SEPT 21, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

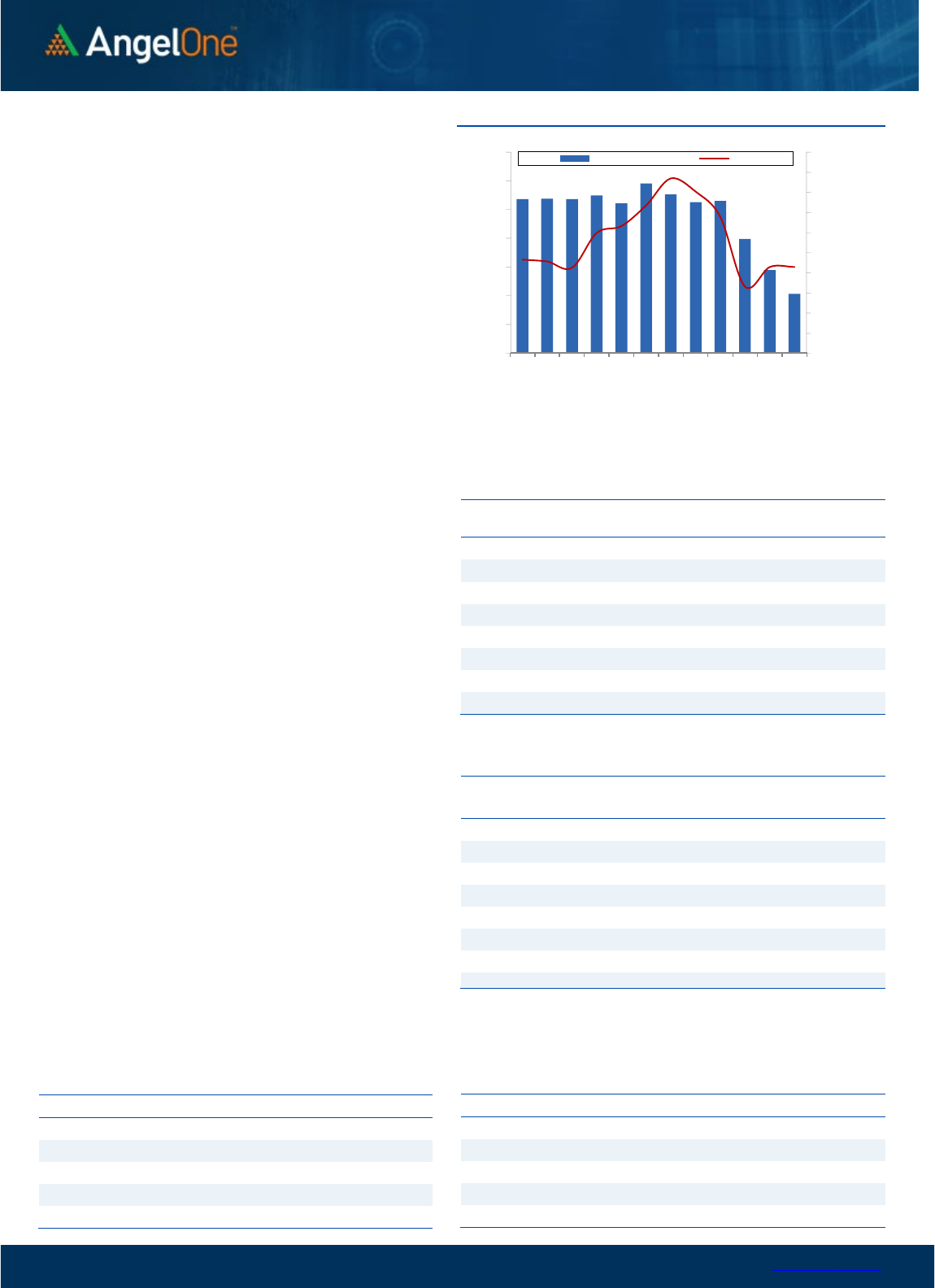

Nifty Bank Outlook (41468)

Bank Nifty as well started with a gap-up opening and as the day

progressed the momentum accelerated beyond the 41600 levels.

As the prices approached the all-time high levels there was some

tentativeness which erased some gains to eventually end with

gains of 1.38% at 41468.

