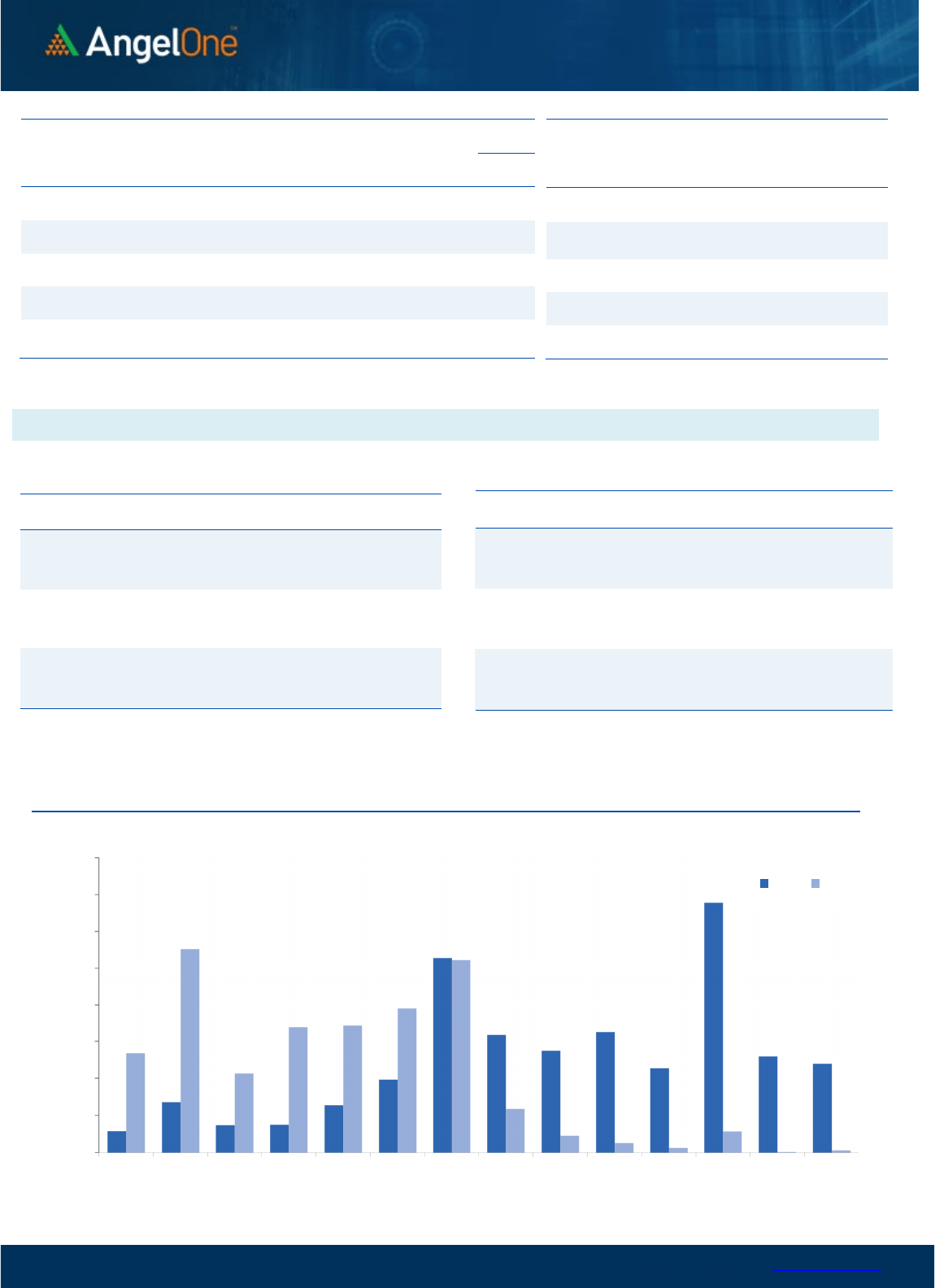

Nifty Bank Outlook (40100)

The Bank Nifty index has snapped its winning streak of four

consecutive sessions and has underperformed the benchmark

index in the last trading session. The index has settled at the 40100

level, with a correction of 0.68 percent.

