May 20, 2022

www.angelone.in

Technical & Derivatives Report

Nifty Bank Outlook

-

(33316

)

Bank Nifty as well started with a massive gap down opening and

with no significant intraday bounce continued to creep lower

throughout the session to eventually end with a loss of around

2.50% at 33316.

Looking at the decent bounce of the initial part of the week and

placement of RSI smoothed on the daily chart we were of a view

that the current bounce may extend in the near term however

the mayhem seen across the global financial markets spilled

water on this expectation. With yesterday's sell-off prices are

back to key support levels around the 33000 levels and the

oscillators are still in the oversold zone. It would be crucial to

see how markets react around this make or break level; if they

slip below it then further weakness can be seen towards the

March swing low of 32000 - 32200 levels. On the flip side, it

would be a daunting task for the bulls to reclaim yesterday's lost

ground and the bearish gap zone between 33600 - 34200 is

likely to act as resistance. Volatility is likely to remain high and

traders are advised to avoid undue risk.

Key Levels

Support 1 – 33000 Resistance 1 – 33600

Support 2 – 32200 Resistance 2 – 34000

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (52792) / Nifty (15809

)

Yesterday’s opening was painful as Nifty opened lower with

nearly 300 points due to massive overnight sell off in US bourses.

This has certainly caught lot of momentum traders on the wrong

foot who had carried over their longs after Tuesday’s sharp

rebound. Barring negligible bounce in the initial trades, the index

kept decelerating downwards to test the 15800 mark. But

fortunately, there was no major damage seen during the day as

compared to the global screen. Eventually, the tragic weekly

expiry day ended with over two and half a percent cut to the

previous close.

Honestly speaking, yesterday’s gap down opening was

completely out of syllabus thing for most of the market

participants, including us. In fact, all the pre-market strategies

went for a toss as Nifty opened convincingly below the strong

psychological support of 16000. Now we are once again very

much closer to the crucial support zone of 15740 – 15650.

Whether we are going to break this and fall below it or not, the

time will tell and importantly, it depends on how things pan out

globally over the next couple of sessions. Similar to last Friday,

we are still hopeful on holding on to this support. But if this has

to happen, we need to have some solid trigger on the global front,

which will help our market defend this zone.

At this juncture, it’s better to take one step at a time. As far as

levels are concerned, 16000 – 16100 once again becomes a

sturdy wall and till the time, it does not get surpassed, we are

likely to see selling pressure at higher levels.

Key Levels

Support 1 – 15740 Resistance 1 – 16000

Support 2 – 15650 Resistance 2 – 16100

www.angelone.in

Technical & Derivatives Report

May 20, 2022

View

Our market plummeted, tracking the massive

overnight sell-off in the US bourses. The benchmark

index NIFTY shed over 2.65 percent on the expiry day

to close a tad above the 15800 level.

FIIs were net sellers in the cash market segment

to the tune of Rs. 4900 crores. Simultaneously, in

Index futures, they sold worth Rs. 921 crores with

an increase in open interest, indicating short

formation.

Looking at the F&O data, fresh shorts have been

added to both indices. On the options front, the

15800 put strike has seen some addition in the OI,

followed by the 15600-15500 PE, where significant

OI concentration has piled up. On the contrary, a

considerable OI concentration is built on the 16000-

16100 call strikes, suggesting it to be the sturdy

hurdle for Nifty. Considering the recent

developments, some tentativeness could be sensed

among market participants amid the uncertainties

in the global market. Hence, traders are advised to

keep a close tab on global developments and avoid

any aggressive bets for the time being.

Comments

The Nifty futures open interest has increased by 7.99%.

and BANK Nifty futures open interest has increased by

0.02% as the market closed at 15809.40.

The Nifty May future closed with a discount of 39.95

point against a discount of 14.25 point in the last trading

session. The June series closed at a discount of 32.55

point.

The INDIA VIX increased from 22.29 to 24.55. At the

same time, the PCR-OI of Nifty decreased from 0.87 to

0.71.

Few of the liquid counters where we have seen high

cost of carry are MANAPPURAM, TCS, LUPIN, WIPRO

and HCLTECH.