The bulls are back in momentum as the bank index ended at the

highest close ever. Going ahead, the strategy remains of buying on

dips and focusing on stock-specific action. However, in such a

scenario, one should avoid being complacent as we are still not

completely out of woods and the Shooting Star bearish pattern

seen on the weekly chart last week is still active and will get

neglected only once the bank index closes above the 41850 levels.

Also, one should not forget that we are lined up for the key global

event and hence one should avoid aggressive overnight bets and

need to be very selective. As far as levels are concerned, immediate

support is seen at 41100 - 40900 whereas resistance is seen at

41840 - 42000 levels.

Key Levels

Support 1 – 41100 Resistance 1 – 41840

Support 2 – 40900 Resistance 2 – 42000

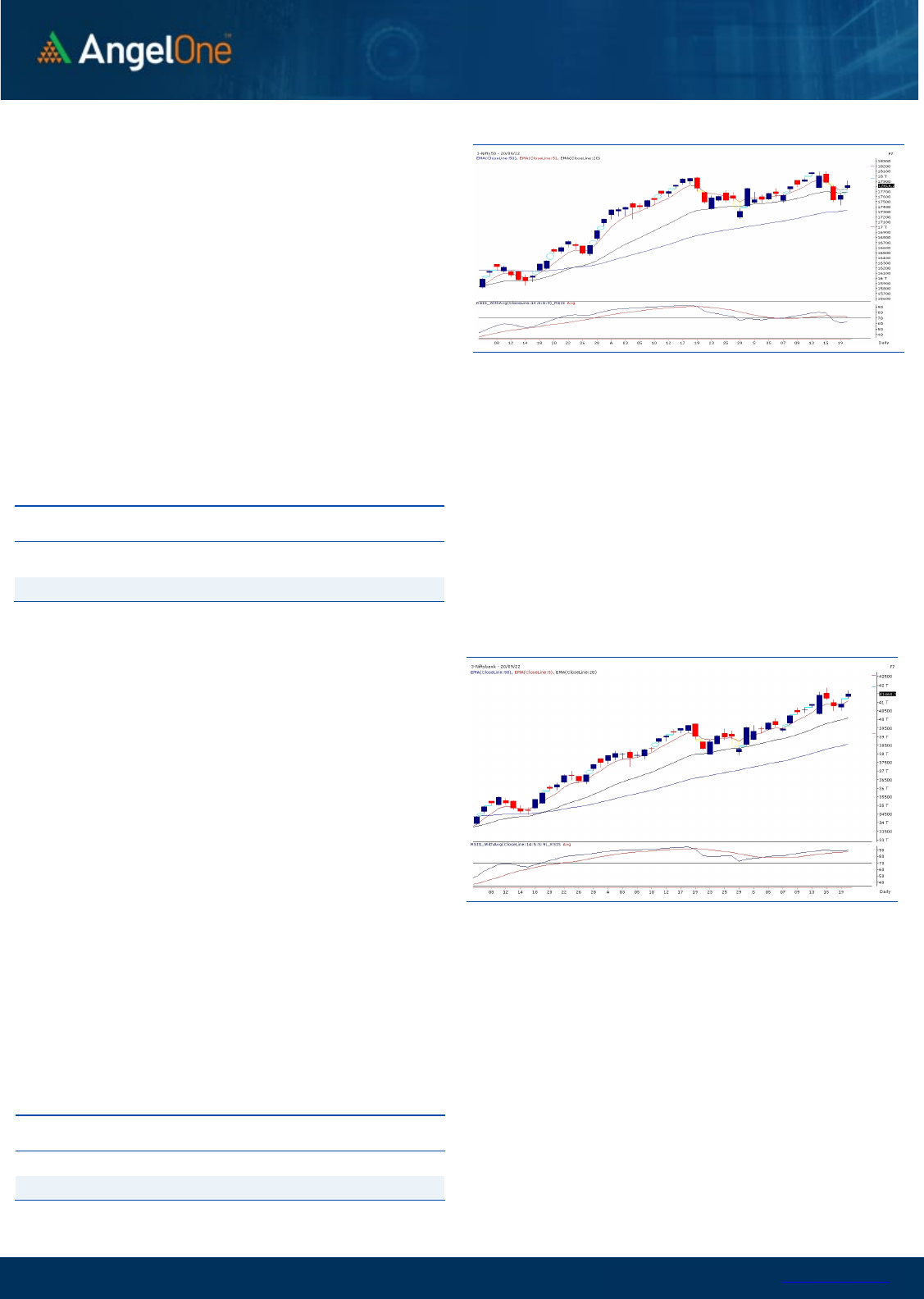

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Weekly

Chart

Sensex (59720) / Nifty (17816)

