November 18, 2021

www.angelone.in

Technical & Derivatives Report

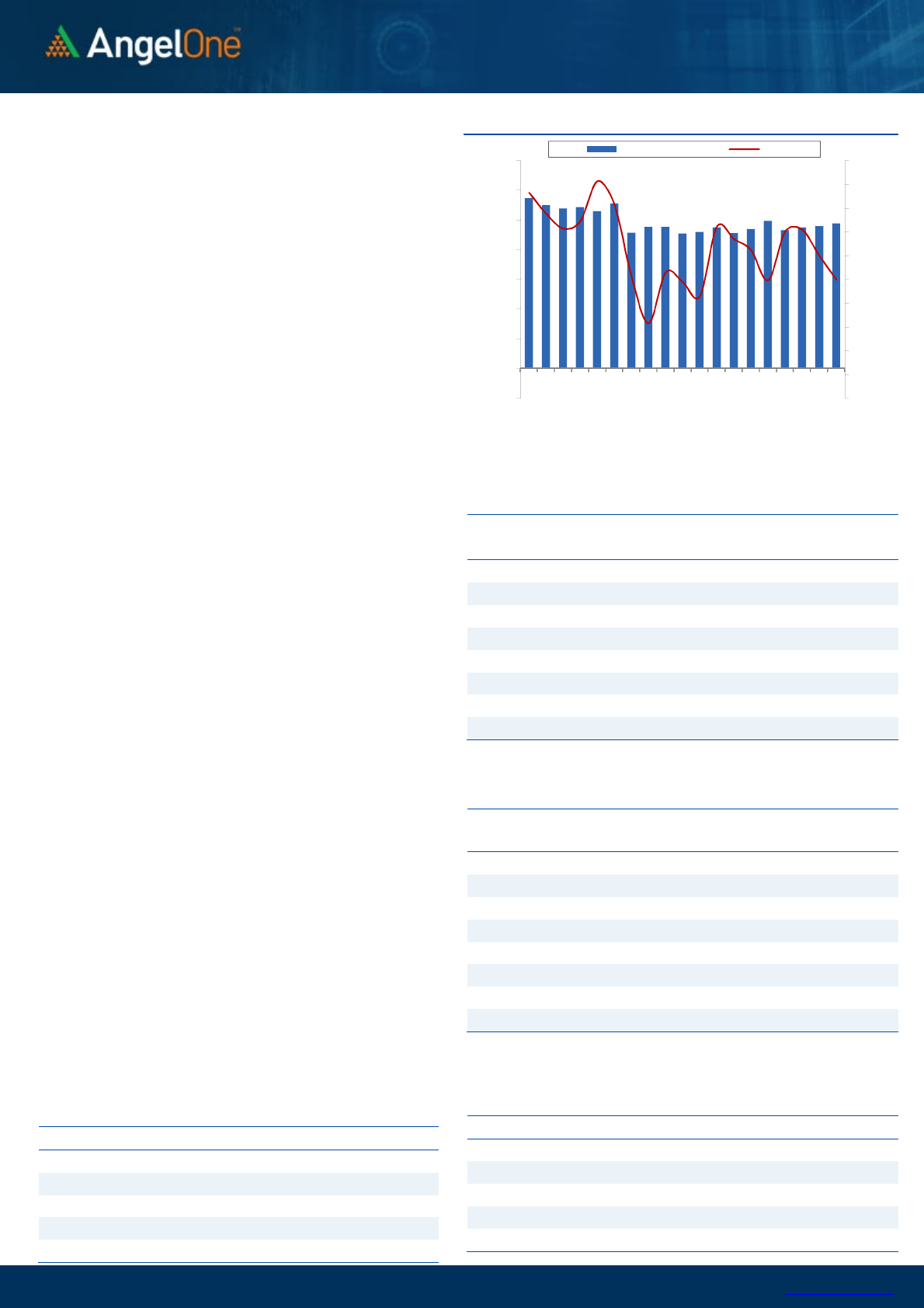

Nifty Bank Outlook - (38042)

Wednesday’s sell-off was followed by a gap down opening for the

banking index as well. As we progressed, some respite was observed

in initial two hours of trade but similar to recent trend it got sold into

to tank below 38000 mark. Finally, we closed third consecutive session

in red with a cut of nearly seventh tenth of a percent.

