May 18, 2022

www.angelone.in

Technical & Derivatives

Report

Nifty Bank Outlook

-

(34302)

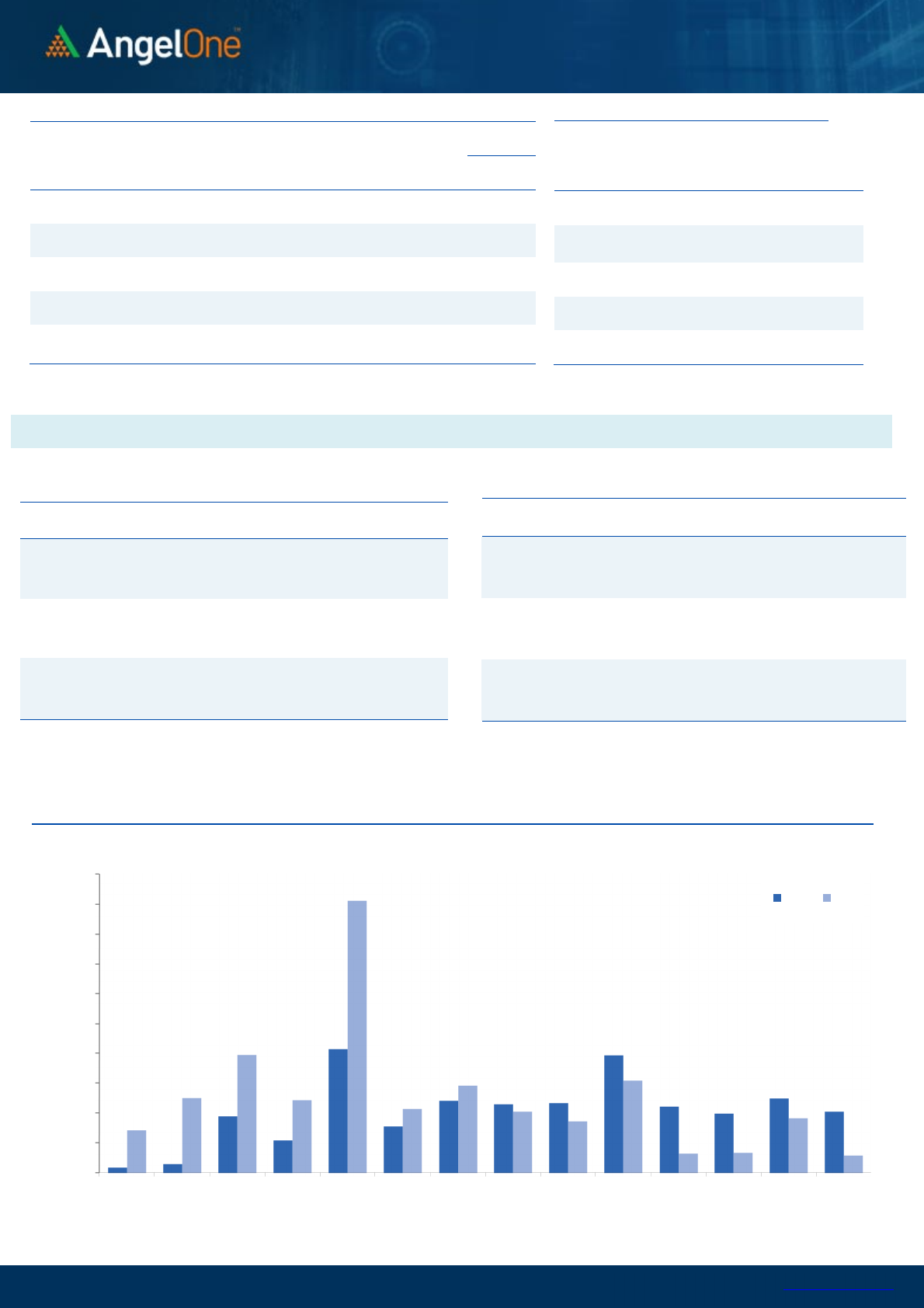

Bank Nifty as well started on a positive note and the momentum

continued throughout the session to eventually end with strong

gains of over two percent tad above 34300.