On the technical aspect, the banking index is still in the bullish

trajectory as it hovers well above all its major exponential moving

averages on the daily chart. Also, the cycle of higher highs – higher

lows is maintained, signifying the bullish quotient in the index.

Meanwhile, the undertone is likely to favor the bulls, wherein any

minor correction could be seen as an opportunity to add fresh

longs. As far as levels are concerned, the 21-DEMA placed around

39500 is likely to provide a cushion for any blip, while on the flip

side, 40500-40650 is expected to act as the immediate hurdle.

Key Levels

Support 1 – 39850 Resistance 1 – 40500

Support 2 – 39500 Resistance 2 – 40650

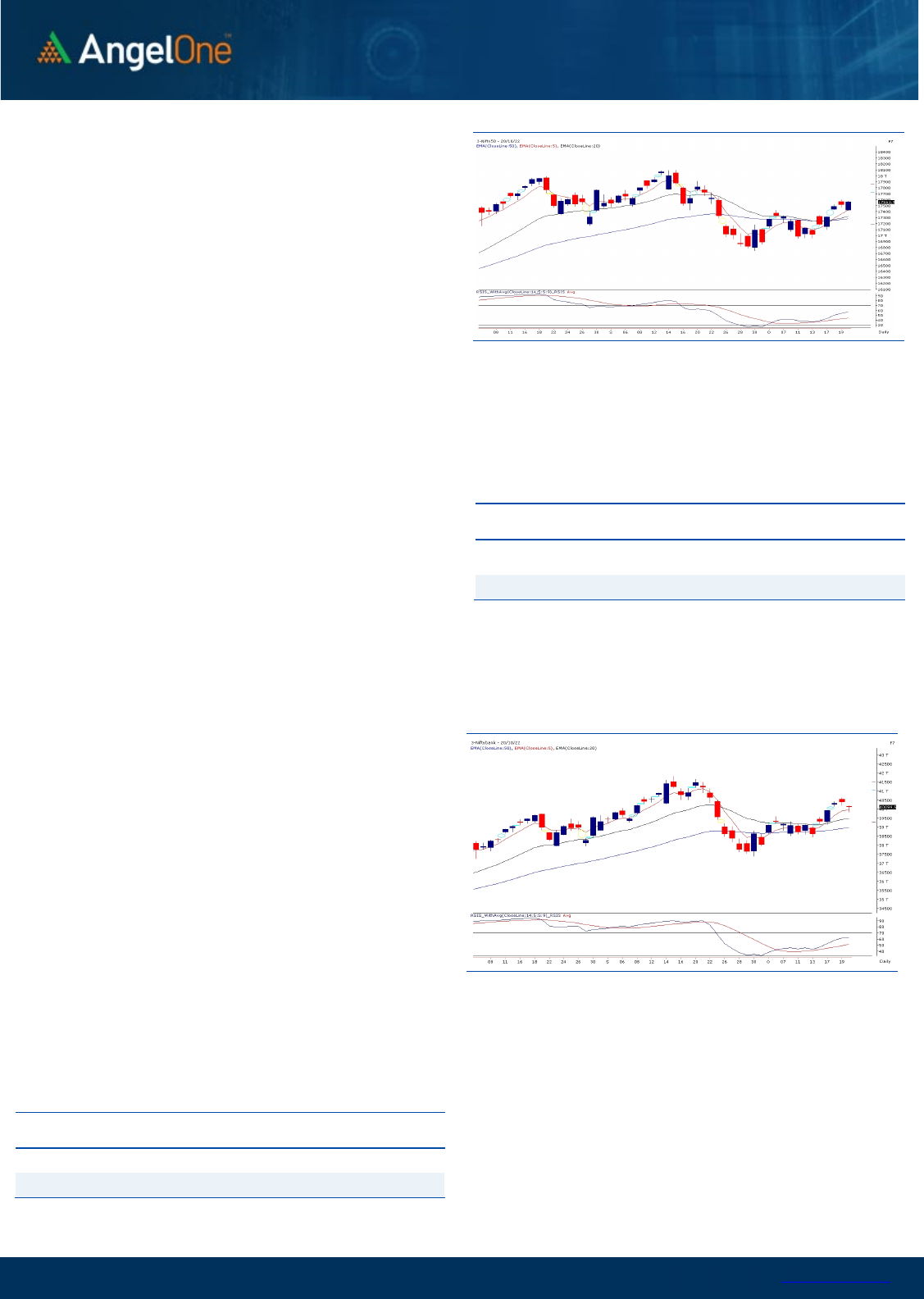

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (59203) / Nifty (17564)