The banking index has been the major dragger lately and this has in

turn resulted the benchmark index closing below 20 DEMA. With

BankNifty’s recent price action, we have already cautioned traders to

avoid any kind of bottom fishing. As anticipated, index has slipped

below the supports of 38300-38400 on the closing bases and looks

poised for follow-up selling towards 37700 and then 37300. Hence, we

would advocate buy ATM puts incase of any intraday recoveries in

today’s weekly expiry session.

Key Levels

Support 1 – 37700 Resistance 1 – 38500

Support 2 – 37300 Resistance 2 – 38700

Exhibit 2: Nifty Bank Daily Chart

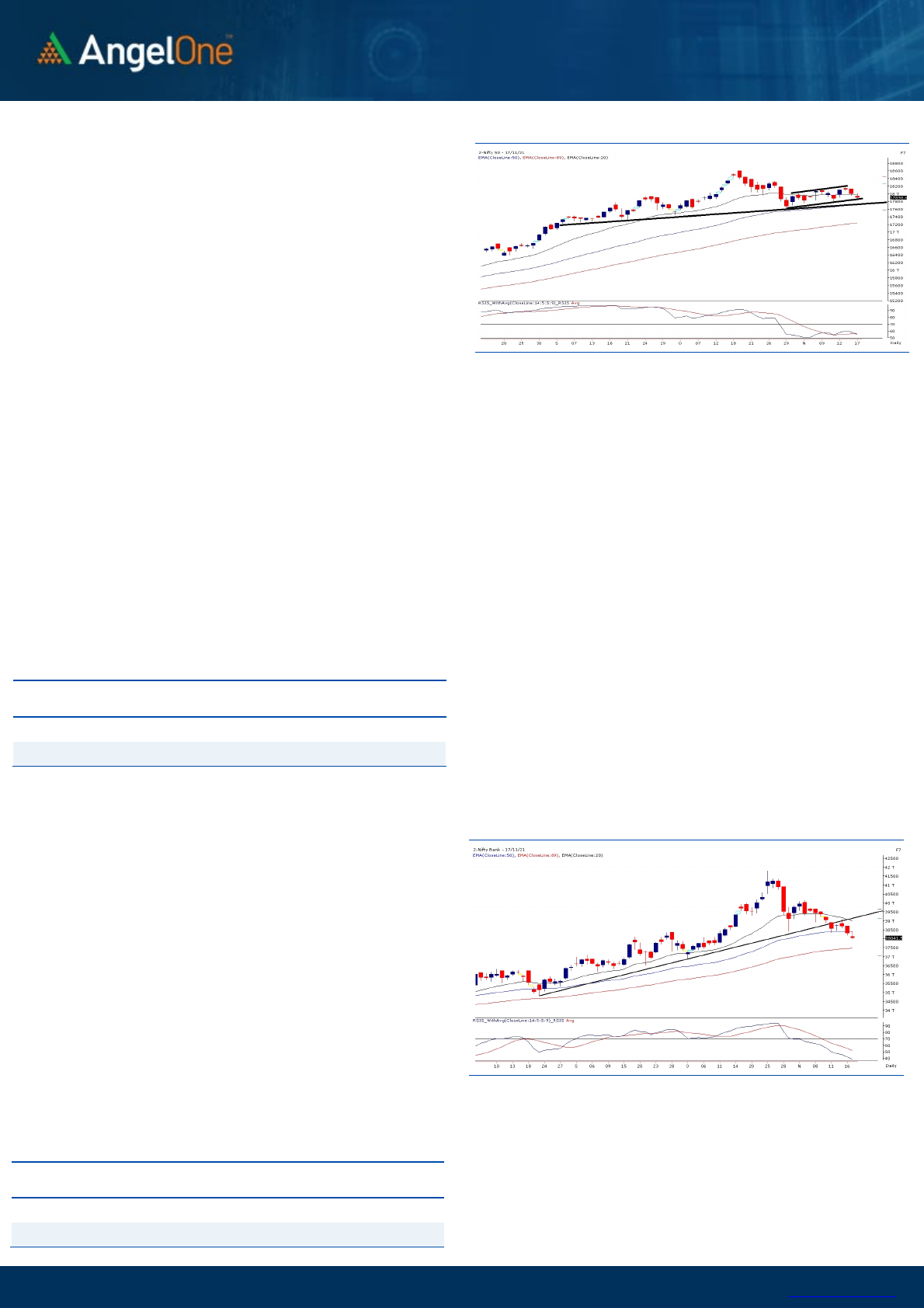

Sensex (60008) / Nifty (17899)

The SGX Nifty was indicating a sluggish start yesterday morning and in

line with this, our markets started the day on a soft note. In the first

couple of hours, market managed to recover from lower levels to

reclaim the 18000 mark. This was then followed by some consolidation

but once again last hour nervousness poured complete water as we

witnessed a sharp decline to sneak below 17900 at the close.