Following the bullish reversal candlestick pattern on Monday

known as 'Inside Bar' the bank index finally witnessed a much-

awaited bounce back yesterday. The way some of the counters

moved within this space and the way the bank nifty has closed

certainly bodes well for the bulls. However, as mentioned above

this upmove should only be considered as a pullback as of now,

and a one step at a time approach should be taken. As far as

levels are concerned, 34800 - 35000 are the next levels to

check on the pull-back moves whereas, on the flip side, 34000

- 33800 is the immediate support zone. As long as the

mentioned support levels hold, intraday dips can be taken to add

the long positions.

Key Levels

Support 1 – 34000 Resistance 1 – 34800

Support 2 – 33800 Resistance 2 – 35000

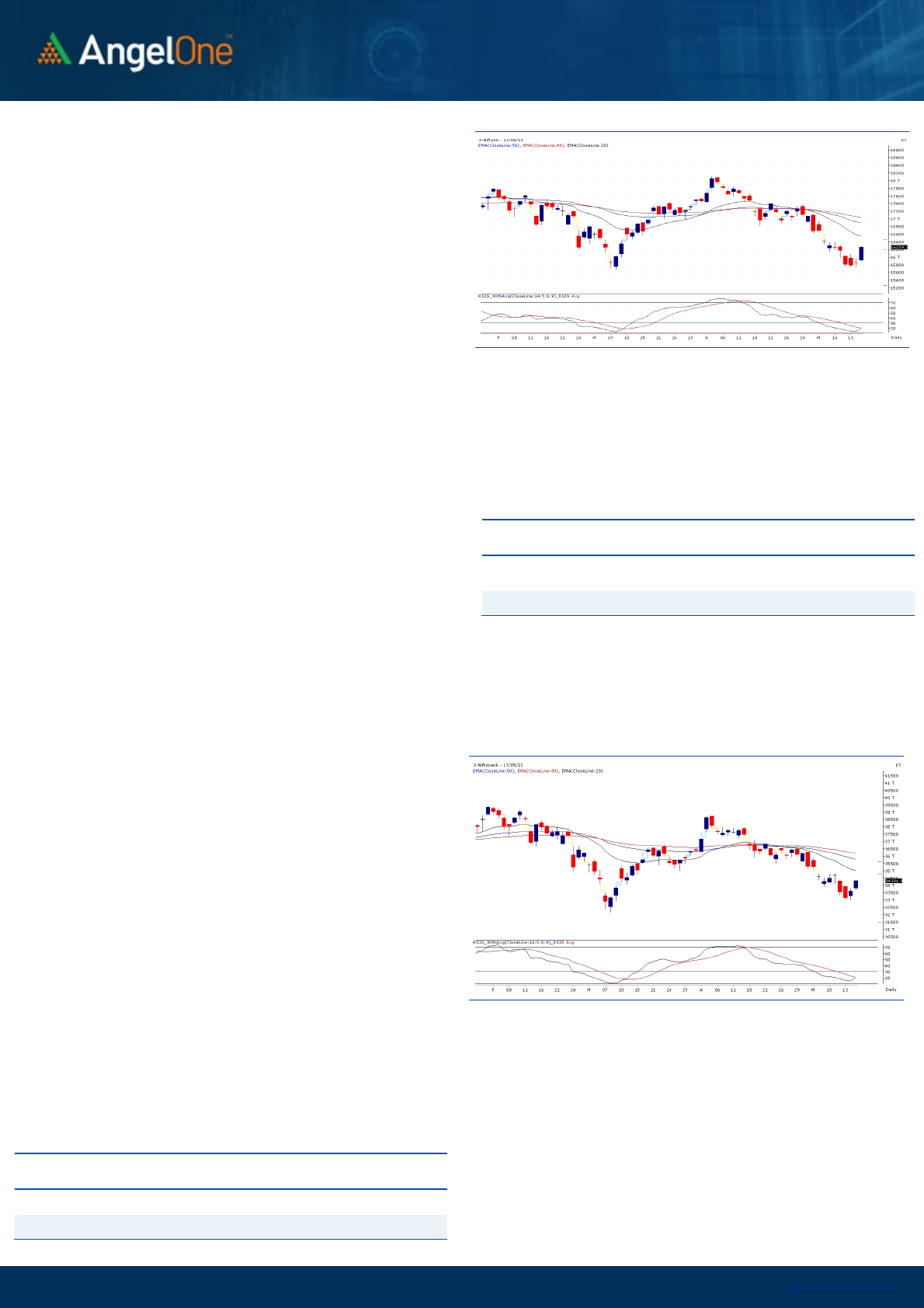

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (54318)

/ Nifty (16259)

The global trading screen early in the morning was pleasant and

as a result, our markets started with a modest upside gap

slightly above 15900. However, the momentum accelerated as

the day progressed across the heavyweight spaces to send Nifty

comfortably beyond 16250 on a closing basis. Unlike recent

sessions, the upward rally was here to stay and did not give up

in the latter half. The robust recovery session concluded with

whopping 2.63% gains to bring back a wider smile in traders’

fraternity.