Yesterday morning, the global markets looked a bit sluggish and

hence, indicated a weak opening for our market. We did open lower

but not to the tune of what SGX was indicating. Nifty started the

session slightly above 17400 and from there, the recovery took

place in a gradual manner. However, as we stepped into the latter

half of the session, the buying accelerated in some of the

heavyweight spaces, which resulted in Nifty ending the session well

inside the positive territory a tad above the 17550 mark.

Technically speaking, the intraday price movement was precisely as

per the sturdy structure of Nifty. If we look at the hourly chart

meticulously, we can see Nifty opening and then finding support

exactly at the ’89-EMA’ levels which acted as a sheet anchor. This is

what we have been mentioning since couple of days, market may

see small profit booking in between but the undertone is strongly

bullish. In such scenarios, rather than shorting form small declines,

it’s better to wait for the opportunity to go long around key

supports. Now the kind of close we have witnessed yesterday; Nifty

is well poised for surpassing 17600 in coming session. If global

market supports, we may see Nifty heading towards 17700 – 17800

soon.

On the flipside, 17500 followed by 17400 remains to be a

sacrosanct support for the forthcoming session. Traders are

advised to continue with the positive bias and look for potential

buyers within the appropriate themes.

Key Levels

Support 1 – 17500 Resistance 1 – 17700

Support 2 – 17400 Resistance 2 – 17800

www.angelone.in

Technical & Derivatives Report

OCT 21, 2022

View

We had a negative start on the weekly expiry

session; however, buying interest was observed

thereafter to recoup all the losses and conclude the

session with the gains of 0.30%.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1865 crores. Simultaneously, in Index

futures, they sold worth Rs. 1785 crores with a rise in

open interest; indicating formation of short positions in

yesterday’s session.

In derivatives front, fresh long formation was seen in

Nifty whereas in Bank Nifty we witnessed short

formations. Surprisingly, the stronger hands turned

net buyers in equities after quite some time but

continued selling in index futures segment. In the

monthly expiry series, we observed fresh writing in

17400 and 17500 put strikes adding decent positions.

Considering yesterday’s respite from the support zone

of 17300-17400, we maintain our bullish stance on

market; hence traders are advised adding longs in any

dips for now.

Comments

The Nifty futures open interest has increased by

10.04%. and Bank Nifty futures open interest has

increased by 4.88% as the market closed at 17512.25.

The Nifty October future closed with a discount of

23.25 point against a discount of 17.60 point in the last

trading session. The November series closed at a

premium of 17.50 point.

The INDIA VIX decreased from 17.45 to 17.23. At the

same time, the PCR-OI of Nifty has increased from

1.13 to 1.22.

Few of the liquid counters where we have seen high

cost of carry are IDEA, BALRAMCHIN, ASTRAL, BPCL

and MFSL.