Within the recent consolidation, the market has started to grind lower

gradually since last three trading sessions. Although the damage is

negligible, we can see some interesting price development on the

chart. In our previous commentary, we had mentioned about the small

‘Channel’ pattern on the hourly chart. With yesterday’s corrective

move, Nifty has reached the lower boundary and the way overall things

are positioned, Nifty seems to be on the verge of a breakdown. In fact,

below 17700 we could see a confirmation of ‘Head and shoulder’

pattern formed on the daily time frame chart. Considering all these

observations, we can see market trading at the make or break levels

now. Any sustainable breakdown from the mentioned supports will

lead to extended correction in the near term; whereas on the flipside,

if Nifty has to regain any strength it needs to first reclaim the 18000

mark on a closing basis. The coming session would be crucial for our

market and hence one needs to a keep a close tab on all the above

mentioned scenarios.

Key Levels

Support 1 – 17800 Resistance 1 – 18000

Support 2 – 17700 Resistance 2 – 18030

Exhibit 1: Nifty Daily Chart

www.angelone.in

Technical &

Derivatives Report

November 18, 2021

View

The rub-off effect of previous session resulted a gap down

opening. This was followed by a range-bound movement

for the major part and eventually in the last hour one more

bout of selling was seen to finally end tad below 17900.

FIIs were net sellers in the cash market segment to the

tune of Rs. 344 crores. In index futures, they bought worth

Rs. 112 crores with increase in open interest indicating

long formations in yesterday’s session.

Index future front, Nifty witnessed fresh short formations

whereas open interest decreased in Bank Nifty indicates

long unwinding. FIIs continued their selling streak in cash

segment whereas they created some long formation in

index futures. Yesterday for most part of the day, traders

at 18000 call strike stood firm which eventually resulted in

a sharp decline towards the end. In fact, we saw decent

unwinding in 18000 Puts due to this corrective move and

now 17900 strike is very much at risk if we continue to grind

lower on the expiry day. Traders are advised exiting longs

on intraday recoveries and even an aggressive trader can

take a punt by going long on At the Money puts. The

banking has been the weakest link and yesterday the kind

of build-up we witnessed in 38500 calls, any bounce back is

likely to get sold into in the BANKNIFTY. Before this, we can

see some writing in 38200 strike which is likely to act as

immediate resistance. Although, 38000 put strike still has

highest open interest, we expect some unwinding pressure

once BANKNIFTY starts staying below the 38000 mark.

Comments

The Nifty futures open interest has increased by 1.42%. Bank

Nifty futures open interest has decreased by 1.37% as market

closed at 17898.65 levels.

The Nifty November future closed with a premium of 10.5

point against a premium of 4.80 point in last trading session.

The December series closed at a premium of 71.6 point.

The INDIA VIX decreased from 15.20 to 14.98. At the same

time, the PCR-OI of Nifty has decreased from 0.86 to 0.81.