Historical Volatility

SCRIP HV

IDEA 94.76

IBULHSGFIN 78.66

ZEEL 72.08

HINDCOPPER 67.81

RBLBANK 66.83

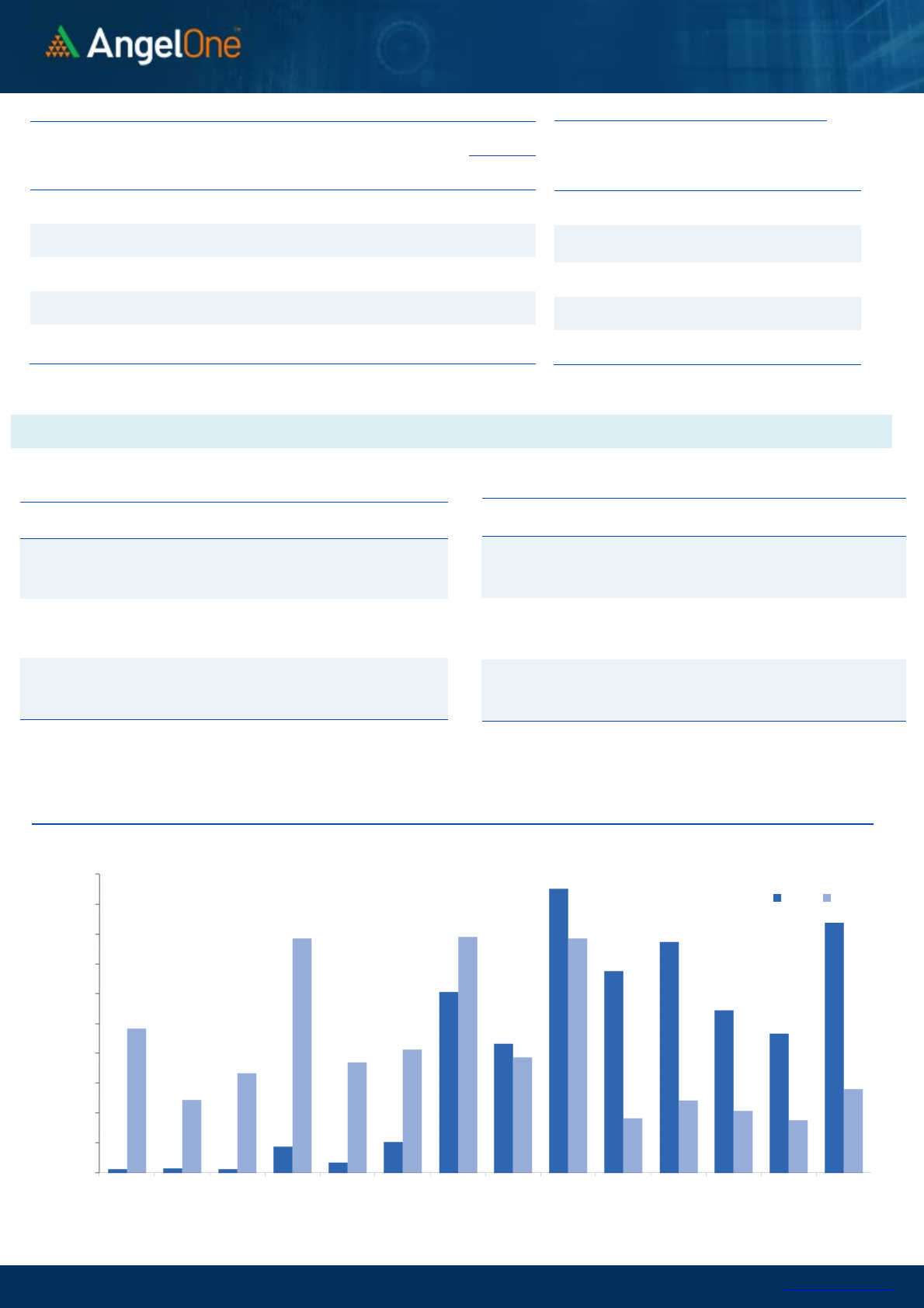

Nifty Vs OI

15000

15500

16000

16500

17000

17500

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

4-29 5-4 5-6 5-10 5-12 5-16 5-18

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ADANIPORTS 94705000 17.45 732.80 -3.49

CUB 12660200 11.60 124.90 0.16

ASTRAL 732600 9.99 1665.65 -4.97

HDFCAMC 4926200 9.32 1706.75 -3.86

HINDPETRO 15930000 8.34 239.00 -1.82

BRITANNIA 1691800 7.39 3332.10 -1.95

JUBLFOOD 11907500 7.30 481.70 -1.75

TCS 12321900 7.22 3264.05 -5.56

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ITC 107872000 -15.73 275.65 3.04