With reference to previous commentary, we had clearly

mentioned how markets are deeply oversold and requires a

small relief on the global front to rebound sharply from their key

supports. The moment we surpassed 16100, the short sellers

were forced to go on the back foot, which provided some impetus

to the convincing move beyond 16250. As of now, yesterday’s rally

should only be construed as a pull back; because markets were

deeply oversold and needed some breather. So rather than

getting complacent, it’s advisable to adopt ‘One step at a time’

strategy. Yes, the kind of recovery we witnessed yesterday, it is

a bit encouraging one and indicates a possible extension towards

16350 – 16500. Hopefully the global screen remains intact like

this, which could provide a much needed push to extend the

move. On the flipside, 16100 – 16000 has now become a

sacrosanct support and till the time, we do not slide below it,

traders can use declines to buy into.

It was a day of broad based participation as lot of beaten down

spaces came back strongly especially, the Metal basket;

courtesy to fresh updates with respect to China reopening.

Hence, traders are advised to keep focusing on individual

counters who are poised for some recovery from their

important supports.

Key Levels

Support 1 – 16100 Resistance 1 – 16350

Support 2 – 16000 Resistance 2 – 16500

www.angelone.in

Technical & Derivatives Report

May 18, 2022

View

The market witnessed strong follow-up momentum

tracking the positive global cues. Broad-based

participation from the heavyweights has made Nifty

bounce beyond the 16250 level.

FIIs were net sellers in the cash market segment

to the tune of Rs. 2192 crores. Simultaneously, in

Index futures, they bought worth Rs. 1064 crores

with a decrease in open interest, indicating some

short covering.

Looking at the F&O data, the stronger hands have

covered their short positions in both indices. On the

options front, a pile-up is visible in the 16000-16100

Put strikes in the options segment, which is

expected to act as a strong support zone. While on

the contrary, a considerable OI concentration is

built on the 16400-16500 call strikes, indicating a

tentative range in the market for the near term.

Considering the momentum in the recent price

action, the sentiments are likely to remain upbeat,

and any minor correction could be seen as an

opportunity to go long. Also, we advocate traders to

trade with a positive bias and should look for stock-

specific trades that are likely to give trending

moves.

Comments

The Nifty futures open interest has decreased by 2.02%.

and BANK Nifty futures open interest has decreased by

1.86% as the market closed at 16259.30.

The Nifty May future closed with a discount of 4.35 point

against a premium of 0.30 point in the last trading

session. The June series closed at a discount of 5.05

point.

The INDIA VIX decreased from 24.52 to 22.74. At the

same time, the PCR-OI of Nifty increased from 0.73 to

1.12.

Few of the liquid counters where we have seen high

cost of carry are ABBOTINDIA, VEDL, HINDALCO,

COROMANDEL and INTELLECT.

