OCT 20, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

Nifty Bank Outlook (40373)

Once again, the start for the day was on a positive note however

there was no follow up buying post opening. In the second half

there was some profit booking and then after trading in a range the

bank index eventually ended with marginal gains of 0.14% at

40373.

Even though the bulls continued with their winning streak, the

intraday moves for the last two sessions have been lethargic. On

the weekly expiry as well, we may see some further consolidation

in key indices and the real action can continue in stock specific

trades. With couple of key results lined up within the banking

space, traders should focus on the outperforming counters. The

bias remains positive and incase of any dips it should be taken as a

buying opportunity. As far as levels are concerned, immediate

support is seen around 40100 - 39900 levels whereas resistance is

seen at 40730 - 40890 levels.

Key Levels

Support 1 – 40100 Resistance 1 – 40730

Support 2 – 39900 Resistance 2 – 40890

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (59107) / Nifty (17512)

For the second consecutive session, our markets witnessed a

healthy gap-up opening, courtesy to an extended rebound in US

bourses. In the initial hour, Nifty hastened towards 17600; but

traders chose to take some money off the table there, and hence,

we witnessed a gradual decline for the major part of the session.

Due to last hour extended selling, Nifty ended the session tad above

17500 by restricting the gains to not even two-tenths of a percent.

In the last 3-4 trading sessions, we have seen an excellent rally in

our markets and hence, after reaching the important junction of

17600, some profit booking was evident. But by this, does the trend

completely reverse? In our sense, No; because the tide seems to

have turned upwards once again, and in between such small

declines are a part of the broader healthy structure. Traders are

advised not to trade against the trend and should rather wait for the

index to revisit key supports to add on to bullish bets. As far as

support is concerned, it is clearly visible in the zone of 17400-17350.

On the flip side, soon we will see Nifty surpassing 17600 to test

17800 and beyond levels. The undertone is strongly bullish and

hence, traders are advised to keep focusing on thematic plays.

Key Levels

Support 1 – 17400 Resistance 1 – 17580

Support 2 – 17300 Resistance 2 – 17650

www.angelone.in

Technical & Derivatives Report

OCT 20, 2022

View

We had a positive start for the day which was then

followed by a range bound session for the index.

Nifty eventually ended tad below 17500.

FIIs were net sellers in the cash market segment to the

tune of Rs. 454 crores. Simultaneously, in Index

futures, they sold worth Rs. 141 crores with a rise in

open interest; indicating formation of mixed bets in

yesterday’s session.

In derivatives front, we hardly observed any relevant

open interest change in both the key indices. FIIs

added mixed bets in index futures and continued selling

equities. However, their Long short ratio has improved

this week to 30% from 23% seen last Friday. As the

Index witnessed some tentativeness around 17600

zone, we observed call writers adding meaningful bets

in 17600-17800 strikes. Suggesting, traders are

expecting 17600 zone to act as hurdle on the weekly

expiry session. For now, 17350 - 17400 remains an

immediate support zone and as long we manage to

sustain above the same there is no sign of worrisome.

Hence, traders can use such dips to add fresh longs in

system.

Comments

The Nifty futures open interest has increased by

0.41%. and Bank Nifty futures open interest has

increased by 0.25% as the market closed at

17512.25.

The Nifty October future closed with a discount of

17.60 point against a premium of 15.05 point in the

last trading session. The November series closed at

a premium of 20.40 point.

The INDIA VIX increased from 17.45 to 17.48. At the

same time, the PCR-OI of Nifty has decreased from

1.19 to 1.13.