The favorable global markets have embarked optimism to our

equities as we witnessed a decent gap up opening, followed by

across-board buying interest. The benchmark index gradually

inched upwards until a correction triggered in the fag end and pared

down some of the initial gains of the market. At last, post the action-

packed session, the Nifty concluded the day a tad above the 17800

level with a gain of 1.10 percent.

On the technical aspect, a consecutive day of gain certainly

showcased inherent strength, but the tentativeness at the higher

levels portrays the nervousness ahead of the Fed meeting. At the

current juncture, the 17950-18000 zone is likely to be seen as the

sturdy hurdle for the index. While on the downside, the immediate

support is placed around the 17660-17740 odd zone, followed by

the sacrosanct support of the 17500 mark.

Key Levels

Support 1 – 17740 Resistance 1 – 17950

Support 2 – 17660 Resistance 2 – 18000

Hence, looking at index placements and the recent price action

that construes the undertone to favor the bulls, participants are

advised to avoid aggressive bets and stay abreast with global and

domestic developments. Also, we advocate continuing with a

stock-centric approach for better trading opportunities.

www.angelone.in

Technical & Derivatives Report

SEPT 21, 2022

View

We once again had a cheerful start for the day and then

follow-up buying was observed to reclaim 17900 with

an ease. However, due to some profit booking in final

hour of trade we trim some gains and hence we finally

concluded the session with the gains of over a percent.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1196 crores. Simultaneously, in Index

futures, they bought worth Rs. 1844 crores with fall in

open interest, indicating covering of bearish bets.

In F&O space, we observed decent short covering in

Nifty, whereas some fresh long addition was observed

in case of banking index. Stronger hands bought

equities and covered shorts in index futures segment,

which is a positive development. Now, their index

futures Long Short Ratio has improved from 32% to

39%. Interestingly, we saw decent unwinding in ATM

and OTM call strikes along with writing in 17600-17800

put strikes. Considering the above development in

above data, we expect 17600-17700 to act as a strong

base now and on the higher side traders can expect

continuation of ongoing move towards 18000-18100.

Comments

The Nifty futures open interest has decreased by

3.18%. and Bank Nifty futures open interest has

increased by 1.44% as the market closed at 17816.25.

The Nifty Sep future closed with a premium of 5.75

point against a premium of 35.30 point in the last

trading session. The Oct series closed at a premium

of 60.85 point.

The INDIA VIX decreased from 19.94 to 18.79. At the

same time, the PCR-OI of Nifty has increased from

0.94 to 1.15.

Few of the liquid counters where we have seen high

cost of carry are IDEA, IBULHSGFIN, GMRINFRA, CUB

and ABB.