Historical Volatility

SCRIP HV

IDEA 95.07

IBULHSGFIN 78.79

ZEEL 72.07

HINDCOPPER 67.92

RBLBANK 66.82

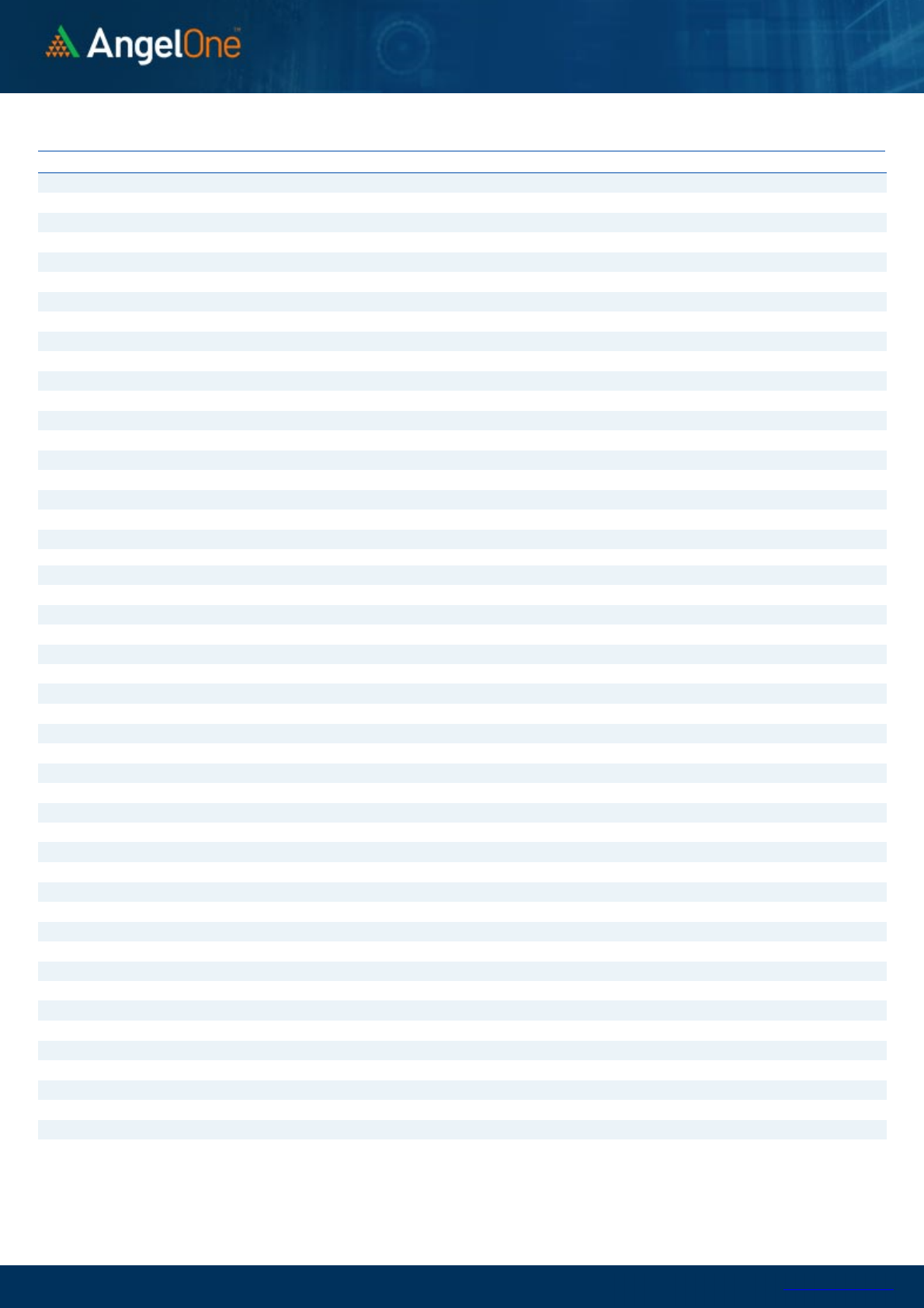

Nifty Vs OI

15000

15500

16000

16500

17000

17500

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

4-27 4-29 5-4 5-6 5-10 5-12 5-16

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

COROMANDEL 1630050 40.60 942.75 6.47

CHAMBLFERT 2367000 11.76 405.90 5.55

BAJAJFINSV 945950 10.92 12972.15 2.51

METROPOLIS 505400 10.88 1932.70 -0.45

ABB 363000 9.83 2294.35 1.96

HINDPETRO 12984300 9.82 255.85 0.61

MCX 2933800 9.77 1211.85 3.35

LALPATHLAB 1162500 9.44 2184.65 -1.10

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GUJGASLTD 2480000 -11.90 555.95 -0.47

APOLLOHOSP 2294250 -8.26 3813.15 3.45

INTELLECT 1299750 -6.98 641.20 10.71

COALINDIA 41055000 -6.59 184.55 7.33

GSPL 2094800 -6.37 263.30 2.48

DIXON 845500 -6.11 3489.15 4.31

TATACHEM 5741000 -5.90 971.80 5.28

HINDALCO 43866450 -5.69 428.40 9.19

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.12 0.81

BANKNIFTY 1.08 0.89

RELIANCE 0.33 0.40

ICICIBANK 0.51 0.52

INFY 0.41 0.48

www.angelone.in

Technical & Derivatives Report

May 18, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty

Spot = 1

6259

.30

FII Statistics for

May

1

7

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4641.35 3577.60 1063.75

164430 13604.10 (8.47)