Few of the liquid counters where we have seen high

cost of carry are IDEA, WHIRLPOOL, ALKEM, FSL

AND RECLTD

Historical Volatility

SCRIP HV

SYNGENE 37.09

CONCOR 42.89

LTTS 49.19

ASTRAL 45.61

AARTIIND 43.30

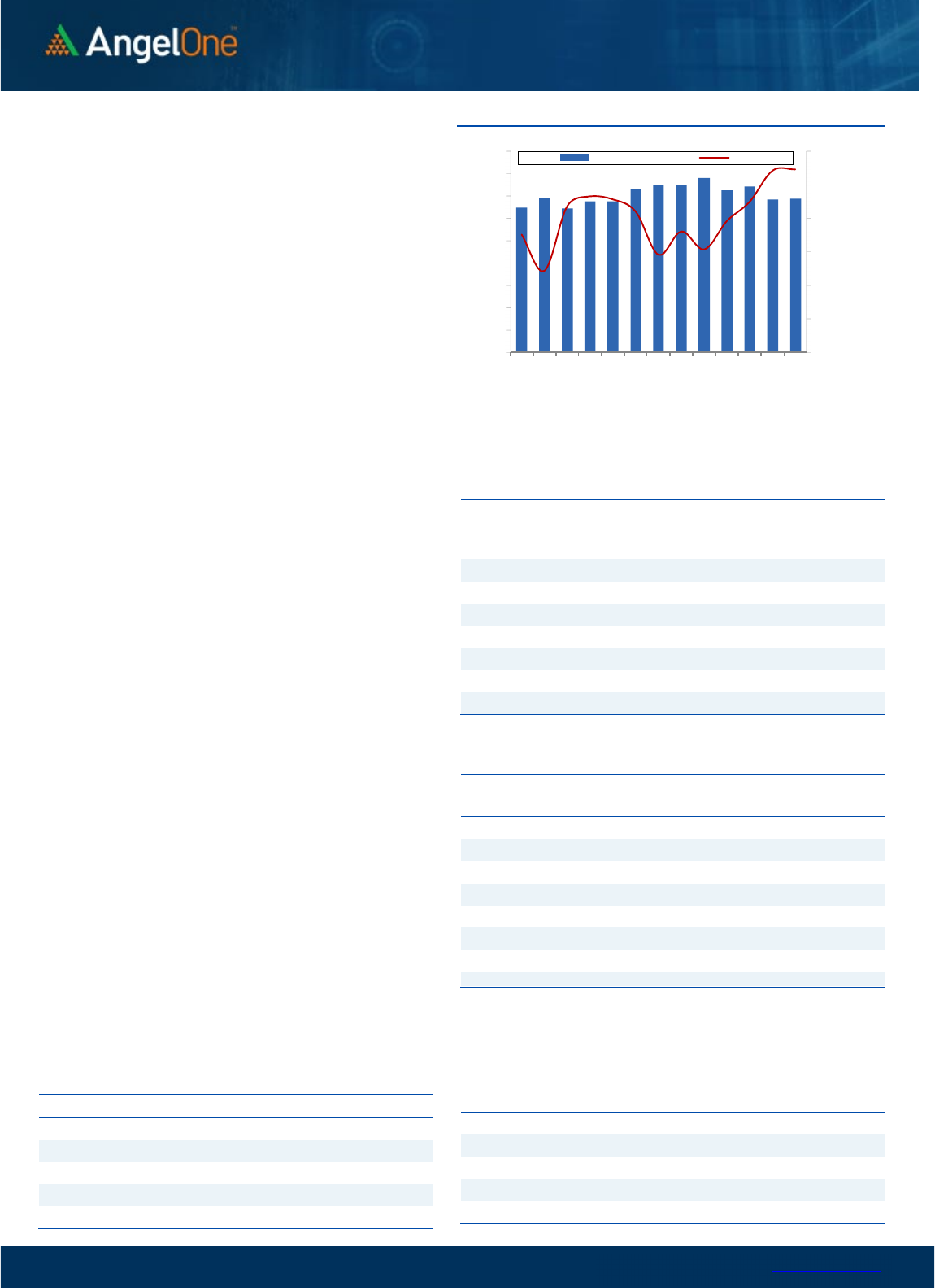

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

9/30 10/4 10/7 10/11 10/13 10/17 10/19

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AARTIIND 1851300 113.32 683.30 5.00

LTTS 1625600 63.11 3495.00 -6.50

TORNTPOWER 4959000 27.45 481.40 -0.42

ULTRACEMCO 2376000 17.79 6398.40 0.73

TVSMOTOR 7802200 15.53 1171.45 3.60

CONCOR 7400000 14.02 771.25 6.87

POLYCAB 1268700 12.92 2706.55 -2.10

ITC 85561600 10.71 346.35 1.76

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BHEL 148281000 -8.41 67.55 -1.32