Historical Volatility

SCRIP HV

IDEA 81.26

IBULHSGFIN 72.97

RBLBANK 72.53

ZEEL 63.90

HINDCOPPER 62.70

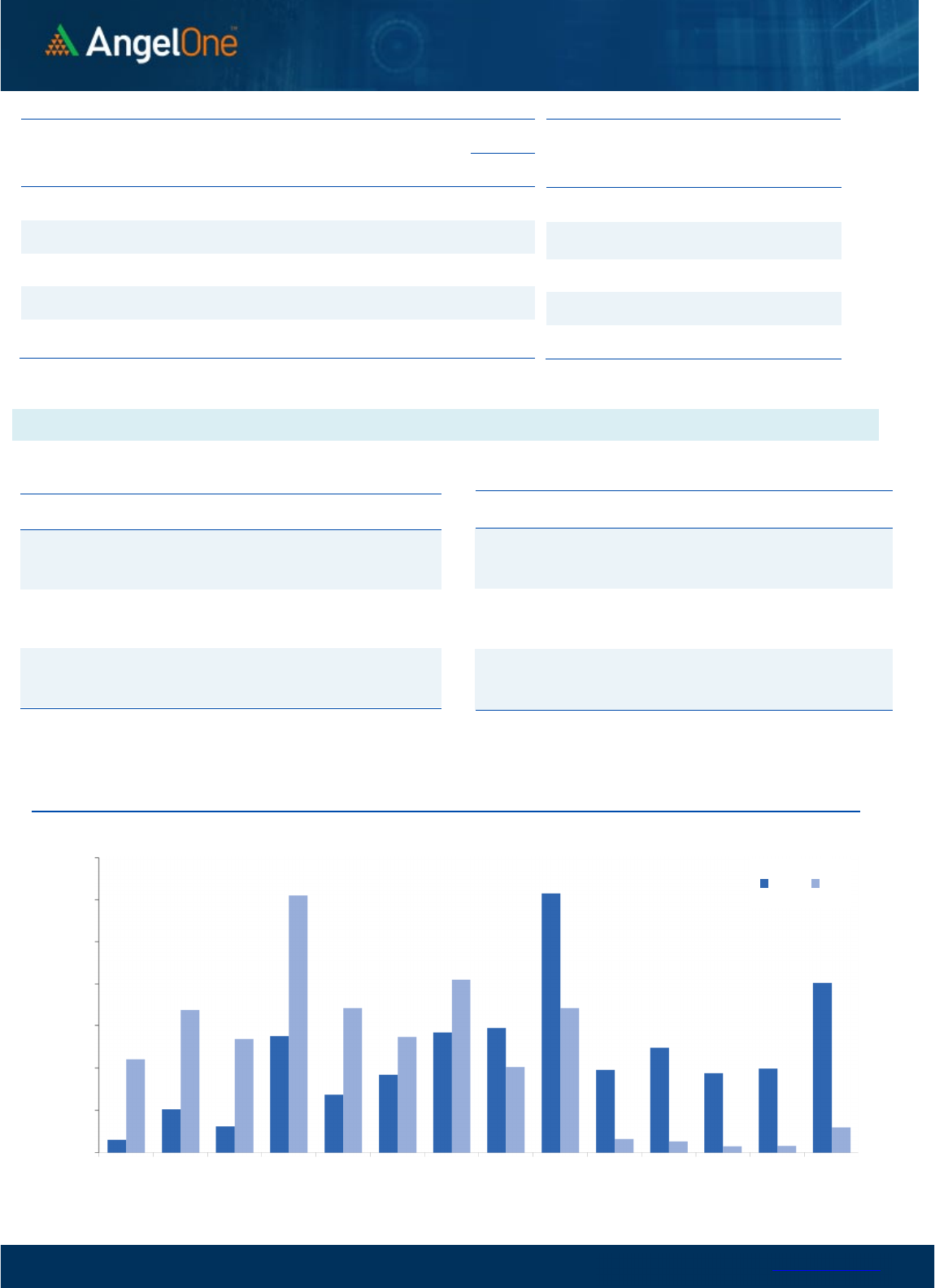

Nifty Vs OI

17200

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

11,500

12,000

12,500

13,000

13,500

14,000

14,500

15,000

9/5 9/7 9/9 9/13 9/15 9/19

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CANFINHOME 5966025 80.61 565.35 -3.93

CIPLA 8585850 14.61 1092.30 4.83

GUJGASLTD 6558750 13.01 503.15 0.24

RAIN 13394500 12.13 181.20 4.47

JKCEMENT 452250 10.91 2909.45 3.18

HONAUT 15885 9.06 40709.90 0.51

LAURUSLABS 6722100 7.95 527.65 3.92

ALKEM 483200 7.09 3319.70 2.25

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ESCORTS 1864500 -15.90 2095.20 -0.25

HEROMOTOCO 2686500 -8.91 2771.55 2.77

INDIACEM 14421700 -8.42 283.45 -2.11

MCX 3313200 -6.21 1284.25 5.02

IRCTC 13767250 -6.10 706.15 2.80

APOLLOTYRE 14210000 -5.78 288.20 -0.33

IPCALAB 1600300 -5.53 871.45 1.72

HINDALCO 29055100 -5.23 421.45 2.32

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.15 0.90

BANKNIFTY 1.07 0.85

RELIANCE 0.47 0.43

ICICIBANK 0.71 0.61

INFY 0.37 0.39

www.angelone.in

Technical & Derivatives Report

SEPT 21, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

,

816.25

FII Statistics for

September

20

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4363.69 2519.66 1844.03

110753 10480.40 (11.70)