Few of the liquid counters where we have seen high cost of

carry are IDEA, INDUSTOWER, BSOFT, LALPATHLAB, AND

GMRINFRA

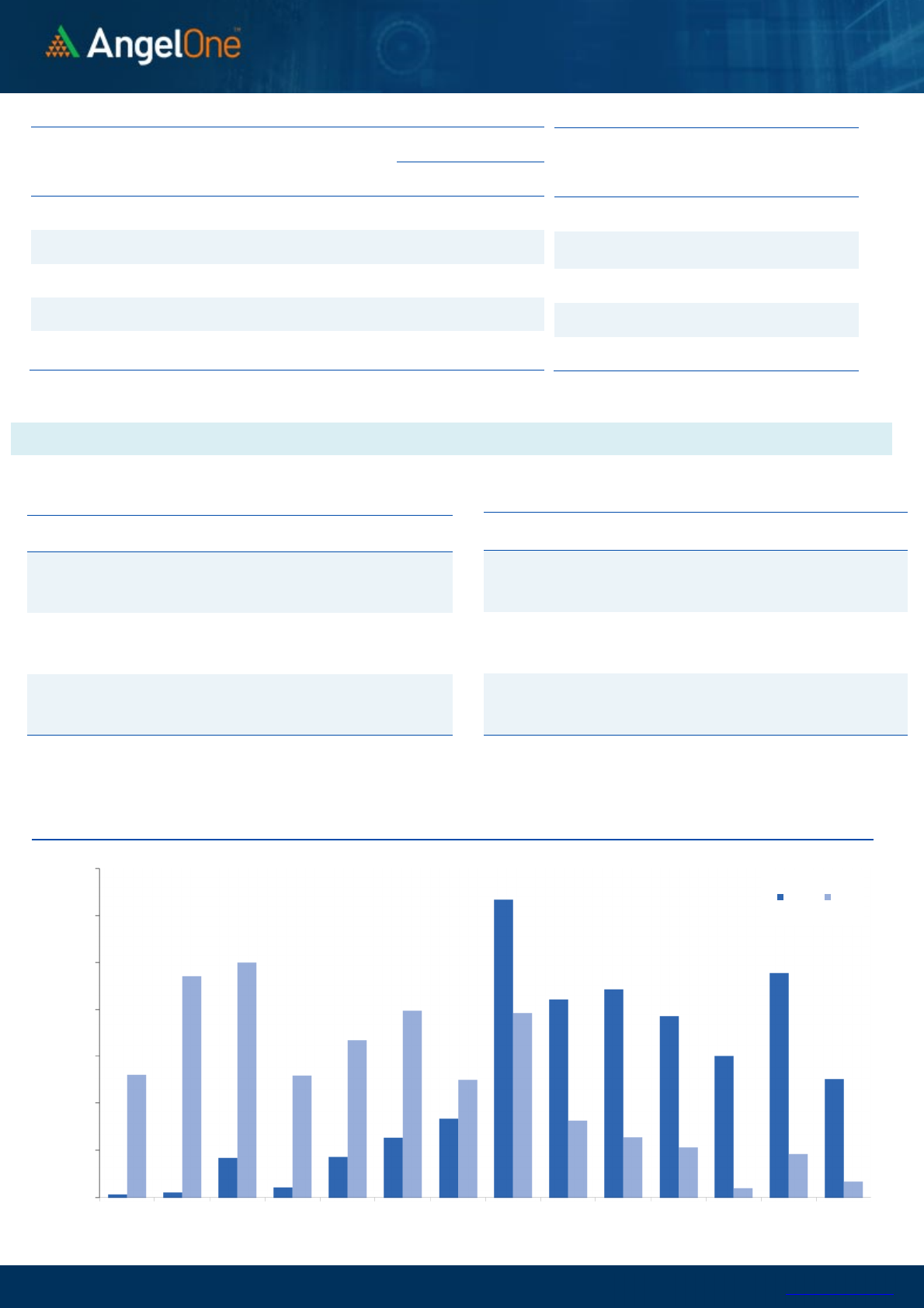

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

18300

18400

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

10-20 10-2210-2610-28 11-1 11-3 11-5 11-1111-1511-17

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BSOFT

4197700 30.94 475.10 8.33

GSPL

1431400 29.34 320.55 1.29

COFORGE

830000 12.37 5839.30 1.80

LALPATHLAB

623250 10.95 3651.85 1.25

APOLLOHOSP

2585750 8.84 5734.00 12.26

IPCALAB

2954025 8.46 2097.15 -2.66

AXISBANK

59462400 8.37 712.35 -1.81

ESCORTS

8694950 7.33 1630.95 -0.01

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CHAMBLFERT

969000 -21.32 355.70 -5.95

MARUTI

2668500 -6.72 8274.70 2.41

SBILIFE

7353750 -6.35 1187.20 2.48

TRENT

2132950 -5.83 1153.20 -3.00

IRCTC

12890625 -5.72 903.60 -1.87

ALKEM

662200 -4.64 3476.90 -2.16

MRF

62730 -3.67 79373.35 0.99

SYNGENE

1378700 -3.62 609.05 1.06

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.81 0.80

BANKNIFTY

0.55 0.88

RELIANCE

0.46 0.48

ICICIBANK

0.40 0.45

INFY

0.52 0.42

Historical Volatility

SCRIP HV

APOLLOHOSP

50.06

BSOFT

55.23

CHAMBLFERT

53.63

LTTS

49.98

SBILIFE

35.38

www.angelone.in

Technical &

Derivatives Report

November 18, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Spot =

17898.65

FII Statistics for November 17, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3749.20 3637.38 111.82