SIEMENS 1527350 -7.01 2885.75 2.07

ESCORTS 1132450 -6.49 1991.60 0.42

BAJAJ-AUTO 2324000 -5.82 3655.80 0.94

GNFC 5846100 -5.80 722.15 1.40

PVR 3273094 -5.79 1781.15 2.99

FEDERALBNK 96960000 -5.59 131.30 -0.87

HDFC 18551100 -5.50 2381.80 1.85

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.13 1.07

BANKNIFTY 1.06 1.03

RELIANCE 0.57 0.37

ICICIBANK 0.54 0.46

INFY 0.47 0.53

www.angelone.in

Technical & Derivatives Report

OCT 20, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Oct Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

512.25

FII Statistics for

October

1

9

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3799.93 3941.30 (141.37) 154150 14020.50 3.71

INDEX

OPTIONS

994668.72 990324.69 4344.03

2026759 185717.57 14.51

STOCK

FUTURES

19379.39 19224.44 154.95

2177023 148737.98 1.36

STOCK

OPTIONS

10592.75 10507.72 85.03

157951 11324.00 5.08

Total

1028440.79

1023998.15

4442.64

4515883

359800.05

7.09

Turnover on

October

1

7

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

409340 37995.42 -18.15

Index Options

110242718 10213416.30

30.53

Stock Futures

833565 58322.29 -3.55

Stock Options

3118245 228087.99 -5.70

Total

31,18,245 228087.99 28.93

*Turnover data as per 17

th

Oct Closing

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17500 156.30

47.40

52.60

17547.40

Sell

17600 108.90

Buy

17500 156.30

85.95

114.05

17585.95

Sell

17700 70.35

Buy

17600 108.90

38.55 61.45 17638.55

Sell

17700 70.35