INDEX

OPTIONS

667020.18 665509.36 1510.82

1389019 129350.32 (0.28)

STOCK

FUTURES

12214.51 11026.91 1187.60

2160691 152803.01 (0.76)

STOCK

OPTIONS

11143.99 11085.63 58.36

205805 14980.08 (0.66)

Total 694742.37

690141.56

4600.81

3866268

307613.81

(0.93)

Turnover on

September

20

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

366661 34884.43 3.68

Index

Options

115757401

10674730.65

19.64

Stock

Futures

922128 68253.77 0.37

Stock

Options

4376995 339325.67 6.02

Total

4,376,995

339325.67 18.98

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17800 221.65

51.10

48.90

17851.10

Sell

17900 170.55

Buy

17800 221.65

95.40

104.60

17895.40

Sell

18000 126.25

Buy

17900 170.55

44.30 55.70 17944.30

Sell 18000 126.25

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17800 197.50

42.75

57.25

17757.25

Sell

17700 154.75

Buy 17800 197.50

75.40

124.60

17724.60

Sell 17600 122.10

Buy

17700 154.75

32.65 67.35 17667.35

Sell 17600 122.10

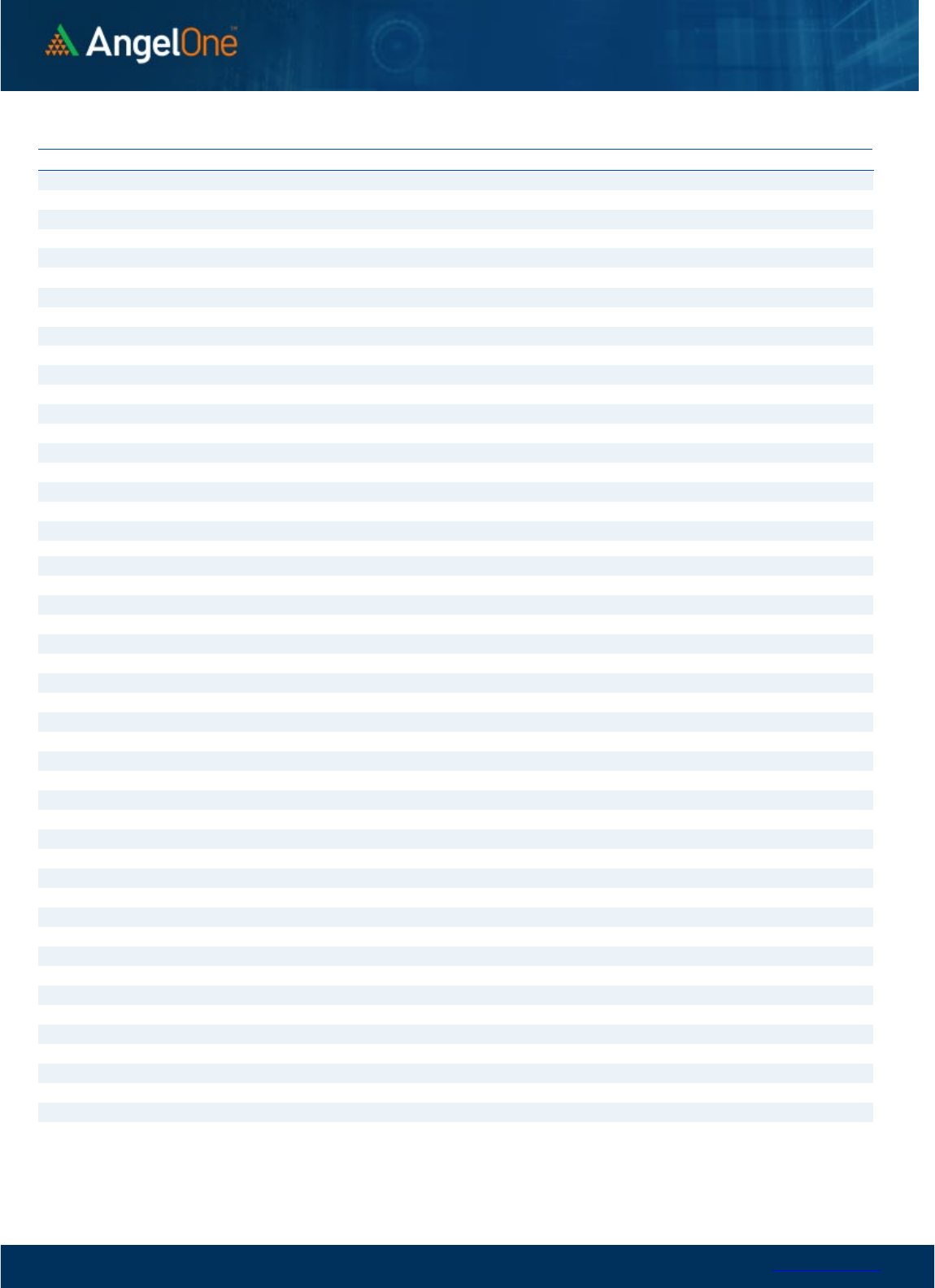

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

SEPT 21, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

954

962

975

983

996

APOLLOHOSP

4,212

4,386

4,490

4,664

4,769

ASIANPAINT 3,303 3,348

3,379

3,424

3,455

AXISBANK 796 804

810 819

825

BAJAJ-AUTO 3,684 3,726

3,767

3,809

3,850

BAJFINANCE 7,488 7,562

7,638 7,712 7,788

BAJAJFINSV

1,765

1,782

1,798

1,815

1,830

BPCL

319

321

324

326

329

BHARTIARTL 779 786

791

798

803

BRITANNIA

3,576

3,613

3,639

3,676

3,702

CIPLA 1,018 1,055

1,076

1,113

1,135

COALINDIA 226 228