Historical Volatility

SCRIP HV

UPL 40.58

AUBANK 48.53

HDFCAMC 37.63

BSOFT 51.82

INDUSINDBK 51.25

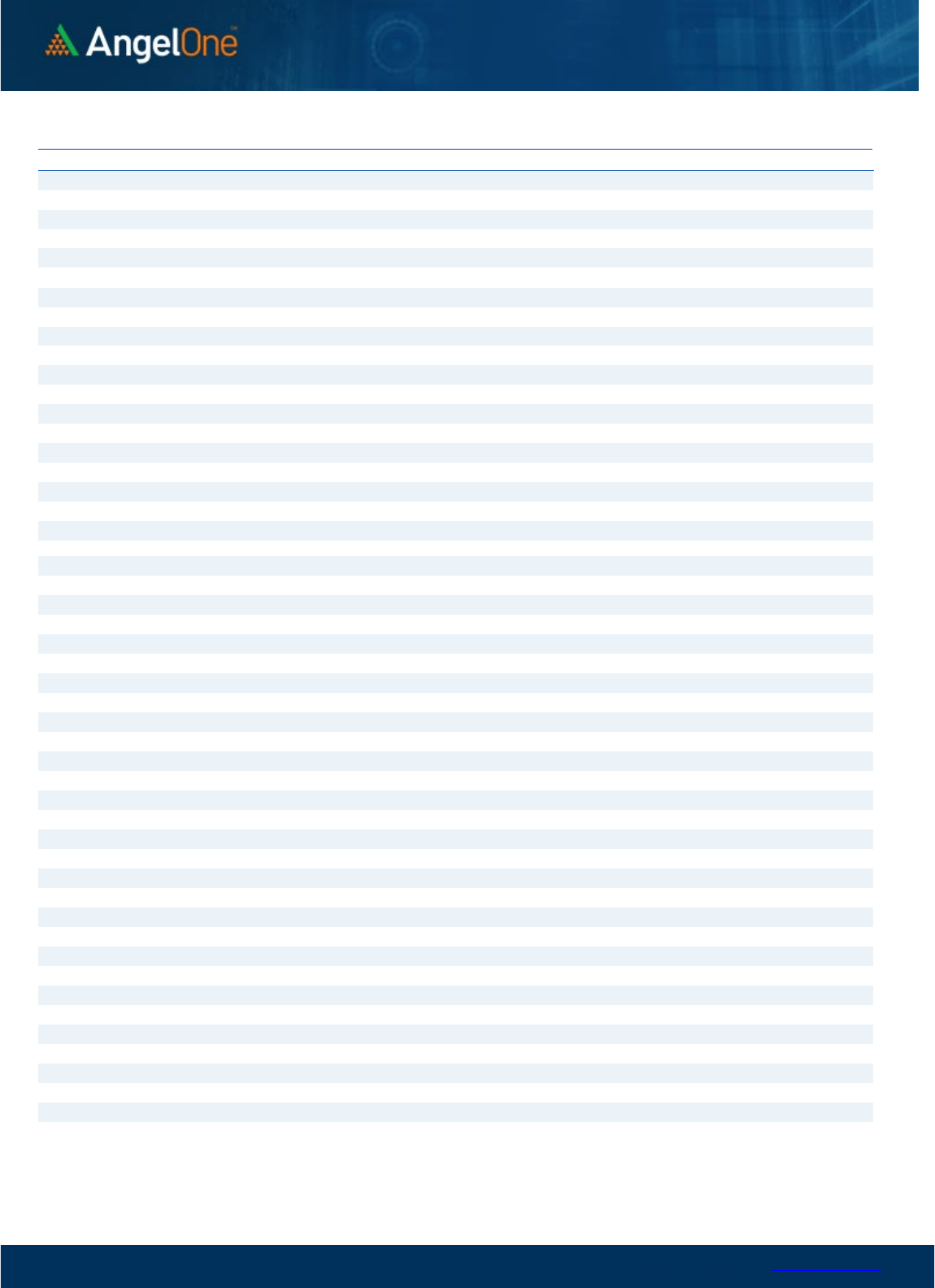

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

10/3 10/6 10/10 10/12 10/14 10/18 10/20

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AARTIIND 2395300 29.38 686.60 -0.35

AUBANK 7580000 14.29 592.35 -4.86

PNB 311200000 11.32 40.50 2.80

IDFCFIRSTB 206805000 9.96 56.80 -0.52

INDUSINDBK 28662300 9.62 1159.95 -4.72

ICICIPRULI 8440500 9.39 518.80 1.93

IDEA 645540000 9.37 8.55 0.58

AXISBANK 51160800 9.02 825.85 -0.50

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

JKCEMENT 390500 -16.20 2684.65 2.34

LTTS 1374800 -15.43 3530.90 2.59

NAVINFLUOR 616500 -13.86 4418.95 1.13

GUJGASLTD 8293750 -13.62 483.65 0.76

DEEPAKNTR 1703000 -13.00 2247.45 -0.56

MUTHOOTFIN 7409625 -12.17 1048.00 0.25

AMARAJABAT 6419000 -11.92 488.55 0.70

RAMCOCEM 3805450 -11.63 708.10 1.70

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.22 0.97

BANKNIFTY 0.89 0.94

RELIANCE 0.54 0.36

ICICIBANK 0.53 0.52

INFY 0.50 0.38

www.angelone.in

Technical & Derivatives Report

OCT 21, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Oct Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