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

17500 162.95

41.10

58.90

17458.90

Sell 17400 121.85

Buy 17500 162.95

74.95

125.05

17425.05

Sell

17300 88.00

Buy

17400 121.85

33.85 66.15 17366.15

Sell

17300 88.00

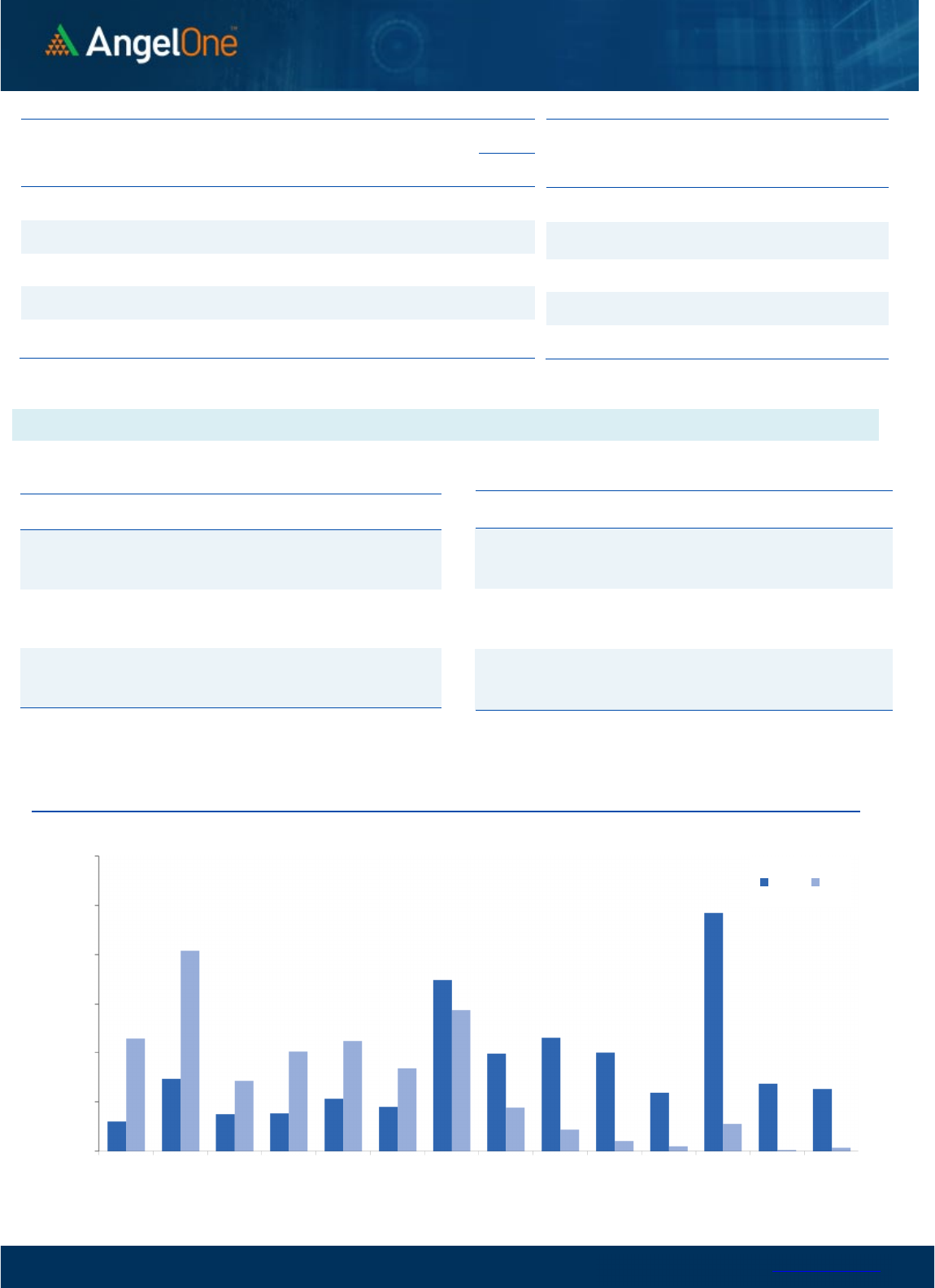

Nifty Put

-

Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200

Call Put

www.angelone.in

Technical & Derivatives Report

OCT 20, 2022

`

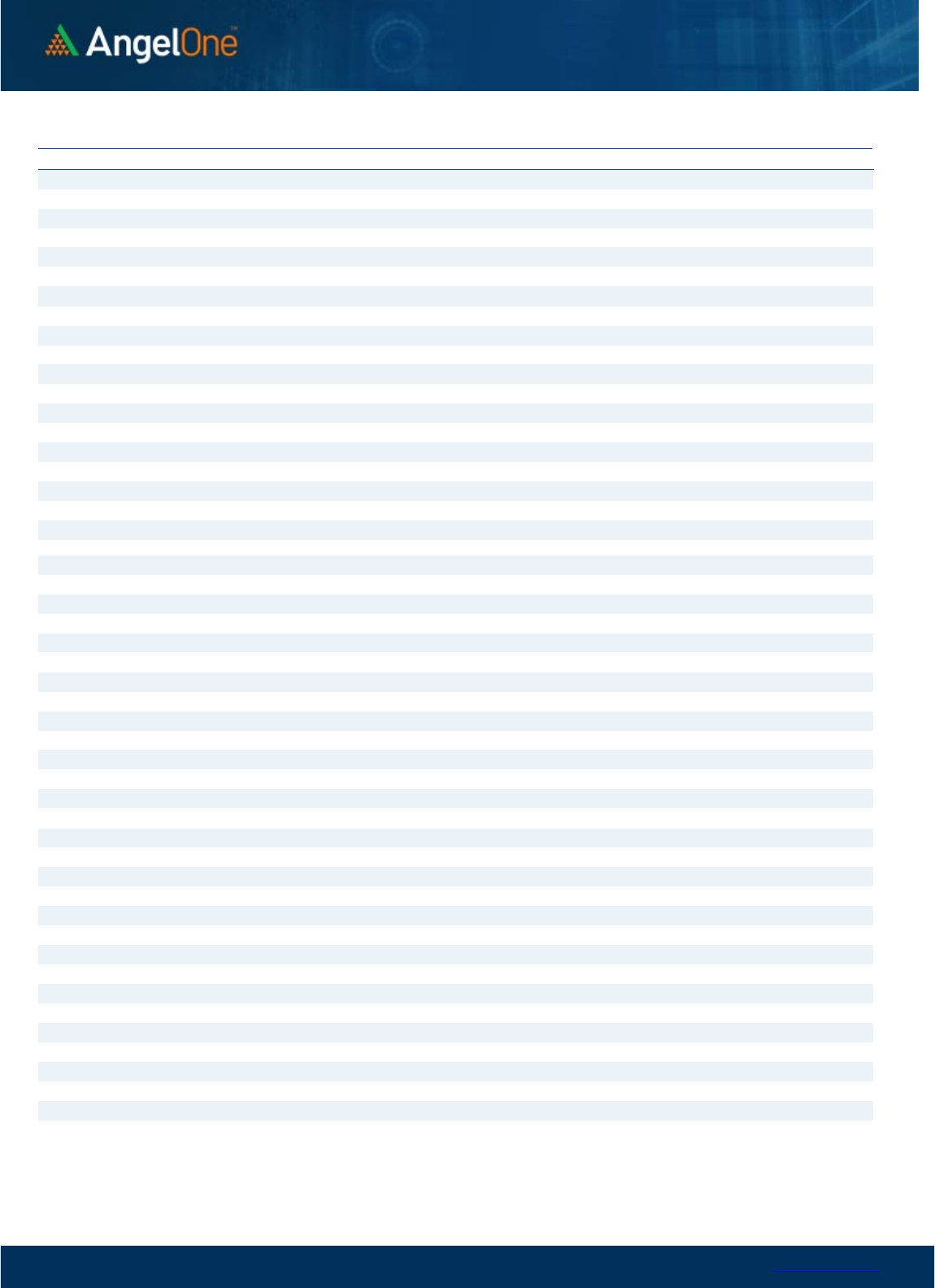

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT 3,232 3,255

3,282

3,305

3,333

ADANIPORTS

788

796

810

819

832

APOLLOHOSP 4,314 4,351

4,379

4,416

4,443

ASIANPAINT 3,169 3,191

3,218

3,240

3,268

AXISBANK

807

818

828

840

850

BAJAJ-AUTO 3,572 3,614

3,666

3,707

3,759

BAJFINANCE 7,300 7,340

7,390

7,430

7,480

BAJAJFINSV 1,669 1,684

1,707

1,722

1,746

BPCL

287

290

294

297

301

BHARTIARTL

775

779

784

788

793

BRITANNIA 3,719 3,744

3,767

3,791

3,814

CIPLA 1,103 1,112

1,129

1,138

1,155

COALINDIA

233

236

239

242

245

DIVISLAB 3,544 3,576

3,594

3,626

3,644

DRREDDY 4,250 4,283

4,339

4,372

4,428

EICHERMOT 3,548 3,580

3,632

3,665

3,717

GRASIM 1,656 1,670

1,692

1,706

1,727

HCLTECH

986

991

999

1,003

1,011

HDFCBANK 1,439 1,449

1,463

1,473

1,487

HDFCLIFE

526

529

532

535

538

HDFC 2,341 2,362

2,389

2,409

2,436

HEROMOTOCO 2,507 2,524

2,549

2,566

2,591

HINDALCO

384

387

393

396

401

HINDUNILVR 2,554 2,568

2,593

2,608

2,632

ICICIBANK

878

885

893

900

908

INDUSINDBK 1,198 1,208