INDEX

OPTIONS

651522.19 650293.66 1228.53

1770738 145596.99 9.11

STOCK

FUTURES

16242.00 14250.86 1991.14

2339886 145599.45 0.16

STOCK

OPTIONS

8689.93 8786.77 (96.84) 154819 9970.01 (1.12)

Total

681095.47

676908.89

4186.58

4429873

314770.55

3.13

Turnover on

May

1

7

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

481910 39730.76 3.63

Index

Options

97869928 8104852.52

24.65

Stock

Futures

976791 59481.59 11.16

Stock

Options

3820853 247445.93 26.22

Total

38,20,853 247445.93 24.47

Bull

-

Call

Spreads

Action Strike Price Risk Reward BEP

Buy

16200 244.45

55.65 44.35 16255.65

Sell

16300 188.80

Buy

16200 244.45

102.20 97.80 16302.20

Sell

16400 142.25

Buy

16300 188.80

46.55 53.45 16346.55

Sell 16400 142.25

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

16200 186.85

37.45 62.55 16162.55

Sell

16100 149.40

Buy

16200 186.85

66.80 133.20 16133.20

Sell

16000 120.05

Buy

16100 149.40

29.35 70.65 16070.65

Sell

16000 120.05

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

15600 15700 15800 15900 16000 16100 16200 16300 16400 16500 16600 16700 16800 16900