5

63.95

FII Statistics for

October

20

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4258.78 6043.64 (1784.86) 179687 16308.59 16.57

INDEX

OPTIONS

2263885.03 2248671.22 15213.81

1417529 127960.24 (30.06)

STOCK

FUTURES

48280.05 46930.76 1349.29

2170635 149284.36 (0.29)

STOCK

OPTIONS

9112.49 8892.83 219.66

161183 11690.67 2.05

Total 2325536.35

2310538.45

14997.90

3929034

305243.86

(13.00)

Turnover on

October

20

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

410639 38231.43 9.26

Index Options

306200177 50528.06 9.97

Stock

Futures

1767891 124418.14 50.06

Stock Options

3370401 2910.05 -20.26

Total

3,370,401 2910.05 29.00

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17600 108.40

40.50

59.50

17640.50

Sell

17700 67.90

Buy

17600 108.40

69.25

130.75

17669.25

Sell

17800 39.15

Buy

17700 67.90

28.75 71.25 17728.75

Sell 17800 39.15

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17500 120.45

38.35

61.65

17461.65

Sell

17400 82.10

Buy 17500 120.45

64.70

135.30

17435.30

Sell 17300 55.75

Buy

17400 82.10

26.35 73.65 17373.65

Sell 17300 55.75

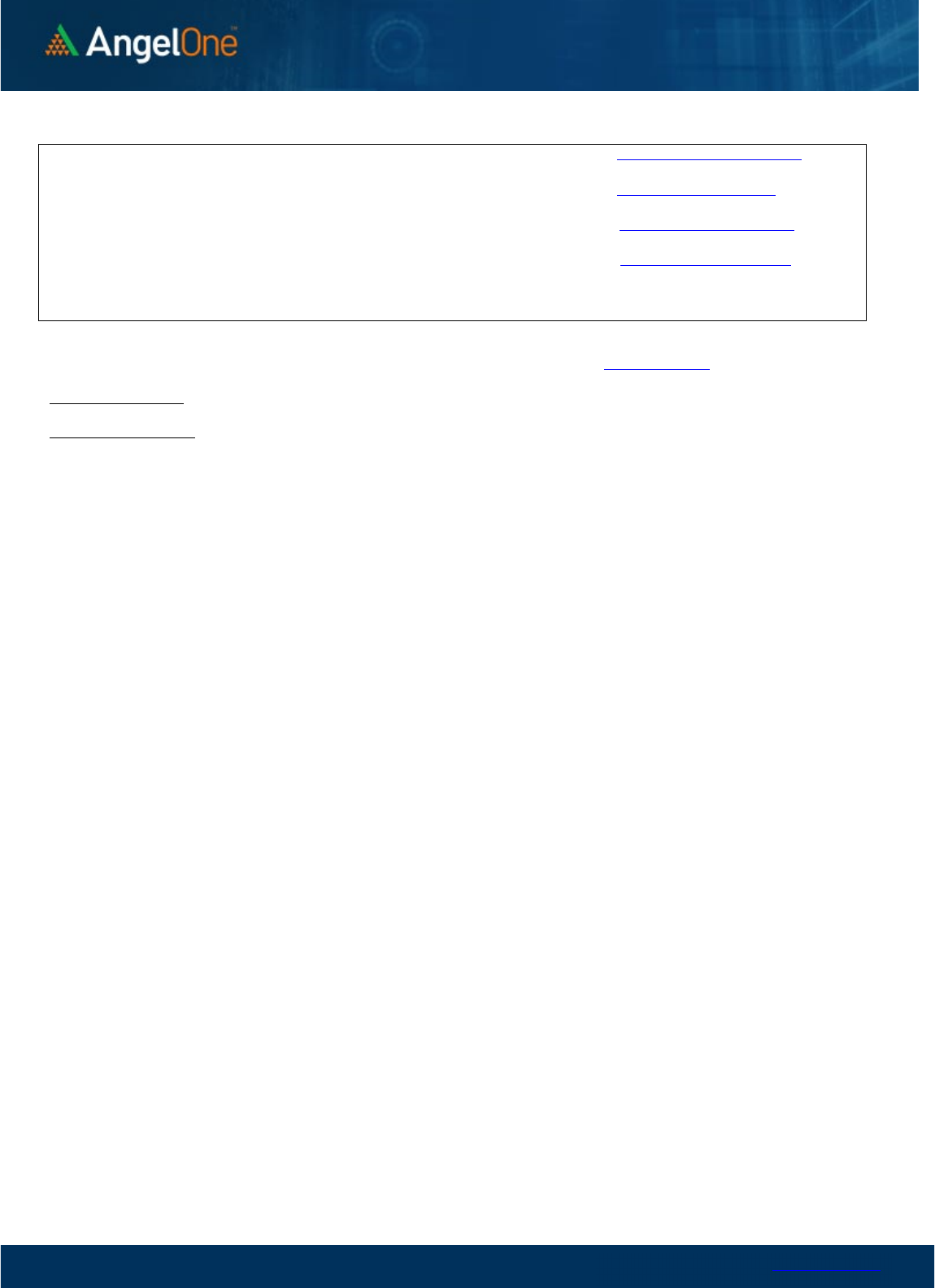

Nifty Put

-

Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

7000,000

8000,000

16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200

Call Put

www.angelone.in

Technical & Derivatives Report

OCT 21, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT 3,202 3,280

3,322

3,400

3,442

ADANIPORTS

785

803

812 830

840

APOLLOHOSP 4,239 4,281

4,337 4,379

4,435

ASIANPAINT

3,021

3,081

3,162

3,221 3,302

AXISBANK 810 818

825

833

840

BAJAJ-AUTO 3,543 3,617

3,661

3,735

3,778

BAJFINANCE

7,193

7,313

7,381

7,501

7,569

BAJAJFINSV

1,657