1,220

1,230

1,242

INFY 1,467 1,476

1,491

1,500

1,514

ITC

337

342

345

349

352

JSW STEEL

615

621

630

636

645

KOTAKBANK 1,845 1,857

1,867

1,880

1,890

LT 1,873 1,889

1,918

1,934

1,963

M&M 1,232 1,240

1,252

1,261

1,273

MARUTI 8,596 8,658

8,756

8,818

8,916

NESTLEIND

19,020

19,380

19,614

19,973

20,207

NTPC

161

163

165

167

170

ONGC

127

127

128

129

129

POWERGRID

211

212

215

216

219

RELIANCE 2,402 2,448

2,488

2,534

2,574

SBILIFE 1,204 1,216

1,225

1,236

1,245

SBIN

544

549

556

561

568

SUNPHARMA

959

968

974

983

990

TCS 3,084 3,103

3,131

3,150

3,178

TATACONSUM

752

758

768

774

783

TATAMOTORS

391

395

401

405

411

TATASTEEL 99 99

100

101

102

TECHM 1,008 1,014

1,022

1,027

1,036

TITAN 2,617 2,631

2,654

2,668

2,691

ULTRACEMCO 6,169 6,284

6,365

6,480

6,561

UPL

667

672

681

685

694

WIPRO

375

376

379

380

383

www.angelone.in

Technical & Derivatives Report

OCT 20, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited

is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the

report or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market

making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is

for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has

not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel One

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in

the subject company. Research analyst has not served as an officer, director or employee of the subject company.