Call Put

www.angelone.in

Technical & Derivatives Report

May 18, 2022

`

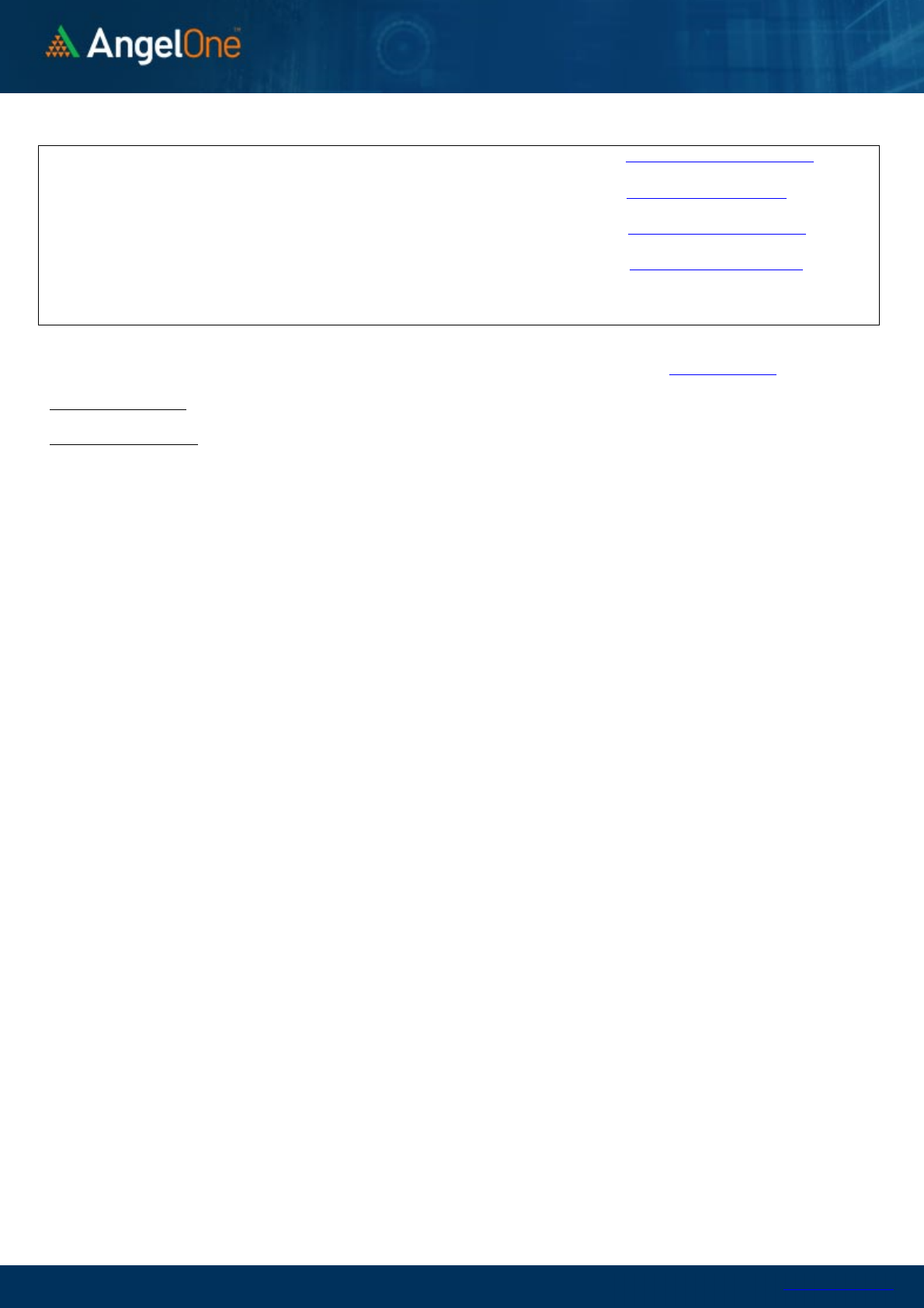

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 704 724

736 756 768

APOLLOHOSP 3,620 3,716

3,775 3,871 3,930

ASIANPAINT 2,914 2,982

3,019 3,087 3,125

AXISBANK 635 645

651 661 668

BAJAJ-AUTO 3,690 3,716

3,752 3,778 3,814

BAJFINANCE 5,582 5,710

5,779 5,907 5,976

BAJAJFINSV 12,484 12,728

12,874 13,119 13,265

BPCL 331 337

340 346 349

BHARTIARTL 683 695

703 714 722

BRITANNIA 3,248 3,309

3,346 3,406 3,443

CIPLA 907 922

932 947 957

COALINDIA 169 177

181 189 193

DIVISLAB 4,162 4,233

4,273 4,344 4,384

DRREDDY 3,833 3,868

3,907 3,942 3,980

EICHERMOT 2,559 2,633

2,674 2,748 2,788

GRASIM 1,431 1,456

1,473 1,498 1,515

HCLTECH 1,031 1,057

1,071 1,097 1,112

HDFCBANK 1,291 1,302

1,310 1,321 1,329

HDFCLIFE 537 546

551 560 566

HDFC 2,147 2,169

2,183 2,205 2,218

HEROMOTOCO 2,485 2,504

2,521 2,541 2,558

HINDALCO 382 405

421 444 461

HINDUNILVR 2,192 2,219

2,248 2,274 2,303

ICICIBANK 676 693

702 720 729

INDUSINDBK 882 893

899 910 916

INFY 1,464 1,491

1,508 1,535 1,552

ITC 251 258

262 269 272

JSW STEEL 596 619

632 655 669

KOTAKBANK 1,807 1,824

1,834 1,851 1,862

LT 1,523 1,563

1,586 1,626 1,649

M&M 890 900

909 919 928

MARUTI 7,128 7,330

7,458 7,660 7,787

NESTLEIND 16,067 16,195

16,293 16,421 16,518

NTPC 145 148

149 152 154

ONGC 153 158

161 166 169

POWERGRID 230 235

237 241 243

RELIANCE 2,392 2,461

2,500 2,569 2,608

SBILIFE 1,022 1,046

1,061 1,085 1,100

SHREECEM 21,583 21,809

22,016 22,243 22,450

SBIN 451 459

464 473 478

SUNPHARMA 872 882

889 899 906

TCS 3,306 3,379

3,423 3,496 3,540

TATACONSUM

711 723

733 744 754

TATAMOTORS 398 411

418 432 439

TATASTEEL 1,085 1,137

1,167 1,219 1,249

TECHM 1,170 1,184

1,197 1,211 1,224

TITAN 2,083 2,130

2,157 2,204 2,231

ULTRACEMCO 5,926 6,017

6,071 6,162 6,217

UPL 791 804

812 825 833

WIPRO 461 474

481 494 502

www.angelone.in

Technical & Derivatives Report

May 18, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.