170638 15557.37 2.68

INDEX

OPTIONS

491263.78 493488.35 (2224.57) 1663668 151917.43 3.94

297314.41

STOCK

FUTURES

14536.62 14658.01 (121.39) 1841363 137180.03 0.75

STOCK

OPTIONS

25959.20 25740.88 218.32

352785 26891.16 2.15

Total

535508.80

537524.62

(2015.82) 4028454

331545.99

2.25

43446.77

Turnover on November 17, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

263134 24414.69 -5.39

Index Options

67339952 6320783.99 26.18

Stock Futures

913791 72112.15 2.41

Stock Options

3878091 314318.66 7.12

Total

7,23,94,968

6731629.49 24.68

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17900 152.50

48.75 51.25 17948.75

Sell

18000 103.75

Buy

17900 152.50

84.60 115.40 17984.60

Sell

18100 67.90

Buy

18000 103.75

35.85 64.15 18035.85

Sell

18100 67.90

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17900 138.70

40.85 59.15 17859.15

Sell

17800 97.85

Buy

17900 138.70

71.00 129.00 17829.00

Sell

17700 67.70

Buy

17800 97.85

30.15 69.85 17769.85

Sell

17700 67.70

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500 18600

Call Put

www.angelone.in

Technical &

Derivatives Report

November 18, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 726 731

738 743 750

ASIANPAINT 3,137 3,184

3,212 3,258 3,287

AXISBANK 697 704

715 723 733

BAJAJ-AUTO 3,534 3,559

3,601 3,626 3,669

BAJFINANCE 7,436 7,522

7,607 7,693 7,778

BAJAJFINSV 17,954 18,105

18,262 18,413 18,571

BPCL 407 410

416 419 424

BHARTIARTL 707 713

723 730 739

BRITANNIA 3,549 3,582

3,641 3,674 3,733

CIPLA 889 897

909 918 930

COALINDIA 153 155

157 158 161

DIVISLAB 4,700 4,732

4,789 4,821 4,879

DRREDDY 4,706 4,737

4,781 4,812 4,856

EICHERMOT 2,609 2,642

2,696 2,728 2,782

GRASIM 1,763 1,778

1,802 1,816 1,840

HCLTECH 1,141 1,147

1,156 1,161 1,170

HDFCBANK 1,519 1,525

1,534 1,540 1,550

HDFCLIFE 700 706

714 720 728

HDFC 2,908 2,928

2,953 2,973 2,998

HEROMOTOCO 2,710 2,730

2,752 2,771 2,793

HINDALCO 435 440

445 450 454

HINDUNILVR 2,373 2,382

2,396 2,405 2,419

ICICIBANK 748 754

763 770 779

IOC 126 127

129 131 133

INDUSINDBK 1,002 1,018

1,030 1,046 1,058

INFY 1,769 1,778

1,790 1,799 1,811

ITC 231 235

240 245 250

JSW STEEL 651 657

664 670 677

KOTAKBANK 2,024 2,038

2,060 2,075 2,097

LT 1,923 1,938

1,958 1,973 1,994

M&M 928 941

960 973 992

MARUTI 7,878 8,077

8,213 8,411 8,548

NESTLEIND 19,266 19,372

19,468 19,574 19,670

NTPC 132 134

136 138 140

ONGC 155 156

158 159 160

POWERGRID 184 187

191 194 197

RELIANCE 2,437 2,450

2,475 2,488 2,513

SBILIFE 1,131 1,159

1,178 1,206 1,225

SHREECEM 27,192 27,442

27,868 28,117 28,544

SBIN 484 491

498 505 513

SUNPHARMA 777 784

795 802 812

TCS 3,474 3,498

3,530 3,554 3,587

TATACONSUM

824 830

839 845 854

TATAMOTORS 513 521

529 538 545

TATASTEEL 1,202 1,211

1,224 1,233 1,246

TECHM 1,583 1,601

1,613 1,631 1,643

TITAN 2,462 2,481

2,510 2,529 2,558

ULTRACEMCO 7,721 7,789

7,869 7,937 8,017

UPL 737 747

762 771 786

WIPRO 653 657

663 667 673

www.angelone.in

Technical &

Derivatives Report

November 18, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in