1,691

1,711

1,745

1,764

BPCL

284

290

295

301

306

BHARTIARTL 773 783

788

799

804

BRITANNIA

3,725

3,758

3,780 3,813

3,835

CIPLA 1,107 1,122

1,132 1,147

1,157

COALINDIA

230

236

239

244

248

DIVISLAB 3,533 3,592

3,624 3,683

3,715

DRREDDY 4,253 4,301

4,328 4,376

4,403

EICHERMOT 3,524 3,587

3,624 3,687 3,724

GRASIM

1,657

1,673

1,684

1,700

1,711

HCLTECH 977 997

1,008

1,028

1,040

HDFCBANK

1,438

1,443

1,448

1,454

1,458

HDFCLIFE

523

530

534

541

545

HDFC

2,336

2,353

2,364 2,380

2,392

HEROMOTOCO

2,479

2,522

2,546 2,589

2,613

HINDALCO

374

385

391

401

407

HINDUNILVR

2,551

2,576

2,593

2,618

2,635

ICICIBANK

874

881

887

895

901

INDUSINDBK 1,111 1,135

1,175 1,199

1,239

INFY

1,463

1,482

1,493

1,512

1,523

ITC

342

346

348

352

355

JSW STEEL

609

619

624

634

639

KOTAKBANK

1,840

1,852

1,867

1,879

1,895

LT 1,871 1,888

1,903

1,919

1,934

M&M 1,212 1,231

1,243

1,261

1,273

MARUTI 8,558 8,633

8,686 8,761

8,814

NESTLEIND

19,525

19,793

19,968

20,237

20,412

NTPC

159

163

165

169

172

ONGC 124 127

129

132

134

POWERGRID 210 214

216

220

222

RELIANCE 2,468 2,484

2,502 2,518

2,536

SBILIFE

1,206

1,215

1,222

1,231

1,238

SBIN 541 548

553

560

564

SUNPHARMA

960

970

977

987

993

TCS 3,086 3,122

3,141

3,177

3,196

TATACONSUM

750

760

766

777

783

TATAMOTORS

390

394

397

401

404

TATASTEEL 98 99

100 102 103

TECHM

994

1,018

1,031

1,054

1,067

TITAN 2,556 2,594

2,619

2,657

2,682

ULTRACEMCO

6,195

6,249

6,331

6,385

6,467

UPL

650

682

699

731

748

WIPRO 373 377

380

384

387

www.angelone.in

Technical & Derivatives Report

OCT 21, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.