COROMANDEL 1508500 -8.05 908.60 -2.54

DELTACORP 17820400 -6.94 228.40 -0.11

PERSISTENT 434550 -6.06 3616.40 -6.44

BALRAMCHIN 7443200 -4.98 407.05 -5.02

INTELLECT 1179000 -4.50 625.80 -3.30

LICHSGFIN 23712000 -4.22 354.45 -1.21

DEEPAKNTR 1256250 -3.66 1981.85 -2.86

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.71 0.87

BANKNIFTY 0.82 0.99

RELIANCE 0.30 0.52

ICICIBANK 0.47 0.75

INFY 0.37 0.65

www.angelone.in

Technical & Derivatives Report

May 20, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Spot = 1

5809

.

4

0

FII Statistics for

May

1

9

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4838.54 5759.31 (920.77) 183823 14723.13 11.05

INDEX

OPTIONS

1056857.01 1039952.96 16904.05

1528187 121736.38 (21.31)

STOCK

FUTURES

19544.89 19501.12 43.77

2417214 145668.64 3.37

STOCK

OPTIONS

9274.52 9296.75 (22.23) 160967 10064.66 1.80

Total

1090514.96

1074510.14

16004.82

4290191

292192.81

(6.82)

Turnover on

May

1

9

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

485014 39173.37 1.65

Index

Options

208656124 17132694.46 56.34

Stock

Futures

1137875 69058.73 8.94

Stock

Options

3745452 239986.56

-4.42

Total

37,45,452 239986.56

54.54

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

15800 192.00

48.25 51.75 15848.25

Sell

15900 143.75

Buy

15800 192.00

88.30 111.70 15888.30

Sell

16000 103.70

Buy

15900 143.75

40.05 59.95 15940.05

Sell 16000 103.70

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

15800 224.65

43.00 57.00 15757.00

Sell

15700 181.65

Buy

15800 224.65

80.55 119.45 15719.45

Sell

15600 144.10

Buy

15700 181.65

37.55 62.45 15662.45

Sell

15600 144.10

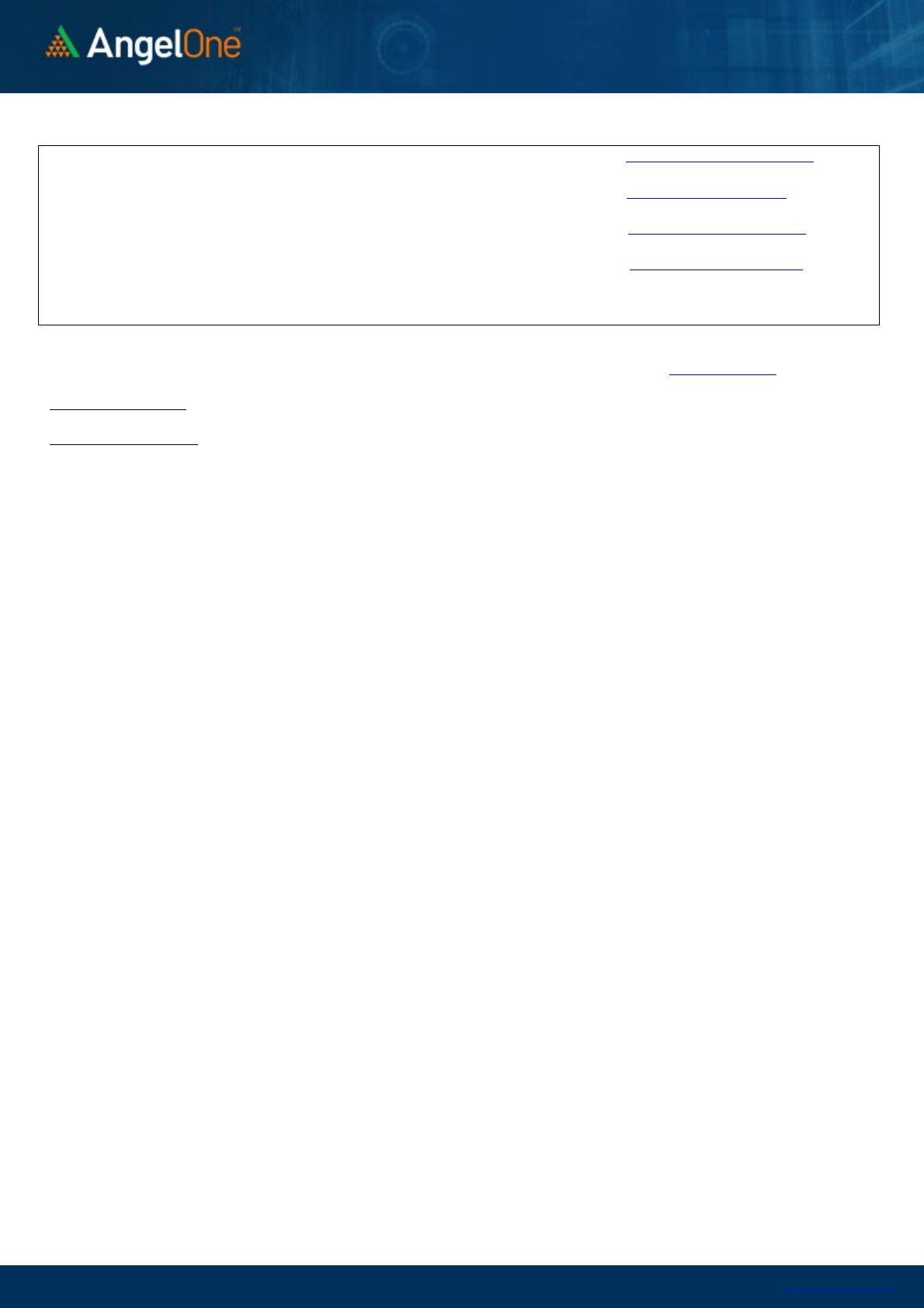

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

15200 15300 15400 15500 15600 15700 15800 15900 16000 16100 16200 16300 16400 16500

Call Put

www.angelone.in

Technical & Derivatives Report