231

233

236

DIVISLAB

3,596

3,614

3,633

3,651

3,670

DRREDDY 4,055 4,135

4,187

4,267

4,319

EICHERMOT

3,572

3,642

3,690

3,760

3,808

GRASIM 1,710 1,726

1,747

1,763

1,784

HCLTECH

893

904

912

923

931

HDFCBANK

1,504

1,512

1,518

1,527

1,532

HDFCLIFE

540

550

557

567

575

HDFC 2,435 2,461

2,477

2,503

2,519

HEROMOTOCO

2,661

2,716

2,770

2,825 2,878

HINDALCO 410 416

422

427

433

HINDUNILVR 2,553 2,568

2,595 2,610

2,637

ICICIBANK

900

909

916

924

931

INDUSINDBK

1,224

1,244

1,260

1,280

1,296

INFY

1,367

1,378

1,396

1,406

1,424

ITC

332

334

337

339 341

JSW STEEL

674

681

690

697

706

KOTAKBANK 1,916 1,928

1,945

1,957

1,974

LT

1,907

1,920

1,938

1,951

1,969

M&M

1,288

1,296

1,304

1,311

1,319

MARUTI

9,147

9,224

9,327

9,404 9,507

NESTLEIND

18,359

18,488

18,704

18,833

19,049

NTPC

170

171

172

173

174

ONGC 130 132

133

134 135

POWERGRID

230

231

234

235

238

RELIANCE 2,469 2,486

2,512

2,529

2,555

SBILIFE

1,297

1,303

1,313 1,319

1,329

SHREECEM

22,351

22,797

23,260 23,706

24,169

SBIN

570

572

575

577

580

SUNPHARMA

863

888

901

926

939

TCS 3,000 3,020

3,050 3,070

3,100

TATACONSUM

787

796

804

813 821

TATAMOTORS

423

429

436

442

449

TATASTEEL 103 104

105

107

108

TECHM

1,042

1,049

1,057

1,065

1,073

TITAN

2,612

2,648

2,671

2,707

2,729

ULTRACEMCO

6,397

6,441

6,502 6,546

6,607

UPL

710

715

719

724

729

WIPRO 401 403

406

408

411

www.angelone.in

Technical & Derivatives Report

SEPT 21, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.