May 20, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 719 726

737 743 754

APOLLOHOSP 3,545 3,588

3,653 3,697 3,761

ASIANPAINT 2,968 3,008

3,040 3,079 3,111

AXISBANK 633 642

650 658 666

BAJAJ-AUTO 3,621 3,660

3,719 3,758 3,817

BAJFINANCE 5,554 5,630

5,688 5,764 5,822

BAJAJFINSV 12,002 12,208

12,380 12,586 12,758

BPCL 321 324

327 330 333

BHARTIARTL 653 664

678 689 704

BRITANNIA 3,262 3,297

3,343 3,378 3,423

CIPLA 923 930

942 950 962

COALINDIA 179 180

182 183 185

DIVISLAB 4,095 4,147

4,242 4,294 4,389

DRREDDY 3,739 3,834

3,924 4,020 4,110

EICHERMOT 2,554 2,602

2,670 2,718 2,786

GRASIM 1,434 1,446

1,458 1,470 1,483

HCLTECH 970 990

1,024 1,044 1,078

HDFCBANK 1,269 1,278

1,287 1,296 1,305

HDFCLIFE 512 520

534 542 556

HDFC 2,103 2,120

2,139 2,156 2,176

HEROMOTOCO 2,473 2,494

2,522 2,543 2,570

HINDALCO 407 412

419 424 431

HINDUNILVR 2,226 2,245

2,265 2,284 2,303

ICICIBANK 678 684

692 697 705

INDUSINDBK 842 854

872 885 903

INFY 1,376 1,402

1,443 1,469 1,510

ITC 256 266

273 282 289

JSW STEEL 573 587

606 619 639

KOTAKBANK 1,747 1,765

1,796 1,814 1,845

LT 1,528 1,538

1,550 1,560 1,573

M&M 859 871

892 904 925

MARUTI 7,298 7,351

7,438 7,491 7,578

NESTLEIND 15,868 15,981

16,113 16,226 16,358

NTPC 145 146

147 149 150

ONGC 156 158

160 162 164

POWERGRID 219 223

227 231 235

RELIANCE 2,440 2,460

2,486 2,506 2,533

SBILIFE 1,032 1,044

1,059 1,071 1,086

SHREECEM 21,479 21,848

22,074 22,443 22,669

SBIN 442 445

447 450 453

SUNPHARMA 866 875

888 897 909

TCS 3,124 3,193

3,299 3,368 3,474

TATACONSUM

701 711

729 739 757

TATAMOTORS 390 394

401 405 411

TATASTEEL 1,091 1,107

1,131 1,146 1,170

TECHM 1,067 1,088

1,121 1,142 1,175

TITAN 2,007 2,059

2,108 2,160 2,209

ULTRACEMCO 5,973 6,023

6,100 6,149 6,226

UPL 798 806

811 819 824

WIPRO 435 443

458 467 482

www.angelone.in

Technical & Derivatives Report

May 20, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.